In 2003, the Davis Area Cooperative Housing Association (DACHA) was formed as a limited-equity cooperative. The units were owned by a nonprofit corporation, DACHA, and member households of the organization occupy the individual units. The individual does not own the individual unit, but rather the residents own the cooperative as a whole and possess the exclusive right to occupy one specific unit within the cooperative.

In 2003, the Davis Area Cooperative Housing Association (DACHA) was formed as a limited-equity cooperative. The units were owned by a nonprofit corporation, DACHA, and member households of the organization occupy the individual units. The individual does not own the individual unit, but rather the residents own the cooperative as a whole and possess the exclusive right to occupy one specific unit within the cooperative.

Those interested in living in these units buy a share into the cooperative which makes them a member of DACHA. Each individual needed to buy a share and also make a month carrying charge toward the costs of the unit and the cooperative. This is a limited equity arrangement, meaning they would buy into their share, and they would accrue interest but not really equity over time until the point in time that they would sell their unit, at which time they would get their original share amount plus interest.

There were a number of other issues as well, including claims about misrepresentation of the nature of ownership in the cooperative by the developers and consultants, Neighborhood Partners. Those issues are of course a matter of dispute, and are included as a frame of reference for a large number of issues that were raised that caused the city staff and the city council to eventually act on behalf of the DACHA residents.

In June of 2006, an audit was commissioned. Again, the issues involving the findings of the audit are complex, subject to dispute between the various parties, and often outside of the framework of this story, nevertheless, the audit report found DACHA to be in financial distress and not sustainable in the long run.

In 2006, Neighborhood Partners would sue DACHA for breach of contract. The case would go to binding arbitration in June of this year, Neighborhood Partners were awarded just under $350,000 from DACHA.

In the meantime, the council and city staff would act to attempt to help DACHA by provided a loan of $4.15 million that would allow DACHA to refinance, pay off their existing debts, and also reduce their share costs from $22,000 to $6250 and reduce their monthly carrying charges that ran as high as $1800 per month and substantially reduce them.

These reductions were to address key concerns about the sustainability and affordability of the DACHA coop.

VANGUARD INVESTIGATION

Moreover, the legality of this action is also in question. A memo from the City Attorney argues that the action is legal. Lawyers for Twin Pines Cooperative Foundation, who are Plaintiffs in a lawsuit against DACHA argue that the action represents a violation of Safety Code Section 33007.5.

The victims in this are the affordable housing residents of DACHA, who now face considerable additional legal action above and beyond the nearly $350,000 arbitration judgment by Twin Pines Cooperative Foundation due to what from the Vanguard’s research is a city staff designed and council approved refinance.

Refund

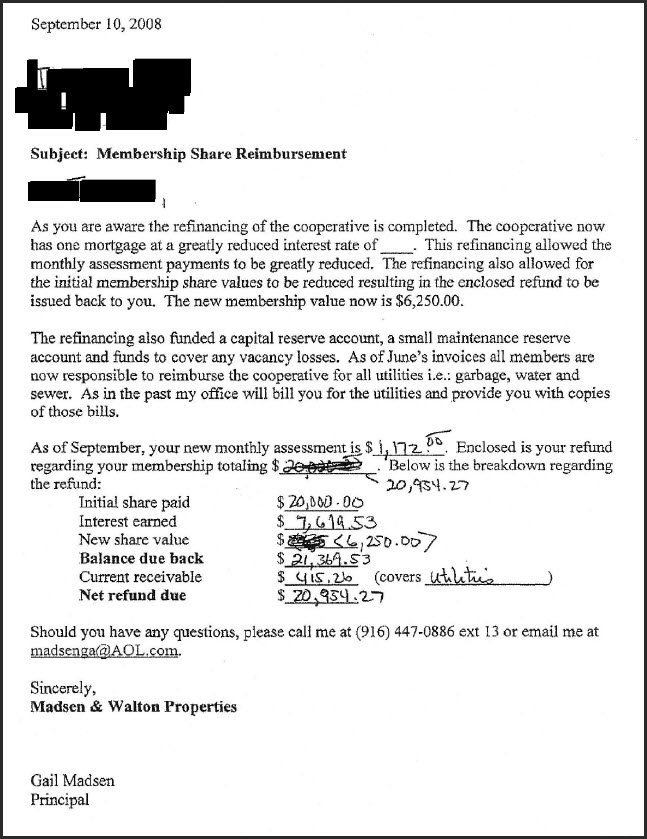

members who paid more that (sic) $6250.00 were credited back the difference between amount they paid for the share (original payment and interest accrued under the Limited Equity Model) minus $6,250 (the stabilized required share amount) and any outstanding payments due to DACHA.

The refinance ballot given to members in July of 2008 and voted on by or before August 10, 2008 also made it clear that the share stabilization program would also include a refund to existing members.

I also understand and accept that a condition of this loan is a comprehensive share reduction and stabilization of all DACHA shares to $6,250 per member, not including credit for any member improvements recognized and credited by DACHA, and that payments resulting from this share reduction will be provided to me by the first of September.

Moreover the Vanguard has obtained records of repayments to residents. The document from Madsen and Walton Properties shows the refund payment for each of the residents. The name has been redacted to protect their identity. This is one of many such documents that exist. For our purposes, this acknowledges, that the residents did indeed receive a refund. It reads in part, “Enclosed is your refund regarding your membership totaling…”

Staff Actions

This is a crucial point because right now the members of DACHA are being sued it appears for actions that the city staff devised and implemented.

In addition to the on-the-record statement by the DACHA, there is also the explicit language quoted and cited above from the DACHA ballot that the city had in their possession that was obtained by the Vanguard through a public records act request. Based on both the testimony of DACHA board members and this evidence, it is reasonable to conclude that the staff both knew and authorized the refund to DACHA members. Indeed, City Attorney Steiner’s memo demonstrates that this is probably once again not a fact in dispute.

Council Authorization

Councilmember Lamar Heystek at last night’s council meeting indicated his own lack of clarity with the staff report:

I can’t assess whether we knew what we were talking about in terms of share stabilization… Staff materials weren’t necessarily clear to me in retrospect. Now I see other things happening that I may or may not have known judging from those materials should have happened.

The staff report does in fact appear to be rather ambiguous on this point. It never mentions the term refund. Nor does it mention explicitly that residents will receive payment. The closest the staff report comes to mentioning even the possibility of refund comes at the bottom of page two. It reads:

The share stabilization will result in all members having a matching share investment of $6,250 as their current share amount.

This certainly does not appear to be a statement that is clear in terms of what would transpire.

A request for the video of the council meeting resulted in an acknowledgment that the city does not have this recording anymore. [As a side note, this is a very disappointing revelation since I had believed that the city council in early 2008 had directed staff to look into ways to preserve meeting recordings. Apparently this is not occurring and this is another example of a loss of the historic record that could verify whether information was presented.]

In contrast to city’s staff report, the DACHA ballot from July 2008 appears to be far more explicit in its mention that there would be refund payments issued. Indeed, it directly states it whereas the council agenda item never does.

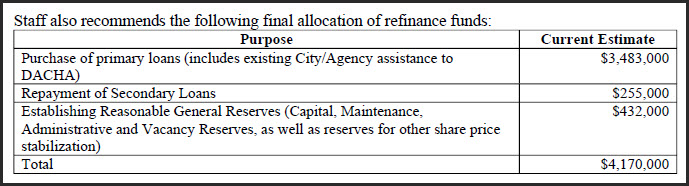

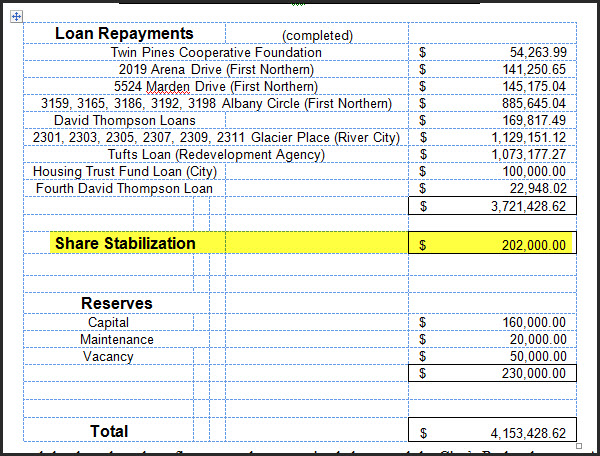

More concerning is an examination of the spreadsheet charts on the DACHA ballot versus the Council agenda item.

The chart above is from the council agenda item. Notice there is no direct mention of DACHA repayments. Now look below at the chart that appeared on the DACHA ballot.

The DACHA ballot explicitly mentions the $202,000 that would go to share stabilization. Looking at these two charts makes it obvious as to what is occurring. The City Council agenda item has $432,000 put into General Reserves, but the DACHA ballot has just $230,000. If you add Share Stabilization to the Reserves you magically get the $432,000.

Only examining the fine print does one see that under the heading “Establishing Reasonable Reserves” right at the end it says: “as well as reserves for other share price stabilization.”

This indicates that the money is clearly there in the staff report, but from this vantage point it appears to be hidden from view. Moreover, there should be questions as to why share stabilization could accurately be listed under a term called, “reserves.” Reserves imply a longterm holding of money for a designated purpose while this money was paid out very shortly after the loan refinance occurred.

LEGAL ISSUES

Nevertheless in our evaluation, we are at least in part moved by the fact that the plaintiffs at least site the pertinent state laws whereas the city attorney appears to only make assertions.

From the standpoint of the plaintiffs there are specific laws that govern the distribution of assets from a non-profit cooperative and they argue that DACHA’s refund to members violates those laws.

The transfer value (shares) was established for each unit at creation in compliance with state law.

Safety Code Section 33007.5. Health and Safety Code Section 33007.5 provides that members are only allowed to receive a distribution of “transfer value” at such time as the members ceases to be a permanent member of the corporation.

In their lawsuit, lawyers for the plaintiff argue the followings:

Plaintiff is further informed and believes, and on that basis alleges that in contravention of California Law, DACHA’s Board of Directors recently returned more than half of the transfer value, as that term is defined in the limited equity hosing cooperative law, to the existing Members. As a part of the “comprehensive refinancing” with the City of Davis, DACHA’s loan from the City was used to return funds to current members. In a report submitted to the Redevelopment Agency of the City of Davis, DACHA and the City staff explained that all members would have their share investment lowered to $6250 from a high of $22,000, which would leave a sum of $185,000 to $200,000 for a distribution of corporate assets to the current members.

They continue:

The aforementioned acts constitute a violation of Health and Safety Code §33007.5 and are deemed an illegal distribution of the assets of a non-profit public benefit corporation in violation of Corporation Code §5410.

The Vanguard has also obtained a memo from City Attorney Harriet Steiner that disputes the claim that this is in violation of the law.

In all candor, I find your position with respect to DACHA and the share stabilization program untenable. The share stabilization program has been reviewed by my office and it is our opinion that, as proposed, the program is legal. Further, we believe that it is appropriate and proper to implement this program to achieve affordability for this project.

While Ms. Steiner definitely asserts that the program was legal, she never makes a legal argument or cites any law. Indeed Ms. Steiner’s memo looks more like a policy statement than a legal memo.

At one point, Ms. Steiner admonishes David Thompson, one of the principles for both Twin Pines and Neighborhood Partners, who had created and developed the DACHA project.

She writes,

“It is my recollection that Mr. Thompson was: present at the July 15, 2008 Council meeting when the item was discussed, considered and approved by the Redevelopment Agency, It is also my recollection that he did not speak on this matter, nor did he in any other way bring up the concerns that you and he now raise.”

This is of course largely irrelevant to the legality of the action. But the reason he did not bring up this issue at the time, is that it was not clear to him that the council had in fact authorized refunds to the DACHA residents.

The City Attorney continues:

“In short. it is my understanding that the share stabilization corrects and stabilizes the share costs. as originally planned, and will promote the affordability of this project as it moves into the future. Contrary to your allegation, there was no distribution to the members. Rather, the share stabilization was necessary to effectuate the original purpose of the limited equity cooperative.”

It is unclear her exact point here. There was a distribution of transfer value to the residents, a fact not in dispute and not disputed earlier by the City Attorney herself. She cites no law here that enables the city to lawfully return money to the residents, she does make a number of policy statements and assertions.

The city may of course not have any legal liability in this case. However, the city’s policies have placed affordable housing residents at considerable legal peril. The question remains as to what obligations the city and city council have.

Toward those ends, I went before council last night and presented my findings during public comment. Mayor Ruth Asmundson generously granted me five minutes to make this presentation. Councilmember Heystek pushed for a discussion and clarification of DACHA to be agendized as soon as possible.

City Manager Bill Emlen agreed.

“We actually welcome the opportunity to put that on the agenda if that’s the council’s desire.”

CONCLUSION

Finally there is the legal question. The City Attorney may be able to escape legal culpability on this based on the ambiguous nature of the law, however, the actions of the city has exposed DACHA to considerable legal difficulty that is mounting on top of an already nearly $350,000 judgment in arbitration. The intent of the city seems to be above reproach—they were trying to help affordable housing residents to be able to continue to afford to live in their homes. However, the application of that policy is deeply troubling and the community deserves a full accounting.

—David M. Greenwald reporting

What was the reason Neighborhood Partners was awarded $350K?

Is David Thompson part of NP and DACHA?

Who is DACHA Board, residents? If so whom is suing whom?

And lastly, under whose watch: Gerilyn or. ?

I know we can be proud of our affordable housing program but it seems to have been designed with many loopholes, scandals in past with developers signing up for several units, equity skyrocketing sp second buyer does not benefit from affordability, etc.

The problem here is the city was advising DACHA, probably gave them bad legal advice, and DACHA will be the ones to suffer the city’s malfeasance. DACHA could try and sue the city, but there are severe limitations on the ability of private citizens to sue governmental entities. Worse, it is my understanding developer Thompson misled DACHA folks as to what a housing cooperative was. DACHA was like a babe in the woods, fed to the wolves.

DPD: to me, none of this is murky or unclear.

The City Attorney’s legal memo is incorrect, and should be challenged by the CC.

I think that the City Attorney is conflicted on this, as her advice is allowing staff to participate in what may be legal violations.

When the CC voted to dontate those affordable properties to DACHA, it was supposed to be owned in perpetuity by DACHA, not the residents.

Also, the City Attorney said in late September that there was no distribution by DACHA to its members, but in early September, out of the loan that the city provided to DACHA, DACHA issued checks up to $200,000 total to the DACHA members.

I think that the CC should refer this matter to the Yolo County Grand Jury without delay.

In the opening paragraphs of this article: “help DACHA by provided a loan of $4.15 million that would allow DACHA to refinance, pay off their existing debts, and also reduce their share costs from $22,000 to $6250” It seems obvious that to reduce everyone’s share cost, those who paid more would receive refunds.

With regard to the spreadsheet charts “Only examining the fine print does one see that under the heading “Establishing Reasonable Reserves” right at the end it says: “as well as reserves for other share price stabilization.” I fail to see any “fine print” unless you define fine print as anything you skip over in haste while reading the document. The font size in the body of the spreadsheet seems to be the same, while the heading “Staff also recommends . . .” may be a slightly larger font size.

Finally, “In conclusion, there can be little doubt that the residents of DACHA received refund payments after the city loaned DACHA $4.15 million in order to refinance their loans and stabilize shares.” Again the mention of stabilizing shares. How does one stabilize shares without making the cost of each share equal? If share prices were to remain at $22,000 then no refunds, but if new shares are to cost $6250, the original share owners should receive a refund so all shares are stabilized at a set price.

There may be many issues with affordable housing in Davis, but this “refund” seems to be well enough documented as I look at what was presented here. Maybe the city should have never made the loan, maybe council members should ask more questions if they do not understand. Certainly, after voting for something, saying “it was not clear at the time” is simply politics and trying to escape responsibility.

Papa Jon: That issue came up because apparently some of the councilmembers in addition to the Twin Pines Principles did not realize what the refince entailed. There’s of course also the issue of legality.

Dear DACHA Members and City Staff: I was on the CC when DACHA was founded, and the CC turned over the first properties. Those properties were never meant to be owned individually by the occupants. All of you should drop the attempts to take those homes, pay back everything the City has improperly given DACHA members, and enjoy those nice, affordable homes that others can enjoy when the current occupants move on.

Staff: stop facilitating these efforts to take public property.

Mr. Harrington. I have no doubt David Thompson – the architect of this disaster – told you these units were never going to be individually owned. But as a former DACHA member(anonymous) we were told something different. We were told that it would start off as a coop, but that the paperwork to make it a land lease was filed. This land lease petition is public record. However, at the last minute, David Thompson abandoned the petition, and hired himself and Luke Watkins on as ‘consultants’ for $125. an hour. Mr. Thompson knew the model was not sustainable, and was looking to milk every last penny out of it and the city. Also, David Thompson never had a real estate license to do this in the first place. This was a requirement but he got way with that also. I would ask the Vanguard to look up and publish the land lease, and ask Mr. Thompson to show proof of his real estate license during this time – or anytime for that matter.

“I have no doubt David Thompson – the architect of this disaster – told you these units were never going to be individually owned. But as a former DACHA member(anonymous) we were told something different. We were told that it would start off as a coop, but that the paperwork to make it a land lease was filed. This land lease petition is public record. However, at the last minute, David Thompson abandoned the petition, and hired himself and Luke Watkins on as ‘consultants’ for $125. an hour. Mr. Thompson knew the model was not sustainable, and was looking to milk every last penny out of it and the city. Also, David Thompson never had a real estate license to do this in the first place. This was a requirement but he got way with that also. I would ask the Vanguard to look up and publish the land lease, and ask Mr. Thompson to show proof of his real estate license during this time – or anytime for that matter.”

And the plot thickens! Interesting information.