On Wednesday, the vanguard reported that the city of Davis has been added to the lawsuit filed by Twin Pines Cooperative Foundation against the Davis Area Community Housing Association (DACHA).

On Wednesday, the vanguard reported that the city of Davis has been added to the lawsuit filed by Twin Pines Cooperative Foundation against the Davis Area Community Housing Association (DACHA).

Judge Reed quickly ruled that he was allowing the city to now be named in the suit. The bigger issue was whether the Judge would issue a Temporary Restraining Order (TRO) against the foreclosure of the DACHA property. He declined to rule on it on Tuesday citing that he had not had time to read all of the documents. That hearing was scheduled to take place at 10 am on Thursday morning. The foreclosure auction was set to occur at 12:45 on Thursday.

She said, ” While we were hopeful that both Neighborhood Partners and Twin Pines would talk to DACHA and among them develop a comprehensive and reasonable settlement, this has not happened. It is unfortunate that Twin Pines has chosen to move forward on its litigation path rather than work towards common ground and the protection of affordable housing.”

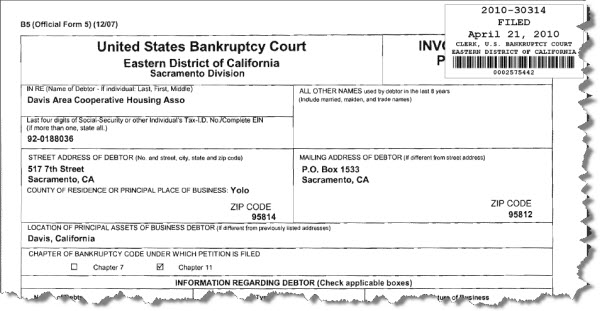

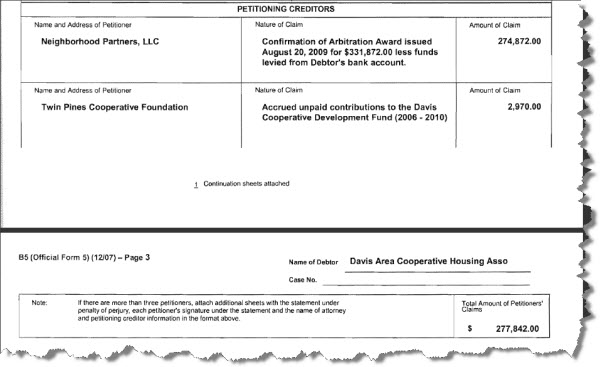

However, late Wednesday, an action took place that delayed either of the hearing and the foreclosure auction from occurring. Both Neighborhood Partners and Twin Pines Cooperative Foundation filed for what is called involuntary bankruptcy.

According to the principles involved in this suit, “This petition begins a process that allows a federal bankruptcy judge to fully evaluate the issues that have been at the heart of this dispute. Since the Davis city council refused to authorize its own third party investigation into this matter, late yesterday, after weighing the legal alternatives, we determined that this was the most cost effective approach to halting the foreclosure and getting an impartial evaluation of the situation.”

They believe it will put a temporary “stay” on any legal efforts by DACHA’s creditors to collect debts owed to them. This includes the city’s foreclosure auction and the Twin Pines lawsuit.

According to section 303 of US Code, “An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.”

The documentation the Vanguard found suggests:

“The bankruptcy provides the opportunity for the automatic appointment of a Chapter 7 Trustee, or, for cause, the appointment of a Chapter 11 Trustee. Thus focusing attention on the conduct of the debtor – whether it be illegal or inadequate.

A secondary benefit: If the petition is accepted by the Court, the creditors involved in the filing can submit an administrative claim for “actual, necessary expenses” incurred up to the time of the order for relief. These expenses include attorney’s and accountant’s fees and costs, legal fees and costs for preparation and filing of the petition, time involved in contacting other creditors to join the filing, and any litigation directly related to the petition. Administrative claims receive first priority under U.S. bankruptcy law and, thus, are paid before any other claims.”

However, the same report cautions, “Involuntary bankruptcies are not common because they can be difficult and risky for the filing creditors.”

This is an unusual case in that the efforts to avoid payment or at least the lack of payment is a matter of public record.

City Attorney Harriet Steiner did not respond to the Vanguard’s request for information on Thursday. It is unclear how this will impact current events surrounding DACHA or the eventual foreclosure by the city of Davis, which has now at least temporarily been halted.

—David M. Greenwald reporting

I’ve never even heard of involuntary bankruptcy. This DACHA story is fascinating. David, without your writing about it, I’d be pretty darn clueless. Thank you.

I hate to say this, but my trust of city staff is decreasing the more I learn about the DACHA issues. Not exactly what you want to be feeling as a resident of Davis. Why do I feel like I’m not getting the whole truth??

The lawyers representing David Thompson and Luke Watkins obviously concluded that judge Reed would probably not give them the TRO that they requested and this “involuntary bankruptcy” filing was the only way to stop the auction yesterday. This is very likely just a delaying tactic that will go nowhere except further drain the city’s coffers(so much for Thompson’s and Watkins’s concerns about Davis taxpayer’s monies).

I want to believe NPs I really do however this tact plus the previous one to delay foreclosure both seem to be self serving. It is difficult for the average reader to sort out the back and forth since the stories seem so disparate. Although seating an illegal board is not good, that does not seem so compelling as to be their primary off stated concern of NP. I am in favor of an independent investigation.

This battle between the city and Thompson/Watkins reminds me of the Radiology Associates vs Trader Joe’s issue that was inflated here into some kind of Davis morality play. I would hazard a guess that it(like this DACHA battle) was essentially about MONEY and not who is wearing the

“white hat”. I drove past University Mall a few days ago and it appears that Radiology Associates and its building are quietly gone with a new Trader Joe’s building coming to Davis this fall/winter.

Neighborhood Partners has made a number of efforts to solve the DACHA situation. Here are some of the efforts.

In June of 2009, my wife and I sat down with Mayor Asmundson to go over the DACHA details, documents and alleged illegalities relating to $4 million of public funds. We do consider that a board composed of ineligible members obtaining public funds and carrying out other activities is a serious question. The Mayor agreed to obtain those documents for the Council to review. We hoped that the issues would be made public. The Mayor never did fulfill her promise and implied that staff did not want to. With the Mayor’s leadership we could have started cleaning up the DACHA mess last summer.

In October of 2009 Neighborhood Partners, LLC., said at the podium at the Council meeting that we would be willing to sit down to arrive at solutions but the City must agree to an independent investigation. Lamar Heystek made the motion seconded by Don Saylor the vote failed 3-2 with Asmundson, Greenwald and Souza voting no.

At that same Council meeting the City Attorney said that it was okay for the DACHA members to us the $4 million borrowed from the City of Davis to distribute to themselves over $200,000 in public funds because “there were no encumbrances.” NP has looked over the city documents and the title company documents and it appears there were always encumbrances. Twin Pines Cooperative Foundation had provided a legal opinion to DACHA and the City from Goldfarb and Lippman in 2007 that said that you cannot distribute funds to members unless they have left the Co-op. We have asked publicly for the City Attorney to show us the point at which there were no encumbrances. The City Attorney has not replied. That $200,000 in public funds belongs to the citizens of Davis

My wife and I sat down again on March 26 with Mayor Asmundson to discuss arriving at a solution. The Mayor said she was willing to consider an independent investigation in light of the fuller allegations we showed her. We felt we had finally made progress. I sent the Mayor a follow a revised proposal over the weekend. The following Tuesday in the Enterprise is the foreclosure notice. I wondered why we had met if that was in the works.

At the Wednesday April 7 Council Steve Souza approached NP and DACHA board members and told us he was sending a settlement outline to us. NP and the DACHA President met with Council member Souza on Sunday April 11. Although difficult, I think all parties felt we made progress. However, while I think I can represent that DACHA, NP and TPCF felt we were moving to some possible solutions we lost contact with Council member Souza. NP does appreciate that we were finally in good honest communication with the DACHA board.

“She (Steiner) said, ” While we were hopeful that both Neighborhood Partners and Twin Pines would talk to DACHA and among them develop a comprehensive and reasonable settlement, this has not happened.

But Harriet, that was happening. Given that we were making progress and there were a number of reasonable solutions NP continued to ask the City Council to hold off on the foreclosure. It is the City that put an end to the useful discussions.

The sticking point for the negotiations with Council member Souza appears to be that there must be no investigations of any of the allegations and the issues must go away, that DACHA be provided with the option after three years to be allowed to turn the assets into private gain ($4 million required by law to go to TPCF upon dissolution could go to private individuals) and that TPCF must drop its lawsuit about the allegations of breaking state law and not receive legal fees.

This is a “follow the money” fight.

The 20 DACHA homes are worth $8 million dollars. NP helped DACHA get those homes for $4 million. Twin Pines Cooperative Foundation was named in the articles of incorporation as the recipient of any value if DACHA were to be dissolved. TPCF also committed that it would use that value to invest in other cooperative housing in Davis. TPCF could help create another successful Dos Pinos Housing Cooperative.

On the other hand you have members of DACHA and the previous board who want to dissolve the organization, then get the homes back and possibly in a few years get the houses fee simple and over time gain $200,000 each in value.

The city’s action appears to favor the road to individual private gain versus the road to preserving nonprofit asset through another Dos Pinos.

April 23, 2010 (St George’s Day in England)

To: Whom it May Concern

Fr: David Thompson, Twin Pines Cooperative Foundation

Re: The alleged laws and bylaws broken by the DACHA board

Why will the City of Davis not act to look into these allegations?

Why is the City of Davis pursuing foreclosure in light of the following allegations?

Shouldn’t the City look into these allegations before taking any action on DACHA?

•In mid 2005, DACHA members and later DACHA board members and officers began to have talks with Davis City staff on how to dissolve the co-op and obtain another form of home ownership. The end result of this effort would mean that the $8 million dollars of DACHA assets minus the $4 million owed to the city + $4 million dollars in net value, would be removed as the asset that should be turned over to Twin Pines Cooperative Foundation and instead the $4 million would be distributed over time, against the law to the 20 members of DACHA. Each member would gain $200,000 of public funds. Each one of these actions is against California Law and the IRS regulations about the improper distribution of the assets of a nonprofit tax exempt entity.

•Almost all of the DACHA board members were according to the bylaws ineligible during the period starting in October of 2005 to fall of 2009. If a board member was behind more than 30 days they were required by the by laws to be automatically removed from the board.

•The DACHA board filled the sponsor board seats with ineligible members. The DACHA board did not (as required by the bylaws) notify Twin Pines Cooperative Foundation that four of the sponsor seats were vacant. The DACHA board filled the sponsor seats with ineligible residents.

•Since mid 2006 to fall of 2009, almost every DACHA board member has been ineligible.

•The DACHA board members who borrowed over 4 million in public funds were according to the bylaws ineligible.

•The President of DACHA who signed all of the loan documents for over $4 million in public funds was according to the bylaws ineligible to serve.

•The DACHA officers who signed under penalty of perjury with the Secretary of State changing the articles of incorporation to remove TPCF as the recipient of remainder corporate assets were both according to the bylaws ineligible to serve.

•The distribution of over $200,000 in public funds to the members by the DACHA was against the law according to a legal opinion from Goldfarb and Lipman.

•The Auditor hired by the City of Davis said that the DACHA board had broken California Law by not producing 14 sets of required corporate minutes. “We requested minutes from the DACHA board meetings for the 2005 and 2004 calendar years. We received minutes only through March 2004. Board minutes are required by law for all corporations.” The Davis City Council received that report and took no action.

April 23, 2010

To: Whom it May Concern

Fr: David Thompson, Twin Pines Cooperative Foundation

RE: Allegations about DACHA

•City Loan documents required an annual audit of DACHA. No audit was done by DACHA for the city in 2007 or 2008. Even without a required audit city staff recommended in 2008 and the Council approved a loan of over $4 million of public funds to a DACHA board composed of ineligible members. The audit would have shown that at the time of the loan being made the 20 households in Dacha were delinquent to the organization by $64,000 and the board members were delinquent over $20,000. City staff never reported to the Council that there were sizeable arrears. I have checked with local bankers and none of them can understand why city staff did not reveal this information to the Council.

•The Arbitrator agreed to by all parties said that the DACHA board members who had testified were ineligible to serve on the board. Two of these members appear to have been in serious arrears in their fees during times that they were members of the Board, in direct contravention of the bylaws”. (Page 7 of the Arbitration Award. The City Council took no action.

•The Arbitrator wrote in his report filed with Yolo Superior Court and provided to the Davis City Council. “What is curious is that representatives of the City of Davis were present throughout the entire time when the new Board took these untoward actions and they did little to discourage the Board”. (Page 5 of Arbitrations Award)

•The City Council was sent that report and took no action.

•The Davis city staff knew that the DACHA board members were ineligible.

•The DACHA board has conducted numerous self-dealing transactions in contravention of the Davis Sterling Act and California Corporations Code.

•A representative appointed by the City of Davis was present at most meetings where these allegations took place.

•Staff of the City of Davis attended almost all of the board meetings where these allegations took place.

•DACHA and the City of Davis are intending to dissolve the corporation but after the act of foreclosure. DACHA appears to be avoiding following the legal process for dissolution required by the State of California. That legal process is outlined in AB 1246, Chapter 520, in Section 817a on page 5.

•DACHA does have $230,000 in reserves and $200,000 in corporate assets distributed by DACHA to the members in contravention of the legal opinion provided to the city by Goldfarb and Lipman.

•The Davis City Attorney claimed it could be done because there were no encumbrances. However, the City Attorney has never yet shown when there were no encumbrances.

•The Davis City Manager wrote that he was not going to look into further allegations unless the Council directed him to.

•There are plenty of assets to cure the default. So is there a need for foreclosure?

•Why not start to clear things up with an independent investigation?

All of this happened and city staff appear to have done nothing.

David Thompson, Twin Pines Cooperative Foundation. April 23, 2010

[quote]The city’s action appears to favor the road to individual private gain versus the road to preserving nonprofit asset through another Dos Pinos. — David Thompson[/quote]I just want to clarify that the $500,000 claim and lawsuit by Neighborhood Partners against the low and moderate income members of DACHA and the subsequent very large levy that they placed on Dacha’s account was for the personal payment of David Thompson and Luke Watkins of Neighborhood Partners; it was not for “preserving nonprofit asset through another Dos Pinos”.

To clarify: Dos Pinos always had a board composed of Dos Pinos members that entered into contracts for the organization. In contrast, DACHA originally had a non-member board that was appointed by David Thompson and Luke Watkin (Neighborhood Partners) that entered into contracts which bound DACHA members to expand the cooperative by buying many additional houses (the arbitrator said it was 60), and to pay David Thompson and Luke Watkins between $8,000 and $12,000 per house, plus additional unspecified “extraordinary” costs.

However, David Thompson acknowledged that the City had not promised to provide these 60 (according to the arbitrator) additional houses at the below market costs that would be necessary. Yet David Thompson’s and Luke Watkin’s appointed, non-member board wrote a contract obligating DACHA to pay Neighborhood Partners (David Thompson and Luke Watkins) for their services involved with acquiring these future units, whether or not these units were available or made financial sense to the organization. Again, it is primarily for the $8,000 to $12,000 payment per future houses that had not, in fact, been added to the cooperative that David Thompson and Luke Watkins sued the cooperative.

The resulting levy against the account of DACHA is a major contributing factor to DACHA’s current situation. The city’s redevelopment agency’s affordable housing fund is trying to preserve its huge investment in these properties so that we can provide affordable housing in the future. That is the reason we are foreclosing.

I strongly disagree with David Thompson’s assertion that ”The city’s action appears to favor the road to individual private gain versus the road to preserving nonprofit asset through another Dos Pinos”.

[quote]At that same Council meeting the City Attorney said that it was okay for the DACHA members to us the $4 million borrowed from the City of Davis to distribute to themselves over $200,000 in public funds because “there were no encumbrances.” [/quote]David Thompson himself had long ago suggested applying for publicly funded grants that would forgive loans for the membership fees or to allow DACHA members to keep more equity in their houses. I have documented this in prior posts in the last Vanguard article on DACHA.

The city’s redevelopment agency did something very similar to the recommendations that David Thompson himself made during the audit. That was to forgive part of the membership cost in order to assure that new members would be willing to join. Without new members to replace those leaving, the organization becomes insolvent.

” entered into contracts which bound DACHA members to expand the cooperative by buying many additional houses (the arbitrator said it was 60), and to pay David Thompson and Luke Watkins between $8,000 and $12,000 per house, plus additional unspecified “extraordinary” costs.”

Who agreed to these contracts? Did the city? What was the role the city played in the creation, formation, and then restructuring of this cooperative?

Brian: This contract was between the Neighborhood Partners (David Thompson and Luke Watkins) and the DACHA board appointed by Neighborhood Partners.

Brian: Neighborhood Partners proposed, structured and designed the cooperative. The city helped fund it.

David Thompson himself assured the City that any investments made in the cooperative would be secure because foreclosure was always an option. In documents submitted during the audit, David Thompson wrote: [quote]The City investment is not at risk. If the worst case scenario happens the banks foreclose, the city restrictions are lifted and the homes get sold at market value. All the lenders including the city get their funds back (attachment 4, handwritten page 63) — communication from David Thompson[/quote]In fact, the city does not intend to sell the houses at market value, as David Thompson implied was an acceptable option; the city is committed to keeping the units permanently affordable.

Concerned citizen says: “…Why do I feel like I’m not getting the whole truth??”

That’s just the way it is when a legal battle is underway or is anticipated. I guess it comes down to how you assess the two parties: one is attempting to defend the assets/interests of the city and the other claiming some sort of elaborate conspiracy on the city’s part to “get them”.

Sue:

Tha Attorney General’s office supervises all dissolutions of limited equity cooperatives. DACHA and the City are not following the process required by the Attorney General and by State Law. Why is the City not following California Law?

When Sue will you address the question as to the eligibility of the board members according to the DACHA bylaws?

When Sue will you address the question about the City Attorney saying there were “no encumbrances” when the DACHA board distributed $200,000 of public funds to its members?

Sue are you convinced by the loan documents that the distribution was done when there were no encumbrances?

Sue can you confirm that you believe that there were “no encumbrances” and that city staff have provided you with the loan documents to prove it?

Sue did not the City Manager sign documents creating encumbrances in August and was not the distribution to members made in September? I gave those ducuments to the Council at a meeting a couple of months ago.

Could DACHA have distributed $200,000 in funds to its members before it had those borrowed public funds in its account?

The Auditor hired by the City told you that DACHA was breaking the law by not having or providing the minutes of the meetings (which we know from testimony under oath that DACHA had received)? What did you do Sue when you were told DACHA was breaking California Law? What did the City do when it was told that DACHA was breaking the California Law?

The Arbitrator approved by Yolo County Superior Court reported that the board members he had met with were both in violation of the bylaws (and therefore ineligible to serve). Sue, you received that report what did you do?. What did the City Council do?

No one from the City will answer these questions. Three members of the City Council have seen many of the documents.

Please meet with me and I will show you all these documents call me at 757-2233.

David Thompson, Twin Pines Cooperative Foundation

Sue:

NP frequently offerred to do the work on the additional homes to earn our keep rathern than go through a law suit. We offered that in mediation (which we did not have to go through but volunteered to).

During arbitration and even on the last day of arbitration testimony we said we would much prefer to do the work. We were turned down by the DACHA board.

DACHA had numerous chances to solve this. Who gave them the advice to not to work with us? It always made sense to come to a solution.

Sue:

You said.

In fact, the city does not intend to sell the houses at market value, as David Thompson implied was an acceptable option; the city is committed to keeping the units permanently affordable.

Sue, the members of DACHA and the President of DACHA on behalf of the members have all asked you get rid of the limited equity co-op and allow them a much better deal. They have frequently used 6.5% per year on the home value as their preference.

I have show the city charts that show that the value of the DACHA homes rises to market. The homes cannot be permanently affordable. But the former DACHA members could obtain $200,000 each under any of the city scenarios.

If the City is going to give $4 million away should’nt everyone be allowed to buy a ticket?

“The sticking point for the negotiations with Council member Souza appears to be that there must be no investigations of any of the allegations and the issues must go away, that DACHA be provided with the option after three years to be allowed to turn the assets into private gain ($4 million required by law to go to TPCF upon dissolution could go to private individuals) and that TPCF must drop its lawsuit about the allegations of breaking state law and not receive legal fees.

David Thompson”

Could there be a better illustration, with this self-serving David Thompson public version of this private discussion, of why Councilman Sousa was rather naive to be holding a private conversation without counsel present with the party who was threatening to sue the city?

Remember Davisite, Souza is the “shrewd negotiator” just ask Guidaro.

davisite2

Given the allegations that have been put forward on this blog about the actions of the DACHA board are you telling me that all these actions are okay with you and should not be looked at?

Seems like you have not said anything about this misuse of public funds?

Please keep the facts correct,the meeting was only with NP and DACHA. TPCF was taken off the table.

NP has not threatened to sue the city.

David Thompson, Neighborhood Partners.

What is shrewd about offering David Thompson ammunition to make the city look like it’s trying to cover up a malfeasance and David Thompson claiming that the “sticking point” was his unassailable principles that wrongdoing must be outed! Give me a break!

David Thompson writes:

“Sue, the members of DACHA and the President of DACHA on behalf of the members have all asked you get rid of the limited equity co-op and allow them a much better deal. They have frequently used 6.5% per year on the home value as their preference.

I have show the city charts that show that the value of the DACHA homes rises to market. The homes cannot be permanently affordable. But the former DACHA members could obtain $200,000 each under any of the city scenarios. — David Thompson”

First, I really do not understand David Thompson’s assertions that former DACHA members “could obtain $200,000 each under any of the city scenarios”. The council is committing to keeping the houses permanently affordable.

Truly noteworthy to me is that David Thompson and Luke Watkins themselves were among the applicants who prepared an application in 2004 to use pubic funds to turn DACHA into a form of home ownership, and David Thompson is listed as the contact person. They argued in the grant application that DACHA should turn itself into a Community Land Trust, which is a form of limited equity home ownership.

In their own words: ”the home owner owns the home and leases the land from the CLT”. This form of home ownership is similar to that of Aggie Village.

Truly noteworthy is that neighborhood Partners (David Thompson and Luke Watkins) argued that they had used a limited equity cooperative model because time was limited, but they would have preferred a limited equity home ownership model.

They wrote:

“NP’s (Neighborhood Partners’) study for the DACHA board and for the Center for Cooperatives shows that a CLT (ownership model) provides more effective tools and flexibility at a lower cost for single family homes than a LEHC (cooperative model). The need is therefore to transform DACHA into a CLT to meet the needs of low/mod income households in Davis…Block Grant application, David Thompson and Luke Watkins et.al.”

Among the reasons they offered for superiority of the home ownership model over cooperative model was that the home ownership model “would substantially reduce its organizational operating costs per home”.

One of the things that has personally disturbed me the most during this whole affair and that has motivated me to work so hard on this issue is that the DACHA members are the low and moderate income people who we are trying to help. That is the whole purpose of our affordable housing program.

These low and moderate income DACHA members have been in danger of losing the money they invested to purchase membership shares, which is the equivalent of their down payment. I would guess that this represents the life savings of many of these members.

Yet, in my humble opinion, they have been accused of being greedy and acting selfishly or illegally for venturing or participating in solutions to the business model that the auditor stated was troubled. Most of these solutions are similar to the ones that David Thompson and Luke Watkins themselves had suggested at earlier periods of the cooperative’s history, such as using affordable housing funds to forgive parts of the loans for the membership fees in order to create sustainability, and turning the cooperative into a form of limited equity housing.

And, in my humble opinion, our attempts to salvage the cooperative and finally, to salvage the the affordability of the houses and our affordable housing funds, seems to be blocked by lawsuits by Neigborhood Partners at every juncture.

P.S. I would be happy to forward David Greenwald a copy of grant application to turn DACHA into a home ownership model.

Davisite: Did you forget to switch on your sarcasm detector?

David Greenwald: Is there any systemic reason why the quote box, italics, etc., are no longer working on my computer? They are appearing at the bottom of the page, rather than where the cursor is. I am using internet explorer. I’ll try Firefox.

[quote]David Greenwald: Is there any systemic reason why the quote box, italics, etc., are no longer working on my computer? They are appearing at the bottom of the page, rather than where the cursor is. I am using internet explorer. I’ll try Firefox. [/quote]

The browser would be my guess, I’ll forward to the webmaster.

“Davisite: Did you forget to switch on your sarcasm detector?”

Sorry…. My detector was off as sarcasm has been conspicuously absent in this thread. I couldn’t figure out what you were referring to …. Souza being shrewd?… Duplicitous perhaps? self-aggrandizing, yes but definitely not terribly shrewd.

David Thompson writes: [quote]”Sue, the members of DACHA and the President of DACHA on behalf of the members have all asked you get rid of the limited equity co-op and allow them a much better deal. They have frequently used 6.5% per year on the home value as their preference.

I have show the city charts that show that the value of the DACHA homes rises to market. The homes cannot be permanently affordable. But the former DACHA members could obtain $200,000 each under any of the city scenarios. — David Thompson” [/quote]

First, I really do not understand David Thompson’s assertions that former DACHA members “could obtain $200,000 each under any of the city scenarios”. The council is committing to keeping the houses permanently affordable.

Truly noteworthy to me is that David Thompson and Luke Watkins themselves were among the applicants who prepared an application in 2004 to use pubic funds to turn DACHA into a form of home ownership, and David Thompson is listed as the contact person. They argued in the grant application that DACHA should turn itself into a Community Land Trust, which is a form of limited equity home ownership.

In their own words: ”the home owner owns the home and leases the land from the CLT”. This form of home ownership is similar to that of Aggie Village.

Truly noteworthy is that neighborhood Partners (David Thompson and Luke Watkins) argued that they had used a limited equity cooperative model because time was limited, but they would have preferred a limited equity home ownership model.

They wrote:

[quote]”NP’s (Neighborhood Partners’) study for the DACHA board and for the Center for Cooperatives shows that a CLT (ownership model) provides more effective tools and flexibility at a lower cost for single family homes than a LEHC (cooperative model). The need is therefore to transform DACHA into a CLT to meet the needs of low/mod income households in Davis…Block Grant application, David Thompson and Luke Watkins et.al.”

[/quote]

Among the reasons they offered for superiority of the home ownership model over cooperative model was that the home ownership model “would substantially reduce its organizational operating costs per home”.

One of the things that has personally disturbed me the most during this whole affair and that has motivated me to work so hard on this issue is that the DACHA members are the low and moderate income people who we are trying to help. That is the whole purpose of our affordable housing program.

These low and moderate income DACHA members have been in danger of losing the money they invested to purchase membership shares, which is the equivalent of their down payment. I would guess that this represents the life savings of many of these members.

Yet, in my humble opinion, they have been accused by Neighborhood Partners of being greedy and acting selfishly or illegally for venturing or participating in solutions to the business model that the auditor stated was troubled. As Luke Watkins wrote the other day, the city has been: [quote]“Wasting public resources to help a group of people illegally dissolve a cooperative, so that they can all reap the benefits of single family homeownership equity growth”.—Luke Watkins, Davis Vanguard[/quote]Yet, most of these solutions are similar to the ones that David Thompson and Luke Watkins themselves had suggested at earlier periods of the cooperative’s history, such as using affordable housing funds to forgive parts of the loans for the membership fees in order to create sustainability, and turning the cooperative into a form of limited equity housing.

And, in my humble opinion, our attempts to salvage the cooperative and finally, to salvage the the affordability of the houses and our affordable housing funds, seems to be blocked by lawsuits by Neigborhood Partners at every juncture.

P.S. I would be happy to forward David Greenwald a copy of grant application to turn DACHA into a home ownership model.

David Greenwald,

Could you please remove my 5:27 post. The quote box is working in Firefox, but not Explorer, so I reposted it with quote boxes? Thanks.

There were posts removed by request of an author.

The real lessons of this sordid incident:

1. The coop system does not work in the long term.

2. Increasing government meddling in more and more areas of the economy lead to increased opportunities for self-dealing, corruption and fleecing of public funds by government employees, politicians, and private groups acting in concert with public agencies.

3. The vast majority of Davis homeowners bought their homes, pay their mortgages and maintain and improve their houses with no government aid. Where government does try to manipulate home ownership (Fannie Mae,

Community Investment Acts, etc) it leads to disaster in the long term, except for the political appointees who benefit personally (Raines at Fannie Mae, Rham).

4. When these things inevitably blow up, the taxpayers and public are left holding the bag.

Sue:

Don’t forget the Council voted no on doing the CLT. I think you voted no on DACHA becoming a CLT.

For 60 days the CLT was a concept that the law said could not be done. City staff turned down every application for funds to make it work as a co-op.

There are limited equity co-ops under the CLT model that were the models we were looking at such as Burlington and Northern California. I have visited both of them.

Recently, the city committed millions of dollars to a CLT and you found out how difficult it is to make it work. You were the only council member who voted to keep spending millions on a CLT that had to be disbanded. So you vote yes for millions of dollars when someone else proposes a CLT? NP could have saved you that money. How much did the CLT cost the City?

Under state law you could unite DACHA with an existing cooperative but you refuse to do that.

Why not follow state law on the dissolution of a cooperative?

DACHA would be saved, the members could be made whole, and the city would be made whole.

But more’s the mystery, why do you never answer the allegations about the illegalities that have occurred with public funds?

Why do you never ask why can’t we replicate Dos Pinos and have an organization we can be proud of?

The solutions are quite simple if you truly want to solve the situation.

David Thompson, Neighbourhood Partners.

This back and forth is growing tiresome. Claims and counterclaims. We will not sort out the veracity of David Thompson’s narrative or the city’s narrative here. As a reasonably well-informed Davis voter, these are my conclusions:

DACHA was Neighborhood Partner’s creation and fairness demands that NP “take a hit” for its failure. DACHA is in serious trouble and the city has decided on a path that it feels is best to protect its loan to DACHA and to protect DACHA’s affordable housing status. Neighborhood Partners is attempting to thwart the city’s efforts, claiming high-principled motives which also probably favor their “bottom line”. The city may well have been lax in its oversight and it probably largely stems from a misplaced reliance by staff and the Council Majority on David Thompson’s posture of infallibility with regard to arcane affordable housing matters. David Thompson’s position as a partner in Neighborhood Partners and President of Twin Pines Cooperative Foundation blurs the separation of power and responsibility, further confusing the narrative. The contract that Neighborhood Partners signed with its own appointed non-member DACHA board which they are now demanding be implemented appears,on its face, to be quite problematic.

davisite2: You said, “We will not sort out the veracity of David Thompson’s narrative or the city’s narrative here”.

So why does the city not do an independent investigation?

People can start by looking at the documents at this DACHA website.

http://sites.google.com/site/itsthelawdacha/home

Look at why Dos Pinos succeeds! I helped set up Dos Pinos and their success will be part of a national study in July.

Has Dos Pinos allowed ineligible members to serve on the board?

Has Dos Pinos allowed the members to be delinquent $64,000?

None of the Dos Pinos lenders would allow that to happen so why did the City allow DACHA?

Has a Dos Pinos President been delinquent during her term?

Has a Dos Pinos Treasurer been delinquent during all of her four year term?

Have ineligible Dos Pinos Board officers signed loan documents for public funds?

Has the Dos Pinos board distributed public funds to its members in contravention of a legal opinion it received?

Did DACHA or city staff ask Dos Pinos to help them clean up the co-op?

davisite2 you seem to argue that nothing should be done about the misuse of public funds.

Quotes from the Arbitration Award filed with the Yolo County Court in June, 2009.

Quotes by Kenneth M. Malovos, the attorney jointly chosen by DACHA and Neighborhood Partners and approved by the Yolo County Superior Court.

“What is curious is that representatives of the City of Davis were present throughout the entire time when the new Board took these untoward actions and they did little to discourage the Board”. (Page 5 of Arbitration Award)

“The testimony by three members from DACHA who appeared at the arbitration can only be described as cavalier. For the most part their testimony was characterized by failures of memory, contradictions and a certain inability to admit even their own written words. Two of these members appear to have been in serious arrears in their fees during times that they were members of the Board, in direct contravention of the bylaws”. (Page 7 of the Arbitration Award)

[quote]But more’s the mystery, why do you never answer the allegations about the illegalities that have occurred with public funds? — David Thompson[/quote]Because I trust our attorneys when it comes to the technicalities of this particular issue.[quote]Why do you never ask why can’t we replicate Dos Pinos and have an organization we can be proud of?– David Thompson [/quote]

There are so many differences between Dos Pinos and DACHA that it is hard to know where to begin.

For starters:

* Dos Pinos is comprised of multi-family units in one location. Hence, there are social benefits that compensate for extra work involved in meetings, organization, etc.

* Dos Pinos was purchased at one time. In DACHA, houses were added at different times, at different prices, and with different loans, making for chaotic bookkeeping, as was pointed out forcefully by our independent audit, and tremendous complexity.

* Dos Pinos did not have a non-member board appointed by a for-profit developer which established policies and which signed contracts with that same developer that would bind its members. I would think that a cooperative that was democratically controlled by its members from its inception is quite a different model.

* Dos Pinos was not required to expand regardless of future conditions or desires of its members.

It is ironic that in the application that you made in 1994 to turn DACHA into a home ownership model, you suggested turning Dos Pinos from a cooperative to a home ownership model as well.

If David Greenwald would like to post that application, I can forward it to him.

Okay, here is the link to the block grant application where David Thompson argues that it would be better to turn DACHA into a form of home ownership, and that Dos Pinos as well should be turned from a cooperative into a form of home ownership:

[quote]http://cityofdavis.org/cs/cdbg/0405pdf/0405-DACHA.pdf[/quote]

Let’s see if this will link better:

http://cityofdavis.org/cs/cdbg/0405pdf/0405-DACHA.pdf

Sorry, you might have to cut and paste it — but it pops right up!

I just can’t believe the lengths this man is going to. I hope some people question why haven’t DACHA members spoke out against this? The reason is they are scared and do not have the resources to protect themselves from these lawsuit crazed people.

Let’s start at the beginning.

-David Thompson created DACHA, bylaws, his contract, and appointed the original DACHA board which in turn agreed to all of the contracts etc.

David Thompson created.

-NP was responsible for finding the original loans for all of the DACHA units which included interest only and balloon payments.

Did you know that David Thompson and Luke Watkins never had a Real Estate license while acquiring all of the 20 units for DACHA?

-David Thompson made the agendas for Executive session and regular session meetings as well as kept and made board minutes.

Is this a conflict of interest as well as possibly illegal?

-David Thomson promised residents that they would OWN their home with a land trust and it was not just for 60 days. David Thompson himself was promising DACHA members up until the last units on Glacier were filled.

LAND TRUST APPLICATION

Please copy and paste this link-

http://www.city.davis.ca.us/cs/cdbg/0405pdf/0405-DACHA.pdf

-I also think it’s important to note the income group he was trying to help 80%. HE presented this to the DACHA board and I find it interesting that TPCF now faults the city for “changing” the income group.

-NP NEVER billed for 2-3 years for his so called extra services that amounted to over $100,000 and were not in his “development” ONLY contract or ever voted for by the DACHA Executive board.

I find it strange that NP did not bill until the DACHA members started to take over the Board?

-Members of DACHA became very concerned with the rising costs which led to the audit.

CITY OF DAVIS DACHA AUDIT

Please copy and paste this link-

http://www.city.davis.ca.us/meetings/councilpackets/20060627/11_DACHA_Audit.pdf

These finding were BEFORE Dacha residents took over the board when Neighborhood Partners was still the consultant.

Would this be considered an INVESTIGATION?

-TPCF (David Thompson is President) sues DACHA and wants to undo the refinance because of this so called illegally seated board.

Could part of it be that the beneficiary was originally TPCF

(David Thompson is President)and that changed when the city loaned over 4 million dollars to DACHA and the city became benficiary?

-The president of DACHA was not behind while signing the the refinance documents as TPCF President David Thompson thinks.

-Where did TPCF get all of this Information? Maybe from NP lawsuit and I thought that information was to only be used for that purpose?

IF any board members were behind they would have had to have approved payment plans as well as a change in the bylwas.

-NP and TPCF file a petition for an involuntary Bankruptcy.

I have read that it takes 3 people to do this, how did it go through?

I have researched Chapter 11 and it will cost upwards of $100,000 how can DACHA pay for it given it’s current?

-David Thompson is so concerned about misuse of public funds but continues to use them dragging this out and is willing to take them from DACHAs(public funds)reserve to settle his arbritration award.

I do find it interesting that NP is not suing the city but TPCF is, and David is the president?

I could go on and on but my point is that yes there is much much more to this story.

It’s just sad that these programs are supposed to help lower income families and all that has happened is the complete opposite.

I do have one last question. David you are so sure that wrong doing has been done, if it comes out in the end that no wrong doing has happened are you and TPCF going to foot the bill for these huge expenses and maybe a public appology?

In general, when litigation is ongoing, both sides would do well to keep quiet, and let the courts settle matters. Trying contentious issues in the press is not particularly useful, since statements made by either side will more often than not self-serving. Repeating one’s position over and over again does not change reality or one’s true legal position. From where I sit, it seems as if the result of all the accusations and counter accusations thus far is that the “well is poisoned” as far as NP doing business with the city ever again… mutual trust has been seriously eroded. It seems saving one’s “reputation” is more at the heart of this “he said/she said” contest than anything else at this point.

One thing that does seem clear however, is the specific model for DACHA was flawed from the beginning as Sue has pointed out –

“DACHA originally had a non-member board that was appointed by David Thompson and Luke Watkin (Neighborhood Partners) that entered into contracts which bound DACHA members to expand the cooperative by buying many additional houses (the arbitrator said it was 60), and to pay David Thompson and Luke Watkins between $8,000 and $12,000 per house, plus additional unspecified “extraordinary” costs.

However, David Thompson acknowledged that the City had not promised to provide these 60 (according to the arbitrator) additional houses at the below market costs that would be necessary. Yet David Thompson’s and Luke Watkin’s appointed, non-member board wrote a contract obligating DACHA to pay Neighborhood Partners (David Thompson and Luke Watkins) for their services involved with acquiring these future units, whether or not these units were available or made financial sense to the organization. Again, it is primarily for the $8,000 to $12,000 payment per future houses that had not, in fact, been added to the cooperative that David Thompson and Luke Watkins sued the cooperative.

The resulting levy against the account of DACHA is a major contributing factor to DACHA’s current situation. The city’s redevelopment agency’s affordable housing fund is trying to preserve its huge investment in these properties so that we can provide affordable housing in the future. That is the reason we are foreclosing.”