Council will be looking to potentially put a revenue measure on the ballot. Staff is requesting authorization to proceed with citywide polling similar to what was conducted in 2014, which eventually convinced the council not to attempt a revenue measure for November 2014.

In the spring of 2014, the city commissioned a poll at a cost of $25,000. Staff does not have specific quotes at this time, but believes that a similar poll would cost roughly the same.

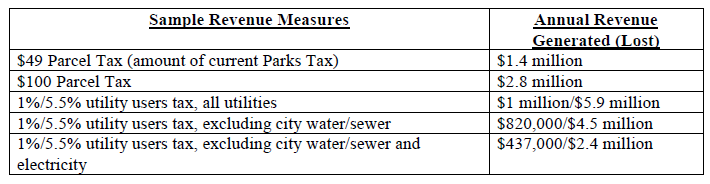

Here are some potential measures and revenue projection that the city would look at:

Back in July, council had a discussion of various options. Council, at the time, “directed staff to remove the option of a sugary beverages tax as a revenue measure and continue it on a separate track as a policy discussion.”

In July, staff writes, “collective City Council comments indicated greater interest in a parcel tax, as opposed to a utility user tax, however both options were left on the table. Council members at that meeting and subsequently have suggested different amounts and purposes for a possible parcel tax…”

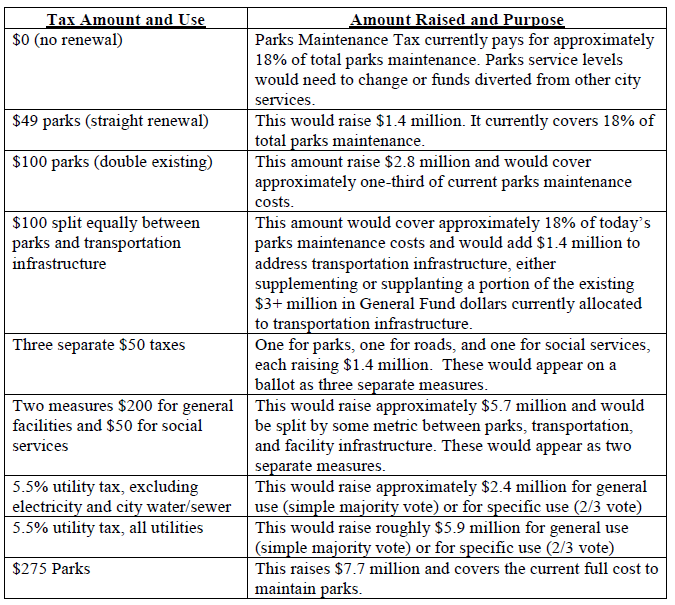

Here are some of the options on the table:

Staff writes, “In addition to amount and purpose of a measure, Council will also want to consider the clarity and ease of the message of the ballot measure – how easy will it be to inform a citizen about the purpose of the measure? Are there certain groups in the community who want the measure and are willing to champion it? Does the City Council want to create a separate oversight committee, use existing bodies, or assume responsibility for oversight itself?”

Staff writes that it is still in the process of researching measure options, but “believes a citywide poll would assist in informing both staff and the City Council of current community sentiment for types of measures and measure amounts.

“With results in hand, the City Council will be able to make a fully informed decision by the early February deadline about the best course of action for the June ballot as relates to a revenue

measure,” staff continues.

The city last performed a citywide poll in June of 2014. At that time, “the pollsters asked 504 Davis residents a variety of questions to gauge citizen satisfaction with city services. A subset of voters were also asked their level of interest in hypothetical ballot measures. The poll was structured to last twenty minutes.”

At that time, “46.5% of the respondents said they would definitely or probably support a $149 parcel tax and 44.1% said they definitely or probably would not.”

Maintenance of bike paths, parks, roads and greenbelts were the actions that would make voters more likely to vote in favor of a measure. The activities that would make people less likely to vote in favor were construction of a new pool and developing a new sports complex.

If the council is in favor of polling now, “staff requests feedback from the Council related to the scope of potential questions.”

Staff asks about the following questions:

- Potential parcel tax options?

- Potential utility user tax options?

- Length of time of a measure?

- An inflator?

- Uses for potential revenue?

- Parks infrastructure/maintenance

- Road infrastructure/maintenance

- Bike path infrastructure/maintenance

- City facilities

- Social services, such as services for the homeless

- New projects

- Other?

If the city proceeds, “staff estimates two months to select a polling company, develop questions, complete the poll and return to the City Council with results. Given holidays and the Council schedule, this likely means staff would present the results to the Council no later than the first meeting in January, allowing a few weeks before the Council must make a final decision about the June election.”

—David M. Greenwald reporting

They should revisit the sugar tax as well as implement on on manufactured housing.

They are going to consider the sugar tax, but they need to do it separate from the revenue tax measures.

There is nothing they can do on manufactured housing that’s governed by state law.

I vote for a 2/3’s majority utility users tax with the funds being designated for special use like parks or roads. That way the tax can’t be used to raise wages or for social services.

I feel a utility tax is the fairest way to distribute the levy more evenly so that everyone in Davis has skin in the game.

Keep the social services tax off the ballot. That will hinder any tax from getting passed.

I will be interested in the opinions of the other 40 regular commenters when the weigh in.

I think parcel tax is far more likely than utility taxes.

The city should lease the old Whole Foods space and divide it into six different smaller spaces. They should then sublease each for a MJ dispensary. They should also have a cashier and prohibit the dispensaries from accepting payment, instead using the central cashier.

The city would benefit from the tax and the rent on the spaces. The dispensaries would benefit from the city depositing the money and electronically, paying them and holding the master lease. The setup would be more secure and would allow the city to better manage the MJ rollout and maximise revenues.

Great idea, and when the MJ shoppers get the munchies there are restaurants located real close.

It’s a win-win.

Dispersed MJ parlors that take cash will lead to revenue and safety problems. Whole Bud is centrally located and would be easy to reach from the new Dorms@Nishi

Whole Bud? LMAO

Maybe Gap can also change to Gap Ganja?

Mary Jane Mikunis?

Pot Plutos?

Too bad ‘Habit’ Burger closed. It could’ve kept its name.

Stoner Central

Bong the kasbah

Dope Souk

“They are going to consider the sugar tax, but they need to do it separate from the revenue tax measures.”

Why does it need to be done separately ? Do you mean separately in terms of timing of consideration, vs on a different ballot ?

Separately in terms of consideration. I think they’ll be on the same ballot. The issues are different and so it’s important not to conflate in the public’s eye these issues.

Why not conflate? Would you prefer a parcel tax or a tax on aspiring diabetics?

On is for revenue and one is for health issues – thus different purposes

As I’ve stated before, I’ll support a sugary beverage tax as long as the funds are used for roads or parks. Try to designate the revenue for some cause and I think it’s dead in the water.

You can’t use it for roads or parks because the goal is declining revenue not ongoing revenue.

Every bit helps. Roads and parks can also be supplemented by other taxation if needed.

It’s not a matter of every bit helps, it’s a matter of creating and producing a reliable funding stream.on an ongoing basis.

Yes and the soda tax can help any other road’s tax. I’m not saying a beverage tax directed towards roads is the total answer, but it can’t hurt. Why don’t you get this?

You believe that alcohol taxes are for health or revenue? They have produced revenue for 100’s of years. Sugar is not going away…

$50 for roads, raising $1.4 million… how much is actually needed to bring all the roads up to a reasonable level? Is there a way to base a tax on California vehicle registration? Can a local use tax be created for owning and/or using cars? Automobile users already don’t pay for the cost of driving but with a parcel or utility tax someone who only uses a bicycle has to pay the same for the roads (via this tax) as someone who drives half-way across town to get coffee every morning. If they have an electric car and the utility tax excludes electricity, it’s even more ridiculous. Can a tax on vehicles be used to purchase strong lighting systems for cyclists? Or does it have to be used on infrastructure, etc?