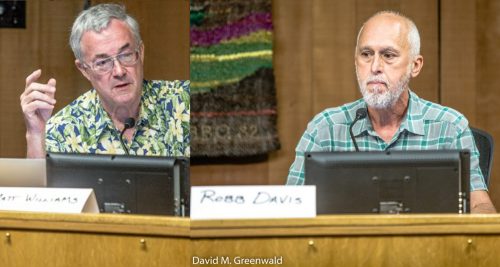

On Saturday afternoon Mayor Robb Davis took the time to provide eleven (11) responses (see LINK) to the eleven specific points I had made in my earlier comment (see LINK) Saturday morning. I thank Robb for doing so, and particularly thank him for the structured format he used to reply.

This is the third in a series of articles in which I will respond to all eleven of Robb’s points. I believe that covering them one-by-one will produce a more focused and fruitful dialogue. The first response can be viewed HERE. The second response can be viewed HERE.

Matt: Nishi 2018 has no dollars for deferred maintenance of capital infrastructure.

Robb: See previous point. We don’t need it because the developer is responsible.

Matt: That is the same short-sighted, politically-driven thinking that created the current dilapidated state of our roads and the $8 million annual shortfall in the City Budget.

Robb: That is an editorial comment to which I will not respond.

The interchange above is at the heart of the City’s current unsustainable fiscal situation. Past Councils for well over a decade have ignored the advice of Staff regarding the maintenance of the City’s capital infrastructure. The year-by-year individual circumstances have differed, but the behavior pattern was the same. Over and over again, the Council chose to avoid a public dialogue about the fact that our City’s appetite for spending exceeded its annual income.

When faced with a choice between (1) spending the Staff-recommended dollars on roads and buildings maintenance, and (2) telling the citizens/taxpayers that we needed to draw down the City’s General Fund Reserve below 15%, they chose not to have the public dialogue. Why?

Public discussions about the fiscal sustainability of a City you were elected to serve are always difficult. Politicians see them as politically dangerous, because voters have been known to shoot the messenger. So the “wise” political move is often to maintain the illusion of a healthy General Fund Reserve balance by ignoring the professional advice of Staff about spending money on capital infrastructure maintenance. The result is an increase in Deferred Capital Maintenance. After a decade of deferred capital maintenance the roads begin to develop serious cracks and potholes, and the new Fire Chief, Nate Trauernicht, when conducting a winter inspection of the 5th Street fire station during a rain storm finds water pouring into the station through holes in the roof.

The circumstances are different, but Robb is falling into the same pattern of behavior when he says “We don’t need it because the developer is responsible.” He is only looking at the on-site capital infrastructure. Under the provisions of the Development Agreement, the Nishi site owners are indeed responsible for roads and bike paths maintenance. They are also responsible for the on-site parks and open space (their urban forest, the proposed mitigation of the air quality impacts of I-80). However, as EPS clearly outlined for the City in its Nishi 2016 fiscal analysis, capital infrastructure maintenance is not limited to the boundaries of the site. By applying for annexation into the City of Davis, the Nishi developers are clearly, and explicitly, saying that they see value in becoming part of the whole community of the City of Davis. They see value in their residents being part of that whole community.

The Nishi developers are not being forced to seek annexation to Davis (although there are definitely are practical reasons to do so … I wouldn’t want to be accused of a red herring-ism) They have an alternative. They can file their project application within their current jurisdiction, YoloCounty. However, they have chosen not to do so. That is their choice … just as it is the City of Davis’ choice to look at the application with the whole City in mind, not just the boundaries of the specific site in mind.

That means the maintenance of the whole capital infrastructure of the City needs to be considered, for example

- the network of roads that the 700 cars in the 700 Nishi parking spaces will use

- the network of greenbelts and greenbelt pathways that are so much a part of the “whole community”

- the system of parks with their soft and hard surfaces and structures

- City Buildings, and their components like roofs.

- Police cars

- Fire trucks

These are the components of capital infrastructure maintenance that have been deferred by past Councils, with the result being the $8 million recurring annual shortfall identified by Bob Leland in the Forecast chapter of the 2017-2018 City Budget. Our current Council is attempting to be open and transparent about the magnitude of that shortfall. They are working hard to not repeat the errors of past Councils that created that shortfall, which makes the willingness to be short-sighted about Nishi all the more bewildering. The City’s economic/financial consultants EPS/Plescia/Goodwin,working with the FBC mapped out a plan for Nishi’s financial contributions to the City that was at the same 1.6% Effective Tax Rate of the just recently completed Cannery development (and Cannery wasn’t even asking for the value of annexation). The question that Robb and the Council have not answered is Why are we not analyzing the financial contributions of this current Nishi development with the same thorough fiscal thought process.

Matt: Guess who picks up the fiscal difference … Davis taxpayers.

Robb: Which fiscal difference?

The simple answer to that question is … the fiscal difference between the narrow perspective of the specific site versus the broad holistic perspective of the whole community. That whole community that the Nishi developers see value in being annexed into.

Past Councils looked at the costs of maintenance of the City’s capital infrastructure from the narrow perspective of the political consequences of drawing down the General Fund Reserve in order to pay for the maintenance Staff was recommending. If they had look ed at those maintenance costs from the whole community perspective, we probably would not be in the current situation of both crumbling roads and buildings and a budget shortfall.

I have yet to see anyone challenge Matt on the facts, in this series of articles. Looks like there’s eight more articles to come!

Every property owner in the city pays taxes that support roadway maintenance. That is not in question. The policy issue (not fact issue) is whether a new subdivision should pay a different rate of taxation than other parts of the city for that purpose. Robb is correct in my view: there is no “fiscal difference.”

Don chooses to overlook the key difference between Nishi and all the parcels already within the City Limits. None of those parcels are asking for the added value associated with annexation to the City.

That’s been true since ‘earth was new’… anything other than original “Davisville” was annexed… none paid a “value added” tax for the ‘privelege’…

Philosophially, I am opposed to the notion that the property owner seeking annexation should pay such wehrgelt.

The other difference is that you end up with a huge risk of pumping in money on the planning process and not being able to do a project.

Howard, although I don’t personally agree with him, FBC Commissioner Ray Salomon has been consistent in his repeated argument that the best solution for Nishi is for it to be developed under its current status as part of unincorporated Yolo County. That is a legitimate option for the developer … one that they have chosen not to take.

Another option they have is to do their project in concert with UC Davis.

Under the rules of LAFCO a request for annexation by a parcel or a jurisdiction does not get a default answer. There is a process.

If the world were a static place, I would agree with your statement, “That’s been true since ‘earth was new’… anything other than original “Davisville” was annexed… none paid a “value added” tax for the ‘privilege’…” But the world is not a static place, and Critical Thinking was invented as a logical way to handle the assessment of information … especially new/updated information. You more than any Vanguard poster know the history behind how our beloved City got into the current mess we have with lotsof deferred maintenance, crumbling streets and buildings, and a $8 million annual Budget shortfall. It is time for some serious Critical Thinking.

David Greenwald said . . . “The other difference is that you end up with a huge risk of pumping in money on the planning process and not being able to do a project.”

I personally believe that is very clear evidence that we have a process problem. For example, we have one apartment project already approved at 5 stories, Lincoln 40. A second project being currently reviewed with a 7-story height, Davis Live. And a third project application where the developers are saying that anything over 3-stories is fiscally infeasible.

Our City has (A) a dysfunctional General Plan, and (B) a planning history where 61.5% of the surface area of Davis shows that the provisions of its underlying “standard” zoning has been negotiated away. That sends a clear message that no current zoning or General Plan designation can be relied on, and everything is subject to negotiation.

That is where the “huge risk of pumping in money on the planning process and not being able to do a project” lies.

Yes, it is now known as Measure R.

Nah, the General Plan is fine, though significantly overdue for a ‘refresher.’ What is dysfunctional is our collection of highly involved ‘activists’ who don’t bother reading the General Plan (and other foundation documents and supporting State laws) and push their own agenda, regardless of the impact on the community or our long-term planning.

Matt, like many others before him, is pushing his personal agenda while looking to spend other people’s money to make it happen. I suggest he offer to buy the Nishi property from the current owners and put forward his own project that fits his criteria, instead of trying to force someone else to fund his personal desires.

The current Nishi project is what we get with Measure R in place. If you don’t like the project, change the law.

Actually Ron, today’s article addressed three of Robb’s points, and yesterday addressed two, so the maximum number of additional articles is five. However I suspect it will only be three.

With that said, if Robb publishes an article that makes good on his promise to the audience at the May 6th CivEnergy Forum, the article trajectory might be adjusted.

Matt’s been challenged many times on many fronts. You’re making a false claim.

David, I agree with you that I have been challenges many times on many fronts, but rarely on quantitative data. My qualitative beliefs are always subject to challenge, just as yours are. Qualitative beliefs are like sphincters, everyone has one.

With that said, challenging me on the quantitative data doesn’t accomplish much. The right audience for such challenges is David Zehnder of EPS, Dave Freudenberger of Goodwin Consulting Group and Andy Plescia of A. Plescia & Co.

So, I have a full time job. Was home at 11:30 last night after a CC meeting that started at 5:30. I will be involved in CC business each night this week on various projects (though I hope to sneak a dinner with my wife at the Farmers’ Market tonight).

I do not intend to respond to Matt further.

However, I do not want to be accused of failing to keep promises so what, exactly, did I promise the audience at the CivEnergy Forum? I honestly do not recall. I am sure you will take the time to find my exact words of promise and put them on this post. Thanks.

Thank you for your service Robb

Robb, I concur heartily with Jim Hoch … thank you for your service.

To address your request in your third paragraph above, yesterday’s article (see LINK) contains the embedded video, which starts at the point where you made promise. I’ll try and embed that video here. Embed definitely works in articles, but may not work in comments. [embed]https://youtu.be/harD_iY1w8w?t=5887[/embed]

’embedment’ seems to be “no go”… but a copy/paste of the link works… thx…

I incorrectly identified the CSD as a CFD during the forum. A CFD is typically used to finance infrastructure up front and is often used to bond to move expenditures forward with a revenue stream to pay them off over time. A CSD is typically used to provide resources for replacement/maintenance of infrastructure. I erred in referring to the CSD as a CFD and regret the error. It was not my intent to lead anyone astray or confuse the issues. I was merely suggesting that a revenue stream to cover the costs of replacement was in place.

In the current project the developer is taking on many of those costs—those related to physical infrastructure on the site that would typically be covered by the general fund or special funds like the parks tax and, if it were to pass, the road/bike path infrastructure path. Though the owners of Nishi would pay those taxes if the project is approved (and the tax measures are), the money collected there would be not be used for infrastructure there since the developers have agreed to cover those costs.

CSD’s… not as familiar with those, compared to CFD’s… are seeming to be insidious… appears to be a ‘blank check’… locked in to contribution, see no evidence that the rates are capped. City CFD’s can be ‘bought out of’ (done that, both citywide and Mace Ranch)… DJUSD’s can’t be bought out of… apparently…

Am guessing CSD’s are open ended, and, like, forever… not good public policy, in my opinion… if I was in a SD, doubtful I’d ever vote for a parcel tax, eithe City or DJUSD…

Technically, per IRS, CFD “taxes”, aren’t… therefore not deductible (at maybe 15 cents-20 cents on the dollar, based on your tax bracket)… they had not been rigorously enforcing that, tho’… no telling what it will look like with tax code changes, and limits of what is deductible…

Perhaps the DV could explain more about CSD’s, with cites to the enabling codes…

Robb… you owe no apologies, as you pretty much nailed the definition of CFD’s quite well… as others have said, thank you for your service these last four years, and best wishes for you and yours moving forward… will miss your reasoned/thoughtful voice on CC.

I agree with Howard, Robb has nailed the definition of CFDs and explained the very understandable confusion that existed at the May 6th CivEnergy Forum. Thanks for taking time in your busy schedule.

Regarding Howard’s request for more information about CSDs, there really isn’t much, as they are a very new financing device. When the Finance and Budget Commission first suggested one as a way to address the $106,000 per year deficit that EPS had initially projected for the Nishi 2016 project, EPS/Plescia/Goodwin, together with the City Attorney had to do some research to determine whether a CSD would pass legal muster. They reported their findings to Council, which included a name change from Community Services District to “Land-Secured Financing District for Services” which was incorporated into the Baseline Features document, the Development Agreement, as well as the February 16, 2016 Staff Report (see http://cityofdavis.org/home/showdocument?id=5181)

“Nishi 2018 has no dollars for deferred maintenance of capital infrastructure.”

Matt, your accounting is wrong. You are asking current residents to double pay for infrastructure–first to recover the costs of the initial investment, and then again to pay for the replacement infrastructure that future residents will enjoy. In ratemaking at the CPUC (where I have spent 3 decades intervening), the utilities are never required to prepay replacement of capital infrastructure. The depreciation allowance (return of investment) goes, along with the return on investment, to shareholders and bondholders to repay that initial investment. The same will be true at Nishi or any other new development.

They may not be paying for replacement in place, but that’s not the analysis that you’re presenting here. That would be a short in taxes that all other city residents are also incurring (which is apparently occurring, but needs to be fixed separately.) In other words, the problem is not unique to Nishi.

Please drop this line of analysis because it is simply incorrect.

I respectfully disagree Richard. You appear to be applying corporate financing principles to individual homeowners.

I do wholeheartedly agree with your statement that “That would be a short in taxes that all other city residents are also incurring (which is apparently occurring, but needs to be fixed separately.) In other words, the problem is not unique to Nishi.”

If you have a quibble with the fiscal/economic analysis, then that quibble is with EPS who put the original Nishi 2016 analysis together that initially showed a $106,000 per year deficit. Based on that analysis the Community Services District (CSD) approach totaling $635,000 per year (1) was proposed by the Finance and Budget Commission, (2) validated by the EPS/Plescia/Goodwin consulting team, (3) in conjunction with staff and (4) the City Attorney, and (5) mutually agreed to by the developer and City Council (under the modified name of a “Land-Secured Financing District”). It had the same fiscal impact as a CFD, but was a proactive maintenance of homeowner/taxpayer value rather than a retroactive give-away to the developer. And it accomplished it with 0% closing costs rather than 20% closing/reserve costs and 0% annual interest rate rather than 6% annual interest rate.