VANGUARD ANALYSIS – Polling last week showed support for Proposition 30 had dropped to as low as 46 percent – still technically ahead in the polls, but conventional wisdom is that measures with less than 50 percent support, especially tax measures, are in trouble.

VANGUARD ANALYSIS – Polling last week showed support for Proposition 30 had dropped to as low as 46 percent – still technically ahead in the polls, but conventional wisdom is that measures with less than 50 percent support, especially tax measures, are in trouble.

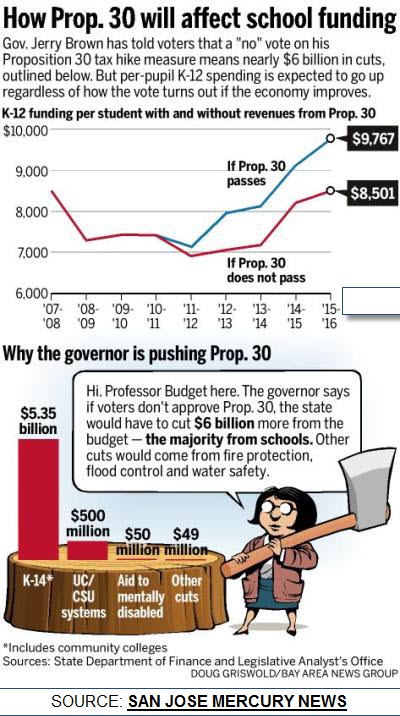

That means that K-12 schools will be hammered with six billion dollars in cuts, including about 3.7 million dollars locally – an amount that might be offset starting in July 2013 if voters in Davis approve the parcel tax Measure E that will not only renew previous emergency funding from 2011 but also add a contingency in case Proposition 30 goes down.

The other immediate major impact is on UC Davis students, who are facing yet another double-digit tuition increase should Proposition 30 fail.

That is the conventional view, and certainly the one that Governor Jerry Brown is trying to sell the voters. One that polls suggests voters are not buying.

An analysis by Mike Rosenberg of the San Jose Mercury News this week calls into question many of the operating assumptions by proponents of the tax measure. However, try as he might, he can never really offer an alternative to the governor’s tax proposal as a viable means to continue school funding in the near term

The San Jose Mercury News reviewed the state budget and made two major findings.

First they found, “The estimated $6 billion in extra revenue annually from Proposition 30 quickly would put the state on track to return to peak spending levels before the Great Recession.”

Second, “The inflation-adjusted tax burden of Californians is now about the same as the average over the past two decades — and will remain so even if Proposition 30 passes. But that tax burden is still among the highest in the nation.”

The Mercury News argues if Proposition 30 fails in November as expected, “it will take a few years for spending on schools to return to funding levels before the recession began in 2008, according to projections from the Department of Finance.”

The Brown administration argues that schools cannot wait that long.

“The idea is to more quickly rebuild the losses we’ve seen in education,” said Finance Department spokesman H.D. Palmer as quoted by the Mercury News.

“Proposition 30 will restore funding to schools and prevent billions of cuts this year,” Governor Brown said in one TV ad.

However, the analysis by the Mercury News questions that premise, finding, “Even if the measure fails, funding for schools is expected to increase 21 percent from 2012 to 2015 because of economic growth. The $6 billion trigger-cut figure stems from the fact that he and the Legislature started the budget year by assuming that Proposition 30 would pass.”

The immediate impact, however, is drastic – because they will have to cut the second half of the school year compared to the first half and it comes on top of a 7.9 percent drop in per-pupil spending over the last four years.

Writes the Mercury News, “John Mockler, Brown’s campaign finance adviser, argues that the proposed cuts would hit hard because the state has partially solved its financial problems in recent years by borrowing and using gimmicks that no longer work. He likened it to paying your rent with a credit card for months while hoping that your finances will turn around.”

“At some point, you owe so much you stop putting the rent on the credit card,” Mr. Mockler said.

But here’s the interesting analysis. The administration argues that paying the current bills, topping more than $10 billion, would mean cutting up to 15 days from the school year.

Writes the Mercury News, “Part of the reason the cuts are so dire now, despite the economic recovery, is that many schools are reaching their credit limit and can’t borrow any more.”

However, they point out: “But the nonpartisan Legislative Analyst’s Office called the idea to shorten the school year a ‘back of the envelope’ calculation that seems unlikely to occur because many schools could trim costs in other, admittedly severe ways — trying to renegotiate with unions to reduce staff, for example — before reducing the school year, which typically is seen as a last resort.”

Here I think the Mercury News analysis is wrong. Davis would attempt, for example, to renegotiate with their bargaining units, but they have already been reducing staff for five years. They cannot reasonably reduce additional staff and certainly not midyear.

So their answer is going to be renegotiating with their employees to reduce the school year.

So the Mercury News analysis is not taking into account the condition on the ground for schools.

Their analysis seems to look at the intermediate term rather than the short term.

The Mercury News analyzes the state’s finances:

They write, “A recent Department of Finance review found that taxpayers are giving the state nearly $3,100 each on average in 2012. That’s up slightly from the depths of the recession, but when adjusted for inflation, it’s still about $300 less than what Californians paid the state during the late 1990s and the middle of the last decade, when the economy was much better.”

They add, “The general fund, which pays for things such as schools and jails, would reach $91 billion in the current fiscal year if the measure is approved. Adjusted for inflation, that’s the second-lowest it’s been since 1998, though it’s higher than last year, largely because of the extra revenues counted on from Proposition 30.”

Passing the measure would be “a modest step in the right direction,” said Hope Richardson, a policy analyst with the left-leaning California Budget Project. “It’s not going to solve all our problems, but it is going to us bring us closer to a balanced budget and reduce the pressure on the Legislature to make cuts.”

Nevertheless, the Mercury News does not believe that the failure of Proposition 30 would be catastrophic, or at least attempts to make that case only to undermine that conclusion midsentence.

“Polls last week showed that not enough voters believe Brown’s arguments,” the Mercury News writes. “The USC Dornsife/L.A. Times Poll released Thursday showed that just 46 percent of voters are likely to approve Proposition 30; that support drops to 44 percent when respondents are given arguments from both sides — including Brown’s contention that the measure would stop school cuts.”

“Nobody wants to cut education, but there’s a lack of trust in how this is going to work and if the money’s going to be used appropriately,” said Drew Lieberman, the poll’s Democratic pollster.

The Mercury News argues, “Even with the passage of Proposition 30, the state — as it has many times in recent years — could miss projections and wind up with lower-than-expected revenues. That’s because even the new revenue from Proposition 30 would be subject to ‘multibillion-dollar’ swings, depending on the economy, the Legislative Analyst’s Office warns.”

They note that the state is already in the new fiscal year that started July 1, running nearly $400 million behind expectations. However, the paper fails to point out that’s one-third of the year, putting us on a projection of a $1.2 billion shortfall – not ideal, but hardly the $9 billion shortfall we have seen in previous years.

The paper argues there are options to avoid the $6 billion in trigger cuts.

They write, “The governor could call in the Legislature after the election and find other areas of the budget to slash…”

Despite this claim, the Mercury News suddenly admits it is not really a plausible alternative. They state that “outside experts who have reviewed the budget are skeptical that politicians will be able to find more money to pull from programs such as prisons, health services and aid to the poor and disabled.”

They add, “Mockler said he’s angered at the suggestion that Brown is bluffing on the trigger cuts and advises people who did not think education needs more money to ‘go visit a damn school,’ where he says California is spending $80,000 less per classroom than the average U.S. state.”

“There is no more money available to reverse any cuts,” Mr. Mockler said. “The cuts have been made not for scare tactics, but because they must be made if we are to balance our budgets and not go bankrupt.”

We agree with the administration here. There is not enough fungible money in the state to slash $6 billion from anywhere other than education – unfortunately.

So, in the end, we think that the governor is largely correct in his analysis. If the governor’s tax measure fails, that will mean in the short term $6 billion less for schools and that will likely mean shorter schools years and modest impacts on the education for students.

Moreover, the Mercury News projects that by 2015-16, even without the passage of Proposition 30, per pupil funding levels will return to where they were in 2007-08 – but that appears to be unadjusted dollars. It will also mean that funding is about $1250 per pupil less in 2015-16 than it would be if Proposition 30 passes.

In the short term, we believe that will be devastating to schools, meaning fewer teachers, larger class sizes, school closures and a shorter school year.

In addition, there will be $500 million cut from UC and CSU, meaning another round of double digit tuition hikes. Last year, those hikes brought about virtual riots on campus.

There will be $50 million in cuts to the mentally disabled and another $49 million in cuts.

Bottom line, the governor is not bluffing and despite Mercury News‘ claims, there really is no alternative to the trigger cuts.

—David M. Greenwald reporting

Forgive my ignorance but won’t the state legislature have to pass the cuts Brown has proposed if 30 doesn’t pass? It won’t be automatic?

So, if prop-30 passes and the economy heats up again to bring in pre-recession tax revenue, will California give the money back to tax-payers, or will CA government find ways to increase spending to even greater levels to pad the pockets of their public employee union pals?

Jeff, we all know the answer to that one. Once they get their hands on the money it’s like crack to them. And if you think higher taxes on sales and the people making over $250,000/year is just going to be temporary then you’re living in a dream world.

Jeff: Isn’t it a temporary measure? So you think the economy is going to heat up enough in the next five years for your question to matter?

There are plenty of examples of ballot language getting sued in California, but usually it’s before the election.

David: Mine was a bit of a rhetorical question. Rusty covers my concern that there will not be enough fiscal restraint on spending if prop-30 passes, and we will be back to cries of underfunding again when the term for these new tax and spend bills expire.

The way the story for prop-30 is playing out… it uses the kids as an emotive human shield to extort more money from struggling hard-working folk in the private sector to continue to fund lucrative pay, benefits and pension arrangements for public sector union employees.

Think about it… the economy sucks and revenue is down across the board. Higher earners have lost a much higher percentage of wealth and income than have mid earners and low earners. Most of the wage-gap crap that the left and media has used to enflame class war is pre-recession data.

So, everyone is feeling the pain, yet somehow our unionized public sector employees are to be protected from it. They are special and privileged and unless we accept greater financial pain to keep them special and privileged, they are going to punish the kids.

Too bad the Governor did not go more aggressive on pension reform. It would have made a difference in the minds of many voters that there is shared pain between the public sector workers and private sector workers. In the end, if pop-30 fails, this will be the reason. Voters are fed up with the Democrat-union consortium that is bankrupting this state and all the cities across the state. If Old Moonbeam Brown had demonstrated some cojones equal to his bluster and made some REAL cuts to the public sector union payola, I think voters would be more apt to vote for tax increases.

I think there are several problems with your analysis:

1. You don’t account for large chunks of money that can be cut

2. How are the unionized public sector employees protected? They have taken wage cuts, furloughs, and been layed off?

3. I’m not sure what more the governor could have done on pension reform given court requirements about current employees

Why is it always cuts to schools (and cops and firemen).

How about getting rid of:

The California Acupuncture Board

The California African American Museum

The California Biodiversity Council

The California Childrens Cyber Safety Agency

And many other groups on the list below to give more money to the schools (or cops and firemen):

http://www.ca.gov/Apps/Agencies.aspx

[quote]The California Acupuncture Board

The California African American Museum

The California Biodiversity Council

The California Childrens Cyber Safety Agency[/quote]

The budget for those four entities combined is what?

Thanks for posting this graph.

I had been under the impression that revenues to schools would be cut drastically if Prop 30 failed. I am rethinking support of this Proposition.

Davis will get $3.7 million less if Prop 30 fails. You have to look at the gap between blue and red to see the impact.

But the red graph goes up from 11/12 to 12/13.

Up less than the blue graph, but still up.

How is that a cut? What am I missing?

There are two things going on here.

First, the budget that was passed funded districts assuming the blue line and the districts will have to cut to the red line.

Second, and this is the critical problem that the district has been dealing with from day one of this slowdown – a flat line produces about a $3.5 million deficit and it has to do with step and column, it has to do with inflation, so a flat line does not allow a district to tread water.

The third problem is what the SJMN alludes to – districts have been so backed up that they have zero margin. So yes, the red line is moving up, but not enough to make up for all of the cost increases from this year, let alone deferred cost increases from previous years.

Thank you for this.

Related to David’s point about education cost inflation…

(from a Pepperdine study)

[quote]If we had just held total expenditures (excluding expenditures for teacher salaries and benefits and capital expenditures) to the same increase as the PCPI in FY 07-08 we would have freed up well over $1.8 billion, enough money to employ an additional 22,076 teachers. To put this in perspective there were 300,361 FTE teachers statewide in FY 08-09.[/quote]

Evidence of the K-12 education system being more an adult jobs program than a service for the kids:

[img]http://www.cscdc.org/miscjeff/edinflation1.jpg[/img]

Evidence that there is little connection to inflation when it comes to cost increases for our K-12 education system:

[img]http://www.cscdc.org/miscjeff/edinflation2.jpg[/img]

This is my problem with prop-30. The evidence is that the system does not know how to grow efficiency. Instead it just bloats. If we give it more money, it will just learn to bloat more.

The systems’ response to funding challenges is to cut services to the kids instead of growing greater efficiency (learning to do more with less). So, how do we fix this problem? Because it is a problem when any organization’s cost structure continues to exceed the rate of inflation.

Here are the links to those two images. I don’t know why they cut off this time instead of resizing:

[url]http://www.cscdc.org/miscjeff/edinflation1.jpg[/url]

[url]http://www.cscdc.org/miscjeff/edinflation2.jpg[/url]

[i]I don’t know why they cut off this time instead of resizing:

[/i]

I got it. There’s some peculiarity about the tags that does that. I had to add a space.

Another related impact is funding of community colleges. During these times demand for community colleges has increased compared to better times (a typical trend), but funding has actually been cut.

JR:

Had a conversation with someone with a lot more knowledge on this than I have. Apparently, and my answer above partially captures it, the big problem is that there is a difference between what the state is accounting for giving to the school districts and the cash that actually goes to the school district. I’m a bit foggy, but it has to do with deferrals and when money gets to the district and how much it accounts for.

The bottom line is that the graph provided by the Mercury News is not capturing a huge amount of the problem.

[i]Another related impact is funding of community colleges.[/i]

I wonder if community colleges also have a history of cost increases exceeding the PCPI?

JB

“Higher earners have lost a much higher percentage of wealth and income than have mid earners and low earners.”

Your data please. I consider myself a “higher earner” and have not lost significantly. Also, a comparison of percentage loss does not even come close to describing the impact of that loss. A 10 % loss for one of the 1% might make the difference between what, purchasing a fifth luxury car vs waiting a year ? What do you think that same 10% loss might mean to the family on the brink of foreclosure or having to decide between rent and a life extending medication ?

[i]Your data please. I consider myself a “higher earner” and have not lost significantly.[/i]

medwoman:

This from a recent Federal Reserve Report…

[quote]In the paper introducing the new data, Fed economists note: “Decreases in incomes were much larger for the higher education groups, and mean income actually rose for the no-high-school-diploma group,” [/quote]

Also, see this:

[img]http://www.cscdc.org/miscjeff/incomedrop.jpg[/img]

Now, the top wealthy have most of their assets in investments and the stock market has been growing much faster than the economy and employment, so the wealthy have made up ground that they lost during the first two years of the recession.

However, the point is that the top 20% are less well off today that they were in 2002. So why are we talking about increasing taxes on them?

JB wrote:

> Higher earners have lost a much higher percentage

> of wealth and income than have mid earners and

> low earners.

Then medwoman wrote:

> Your data please. I consider myself a “higher earner”

> and have not lost significantly.

Most “high earners” have wealth (e.g. a net worth) while most mid earners don’t have any wealth (they have more debt than assets) and very few low earners have any wealth (any real net worth) at all.

I don’t know if medwoman owns a home, but (according to Zillow.com) since 2006 the average Davis homeowner has lost ~$200K in home value (from an average of ~$600K+ to an average of ~$400K+). The real “high earners” in town who had $1.5mm homes in 2006 are probably down ~$400K on average.

I don’t know how much medwoman makes or her net worth, but $200K to $400K is “significant” for just about everybody. In Davis just about all the “high earners” are homeowners and I have yet to meet anyone in town that has brushed off the loss in value as “insignificant”…

Sorry… I am having trouble with images not resizing and truncating the right-side.

Here is the link to the image I posted @ 5:29.

[url]http://www.cscdc.org/miscjeff/incomedrop.jpg[/url]

[i]A 10 % loss for one of the 1% might make the difference between what, purchasing a fifth luxury car vs waiting a year ? What do you think that same 10% loss might mean to the family on the brink of foreclosure or having to decide between rent and a life extending medication ?[/i]

The family that does not purchase that fifth luxury car doesn’t:

– Provide sales revenue to the auto dealer… so that auto dealer lays off employees.

– Install custom tires and wheels and a custom stereo… so those product and service providers lays off employees.

– Get the car washed and detailed… so the car wash has to lay off employees.

etc…

etc…

etc…

Guess what… that family that on the brink of foreclosure relied on the income from the job that they lost being laid off.

Also, that wealthy person that you taxed again has less disposable income and donates less to charity that helps people in need.

See how class wars and egalitarianism hurts everyone except the politicians?

[i]See how class wars and egalitarianism hurts everyone except the politicians?[/i]

No. Progressive taxation is based on the premise that food, shelter, health care, and other necessities of life take a higher proportion of the income of those on the lower end of the scale, and that wealthier people are less adversely affected by paying a higher proportion of the costs of government.

Apparently a flat tax system would be more fair since the tax system is already progressive and not working.

What we really need is a much more transparent tax system.

So vote for Mitt Romney who wants to eliminate loopholes and deductions so that tax system is more transparent and as Obama likes to say “folks will pay more of their fair share”.

Why is it not working? By the way, Mitt Romney doesn’t support a flat tax, and hasn’t identified the loopholes and deductions he’d eliminate. Home mortgage? You ok with that?

It won’t be the home mortgage deduction. But I expect he will push for deduction limits for things like the Home mortgage deduction. I already get hit with AMT. Last year it wiped out $6000 of deductions (I have two mortgages). So I really don’t have a problem with a cap on personal deductions. The good news about that type of thing is it would be transparent. AMT is a freak. You cannot even figure out what it will cost you until you prepare your total 1040. Then poof… you have to write a check you didn’t plan for and there goes $6000 of discretionary income that you would have used to pump back into the economy.

Romney does want to get rid of many individual tax credits and many of the business deductions and tax credits. He wants to do this and keep tax revenue neutral. What he is basing this concept on is the theory that a simplified and transparent tax system will encourage more business investment and risk taking because it provides for more certainty. It will also prevent politicians from using the tax code to suck more revenue from some, and reward others… without the public understanding what is happening.

JB, thanks for the graph showing the change in income of the various income groups under successive presidential administrations. What caught me by surprise is how the income of the wealthy spiked under Carter after declining under Nixon and Ford. I wonder why the wealthy despised Carter so?

-Michael Bisch