As we face yet another round of cuts to education in Davis that could result in the loss of an additional 30 to 50 teachers depending on how the math falls out and how the legislature and governor end up passing a budget. The situation with higher education is becoming increasingly dire with furloughs, cuts in classes, and massive fee increases. In a lot of ways the very fabric of California’s existence is coming apart at the seems. We have cut programs and funding to the bone but any even hint of a discussion of taxation is DOA.

As we face yet another round of cuts to education in Davis that could result in the loss of an additional 30 to 50 teachers depending on how the math falls out and how the legislature and governor end up passing a budget. The situation with higher education is becoming increasingly dire with furloughs, cuts in classes, and massive fee increases. In a lot of ways the very fabric of California’s existence is coming apart at the seems. We have cut programs and funding to the bone but any even hint of a discussion of taxation is DOA.

To give this discussion a Davis flavor, Lenny Goldberg from the California Tax Reform Association is a Davis resident. Last week he had an interesting article in the Capitol Weekly that followed the CTRA’s proposals for finding $20 billion in tax revenues that can help us balance the budget without further cuts to schools and other programs.

“The Governor’s proposals for housing tax credits and job tax credits are, alas, giveaways that he apparently believes in.

Last year’s developer credit, which only applied to new houses not yet lived in, gave preference to developers with excess inventory over homeowners trying to sell in a collapsing market. The new $200 million credit takes taxpayer dollars and temporarily pumps up a housing market which eventually has to seek a real level. Doesn’t anyone believe in market forces anymore? And, this $200 million does not have to create a single new job, nor is it likely to, by artificially delaying the settling (in economists’ terms, equilibrium) in the housing market.”

He continues:

“And, there’s a $3,000 job training credit for employers. Low-wage jobs may cost employers well over $20,000 per year; good jobs will cost, in total, $50,000 to $60,000 a year when other employment costs are figured in. In the real economy, employers hire when the new employee contributes to the bottom line, not just temporarily but permanently.

Dan Walters got it right in the Bee: if you want to enact a useless tax break, get rid of some other useless tax breaks, such as the $500 million enterprise zone program, which, through rigorous economic analysis, has been shown to create no new jobs. Better yet, use the revenue from eliminating useless tax breaks to stop real cuts in programs and jobs. Real economics, anyone?”

Economists recommend taxing “economic rents.” These are windfalls that are earned as the result of the actions of others that do not affect new investment.

“A tax on oil production, proposed once by the Governor, is the most obvious of those. Heavy, expensive California oil costs about $20 per barrel to produce, yet the world market prices reflected in California are in the range of $70. A tax of about $7 per barrel, as opposed to our current 60 cents, would have no effect on gas prices or production, according to a Rand Corporation study. In terms of economic impact, this is a free $1 billion, most of it from four multinational oil companies.

The oil industry mobilized a large astroturf campaign against a bill by Assemblyman Alberto Torrico for an oil production tax to be used for higher education, but the only economic argument they could muster was that 10-barrel/day stripper wells would be shut in early—except, of course, these have been exempt from tax in every oil tax proposal in the last 50 years! So, big oil can mount a major lobbying effort but cannot muster a single economic argument.”

He asks the paramount question that I have been grappling with for quite sometime: What is better for the economy, useless tax breaks or slashing public programs?

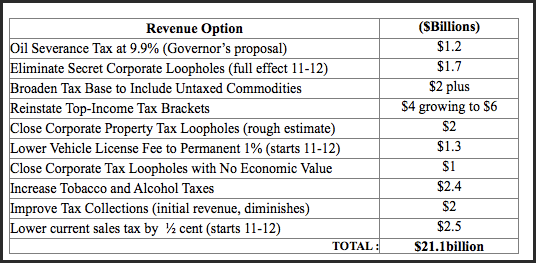

The CTRA presents a list of $20 billion of low-hanging fruit in the tax system. He suggests that the “economics of some those could, admittedly, be debatable.” So he suggests, let’s debate them. Maybe we only find $10 to $15 that we agree on. At least that is a start and we do not concede the point.

You can go to the CTRA site for the documentation:

1. Enact an Oil Severance Tax at 9.9% ($1.2 billion): California is the only state, and the only place in the world, that does not tax oil production. 9.9% is the rate proposed by Governor Schwarzenegger. Contrary to oil industry propaganda, California has the lowest tax on oil in the nation—about 60 cents/barrel—when it should be $6-$7 per barrel at current prices. This tax will have no effect on the price of gasoline or on oil production.

2. Eliminate Secret Corporate Tax Loopholes ($1.7 billion): As part of the September 2008 and February 2009 budget agreements, the Legislature passed new corporate loopholes in secret—loss carry-backs, credit sharing, and elective single-sales factor. These take effect in 2011. Contrary to the Governor’s rhetoric, it is not a “tax increase” to repeal these before they go into effect, and they are egregious new loopholes, benefiting mostly the largest corporations, that the state can ill afford.

3. Broaden Sales Tax Base to Include Untaxed Commodities ($2 billion or more): There is virtually unanimous agreement that our sales tax base is too narrow. The Governor has supported broadening it, and the first steps should include entertainment, admissions, parking, golf and skiing, hotels (i.e. the temporary rental of space) and digital products—all of which are commodities easily subject to tax. Beyond that, sales taxes on telecommunications, cable and satellite would generate $2 billion more.

4. Reinstate Top Income Tax Brackets to 11% ($4 billion now, growing to $6 billion in out-years): The top 1% of earners earn an unprecedented 25% of income in California! While that may go down a little due to the recession, the recovery of the stock market means capital gains for the wealthy are likely to recover, while ordinary incomes in a slow economy are not. State income taxes have no impact on the location of the wealthy or investment in California, and this revenue will grow faster than economic recovery.

5. Close Corporate Property Tax Loopholes ($2 billion): Statutory definitions of change of ownership are thoroughly loophole-ridden. CTRA research has been identifying numerous cases where properties have not been reassessed at market value following a change in ownership. We estimate that tightening corporate property tax loopholes would raise $2 billion. The legislature can act by statute to close this loophole, potentially by a majority vote in a two-step approach.

6. Maintain Vehicle License Fee (VLF) at 1% ($1.3 billion): The VLF is supposed to be an in-lieu property tax, but was cut from 2% to .6%. A long-term resolution of this issue would put the VLF at the Prop. 13 rate, 1%, slightly below the current 1.15 temporary rate, beginning in 11-12.

7. Close Useless Corporate Tax Loopholes ($1 billion): Enterprise zones have been demonstrated to have no impact on jobs ($500 million). Avoidance of capital gains on commercial property sales—so called like-kind exchanges—are driven by federal, not state considerations ($350 million). Placing offshore tax havens in the water’s edge stops blatant tax manipulation ($150 million). Impact on economic decisions: zero.

8. Increase Tobacco and Alcohol Taxes ($2.4 billion): Taxing products with negative impacts on society has positive effects. Enacting a tax at 10 cents/drink generates $1.4 billion, and proposals for increased tobacco taxes have been keyed at generating $1 billion as well.

9. Improve Tax Collections ($2 billion initially, less on-going): Governor Schwarzenegger vetoed majority vote legislation which would have provided an initial $2 billion in improvements in collections, including withholding on independent contractors, tightening nexus (Amazon issue), and proposing a bank records match. That amount would fall as others, above, phase up.

10. Lower current sales tax by ½ cent ($2.5 billion): The temporary1-cent sales tax increase will expire July 2011. Lowering the sales tax by ½ of that should grow to $3 billion, particularly with a broader base. This could phase down by ¼ cent/year as the state’s fiscal condition recovers.

They argue that most of these tax changes would have little to no negative economic impact.

“To the extent there is any negative impact, it will be vastly overwhelmed by the negative impact of a state unable to finance infrastructure, that allows its higher education system and schools to deteriorate, that forces cutbacks in local government, and that shreds its safety net for its poorest citizens.”

Disagree with their analysis or that this would have little impact–let’s debate and discuss it. No more phony discussions that we are the highest taxed state. No more automatically dismissing even the possibility that some of these could generate revenue without a discussion of how they would harm the economy.

What is at stake here are the rest of the programs and the future of education not just in California but in your own backyard. I think given that, it’s worth at least debating the possibility of taxation.

—David M. Greenwald reporting

we DO NOT need any new taxes. In fact, I fully intend to vote against the reinstatement of the local sales tax. The simple fact is that government services have grown too big and that the only solution is a painful process of reorganization.

The focus during this process should not be on trying to maintain the size of organizations, but on the purpose.

During budget crises it is venal the way that state agencies focus on cut-backs where they are most visible and create instant pain for the public. An easy example is State Parks. Here they “close” parks that are essentially just large tracts of publicly owned land instead of eliminating part of their vast bureaucracy in Sacramento.

Best solution is to go into Sacramento and close entire state buildings and fire everyone inside. I doubt anyone would miss them.

In Davis, how many people would honestly miss it if City Hall closed for the next six months?

Close the District office in Davis and few tears would be shed.

If we had enough elected officials with integrity, this process could have been avoided, but none of them have been able to stand up and say enough forcefully enough to trim-back government spending.

Sort of like a fat person losing weight, either they can use self-discipline, exercise and good meal choices, or they can staple their stomach… This is definitely a case for a stomach staple.

NO MORE REVENUE!

Thanks for proving the point that we can’t have an honest debate on taxes. Care to dispute his specific suggestions?

“Best solution is to go into Sacramento and close entire state buildings and fire everyone inside. I doubt anyone would miss them.”

Let’s see:

1. What would that do to the economy?

2. What would that do to government functions?

3. How much money would that actually save?

Excellent questions:

1. Depends on who you are. The hundreds of folks living on the public dole in the building would have to find real jobs, hopefully ones that are productive. Since the average cost per worker to the taxpayer exceeds $100K per year (including our long-term liabilities to their bloated pension and medical system) putting them all immediately on unemployment would result in a net savings.

2. Since the overwhelming majority of these people serve in the ridiculously unproductive role as “regulators” it would probably result in a significant improvement for the economy as a whole and make a lot of people’s lives significantly better. Most government functions are make-work so the loss of these jobs would be insignificant.

3. Quite a lot, as mentioned before, each one of these mouths to feed cost well over $100K a year. We are not talking about regular workers from the private sector- these people are EXPENSIVE! Floor after floor of them, 100 per floor, $10M a floor, $100M a building, plus the savings on all of the mindless garbage they generate as a group.

Sorry, but I deal with the circus over in Sacramento regularly and can’t count the number of meetings where 12 over-paid public employees attend a meeting where 1 would do, and watch them waste a fortune for every decision.

End the circus, send the clowns home.

“

1. Depends on who you are. The hundreds of folks living on the public dole in the building would have to find real jobs, hopefully ones that are productive. Since the average cost per worker to the taxpayer exceeds $100K per year (including our long-term liabilities to their bloated pension and medical system) putting them all immediately on unemployment would result in a net savings.”

Your figure is not even close to being true. The average state worker, average, not median, makes less than $40K per year. Where does the extra $60K come from?

The “average” state worker does not work in downtown Sacramento… The “average” worker includes caltrans guys fixing potholes, park rangers, janitors and secretaries.

The buildings in downtown Sacramento are disproportionately filled with the highest paid public employees in the state. They are the top of the curve. The lowest paid workers (secretaries) make $40K+ and don’t forget that the long-term liabilities for these boatweights start when they can retire at 55 years of age!

$100K per employee is conservative when you add in their medical, dental, retirement, training costs, vehicles (yes many get publicly provided vehicles) plus the cost of the actual physical building for each.

Dump the lot of them and sell the buildings for mini-storage.

Gunrock, your comments unfortunately show why there can’t be a real debate on taxes in California. You’re convinced, without looking at any actual numbers, that it must be easy to cut spending without cutting real services. You want to save money by firing management because who needs management; you Know Better.

Elsewhere in America, there are a lot of civil servants who are glad that they don’t work for the state of California. They see a state government poisoned by direct democracy. In California, the more that people who Know Better take matters into their own hands, the more they blame the civil service whose hands they tied. The state is drinking saltwater and getting thirstier all the time; more and more money is devoted to budget contradictions and rigid allocations. Sometimes I wonder if the entire state government will fall into federal receivership, as has already happened with the prisons. I’m really not sure that there is any other way out.

Of course the city sales tax in Davis has nothing to do with anything that you saw in any state government buildings in Sacramento. I have the feeling that the city sales tax is a good idea, but I don’t live for its renewal. If it doesn’t get renewed, I know what will happen though: The city will cut real services, its budget problems will look worse, and the critics will be as wound up as ever.

“The buildings in downtown Sacramento are disproportionately filled with the highest paid public employees in the state. “

That’s not true either. There are people who are at the top, but my wife representatives a lot of people in a lot of different Sacramento buildings and all of them make less than $40K per year.

It would be helpful as Greg suggests if you looked up some of the numbers so we could have an honest discussion rather than respond to something in a rather visceral manner.

Let me ask you this: of the proposals made by CTRA, how many of them would affect you personally and directly?

Hmmm… in answer to your question, none of the CTRA proposals would affect me personally and directly. That being said, I am opposed to any additional revenue for the state of California. Our current operating costs are too high and giving the state any additional money is as responsible as giving whiskey and carkeys to teenage boys.

Tell me that there will be actual budget cuts, meaningful wholesale reductions in the number of regulators in Sacto, vacant buildings formerly populated by SEIU employees and we can talk about responsible revenue enhancements if needed later. But that isn’t on the table. The only way we are going to take advantage of this amazing opportunity for change is to deny the beast additional revenue.

And as to the concept that I Know Better, I do know far better what is best for me than legions of overly paid public employees. I see nothing good or productive for our state coming from them. Having the state go into default would be one positive step. Perhaps people would stop loaning us money and we would have to make meaningful progress on cost reduction.

The CTRA proposals themselves look like a mixture of good ideas and wishful thinking. It sounds too simple to raise money with just an oil excise tax. I would think that there must be some catch, or some semantic trick to just make it look like the oil companies aren’t just getting a free ride — after all, who likes oil companies? But I haven’t found any such fine print yet, and maybe California is passing up $1 billion or so in revenue this way. (People have also proposed tying this revenue to higher education, and that extended suggestion isn’t credible.)

A proposal like “Eliminate Secret Corporate Tax Loopholes” sounds too good to be true. Who could ever be for “secret corporate loopholes”? If they were truly secret, CTRA wouldn’t know about them. “Loophole” is another loaded word that can be used to describe any perceived tax advantage. Unless CTRA can explain it better, this is closer to a sound bite than a serious proposal.

Maintain the vehicle license fee. This is the only suggestion in the list that addresses individual responsibility to pay for state services, instead of coloring everything corporate, secret, useless, and loopholed. I wouldn’t know what kind of vehicle license fee is low or high, but it is true that this is a relatively stable source of revenue, and one whose base can’t leave the state with the stroke of a pen. That is, yes, you can drive a car out of California, but if you do, you won’t have it in the state to use it.

Unlike taxes on capital gains. You can run into various rich people in Los Angeles and San Francisco who “reside” in Arizona, Colorado, etc. Some of them even have the gall to lecture California voters, while they happen to be “visiting”, that taxes “drove” them out of the state. It’s frustrating, but it happens, and it is one reason that California would ideally rely less on capital gains and more on other taxes.

Property taxes also tax an entity that can’t leave the state with the stroke of a pen. John McCain may be an Arizona resident, but some of his houses stay put in California. But the elephant in the room is Proposition 13, which not only limits taxes on this stable base, but also dictates that anyone who opposes a tax in general is twice as correct as anyone who favors it. This grand stroke of direct democracy ironically undermines democracy. In light of Prop 13, I’m wondering how much CTRA’s suggestions matter.

On the positive side, George Lakoff is circulating an interesting proposition to get rid of the democracy-sapping supermajorities created by other state propositions. If it gets on the ballot, then for sure I will vote for it. (And it might fail, but at least it won’t need a 2/3 majority.)

[i]And as to the concept that I Know Better, I do know far better what is best for me than legions of overly paid public employees.[/i]

I know better what is best for you too, even though you use a pseudonym and I don’t know you. What is best for you is if you get full public services, including roads, prisons, hospitals, and schools, without paying any taxes. As for blaming some vague group of useless government bureaucrats, at least it’s a step up from blaming the Jews. (Sort of. In the Middle Ages, many European countries told the Jews that they had to be the tax collectors.)

the jews? seriously Greg… lets take a deep breath and calm ourselves.

I am not opposed to taxes per se. I am opposed to the runaway growth in the public regulatory bureaucracy in California. This is exacerbated by the parallel growth in the cost per bureaucrat through ridiculous retirement perks, health benefits that exceed what the general public receives etc.

Lets not be vague, http://www.workerscompensation.com/compnewsnetwork/news/employercostscomp.html will give you an idea of the disparity between what someone with a real job and a public employee costs. In short, the difference is $27.49 on average in the private sector and $39.83 state and local workers… This comes from one source, democrats who suck-up to the public employee unions for votes.

For every dollar spent in taxes, it is often argued that this takes $1.50 of growth out of the economy.

We are not talking about fundamental services, we are talking about the enormous growth in the regulatory machine in Sacramento.

Cal EPA (as one example) could be closed tomorrow and the economy and environment wouldn’t miss a soul there. The PUC and the entirety of Caltrans HQ could go as well. Mostly a haven for people carry coffee cups from meeting to meeting waiting to retire.

The solution is to make public employee unions illegal and allow managers to fire the folks we don’t need anymore and bring retirement plans into line.

You may not like this, but sanity might prevail and the public employees could go back to working for the public rather than themselves.

[i]Lets not be vague, http://www.workerscompensation…scomp.html will give you an idea of the disparity between what someone with a real job and a public employee costs.[/i]

That comparison is a bait and switch. You were saying that you’re not against the salt-of-the-earth public employees like Caltrans guys fixing potholes, janitors, etc. But they are the ones who are making more money than in the private sector and with much better benefits. They’re the ones in the big unions. Voters don’t have the heart to tell janitors who make $11 an hour with benefits that they should make minimum wage with no benefits.

The civil servants who you say waste your time in meetings aren’t unionized. They make a lot less than their counterparts in the private sector, who are generally consultants and business partners who aren’t included in your wage comparison. In fact, as Rich Rifkin explained, many of these private-sector consultants retired from public service and now land contracts with their old employers. They don’t even need you to ask that they be fired; they’re ready to quit. Your ideology of sacking the civil service leads to a downward spiral of expensive consulting contracts. This is one reason that the Iraq War will cost a trillion dollars by the end (not just a turn of phrase, an actual $1,000,000,000,000). Ordinary Army bureaucracy was replaced by contracts to firms run by Army veterans.

[i]Cal EPA (as one example) could be closed tomorrow and the economy and environment wouldn’t miss a soul there.[/i]

Yeah I know, the environment is a Democrat; it runs to the government for protection.

[i]The solution is to make public employee unions illegal and allow managers to fire the folks we don’t need anymore and bring retirement plans into line.[/i]

Here there is some truth to what you say. What you may not realize is that the purge would begin with the prison guards’ union, not Cal EPA. You have this vision of buildings full of well-paid, highly unionized employees who bleed the economy. California’s prisons fit your argument more than any of your examples. Is the plan to close some of them down and sell the buildings? I’m all for it, but are you?

whew! Okay, lets be clear, I don’t think any public employees are “salt of the earth.” I think that we would agree that the prison guard lobby are certainly the most successful, and perhaps per-capita, the most over-paid group in CA. I would shut-down half the prisons and simply declare that incarcerating people over victimless crimes (like marijuana) is simply penalizing society while acting as a means to increase profits for the surviving drug sellers.

True statement about the revolving door- but simply closing some of these organizations actually would obviate the need for many of these services. It is a rare activity in Sacto that is actually essential. Just take the legislature’s accumulated years of regulations and deem them “advisory” and send the jokers home.

Iraq is good example of mission creep. Same problem we have in CA- simple mission made complex by bureaucrats. Winning is simple, governing nearly impossible. Get rid of the good-old boy system and put it out to the lowest bidder- I am pretty sure we could get a legion from Somlia to whack Iraqi heads together for 1/10 of what we are paying now and we could go home.

CalEPA has very very little to do with protecting the environment, I won’t bore you with the sordid details, but will simply leave it that the whole building could vanish and mother earth would breathe a sigh of relief. I doubt I could convince you of this, but my opinion after dealing with them for many years (as an active environmentalist) is that it’s directives have done more harm to the state than almost any other agency.

But back on point- I would love to see an actual debate on tax policy, but the first step should be exactly how much do we really need to raise?

[i]I would shut-down half the prisons and simply declare that incarcerating people over victimless crimes (like marijuana) is simply penalizing society while acting as a means to increase profits for the surviving drug sellers.[/i]

Here is a good example of where I thought we could find common ground, until you get to the point of “simply” do this and “simply” do that. You have the idea that it’s all simple, that there must be a solution that would hardly make anyone unhappy, least of all you. It’s not that simple.

Rest assured that the vast majority of California’s prisoners are in there for actual crimes that have victims. Almost no one, I’m sure less than 1%, is in state prison for marijuana. When drugs are involved, it’s usually hard drugs, and it’s very often a drug enhancement of robbery or assault. A big fraction of the prisoners are lifers who killed somebody. The reason that California’s prisons are full is not victimless crimes. It’s because of a habit, propelled by three strikes laws, other mandatory sentencing, elected judges, and Polly Klaas type stories, of tossing off 10 or 20 years or even life in prison as if it’s nothing. Canada does much less of this, and partly for that reason doesn’t spend more than a tiny fraction of what California spends on prisons.

Rest assured that if they let out a lot of prisoners, a few of them would commit crimes and there would be some painful scandals. Or rather, when, because the federal receiver is forcing them to do it.

[i]Get rid of the good-old boy system and put it out to the lowest bidder[/i]

But if you want to sack the bureaucrats, who is supposed to put projects out to bid? The state already issues a lot of contracts, and of course it needs people to take the bids and monitor the work. If you’re not satisfied with that, then the only place left to go is to outsource the whole show, contract out the agencies that issue the contracts, and basically outsource public responsibility. That’s a dangerous step, and certainly not one that saves money.

[i]CalEPA has very very little to do with protecting the environment[/i]

Which is it, that the wrong people are charged with protecting the environment, or that the environment doesn’t need protection?