By Mikaela Fenton

The United States is facing a housing crisis. The American workforce of moderate-income citizens—or people who make between 80% and 120% of the area median income (AMI)—has been highly affected. This group is often stuck paying a significant portion of their income towards rent and cannot make the jump to homeownership due to such high home prices and their inability to save. When people are contributing so much of their income to housing, it makes it difficult to pay for other necessities such as food and health care1.

While there have been numerous efforts to address housing affordability for moderate income households, the problem seems insurmountable. The City of Davis’ long experience with affordable housing provides unique insight into different affordable ownership models. To inform future affordable ownership housing initiatives and legislation, the author compared four different models of affordable housing in the City of Davis with market rate and  rental models to determine their strengths, deficits, and capacity for long term affordability.

rental models to determine their strengths, deficits, and capacity for long term affordability.

The Study

The four models included Aggie Village, Dos Pinos, Southfield Park, and the City of Davis Affordable Ownership Housing Program (Davis AOH Program). Aggie Village is a form of university housing. The university owns the land and caps sale prices for residents who own the homes. Dos Pinos is a limited equity housing cooperative (LEHC). Southfield Park is one of the City of Davis’s affordable housing projects. It features 2- and 3-bedroom condos which are limited to income qualified buyers and can only appreciate 5.5% a year. The Davis AOH Program also offers opportunities for income qualified households which can appreciate 3.75% per year. The market rate models are referred to as Purchasing Market Rate and Rental Market Rate.

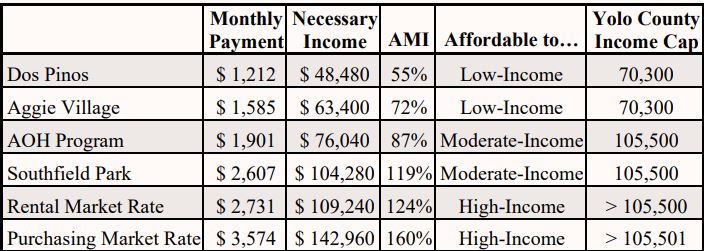

The research for the study was mainly quantitative. The author selected a 3-bedroom unit from each model to analyze and the earliest available sale price, down payment, and monthly payment were compared with 2019. Using the monthly payment, the author used the Department of Housing and Urban Development’s (HUD) definition of affordable—paying 30% or less of income—and the area median income (AMI) to determine if the unit was affordable to extremely low, very low, low, or moderate-income four person families in Yolo County.

Findings

In terms of income levels, Dos Pinos and Aggie Village were affordable to low-income families, the Davis AOH Program and Southfield Park were affordable to moderate-income families, and Rental and Purchasing Market Rate were only affordable to high-income four person families in Yolo County.

The average income for a family of four in Yolo County is $87,900. At a 30% HUD cap they would be able to spend $2,198 a month on housing. This family would be able to afford to purchase a home/unit at Aggie Village, Dos Pinos, or through the Davis AOH Program. If the families were to purchase a home on the market in Davis, Southfield Park, or rent in Davis, they would be contributing significantly more of their incomes towards housing than the other models.

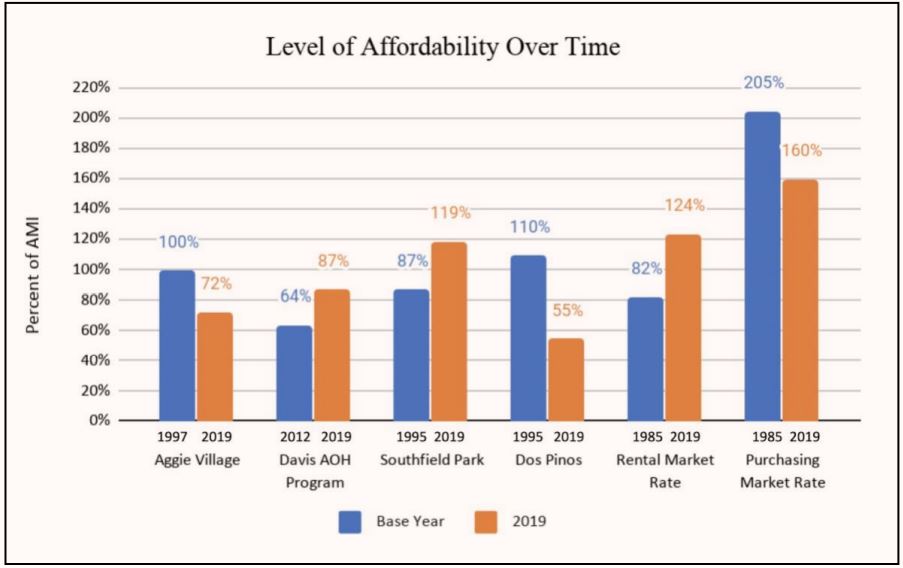

The level of affordability changed over time. Aggie Village and Dos Pinos were the only two models that became more affordable over time. Purchasing Market Rate has also become more affordable, but it is still only considered affordable to those who make 160% of the AMI. In contrast, the Davis AOH Program, Southfield Park and Rental Market Rate have all become less affordable over time.

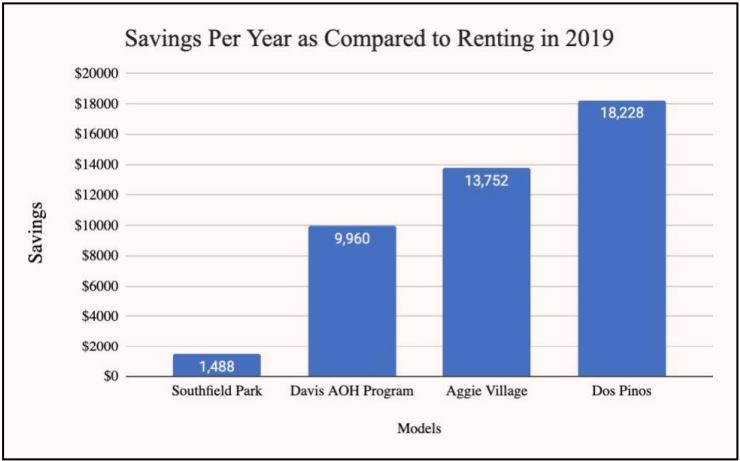

All of these affordable ownership models are less expensive than Purchasing Market Rate, but some also offer considerable savings as compared to renting. The most significant savings appear at Aggie Village and Dos Pinos where residents would save over 13 and 18 thousand dollars respectively per year as opposed to renting at market rate.

Discussion

Discussion

Of the four models, Dos Pinos is the most affordable model by monthly housing costs and has been shown to become more affordable over time2&3. It bears noting that the monthly carrying charges for the apartments at Dos Pinos are not statistically accurate in their comparison. The Dos Pinos monthly carrying charge is extremely inclusive and covers all the vast majority of housing expenses including interest payments, mortgage insurance, and repairs. Thus, in reality Dos Pinos carrying charges are much lower than the monthly costs of the other models.

However, as a model, LEHCs do have some downsides. If the cooperative pays market price for land and buildings, when first built, the initial residents will need to be in a higher income bracket to afford living there. For a LEHC to be affordable to a moderate-income family there needs to be either leased land or a below market price concession on the land, the buildings or the financing. Over time, the monthly payments will become affordable to lower income residents, but the share will rise in price. The share price could make living there out of their reach even if potential residents could afford the monthly payments. At Dos Pinos, the full share must be paid up front and members cannot use the share as loan collateral.

Yet in spite of these downsides, the monthly payment becomes remarkably affordable over time. Perhaps the most outstanding statistic in all of this study is the savings for families who live at Dos Pinos compared to a market rate rental. The median family of four living in the average three-bedroom apartment in Davis would pay $2,731 per month. By living at Dos Pinos (and paying $1,212 per month), this family would save $18,228 per year. The median income family renting the average apartment in Davis is paying 37% of their income. Their overpayment of rental housing cost by the median income family in Davis prevents them from ever saving for the conventional down payment.

Conclusions

As the United States faces a housing crisis, and more presently an economic downturn, the issue of affordable ownership housing has only become more important. Policy makers and planners should know that models like Dos Pinos are best for creating and preserving affordable ownership housing. LEHCS become more affordable over time and provide savings for residents that would have been spent on housing if they lived in market rate rental units. Affordable ownership housing is a unique strategy that can significantly impact people and communities in a positive way. Our workforce of middle-income families need more of it.

Read full study here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3621065