Coming Months Will Be Telling As to Whether Reform is Real or Illusory –

Coming Months Will Be Telling As to Whether Reform is Real or Illusory –

The council may not have hit a home run, but it was a solid double that was a marked improvement over the series of foul balls and swing-and-misses that we had seen in the previous council.

As Mayor Pro Tem Rochelle Swanson put it, “We absolutely know in hard dollars where we’re at.”

Where we are at is in a world of hurt. As Councilmember Sue Greenwald told the council, “Starting two and a half years from now, when the permanent increases start to kick in, how much more per year in absolute dollars will we have to pay out in pensions and retiree health over what we pay today, assuming a one-half percent decrease in the return rate assumptions?”

The answer is scary.

“We will be paying $7 million more than we’re paying today,” Councilmember Greenwald said.

“That’s every year, pretty much forever, that we’ll have to readjust our budget pie,” she said. “This is huge and you can just see that in the 53% in four years, in the absolute value of our benefits.”

We saw that acknowledgment in part because Interim City Manager Paul Navazio finally brought in realistic assumptions. His previous projections were all based on the continuation of the 7.75 annual rate of returns (ARR).

An annual revision down to a more realistic 7.25% ARR means that the city’s costs increase to $7 million.

As Mayor Joe Krovoza pointed out, even that may not be realistic enough. He said that we might even be going below 6.25% and there are those who argue that in the 4s or 5s is more realistic.

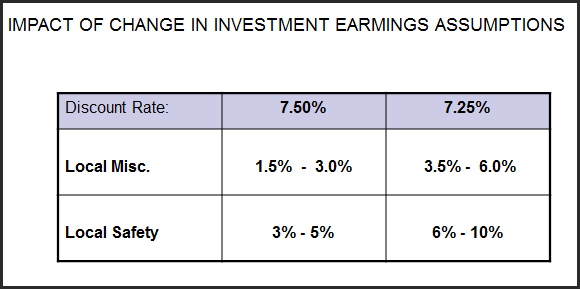

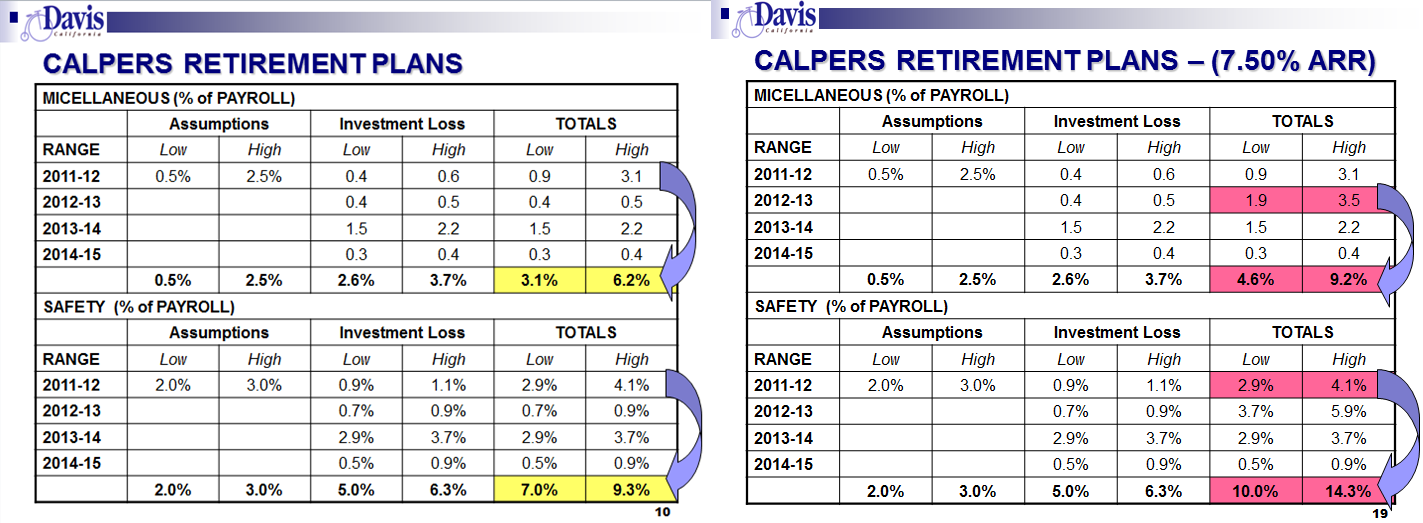

Understanding the impact of the change in investment earnings assumptions is the key missing link. Just a quarter percent drop in the assumptions means a 3% to 5% impact on the budget. Bring it up to 7.25%, the most likely place that CalPERS goes in the near future and you see a 6 to 10% hit.

Assuming a linear impact, you can see that for every quarter percent, you are looking at about a 3% impact on miscellaneous employees and a 5% impact on safety. The numbers get scary pretty quick when you understand those numbers are additional percentages of payroll over and above what we are paying now.

Sue Greenwald figured at 7.25%, that number, combined with rate increases, will result in a $7 million hit on the budget.

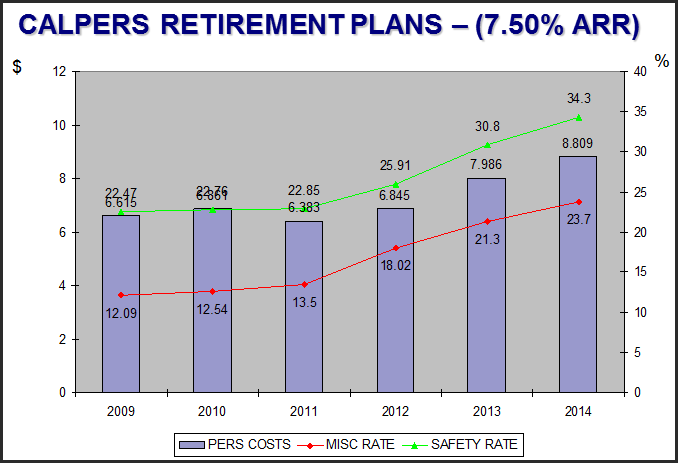

Here you can see the impact of just moving from 7.75 to 7.5% ARR.

In raw percentages, under current projections, pensions will be over a third of the safety payroll by 2014 and nearly a quarter of miscellaneous payroll.

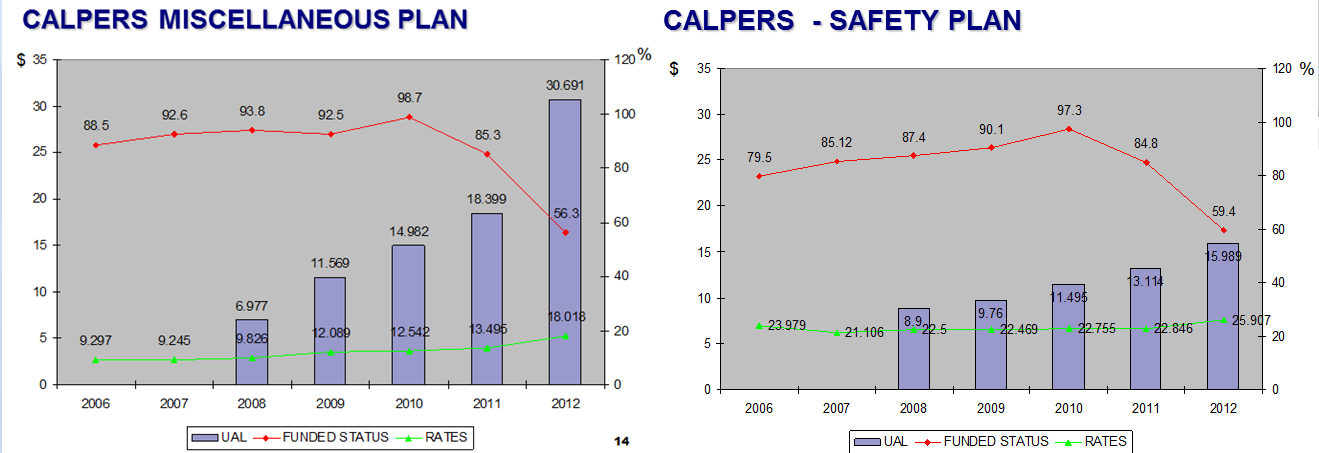

The other problem is that CalPERS is undergoing rate smoothing, ostensibly to reduce the impact on the state budget of the true PERS rate increases. The result, though, is it will take the city’s pension fund from nearly fully-funded in 2009/10 to just over half-funded in 2011/12.

Our unfunded liability would be over $45 million up from $25 million just two years ago.

The Council however, expressed interest in pre-funding the pensions.

As Mayor Pro Tem Swanson said, “It would be irresponsible for us to go into another round of contract negotiations if our budget really doesn’t reflect the true costs. I think everybody needs to know absolutely up front.”

It was Stephen Souza who laid out nine ideas on where to go.

First, he talked about creating a blended retirement plan with a 401K-style added to the current defined benefits plan. Councilmember Sue Greenwald took exception to that and wants to find a way to make defined benefits sustainable.

Second, Mr. Souza spoke to the need to roll back or repeal retirement plans “in excess levels needed to retain a fair standard of living that are not financially sustainable.”

Third, he said, current employees should all participate in funding of these programs and that calls for, fourth, further sharing of the risk by all sides.

Fifth, he spoke of the need to have a tiered plan program.

He also said that we need to look at regional efforts, as the sixth point.

“We can’t do this alone, because if we do this alone, we become the training grounds for everybody else,” he said citing the risk that unless we do it on a regional basis another city that pays higher pensions/ benefits will end up hiring our employees away.

Seventh, and echoing the point above, he wants to accelerate payments to CalPERS based on the 2013-14 costs. This will bring our obligation down. He made the point that we won’t do it overnight as we got into this mess over years and many rounds of negotiations.

Eighth, he wants to seek options to allow existing employees to be able to opt into a lower tier. This was a point that Mr. Navazio made but stipulated that it might need legislation in order to put it into effect.

Finally, he spoke to the need to continue paying down the unfunded liability by increasing our OPEB (Other Post-Employment Benefits) over the years until we find another means of doing that.

While we may not agree with everything that Mr. Souza suggested, it is a huge step forward for him from two years ago. He pointed out that we have a collective bargaining process that will limit our ability to take these actions overnight.

On the other hand, I think the biggest problem with the last go around was that council and the city manager were trying to downplay the problems and for the first time on Tuesday, they laid bare the entire dilemma.

Mayor Krovoza stated, “I am particularly interested in making sure we are looking at systems that look beyond the state government.”

As he pointed out, CalPERS in part got us into this mess. In addition to the collapse of the stock market and investments, CalPERS underestimated the rate of salary increases, and the longevity of employees.

As the Mayor stated on Tuesday, “We’ve been trusting CalPERS absolutely to our detriment. Now, we as a city have to say what is our best judgment as to what we think is going to happen and figure out how we as a city on an actuarial basis can put aside the right amount of money.”

He added, “I think this makes us more sustainable and I even think this makes us an attractive place to work when we can show employees that we have a system of compensation that people can really rely on and bank on.”

One of the big pushes that was made in the last round of negotiations was the need for an outside negotiator. Instead the city had a negotiating team, fraught with conflicts of interest. In fact, the HR director said across the table from her husband on negotiations for one of the bargaining units – by the way, her own as well as her husband’s.

By having the city negotiate, it limited the ability of the city to make the hard case, fearing that they would have to work with these same employees later.

On Tuesday, Joe Krovoza expressed support for the outside negotiator, something that he campaigned on.

He told Council, “It is my view that we should have a special negotiator negotiating our next set of MOUs. I want that to be the case if I have support on this council, for our next labor rounds.”

He seemed to have strong support. He also expressed support for beginning that process sooner rather than later. This was another problem with the last round of negotiations.

Sue Greenwald expressed gratitude and support for this suggestions.

She said, “For years I have been trying to get an outside labor negotiator, and I prevailed for a short period of time. Somehow or other he never came back, he was given a bit of a rough time.”

“I’m very happy that we’re moving towards an outside labor negotiator,” she added.

Councilmember Greenwald also suggested that the council be involved in the hiring this time.

What was the difference on Tuesday? One of the two largest impediments to change appears to have been former City Manager Bill Emlen, who would rarely publicly acknowledge the severity of the situation. And the moving on of Don Saylor, the strong apologist for past policies, also helped clear the way.

On this night, I would give Stephen Souza credit. In the 2008 elections, he had joined Don Saylor in celebrating the fiscal accomplishments of the city that were on shaky ground at best, even in those pre-September 2008 days.

Mr. Souza stepped up, acknowledging the unsustainability of current structures and pushing for reform alongside his colleagues.

But there was something else different this time. There were not 40 uniformed firefighters sitting in the audience pressuring the councilmembers they had bought and paid for.

In fact, there were no employees at all. The chambers were relatively empty, other than a couple of members of the press and a candidate for council.

This night was made possible based on the decision first by Joe Krovoza and then by Rochelle Swanson not to take money from the firefighters or any other employee group. They were then free to look at the facts and the facts here are overwhelming.

We cannot sustain the rate of pension increases coupled with employee salary increases we incurred in the last decade. No longer can we rely on double-digit revenue increases in property taxes.

This is a new world. Unfortunately the numbers are worse than we thought. We have a very limited time. Council took the first step and that was to make a strong statement of conviction.

Rochelle Swanson’s motion was read twice at council and will also be printed twice here for emphasis.

She said, “I move to express the city council’s intent to pursue long-term sustainable contracts and employee benefit programs by implementation of long and short-term reduction measures and directing the interim city manager to return to the council with recommendations on the appropriate means of implementing this intent and strategies to utilize outside expertise.”

That was not a home run. There were no specifics, though the City Attorney warned against such specifics. However it was a solid double that could set up a big inning for those of us who have been crying for reform.

On this night, that is all we can really ask for.

—David M. Greenwald reporting

[quote]Instead the city had a negotiating team, fraught with conflicts of interest. In fact, the HR director said across the table from her husband on negotiations for one of the bargaining units – by the way, her own as well as her husband’s.[/quote]

Sounds like the City of Bell.

After watching last night’s city council meeting, I would like to make the following comments:

1) I was disturbed when there was mention of possibly raising taxes to fix the city’s fiscal problems. I very much doubt this will fly – citizens are tapped out. Many have lost income, jobs, investments. The city was irresponsible in how it got us into this mess – and needs to figure out how to get itself out of this mess w/o making citizens pay the price for what were the city’s mistakes.

2) For the first time, I believe city staff (Paul Navazio) was far more truthful in spelling out the city’s dire fiscal situation, w/o trying to paper it over w excuses, rationalizations, creative bookkeeping and the like. High praise goes to Paul Navazio for having the courage to finally tell the truth. It seems clear that former City Manager Bill Emlen appears to have been a past master at obfuscation, creative bookkeeping, manipulation when it came to the dire nature of the budget – perhaps naively and foolishly thinking somehow things were going to get better.

3) Saylor is gone from the City Council, and an entirely different City Council that is more answerable to citizens seems to be seated at the dais now, who are not beholden to special interests. Even Council member Souza – who was inextricably linked w Saylor’s poor fiscal policies – has changed his tune, which is a welcome reversal on Souza’s part.

4) Council member Sue Greenwald and Lamar Heystek have been highly vindicated (and Davis Enterprise columnist Rich Rifkin; Davis Vangaurd writer Davis Greenwald as well), when they called for serious budgetary reform. Sue Greenwald laid out what seems like a reasonable plan to do away w the Cafeteria cash-outs, and other ideas that could at least take care of the unfunded liability with respect to medical benefits.

5) Mayor Joe Krovoza provided excellent leadership in allowing each Council member to fully voice deep reservations about the city’s old way of doing things, encouraging city staff to come up with possible long term solutions to the fiscal mess the city is in. I honestly believe city staff got the message loud and clear. Additionally, I sensed a new attitude in city staff, who seem much more receptive to making the necessary changes to get the city on a better fiscal footing.

6) A clear message was sent by City Council to city staff that bargaining on labor contracts requires an independent negotiator. My comment to that would be “Duh!”.

7) Specifics are not necessary at this point – city staff will scour around for a plethora of responsible ideas to place before the City Council. That is their job, and city staff seems more than willing to start this process.

8) Mayor Joe Krovoza emphatically pointed out PERS was certainly at fault here, and the city is paying for it. He indicated, and rightly so, that the city has to become less dependent on PERS and their lousy assessment mechanisms, and think on its own about how to extricate itself from the fiscal mess we are in.

I can’t tell you what a breath of fresh air last night was. There was no shilly-shallying about the city’s fiscal problems. The only fly in the ointment was Council member Souza’s constant reminder that other city’s are in the same boat. So what? That does not obviate the need for Davis to show itself to be a responsible city, and do what is needed to get itself back on a positive fiscal footing (or at least a less negative footing).

I would say a brand new day has hopefully dawned upon Davis. It will be a difficult road, but I sense the newly seated City Council is ready to roll up its sleeves and do the hard work it is faced with to get the job done. I’m not expecting miracles. It took years to get into this fiscal mess, and it may take years to get out of it. But there must be a collective will, including on the part of the bargaining units, to make things right. If the city doesn’t fix its fiscal problems, the city potentially could run out of money and there will be no funding for pensions, as happened in Prichard, Alabama. Or bankruptcy for the city may be in the offing, in which case the bankruptcy judge will rewrite the employee contracts.

In short, what the city staff and City Council are saying is that it cannot be business as usual…which is the absolute truth…

Very good presentation by staff (really, by Paul Navazio) last night. I thought the comments of all four members of the council were encouraging. However, I think the lack of questions or ideas of how to solve our retiree medical problem was disappointing.

I don’t think the admonition of Harriet Steiner at the beginning–that the council should not pronounce its bargaining positions in advance of labor negotiations–was the problem. I just don’t think anyone on the council really has a grasp as to what they must do in the next contracts to really fix this problem.

In my February 1 column–you can read my column in today’s Davis Enterprise–I will lay out a practical solution to the problem of retiree medical.

As to solving the long-term pension funding challenge, I think the council now has a grasp on what they need to do:

1. They need to adopt new second-tier formulas for all new hires–2% at 60 for miscellaneous and 2% at 55 for public safety; and

2. They need to place a hard cap on the annual growth of “total compensation.” This is what was done in the last fire contract; and I think it is the best way to address this challenge. Insofar as pension costs rise or medical premiums go up, a total comp approach will guarantee that Davis has the funds to keep everyone on the payroll employed and allow the city to provide services at the current level. If at some point revenues go up, then the total comp approach will allow the city to give its workers a raise.

I also appreciate the discussion brought up by Mr. Navazio and endorsed by some comments of the council to conspire with other cities in the Sacramento region to reduce benefits collectively, so that those cities who take action are not harmed by those who don’t. However, I think there is a (probably harmless) falsehood built into this approach–that there is a city or other agency in our area which would steal our best future employees* by offering them a much more lucrative benefits package. The unassailable fact is that every city in our region is hurting now and will be hurting for the next 10 years or more.

Those cities which in the past did try to outbid us–notably Elk Grove, West Sac and Roseville–are worse off than everyone else because of that behavior. It’s implausible that in 3 years Elk Grove is going to outbid us for landscapers, firefighters, cops or city planners.

*I don’t disagree with those who say that we need to offer competitive compensation packages for some key positions (such as city manager, police chief, city attorney, planning director and perhaps city engineer). However, I doubt that we would suffer a serious lack of attraction and retention for other positions if we simply paid what we could afford for most other jobs. Our employees who leave to go to other cities generally do so because they are personally ambitious and want to rise to the highest levels of municipal governance. Our giving a mid-level employee 20% or 25% more money won’t make a difference if his goal is to become a city manager. On the other hand, most city employees are not so ambitious. Their priorities are to live a comfortable life in Davis, and they won’t quit here just because they could make a bit more in Redding or in Rancho Cucamonga.

One note with regard to the graphs David has displayed above titled, “CalPERS Miscellaneous Plan” and “CalPERS Safety Plan”: Paul Navazio discussed the red line in those graphs without mentioning a key fact–those red lines represent market valuations, not actuarial valuations. In almost all of the rest of Paul’s presentation, he was discussion our AVA (actuarial valuation of assets). But it should be noted that our MVA is substantially worse than our AVA. (I think that is true for every CalPERS agency.)

The MVA is the real world figure. It is what we have really funded as of the date expressed. It is what determines our current pension funding rates. The AVA, by contrast, presumes a lot more about what will happen in the future. The AVA is not a worthless number. It might make more sense to exclusively use the AVA. However, I think it confuses the matter to go back and forth between the two. (In my January 5 column, I only stated market-valuations in order to avoid this problem.)

One interesting note by Paul Navazio on why our unfunded retiree medical debt was reduced by the actuary from $65.5 million to around $53 million (I don’t recall the new number he gave): the actuary believes that medical inflation will slow down. Paul had told me some time ago that the new number was lower, but I didn’t think to ask him why. I will trust the actuary that his assumption about medical inflation makes sense. My instinct is to think that assumption is right–that we cannot endlessly absorb 9-10% per year increases in medical costs.

To Rich Rifkin: Thanks for the additional insight. We deeply appreciate your efforts on this most important issue…

Rifkin: “I also appreciate the discussion brought up by Mr. Navazio and endorsed by some comments of the council to conspire with other cities in the Sacramento region to reduce benefits collectively, so that those cities who take action are not harmed by those who don’t. However, I think there is a (probably harmless) falsehood built into this approach–that there is a city or other agency in our area which would steal our best future employees* by offering them a much more lucrative benefits package. The unassailable fact is that every city in our region is hurting now and will be hurting for the next 10 years or more.”

I agree that there is probably an overconcern about what other cities do at this point. It matters not one whit what other jurisdictions choose to do – our city needs to do what is fiscally right for our city first and foremost. Let us set the shining example of how to be financially responsible/prudent. And yet some City Council members seemed a bit reluctant for Davis to “show the way” in this regard, for fear city employees would somehow desert us for higher compensation elsewhere. I don’t care if they do – there are plenty of qualified people to fill their shoes. These are tough times, and call for tough measures – and we should not be worried about “keeping up w the Jones”! That is precisely what got us into this mess in the first place…

Rich,

The reason that no specifics were offered last night was ENTIRELY because of the fact that it is not allowed by the laws that pertain to collective bargaining. We must follow the law.

Rolling back the pension formula to pre-1999 levels for new employees– formulas which were considered generous at the time by those of us who were hired back then –, is something that we can (and in my personal opinion should) propose (but remember, we are not allowed by law to dictate this until we have listened with an open mind to proposals by the employees bargaining groups). But rolling back these formulas will only help cities a generation down the road, since every employee today is covered by them.

Court decisions or constitutional changes might allow us to lower the formula for existing employees going forward, but that is not the case now.

So, as I said at the meeting, my main SUGGESTIONS (although again, by LAW, these just my own SUGGESTIONS), that I made last night involved increasing employee contributions to the pensions, as is being done everywhere else in the public sector now. We don’t have too many other options, aside from keeping salary increases in check (the higher the salaries, the higher the pensions) and looking at how the base retirement salary is calculated. Also on the table could be pension caps, but I don’t know the laws regarding these at this time.

In terms of health care, my suggestions last night were to focus on major cafeteria cash-out reductions and moderate increases in employee contributions. I would also be interested in proposals that would allow us to further cut retiree benefits for those taking early retirement, having full benefits kick in only at medicare age, when people need them the most and when they cost the city only about one half or one third as much. I believe this would require changes in PERS rules, and I hope that as a city we can help lobby to achieve this type of flexibility in PERS plans.

To Sue Greenwald: Excellent suggestions. You go girl!

Personally, I did not see a big improvement in this staff report. Historically, our staff reports have always had the accurate numbers embedded in them; the problem as been the lack of strong summary statements which make the seriousness of the situation clear.

I saw much of the same problem in last night’s presentation. In order to get to the bottom line, I had to ask staff point blank before the meeting how much more we would owe in benefits in two and a half years than we owe today, assuming a 1/2 percent decrease in earnings assumptions. This was not volunteered and did not appear in the staff report.

Similarly, we had to do the calculations ourselves in order to see that the amount that the cost of benefits to the city had increased 53% during the last four years.

[i]”The reason that no specifics were offered last night was ENTIRELY because of the fact that it is not allowed by the laws that pertain to collective bargaining.”[/i]

Point taken.

Yet nothing would have constrained your colleagues from saying something like this:

[i] “As to our retiree medical liability situation, we ought to be moving in the direction of discouraging our employees from retiring as young as we are now encouraging them to retire. If miscellaneous employees would retire on average at age 65 and safety employees would retire on average at age 60, most (but not all) of our retiree medical liability would disappear.

“We also need to look at the absolute amount of money we are spending on medical benefits for each employee and each of our retirees. There is only so much money to go around. If we want all of our employees to have adequate medical coverage–and that is a value our City has long held–then we might have to cap the benefit so that any employee or retiree making more than $5,000 a month in salary and overtime or pension will have to pick up the bill for spousal and dependent coverage; and (as Sue Greenwald stressed) we might need to cap the cash-out at a lower level.”[/i]

Other than Sue raising the cafeteria cash-out suggestion, no one on the council offered ideas for fixing this problem. There was agreement (AFAICT) on slowly moving to a fully funded status by 2014 (though Paul’s charts showed we can’t quite get there at the rate we are going). But that is just a way of shoving more money in now and having to shove in less later. That’s not an idea for how to make medical expenses for the City lower.

One note on a suggestion raised by Stephen Souza about moving to a hybrid system of a 401K plan mixed with a pension program: The Orange County Register yesterday had a story about that ([url]http://totalbuzz.ocregister.com/2011/01/18/o-c-hybrid-pension-plan-applauded/47612/[/url]). I don’t know if any CalPERS affiliated agencies have gone in this direction. (I don’t think any have.) O.C. is not a part of the CalPERS system, so it may have some options that we don’t have in Davis. Here is an excerpt from that story: [quote]“Orange County’s approach, which has the support of the county’s largest public employee union, the Orange County Employees Association, deserves the attention of public employers and workers across the country because it shows how to provide retirement security in a financially sustainable way,” Ferguson wrote.“Orange County’s approach increases cost certainty for the county while providing a meaningful path to retirement security for workers,” he wrote. “It also stems the tide of unfunded public liabilities without wholly shifting the retirement funding risk to workers.”

Orange County’s new hybrid pension plan, which was rolled out May 7, allows new hires to choose between the current pension formula (2.7 percent of salary for each year worked, beginning at age 55); and the new lower pension formula (1.62 percent of salary for each year worked, beginning at age 65) – but combined with a 401K-type plan, with matching contributions from the county up to 2 percent.

Most county employees contribute between 11% – 15% of their paychecks to pay for their pensions. A lower pension plan means less contributions and more money in their take-home pay.[/quote]

[i]”Understanding the impact of the change in investment earnings assumptions is the key missing link. Just a quarter percent drop in the assumptions means a 3% to 5% impact on the budget. Bring it up to 7.25%, the most likely place that CalPERS goes in the near future and you see a 6 to 10% hit. Sue Greenwald figured at 7.25%, that number, combined with rate increases, will result in a $7 million hit on the budget.”[/i]

One important thing to be understood about this change in assumptions: it [u]does not really matter what CalPERS or its actuaries assume its market rate of return will be[/u]. All that matters is what the actual rate of return is.

CalPERS has assumed for a long time that its ROI would be 7.75% per year. But regardless of that assumption, when its actual ROI was short of that target, the rates it charges to its member agencies had to go up, based on the actual returns, not the assumed returns.

In my opinion, I think the 7.25% ROI assumption is more realistic guess going forward. And thus for planning purposes I think it makes sense to assume that.

I ran a spreadsheet on the returns of the S&P 500* and found that [b]from January 1950 to January 2011, the average monthly 20-year ROI was 7.24% per year.[/b]

For the same period, the average monthly 10-year ROI was 7.28% per year. For the same period, the average monthly 30-year ROI was 7.22% per year. For the same period, the average monthly 40-year ROI was 7.33% per year.

So pretty much whatever reasonable length of your investment period in the S&P 500, you generally are going to get around 7.25%.

So why then has CalPERS assumed a much higher ROI? I think there are two reasons: 1) Hubris. A lot of stock pickers think they can outperform the market. They can’t for the long-term, unless they are Bernard Madoff; and 2) Lucky timing.

If you start tracking your 10-year, 20-year and 30-year average returns of the S&P 500 on January 1, 1981, you will get much better average rates of return than if you go back to January 1, 1950. That’s because you miss the great malaise of the 1970s. Here are those averages:

10-year 9.01%; 20-year 8.91%; and 30-year 7.94%.

I don’t think anything has fundamentally changed about multi-national corporate profits. That’s what determines the prices of stocks and hence gives you your rates of return. But it can be illusory to look at returns over a short period of time (especially when that period misses a bad decade) and think that period will be repeated.

It works in the other direction as well. If you start today and work backwards using just 10-year cycles, you would wrongly think that the rates of return for publicly traded stocks is incredibly poor. For example, from October 1, 1998 to October 1, 2008, the 10-year ROI was -1.25% per year. And every month since October, 1 2008 has produced a negative ROI for its 10-year preceding period. The single worst 10-year period for the S&P 500 was from Feb. 1999 to Feb 2009. The average ROI was -5.08% per year.

On the other hand, if your sell date was Feb 2009, but your buy date was instead Feb 1979, you would have made an average annual return on investment (not counting taxes) of 7.01% per year.

—————

*The S&P 500 was created in 1957. However, S&P published other indexes going back to the 1920s. The numbers I used come from a Yahoo spreadsheet and began in January, 1950. I assume Yahoo’s numbers from 1950-57 were recreated.

I should also note that there are other market indexes, like the DJIA, which more-less track a market rate of return. However, it is worth noting that the Dow has long performed worse than the S&P 500 and the Dow stocks tend to miss the periods of rapid growth for the 40 large companies that make up the DJIA.

I think there is an uncanny similarity between the City of Davis and the way it plays with its budget woes and this article I found in the Wall Street Journal. Why Bed Bugs Won’t Die [url]http://online.wsj.com/article/SB10001424052748703951704576092302399464190.html?mod=WSJ_hp_MIDDLENexttoWhatsNewsForth[/url]

I have to say that possibly some individuals on the city council might have a hard time finding the similarities but then again, I guess that is why the city is in the shape it is now.

First, thanks to Rich, Sue, David, Elaine and a few others your persistence and commitment to helping the city pull its collective head out of the sand and deal with this massive looming problem.

“Rich: The MVA is the real world figure;

If miscellaneous employees would retire on average at age 65 and safety employees would retire on average at age 60, most (but not all) of our retiree medical liability would disappear. “

Absolutely. Now is a time to be very conservative in our estimates. Also, I can’t understand why anyone continues to support a system that provides an end of career 10 or 15-year paid vacation to all public-sector employees. When did we become entitled to that? What social or economic benefit does it provide? Everyone should work until they are 65 unless they save enough to retire early. Give safety employees a 5-year end of year paid vacation… I can accept that, especially for law enforcement.

Do I understand that 2% at 60, assuming 35 years of service, equals 70% of pay? Another consideration for anyone crying “unfair” over this… shouldn’t the kids be done with college and the house paid for at this point? At retirement I would be ecstatic to earn 70% of my pay for the rest of my life (with COLA) without having to work. Remember that 70% means less income tax liability than 100%, so the net is probably 75% or more.

Another related question, can’t employees coordinate their unused accrued sick leave to retire early at full pension?

One last question, with the current contract, can a city employee retire earlier at reduced pension?

One idea used in the private sector when defined benefit plans existed was to buy out high-compensation/benefit employees with offers of early retirement and replace them with new employees in a more market-based compensation plan. Of course in the private sector employees factor the risk that the company can fail and their pensions could disappear. Our city employees should be advised that the same could occur given the city could file bankruptcy and have the court force a renegotiation of all pension payments.

Rifkin: “One important thing to be understood about this change in assumptions: it does not really matter what CalPERS or its actuaries assume its market rate of return will be. All that matters is what the actual rate of return is.”

Amen.

To craised: From article you cited – “The findings add to a growing body of evidence from molecular-biology studies that bedbugs have recently evolved at leastthree improved biochemical defenses against common pesticides. Bedbugs today appear to have nerve cells better able to withstand the chemical effects, higher levels of enzymes that detoxify the lethal substances, and thicker shells that can block insecticides.

“These bugs have several back doors open to escape,” said evolutionary entomologist Klaus Reinhardt at the University of Tuebingen in Germany, who was familiar with the new research butn’t involved in the projects. “Simple spraying around of some pesticides may not [be enough] now or in the future.””

If you reword the above paragraphs, it certainly does seem uncannily similar! LOL (See below)

The findings add to a growing body of evidence from fiscal studies that politicians have recently evolved at least three improved political defenses against doing anything productive. Politicians today appear to have nerve cells better able to withstand the effects of taxpayer scorn, higher levels of tolerance that detoxify the lethal effects of public outrage, and thicker shells that can block any criticism.

“These politicians have several back doors open to escape,” said evolutionary investigator Klaus Thickshell at the University of TooBigEgo in the United States, who was familiar with the new research but isn’t involved in the projects. “Simple spraying around of some pesticides may not [be enough] now or in the future.”

JB: [i]”Do I understand that 2% at 60, assuming 35 years of service, equals 70% of pay?”[/i]

Correct.

JB: [i]”Another related question, can’t employees coordinate their unused accrued sick leave to retire early at full pension?”[/i]

It depends on their contract, but generally the answer is yes. In Davis, our current contract with the firefighters reads, “City agrees, at no cost to employees, to provide that unused accumulated sick leave shall be credited as time in serve at the time of retirement.”

So for example, if you have a 48-year-old firefighter who started at age 20 and he has 2 years built up of unused sick leave (which is actually very common), he can get credited with two years of work time, effectively making him a 30-year employee who is for retirement purposes 50 years old. (Note that 3% at 50 means you have to be at least 50 to qualify for retirement. Even though he is 48, he would qualify because he would get 2 extra years of credit.) So he gets 90% of his final salary + COLAs for say the next 40-45 years.

But he does not have to stop working. He could leave Davis and go to say, Sacramento County, which is not a part of the CalPERS system. Say he gets a high-paid job with Sac County as an Arson Investigator. He could work for them for the next 17 years, making his hefty pension and his hefty salary. Then when he is 65, he could retire from Sac County and live very well for the rest of his long life on two pensions.

[i]”One last question, with the current contract, can a city employee retire earlier at reduced pension?”[/i]

In order to qualify for any CalPERS retirement benefits, an employee must work a minimum of five years and must meet the minimum age of retirement (50 for safety and 55 for miscellaneous), unless he has service credits which boost him up to the minimum age.

There is another broad category of exceptions for early retirements: disability. A shockingly high 35% of our safety employees retire prematurely due to “disability.” (I am suspicious that some of these may be bogus, but I have not yet looked into it.) These disability retirements are not all due to injuries on the job. A cop who say develops heart disease in his 40s can qualify for a “non-industrial disability.” I don’t think there is anyone who is checking to see a few years down the road if that kind of retiree is still disabled.

[quote]A cop who say develops heart disease in his 40s can qualify for a “non-industrial disability.” I don’t think there is anyone who is checking to see a few years down the road if that kind of retiree is still disabled. [/quote]

I have a feeling that many make miraculous recoveries. Disability retirement can be amazingly therapeutic it seems!

If our city negotiators have conflicts of interest, it is no wonder that we are in the position we are in.

This is not difficult to figure out — we are screwed relative to current hires; future hires come in under a very stripped down 401 or 457 plan in which our contributions are clearly known, limited, and paid for in full as we pay salaries. Safety and Industrial categories — all the same. Pay as we go — adjust salaries higher if needed, but end the pension plans for all new hires.

“If our city negotiators have conflicts of interest, it is no wonder that we are in the position we are in.”

There is always a conflict of interest between management and/or government officials holding the purse strings… and labor. In the private sector, it is the shared goal of business viability that becomes the driving force for cooperation. When the company is raking in the profit and managers are making millions while reducing labors’ pay, benefits and jobs, then that cooperative mechanism is reduced or lost. However, all organizations require quality labor to compete and survive. Managers of any private company that cut and outsource… while still managing to meet their profitability targets must still pay the market rate for all required labor/talent. That labor must help the company be profitable or their jobs go away. Labor is essential, but is generally the largest expense for a company, so it is the main target for attempted optimization through negotiation.

For the public sector, the main difference, and the main conflict of interest that impairs prudent fiscal management, is the lack of shared goals for financial viability of the employer combined with the perception of endless support/authority to increase revenue though increased taxation.

The private business can only increase revenue by increasing the real or perceived value, or the quantity, of goods and services sold. If you are private labor, you share in the challenge of this… you must work harder to improve or produce more.

Conversely, the public organization has developed the historical perspective that another tax, another bond; another supplemental property tax will be available to meet the growing demands for revenue. Complete fiscal failure of the “business” of government has never occurred, and therefore labor (and many managers and politicians) do not share the goal for ensuring fiscal viability.

My thinking is that we may be better served by complete fiscal collapse of government so we help change the existing perception that public-sector revenue is endless and government cannot collapse (what does “government not able to pay its bills” really look and feel like)… and then developing the shared goals and cooperation to prevent it from happening again. There is too much kicking the budget can back and forth and down the road. Too few have the stomach to take or accept the necessary bold steps because they cannot visualize the pain of the looming crisis.

As a strategy, it may be better to allow the pain to occur and then negotiate.

[i]”If our city negotiators have conflicts of interest, it is no wonder that we are in the position we are in.”[/i]

In a big picture sense, this is ultimately the fault of the voters in Davis. We have for many years elected people to serve on the City Council who do not see it as their duty to fight for the taxpayers’ best interests. We have been electing members to the Council whose ideology is pro-labor. So it should come as no shock that the City Council would have hired members of the City staff to negotiate on behalf of the taxpayers. The members of the Council who made that choice knew they would not strike the best bargains for the taxpayers.

I should add that just by hiring a professional negotiator we are not guaranteeing that the taxpayers will be better represented than we have been by the staff negotiating team. It depends on which professional negotiator we hire. We could pick one who is soft, or we could pick one who is a hard ass. And it also depends on what instructions our City Council gives the negotiator. If they tell him to demand “this, that and the other,” then perhaps our City’s needs will be met. But they might not ask for any substantial reforms in the labor contracts, and that’s the result we will get.

Good points all; a very tough situation that will require tough medicine and a resolve to change things in dramatic ways — especially in regards to the retirement packages of new hires. In my view, it is very hard to renegotiate past promised pension and health care benefits as they were a component of compensation earned at the time of service. Perhaps salary cuts for current employees, and no defined benefit pension plans for new hires is the best approach to gently bring back some cost control.

[quote]My thinking is that we may be better served by complete fiscal collapse of government so we help change the existing perception that public-sector revenue is endless and government cannot collapse (what does “government not able to pay its bills” really look and feel like)… and then developing the shared goals and cooperation to prevent it from happening again. [/quote]

In an emergency, money must be conserved. Taxpayers should no longer subsidize housing, day care, senior care, and programs for vagrants. These types of steps must come before default and collapse.

“These types of steps must come before default and collapse.”

[url]http://www.pbs.org/newshour/rundown/2011/01/conservative-republicans-name-25-trillion-in-cuts-from-fed-budget.html[/url]

These type of steps?

Let’s see if enough of us have the stomach.

I nominate Rifkin for City labor negotiator.

I second the motion.

[quote]Rifkin: “One important thing to be understood about this change in assumptions: it does not really matter what CalPERS or its actuaries assume its market rate of return will be. All that matters is what the actual rate of return is.”

Amen. [/quote]

I have to point out unfortunately that Rich is not correct here. It does matter what the assumptions are because the ARR plays out over a 30 year period. If CalPERS overestimates what that rate is we have an unfunded liability. If they underestimate it, we are superfunded. The problem is that we won’t know for a long time and the as you see, the estimate/ assumptions make millions of dollars of difference when they are off just half a percent.

DG: [i]”It does matter what the assumptions are because the ARR plays out over a 30 year period.”[/i]

That does not mean anything. The 30 years of return are whatever they are, regardless of what the assumed ROI is. It is the actual rate of return which ALWAYS determines what the rates need to be in order to fund a given pension benefit. ALWAYS.

The significance of CalPERS lowering its assumed ROI is simply to let its member agencies plan in advance how much they can expect to pay in a future period when CalPERS expects the ROI to be more modest and hence rates charged to agencies much higher.

[i]”If CalPERS overestimates what that rate is we have an unfunded liability.”[/i]

That’s the station we are now in, and CalPERS did not change its assumptions in order to get us in this place.

[i]”If they underestimate it, we are superfunded.”[/i]

We were “superfunded” in the late 1990s, but the rate of return assumption by CalPERS did not change in that period. What mattered was that the actual, not assumed, rate of ROI went up higher than was planned for.

[i]”The problem is that we won’t know for a long time and the as you see, the estimate/assumptions make millions of dollars of difference when they are off just half a percent.”[/i]

Right. But this is all for planning purposes. If CalPERS assumes a ROI of 7.25% for the next 10 years but actually makes a ROI of 8.25%, they will either become superfunded or they will lower the rates they charge member agencies.

All I am saying here is that in the long run what matters is what return PERS gets on its investments, not what they assume they will get. The assumption is meaningful in the short term, because it determines what an agency must plan for. But it loses meaning over the long run to the real values of real returns.