by Rob White

by Rob White

Over the past few months, the City Manager and other key staff have been presenting information to various community groups regarding the City’s structural budget shortfall over the next five years. The purpose of the presentations has been to provide information to parts of the community that may not otherwise typically hear about these topics. The groups have included service clubs, parent-teacher associations and homeowner groups.

Additionally, the City Council has discussed the topic many times at their meetings, information has been made available at the Saturday Farmer’s Market, the Finance and Budget Commission (FBC) has been discussing the issue regularly and several groups of citizens or community organizations have provided suggestions to staff for ways to create transparency and get the information out to the community. And of course, we have seen significant discussion on the Vanguard and in the Enterprise.

But because of the diversity in the Davis community, and because no one communication channel works to get the message out to the majority of the populace, it has been challenging to effectively educate and inform the broader community about the budget challenges and potential solutions.

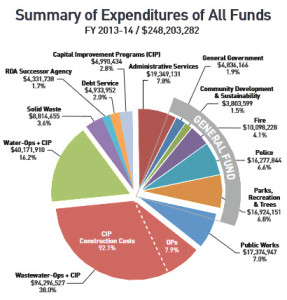

One item that has come as a result of these efforts is a simple one-page description of the budget, the current fiscal instability and some potential solutions. We are calling it the “Budget in Brief” and it is the result of many discussions with the City Council, FBC, community groups and interested citizens. You can find that one-pager here:

Additionally, the City Manager made a presentation to the City Council at its April 15th meeting with two more pieces of information regarding the current budget challenges: 1) proposed budget reductions and efficiencies that would result in a cost savings of about $1.1 million (here) and 2) a list of more significant cuts that would be needed if additional revenue sources were not enacted for the fiscal year 2014-2015 budget (here).

The proposed list is being recommended by the City Manager regardless of new revenue sources. These are efficiencies in operations and primarily vacant positions that are not mission critical to City operations, though they do reduce the capacity of current staff to address community needs as effectively as we might like to.

The list of more significant suggested cuts demonstrates just how substantial the budget shortfall has become and includes two scenarios: a 12.5% reduction across all city departments and a 25% reduction that did not include cuts to safety (Fire and Police). Depending on the scenario, the city would need to reduce staffing by between 40 and 47 positions, which would result in a savings of about $5.5 million annually.

To put the City’s staffing picture in to focus, the City Manager’s presentation also included a graphic that demonstrated that with the proposed $1.1 million reductions for the Fiscal Year 2014-2015 budget, the City would have 110 fewer staffing positions than it had for Fiscal Year 2008-2009. This results in a cost savings of almost $11 million year over year. Perhaps more telling is that the City’s staffing to provide community services was almost 9 City staff for every 1,000 population in the early 1990s, which dropped to about 7.4 staff/1,000 residents in Fiscal Year 1996-1997 and would be about 5.4 staff/1,000 residents if the proposed cuts are enacted for Fiscal year 2014-2015.

So what is my point?

First, to once again highlight that the City Council, commissions, staff and representatives from the community are all working hard to figure out how to close a structural budget deficit that will continue to grow and create worse issues if not addressed. (Note: a structural budget deficit is the result of continued projected growth in expenses that are not controllable based on one-time cuts or one-time revenue sources. For public agencies throughout California, much of the structural budget deficits were created by pension changes in the 1990s and early 2000s when the economy was doing much better and CalPERS was informing local governments that long-range investments were growing exponentially. Coupled with the worst recession in 75 years, and other pivotal decision points, it created much of the current fiscal problems we are experiencing at local governments across the State.)

Second, this is every Davisites problem. Solutions cannot be implemented without sacrifice on all accounts and budget cuts in the City government, no matter how small or large, will have a noticeable impact on programs and services.

Which brings me to the title of my article. I am sure that many of you had a parent or adult figure in your life that would use the phrase “if you’re not part of the solution, you’re part of the problem.” To me, that simply means that everyone affected by a situation needs to work together to implement a resolution.

We see this most readily demonstrated during times of crisis. Think about how the country pulled together after the Katrina Hurricane disaster, or in a more local example, after the 1989 earthquake in the Bay Area. We see some of the best of humanity at these times, where people demonstrate significant acts of heroism and common humanity without regard to self.

Of course, some live in that respect most of the time. And these every day heroes that help to provide relief to third-world countries and the locally less fortunate should be lauded for their efforts, even when it’s not highly visible as a result of cataclysmic disaster.

With respect to the budget shortfall, how can you be part of the solution? Start by becoming educated on what the issues are, how we arrived at this juncture and then help inform your neighbors, coworkers, and friends. City budgets are complex, require professionals to understand the nuances and have many legal and administrative requirements. But the more informed we all become, the easier it will be to discuss solutions and ideas. Resources that explain how local government budgets work can be found here.

If you have ideas on where cost-savings or efficiencies might be implemented, let the City know. You can do this through various means, including an email or phone call to the City Manager, attending a City Council meeting or talking to a City staff member at an event. Though no ideas are bad, some may be difficult to enact or not doable because of the complexity of how a city budget works, but your idea might also be a solution no one has thought of before.

Also remember that collaboration and partnership across the community is what will result in an effective process to get to a fiscally sound future. There is a significant lack of revenue to provide the services and infrastructure that have become hallmarks of the Davis community. Some of these service gaps have been filled by service clubs, community organizations and one-time grant funds. But the gaps have resulted from a severe economic downturn and a slow recovery, as well as social and policy decisions made by the community over several decades.

We can (and should) look retrospectively at the reasons for how we arrived at this challenging time for our City’s budget, but we also need to look ahead and identify what can be done to fix the issues.

Some of that is being done now with budget reductions and additional efficiencies. Community groups are taking on more and more of the tasks previously provided the City. And the community as a whole is becoming accustomed to the reality that solutions to many of our issues will require more volunteerism to address the growing backlog of needs.

The community will also have an opportunity to weigh in on a new revenue source in the coming election through a 6 year sales tax increase of an additional ½ percent (a total of 1 percent). This could provide about $3.5 million in additional annual revenue to the City’s budget and give the community a small window of opportunity to identify and enact long-term solutions.

And for the long-term, the City Council has directed staff to identify opportunities for increased property and sales tax through growth of the local businesses. This includes the technology businesses you probably read about on an ever-increasing regularity – large companies like Marrone Bio Innovation, FMC Schilling Robotics and DMG Mori, as well as smaller companies like Mytrus, Engage3 and BioConsorita. It also includes downtown retailers and restaurants, businesses in our neighborhood shopping centers and startup companies of all kinds.

The community has also engaged in the discussion of a new innovation park that might be built on the edge of the City. Several locations have been identified as potential locations and the at least two groups have publicly expressed interest in creating a 200 acre innovation park as a place for our rapidly growing technology and research companies to locate without leaving Davis.

This has the potential to create 1000s of new jobs, millions of dollars of additional annual revenue for the City and support the continued research mission of the university on global solutions in areas like agriculture and medicine. But any proposal would require a vote of the community and this is again where you come in and can be part of the solution… get informed on the discussion, engage in the process and provide your input to find the best solution for the community as a whole.

Thanks for considering these thoughts. I look forward to your comments and questions. My email is rwhite@cityofdavis.org if you choose to email me directly.

rob – i always considered the expression trite. after all, being part of the solution or the problem is subjective, not objective. to use an unfortunate analogy, we may have to destroy the village in order to save it.

reading david’s piece makes me wonder if community engagement can work when council is liable to listen to the loudest voice in the room.

the numbers in the budget are ugly. but maybe we need to shut down people’s parks, greenbelts, and pools in order to get their attention. because right now, i don’t think a parcel tax passes.

the numbers in the budget are ugly. but maybe we need to shut down people’s parks, greenbelts, and pools in order to get their attention. because right now, the city is headed toward bankruptcy without urgent and robust economic development.

DP

I hope that you are wrong and that the parcel tax will pass. What ever else may be true, we, as voters will most assuredly get the city that we deserve.

FWIW, a parcel tax is needlessly unfair. An ad valorem bonded property tax increase, while still not ideal, is many times more equitable than a parcel tax.

I have been pondering this Rich… Do we know for sure that is true (more equitable)? I say this because an ad valorem tax is imposed per $X assessed value so those who have been in their homes for many years benefit (ceteris paribus) because of the lower assessment. I am not saying I disagree but is it unambiguously more equitable? It would be interesting (and useful) to assess this empirically across all Davis properties.

Robb, the ceteris paribus issue you illustrate here also applies in water rates in California. The component of the Fixed Fee in any water rate structure that covers Fire Readiness realistically provides value to each rate payer as fire insurance. As such, it would make a lot of sense to use the assessed value of a property as the basis for the “insurance premium” for the Fire Readiness component of water rates. Unfortunately, because of Prop 13, assessed values in California do not correlate to current reality, only to historical reality.

Robb, it is fairly close to equitable. But due to Prop 13, it is somewhat unfair, all else held equal, to Neighbor A, who bought his house in 2007 and Neighbor B, who bought his identical house in 1983. Neighbor A’s house is assessed much higher and he will pay a higher ad valorem tax.

Yet, it is still far more equitable than requiring the person with the small cottage in Old East Davis, for example, to pay the same parcel tax as the guy who owns a McMansion on Montgomery Ave. or a McEstate near Lake Alhambra.

Presumably, better roads and other public infrastructure raises everyone’s property values by some X%. So if Property X is worth twice as much as Property Z, X will benefit twice as much as Z if the streets are in good repair. I would think, then, that X should pay twice as much as Z.

Rifs

Please explain. I am not familiar with an ad valorem bonded property tax increase.

As you know, a parcel tax charges a fixed amount–say $200–to every property owner, regardless of the size or value of his property. An ad valorem tax is based on the assessed rate.

Yes, our assessed rates are not totally fair, because of under Prop 13. Nonetheless, in most cases, an ad valorem tax costs twice as much if your property is worth twice as much.

For example, under an ad valorem tax a house in Lake Alhambra Estates which is assessed at $1.2 million would pay twice as much as a house assessed at $600,000 in Mace Ranch, and a small cottage downtown worth $300,000 would pay one-fourth as much as the Lake Alhambra property. Likewise, with commercial properties, a small business in a converted house would owe much less than a major manufacturer like Mori Seiki with an ad valorem tax.

The reason I mention a bonded property tax is because, under Prop 13, you cannot raise property taxes above (our current) 1% of assessed value, unless the tax is used to pay off a bond. So what is being suggested–this was not my idea; it was something the City offered for consideration in January–is to float a long-term bond (say 25 years) which produces say $2 million in revenue every year. The ad valorem tax would then be imposed in order to pay the principal and interest on the bond every year for the 25 years.

It sounds like someone is trying to come up with a fancy way to get around Prop 13’s limitations. But Davis leaders and citizens created much of this problem.

1. By saying no to numerous businesses over the years for multiple reasons.

2. By adding numerous added services, benefits, and amenities that many communities don’t have.

Will this newfangled bond approach be used to pay off the $1 Million used for a fancy utility study, to pay for deteriorating roads, and any other desire of the day?

“It sounds like someone is trying to come up with a fancy way to get around Prop 13′s limitations.”

That is false. If you read Prop 13, the bonded ad valorem tax is written into the proposition’s language. It is in one of the first couple paragraphs.