Suddenly the business community came before the council, and while they remained in support of the project, they argued that the rate increases were too steep and too sharp, particularly given this economy.

Leading the way on the council, moving toward all-debt financing, was Councilmember Brett Lee. At first his colleagues were skeptical, but in the end, it was a 5-0 vote.

The council approved a recommendation to “Adopt the procedural resolution for providing notice and receiving and tabulating written protests to water, sewer and solid waste property-related fees and charges.”

However, the second part of the motion, made by Councilmember Rochelle Swanson, was altered from the staff-recommended language to read, “Approve the water rates for a five-year time frame that can be included in a notice to customers for raising water rates in accordance with the all-debt scenario.”

It was the business community that raised the issue first, that sounded the alarm. Greg McNeese said that, while he thinks the process is so much better than before, “One thing that concerns us is the rates being so close to what they were before.”

He encouraged the council to find a way to do as much as possible a “pay as you go project” but to be able to “finance them and get these rates down to something that is easier for us to afford right now.”

Dobie Fleeman said that, while the Government Relations Committee of the Davis Chamber of Commerce continues to support the need for the water project, he expressed concern about ” the affordability of the water rates necessary to complete the project.”

He said, after a lengthy period of analysis, “We are having a difficult time understanding how the project could decrease in size and scope some $22 million and yet the proposed rates are essentially unchanged if not higher under the scaled down plan.”

“It was those very rates in September 2011 and the community’s reaction to those rates that have brought us to where we are tonight,” he added.

The big difference, as outlined by Herb Niederberger, the City’s General Manager of Utilities, had to with the method of financing the project.

“The original model [relied] exclusively for borrowing for all capital improvements for these very long term investments,” Mr. Fleeman continued. “The city consultant explained to us that the new rates are based on paying the entire $36.9 million in local capital improvements on a pay as you go basis rather than financing them with 30 year bonds.”

“In summary, we are very concerned over the assumptions made concerning the ability of the community to absorb the premiums introduced by the election to pursue the pay-go approach as a catch-up strategy for the many years of deferred maintenance and our failure to move ahead with previous rate increases,” Mr. Fleeman concluded, adding that this issue was not adequately addressed by the Water Advisory Committee.

Mr. Fleeman’s comment was backed up by a number of other business leaders in the community.

Herb Niederberger responded that in 2011, the proposal was to finance the entire project costs, including the local projects. However, as the project progressed, the proposal shifted to funding the local projects on a pay as you go basis for the first five years, and debt finance the remainder of the project.

Mr. Niederberger said, “We did not think this was the most prudent way to establish rates.”

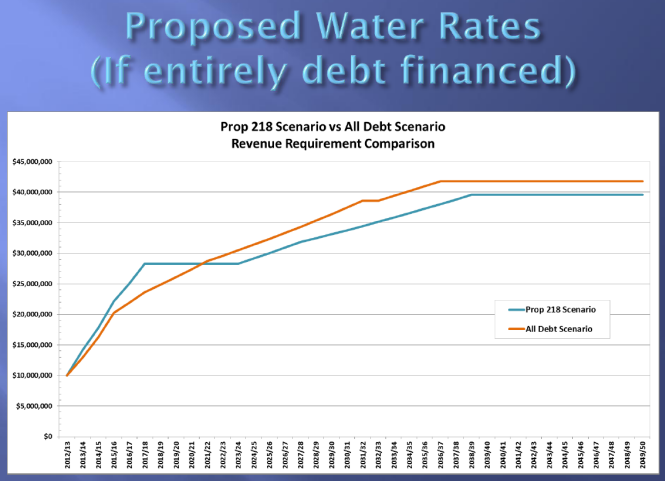

“If you finance all of the projects through a conventional debt scenario, the first five years of rate increases is lower than what we have proposed, by about 15%,” he said. “If you look at the long term… you see that over time, we have to collect a lot more revenue from the customers in order to pay back the financing, the addition debt incurred by the local projects.”

City Manager Steve Pinkerton noted that they are restricted by law to only include five years of rates on the Proposition 218 notice.

“Our goal to be able to maximize our bond rating was to be able to have all of the Prop 218 rate increases in place at the time of financing,” he said. “Whereas in this case you would see a fairly constant series of five year rate increases for at least another decade plus before we would be able to ensure the bond holders that we have all of the revenue in place.”

He said it would certainly have an impact on the city’s bond rating.

“From a staff perspective, we felt like, given the fact that we wanted to maximize our ability to issue low-cost bonds and be able to tell the rate agencies all of our revenues are in place for the future, we felt like this was the best way to go,” Mr. Pinkerton said.

It was Councilmember Brett Lee who seized the initiative, noting, “While overall in the long run, fully financing everything generates a larger cost, that’s true of any financing. It’s always cheaper to pay cash.”

“At the five year mark, just looking at the chart, there is a fairly substantial difference (15 to 18%) in terms of the typical user,” he said. “It’s not a huge amount but it is a meaningful amount. I think that for many people, while it would be nice to pay less over the full life of the project, I think for many residential customers, the increases are rather steep and I think it’s nicer to have a slower ramp up until you hit that rate.”

“I’m swayed by this idea of fully financing,” he said. “In general it’s better to not finance if you don’t have to. But it’s a fairly steep rate increase for many folks.”

Councilmember Lee said that while this is not a clear-cut choice, “I am leaning towards the side that smooths the rate increase and spreads it over a longer period of time.”

It was clear this was not an approach that staff was comfortable with.

Herb Niederberger said, “We are obligated to provide to you the most prudent recommendation that we can to keep the city as fiscally healthy as possible…. I think I said it before, whatever this city council comes up with, we will make work.”

Mayor Joe Krovoza, participating via phone from Washington DC, told the council, “I think the all-debt scenario is probably more interesting to me unless there’s some things that might happen in the near future that make us regret that we spread it out.”

He did note that it would be attractive to be able to tell the ratepayers that if we go with the proposed Prop 218, after five years, rates would basically flatten out.

“One of the things people have talked about is the sense that this is needed for the long term sustainability of the community,” Councilmember Lee said. “The push back has come in terms of what the rate increases are.”

“We have a group of people who have been very active in following this issue and they’ve come before us and have asked for a fairly straightforward change,” he said. “The changes they are asking for really spreads that increase over a much greater period of time from four years to seven years before you hit that max level.”

The critical point he made was that in 20 to 40 years from now, you are looking at just a five percent difference in terms of revenue requirement. As we know from other discussions, that type of difference in revenue requirement might be negligible in terms of the rate structure.

“Five percent twenty years from now is not a huge amount,” Councilmember Lee pointed out.

“After having this back and forth and sort of hearing both sides, the all-debt scenario is somewhat more appealing for me,” Councilmember Lucas Frerichs added. “If there’s a way to smooth things out over time … after our conversation, the all-debt scenario is something that I’m interested in.”

Staff assured council that they could have the all-debt scenario drafted up and ready to go for a mailing at the end of January.

—David M. Greenwald reporting

So the CC voted to vastly increase our debt, and at a higher interest rate due to the increased risk? They did it on the fly, without adequate quantification of the real numbers involved. There was one single page that staff passed out to the CC at the start of the agenda item, and it was put up on the scree.

I was there last night. The take away is that the CC did this solely to reduce the rate spike, and thereby attempt to increase their chances of passing Measure I.

“I was there last night. The take away is that the CC did this solely to reduce the rate spike, and thereby attempt to increase their chances of passing Measure I.”

While I am its greatest critic, populism is the Davis way, making the council appear like marionettes, reacting to competing tugs, reversing their course with each pull .

Of course Michael, that was pretty clear.

I missed what Elaine said during the meeting. Did the WAC spend time examining THESE rates that were similar to 2011 rates. I remember the WAC and think it was Elaine, passed a smoothing out of rates during their tenure, but it seemed what the staff showed last night was never shown to the WAC. Can someone clarify?

BTW, I really appreciated staff’s attempt to use “pay as we go” for the costs of fixing current supply system infrastructure. Too bad the political goals of the electeds tossed the staff’s fiscally conservative approach.

Michael, will the 218 notice have the return envelope with the yes or no check box like last time?

Rusty: I dont know yet. That return envelope was a special summer 2011 deal, proposed by Mayor Krovoza I believe.

Time will tell if the 5/0 vote last night helps or hurts the chances of passage of Measure I. People are still pretty burnt by the idea of 100% financing of real estate, major consumer purchases, and business projects, me included. This very concept is one of the primary reasons our national economy melted down.

As to bringing it local, our city budget is in a world of hurt because the City has bestowed huge benefits and comp packages on certain employees and groups, without the money in the revenue stream to pay for those generous gifts.

After last night’s 5/0 vote to borrow well over $100 million solely on a credit card (bonds), I can see the City has learned nothing.

It was bizzare to see some business groups supporting the 100% credit card concept, after all they have been through these past 5 years.

Actually all debt financing might save individuals in the long run too. As Davis grows there will be more users who can share in the costs in the the out years.

Let’s see… Mr H opposes steep increases in rates…. Mr H opposes smoothing those out by all financing… bottom line: Mr H does not want to see a surface water solution under any terms.

I will be voting in favor of the surface water project… I have not seen a rate structure that I feel strongly about, but as I look at the area below the “curves”, it appears, at the end of the day, my family will be better off, in the long haul, with the higher rates sooner, lower rates later.

Don’t bother to tell me how I SHOULD feel about this. In exchange I will not tell anyone how they SHOULD feel.

[quote]This very concept is one of the primary reasons our national economy melted down.[/quote]

Keep demonstrating your ignorance, Mike.

Ryan: remember those fancy no-down payment home loans, or the ones with interest only for years, then the ARM hits the homeowner? Or the investment instruments that were based on packages of these risky loans? Ringing a bell for you yet?

It’s fiscally insane for the City Council, in order to reduce the rate spike and win Measure I on March 5, to burden us with these big new projects 100% paid for with a credit card.

I think the CC did more damage to our city last night, in one hour’s time, than I have ever witnessed before in nearly 13 years of participating in city goverance issues.

And it was led by Brett Lee, of all people.

So Michael – Are you saying that the financing that the City will take on here will have an adjustable rate that will sky-rocket in X years? Or are you saying there will be a “balloon payment”?

When I pay off something with a credit card the interest rate is fixed.

So… what are you saying about the financing of this debt exactly? Does “all-debt” imply the city will have to engage in some exotic financing scheme like those you describe?

Depends on how these things have traditionally been structured. I know when they built Berryessa the farmers in Solano actually had leans on their property that they paid off over 30 years.

SODA said . . .

[i]”Of course Michael, that was pretty clear.

I missed what Elaine said during the meeting. Did the WAC spend time examining THESE rates that were similar to 2011 rates. I remember the WAC and think it was Elaine, passed a smoothing out of rates during their tenure, but it seemed what the staff showed last night was never shown to the WAC. Can someone clarify?”[/i]

SODA, the WAC did indeed look at delayed financing, which is the first cousin of this development. We looked at in the context of the decision between the West Sacramento alternative and the WDCWA alternative. At the time, in order to simplify the analysis of the WS vs. WDCWA choice on a motion by Helen Thompson that was passed unanimously (IIRC), the WAC eliminated the delayed financing alternative from consideration.

Did the WAC consider “THESE rates” specifically? No, we did not.

With that said, under Prop 218 rules, an agency’s management can implement rates that are lower than the approved rates at any time, and THESE rates (as discussed last night) are lower than what the WAC did consider.

Michael Harrington said . . .

[i]”BTW, I really appreciated staff’s attempt to use “pay as we go” for the costs of fixing current supply system infrastructure. Too bad the political goals of the electeds tossed the staff’s fiscally conservative approach.”[/i]

Michael, that is one way to look at it, and from a purely personal perspective I prefer that approach. However, when I got up this morning and told my wife what had been decided, her immediate reaction was, “That makes a lot of sense. It spreads the payments over a broader set of years, and as a result has future new residents of Davis more actively contributing to the costs of the project.”

What do they say, you can’t please all the people all the time.

Later this morning when talking to a Willowbank resident who is a senior manager in the finance industry, he said that given the very low interest rates that exist now, and the very, very small spread between those interest rates and the Consumer Price Index annual increases, using debt is very good financial management.

Again, you can’t please all the people all the time. I still prefer the pay as you go alternative.

hpierce said . . .

[i]”I will be voting in favor of the surface water project… I have not seen a rate structure that I feel strongly about, but as I look at the area below the “curves”, [b]it appears, at the end of the day, my family will be better off, in the long haul, with the higher rates sooner, lower rates later. [/b]

Don’t bother to tell me how I SHOULD feel about this. In exchange I will not tell anyone how they SHOULD feel.”[/i]

Your bolded words are how I feel as well.

But the conservative paygo advocates should not be complaining on behalf of those who can’t afford the larger increases paygo requires. You can only have it both ways if you go the full financing route where you get lower rates now and have more payers later. In fact, the 15% reduction in rates up front can be sustained with a 1% annual growth rate over 30 years.

michael harrington – when you bought your properties did you pay with cash? or did you finance your purchase with debt, borrowed from the bank? you act as though loans are a bad idea, but we borrow all of the time in order to be able to spread payments into more affordable chunks. the council did exactly that. do we pay more? in terms of revenue, yes. but in terms of impact, the slower ramp up is better for the average person and its likely it will not have a huge impact on rates in the back end.

it now seems clear to me that harrington only wants to defeat this project, he doesn’t care the impact on the typical ratepayer.

Growth issue – This is what Mike is referring to: [quote]”remember those fancy no-down payment home loans, or the ones with interest only for years, then the ARM hits the homeowner?” [/quote] I believe he’s talking about sub-prime loans that were offered to people did not qualify for traditional loans. That this was the cause of the economic crash in 2008 is not quite correct. These were just the chips that investment banks gambled with. He must be assuming that the City is thinking of financing the project using the same model of financing or that this is the only model available.

I think that the Council decided that financing the project will allow the City to slow the rapid rise in rates for existing residents and allow for future residents to contribute to the cost of this upgrade.

Ryan: the “pay as you go” portion that was converted to 100% financing last night had to do with the current system maintenance and repairs and upgrades.

The undertow to some comments above is that future growth in population will be needed to pay for all this new debt.

The project is at least 2x too large, and not needed for years, and the implication is that we should build it too large for what we really need, and bring in lots of new population to pay for that unnecessarily large surface water plant.

Nice to see a lively discussion generated by talk of money and population growth.

Mike, now we are back to your base fear – that this project will pave the way for massive development.

Smoothing out the rate increases will allow those with current stagnant salaries to afford the later increases once the economy recovers. There are those who would rather pay higher now and then lower depending on where they are in terms of retirement. Have you considered that, Mike?

“BTW, I really appreciated staff’s attempt to use “pay as we go” for the costs of fixing current supply system infrastructure. Too bad the political goals of the electeds tossed the staff’s fiscally conservative approach.” -Harrington

It’s good to know Harrington would support the surface project if only it was “pay as we go”.

-Michael Bisch

I believe that David Greenwald and Sue Greenwald have argued that affordability, not the long run total cost, is the most important factor for rate payers. While my personal preference would be pay as you go, if the city council and the Davis electorate would prefer to the debt financing method, then so it should be.

Most crucial is that it has become clear that we will pay higher rates, with or without a new, cleaner water source. The question is, would you rather pay fines to California, or would you prefer to buy a cleaner, better source of of water for us and our children to drink.

I don’t think a 1% break even growth rate figured into the financing structure is too much growth although recent letters to the editor have raised the growth issue as a reason to oppose the project. Of course without water you can’t grow or live for that matter. It may be the third rail of Davis politics but I’m not afraid to talk about it. After all, isn’t that what the general plans states as the rate we should grow? By the way with a 2% growth rate we could save another 15%.