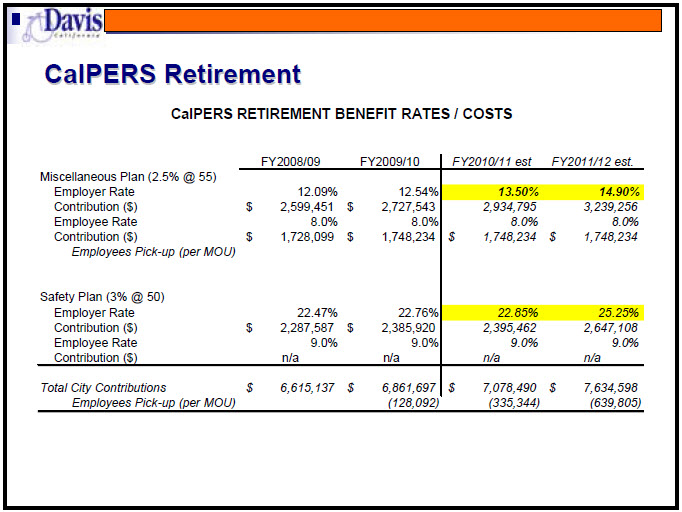

Last week the Vanguard reported that the city of Davis was about to take a hit both in terms of pensions and retiree health benefits. The projections offered by finance director Paul Navazio show that PERS contributions rates would climb by about 8.5% on the safety side and a mitigated five percent on the non-safety side.

Last week the Vanguard reported that the city of Davis was about to take a hit both in terms of pensions and retiree health benefits. The projections offered by finance director Paul Navazio show that PERS contributions rates would climb by about 8.5% on the safety side and a mitigated five percent on the non-safety side.

Using those numbers which are aided by CalPERS rate-smoothing mechanism, the city of Davis is looking at paying out between 9 and 10 million dollars from the general fund by 2013-14.

Until now that is.

A report was released from a study from Stanford that shows that California’s three biggest pension funds are as much as $500 billion short of meeting future retiree benefits, that includes CalPERS, CalSTRS, and the UC Retirement System. They are understating their future liabilities by using projected rates of return that don’t properly account for investment risk.

This is what has been feared for some time. The fund estimates an average annual return of between 7.5 and 8 percent. The report recommends a much more conservative calculation of 4.14 percent.

Is the study politicized? Governor Arnold Schwarzenegger did commission the study. However, the study was advised by Joe Nation, a former Democratic Assemblyman.

Spokespeople for CalPERS dispute the study. A spokeperson said on Monday:

“This study is an exercise in applying a new funny math to pension financing. It ignores the reality of the last 20 years — that even in spite of several market downturns, Calpers continued through a well-balanced, diversified portfolio to return 7.9 percent in investment earnings over the last 20 years.”

However, critics say using past performance as a projection for the future is too high given today’s economic climate.

Joe Nation who advised the study said, “You should not use an 8 percent rate when the liabilities are set in stone.”

The research team reports:

“Adjusting the discount rate used on liabilities to a risk-free rate, we estimate the combined funding shortfall of CalPERS, CalSTRS, and UCRS prior to the 2008/2009 recession at $425.2 billion. At the time of this writing, the funds have not released more recent financial reports, but due to the previously mentioned $109.7 billion loss the three funds collectively sustained, we estimate the current shortfall at more than half a trillion dollars.”

The governor’s economic adviser David Crane said, “What’s been going on is decades of underreporting debt. We’ve seen this in the financial crisis recently where companies and even government agencies like Fannie Mae, Lehman and others underreported their debt.”

The report suggests scaling back benefits to newly hired employees, it also suggests putting money into less risky investments, and giving state employees a hybrid plan that would include a self-directed 401K option.

What this means for Davis

The problem that CalPERS faces is that a more modest growth assumption leads to these type of numbers. It is alarming to hear that the pension funds may be half a trillion short. But we need to plan more conservatives. If a 4.14 percent growth is less risky and more realistic, then perhaps that ought to be the approach.

If that happens then local governments like the city of Davis are on the hook for huge amounts of liability because they have essentially promised millions that are not funded.

The finance director understands this very well, but there is zero plan by the city to fully fund its PERS liability as it has moved to fully fund its retiree health liability. That liability is currently over $20 million and it will probably grow especially as rate smoothing obscures the true increase in costs.

I would like to see the city be honest about the full numbers that we are dealing with in terms of liability, what it would cost us to fully fund our employee pensions regardless of what CalPERS calls for.

What people may have to recognize is that we may have to pay closer to double per year what we are. Right now that means we would be paying $13 to $15 million for pensions as opposed to $6.5 to $7.5 million. What will that do to our budget?

When we talk about a ticking bomb, that is part of the equation.

The good news is that Davis is hardly alone in this respect, the bad news is that means there will be less possibility of Davis getting help. We could be looking at a severe cutback in municipal services in the future all because we decided to greatly increase our employee compensation and pension obligations over a five year period the past decade.

And our MOUs did absolutely nothing to shield or buffer us from this blow if it comes. We slept-walked through a five year period giving out huge salary and pension increases as though the bill and the consequences would never come due. That due day is rapidly approaching.

—David M. Greenwald reporting

This all depends on rate of return. the rate of return from the bottom of the stock market last year is around 70%. The long term historical average rate of return is 11%. This is all so much static. Estimating future returns is always a guessing game. The pension funding formula’s instituted in the late 90’s are unsustainable for those earning 3% at 50 but playing this numbers game is all about the politics of moving public opinion on the issue not about any real projection of what will happen in the future. I didn’t notice a level of confidence value for the Stanford study. Did I miss it?

Another problem with a committed higher rate of return is political and CALPERS management pressure to achieve these returns… which in turn leads to an unhealthy appetite for higher risk investments. Given the lessons of this latest financial market tsunami, we would all be much safer under committing while attempting to over perform.

It is interesting that the reporting template for this includes the insinuation of governor-right-biased, but not the arguments against it being legislature-left-biased.

I saw a TV ad for Meg Whitman where she says government should operate more like a business… that government is 90% talk and 10% action, and she would like it closer to private business which is generally 10% and 90% action. The challenge is to take the politics out of government and elect leaders that can make rational management business decisions based on well founded business principles, and not to satiate short-term popularity needs. To date, the inability of voters – inflamed and supported by the media-turned-political-influence establishment – to give up some of their selfish wants and single-issue causes has become our political cancer. Frankly, the business-capable people know better than to run for office or they will be ripped to shreds. Hence, we get to entertain these type of business-senseless arguments for more aggressive return projections after seeing a decade of returns wiped out from the same.

DPD: “The good news is that Davis is hardly alone in this respect, the bad news is that means there will be less possibility of Davis getting help. We could be looking at a severe cutback in municipal services in the future all because we decided to greatly increase our employee compensation and pension obligations over a five year period the past decade.”

Cutback in municipal services along with INCREASES IN TAXES/FEES.

Jeff Boone: “To date, the inability of voters – inflamed and supported by the media-turned-political-influence establishment – to give up some of their selfish wants and single-issue causes has become our political cancer.”

The real “cancer” is the bait and switch games going on. Politicians use two tactics in particular:

1) Shell game One: Divide funding into two pots of money – operating expenses and facilities money. That is why UC Davis is able to renovate the MU gameroom and coffee house at the same time they are, in the name of a fiscal crisis, raising student tuition 32% in one year, firing staff and eliminating courses. This is how the DHS Stadium was renovated as teachers were in danger of being pink slipped. Courthouses are being built across the country as court staff are being laid off. Yet money to fund facilities/operating expenses comes from one pot of money – the taxpayers’ collective pockets. But allowing money to be put under different “shells” hides much of the public $$$ from scrutiny as to how it is spent. In short, this shell game cuts down on accountability and prioritization of need.

2) Shell Game Two: Frills are kept in place, but basics are cut, such as in the above examples. Why? Because cutting basics hurts taxpayers deeply – they severely feel the pain – which will coerce a taxpayer into forking over more money in the way of agreeing to new taxes – so basic services will not be decreased. But this method allows frills to remain in place, such as renovating a game room. In other words these shell games are used to achieve the following result: higher taxes/fees so it’s business as usual in terms of gov’t spending.

This is going to happen at the nat’l level to inplement Obamacare. Guess what’s coming? VAT – value added tax. A nat’l sales tax to pay for health care reform. Everything you purchase will now be taxed more heavily, giving you less disposable income than you already have. You didn’t think the miracle of health care reform was going to happen for free did you? There will also be cuts to Medicare to institute Obamacare, by the way. Again, more shell games, moving the money around, to force the hand of taxpayers to shell out tax $$$. I call it robbing Peter to pay Paul. If Obama needs to institute a VAT, say so up front. If there are going to be cuts to Medicare, say so up front. We need to know the true cost of health care reform, and just how high it will be on our priority list in view of other needs, like jobs creation or staving off foreclosures.

Politicians don’t prioritize expenditures, won’t be honest about what they are doing, use all sorts of creative bookkeeping to distort what is really going on, work the system to squeeze endless amounts of money from taxpayers by hiding the ball. And politicians wonder why we are fed up with them?

correction: “…so basic services will NOW be decreased…”

correction – never mind, I was right in the first place – geeeeze – too tired this morning I guess!

[i]”The long term historical average rate of return is 11%.”[/i]

The number I know (from a long-term study) is 10.8%. Perhaps you are using 11% for that?

However, that number really means little when it comes to real world investing. First, it ignores taxes. That works for some non-profits, but not for most investors. (I really don’t know if public pensions pay any taxes. I presume they don’t. But I don’t know.)

That higher number also presumes zero transaction costs and zero overhead. In other words, you put money into the S&P 500 and you keep it all there and never take out your principal and every dollar in dividends you receive you plow back into your principal and it costs you nothing each time you buy stocks with your new money invested and with your dividends.

But public pension plans certainly have transaction costs and they have a lot of overhead. Speaking of which, I just saw the new CalSTRS complex in West Sac. Very nice building. (See the photo below.) Once you figure in transaction costs (but not overhead), that 10.8% potential return falls closer to 8.5%.

But even that number is unrealistic, because the 10.8% number is high due to very good dividend payments which S&P 500 companies used to pay up until the mid-1960s and have curtailed ever since. That is, a much higher percentage of your return now comes from capital gains, not dividends. The result (since the mid-1960s) has been a lower annual average compounded ROI — closer to 8%.

CalPERS uses 7.75% and that on the face of it seems realistic. However, keep in mind that the CalPERS portfolio includes a lot of government and corporate bonds which pay a lot less than 8% per year and a lot of real estate, which (even if PERS had not gotten crushed in the current collapse) normally returns far less than stock investing.

Because they have had trouble making that 7.75% target, PERS is now considering a new, lower target. Here is a story from the Chronicle ([url]http://articles.sfgate.com/2010-03-02/business/18371953_1_calpers-million-investment-san-francisco[/url]) one month ago: [quote]In light of “market conditions over the last year,” the California Public Employees’ Retirement System said Sunday that it’s considering lowering the benchmark 7.75 percent return on investments judged necessary to cover its obligations. That could mean additional pain for state employees and California taxpayers.

Larry Fink, CEO of the giant money management firm, BlackRock Inc., with which CalPERS has invested, told its board in July, “You’ll be lucky to get 6 percent on your portfolios, maybe 5 percent.”

Meanwhile, add another crash-and-burn investment to CalPERS’ list.

In addition to the $600 million worth of recent real estate losses from Manhattan to East Palo Alto, an $800 million condo and hotel complex in Boston, called the Columbus Center, is on the verge of default. Departed investment adviser, San Francisco’s Victor MacFarlane, negotiated CalPERS’ investment in the project, which barely got off the ground.

[quote] [img]http://rankeramg.com/wp-content/uploads/proj_calstrs2.jpg[/img]

I wish the city council majority had listened to Sue Greenwald some years back when she did the math and tried to steer us away from this. Yes, Davis has plenty of company in the area of unsustainable retirement costs, but we would have been among the lucky few with a considerable smaller problem if her sound numbers had not been dismissed.

considerablY, not considerable. sorry.

There was an interesting article in the New York Times last week that showed a table of budget deficits and unfunded pension liabilities by state as a percentage of state GDP. It showed California to be ranked 23rd because although California has a large nominal deficits it also has a large GDP. In other words, California’s problems are about average for all the states so it seems that all this consternation over the California budgetary problems is being overblown because people are only looking at one side of the equation without the perspective of the GDP side for context.

The use of GDP comparing just about anything can be distorting. There are too many other mitigating factors.

If California were a country, it would have the 8th largest GDP just ahead of Russia (per the International Monetary Fund). The next highest-producing state, Texas, would rank 12th – just ahead of India. However, comparing Californian-Russian or Texan-Indian deficits or public pension liabilities would not make sense.

Just as countries differ too much to support GDP-based comparisons, so do states. California may rank 23rd based on GDP, but it has the largest unfunded pension liability and the 3rd highest total tax rate. It is also the largest and most populous state with more human and geographic diversity than all others. The point here is that California has more competing spending demands, and less ability to generate additional tax revenue through increased taxation. Because of this, GDP-based comparisons of deficits and pension liability – like for many other comparisons – distort and deflect the real scope of the problem.

http://www.nytimes.com/2010/03/30/business/economy/30states.html?scp=16&sq=state budgets&st=cse

Here is the link.

Mr. Toad:

Thanks for the link. I read the article. The premise is that some state deficit problems are not likely as dire as math would indicate.

I love this quote: “Goldman Sachs, in a research report last week, acknowledged the pension issue but concluded the states were very unlikely to default on their debt and noted the states had 30 years to close pension shortfalls.”

I think Bear Stearns issued a similar report four years ago about securitized home mortgage pools.

I certainly wouldn’t buy a used car from Goldman nor a used mortgage or be on the other side of a credit default swap from them so I get your sarcasm but I also would take something antiunion coming out of the Hoover Institute with an equal amount of doubt. After all, just think of who the place is named after and the kind of people who work there. If ever there was a piece of propaganda that reeked of the party of Hoover and Bush supporting the candidacies of Whitman and Campbell you can see it in this study.

Anyway one thing that bothers me about the Hoover study is that it lumps all unfunded pension liabilities together when there is a huge difference between the pension of a teacher who gets 1.4% at 55 or 2.4% at 62 and a cop who gets 3% at 50. Then to get all worked up about the total amount of bondage of California taxpayers without putting it in perspective by looking at it relative to the size of the California economy or the fiscal problems of other states as the NYT article does seems to overstate our problems.

I also found it interesting that the NYT article listed Alaska as the state with the largest finance problems when adjusted for GDP interesting because that is the state that was run until recently by that now famous conservative and Tea Party favorite Sarah Palin.

Hey Toad:

I hear you on that. One reason I didn’t completely discard it is Joe Nation was the supervisor for the project, he has legit liberal creds, which to me pulled it out of the Hoover Institute/ Governor Arnold stigma.

I also found it interesting that the NYT article listed Alaska as the state with the largest finance problems when adjusted for GDP

That is interesting and maybe another indication that the GDP-based comparison causes distortion. Alaska can just drill more oil wells to solve their funding problems.

One reason I didn’t completely discard it is Joe Nation was the supervisor for the project, he has legit liberal creds

In other words he is sure to be biased in a way that you can agree with? Isn’t it interesting how we almost automatically discount analyses from people and institutions we associate with different political views. It reminds me of a time when a goups of people might discount other groups of people because of their religion or culture.

The crux of the rate of return issue is that pensions should use the RISK FREE RATE, not the casino rate.

Politicians and their supporters will drive us all off the cliff. There are seemingly no bounds to the Magical Thinking behind those who would deny the pension shortfall.

No matter, as the Greatest Depression has arrived and will cure the problems eventually. Reality will be achieved by choice, or market forces..

Historical market averages do not apply to the future as we are now a hollowed out country due to globalisation.

Try using the last 10 years as a market average and you can see where this is going ! Its NEGATIVE. 14,000 dow to 10,900 dow.. hmmm not too good.

OH, and the 10,900 Dow was only achieved by spending Trillions of TAX DOLLARS and DEBT !!! You cannot indebt yourself into prosperity !

Game over.. got your victory garden and chickens yet? You will need them.

Actually Town the Dow was 14,000 in 2007 not 2000 but your point is well taken future returns can’t be based on past returns and that is why they use a number lower than the long term return of the stock market and diversify the portfolio.Of course the longer the time frame the greater the chance the probabilities are precise.

My objection is not that some state pensions are problematic it is the broad strokes that this report painted all public employees as part of the problem when that is not the case.

From the Wall Street Journal “The figure dwarfs the funds’ own combined shortfall estimate of $55 billion as of July 2008, according to the report, which doesn’t account for the more than $100 billion loss sustained by the funds during the recession. That adds a further wrinkle to California’s already precarious fiscal situation.

“The study, prepared by Stanford graduate students for Gov. Arnold Schwarzenegger, used a more conservative formula to estimate the pension systems’ unfunded obligations, an approach advocated by a growing chorus of experts. The report also recommended increasing contributions to the funds, investing in less risky assets and trimming pension benefits for future employees.”

The 100 billion dollar loss through July 2008 number is too old since the stock market is up 70% since March of 2008. Also using a more conservative formula is likely to result in a bigger unfunded liability. You change the formula you change the result but before you do so you should at least make an argument for why you need to change the formula and why you need to change it. The end result is that the report represents conservative claptrap designed to scare the hell out of voters to change the pension system in their own image. I wonder how Stanford’s pension fund would do using the same criteria?

Should read: and how you need to change it

It appears that the Stanford group used a 4.4% return a number that is ridiculous see the critique at the link

http://www.prospect.org/csnc/blogs/beat_the_press_archive?month=04&year=2010&base_name=california_gets_a_bad_rap_on_p

Mr. Toad.. your still assuming the future will be the same as the past.

Ask the Roman empire how this worked out.

4.4 % is reality. 8% is just not going to happen. This is the Greatest Depression. The sooner we all get “real” the better.

Oh, and the study was a bi-partisan proposal, so no need to blame Arnold.

“The 100 billion dollar loss through July 2008 number is too old since the stock market is up 70% since March of 2008.”

You need to look at how PERS investments performed not just the stock market. CalPERS investments are only up 30% over that time.

4.4% is less then the rate on the 30 year T Bond at a time when interest rates are at historic lows. Bi-partisan bismartisan. How come no respected Stanford economist put his name on the Graduate students’ work as is the custom in academia? Watch the grad students get appointments from Arnold.

Toad, I pointed this out to you before, the supervisor was Joe Nation, who was a Democratic Assemblyman. So I do not understand your point here.

Up 30% of how much? More than 200 billion so how far down is the fund really.

What Stanford economist signed on. This is a hatchet job, clear and simple, obviously politically motivated. Nation may have been a decent member of the assembly but it is clear he is carrying water for his new pay masters.

Joe Nation is a lecturer at Stanford in public policy. A lecturer is very different from a professor and public policy is very different from economics. So, Nation is a familiar type of side employee in academia. If he wants to, he can make his credentials look bigger than they really are.

The fact that Nation used to be an elected state politician doesn’t help.

As “Mr. Toad” has pointed out, Nation takes it as an axiom that if a fund guarantees benefits, it should therefore only make risk-free investments. Now, I have a lot of money tied up with UCRP, I am on one of these plans, and I have no collective bargaining rights nor any other political influence over how I am paid. Speaking as someone with a lot at stake in the system, Nation’s “study” and his advice do nothing for me. He proposes a scared-turtle strategy for my pension, a strategy that would only make sense if most subscribers were already retired.

It is true that CalPERS, CalSTRS, and UCRP face serious problems. However, various actors, certainly Arnold Schwarzenegger and maybe Joe Nation but also other people, want to exploit these problems for their own ends. Or even to score populist points without any rational goal. In politics, it takes work to separate the people who truly want to solve problem, from people who don’t mind making problems worse in the name of solving them.

However, various actors, certainly Arnold Schwarzenegger and maybe Joe Nation but also other people, want to exploit these problems for their own ends.

What ends would those be? I tend to view the motive and skin in the game a bit differently. Those that discount this Standford report as political fodder probably have more to gain or lose than does Schwarzenegger. Besides, haven’t we all learned some lessons in applied fiscal conservatism?

Good point Jeff. The bottom line here is whether or not you believe that 7.75% growth is a reasonable assumption given the current climate. If it isn’t or even if we believe it isn’t, then perhaps we need to plan for it rather than have the bill come due in the next thirty years.

One thing is clear, the pension problem will not be dealt with appropriately; either locally at the City level, or the State level. The powers that be to deal with the issues are in a permanent state of denial.

If Davis had some real forethought, they would be circling the town with truck gardens.. Your going to need them.

This is a perfect storm of ‘peak economy’ and ‘peak oil’.. The downslope of all empires is rough and tumble. The debt deflation is upon us. Homes are still hugely overpriced, propped up by debts that our children will be asked to pay… The debts are un-payable already.. Default is ahead. Smoke and mirrors only gets you so far. 8% is long gone.

Eventually you will be using a local/regional currency. TIme to embrace the future as any amount of wishful thinking is not going to fix the problem. Get ready for a much lower standard of living.

[i]What ends would those be?[/i]

Schwarzenegger, for one, would like to bully the legislature to get budget concessions. Which is not to say that he’s the only bully or the main bully in town. Rather, the state government has turned into a dog-eat-dog world in which everyone has to bully someone to get much done. (Thanks to the state proposition system – it never hurts to repeat that point.)

Joe Nation has a lot to gain from publicity. If he wanted to be a successful research professor, that’s not what he is. A lot of academics on all sides of politics try to get recognition in newspapers if they don’t win recognition in journals. Or Nation may want to get back into politics. Or he may have both goals in mind.

How much such people have to gain is not as much the point as what they have to gain. If you play tennis against someone else, it matters more that he’s trying to win against you, than how much he has at stake. But for the record, if someone like Joe Nation defines his career by publicity, then he has as much at stake as anyone.

[i]The bottom line here is whether or not you believe that 7.75% growth is a reasonable assumption given the current climate.[/i]

But Nation did not argue that 7.75% was wrong because of “the current climate”. He argued for another figure by saying that defined benefits require risk-free investments. This is a convenient argument for him, since Stanford has a defined-contribution plan, so his logic allows his pension a broader base of investments than Treasury bonds. It’s not a convenient argument for me, since I have the type of pension that he thinks should hide and crawl like a turtle.

Besides, likely returns aren’t based on a “climate”. If anything, when a broad basket of stocks has crashed, it can be more likely to rebound than fall further, if the crash scared too many buyers out of the market. Climate-based investors are the type of people who like to buy high and sell low.

[b]GREG K:[/b] [i] “Nation takes it as an axiom that if a fund guarantees benefits, it should therefore [u]only[/u] make risk-free investments.”[/i]

I don’t know what your source for that claim is. However, that is not what the SIEPR paper ([url]http://siepr.stanford.edu/system/files/shared/GoingforBroke_pb.pdf[/url]) called for. This is the pertinent phrase from that paper: [quote] Historically, if CalPERS had simply invested in investmentgrade corporate bonds, the fund could have earned 7.25 percent, only .66 percent less than it has earned with its highly volatile portfolio. This small reduction in earnings would have allowed CalPERS to reduce volatility by a full 7.68 percentage points. Therefore, in order to avoid future severe underfunded scenarios, [i]we recommend that CalPERS, CalSTRS, and UCRS allocate [u]more[/u] of their investment portfolios to fixed-income asset classes[/i], thereby reducing risk with a minimal loss of long-term investment performance.[/quote] Historically — that is, until the early 1980s — most public pension funds invested exclusively or almost exclusively in bonds. However, because stocks perform better over the long-run, laws were changed to allow pension funds to invest in equities. My feeling is that the funds ought to be allowed to determine the best mix in their portfolios so that they maximize returns over the long-run at the risk level (or volatility level) they think makes sense. So here I disagree with the Nation notion of increasing bonds (aka “fixed-income asset classes”) as a matter of public policy. But if the directors of the pensions determine that they need to reduce volatility, then I’m sure they will take Nation’s notion into account.

[b]GREG K:[/b] [i]”Nation is a familiar type of side employee in academia. If he wants to, he can make his credentials look bigger than they really are.”[/i]

There is really no need to try to disparage his credentials. What should count is the wisdom of his conclusions and the method by which he reached them. His academic background seems to me adequate for taking on this sort of a question. From the paper: “Nation … received a Ph.D. in Public Policy Analysis from the Pardee RAND Graduate School; his graduate work focused on budget modeling and longterm budget projections.” I am not saying his study is correct, because he has a background in modeling longterm budgets. But that background does not hurt.

David: The bottom line here is whether or not you believe that 7.75% growth is a reasonable assumption given the current climate.

Who knows? There are signs that we will never get back to the returns of the last 40 years… at least for another several years. However, as I near retirement age I will move more of my investment portfolio to lower risk instruments. Retirement=fiscal conservatism, right?

On a realated note, does anyone know if these pension fund money managers receive any comission or bonus based on fund performance?

If you take the 11% long term return of the stick market and the 30 year t-bond rate of 4.5% and average them on a 50/50 asset allocation you get a return of 7.75%. A 50/50 asset allocation for a retirement system seems reasonable to me and I think it would to most financial planners who recommend the same for personal retirement funds 401k 403b etc. at the time of retirement.

This is an obviously flawed study that no honest financial planner would put forward. It has had its desired effect, to get headlines. What is sad is that the press has not been more critical of it and reported it without serious analysis.

There are serious policy issues that need to be addressed regarding public employee pensions but citation of this study only serves to undermine the credibility of the critics of current policy. If the Vanguard of Davis wants to be taken seriously it needs to be more careful in analyzing the arguments it puts forward.

Rich, well okay I oversimplified a bit. The paper says, “Since pension liabilities are effectively riskless, we believe they should be discounted and reported at risk free rates.” In other words, they are saying that some of the funds can be invested with a risky rabbit strategy, if less than currently, but they should make me pay into UCRP as if all of it is a timid turtle investment.

Since I am a mid-career UC employee, for me it comes to the same thing. Nation thinks that I should pay into a huge cash cushion that I’m never going to see. He sees that as my burden because I’m promised defined benefits in the face of stock market risks. His prescription is entirely against my interests. I suppose that it would sound good to a UC money manager who wants to work with a much larger endowment.

[i]There is really no need to try to disparage his credentials.[/i]

I have nothing against Joe Nation’s actual credentials. The problem is that this did not land in the papers as a Joe Nation study, it landed in the papers and on the Vanguard as a STANFORD study. What would you make of a STANFORD study or a HARVARD study that turned out to be written by, say, the grader for first-year Spanish? It’s not that there is anything wrong with Joe Nation himself or even technically his press release. Technically speaking, he’s honest. Even so, he gets the benefit of a degree of misrepresentation.

As for the study itself, again, it’s fine as far as it goes, but there is really not much more in it than a graduate term paper. They pick a very low number arbitrarily, in order to say that I need to pay in several times more than CalPERS says I need to pay. Yes, even the best forecast would have a degree of guesswork, but that does not a reason to guess based on feelings and politics.

Right on , MR. Toad and Greg Kuperburg , keep fighting the fight of common sense !

[i]”They pick a very low number arbitrarily, in order to say that I need to pay in several times more than CalPERS says I need to pay.”[/i]

Yet by raising its contribution rates, as CalPERS has, CalPERS — not Mr. Nation — is saying that public employees and public employers in the CalPERS system need to pay a lot more. And those announced increases in contributions are [i]before[/i] CalPERS has even considered the notion — which, if you look at my link above, suggests they are considering — that they no longer believe 7.75% is realistic for the long term.

Jeff asked above “… if these pension fund money managers receive any comission or bonus based on fund performance?” Yes, they do. The fund managers are not CalPERS’ employees. They work on contract for equity management companies like Blackstone. However, there is currently a commission scandal ([url]http://www.latimes.com/business/la-fi-calpers-bill8-2010apr08,0,5554526.story[/url]) with CalPERS — it tangentially involves Blacksone — having to do with paying large commmissions to Wall Street “placement agents,” who “… help smaller funds pitch their products to public and private pension funds, university endowments and other institutional investors.”

The real importance of a story like this, to me, is to know that CalPERS and other pension funds are not unmanaged funds run by a computer program. (I am sure they would make equally good or better returns if they were.) A managed fund is one which pays its fund managers and has all sorts of costs and fees associated with its investments. And, of course, CalPERS has a lot of overhead in just doing things like dealing with its member agencies and its pensioners and its thousands of employees. As such, it is a mistake to think its market returns, even its stock market returns, should return anywhere near as much as a zero-transaction fee, zero overhead index fund, like the S&P.

This is an obviously flawed study that no honest financial planner would put forward. It has had its desired effect, to get headlines. What is sad is that the press has not been more critical of it and reported it without serious analysis.

even the best forecast would have a degree of guesswork, but that does not a reason to guess based on feelings and politics.

Well isn’t this the season for wild ass emotive claims of unsubstantiated crisis in order to win some ideological battle? If this is a Schwarzenegger play, I guess he pulled it right out of the Obama-Pelosi-Reid playbook.

[i]Yet by raising its contribution rates, as CalPERS has, CalPERS — not Mr. Nation — is saying that public employees and public employers in the CalPERS system need to pay a lot more.[/i]

Yes, that’s true, CalPERS, CalSTRS, and UCRP all say that a larger fraction of salary must go to retirement. For a while, they took almost nothing from people’s salaries because returns were very good. Last year returns were really bad, so now they want to take a lot. I heard recently that without some kind of gradual ramp-up, UCRP would theoretically take a third of my salary for retirement, for the next few years.

If that is their projection, then Nation is saying that even a third of my salary isn’t good enough; it needs to be more than half.

Now, I’m usually not one to complain about my own pay, taxes, or property values. Frankly for me, as a Davis resident, my share of the entire city budget is not really so much money. Moreover, people are arguing over maybe 1/10 of the city budget at the most, not the whole thing. But telling me that either I or my employer needs to set aside half of my salary for retirement, in the name of risk-free returns? Good grief, even for me, it makes me feel like guarding my wallet.

[i]Well isn’t this the season for wild ass emotive claims of unsubstantiated crisis in order to win some ideological battle?[/i]

Maybe, but not in my house.

[i]”I heard recently that without some kind of gradual ramp-up, UCRP would theoretically take [u]a third[/u] of my salary for retirement, for the next few years.”[/i]

In the CalPERS system — but maybe not UCRP? — there are strict limits on the percentage of an employee’s salary which can be taken for his share of the pension contribution. The cap on that percentage depends on his retirement plan’s formula.

In the City of Davis, cops and firefighters* have a 3% at 50 formula; and their cap is 9% of salary. All Davis cops and firefighters do in fact pay 9% of their salaries to CalPERS for their pensions**. However, the city share for their pensions is still very high. It is equal to about 27% of their salaries. In other words, to fund a 3% at 50 pension for a firefighter making a base salary of $100,000 a year, it costs about $36,000 right now. And when that goes up in the next few years as CalPERS increases its rates, the firefighter’s cap at 9% will mean the increase is going to be borne*** by the taxpayers.

All non-safety employees are on the 2.5% at 55 formula. The cap on their employee contribution is 8%. However, in Davis — thanks City Council!!! — the employees pay 0%. That’s right, the taxpayers pay the entire employee share. But that share is still less money than it costs for the employer share for 3% at 50.

*If you look at the City’s labor contracts, you would think it is only the actual firefighters and captains who are on 3% at 50. But that is not true. Rose Conroy, who just retired as Chief and was paid her salary based on the Department Heads contract, was covered by 3% at 50. I don’t know which formula is used for the Police Chief, but I would not be surprised he too gets 3% at 50. Yet all other department heads are on the non-safety formula, 2.5% at 55. At the very least, I think the city contracts should make that clear. They don’t. They explicitly say that all department heads, including Police and Fire, are on 2.5% at 55.

**They pay nothing for their lifetime retiree medical, dental and vision benefits.

***The only smart change which was made in the last round of contracts, capping the nominal growth of employee compensation, will make my statement less true. The way it will work when CalPERS rates go up is this: Say the employer share goes up to 35%, which would represent an 8% increase in total comp. Yet the contract now limits the total increase in employee comp to 103% of the last year of the old contract. So what will happen is salaries will be lowered as much as necessary to reduce the pension costs for the City, to the point where total comp rises just 3% over the period of the contract. The total comp clause also accounts for large increases in cafeteria benefit costs. As such, even if the pension rate increases are modest, higher health insurance rates might freeze or push down salaries.

[i]In the CalPERS system — but maybe not UCRP? — there are strict limits on the percentage of an employee’s salary which can be taken for his share of the pension contribution.[/i]

What I meant was, a third of the amount of my salary, either from me or from the employer. In the long run, they’re not as different as you might think, because they are both a tax on labor.

Pensions are a main form of compensation for almost all public workers, and many private-sector workers. So ultimately, declaring a pension crisis is a convenient, indirect way of telling people that they’re overpaid. It’s a way to mix concern for workers, whether they’ll get what they have been promised, with contempt, that they were promised too much in the first place.

In my case, I have never been able to or wanted to plead poverty. University faculty are paid as highly skilled workers, even if they are at the low end of that lucky scale. Even so, I would rather that people tell me straight that I shouldn’t be paid as much to work for the University of California as for the University of Texas or Michigan or Illinois, than to put on a Chicken Little act over pensions.

[i]”In the long run, they’re not as different as you might think, because they are both a tax on labor.”[/i]

Agreed. However, there is a psychological difference which may or may not mean something to some workers and there is a political difference which has a real world impact.

The psychological impact is this: If you take the guy making $100,000 and reduce his pay by $9,000 to cover his share of his pension contribution, he naturally feels like he is paying a helluva lot for his pension, but it’s worth it. On the other hand, if he had to make the employee and the employer contribution, and you gave him a salary of $127,000 a year and then took out of that $36,000 (so his bottom line is the same), chances are he will feel like he is being robbed by The Man and the system is not as good for him. It may be immaterial. But that is human nature. It’s the reason why jewelry is marked up by 300% and then sold at half off.

The political impact is this: base salaries have tended to be set in comparison with base salaries at other comp agencies. Benefits tend to be set that way, too. So if City C is paying a city engineer $132,000 + comparable benefits, Davis will match that amount and benefits. But in City C, the engineer is paying his full 8% employee contribution. In Davis, the employee is paying none of it*. So his total comp is substantially higher.

*I spoke with a county administrator (not in Yolo County) who told me, at a time last year when his agency was trying to reduce all formulas for new hires, that Davis is “the only” agency he knows of in California which pays its employees’ full share. A few, he said, pay partial shares. In most, the employees pay the employee share.

Rifkin and Greenwald have been pounding away at generous retirement benefits for a long time. It is an important debate that needs to be argued but the Stanford study is so ridiculous it ends up detracting from an honest debate about the seemingly unsustainable pension increases that were handed out during the dot com bubble and the archaic clauses of City of Davis employee contracts that have been eliminated from most municipalities throughout the state.

Show me a pension fund manager anywhere who has a target return on investment of the 30 year t-bond rate and I’ll show you someone who has an unemployment claim.

One other thing about PERS and STRS management, these funds are so big that it is almost impossible for them to beat the market because they essentially are the market. The cheapest and optimal way for them to invest would be through index type funds thus reducing the management fees that eat away at returns.

[i]”… the Stanford study is so ridiculous it ends up detracting from an honest debate … Show me a pension fund manager anywhere who has a target return on investment of the 30 year t-bond rate and I’ll show you someone who has an unemployment claim.”[/i]

The Stanford (or Nation) study does not call for “a target return on investment of the 30 year t-bond rate.” You misunderstood or misread the story you linked to.

[i]”It appears that the Stanford group used a 4.4% return a number that is ridiculous.”[/i]

Two problems. First, the number quoted is actually 4.14%, not 4.4%. (The only reason that mistake matters is I searched high and low to find anything which said 4.4% and it was absent.) Second, no one called that a target return. That number is what was calculated to be “a risk-free yield” — it is based on 10-year t-bonds — which Nation uses as a basis to measure relative portfolio volatility in the various California public pension funds.

In other words, 4.14% is the yield you would get if you wanted to avoid all risk of portfolio volatility, so you could always be sure to have exactly the right amount of money to pay your pension liabilities.

[b]But the Nation group never called for the pension funds to adopt a zero-volatility strategy.[/b] Nor did they, as Kuperberg claimed at first, suggest the funds no longer invest in equities.

Rather, if you read the study, you will see they have called for a slightly different mix which would, in their estimation, not lower the total return too much but would substantially reduce the risk of facing a situation like all the funds have now, of having to turn to workers and taxpayers and demanding they increase their payments into the funds, because the market returns went south.

The risk ratios that Nation advises are 80%/80%. Here are their words: [quote]… we propose an “80/80 strategy” as a prudent funding target: pension funds should contribute and invest their portfolios so that net assets limit the chance of a deficit greater than 20 percent to a likelihood of no more than 20 percent, (i.e., an 80 percent likelihood that a fund will be able to cover at least 80 percent of its liabilities). Even under this strategy, given the current investment portfolios and wide variance of returns, there is only a 60 percent chance of a surplus. Hence, we consider an 80/80 approach at the low end of cautious. (If under an 80/80 scheme a pension ends up overfunded, any surplus should only be allowed to be used to repay state debt, however in a prudent way such that an 80/80 strategy would always be preserved.) We estimate that adopting an 80/80 strategy for all three funds as of June 2008 would have required a collective infusion of $200 billion. Under conventional funding metrics, this would translate into a funding ratio of 130 percent.[/quote]

You are correct about 4.14%, I read the number wrong. Still the problem with this value is best stated in the following quote from Dean Baker at the American Prospect “Suppose we assume that pension liabilities grow at the nominal rate of 5 percent a year. If we sum the liabilities over 40 years, using a 4.14 percent discount rate gives a 70 percent higher cost than using a 7.0 percent discount rate. Stocks have historically provided a real return of 7 percentage points above the inflation rate, so assuming a nominal return of 7.0 percent for the mixed portfolio is hardly unreasonable.”

So what is going on here is that there is a movement to get rid of defined benefit plans and using a rate of return number that is unreasonably low gives an answer that is unreasonably high. An honest discussion would use a number that is realistic over the long term based on historic long term rates of return. These rates give the best approximation available. As for managers wanting a 4.14% portfolio rate of return, nobody would hire a pension manager with that goal. i doubt you can find me a pension fund anywhere, public or private, with a 4.14% rate of return as an investment goal. So unless the numbers are realistic to real pension trustee’s the answers are meaningless.

The arguments against these recommendations for lower-risk investments confound me a bit. These are defined benefit plans and I would think all retirees and future retirees would welcome the stability that would result from the Nation recommendations. I assume that those arguing are hedging their bets that the state would find ways to fund shortfalls in order to meet existing commitments. I think that is a dangerous assumption. Just like today, a significant shortfall would be the result of a significant market decline which would also mean funding shortfalls in almost all other competing interests. Combine that situation with a growing void between the public sector retiree have and the private sector retiree have nots, and there will likely not be enough political capital for a success vote to tax ourselves more.

These public pension funds should be self sustaining and stable and a lower-risk investment strategy seems prudent and beneficial to the some of the very people that argue against it.

[b]the problem with this value is best stated in the following quote from Dean Baker at the American Prospect[/b]

You do understand that Dean Baker is pulling numbers out of rectum? None of those numbers have anything to do with the Stanford group’s recommendation. Baker also sidestepped the question of portfolio volatility. (I am fairly certain Mr. Baker did not read Mr. Nation’s article. He just misunderstood what the NYT reported on it.)

Look, I am not arguing that Nation gets this right. I really have no idea. But it is very strange to rip Nation, as Baker does, using numbers he just made up and to rip a strategy, as Baker does, which Nation never advocated.