Back in November 2012, the Davis City Council approved a “Pre-Development Cost Funding and Negotiation Agreement for the Nishi Property, with the goal of planning the site as a mix of university-related research park development complemented by high density urban housing.”

The pre-development concept was for the city to share predevelopment costs with the property owner, but upon completion of the environmental review and successful voter approval through a Measure R vote, the city’s contribution would be reimbursed by the developer.

Costs are anticipated at $350,000 for the city’s share, and an equal amount from the property owner. Final structure of the real estate deal would be established through a Development Agreement.

Council last year supported the effort, with a check-in period.

At this time, staff is reporting that representatives from the city, UC Davis, the property owner and the county “have been working diligently to get to a starting point for community discussion on planning for the mixed-use innovation district.”

Staff reports that this group has begun to “identify opportunities for integrating Nishi planning efforts with campus planning efforts;” “developed a set of draft shared goals and entity-specific objectives;” “engaged traffic and archeological consultants for background investigation;” “conducted preliminary engineering feasibility for a railroad undercrossing, and obtained conceptual approval from UPRR;” and has begun to look into planning and design features.

In the city’s fiscal analysis, “The City’s share of the pre-application process was estimated at $350,000, to be matched 1:1 with property owner contributions. Funds were allocated from fund balance that the former Redevelopment Agency had transferred to the City prior to its dissolution.”

“The City’s ability to keep that fund balance has been questioned by the State Department of Finance,” staff reports. “Staff is recommending funds be re-allocated from the General Fund for this effort. If the Agency’s fund balance is required to be transmitted to Yolo County for redistribution, the revenues that will be received by the City will be sufficient to cover this expense. In addition to the cost-sharing with the property owner for predevelopment of the Nishi property, many of the joint planning expenses are being shared with the UC Davis campus.”

Back in October of 2010, the council approved actions “to maintain a steady supply of developable business park/industrial land. Immediate actions included initiating planning of the Nishi property as a mix of university-related research park development complemented by high density urban housing.”

The city is looking to work with UC Davis “to identify and explore options, viability and costs for circulation and access options that involve university property.”

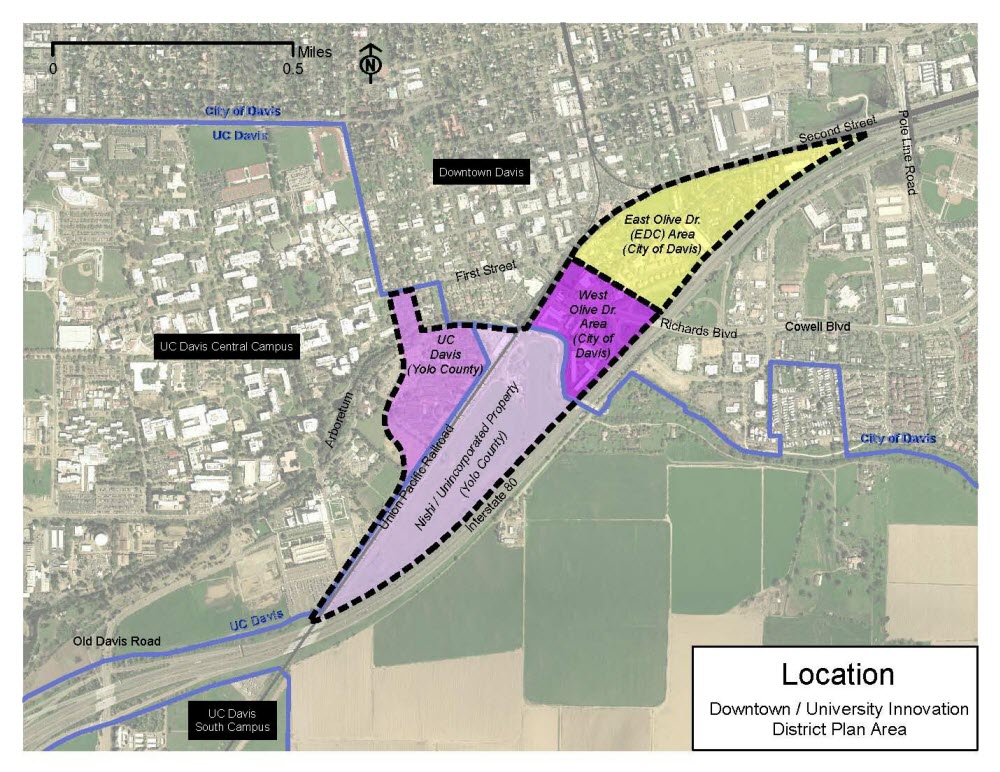

Back in February, “[t]he City and the campus jointly submitted an application for grant funds for the Sustainable Communities Planning Grant and Incentives Program. The goal of the application was to secure funds for a process to develop alignment of goals and closely-coordinated planning between the City and the University for the Nishi property, adjacent UC Davis land, and both East and West Olive Drive. Although the grant application scored highly, it was not selected for funding.”

Staff reports, “While the university will undertake planning studies for this side of campus to inform an update of their long range development plan and will look for opportunities to coordinate with City on similar studies of adjacent, non-university properties, staff continues to meet with the property owner to explore ways to advance planning on the Nishi property with limited local resources.”

Staff proposed a cost-sharing approach with the property owner for the predevelopment of the Nishi site – unlike what the city has taken with other Measure J projects, where the cost has been borne by the property owner.

“The recommended agreement calls for a 50:50 share of out-of-pocket predevelopment costs between the property owner and the city,” the report read.

The council stopped short of committing fully to spending more than one third of a million on predevelopment planning for the Nishi property, and instead agreed to check in with staff at $100,000 or six months – whichever comes first. Brett Lee cast the lone dissenting vote.

Mayor Joe Krovoza told the council, “I would ask everyone to understand and not impute or infer that somehow this is a proposal that has come before the council in significant years prior.”

He argued, “This is about jobs. This about connecting to the university. And this is not about peripheral development. There has never been a Measure R vote in this community that has been about those very different elements. It’s always been 100% residential. It has always been peripheral and it has not been necessarily connected to the life blood of this community – the university.”

Councilmember Brett Lee disagreed with the belief that the city was likely to replenish this money taken from the parking fund, arguing, “A realistic view of the situation would be that money will be lost based on the last Measure J/R votes, that’s an uphill battle.”

“I don’t think it’s safe to assume that number one, we will get to a vote,” he said. “And that number two it would be approved by the voters.”

Councilmember Lee’s idea was to commit to a smaller amount of money and look into a simple survey of the voters to see if there was any kind support for this project.

The mayor, however, downplayed a public survey, arguing that people would think about previous iterations of this project rather than the current proposal, which he called something that is “very very different.”

Instead, the mayor thinks this is an authorization of staff to engage as a real partner on this project.

“The reason I am comfortable with the [cost] splitting in this situation is because we’re looking at taking over, and owning, and managing over fifty percent of the land at issue,” the mayor said. “If that is the deal that we’re heading for, it’s very appropriate that we share in the costs of this deal.”

Moreover, Mayor Krovoza agreed with city staffer Ken Hiatt that “no developer’s probably going to take the risk on a piece of property like this, given past community votes.”

Staff on Tuesday asks that the council confirm city-specific goals for the efforts to plan the Nishi property as a mixed-use innovation district and approve the budget adjustment that re-allocates the funds from the former Redevelopment Agency to the general fund.

—David M. Greenwald reporting

wow, an update on nishi and no comments? we are talking about spending money now from the general fund, which we don’t have, is that a wise idea?

DP: I’ll bite. This is not about an innovation hub, this is about a very high density residential project from John Whitcombe and partners (maybe 700-900 units). The business park component is secondary at best. It seems to me the first step in getting a positive Measure J/R vote is to accurately inform the public about the project.

The CC wants Con Agra and this project in the same decade? I doubt developer fairy dust will sparkle for both.

“The CC wants Con Agra and this project in the same decade?”

With only 342 single family homes built in Davis in the decade ending 12-31-2012 its no wonder there would be pent up demand to build more in this decade.

“, this is about a very high density residential project from John Whitcombe and partners (maybe 700-900 units).”

the owner here is tim ruff. and what you are calling high density residential is actually going to be student housing for the most part. seems like this is where we want student housing to be.

With 12,000 single family homes in Davis adding at a rate of 34 a year is a 0.28% growth rate for this category

over the last decade far below the 1% annual goal for growth.

34 a year? I think you slipped a decimal.

By the way: it’s not a goal, it’s a cap.

If all 550 were single family

, which they are not it would raise it to 0.675% over 11 years. It would be less though since it will take a long time to build out.

Don, the 2.1% of The Cannery spread over a 3-year buildout period is 0.7% per year. Add 0.7% and 0.28% and you get 0.98% . . . very close to, but below, 1%.