Mixed into the discussion on Tuesday night on organizational restructuring and additional budget cuts by the city as the result of the failure to achieve the cost-savings needed through the recent round of employee bargaining agreements, was a very alarming discussion on what will become sky-rocketing costs for city retirees.

Mixed into the discussion on Tuesday night on organizational restructuring and additional budget cuts by the city as the result of the failure to achieve the cost-savings needed through the recent round of employee bargaining agreements, was a very alarming discussion on what will become sky-rocketing costs for city retirees.

It appears based on the calculations that the city is looking at as much as four to six million dollars in additional costs for retirees over the next five years. That will put a huge strain on the yearly budget and probably force additional service cuts considering projections of a fairly flat revenue. All of this will be to pay for increases to employee compensation from the middle part of the last decade.

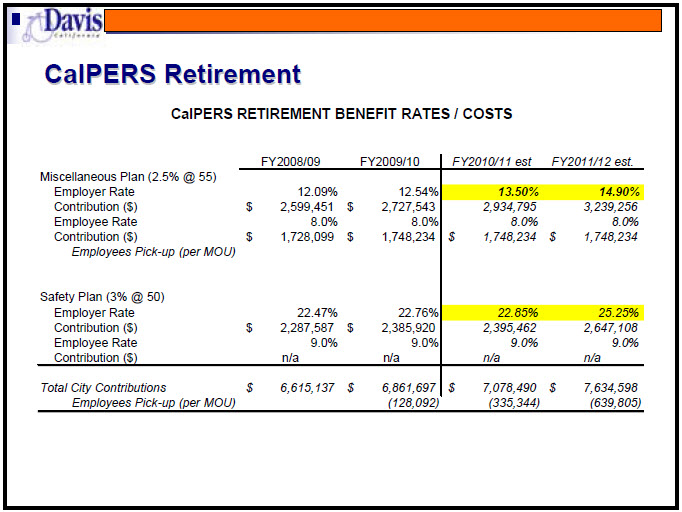

Let us begin looking at what happens to CalPERS Contribution Rates.

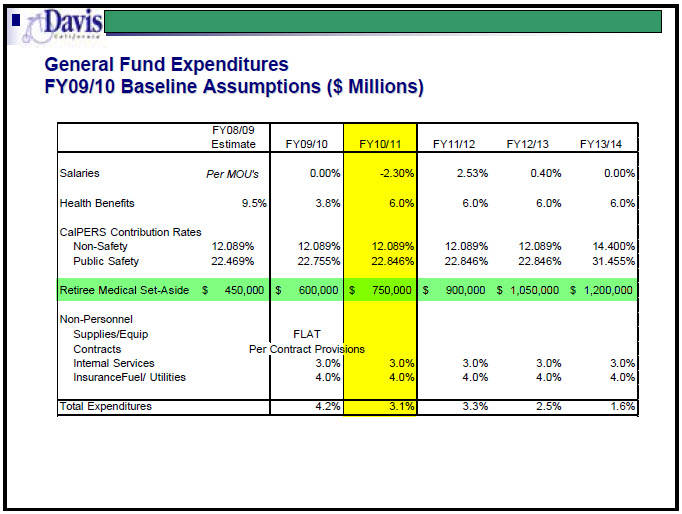

Here we see if you look at the contribution rates they are flat in terms of percentages for the next three years, but suddenly in Fiscal Year 2013-14, they jump up.

Said Paul Navazio on Tuesday night:

“On the safety side, rates are projected to be relatively flat largely as the rate smoothing but, what we built into this model, and it’s somewhat alarming, is an estimate of about an 8 or an 8.5% rate increase in the cost of the safety retirement cost beginning in 13/14 going from 22.8% currently to 31.5%.”

Somewhat alarming? That’s an understatement. That is greater than a 33% increase in costs on the employee side. Now the city has factored in a 3% buffer for increased costs for the non-safety personnel as determined by the MOU. But guess what, we have no buffer for non-safety costs.

What we see here is that without the huge increases, the city is looking at about a $300,000 increase this year, and a $600,000 increase next year. Extrapolate that out and we are probably looking at a budget hit of somewhere between $1.8 and $2.4 million by 2013-14. That means we are looking at between $9 million and $10 million of our general fund budget going to retiree pensions by 2013-14. And consider in the chart above, Mr. Navazio is projecting a relatively flat budget over that time. We will come back to this point.

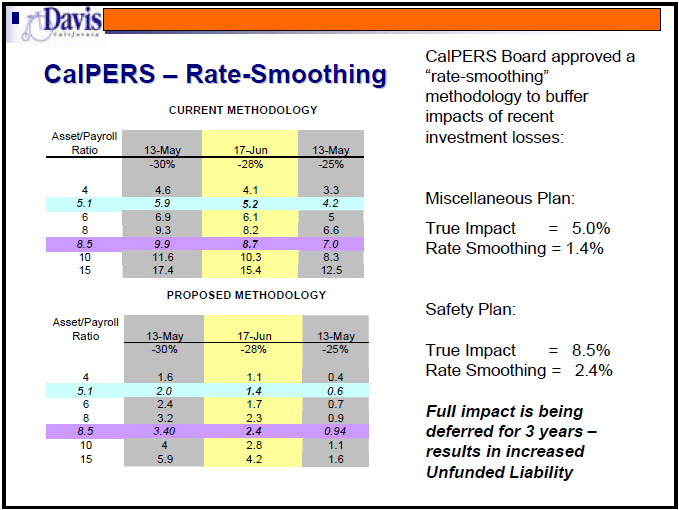

What is happening here is that CalPERS is trying to smooth out the impact of their severe losses from last year. The result is that the full impact of billion dollars in economic hits will be deferred for three years. So instead of paying the 8.5% increase for public safety and the 5% increase for non-safety (the first three of which is buffered by the MOU), we are only picking up 2.4% on the safety side and 1.4% on the miscellaneous side. CalPERS is gambling that they can make this work by turning about a 7.75% return on their investment over a 30 year period.

However, if they fall short, local governments like Davis will be caught with the tab. We talk a lot about the unfunded liability on the retiree health side, but on the pensions side, we are facing what may be a $20 million unfunded liability that will probably be factored into costs down the line.

Let’s examine the retiree health costs. As we have explained, the city currently faces between a $42 million and $60 million unfunded retiree health liability. That means that money that we have promised to city employees when they retire has not been funded at this point.

The city discovered this problem with new reporting regulations called GASB-45 which demonstrated to the city that benefits that were promised to employees were not presently funded and at some point the city would have to pay out money that they had not allocated. The city had been operating on what is referred to as a pay-as-you-go basis. They have recognized for some time that if they shift to fully-funding the benefits as they accrue, they save a sizable amount of money. The bad news though is that on a yearly basis the city’s costs will go up by several million on an all-funds basis, money that has to come from somewhere.

Paul Navazio explained:

“We budget and spend annually currently nearly $1.8, $1.9 million is the cost of the direct premiums for our active retirees. As you’re aware, we used to just budget on a pay-as-you-go, which meant we weren’t setting aside the money for the current employees so that the money’s there when they retire. The actuarial study showed us that based on different assumptions we were looking at about a $42 million unfunded liability and instead of budgeting the equivalent of 4% of salaries per year (which was the $1.8, $1.9 million per year), we would have to budget closed to 16% which is closer to $6 million. Hence were $4 million short on an all funds basis between the pay as you go and the full funding. What we’re in the process of implementing is bringing our total budget allocation each year for that benefit to roughly about a $6 million per year appropriation which is going to include continuing paying the premiums but about a $4 million cost and the general fund is about 60% of that. So about $2.4 million per year is what the general fund requirement is towards that unfunded liability.”

So the cost of the city to fully fund health benefits is somewhere around $4 million on an all funds basis and $2.4 million from the general fund.

We will get into what that means in a moment. But this is how it impacts the budget for the next four years.

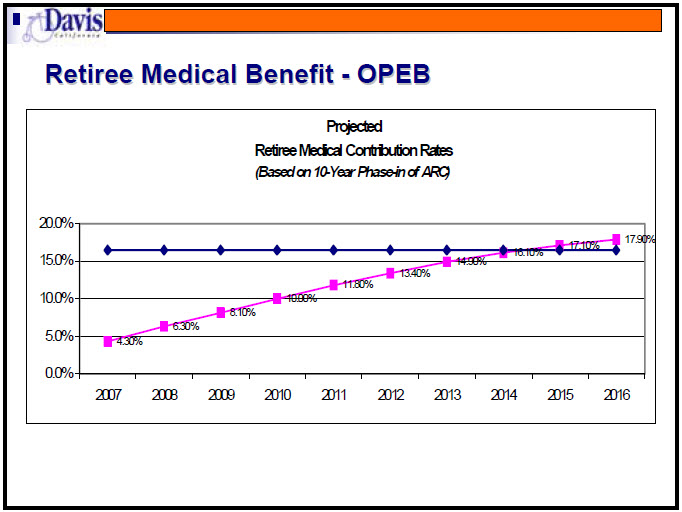

The blue line is how much it costs to fully fund and the pink line is our trend moving towards fully funding the benefits using a 10-year phase-in.

In dollars, we go from $450,000 in 08/09 to $1.2 million by 13/14 and that only gets us halfway there.

What is not clear is that if when we get to fully funded status, that means we are beginning to payoff from that $40 to $60 million in unfunded liability. Toward that end, Mr. Navazio tried to explain what full-funding meant. He said, it does not mean actually paying off the liability, but it means funding on annual basis what would enable the city to pay off the liability over a 20 to 30 year period of time.

However, it seems to me what we are talking about paying is not that $40 to $60 million but merely enough to fully fund current benefits promised rather than back-filling past benefits. I have additional questions about what that number means, is that a current deficit between what was promised and what was paid? Is it a projected deficit? Is that money in current dollars or future dollars? In other words, are we actually looking at paying a lot more than we are currently stating we will pay. What happens if health premiums continue to rise?

The bottom line here though is quite frightening. We are currently looking at doubling our retiree medical set-aside costs from the current budget to 13/14. We are also looking at perhaps a $2.4 million hit on PERS by 2013/14. That is $3 million additional dollars in budget that assumes very little increase in the cost of supplies and contracts and in a budget that assumes expenditure increases of 3% or less on annual basis, in other words, less than the cost of inflation.

To achieve that it looks like we will have to make more service cuts in the out-years to keep pace with the soaring costs of retiree benefits that were largely accrued and inflated during the middle part of the first decade of the new century. Worse yet, while they can assume a fairly flat contract provision, the current MOUs are only three year terms, which means they expire at the end of 11/12 and there will be a new contract for 12/13 and 13/14.

These costs are the tip of the iceberg, but they may result in further cuts in services. And the bill has not fully even come due in 13/14. And just wait, starting next year there will be a 23% increase in the cost of water for the ratepayers followed by a 20% increase the following three years.

By January 2011, we will have a new city council but they will have to deal with the consequences from the past city council’s policies for a very long time.

—David M. Greenwald reporting

Iceberg Ahead Captain !!!

(Iceberg struck, ship tilting..)

But city “leaders” and employees remain at the dinner table demanding the chef bring them their steak dinners!

Bankruptcy is straight ahead for so many cities, counties, and yes even States.. greed has done them in. We are in for a great realignment, and sadly Davis will not do what is necessary to avoid it.. After all, political careers are at stake! So the pandering to city employees continues.

One change which may come to Davis at some point in the future is retroactively removing some benefits for retirees or freezing the total nominal value of their benefits.

You might think this is illegal: that is, it would be breaking the deal you made with your retirees at the time they quit working and promised them would be in place the rest of their lives.

However, some California cities and counties, this year, have done just this. The most common tactic has been to require current retirees to pick up more and more of the nominal cost of their medical plans. Other agencies have said to retirees, “You no longer can get the best medical care package. You get this lesser package which includes large deductibles and copays. If you want the better package, you have to pay the difference in cost.”

Not surprisingly, these types of retroactive changes are being challenged by lawsuits. For example, this story from Santa Rosa: “Sonoma County retirees sue over health benefits.” ([url]http://www.pressdemocrat.com/article/20090922/articles/909229948[/url])

Personally, if it can be avoided, I hate the notion of retroactively taking away benefits or breaking other promises to retirees. It makes so much more sense to plan your budgets in the out years in advance and not promise any more than you can realistically afford. It also bothers me that these sorts of changes (by percentage of income) harm most those who have small pensions and harm least the fat-cats (like most of our firefighters) whose pensions pay more than most working people in our country take home in salary.

Rather than penalizing our retirees — if we can avoid it and if it is legal — I would prefer we save money by giving city employees a much stronger incentive to retire at age 65, unless they are disabled younger than that. That simple change would erase almost our entire retiree medical liability problem. … And if we ever have to harm the interests of people who are retired, I think in fairness we should set up our system so the retirees living on $13,500 a month pensions pay more in nominal added costs than the person living on a pension of $3,500 a month.

What is the origin of allowing safety employees to retire at age 50 or 55? When Social Security was enacted, the retirement age of 65 was selected because that was about the life expectancy at the time. Personally, I am expecting to work until I am 65 give or take… depending on my health. Like most Americans in the private sector, I do not have any ongoing pension or healthcare benefits. I have to save enough to cover those things.

We have a growing type of a new form of class separation that will be very interesting social phenomenon over the coming years: relatively young retired public employees who are more prosperous than just about every other segment of the population.

So, we know we screwed up ramping up pay and benefits. The many excuses for why we cannot easily fix this problem are why I dislike unions and I am so pissed with the federal government takeover of the health insurance industry. A private company dies when expenses exceed revenue and they can no longer borrow. Because of this, to survive, the company ownership and management will work to find the new equilibrium. We are way out of equilibrium with most of our public-sector pay and benefits; yet unions and politics prevent us from making the logical changes required.

Municipal Bankruptcy looks to be the only hope. Expect unions to ramp up their attorneys to fight this tooth and nail.

I wonder how a firefighter planning to retire at age 52 with 90% pay and full healthcare for the rest of his/her life feels with each report of another young teacher being laid off?

[i]”Municipal Bankruptcy looks to be the only hope. Expect unions to ramp up their attorneys to fight this tooth and nail.”[/i]

They are already doing this. The firefighters (CPF) paid big money to people like our member of the Assembly, Mariko Yamada, to make filing municipal bankruptcy far more expensive and far more difficult. Ms. Yamada even tried to rig the system in her bill by giving folks like her, who have been bought and paid for by the fire unions, a veto at the state level over municipal agencies’ decisions to file bankruptcy.

Fortunately, one Democrat in the State Senate stood up and rejected Ms. Yamada’s bill. That one Democrat was Sen. Lois Wolk of Davis. She was the only one. And the result of this was the firefighters (by way of Darrell Steinberg) had her removed from the Local Government Committee. Now there is no one in position to stop the CPF. All the rest of the Democrats who count are in their camp.

David, thank you for the informative posting. Jeff Boone is right. Some time ago, I heard a report on NPR about social security, and they said that when the retirement age of 65 was set, the average lifespan was 64. It was meant for the last few years of life. I’m 64 now, and God willing, plan to work for at least 3 more years. It is absurd to cash healthy relatively young works out in their fifties. Many people will be collecting retirement far longer than they collected wages. Unfortunately, Rich Rifkin is also right; people vote based on the number of glossy fliers they receive, and politicians like Yamada know where to go to get the money they need. I fear for my children’s futures.

This short mention at Tuesday’s dog and pony show was remarkably similar to Sue’s warnings going back several years while the majority crowed about ‘all is well’. And current projections similar to Lemar’s. Oh those disidents!

DPD: “What is not clear is that if when we get to fully funded status, that means we are beginning to payoff from that $40 to $60 million in unfunded liability. Toward that end, Mr. Navazio tried to explain what full-funding meant. He said, it does not mean actually paying off the liability, but it means funding on annual basis what would enable the city to pay off the liability over a 20 to 30 year period of time.”

I would love it if Mr. Navazio would speak in plain English for all of us po’ dumb folks who just are not sophisticated enough to follow his “creative bookkeeping” and clever “tap dancing” around the true nature of our budget problems.

DPD: “To achieve that it looks like we will have to make more service cuts in the out-years to keep pace with the soaring costs of retiree benefits that were largely accrued and inflated during the middle part of the first decade of the new century.”

You can only cut services to zero – and on the way down as you cut services, there will be much less need for the large number of city staffers this city has, no? The first to go should be those making the most money – upper management – but it won’t work that way.

DPD: “These costs are the tip of the iceberg, but they may result in further cuts in services. And the bill has not fully even come due in 13/14. And just wait, starting next year there will be a 23% increase in the cost of water for the ratepayers followed by a 20% increase the following three years.”

Bankruptcy is an option for cities, as Vallejo discovered, to force the renegotiation of labor contracts (unless laws are passed to limit the powers of bankruptcy judges – a very real possibility). However, bankruptcy has its downsides too.

But the bottom line is there are finite resources for infinite wants. Citizens of Davis can only pay so much in the way of taxes to pay for services, before it gets to the point where their collective pockets are picked clean. Then what? Reckoning time is growing nearer…

All the rest of the Democrats who count are in their camp

But Democrats get a pass these days. They are still living off the political capital of misplaced voter anger.

It is like we are stopped on the side of the road yelling that the guy who just sped passed us driving recklessly, while a bunch of guys in suits steal the engine and all our tires.

ever hear of double-dipping? many public employees, in particular, police, fire and the military, who retire at 50 or 55 and collect benefits also anticipate finding employment for another 5-15 years and collect another set of benefits.

nprice, check your facts.

There is an annual amount of hours you can work while still collecting CalPers benefits. They check that with SSN#. If you go over the hours, you do not get your CalPers. What other set of benefits (other than Social Security – SS) is there to obtain? If they go off and work for another municipality/agency they only build the CalPers retirement and that is the same “set of benefits”. If they go work in private sector, theorhetically they could get SS, but you pay for that…literally in the form of SS taxes.

Working for a municipality for years, getting the CalPers benefit, and then getting SS (if you are elligible – most Davis employees did away with SS in the 70’s) is not exactly double dipping.

A “double dip” would be someone who retires from Federal Service (military/post office/whatever), goes to work for a municipality and then gets *THAT* benefit too. Yes, that could be construed as a “double dip”. Seeing how one would have to suffer through both, I am not sure that is such an evil thing.