In order to put a measure or measures on the ballot for June, the city council must take final action on Tuesday (February 6). At their last meeting, the council, after going back and forth over the amount and form, decided to direct staff to bring forward two separate measures – one for a renewal of the parks tax at the current $49 level with a two-percent inflator and a 20-year sunset, and the other for a $99 transportation tax with a two-percent inflator and a 10-year sunset.

The city commissioned a study by Nichols Consulting which determined the condition of the city’s roads, bike lanes and bike paths. It found that, while a PCI (Pavement Condition Index) of over 70 was “Good,” the city’s average pavement level was 63 for roads and 51 for bike paths.

The report recommended funding at additional levels in order to repair and maintain the city’s roads. This tax, if approved would “generate approximately $2.8 million in the first year, with a 2% annual inflator, to provide funding to supplement $3 million of existing General Fund dollars currently provided in the Capital Improvement Project for Transportation Infrastructure Rehabilitation.”

The city would be required “to continue to provide a minimum of $3 million in contributions in addition to the revenue generated through the tax, in order to levy the full amount of the tax and

meet a maintenance of effort requirement.”

Staff notes: “Based on the Leland long-term forecast the two parcel taxes generate an annual average of $4.6M in new revenue over time, which closes 55% of the average annual $8.3M gap that results over the 21-year period.”

On the parks side, the city commissioned a study by Kitchell Corporation to examine long-term needs in parks and greenbelts.

Staff writes: “Although the City currently budgets $7.7 million for parks maintenance citywide, the report identified almost $1 million in additional costs annually over the next 10-year period.”

The current tax generates $1.4 million and all this new tax would do is maintain that level in real dollars for the next 20 years.

Staff writes: “The 2% inflator should allow the tax to keep up with inflationary increases over the life of the tax so that current buying power is not lost.” Staff adds, “The tax should allow the City to maintain current levels of service in existing parks and greenbelts.”

But it will not cut into the additional needs.

On the other hand, the city is planning to use the Streets and Bike Path Maintenance Special Tax as a way to cut into unfunded needs on that front.

Staff notes: “The City currently allocates $3 million in direct General Fund to fund pavement repair and rehabilitation. In addition, this year’s budget includes $130,000 from construction tax and $800,000 of developer impact fees to be used on eligible transportation projects.”

That means there is an ongoing $3 million which could be $4 million, depending on future availability from construction taxes and the developer impact fees.

But the tax will once again leave the city short, as “the continuing unfunded amount for pavement and pathways is approximately $3.5 million, plus an estimated $4.5 million for related transportation infrastructure needs such as striping, traffic signals, and sidewalks/curbs/gutters.”

Staff notes: “The funding gap is exacerbated by the uncertain and fluctuating nature of funding that has historically flowed to the city from the federal and state levels.”

At the same time, the wording of the tax will set the current $3 million in stone, setting it “as the baseline and requires that, at minimum, this amount of General Fund be included in the budget each year. If, because of a recession or other budget crisis, this amount is not included, then the tax levied for that year would not exceed the total General Fund contribution amount.”

This is critical language that prevents staff from using existing money for other purposes, allowing the council to backfill with tax revenue.

The ordinance specifies: “The revenues collected from this tax shall be used only to supplement existing expenditures for street and bike path maintenance improvements and shall not be used to supplant existing funding for street and bike path maintenance improvements. The baseline maintenance of effort budget for this purpose shall be the Fiscal Year 2017-2018 Adopted General Fund for Transportation Infrastructure Rehabilitation (CIP 8250), which budgeted $3 million. If the maintenance of effort requirement is not met, the tax levied for that year shall not exceed the total General Fund contribution.”

Staff writes, “(It’s) the Council’s intent to allow the taxes to offset roughly half of the unfunded liability and continue to work to address the remainder via outside funding such as grants, economic development efforts, and additional cost savings measures.”

Language for the Parks Tax:

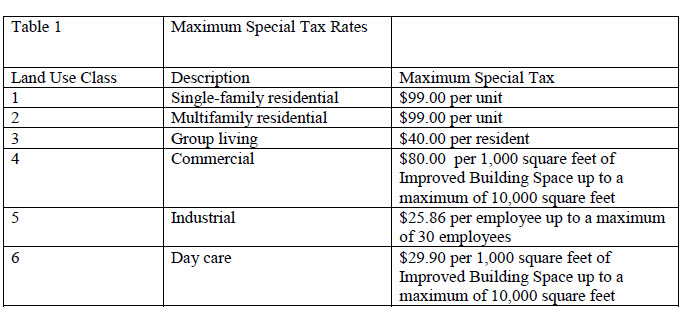

Shall Ordinance XXXX, which extends for 20 years the existing Park Maintenance Tax of $49 per year on residential units and on non-residential units in amounts specified in the Ordinance, adds an annual 2% inflator, and is expected to generate $1.4 million in the first year to fund maintenance of parks, street trees, greenbelts, bike paths, medians, public landscaping, urban wildlife and habitat, swimming pools, and recreational facilities, be adopted?

Language for the Street and Bike Path Maintenance Tax:

Shall Ordinance XXXX be adopted to add Article 15.21 to the Davis Municipal Code to establish a Street and Bike Path Maintenance Tax of $99 per year on residential units and on nonresidential units in amounts specified in the Ordinance, to fund maintenance of streets, bike lanes and paths, sidewalks, and related transportation infrastructure, which is estimated to raise $2.8 million, with a 2% annual inflator, for a period of 10 years?

—David M. Greenwald reporting

Any word if the school district is going to also put a tax measure on the June ballot?

They can’t

Why? Do they have to wait for a general election?

No. But they would have had to act by Thursday

Time to put the measures on the ballot, and vote in June. Final answer.