Seven ways in which the City and the Yes on Measure H campaign make DiSC 2022 appear economically far rosier than is likely.

by Matt Williams

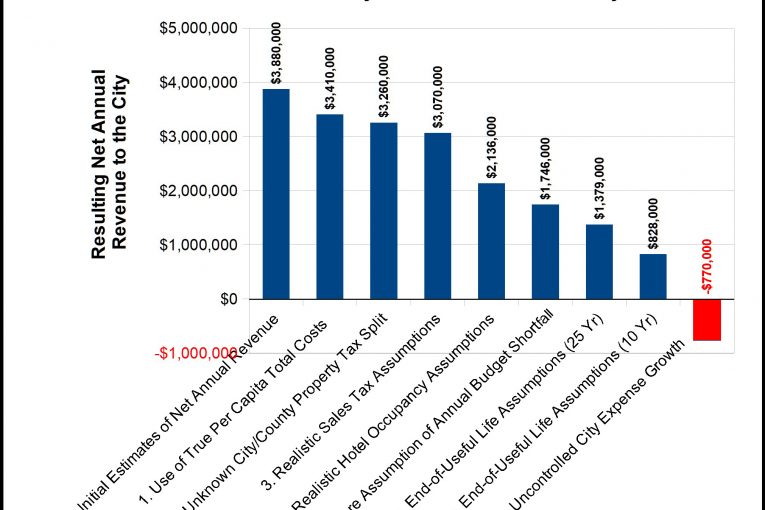

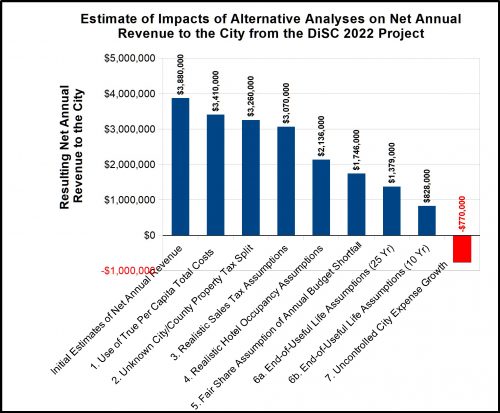

The City and the Yes on Measure H campaign literature for the DiSC project emphasize that one of the important benefits to the City of Davis General Fund is a “$3.9 million net revenue gain for the City of Davis annually to address the city’s $7 million funding gap and maintain our quality of life without a tax increase.”

The net annual revenues projected to accrue to the City that have been presented to the voting public use the most optimistic “best case scenario” to make their pitch … but other less rosy scenarios exist. During the December meeting of the Davis Finance and Budget Commission (FBC), Commissioner Jacobs suggested multiple times that it would be helpful to City Council if the consultant were to run the analysis using a worst-case and best-case scenario. Unfortunately, that suggestion was not implemented by the  City.

City.

Scenario analyses are particularly valuable here in Davis because, for a variety of reasons, past development projects in the City have rarely yielded the revenues the City expected to them to produce. The $3.88 million surplus projected for this Measure H project may be the theoretical best case, but it does not recognize potential adverse impacts on this rosy projection. As shown below, if all of the seven impacts quantified in this document are considered, net annual revenues to the City could actually result in a deficit of $770,000.

Where can that $3.9 million projection be found?

The source is the December 2021 financial analysis prepared by Economic & Planning Systems, Inc. (EPS) the City’s financial consultant, that was presented to the FBC in December 2021 (see full report HERE)

Alternative Analyses Requested by the FBC

The FBC immediately saw three problems with the EPS financial analysis and, prior to its December meeting, asked EPS and City staff to prepare three additional analyses using alternative assumptions. Those three analyses had the potential to significantly reduce the projected $3,880,000 (the “$3.9 million” in Yes on H literature) as follows:

1. A more representative accounting for the City’s Total Costs decreases the City’s projected Annual Net Revenue by $470,000 (see EPS’ Summary A report HERE)

The original EPS financial analysis assumed that the Total Costs of providing services (including fire and police protection and other social services) to the DiSC 2022 project on a per-person basis will only be 75% of what the City spends per-person currently. FBC analyses of the City’s true cost of providing services to projects like DiSC that add to the City’s population show the true Total Costs for City-provided services are greater than (not less than) the per-person existing costs of the City. Including costs at 100% reduces the projected net revenue by $470,000 … from $3,880,000 to $3,410,000.

2. Accounting for the Current Unknown Status of the City/County split of Property Taxes Reduces Annual Net Revenue by $150,000 (see EPS’ Summary B report HERE)

In its original analysis EPS assumed a 50%/50% City/County property tax split. But FBC correctly pointed out that the County has not agreed to this percentage, and the County could deny annexation of the property by the City until a more favorable tax split is agreed upon. When EPS assumed a more conservative 40%/60% City/County split, the net revenue to the City is reduced by $150,000, which further reduces the $3,410,000 to $3,260,000.

3. More realistic Estimates of Retail Sales Tax Generated Decreases the City’s portion of Annual Sales Tax Net Revenue by $190,000 (see EPS Summary C report HERE)

The EPS analysis initially estimated sales tax revenue received by the City from retail sales at DiSC 2022 based on an 80,000 sq.ft. retail area. The FBC found this square footage assumption to be unrealistic. An alternative analysis based on 50,000 sq.ft. of retail reduces sales tax revenue to the City by $190,000, which reduces the $3,260,000 to $3,070,000.

It is worth noting that both the January Staff Report to the Planning Commission and the February Staff Report to City Council only report the $3.88 million figure (see Introduction and Background above), omitting these three alternative scenario analyses requested by the FBC.

Other Alternative Analyses Discussed/Performed by the FBC

There are several other scenarios that the FBC members discussed that would reduce net revenues to the City even further, but which were not formally documented by the City’s financial analyst.

4. Accounting for Realistic City-Wide Hotel Occupancy Reduces Annual Net Revenues to the City by $934,000, which is the amount EPS estimated for DiSC

Local hotel operators have stated unequivocally that the only way a hotel at DiSC will achieve the 85% occupancy used in the EPS analysis is by cannibalizing existing hotel stay days from Davis’ current hotels. The hotel operators were quick to point out that the Development Agreement stipulates that a current hotel demand study must be completed showing sufficient demand before any hotel can be built at DiSC. Cannibalized hotel stay days do not generate any net additional revenue to the City but only shuffle existing revenue from one hotel to another hotel. Addressing that concern reduces the net revenues by an additional $934,000 to $2,136,000.

5. Including DiSC’s “Fair Share” portion of the City’s Annual Budget Shortfall Reduces Annual Net Revenue by $390,000

The City’s $14.5 million annual budget shortfall was not included in the EPS analysis. In addition to the benefit of all the good attributes of our fair city, DiSC needs to be responsible for its “fair share” portion of the problems Davis currently has with its crumbling streets, cracked bike paths, and poor building maintenance. Adding DiSC’s proportional “fair share” of the $14.5 million Budget Shortfall increases project costs by $390,000 per year, which further reduces the $2,136,000 net revenues to $1,746,000.

6a. Accounting for End-of-Useful Life Repair/Maintenance Reduces Annual Net Revenue by a minimum of $367,000/year

FBC members believe strongly that all projects should be responsible for the End of Useful Life Repair/ Replacement costs of the project’s roadways and infrastructure. Using a 25-year useful life, which is extremely generous to the developer, the annual amortization of these costs is $367,000 per year, which further reduces the $1,746,000 to $1,379,000.

6b. Accounting for End-of-Useful Life Repair/Maintenance using a More Realistic Amortization Period Decreases Annual Net Revenues by Another $551,000/year

Road repair or replacement activities typically happen in less than 10 years, so use of a 25-year useful life is unrealistic. Using a more realistic 10-year useful life, the annual amortization costs increase to $918,000, which reduces the $1,379,000 by another $551,000 to $828,000.

7. Recognizing the City’s poor record of budget management argues for caution in accepting the City’s net revenue projections. An adjustment based on this history could be as much as $1,598,000

The DiSC financial analysis ignores the long history of Davis government’s inability to control costs. The Forecast section of the annual City Budget shows that revenues are expected to rise by 2.5% each year, and expenses are expected to rise by 3.5%. If we apply those growth rates to the DiSC project, this reduces net annual revenue from $828,000 to $348,000.

Unfortunately, a review of the actual City Budgets since 2015 shows that the five-year rolling average increase in the City’s expenses has been 4.0%, 8.1%, 7.2%, 9.5%, 10.4%, and 10.3%. Every one of those 5-year averages is above 3.5% … some are far above 3.5%. Moreover, we are entering a new inflationary period. If the City’s expenses increase not by 3.5%, but by 4.5%, this eliminates another $533,000 of net revenue., and the $348,000 positive net revenue becomes a -$185,000 net revenue deficit. If expenses rise by 5.5%, this eliminates another $585,000 of net revenue, and the $185,000 net revenue deficit becomes a -$770,000 annual net deficit. It gets even worse if 8.1%, 7.2%, 9.5%, 10.4%, or 10.3% are used.

Summary

The following is a chart and supporting data table showing the expected reduction in net annual revenues to the City and the resultant final estimated financial gain/deficit to the City based on the above analyses.

Afterword

It is worth noting that the above analysis covers only a portion of the substantial impediments to achieving the theoretical best case. The ones selected are those that have been quantitatively analyzed. Over the past 24 months then-current members of the FBC have raised a number of additional questions that were not quantitatively analyzed, such as the following:

- Commissioner Sufi questioned whether the assumption that only for-profit businesses will be located within the project is reasonable given that many non-profit and governmental organizations are currently located along the Second St. corridor?

- Commissioners Harrington and Axt expressed concerns regarding the impact that COVID-19 may have on occupancy of the commercial space, including the proposed hotel, and suggested doing a worst-case scenario analysis that takes the impact of COVID-19 into account.

- Commissioner Sufi stated his concern that there are challenges to ensuring that this project ultimately becomes a true innovation park and not a commercial park and asked what steps the city would take to ensure that happens.

- Municipal Service Tax revenues in DISC 2020 were projected as $103,000 per year. In DiSC 2022 Municipal Service Tax revenues are projected as $505,000 … five times greater than for DISC 2020, a project that is half the size. Why such a massive change?

- Commissioner Salomon questioned the substantially higher valuation of the commercial properties compared to other similar properties in the region. This has the net effect of increasing property tax revenues greater than what would be received if valuations were lower consistent with prevailing current real estate conditions.

Closing Question for the Voters

Why was it so important to the City to suppress/hide the less-than-best-case scenarios that the FBC requested and EPS delivered?

Several notes:

– Presumably hotel visitation will increase. Regardless of where that occurs, TOT revenues will increase.

– There will be a split of property taxes between the County and City. It will not be 0% for the City, so a realistic value must be assumed. If not 50%, then present a reasonable estimate.

– Business to business product sales from the facility will be taxable. Is this amount included in the sales tax revenues? Note also that the sales of construction materials at the site also will generate sales tax revenue increases. This is often overlooked. (I’ve calculated the amounts for solar projects built in several counties.)

– I’m not sure what’s being included in the End of Life replacement beyond standard annual maintenance. But so long as large scale capital projects are debt financed, it is inappropriate to collect future replacement costs prior to replacement. That makes current residents/customers pay twice for the capital investment, first through repaying debt and equity investment and again in paying into a sinking fund for future expenditures. This also subsidizes future residents/customers by relieving them of the payment obligation of using those assets.

In addition most assets have much longer lives than typically used for depreciation schedules. Unfortunately depreciation schedules don’t distinguish among deterioration/failure, obsolescence and accommodation of growth. Each of those require different treatments in calculating economic costs.

If those costs are not assigned to the development, who else is ultimately going to pay for it? The rest of the city, for example?

This assumes that those specific future residents (of the development) would be the ones solely responsible for that replacement, vs. the entire city. Is there a mechanism that you’re proposing to ensure that occurs?

And if future residents of the development are “subsidized” by the initial residents, wouldn’t that be a consideration in the value of the property sold or rented to the subsequent residents? With the resulting, increased value being received by the initial residents?

Richard, you are correct in your hotel point. The difficulty is deciding on an approximation of what that increase will be. It certainly will not be the full 100% of the EPS projection of 85% occupancy of the new hotel. Further, the project EIR document states …

.

Regarding the Tax Split, if you read the EPS document created for the FBC at their December 2021 meeting, they used a 40-60 split as a reasonable alternative, as well as a 60-40 split.

Yes, EPS did include Business to business product sales in their projection.

As you know full well the whole purpose of scenario analyses is to identify situations that could produce results other than the best case (or for that matter the worst case). A well executed scenario analysis will assign probabilities to the various scenarios and then look at the continuum.

That leaves us with the question “Why was it so important to the City to suppress/hide the less-than-best-case scenarios that the FBC requested and EPS delivered?”

Matt

Absolutely agree that presenting a range of scenarios with explanations about what underlies those scenarios is key. Unfortunately, I’m not sure the FBC has a done a good job of making that presentation either, because there are rosier scenarios as well. If these were presented, the City could then have a fuller discussion on the risks versus benefits of the investments. But also unfortunately, these discussions require a degree of attention and sophistication that most voters can’t really bring to vote intelligently. That’s a key reason why I see the current Measure J/R/D form as counterproductive to creating a vital and thriving community here.

I don’t believe I would put that responsibility on the backs of the FBC Richard. The City developed the scope of work for the financial analysis prepared by EPS. if there were rosier scenarios, then Why was it so important to the City to suppress/hide those rosier scenarios?

Great analysis, Matt. Glad that you brought up the hotel, given that they just built a brand-new one right across the street from the proposed DiSC site. As well as two other new hotels around town.

DiSC would create a housing shortage (if the commercial is actually successful), per the EIR (despite the inclusion of 460 housing units onsite). And yet, neither the fiscal, environmental nor traffic analysis addresses the impact of that increased demand, or how it would be accommodated. (The EIR concluded that demand would be created for 1,269 additional housing units that won’t be provided onsite.)

The additional demand for housing created by DiSC would facilitate even more sprawl on prime farmland, outside of a logical boundary for the city. Already, the city is entertaining the possibility of the massive Shriner’s proposal and Palomino Place. Eventually, the “other half” of DiSC would likely be proposed for that same fate, if the current proposal is approved. (I understand that the DiSC proposal would also result in the site of Ikeda’s fruit stand being incorporated into the city – probably resulting in its subsequent demise for that use.)

The state will also consider the number of “new jobs” created, when assigning Davis its “fair share” housing requirements during the next round. And yet, Davis is already having difficulties addressing the current round of requirements, without even considering the additional demand created by DiSC – assuming that the commercial is actually successful.

Seems irresponsible for the city to present something like this to voters, without really presenting the full impact of it. Including the resulting increased demand for housing that would result. (As you know, housing is a money-loser, for cities.)

Isn’t there already a claimed “housing shortage” in Davis, without even considering the unaddressed, increased demand for housing resulting from DiSC – assuming that the commercial is actually successful?

Alternate Analysis Requested by the FBC

1. I think it depends on how you categorize the people being calculated. Generally (I think) people in commercial properties are assumed to use city services much less than residents. So I’d assume the calculation is a mix of the projected residents in the new homes as well as the workers in the commercial component of DISC?

2. The question is if a 50/50 split is a reasonable assumption. Is there any precedent? That was the agreement (I think) with NISHI. Plus I think the county is under pressure to plan for regional housing by the HCD as well…so it probably has an incentive to approve more housing for the cities in the county. I am not a fan of the housing component to DISC. But I view it as a necessary evil. I’ve guessed that the developers need it to get financing. But It may also be necessary for the city to get a favorable tax split with the county (this is purely conjecture on my part).

3. I think it’s too narrow to limit the analysis of tax revenue generated purely on the commercial sqft in project. Probably the biggest generator of sales tax revenue will come from Target which is practically across the street. All the people living and working there are likely going to shop at the nearby Target and other stores near there. In fact I’d guess that if DISC goes in that the retail space that is available in the Target and nearby shopping centers fills up quickly. So sales tax revenue would would INCREASE and not be cannibalized as some have suggested.

Alternate Analysis Performed by the FBC

4. I find it hard to believe that the new hotel occupancy will completely cannibalize existing hotel occupancy. Is there any data to support this? Plus, a hotel on the eastern edge of Davis may even draw in some who are visiting UCD but might prefer to stay closer to Sacramento for business.

5. Makes no sense to me. “Fair Share”? If anything the new project dilutes the “fair share” for the rest of the community of Davis. By this reasoning; nothing could ever be built in Davis because it takes on part of the “fair share” of existing expenses. I dunno…maybe this needs to be better explained to me. This reasoning to me is like blaming your new stock investment on the problems of your existing portfolio. Nothing will ever be built unless it completely pays for the sins of the previous poor financial decisions by the city as well as bad circumstances (Covid)? The only way to get out of this mess is the get more revenue positive projects approved as well as cut city costs (hopefully without effecting quality of life in Davis too much).

6a. Is completely unreasonable. No developer in their right mind would accept the responsibility of infrastructure maintenance after the build out. That’s the city’s job. Now should that infrastructure maintenance be factored in the city’s financial analysis of the project? Sure. But I’m not sure assigning 100% of the future maintenance cost for the infrastructure IN and AROUND the project is completely fair. There is some degree of general community responsibility (example: people all across Davis pay for the maintenance of Covell and not just the people and businesses that use it heavily. Ideally you could charge/budget that maintenance to more heavily tax the heavier (nearby) users of Covell but that’s not realistic or the way it works).

6b. I would need to see some sort of documentation that supports a 10 year vs. 25 year amortization/maintenance repair schedule. If I recall, the freeway has a 20 year life. 10-13 years to be resealed but that’s not the same as completely resealing the road. From what I know, the single biggest factor in projected road repair is a region’s weather…if it has freezing weather that causes water to freeze in cracks and break apart a road….along with the scraping that comes with snow and ice removal….none of these are problems for Davis. And again, assigning all of the infrastructure maintenance to DISC seems unfair.

7. How does assigning additional cost (based on rate growth) from the city’s budget to DISC work? Are those growth rates already built into the project’s infrastructure numbers? Can you narrow down the “city’s expenses” to road and general services maintenance that is specific to the project (and again, I don’t believe assigning all of that cost to the project is appropriate)? City costs for employees compensation, retirement..etc… should not be assigned by the city to the project.

Afterword

I think the comment about state, UC and non-profit businesses taking up the commercial space is a good one. I’d suggest that the city find some other way to tax these entities. I’m guessing it’s not possible to straight up tax them but there’s got to be some reasonable annual fees that can be assigned.

Innovation park or business park??? What difference does it make???

Could the change in projected muni tax revenue come from the belief that the city can get a more favorable property tax sharing agreement with the county?

The valuation question is a good one. What are the “similar properties in the region”? Remember that in Commercial (non-retail) real estate that new, large and customizable space has a premium value over existing commercial space.

Some thought on Keith’s points.

1. Agreed. EPS uses a 50% factor for employees when calculating their “persons served” for a project.

2. Nishi is a precedent on two levels … (1) the actual agreed to split and (2) the alternative scenario EPS provided the FBC as part of that analysis, which was a 25/75 split. (see https://documents.cityofdavis.org/Media/Default/Documents/PDF/Finance/Commission%20Agenda%20-%20January%202016/January%202016/Item%20No%206c2_Fiscal%20Add%20m1%2011-12-15.pdf and https://documents.cityofdavis.org/Media/Default/Documents/PDF/Finance/Commission%20Agenda%20-%20January%202016/January%202016/Item%20No%206b_Nishi%20Final%20Executive%20Summary%2012-2015.pdf)

3. Good point. That would likely further reduce the projected sales tax revenues.

4. Agreed. I originally had the percentage reduction of the EPS projection of $934,000 TOT revenue set to 90% to account for that. However, I moved it up to 100% for two reasons. The most important one is the requirement of a new market demand study before any hotel is built. “With respect to the proposed hotel on the ARC Site, since the ALH analysis was prepared a new hotel has been constructed proximate to the project site, and the Downtown Davis Specific Plan includes the potential for an additional 150,000 sf of hotel space. While this is a change in circumstances, Mitigation Measure 3-54(b) prohibits the applicant from building the on-site hotel until the applicant demonstrates, to the City’s satisfaction, that there is sufficient unmet demand from ARC Project employees and businesses and/or hotel demand from elsewhere within the Davis marketplace to support the hotel .”

5. The logic is as follows. The City Budget only includes the expenses that there is revenue for, but not any of the needed expeses that are deferred because of a lack of cash. So the true expenses of the City are the Budget dollars plus the Shortfall dollars. Then to get the “per person served” amount to apply to any new project you divide that total expenses amount by the sum of 100% of the population and 50% of the jobs withjin the City Limits.

6a. Not the infrastructure AROUND the project. Just within the project’s boundaries.

6b. Again, not the infrastructure around the project. Just within the project’s boundaries.

7. The way the EPS and City models work they only analyze based on a single year’s revenues and costs. They believe it is simpler to understand that way. So for the DiSC analysis everything is stated in “2021 dollars”

Afterword. The FBC recommended and the developer and City Council implemented a “Make Whole Provision” that was in essence a parcel tax on the Nishi property alone. That worked well.

I tried to leave room for individual readers to be able to pick and choose which scenarios to include and which to exclude. I wanted to avoid being biased in calling attention to the other side’s obvious bias. Some blended scenario somewhere between the two poles is where I personally would land. I was trying to be like Joe Friday and present the information and let each reader come to their own conclusion.

#1 requirement for me is that the City government needs to create an Economic Development Plan that illuminates both the Supply of physical space and the market Demand for that space. They have no plan. They have an inventory of existing vacant (unbuilt raw land )parcels. They have no inventory of the underutilized space within the City Limits … space that can be upgraded to match the market needs. They have no inventory of the vacant existing space within the City Limits … space also that can be upgraded to match the market needs. There is no proactivity. There is no leadership. The City is a rudderless ship. In metaphorical terms, the first step is to equip the ship with a rudder. The two core components of that “rudder” are (1) a Vision of what Davis wants/intends to be in 10 years and 20 years and (2) the Economic Development Plan described above. If you don’t k now where you are going then risk becomes much scarier and (3) an active mutual partnership relationship with UCD.

3. Good point. That would likely further reduce the projected sales tax revenues.

I’m saying the opposite. I believe that sales tax revenues will INCREASE if you attribute the increased commercial activity (sales tax) at the nearby stores like Target in addition to the commercial component at DISC that has been accounted for.

I added to my initial comment about this too.

This reasoning to me is like blaming your new stock investment on the problems of your existing portfolio. Nothing will ever be built unless it completely pays for the sins of the previous poor financial decisions by the city as well as bad circumstances (Covid)? The only way to get out of this mess is the get more revenue positive projects approved as well as cut city costs (hopefully without effecting quality of life in Davis too much).

I corrected my original comment to read INSIDE the project as well as around it. No part of the city is held to be 100% beholden to the cost of maintenance for the streets they occupy.

I’m not sure this addresses my comment. I’m stating that a breakout of what those costs are and if they should be legitimately assigned to the project are needed.

DISC and an overall economic plan are related but separate. Should there be on overarching all encompassing economic development plan that includes all vacant commercial space and lots? Absolutely. But sometimes things (opportunity and obstacles) come at you piecemeal before you have an established plan. The best you can do is work with what’s in front of you at the time. So lack of an economic development plan should not preclude the DISC project from happening. A couple other things about existing infill solutions and peripheral solutions. While I whole heartedly wish for existing infill land and commercial space to be used optimally, none of those spaces could accommodate something like DISC. At least not realistically. There’s a reason why nice new shiny business parks are where companies move to. Companies usually want easy to access (freeway) customizable commercial real estate solutions. New business parks often are far better solutions for companies (especially larger ones that are looking to move to a spot and/or expand) than shoe horning them into tight and restrictive infill spots. Also, cramming all that commercial real estate into the interior of the city will impact the lives (roads, traffic and parking) than a peripheral solution on the outskirts of the city (which will screw over….hopefully just for a while…. parts of East and South Davis). Infill and peripheral solutions need to work together. Peripheral growth solutions need to happen (under controlled conditions) to help support the need to further develop the interior of the city.

.

The upward and downward movement of the value of Stock investments rarely are reflected on an Income Statement. They are Balance Sheet items. Further the performance of a “new stock investment” is independent of the rest of the investment portfolio. The performance of the whole portfolio is affected by each individual stock, but the performance of the individual stocks are not affected by one another.

A much closer analogy happens when a person is considering leasing or buying a car. When you ask the sales agent “How much is this car going to cost me?” if they only tell you about the lease/purchase costs and omit any disclosure of the costs for taxes or the costs for fuel, etc. then they have only told you a portion of the story.

If a property owner (existing or contemplated) asks the City government, “How much does it cost to maintain this city, so that the quality of my life is not deteriorating and/or the value of my property is not being impaired by any deterioration of the city around it?” is full disclosure satisfied by the numbers in Annual Budget? The simple answer is “No.”

If the City were following the rules of Accrual Accounting established by the Financial Accounting Standards Board (FASB) rather than the rules of Cash Accounting established by the Governmental Accounting Standards Board (GASB), they would have to disclose their deferred expenses in their financial reports. That way interested parties would all know what the “level playing field” is financially for the entity doing the reporting. Bottom-line, all the stakeholders in Davis are responsible for both the actual expenses and the deferred expenses … and DiSC is asking to be a full-fledged stakeholder in Davis. Why should they get a sweetheart deal that the existing stakeholders don’t get?

If that type of disclosure was actually required, cities across California wouldn’t be experiencing fiscal deficits in the first place, assuming that decisions were actually based upon that. And the entire Ponzi scheme would not have occurred in the first place.

Your reasoning still escapes me. But maybe I’m misreading your comment.

The “shortfall” is the existing lack of cash the city has to pay for it’s existing expenses. Tacking on those expenses to the project doesn’t make any sense. Your analogy of a car lease is that of one taking on an expense. The project is (without your debatable adjustments) revenue positive. So the more apt analogy is that you’re interviewing for a job but decide not to take it because it won’t cover your existing credit card debt. (and a bigger problem is that you have few other job options).

You’re never going to get anything built if you hold a new project responsible for paying “it’s fair share of EXISTING cash shortfalls”. Or a better question to you is at what point (I guess in revenue) does a project need to cover the sins of it’s new neighbors?

.

When you make a decision whether or not to invest in a company or purchase its stock or loan it money, do you simply look at its Income Statement or do you also look at its Balance Sheet to assess its Accrued Liabilities?

If/when you actually invest or purchase stock, you are not taking on 100% of those Accrued Liabilities, but rather a proportional share of those Accrued Liabilities with the percentage/proportion being the number of shares you are buying divided by the total number of shares outstanding.

The Shortfall is the equivalent of an Accrued Liability. Under GASB Accounting you can not include Accrued Liabilities in the annual Budget, so they have to be tracked “off the books” which is what the City has been doing in the Forecast chapter of the Budget since Mayor Robb Davis insisted that be done in the 2017-2018 Budget.

The proportional “fair share” is the number of persons served (100% of the resident count plus 50% of the employees) for the project, which EPS has calculated as 2,169 (1,002 residents plus 50% of 2.335 commercial employees) divided by the City’s calculated number of persons served (the current 78,420 plus the incremental 2,169).

I think you’ve got it backwards. When you buy a company or buy stock the company does not take on the liabilities of the investor (well…unless the investor moves debt to the acquired company). In your example the city is taking on the liabilities of DISC (as if the city were to take on DISC’s debt for land, construction…etc…) . But your comment was about DISC taking on the the liabilities of the city (it’s share of the city’s shortfall of cash). That just doesn’t compute. You’re discounting a revenue positive (aside from your debatable recalculations) because of the city’s poor finances. If that’s the case then nothing will ever be developed….or at what point does a project need to make up for it’s new neighbor’s liabilities that you’ve suddenly saddled it with?

Again, I look at it like the city is applying for a job. The job doesn’t cover the city’s credit card debt but it’s a job that pays something….and the city doesn’t have a whole lot of other job offers.

Keith, the disconnect you and I have been experiencing has become crystal clear thanks to your 6:46pm comment. As you said, you look at it like the city is applying for a job. I don’t see it that way at all. For me, the City is like Starbucks, whose business model includes both company stores and licensed franchisees … and the developer is applying to purchase one of the company’s franchise licenses.

The reason that someone wants to purchase a franchise license in an established company is because the company has a well known brand name and considerable accumulated good will. The prospective franchisee wants to capitalize on those assets that come with the franchise license.

In the case of DiSC, if the City gives the applicants a positive result in the Measure J vote, and grants them the annexation and entitlements, their 100 acres, which they in all likelihood purchased for approximately $400,000 ($4,000 an acre) becomes instantly worth in excess of $25 million ($250,000 an acre), and that is without any improvements. Based on the limited number of unbuilt lot sales in Davis over recent years, with the improvements a quarter acre lot in Davis is worth over $600,000.

That is all because of the brand name and accumulated good will that come with the “Davis franchise.” That brand name and accumulated good will are Assets of our fair city, but as you know, a Balance Sheet contains not only Assets, but also Liabilities. So if you want to join all the other franchisees who have over the years hitched their wagons to Davis, you get to share with all those stakeholders both the assets and the liabilities … both the good and the bad. Otherwise, you are getting a sweetheart deal.

The long-standing historical system “doesn’t compute.” In Einstein’s terms it is the insanity of doing things the same way they have always been done … and if you check with Chuck Mahron at StrongTowns.org you will find evidence from all across the country that the fiscal outcome in city after city after city is insanity.

What are the consequences of driving a hard bargain with developers so that they cover their fair share of the the city’s expenses when accounted for using FASB standards. In the case of DiSC the per person served proportion is 2.7% of the total (2,169 divided by the sum of 2,169 and 78,420). 2.7% of the $14.5 million accrued liability of the annual shortfall is just under $393,000. Spread over the 460 units that is a cost of $850 per unit per year. Raising the sales or rental price of each unit to cover that $850 per year cost makes housing in Davis less affordable, but is that an inappropriate price to pay for fiscal stability?

Matt,

Your Starbucks analogy and all the stuff you mention, entitlements, etc… (stuff I know all too well about)….is irrelevant. I asked if you had done an IRR for the city’s return on it’s investment in the project. Typically you do an NPV calculation based on CASH. You use a Statement of Cash Flows. So how much does it cost the city in cash and how much does it get back in cash. Granting entitlements doesn’t really cost the city money (aside from some simple admin costs).

You’d use a balance sheet if the city was looking to acquire the project; then it would look at the project’s liabilities on the balance sheet. But that’s not what’s happening.

When an owner pays a franchise to become a franchisee they do not take on the debt of the franchise or the other franchisees.

As for the city providing good will. I think you’re talking about the city being able to capitalize on the value it adds by granting entitlements. I agree. If the city wants to capitalize on the value it adds to development; then it needs to become a developer and landlord. But that’s a different discussion than whether or not DISC is a worthwhile investment for the city.

Again, this idea of a “FAIR share of the cities EXISTING expensive” isn’t FAIR to saddle on any new project. It makes no sense. You’re never going to get anything built if you saddle a project to pay for existing cash shortfalls. Every new project that has net positive revenue will chip in but those project’s value to the city should not be judged on if they cover the cities’ existing cash shortfall. I don’t know how else to put it. No other investment works that way. Like I said, if I’m looking to invest and make money off of some stock I buy; the value of the investment isn’t impacted by personal balance sheet. The investment is good or bad on it’s own.

Matt,

Accountants might like that approach, but economists don’t. A fundamental principle of economics is that an efficient economic action should be based solely on the forward looking marginal or incremental costs of that action. Sunk costs are irrelevant to the most efficient decision.

We’re working with the Local Government Environmental Sustainability Coalition to propose an electrification incentive electricity rate based on this principle: https://mcubedecon.com/2022/04/12/proposing-a-clean-financing-decarbonization-incentive-rate/

Keith is entirely correct: the cost of a Starbuck’s franchise is based entirely on the expected market value of the brand with no relationship to the existing ongoing costs and debt of Starbucks. Starbucks is hoping that the franchise fee is greater than the variable costs of adding a new franchisee so it can then apply that margin to its outstanding debt. Starbucks does not start with its debt load or deferred expenses–it ends with those as a residual after all other value and expenses are accounted for.

Keith,

Thank you for your response. From my experience on the Finance and Budget Commission, as its standard the City does not give any thought to either IRR or NPV. They do all their analyses (whether internally or by a hired consultant like EPS) using constant dollars with every year ignoring the vagaries of inflation.

Further, I suspect that calculating an IRR for the City would be difficult since in every local development that I know of the City has made no actual investment on which to calculate a rate of return. As a result the focus is typically not on the “upside” return, but rather on the “downside” burden that the City takes on whenever a development is approved. The City has only recently started looking into what the downside burden(s) are. The Finance and Budget Commission created a subcommittee to look at the problem the City has had that every development that has been approved has ended up with greater costs to the City than revenues. More often than not the development starts out with a positive operational cash flow, with costs that are less than revenues, but over time as the costs build up at a considerably greater rate than the revenues do, the operational cash flow goes negative. The two graphs and table below show the 15-year effect of having a 2.5% inflation rate of revenues and a 3.5% inflation rate of costs … a zero dollar cash balance in year 15, which means no cash to cover the multi-million expense for the roadways and other capital infrastructure repairs/maintenance/replacement costs.

That has been … and continues to be the reality here in Davis. And to make matters worse the City government chose not to be honest about the situation with the public … acknowledge both the cost inflation problem and the funding gap. Instead they simply chose not to do the necessary repairs/maintenance/replacements and as a result our streets are crumbling.

I strongly believe we are at a crossroads where can continue to repeat that unsustainable behavior, or we can address it.

I’m not suggesting that any individual development should be responsible for any more than their proportional fair share of the total expenses … only their fair share.

That does put the community into a choice between three possible directions as they go forward:

(1) we can continue to do the same as we have done and as a result ring up larger and larger funding gaps as we approve new developments,

(2) we can simply stop “digging a deeper hole” financially and not approve new developments that create larger funding gaps, or

(3) we can put order to our financial ship and come up with a new set of fees and taxes that apply to the whole community (present and future) that generate enough revenue to pay our bills. If the developers of new projects don’t feel they can pass the higher costs on to the purchasers/renters of the residential and/or commercial spaces the dream of creating, then they will not build any projects. if they do feel they actually can pass those costs on to their “buyers” then they will move forward on that revised financial footing and actually build.

.

Expected market value takes into consideration a blend of the assets and the liabilities of the brand. Financial disclosure statements provided to investors prior to investing are required to disclose both assets and liabilities.

In the analogy Starbucks and the City are the equivalent players on the one side of the transaction, while the prospective franchisee and the prospective developer are the equivalent players on the one side of the transaction. You and Keith both have the roles flipped. The City is the seller and the prospective developer is the buyer. Starbucks is the seller and the prospective franchisee is the buyer.

Should all new projects pay for themselves? Absolutely. I’m all too familiar with the ponzi scheme that cities employee in using new development growth to immediately fund things. But tax revenue doesn’t pay for long term services costs. DISC is revenue positive. DISC does not create a funding gap. But that’s not the same as paying part of the city’s existing deficit. It will produce revenue for the city to fund whatever it needs to….including the city’s existing cash shortfall. But that’s not the same as adding a portion of the existing cash shortfall to the project’s financials and then claim that it’s not a revenue positive project. It’ll take more than DISC to get enough new tax revenue to turn around Davis’ cash shortfall. Davis has to approve more commercial projects….and if possible incentivize the leasing of existing space and develop available infill lots. But the low hanging fruit for getting new tax revenue is peripheral development. It’s easier to get companies to new offices and facilities. So peripheral development is a necessary evil.

It wouldn’t be that hard to calculate a project IRR investment for the city. Just figure out what the future costs of providing services and maintenance for DISC. That’s your cash out flow…the “investment”. The “upside” and the “downside” are factored into the revenue and cost projections. You could factor in specific things that effect cash flow positively or negatively. But in lieu of that you can factor in discount rates based on other projects in the city or similar projects in other cities. Those discount rates are then applied as a discounted cashflow for the final NPV calculation.

That’s good info. But then you have to figure out WHY this has been the case…and not simply slap a blanket debbie downer analysis on a new project. What kind of development are we talking about that lost money for the city? What was the commercial: retail, industrial or residential mix that created the sales and property tax revenue that wasn’t enough to pay for ongoing city services? Did those projects enjoy 50/50 county tax revenue splits? There’s a reason why most new projects are mixed use to varying degrees. That’s to capture more sales tax revenue….as well as partially limiting the services costs that go into maintaining purely residential developments.

But this is the biggest disagreement we have:

Again, sure a new project needs to pay for itself. That’s “their fair share”. It doesn’t inherit the city’s financial woes. It doesn’t work that way. You’ll never get anything built in this city if you expect builders and businesses to make payments into the city’s existing deficit as part of it’s financial viability for a city.

I agree that new development should be at least ‘cost/revenue’ neutral… but unless I am incorrect, you have long advocated for a net “profit” for the existing community… paying off past errors, etc.

Did I misunderstand your previous posts (other threads), or did I miss the memo of your change of view?

First, like I said all new development should in the very least, pay for itself. I think new peripheral development should add something to the community. DISC in theory adds a net $3M or so dollars for the city. Residential development is in general is a source of net negative revenue because of the cost of on going services and maintenance. That’s why I think a peripheral residential development should add something like a park or rec service or something. So a new purely residential peripheral development isn’t going to likely be able to pay for itself just with property taxes…but if it installed a public park, public swimming pool or something…it might offset those long term costs to a degree through community amenities. Also there is a community/lifestyle cost to mowing over farm land and paving it over.

Infill development is in theory already accounted for so if you get some nice recreational amenities out of it great but it’s not deal breaker for me.

Where I differ with Matt is that I don’t think any project should be beholden to the financial problems of the city that came before it.

Should all new projects pay for themselves? Absolutely. I’m all too familiar with the ponzi scheme that cities employee in using new development growth to immediately fund things. But tax revenue doesn’t pay for long term services costs. DISC is revenue positive. DISC does not create a funding gap.

Keith, we do not know that your bolded words are true. Some people Believe those words are true. Many more have very little confidence that those words are true. The problem is the credibility of the people making the wildly optimistic pronouncements. Our confidence in our City Council is at an all time low. The Cannery CFD followed by the BrightNight debacle followed by the Mace Mess followed by Dan Carson’s taking Davis citizens to court followed by our Mayor’s paid ad in the Enterprise. The list goes on and on and on. Look at what five former Mayors have said about BrightNight in the Enterprise on April 25, 2020

It is my understanding that a similar letter regarding Measure H by former Mayors has been submitted for publication in the Enterprise.

Couple the fact that we don’t trust the elected officials who are telling us to trust them, the history of Mace Ranch inspires no confidence in the Ramos development team. That is a distrust double whammy.

For me, the following words of Ann Evans published Wednesday in the Enterprise say it all.

You’ve shifted this conversation from one of finances to trust in the elected officials.

There are no guarantees. The builder wants DISC built. Most of the City Council wants it built. So I trust they’re going get it built. The baseline features legally bind the city and developer into providing what’s listed in the baseline features. There is a great amount of economic growth in the region so there’s a good chance that the business park will be successful. It looks like the city and county have negotiated a good tax revenue split that will help ensure the city get’s it’s money.

As for all the rest? I assume politicians do some things a little shady or at least without the full knowledge of every detail easily known to the public. Davis likes to think they’re smart enough to micromanage every little detail of these kinds of things. The YES Campaign and Carson suing the NO Campaign and Pryor?…..Eh, the outrage over this is just part of the political circus designed to get the hoi poloi all riled up. The reality is that it’s just legal administration that had no other way to be done….(Pryor should know what he’s liable for when he puts his name down in a campaign). All this is also largely irrelevant to the financial viability of the project.

.

Keith, why would you trust that. The builder and the members of the City Council collectively add up to six or seven voices total. There are close to 70,000 other voices in Davis … closer to 40,000 if you count registered voters.

To have the trust you have, there needs to be an answer to the following question: “How well does the project align with the community’s Vision of where it wants to be in 20 years?” The sad thing is that no answer to that question is possible, because our elected leadership … that City Council you reference have shown zero leadership in convening a process to get the community to articulate such a Vision. In addition, past City Council’s allowed the creation and passage of a General Plan that articulates no such Vision. Further, more recent City Councils have allowed our 2000 General Plan to lapse into noncompliance with California State Law.

.

There hasn’t been a “shift” but I can understand your thinking there has been. If you go up to the last sentence of the article you will see that trust and the numbers/finances have always been walking “hand in hand.” That last sentence was/is:

Closing Question for the Voters

Why was it so important to the City to suppress/hide the less-than-best-case scenarios that the FBC requested and EPS delivered?

Matt, as you well know, I absolutely agree with you on this point.

This exchange between Matt W and Keith E is exactly the kind of conversation that should be the hallmark of comments on this site. Congratulations to you both.

Actually, you can steer a boat with oars, and sails help propel as well, can steer, as well… what is critical is the keel… unless you have some sort of a keel… unless you presupposed that… a ‘foundation’, as it were…

Bill, I agree with you that you can steer a boat with oars. However, if you hand oars to an individual and say “steer us on an optimally productive course” they will fail miserably if they try to do that without a plan … and to have a good plan you need leadership.

Sails alone can not steer a boat, regardless of whether there is a keel or no keel. Have you ever tried to sail from one point to another with just sails and no rudder?

Matt… I’m sure you know the ancient expression “keeping an even keel”… never heard the expression “keep an even rudder”… I do understand “keeping your hand on the tiller”, which is the lever by which you control the rudder, in small boats under sail… small motorboats have a tiller that adjusts the pitch/direction of the outboard motor…

Richard McC… we are not rudderless… we have too many hands trying to control the tiller, often at cross-purposes… the rudder is there, and will function, if we have a good captain (the public/electeds) who knows the destination, and acts accordingly… I perceive there is little consensus in the public as to destination, and the electeds follow the flow of the public whim, unless they are leaders… (few and far between over my ‘few’ 45+ years in Davis…)

If we lack a rudder, that would be due to the whims/votes of the public… not staff, not CC…

As Pogo would say, “we have met the enemy and it is us”… most want all benefits/amenities, and little/no cost, inconveniences, etc., etc. … human nature… not reality… defies the laws of both science and economics…

[edited]

True story… reflect… your use of an adjective… “wildly”…

The fact is, we do not know, cannot know, what things will be like 1-5-10-20 years from now… Covid, and reactions; inflation/unemployment/stock market; natural disasters; impacts from GHG; price of bacon; etc., etc., etc…

We do not know … the best we can do is to weigh logic (from what we know now, in the present), figure the odds, and roll the dice, hoping we ‘win’… simple and complex at the same time… called ‘life’…

I’ve read the YES on H, and NO on H arguments, here (VG), ballot arguments, campaign literature… none of them, either side, are guarantees… if you want a guarantee in life, it is that will end at some point (unless you go ‘spiritual’)…

Folk who claim this DiSC thingy is a ‘panacea’, or ‘an Armageddon’, are delusional… but the rhetoric (not logic) each bring to the table is largely due to the JeRkeD process folk have chosen… [“be careful what you ask for”? I wonder…]

I am surprised that Matt would trot out this argument again, after it was so thoroughly negated during the approvals of the new hotels that were built in the City in recent years.

What the ‘local hotel operators’ that Matt is referring to are really saying here is that the City needs to protect them from competition, something the City should never do. Any new hotel built in town will increase the revenues for the City, even if 100% of the room stays at the new hotel cannibalized the existing hotels (a claim which no independent analysis will support).

The new hotel, being new, will demand room rates that are greater then the average cost at the existing hotels in town. Since TOT is a percentage of the room rate, the City’s revenues will increase accordingly. The increase will be even greater if there is even just one net new room stay, and will increase further with each additional stay. Increased competition may decrease existing hotel owner’s profits, but it will not decrease TOT revenues for the City.

Further, if the new hotel actually does damage the business of an existing hotel, even causing it to close, the City will still benefit. The owners of damaged business will either reinvest to improve their business, redevelop their property for another use, or sell the property to someone willing to make the necessary improvements. Either way, the City’s revenue increases through increases in property taxes (both secured and unsecured) and construction fees.

Finally, during the discussion before the CC regarding the approval of the recently added hotels, the event planning staff from UCD testified that the year round demand for rooms for existing events at UCD was already significantly greater than the number of rooms available in town and the surrounding cities, and that they could easily fill any new rooms made available. Consequently, I doubt that there has been any negative impact to TOT received by the City since the addition of the new hotels other than the temporary impact due to the pandemic.

It is worth noting that none of the existing hotel businesses have closed as a result of the addition of the new hotels in town even with the pandemic. The same will likely be true with any additional hotel added now, either at DiSC or downtown. Simply put, approving new hotels is a great way for the City to increase tax revenues with little or no downside for City revenues.

There are many problems with the argument that Mark puts forward …

The first is his lack of understanding of how businesses and organizations and governments use scenario analyses. As I said to Richard above, the whole purpose of scenario analyses is to identify situations that could produce results other than the best case (or for that matter the worst case). A well executed scenario analysis will assign probabilities to the various scenarios and then look at the continuum from best case to worst case.

The second is his willingness to disregard the intervening events that have transpired since the last hotel market demand analysis was done … in 2016 I believe. The total room inventory of Davis at that time was 730 rooms. Since then the total room inventory has risen more than 30% to 970 rooms. 120 of the added rooms opened in March 2020 and the other 120 opened in April 2021.

The third is his willingness to disregard any of the lasting effects COVID may have on hotel stay day demand.

And fourth is the recent year-to-year trends in Hotel revenues in the City (a calculation based on the City’s TOT revenues), which have been:

2015 = $11,000,000

2016 = $12,100,000 … a 10% increase

2017 = $12,700,000 … another 5% increase

2018 = $15,300,000 … an additional 20% increase

2019 = $15,800,000 … a further 3% increase (a total of 44% over the $11,000,000 base)

2020 = $10,500,000 … back down to below 2015

Those downside factors, plus the upside factors Mark listed are all good reasons for taking the prudent step that the EIR describes … Prior to approval of the final planned development for the proposed hotel, the applicant shall demonstrate to the City’s satisfaction that there is sufficient unmet demand from a combination of hotel demand from ARC DiSC 2022 Project employees and businesses and/or hotel demand from elsewhere within the Davis marketplace to support the hotel space for which the building permit is requested. The objective of this requirement is to ensure that the hotel developed within the ARC DiSC 2022 Project will not re-allocate demand from existing Davis hotels, but will instead help the City to provide new hotel offerings that will satisfy unmet demand.

We all know that 2020 was an anomalous year due to COVID. A just released Visit California report shows a strong rebound and an expected return to previous levels by 2023: https://www.sfchronicle.com/bayarea/article/Tourists-are-finally-coming-back-to-California-17137451.php

Regarding Matt’s arguments:

1) The City already commissioned Bob Leland from Managment Partners to produce a report investigating the Variable Cost Assumption which found that the 75% variable cost assumption to be well founded. Insisting on 100% variable cost not only defies logic, but is unsupported by evidence. Link to report from Management Partners here: https://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/Finance-and-Budget-Commission/Agendas/2022/2022-01-10/Item-6A-Attachment-1-Marginal%20Cost%20Report.pdf

2) 50-50 is a reasonable assumption to model given the past agreements between the City and County for other Measure J/R/D projects. Also reasonable to do sensitivity analysis as Matt has done here, but the overall magnitude is rather small.

3) The project was approved to include 80,000 sf of retail space, so it seems obvious to me that you would analyze 80,000 sf instead of some arbitrarily lower number. Where did 50,000 sf come from as a reasonable assumption? Here is a link to the project description that shows it will contain 80,000 sf of ancillary retail: https://documents.cityofdavis.org/Media/CommunityDevelopment/Documents/PDF/CDD/Planning/Project-Applications/DiSC%202022/Project%20Description%20DiSC%202022_070721.pdf

4) Of course existing hotel owners claim it will cannibalize their business. Will there be increased competition? Of course. I am still a little confused here though because the argument you presented in the article seems different from the one you are making in response to Keith. Are you saying that we should entirely discount any TOT taxes from the new hotel because it will entirely be cannibalized? I do not understand that logic. There is unmet demand in Davis and adding this hotel will increase TOT taxes and consumption of hotel rooms overall. Your assumption that there will be no increase in the quantity of hotel rooms demanded seems way off to me. Or am I misunderstanding you?

5) I can see your logic more clearly here in your response to Keith. Where are you getting $14.5 million as the deficit? I don’t remember seeing that number floating around and would appreciate understanding the assumptions that are built into it.

6A/B) Why are you making these particular assumptions about infrastructure lifespans? The logic makes sense if your assumptions are correct.

7) Cost containment is important. On this we agree. As for inflation, it cuts both ways. It will increase costs, but also increase revenues regarding sales taxes, property values, etc, so I am not sure that your argument is appropriately capturing this nuance.

Afterword) Commissioner Sufi’s question about the impact of non-profit entities seems to be answered by Article 2.A.7 in the development agreement (page 17) which states that the developer must devise and implement a mechanism to reimburse the City of Davis, DJUSD, and Yolo County for their share of otherwise-required property taxes in the event that the property is acquired or leased by an entity exempt from paying property taxes. Commissioner Harrington and Axt’s concerns about potential long term effects from Covid with respect to demand were already taken into account with the project redesign which significantly reduced the relative amount of office and giving a higher weight to advanced manufacturing and lab space. Commissioner Sufi’s concern about making it an innovation center has been addressed by the project team retaining Bob Geolas who has worked on creating innovation centers around the country for more than 25 years including the highly successful Triangle Research Park. I would have to dig deeper to understand the Municipal Services Tax difference. Commissioner Salomon’s question can be answered by the higher demand for commercial properties in Davis due to the community profile and labor market which is evidenced by the higher prices we see for properties of all types in Davis as compared to the region.

.

The problem with Bob Leland’s report is that it does nothing to explain the findings of the FBC subcommittee of Ezra Beeman, Doug Buzbee, and Gerkern Sufi, which found that the per person growth of City expenses for added members of the City population over the past 20 years has exceeded 100% rather than been at 75%. The subcommittee provided their evidence.

In fact the numbers provided by Bob Leland actually supported the subcommittee’s findings. The Base Year expenses of the City in Budget Year 2007-2008 were $39.1 million (Total General Fund Expenditures net of Debt Service RDA and Capital Projects). If one looks at rolling five year averages in order to avoid annual anomalies, the annual average increases are as follows

2012-13 (covering the five-year period from 2007 through 2012) = 1.0%

2013-14 = 2.5%

2014-15 = 2.6%

2015-16 = 4.0%

2016-17 = 8.1%

2017-18 = 7.2%

2018-19 = 9.5%

2019-20 = 10.4%

That is an aggregate increase in Total General Fund Expenditures net of Debt Service RDA and Capital Projects of over 52% at the same time that the population increased approximately 8%. How in any universe does that data support thew premise that additional persons only cost 75 cents on the dollar?

.

The numbers above show you what the actual cost inflation history for the City has been over the years. Will the broader market inflation that affects sales taxes come anything close to those numbers during the same years? No it not be. Property Values only become additional revenue for the City when a property is sold. The 2017 State of the City Report presented by staff to the DPAC shows that in a 12 month period only 544 single family residences in Davis were sold. That incredibly low turnover is included in Bob Leland’s annual revenue increase calculations that have been included in each Annual Budget since 2017-2018. That revenue increase number is 2.5% per year

.

50-50 is indeed a reasonable assumption. However, as evidenced by the FBC request, and EPS’ provision of the alternate calculations at 40-60 and 60-40, it is not the only assumption. So my question to you wesley is given those well-documented actions by both the FBC and EPS, “Why was it so important to the City to suppress/hide the less-than-best-case scenarios that the FBC requested and EPS delivered?”

.

wesley, as shown in the graphic below prepared by Bob Leland for his 5/5/2020 presentation to City Council, the 20 year total Funding Gap for Capital Infrastructure Maintenance is $291 million. Divide $291 million by 20 and you get an average of $14.55 million per year each year for the 20 year period.

Bob’s full presentation is available on the City website in the 5/5/2020 meeting packet and video.

.

wesley, the assumptions about the useful life of roadways is a matter of public record. The records of the frequency that City of Davis Public Works has made major repairs and maintenance to deal with the vagaries of End of Useful Life is also a matter of public record.

In terms of the calculations, there were no assumptions. The Roadways construction cost numbers were taken directly from Table A-4 of the EPS financial analysis … $9,180,352 in total costs. When you divide $9,180,352 by 25 you get $367,214 per year. If you divide $9,180,352 by 10 you get $918,035 per year. Those were the two numbers used in 6A and 6B.

One assumption that I did make was not to include the $11,797,923 of Sewer/Drainage construction costs from the calculation. Some people would consider that decision on my part as being too generous to the developers, and that a separate scenario for Sewer/Drainage End of Useful Life Repair/Replacement should also be included. If it were included with a 25 year amortization, the additional annual cost would be $472,000 per year.

.

wesley, the answer to your question is provided in the City’s own documentation of the December 2021 FBC meeting. The FBC detailed a subcommittee to do a pre-meeting review of the EPS financial analysis, and submit questions to EPS that would enhance the quality of the FBC meeting … and also improve the chances of the FBC being able to come to a final decision in December rather than January. The subcommittee was comprised of Ezra Beeman, Doug Buzbee, and Gerkern Sufi. If you watch the video of the meeting you will hear Doug Buzbee explain the subcommittee’s logic vis-a-vis the 50,000.

Interestingly enough the EIR addresses the same issue as follows:

Actually, it is unethical, and likely illegal (except in a “Development Agreement”) as well, …

It’s much more like ‘whoring’ yourself out (we’ll trade you our “body”, if we get a financial gain), more than a franchise, justice model/analogy… not just “protecting our interests”… antithetical to the concepts of justice, prudence, responsibility, community…

Some would like it not to be a “zero-sum game”, but so punitive (net loss) that no one would propose anything, given the risks of spending the money for approval, which if obtained, would be a net loss…

Since I know, based on yesterday’s experience, this will go fast into moderation, and be deleted…

I called it! “awaiting moderation”… unlike those of certain others…

[Moderator: Bill, all posts are going into moderation before they are cleared to appear. Nothing you posted yesterday was deleted.]

Bill, you appear to be saying that operating a municipal corporation in a fiscally sound business-like fashion (just like any other corporation) is unethical, illegal, immoral, unjust, imprudent, irresponsible and non-communal. I don’t understand that.

When Starbucks sells franchise rights to a new franchisee, they are selling their “body.” Are they “whoring” when they do so?

A municipal corporation, like Davis, should be fiscally sound… fully agree… but, unlike private corporations, they are ethically, legally, morally (justly) not supposed to “make a profit” for the ‘shareholders’… charter cities can do that, as I understand… different topic…

If Davis was a true/non-municipal corporation, like the private sector, they could raise prices (taxes, sewer rates/water rates, etc.) particularly in the unincorporated portions of the vicinity receiving services… and the customer could decide what services they’d forgo in order to save money and find alternatives… the analogy fails.

More, off-line, but not tonight… but a seed… is Davis a “company”, or an ‘incorporated’ family? Think “living trust”… just a seed for thought…

How do you balance that out with the city (it’s government) trying to improve or at least maintain the standard of living for the existing residents?

For example; if the city could just keep growing at zero financial cost to the existing residents but it would just keep sprawling outwards along with increasing traffic and impacting the public parks and rec services……is that how a city should operate? Just planning to keep allowing whomever that wants to live there regardless of the impact on the existing community?

Reduced expectations, increased taxes, other revenue (which would be taxes)… simple…

But why should new businesses or residents be expected to pay for greater expectations, stable/reduced taxes, fully funding existing ‘debt’, for the current incumbents? How do you ‘balance’ that with ethics, morals, legality?

Ah… the “I got mine, and want more, and even if I was not fiscally prudent, I expect others to pay for that” approach… very prevalent viewpoint, tho’ oft not admitted…

Really? Do you then own the ‘payback’ for liabilities the City incurred befoere you lived here? Are you willing to put more skin in the game (read $$$, to payoff the debt/liabilities incurred not only since you lived her, but also for those who preceded you? If not, why not? I wonder…

Think of a ‘will’, or ‘trust’… is not the trustee/executor responsible for paying off debts of the deceased before distributing the balance of assets? New “issue” should be obliged to be responsible for those debts/liabilities? Not the way I roll…

What is the likelihood that the City’s debt/liabilities, expectations be met if there was NO development, even cost/revenue neutral?

Think… I know you are capable of that.

Stop giving out raises and creating additional positions (such as staffing for the ladder truck, and the two social-worker type positions), and address pension costs (the latter of which almost every city in California hasn’t adequately budgeted for).

But most of all, stop using endless deficits as an excuse to pursue endless sprawl.

Examine how this situation keeps occurring in the first place.

Most of the major population centers around California (e.g., within maybe 30 miles of the coast) aren’t expanding their boundaries at all. And yet, they’re not falling into the ocean.

.

In two simple words … “they aren’t!!!”

Please explain how/where you got the impression that, or came to the conclusion that new businesses or residents are expected to pay for greater expectations.

Bill, your comment shows that you truly did not understand my comment.

Okay, so who are the city’s Council and staff supposed to represent if not the common good of the existing residents in a community?

So that means you believe in decreasing a community’s quality of life to accept others. You expect communities to sacrifice for others that want to live and work in their community. Why you believe communities have such an obligation beyond state mandates is beyond me. You speak with righteousness about ethics….but that’s not in the least bit part of the equation.

But like I said, you really didn’t read my earlier comment. I DO NO BELIEVE THAT NEW RESIDENTS AND BUSINESSES SHOULD HAVE TO PAY FOR THE EXISTING COMMUNITY’S DEBT. But I do believe that new residents and communities should pay for themselves; which includes to some degree the diminished quality of life the new growth represents (traffic, lack of parking, crowds, less access to amenities).

Remember, I support many socialist types of solutions to housing (specific self interested PUBLIC affordable and workforce housing). But you’re trumpeting a very communist criticism to the existing system. “I got mine”…don’t force me to pay for yours….don’t take from me is a very capitalistic attitude. It’s part of the system we’ve always had. People have never been able to just live and work where ever they wanted to in the United States. It’s always been subject to affordability.

Again, you’re not reading my posts. I’m fully aware of the city’s debts and liabilities. I believe the only redeeming quality of DISC is the tax revenue positive contribution it makes to the city. The ONLY redeeming feature.

I trust the builder wants to build to make money. I trust most of the City Council wants DISC built for the tax revenue for the city.

I’m not sure where you’re going with this comment. The CC in theory represents the voters. The Council then acts as it sees best (hopefully without the unwashed masses micromanaging their every step) and after all is said and done they are either re-elected or voted out based on the results of their work.

The City Council put forth what they thought was the most realistic scenario and try to show that how it would benefit the city. Their job is to lead. They are not there to just provide information for the unwashed masses to make a decision for them. Again, the CC makes decisions and then are judged after the fact by hoi polloi and elected or removed from office. In fact Davis provides the plebians far more input into the process than most places through Measure J….much to their detriment.

I trust that too. But how does the builder making money help the City and its residents? And in this case we don’t even have a builder. Ramco rarely actually BUILDS anything. Mace Ranch is a case in point. Can you find a home in Mace Ranch that was actually built by Ramco or a Ramco sister company. Ramco’s business model is doing what they are trying to do at DiSC … buy the land at a low dollar figure ($5,000 an acre in the case of DiSC 2022 … $0.5 million total for the 100 acres) and get the uptick in value when the entitlements are granted (between $250,000 an acre and $500,000 an acre … between $25 million and $50 million total for the 100 acres). Once they have extracted that profit from the land they take that profit elsewhere … out of the community.

There are other ways to grow tax revenue , but they are afraid to explore those ways.

That is correct in theory. But in Davis it is frequently not correct in practice. Our City Councils over the years have demonstrated a consistent inability to communicate constructively with their community. They don’t have the foggiest idea how to educate their constituents on how and why they support some of their decisions. They use the Brown Act as a weapon to justify keeping the citizens uninformed and circle their wagons when they are questioned about their decisions.

The University Mall decision where the Planning Commission had voted UNANIMOUSLY to recommend NOT going forward with the proposed project, but the Council approved it nonetheless is an excellent example. The constituent education step of open disclosure to the public by staff and the Council (and for that matter the developer) did not happen in the leadup to the decision, and no effort was made to explain the logic of the decision, or the judgment criteria used, was made after the decision.

This is where Measure J is having unintended consequences. Because the quality of life is so good at the individual family level in Davis, when you go from family to family one-by-one and ask them about their concerns about community governance, they really don’t have any concerns. Most would say, “My family’s life is very good, and I’m very busy paying attention to living that good life.” Most of them have very little awareness or interest in what happens at City Hall … with the one exception being Land Use issues. Because of Measure J we all hold the power of Veto on whether the city grows beyond its current borders. We don’t have to rely on the Council to look out for our best interests. As a result, recent Council elections have not had much, if any, discussion about the land use principles of the respective candidates. Further, since the vast majority of Davis voters have very little, if any, awareness of the dire straights of the City’s finances, that isn’t an election issue. Our elections revolve around how well known the candidates are. Gloria Partida is a good example. She is well known “based on the results of her work” on LGBTQIA rights. Those kinds of social justice credentials are highly valued in Davis … as they should be. And for the most part they trump the kind of “based on the results of their work” criteria you have described.

You and I will have to agree to disagree on your bolded words. I do not believed that any one of the five City Council members felt that $3.88 million net gain to the General Fund was the most realistic scenario. To find evidence of that, one need go no farther than the just agreed to tax sharing agreement between the City and the County. EPS, the City’s financial analyst, prepared a scenario for the City-County tax sharing agreement that reduced (and alternatively increased) the $3.88 million by $150,000 each year. I ask you, “Why was $3.88 million more realistic than $3.73 million?”