by the No on Measure Q Campaign Committee

Disclaimer: Opinions are those of the writer and do not reflect those of The Vanguard or its Editorial Staff. The Vanguard does not endorse political candidates and is committed to publishing all public opinions and maintaining an open forum subject to guidelines related to decency and tone, not content.

This article factually analyzes and discusses patently false claims made by the Yes on Measure Q campaign in their ballot statements presented to voters.

Introduction and Background

This article is the 3rd in a series presented by the No on Measure Q campaign committee about the significant problems associated with the new tax measure. The first article (see here) provided three good reasons for citizens to vote No on Measure Q including a decided lack of transparency and disclosures by the City Council in bringing the measure to a vote. The 2nd article (see here) gives additional reasons to vote No on the tax measure, discussing the mismanagement of city finances by the current administration.

About Measure Q

If passed on the November ballot, Davis Measure Q would double the extra sales tax from 1% to 2% imposed by the City of Davis on all goods purchased or used within the City except for some food and medicines. Based on the expected $11 million per year generated by the new tax and a Davis population of about 66,000, this works out to be approximately $165/year tax for every man, woman, and child in Davis. And like the previous two ½ percentage point sales and use tax hikes, this tax is permanent. It doesn’t matter if the City’s financial condition substantially changes for the better in the future, this tax never goes away!

In the Past Decade, City of Davis Revenues and Expenses Soared Far in Excess of the Inflation Rate or Population Growth.

Mark Twain famously popularized the saying, “There are 3 kinds of lies: lies, damned lies, and statistics.” We can now add a 4th type of lie – Lies told by the Davis City Council.

In their ballot statement in support of Measure Q, the Davis City Council unequivocally stated, “The City of Davis has worked diligently to manage existing resources efficiently, trimming expenses. Now we need to catch up to inflation, increasing costs, and our growing population.

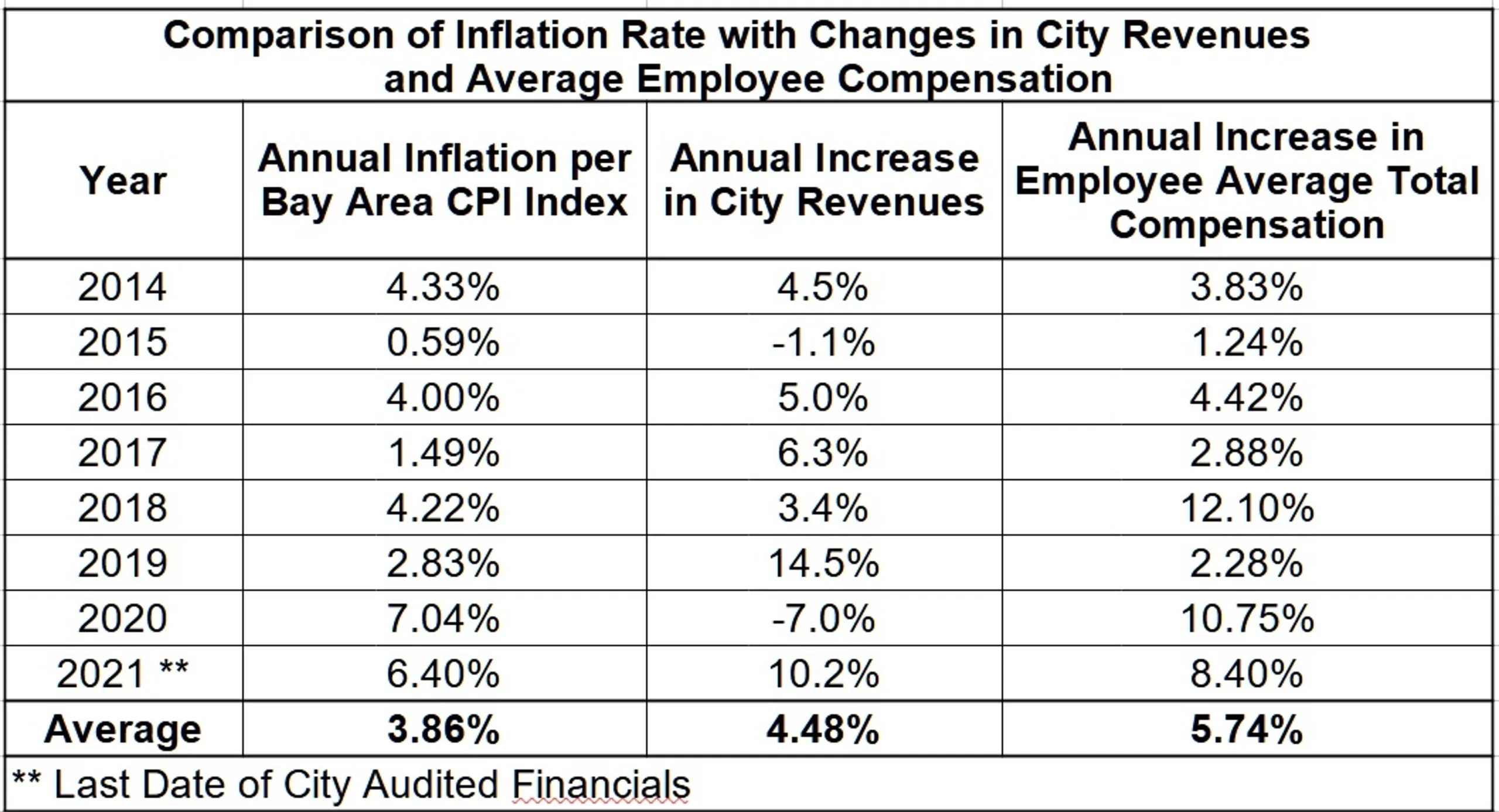

But is this true? The facts say otherwise. The following is a comparison of the annual increase in the inflation rate with annual changes in City revenues and annual changes in employee total compensation in the past decade.

Fact Check #1 – As shown above, from 2014 through 2021 the average annual rate of increase in City Revenues is 4.5%. The average increase in City Employee Total Compensation is 5.7%. . Yet the average rate of Inflation for that time-frame is only 3.8%. Only in a distorted reality is an average revenue increase of 4.5% not keeping pace with a local average inflation that is only 3.8%. The City’s profligate spending increases simply cannot be explained away by the inflation rate.

Fact Check #2 – The population of Davis increased from 66,741 in 2014 to only 67,171 in 2021 (430 people) – or a compound average annual growth rate of less than 0.1%. So population growth is not a valid excuse for out-of-control spending despite claims to the contrary by the City Council. _________________________

Summary and Conclusion

It is obvious from the above data that one of the major forces driving the increase in expenditures by the City, besides spending on new programs and services the city cannot afford, is the soaring cost of City employee compensation – mostly on the high end of senior City management. It has risen far in excess of the inflation rate or other City expenditures. So inflation or population growth, as the Council claims, are certainly not the cause of the City’s excessive spending increases.