Overall one has to say the news could have been far worse when the Pew Center on the State puts California’s state retirement system into the “needs improvement” category as opposed to the lower category of “serious concerns.” Moreover, the study show the impact on the public pension system due to the collapse of the financial markets, however it does not include the rebound that occurred at least on Wall Street after mid-2009.

Overall one has to say the news could have been far worse when the Pew Center on the State puts California’s state retirement system into the “needs improvement” category as opposed to the lower category of “serious concerns.” Moreover, the study show the impact on the public pension system due to the collapse of the financial markets, however it does not include the rebound that occurred at least on Wall Street after mid-2009.

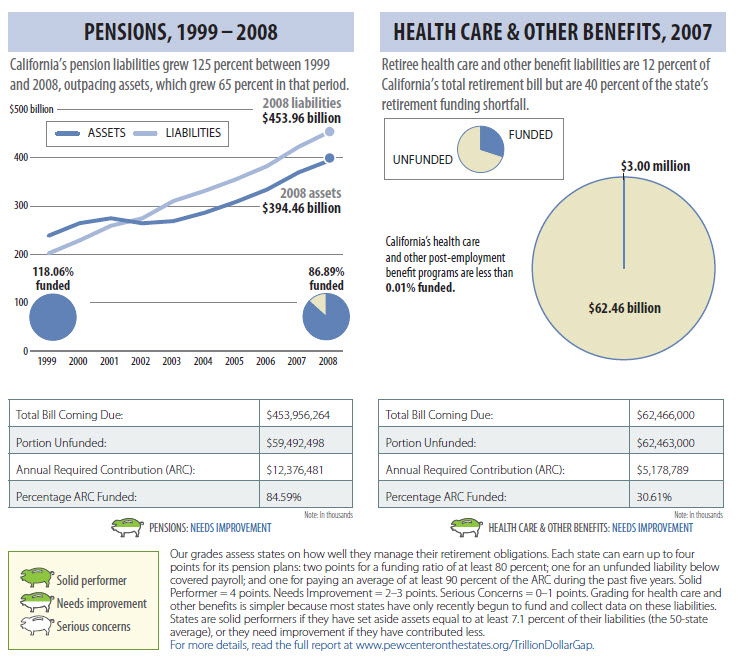

Overall the numbers look like this: California’s state retirement systems have promised current and retired workers around $3.35 trillion in pension, health care, and other post-employment befits as of 2008 but have $2.35 trillion on hand to pay for them. Strictly looking at the retirement system, there were $454 billion in pension and benefits on the book in 2008, $59 billion was unfunded liability, that means that the fund had the assets to cover 87 percent of its obligations.

In aggregate, states’ systems were 84 percent funded–a relatively positive outcome, because most experts advise at least an 80 percent funding level. Still, the unfunded portion–almost $452 billion–is substantial, and states’ overall performance was down slightly from an 85 percent combined funding level, against a $2.3 trillion total liability, in fiscal year 2006. These pension bills come due over time, with the current liability representing benefits that will be paid out to both current and future retirees. Liabilities will continue to grow and, as more workers approach retirement, the consequences of delayed funding will become more pronounced.

However, that seems to understate the nature of the problem. First, the state is trending in the wrong way. Between 1997 and 2001, the state was able to consistently meet its actuarially required pension contributions. However, following 2002, it has not been able to make this payment in full. From 1999 to 2008, the state’s pension liabilities grew 125 percent which greatly outpaced assets which only grew at 65 percent. During that time, the pension fund went from 118% funded to 87% funded.

The even more alarming trend, and the one that we are facing in Davis is the unfunded liability in retirement health. Retiree health care and other benefits represent only 12 percent of California’s total retirement bill but they are 40 percent of the state’s retirement funding shortfall.

Writes the report:

“The state has set aside only $3 million to cover the $62 billion, long-term liability for retiree health care and other benefits. In the face of California’s fiscal crisis, addressing this bill coming due will be a daunting challenge.”

Thus the health care and other post-employment benefit programs are less than 0.01% funded.

Most of the current reform efforts seek to cap benefits, while that may be one approach it may not be the best approach. More importantly what needs to happen is a higher percentage of the obligation needs to be pre-funded, that’s really what this research is showing, particularly on the health side, but also on the pension side.

The idea of an unfunded liability is that we simply have not put enough money in up front to pay our obligations. CalPERS is gambling on a rate-smoothing plan over 30 years to lower the hit, but if we simply fund these upfront, we do not need to roll the proverbial dice in this matter.

Naturally there has been much talk about going to a two-tiered system, but there are perils in that system, particularly since you have unequal benefits for newer employees. That simply is an arrangement that is unsustainable over time and over collective bargaining agreements.

The simpler solution is for mechanisms be put into place to require full-funding for all pensions and benefits. This will not by itself solve the problem, but much as the GASB-45 requirements, it will reveal the actual liabilities. There is an initial cost associated with fully funding retirement. So the city of Davis will have to pay somewhere around $4.5 million a year over thirty years to eliminate the unfunded retirement health liability.

However, the advantage of such a system is then it becomes part of the collective bargaining process. The city can then play that liability off future salaries and benefits.

Much the same way is the decision to fully fund pensions. A government entity can continue to pay the employees’ share of the costs, but if the overall benefit cost goes up, that gets offset against future salary gains. The employees through the bargaining process then get to choose between higher salaries or paying more into their pensions. Either way, the unfunded liability decreases and the threat to the system declines.

Now from my perspective that at least covers the problems with the standard retirement pensions, 3% at 50 is another beast altogether and it should be noted that liabilities began outpacing assets at the very time most cities and governmental jurisdictions moved towards the public safety enhanced benefits of 3% at 50. That along with skyrocketing salaries is threatening the entire system, and certainly at the local level.

That is going to require some more work to undo.

—David M. Greenwald reporting

easy solution is just figure out amount we actually can afford and inform the people in the system that that proportionally, that is what they will get.

If any of them don’t like it, they should get real jobs.

Rate smoothing isn’t necessarily “gambling”. It is tempting to reduce questions of money to “yes we gamble” or “no we don’t gamble”, but the real world is not that simple. Any kind of financial planning involves risk. Even if CalPERS robbed cities of all of their payroll as fast as it possibly could, it would be gambling away their current budgets in favor of a future that might never come. In sober financial planning, everyone knows that less risk is better than more risk, but it’s very difficult to tell when you have minimized risk. The picture is complicated, but the fact is that CalPERS has a better credit rating than many other California institutions.

Sue Greenwald pointed out to me that Moody’s downgraded CalPERS. But Fitch and S&P did not downgrade CalPERS, and even if you took the worst of the three ratings as the truth, ten state GO bonds ([url]http://www.treasurer.ca.gov/ratings/current.asp[/url]) have the same rating and three states have a worse rating. It makes sense for CalPERS to sternly warn Californians of dark clouds, but just because there are some dark clouds, it does not mean the sky is falling. If CalPERS launched a nuclear strike against the dark clouds, then maybe the sky really would fall.

In any case, Davis should play its own hand, not CalPERS’ hand. CalPERS provides certain services at certain prices. We should decide our budgets based on that and not on what we would do if we were CalPERS.

In other news, I’ll throw in one off-topic remark that I think is much worth mentioning. If you didn’t go to Joe Krovoza’s campaign launch on Friday night, you missed a great party. Three members of the city council were there, and so was the entire Davis school board. So were Lois Wolk and Mariko Yamada. I met Stephen Souza, I talked to Don Saylor, and I also finally met Sue Greenwald in person.

I also met Sydney Vergis earlier yesterday, and I have to say that she made a good impression on me.

On Health Care costs:

Medicare advantage insurance plans raised their premiums 14.2% this year. Blue Cross Anthem plans to raise their premiums by 39% this year. The only health care benefit plan that can keep pace with these types of increases is a “you’re on your own, not our problem” plan. At this rate the pension costs will be nothing compared to current employee and retiree medical costs.

I am a state worker and our medical insurance for a family of 3 is $1,300/month for a basic HMO policy. I have been offered better paying jobs in the private sector, but without medical insurance coverage or limited coverage. I could afford to purchase a policy on my own, but given the propensity of insurance companies to exclude anything remotely related to a pre-existing condition, to cancel policies as soon a expensive illness hits, and to just refuse payment if all else fails, I cannot take the chance. I know this is also the case with several of my co-workers. We are in the “will work for health insurance” pool.

Until there is serious comprehensive health care reform in this country, this will only get worse. I workable reform would be:

1) Require everyone to purchase medical insurance

2) Specify what the most basic policy must cover (preventive, catastrophic, chronic illnesses)

3) Require all plans to cover all pre-existing conditions

4) For the indigent, the govt will pay the premium on a sliding scale

5) Specify out of pocket annual and life time co-payment limits

6) Forbid cancellation of policy unless premiums have not been paid for 90 days. Policy would remain in effect during that period.

7) Peg premium increases to the rate of inflation.

8) For those who could but refuse to purchase a policy, enforce a fine.

10) Roll all current Medicare and Medicaid recipients into this program with the govt paying the premiums.

I do not expect any of this to happen in the current political climate.

Greg,

I think I have mentioned this before, but the problem with the current “rate-smoothing” is that it is really a second-order rate smoothing. CALPERS already employs “rate-smoothing”, i.e., they allow a wide range above and below full funding in order to account for business cycles.

At this point, CALPERS funding has gone well below that range, and the actuaries have calculated that it is statistically improbable that CALPERS will make up the shortfall during coming up-cycles. At this point, sound actuarial practice would advise that we start paying substantially more into the fund.

But to do so would be painful and politically unpopular, hence the new rate-smoothing methodology, which in effect dramatically increases our unfunded liability, is being employed.

We already have a hefty CALPERS unfunded liability. I have asked Paul Navazio if he would give us an update on our pension unfunded liability, and to give us some estimates on how the rate-smoothing is effecting our unfunded liability. He said he was already working on it.

Our unfunded retiree medical insurance liability is enormous, but there was a logical fix. Unlike the school district and most other agencies, we have an unusual health benefit that is both extraordinarily expensive and unfair among employees, and that is our $17,800 “cafeteria cash-out” provision. It allows an employee who has an insured spouse to take home an extra $17,800 cash every year over and above salary (very slightly more or less depending on bargaining group). A single person could take home in cash the difference between the cost of a single persons’ health insurance and the family plan, and a couple without children could take home the difference between a 2 person plan and a family plan.

I had been advocating cutting this cash-out by 75%. I estimate that that could save us between $2 and $3 million dollars a year. I suggested using the savings to pay off our unfunded retiree health liability.

This would benefit employees as well as the city, since retiree health insurance does not have the same legal protection as do pension payments.

It is easy when you are young to ignore the realities of retirement. But our city PERS pensions are not really inflation adjusted (only 2% a year) and medicare alone covers only part of the costs if a senior has serious health conditions.

The “controlled inflation”, which is probably the rosy scenario for paying off our country’s large deficits, will leave PERS retirees with decimated pensions. Retiree health insurance to bridge the huge medicare insurance gap could make all the difference between a secure old age and medical bankruptcy.

But we are fortunate; we have the ability to turn an atypical, expensive and unfair benefit provision into a funding source to put our retiree health care back on sound financial ground.

My failure to get majority support for doing so during our recent labor negotiations has been the source of great frustration for me.

[i]I think I have mentioned this before, but the problem with the current “rate-smoothing” is that it is really a second-order rate smoothing. CALPERS already employs “rate-smoothing”, i.e., they allow a wide range above and below full funding in order to account for business cycles.[/i]

You’re absolutely right that CalPERS already uses forms of rate smoothing. That is one of the basic function of any pension plan, to protect its clients from the wild ride of the stock market. So it is not true that rate smoothing is the sin of gambling; the only question is how much or what kind of smoothing is appropriate for CalPERS’ obligations. In fact, the main part of the current rate smoothing policy was adopted in 2005, at a time when it dampened good news instead of easing bad news. The change adopted in 2009 only spread things out by an extra three years.

It is certainly not true that actuaries as a group have rejected CalPERS’ new rate smoothing formula. You can always find an actuary to support any viewpoint, just like you can always find a blogger to support any viewpoint. But the fact is that everything that CalPERS does is written by professional actuaries.

I totally agree that the city should try to save money with its benefits plans. I have no inclination to argue anything for employees on the basis of abstract fairness. But as I said, the city shouldn’t play billiards with a sledgehammer when it comes to labor negotiations. In particular, CalPERS shouldn’t be that sledgehammer. No competent actuary in charge of CalPERS would want that.

Greg K.,

The Pew report is still on my yet to read list, but I did notice the following statement on the chart:

[quote]Data is fiscal

year 2008[/quote]

and:

[quote]Grade is based on whether a pension is at least 80 percent funded, whether it has an unfunded liability that is less than covered payroll, and whether 90 percent of the required contribution has been made during the past five years, on average.[/quote]

CalPERS funding ratio was down to 61% as of June 30, 2009. I am wondering if we are seeing a lag, particularly in view of the “rate smoothing” as it relates to a 5 year rolling average.

[i]My failure to get majority support for doing so during our recent labor negotiations has been the source of great frustration for me.[/i]

I can say something about meeting Sue Greenwald. There I was at Joe’s party. Since the city council has been on television, I recognized everyone immediately, but Sue didn’t recognize me. Yes, there has been a lot of contention lately on and around the city council. And I have been less than gentle in my own comments on the matter. So I was thinking whether I should go up and say hello. The decision was obvious. Of course I should; it would only be fair and it would also be good for me. It was perfectly nice talking to Sue. In fact, she knows some of the Berkeley math faculty who I talked to in grad school and afterwards.

But yes, Sue, I can see that you are greatly frustrated in dealing with the city council. As I said, I also met Don Saylor (for the second time) and Stephen Souza (for the first time). Although I didn’t ask them directly, my impression is that they are also mightily frustrated. If so, I can’t really blame them.

Again, I totally agree that the city should try to save money in its benefits packages. But ultimately, other members of the city council are other players on your team, while (at least during contract negotiations) the city’s unions are on the other side. If you can’t even persuade your teammates to give you the ball, are you really prepared to run through the opposing team?

Personal opinion is that Sue is correct about concept of reducing “cash-out” provisions, & using savings to pay down the retiree medical liability. However, strategically, it would need to be a “weaning”, not a decapitation. Had it been proposed as a 5-10% reduction per year until it reached a max. of $500/mo. (as was negotiated for new hires) perhaps it would have passed muster. As it was, major reductions in one year, on top of furloughs, wasn’t in the cards.

According to my last conversation with staff, the new rate-smoothing formula spreads the loss over 30 years. I can double-check that and get back to you.

According to my last conversation with staff, the new rate-smoothing formula spreads the loss over 30 years. I can double-check that and get back to you.

Here’s a link to the PDF file of the recent Pew Center report:

[url]http://www.pionline.com/assets/docs/CO68648218.PDF[/url]

Here it is, Greg. I found the rate-smoothing memo from CalPERS:[quote]Isolate the asset loss outside of the 80% – 120% corridor and pay for it with a disciplined fixed and certain 30 year amortization schedule. It is prudent for 2008-2009 Fiscal Year investment losses to be subject to a more stringent funding schedule and that they should be paid for in full at the end of the 30 years. In this way we will not rely on future investment returns to pay for 2008-2009 investment losses[/quote]

I think I should summarize my point rather than leave it to inference.

The PEW report could be based on old information. The 30 year rate smoothing of the FY 2008/2009 losses signals that CALPERS is not intending to bring the funding ratio within traditionally acceptable bounds, but it going to defer these payments. Remember the PEW report criteria I copied above: “Grade is based on whether a pension is at least 80 percent funded, whether it has an unfunded liability that is less than covered payroll, and whether 90 percent of the required contribution has been made during the past five years, on average.”

CALPERS high credit rating from S&P in January 2007 was based on the following, according to S&P:

“The System’s high funded ratio, which is the actuarial value of assets divided by the actuarial accrued liability — now approximately 90 percent.S&P’s Ratings Services said that CalPERS has a long history of receiving at least 100 percent of its annual required contributions from employers.”

http://www.calpers.ca.gov/index.jsp?bc=/about/press/pr-2007/jan/sp-rating.xml

It appears that neither the PEW report criteria or the S&P criteria for high credit rating would hold today.

OK… Lamar is not seeking office again… Ruth hasn’t given her intentions… Don is running for supervisor, and in my opinion, is likely to get elected, and will be off the Council next January. Why not recall the other two, get a clean slate in June, and give the Davis voters a new start? Let the current Council indicate that the next highest vote-getter will fill Don’s seat if he goes to the Board of Supervisors.

Sue: [i]I found the rate-smoothing memo from CalPERS[/i]

Yes, I understand that one of the two smoothing windows for CalPERS is 30 years. Page 2 has a clear explanation of the whole policy ([url]http://www.calpers.ca.gov/eip-docs/about/board-cal-agenda/agendas/full/200906/item14.pdf[/url]). It says:

1) Investment gains and losses are smoothed over 15 years within a +-20% wide “corridor”. Outside of this corridor, gains and losses aren’t smoothed.

2) Payments are smoothed over 30 years.

This is what they adopted in 2005. I had thought that they added a new rule with 3 years extra smoothing of some kind, but they actually did something else. In response to the stock market crash last year, they worked out a 3-year partial exception which will fully sunset as of June 30, 2011.

The fact remains that they understand their own bad news and they are raising their rates. The city of Davis shouldn’t write a second prescription of benefits chemotherapy, when CalPERS is already administering its own prescription. We should bargain for benefits concessions, but it would be seen as bad faith if we used CalPERS as a panic button.

[i]It appears that neither the PEW report criteria or the S&P criteria for high credit rating would hold today.[/i]

Again, the Moody’s new credit rating for CalPERS is not all that terrible. Without that rating, CalPERS actually sold its credit reputation to other municipal borrowers (by backing their loans). Even now, they can still do that, just with reduced fees.

hpierce: [i]Why not recall the other two[/i]

Because a recall would fail, that’s why. It is true that many voters were angry when Sue flew off the handle, but she wisely apologized. Stephen Souza has a solid reputation and a recall vote for him would be a complete non sequitur.

Greg,

Without the new rate-smoothing formula, we were due for a large rate hike — I think it was in the range of 4% to 6%. But the new smoothing formula spread out these FY 08/09 losses over 30 years. We went into FY 08/09 a substantial unfunded PERS liability, and the additional rate-smoothing is increasing that unfunded liability. Paul Navazio is working on getting us the updated, larger unfunded pension liability figures, and we should have that report soon.

Again, I don’t know whether the PEW report has taken the new rate-smoothing policy into account, and I don’t know how much this would effect the criteria used by PEW if it has not been taken into account, so I was throwing it out for consideration.

You say: “In any case, Davis should play its own hand, not CalPERS’ hand. CalPERS provides certain services at certain prices. We should decide our budgets based on that and not on what we would do if we were CalPERS.”

Actually, we are responsible for our own unfunded liabilities. I hope your general optimism is warranted. It doesn’t seem to be shared by the PERS chief actuary, but only time will tell.

[i]Actually, we are responsible for our own unfunded liabilities.[/i]

I know full well that the city is responsible for [b]paying[/b] its share of the unfunded liabilities of CalPERS. The city is not responsible for the [b]policy[/b] of these liabilities. CalPERS will decide what to charge the city, and the discussion should end with a good estimate of what that will be. Unfunded liabilities for all compensation issued through today are a sunk cost. It makes no more sense to be afraid of them than to be afraid of last year’s train derailment.

[i]I don’t know whether the PEW report has taken the new rate-smoothing policy into account[/i]

Moody’s has taken everything into account. Yes, the drop in CalPERS’ credit rating is unfortunate news, but a credit rating of Aa3 is not Doomsday.

[i]I hope your general optimism is warranted.[/i]

That is a misinterpretation of everything that I’ve been saying. I don’t have any general optimism. If I want the city council to stay calm, I mean calm like Abraham Lincoln, I do not mean calm like Pollyanna. Ultimately high emotions are going to cost the city money.

As I was telling Don Shor, I don’t trust a rail engineer who spends too much time talking about train wrecks. He is liable to cause what he aims to prevent.

[quote]Unfunded liabilities for all compensation issued through today are a sunk cost. It makes no more sense to be afraid of them than to be afraid of last year’s train derailment.[/quote]We will have to pay for our unfunded liabilities, and it makes all the sense in the world to adjust our spending in order to start paying them off in a timely fashion.

[quote]If I want the city council to stay calm, I mean calm like Abraham Lincoln, I do not mean calm like Pollyanna. Ultimately high emotions are going to cost the city money.[/quote]Everyone was calm while Wall Street’s soothing words led us to disaster. Whether high emotions cost or save the city money certainly remains to be seen.

[i]We will have to pay for our unfunded liabilities, and it makes all the sense in the world to adjust our spending in order to start paying them off in a timely fashion.[/i]

I totally agree with this statement. The city government will have to adjust the amount of service that it pays for, in the face of liabilities that CalPERS will make us pay sooner or later. That’s certainly true, but you, Lamar, and David have sometimes cast the issue rather differently. Instead of asking the city to adjust its spending because of CalPERS, you want city workers to adjust their personal spending. CalPERS has already ramped up what it charges the city, but the way that David and Lamar described it is that the city wasted its sales tax on compensation.

Yes, we have to live within our means. Yes, we should save what we can in negotiations with city workers. No, they don’t have to live within our means to let us off the hook. They have real bargaining power and CalPERS will inevitably be a drain on both sides.

To your credit, your own position is more consistent because you want to renew the sales tax. I would expect city staff to be particularly disgusted by people who warn of a train wreck one day and grease the tracks the next day.

[i]Everyone was calm while Wall Street’s soothing words led us to disaster.[/i]

Actually, there were never any “soothing” words from Wall Street. Wall Street used a lot of exciting words to promise big profits and cheap mortgages. When the crisis hit, Obama stayed calm while McCain chose to parachute into Washington to supposedly save the nation. McCain also shot from the hip when he picked his VP, and she herself is prone to fly off the handle. Obama admires Lincoln, and they are both leaders who stay calm in the face of adversity.

Greg,

I agree with you; I’ve always kept my eye on trying to align spending with revenues and have been assertive in trying to cut expenditures that do not seem worthwhile or to phase them in when they are necessary but too expensive. I’ve supported every city tax. I have not focused only on cutting employee compensation expenditures.

I’ve tried to take a balanced approach to aligning spending with revenues. I care about the welfare of all public employees (of course, coming from a public employee family), and I care about future generations of public employees as well.

I just see things a little differently than you do — I really do think that some of the benefits that have been conferred on city and county workers throughout the country have exceeded those of employees of other public agencies, and have crossed over boundaries of sustainability. By demanding these benefits, I think that these employees are jeopardizing their own future benefits and bringing in a two-tiered system that will rob coming generations of employees of high-quality benefits.

In terms of style, good political leaders have come in both calm and

emotive flavors.

[i]I really do think that some of the benefits that have been conferred on city and county workers throughout the country have exceeded those of employees of other public agencies[/i]

It is true that unionized public employee compensation in California is among the highest in the nation. That isn’t particularly a good thing, and it does mean that the city should try to save money in this area. But you can only gain so much this way, unless you want Davis to be the last in line among California cities to hire people. (“Work for Davis! We pay less than other city governments! We’re sustainable!”)

It is also much harder to rip compensation out of the hands of workers than to not promise it in the first place. You keep arguing that a cut in benefits for future employees is unacceptably unfair, even though that exactly addresses long-term sustainability. The fact is that the city will only save less money if it adds fairness to its list of demands. The city should take what it can get and let the bargaining units sort out fairness for themselves.

In fact, if the bargaining units have their own opinion of what is fair or unfair, it’s not our business to contradict them. Some people do in fact think that a cafeteria cashout is fair. If bargaining units prefer a cashout to the equivalent in salary, why should the city quarrel with that? Again, it can only be more expensive for the city to dictate the exact form of employee benefits; it should instead find the best mutually acceptable deal.

[i]I think that these employees are jeopardizing their own future benefits[/i]

City employees can only take a comment like this as a threat to walk away from committed benefits. This is [b]not[/b] the way to negotiate the best labor contract. If workers can’t trust the city’s promises, they will demand more.

It also doesn’t help to lecture city staff that you don’t trust their reports. Trust is a two-way street. If we don’t trust their work, why should they trust the compensation.

First, I don’t think the compensation is exclusively market-driven. Most of the jobs are generalist in nature and have a large number applicants per position. We don’t compete with or draw from cities exclusively — there is movement between other public agencies and to and from the private sector.

For particularly valuable employees, we have other retention options, such as promotion to higher positions. For areas where we are genuinely off-market — as in can’t find enough qualified applicants — we can reclassify the position.

And if you really believe that compensation is market-driven, wouldn’t a two-tiered approach with lower benefits for new workers be the last thing you would want?

[quote]I think that these employees are jeopardizing their own future benefits

City employees can only take a comment like this as a threat to walk away from committed benefits. This is not the way to negotiate the best labor contract. If workers can’t trust the city’s promises, they will demand more.

[/quote] This one I really don’t get. I am genuinely afraid that our own pension and health benefits will not be there for us because our system is unsustainable. Retiree health benefits are being stripped away in financially stressed California cities as we write. I just don’t understand your interpretation.

[i]I don’t think the compensation is exclusively market-driven.[/i]

It certainly isn’t exclusively market-driven. It’s also driven by labor laws, in particular collective bargaining. Even when there is no collective bargaining, economists have noted certain special features of how people want to be paid. They tend to want job security and income security, instead of cash up front at the market rate.

But what is true is that outside of a certain range, the market creates a wage floor. Below that floor, you won’t get very many competent people; you’d have to settle for the last people left in the job market.

[i]For areas where we are genuinely off-market — as in can’t find enough qualified applicants — we can reclassify the position.[/i]

That’s a brilliant gimmick that any good bureaucrat can appreciate. However, it doesn’t save the city any money.

[i]And if you really believe that compensation is market-driven, wouldn’t a two-tiered approach with lower benefits for new workers be the last thing you would want?[/i]

Yes, if I could set wages all by myself with no collective bargaining, I wouldn’t want it. But if it happens to be the best deal that you can make with a union, you’ll only lose money by tossing it aside.

[i]I am genuinely afraid that our own pension and health benefits will not be there for us because our system is unsustainable.[/i]

Sure, and I’m afraid of car theft. If I warn you over and over again that your car MIGHT GET STOLEN if you don’t buy my insurance, what does that sound like?

If you vehemently warn city workers that one of the wealthiest, quietest cities in the state could default on health care benefits, then most likely they won’t take it seriously. But if they did take it seriously, they would probably take it as a very greedy warning.

Several years ago the state had a two tier retirement system. Those who came in later under the less generous benefit plan knew this and accepted it as the nature of the beast. There were no hard feelings, or anybody saying that because they had less generous benefits they should not have to work as hard or anything of that nature. Anyone hired at any number of large corporations such as IBM, etc.. will not have as generous as a package as someone hired 10-20 yrs ago. Life is not always fair, shit happens, get over it. As long as the city is up front with hires on what benefits they will and will not get, I honestly think no-one would have a problem with it. I also think the city should look seriously at getting away from a defined benefit plan and go the route of a matching 401K, 403B or something that will be sustainable.

[quote]If you vehemently warn city workers that one of the wealthiest, quietest cities in the state could default on health care benefits, then most likely they won’t take it seriously.[/quote]Well they should, because it isn’t an issue of “default”. It appears that retiree benefits can be reduced at will, and we are talking about decisions that will be made many, many councils into the future. We are in fact much more likely to remain insured if our retiree health insurance is fully funded.

[i]Well they should, because it isn’t an issue of “default”. It appears that retiree benefits can be reduced at will, and we are talking about decisions that will be made many, many councils into the future.[/i]

Fine then. It’s not in the fashion that I described, but you are warning them that the city might not keep its promises. You should consider all sides of your message to city employees:

1) They’re overpaid.

2) Their benefits will be a train wreck.

3) You don’t trust their reports.

4) They withhold information from you.

5) They shouldn’t trust their benefits.

6) If they want to buy a house here, your other fight is against developers.

I have never once talked to a city employee about city politics. But if I put myself in their shoes, what is supposed to be the upside? It seems like you’ve done everything you can to make them less productive and to undermine negotiations with them. You say that you care about them, but how are they supposed to believe you?

For me this is not about “caring about” city workers in the sense of codependence. I would rather not base my thinking on their personal affairs. Rather, the issue is keeping peace with people who work for you.

Okay, I have an important clarification here. The PEW report looks at the funding levels as of June 30, 2008, so it does NOT include the huge losses which occurred after June 30. The PEW report definitely understates CALPERS problems, according to their own criteria.

if the contract obligation gets changed for existing retirees and vested members, get ready to fully refund ALL of the military and civillian air time investments. And that would also apply to any ballot measures that change contract obligations.