Last week a key committee for the legislature came out backing the end of redevelopment.

Last week a key committee for the legislature came out backing the end of redevelopment.

On Thursday, a Senate-Assembly budget committee voted to send the spending plan to the floor of both houses in the legislature this week, and that includes the complete elimination of the state’s redevelopment program.

“I commend their work and their willingness to face the tough challenges that this year’s budget presents,” Governor Brown said.

The plan to eliminate redevelopment agencies would save the state about $1.7 billion and comes in a package that eliminates some $14 billion from the state’s budget – a lot of money but not quite what the Governor was asking for. In the end, it was Democratic lawmakers that saw no other option. Republicans, on the other hand, objected to the elimination of redevelopment.

According to the San Jose Mercury news, Democratic lawmakers felt they had “little choice but to divert those redevelopment dollars to schools and local services.”

“I think this is going to happen as a matter of necessity,” State Senator Joe Simitian told the Mercury News.

Sen. Elaine Alquist, D-Santa Clara added, “When I have had to cut billions of dollars from safety-net programs for the elderly and the sick, redirecting redevelopment agency funding is among the least of the worst choices I have had to face.”

However, all is not quite lost for redevelopment. The League of California Cities called the Governor’s plan to eliminate redevelopment agencies unconstitutional, saying it would would violate the measure passed by voters in November.

League Executive Director Chris McKenzie announced last week that the agencies would sue if the Governor’s plan to eliminate RDA’s is passed by the legislature.

“We have authorization, from both the League of California Cities and the California redevelopment agencies, to file a lawsuit if this legislation is approved by the legislature,” Mr. McKenzie said.

“If they are going to directly violate Proposition 22 within months of the voters telling them how to vote, then they will have to deal with the consequences of an outraged electorate,” Mr. McKenzie said.

“We are confident that the governor’s proposal is legally sound,” said a statement from a spokesperson for the Governor, Evan Westrup. “While bloated redevelopment agencies are fast-tracking billions of dollars, hiring high-priced law firms and threatening lawsuits, teachers are facing layoffs and public safety budgets are being slashed in cities across the state. Legal obstruction and obfuscation won’t get us any closer to addressing California’s massive budget deficit.”

The legislature is expected to approve the budget deal in floor votes this week, however, huge questions remain about legal challenges.

The other question is whether cities that rushed to encumber their RDA funding, such as the City of Davis, would able to keep even that money.

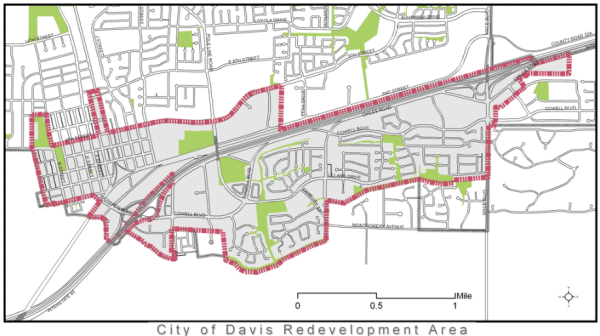

In February, the City of Davis, as many jurisdictions have done, rushed to encumber as many redevelopment projects as they could, voting to issue $4 million worth of taxable and $12 million worth of tax-exempt bonds.

The action added about $1 million to the current debt service obligation of $600 thousand.

There is some question as to whether these last-second programs will be allowed to stick.

According to a report in the San Francisco Chronicle, the bill to end redevelopment would also allow the state to kill any recently-approved projects, in apparent response from the Governor to all of those cities around the state that have been rushing to approve money before the state eliminates RDA’s.

Included in a bill proposed by Brown’s office that would eliminate redevelopment is language which would let the state “review the validity of the adoption or amendment of a redevelopment plan at any time within three years after the date of the adoption of the ordinance adopting or amending the plan, if the adoption of the ordinance occurred after January 1, 2011.”

According to the Chronicle, this means, “any plans approved after Brown’s budget was unveiled in early January could be killed by state officials anytime in the next three years — instead of the normal 90 days.”

“The current proposal allows for a thorough review of the actions cities and redevelopment agencies have been taking to sequester and fast track funds. If violations of the law are found, subsequent action can be considered and/or pursued,” said Evan Westrup, spokesman for Governor Brown. He then declined further comment.

The strongest protection for RDA is probably Proposition 22, the basis for a lawsuit from the League and RDA. However, it is not altogether clear that it would prohibit the state from simply eliminating the program.

According to the Legislative Analyst’s Office analysis of Proposition 22, “this measure reduces or eliminates the state’s authority to:”

- Use state fuel tax revenues to pay debt service on state transportation bonds.

- Borrow or change the distribution of state fuel tax revenues.

- Redirect redevelopment agency property taxes to any other local government.

- Temporarily shift property taxes from cities, counties, and special districts to schools.

- Use vehicle license fee (VLF) revenues to reimburse local governments for state mandated costs.

Writes the LAO, “As a result, this measure affects resources in the state’s General Fund and transportation funds. The General Fund is the state’s main funding source for schools, universities, prisons, health, and social services programs. Transportation funds are placed in separate accounts and used to pay for state and local transportation programs.”

The idea of Proposition 22 was to prevent the state from raiding or borrowing from the fund. However, it does not seem to prevent the state from eliminating the agency altogether, and the legal fight may actually be on the inability of the state to take existing funds rather than eliminating RDA.

This will be an interesting fight that is worth watching with a huge bearing on local policies, not the least of which is land use, as the elimination of RDA means the elimination of Davis’ pass-through agreement with the county.

—David M. Greenwald reporting

[quote] Republicans on the other hand, objected to the elimination of redevelopment.

[/quote]

No surprise here given that RDAs often give sweetheart deals to developers and businesses, which are typicaly Repblican. Sorry but I’ll sleep better at night with RDAs gone.

Frankly I am not surprised that the governor’s plan would include closing loopholes like what Davis is trying. My question is: are we obligated at this point to those bonds and if so what happens to that money if the RDA goes away?

Be careful what you wish for… I suspect the elimination of RDAs is going to be an abysmal failure by Brown’s gov’t. There will be unintended consequences, the money will not “trickle down” to the local level, but rather be absorbed by the huge state bureaucracy to fix their fiscal mess. As Interim City Mgr Paul Navazio noted, the schools in Davis will probably only gain a measly $250,000 next year if RDAs are done away with. Yet the city will have lost a huge millions of dollars engine for economic redevelopment. Only time will tell…

But it very much reminds me of the push to finance redoing the school’s stadium w fancy press box and all, which so many insisted was the “top priority”. Even tho the MPR roof was rotting and the inside molding – the MPR where kids eat lunch and is now closed. The analogy is apt. Whatever limited amount of money from RDAs that is diverted away from economic redevelopment to the schools is not likely to have any appreciable effect on the quality of education in CA schools. The irony is that doing away w RDAs may actually hurt schools in the long run. Think about it. Davis has done a pretty good job of improving economic development – which has resulted in raising property values. Higher property values means more tax revenue for schools, now doesn’t it? Do away w RDAs may result in the failure of cities to keep up with necessary infrastructure, and it is highly likely property values may decline as a result. Just my thoughts…

1) “…bloated redevelopment agencies…”? That’s fairly ironic coming from a State spokesperson. DG, you said something about humor in one of the other threads. There you go.

2) Here we go again with the blustering, “If violations of the law are found, subsequent action can be considered and/or pursued,”. Ergo, if no violations are found, the State is powerless to do anything after the fact. Such is the case with any law or governmental program. Hello!

3) The Davis RDA has funded many projects during its existence. Wu, I challenge you to substantiate your comment, “No surprise here given that RDAs often give sweetheart deals to developers and businesses,…” Please cite three Davis examples with details. I also challenge you to substantiate the claim that the majority of the Davis RDA projects benefited Republicans. Or are you excluding the Davis RDA from your comments?

DG, here’s some more humor. If the point of an RDA is to “give sweetheart deals to developers and businesses,…”, there wouldn’t even be a Davis RDA.

Classic. It appears I’m incapable of properly delivering a humorous line. Let me try again.

If the point of an RDA is to “give sweetheart deals to REPUBLICAN developers and businesses…”, there wouldn’t even be a Davis RDA.

ELAINE: [i]”There will be unintended consequences, the money will not “trickle down” to the local level, but rather be absorbed by the huge state bureaucracy to fix their fiscal mess.”[/i]

That’s not an unintended consequence. That is precisely why Brown wants to get rid of the RDAs. Doing so feeds money that is being spent locally to the state.

[i]Doing so feeds money that is being spent locally to the state.[/i]

You have nothing to support this assertion.

From the LAO report:

[b]”Beginning in 2012-13, any property tax revenues remaining

after the successor agencies pay redevelopment debt would be

distributed to other local governments in the county following

provisions in existing law, [/b]except that:

The additional K-14 property taxes would augment their existing

state funding (not offset state education spending under

Proposition 98) and would be distributed to districts throughout

the county based on enrollment.

The property taxes that otherwise would be distributed to

enterprise special districts would be allocated instead to

counties. (These districts primarily are fee-fi nanced water

and waste disposal districts.)”

Don: reread what you have quoted. It makes my point. The money which is now going to the DRDA will no longer be available for Davis projects. Much of it will go to the K-14 schools, which relieves state obligations. The counties will be treated on a revenue neutral basis. In sum, the state is relieved of some of its school expenses, the counties become revenue neutral, and the RDAs (which generally are cities) are s.o.l. In effect, this proposal is just as Elaine described it above.

Some of it will go to local schools. Some will go back to the city. That is all after bondholders are repaid for redevelopment debt.

More detail from the governor’s budget summary:

“In 2012 13, this is expected to result in an increase in annual local revenues (over the amounts they would have received in pass throughs) of approximately $1.0 billion for schools, $290 million for counties, $490 million for cities, and $100 million for non enterprise special districts. Funds received by K 14 schools would not count toward the Proposition 98 guarantee. These monies would augment existing funding, and could be used at the discretion of school and community college districts. The sums received by schools would be distributed to both school districts and community college districts throughout the county, primarily based on numbers of students.”

The Davis city council can use our city’s share of that $490 million for any redevelopment projects they choose, if the councilmembers consider redevelopment projects to be the highest priority for use of that money.

[url]http://www.ebudget.ca.gov/pdf/BudgetSummary/TaxReliefandLocalGovernment.pdf[/url]

Don, I spoke with someone who works in state government and here is the gist of what I learned:

1. The biggest winner from this change (in the long run) will be the K-12 schools and the community colleges. Under the current RDA system, they are harmed by the RDAs. They will continue to get their full funding as specified by Prop 98, and they will get an additional amount of money which is now going to the RDAs;

2. A second winner is the counties. I was told Yolo County is estimated to get an additional $500,000 per year, once this proposal takes full effect;

3. The state itself, after 2012-13, will be revenue neutral from this change. However, this fiscal year, the state will be a big winner, and Gov. [b]Brown expects to use that money to help solve the state’s current budget deficit problem[/b];

4. The big loser will obviously be the RDAs. It is true that more money than currently goes into the City of Davis general fund will be available to the City Council. But, that added money to the City is far less than the money they now have to spend acting as the Davis RDA. In other words, [b]the members of our Davis City Council will have less money than they do now once the RDA money is eliminated[/b].

Moreover, the large amount of borrowing the Davis RDA just did ($16.6 million) will ultimately have to be repaid by the City of Davis general fund. I was told the interest on the bonds they sold is 9%. (That sounds very high to me.) I don’t know what the period of repayment on those bonds is. If it is 30 years at 9%, that will cost $1,616,000 per year from our general fund each year. If it is 60 years, that will cost $1.5 million per year from our general fund. If the interest on the bonds is 7% and we have 50 years to repay them, the cost to the general fund will be $1.2 million per year. Regardless of the terms of the bonds, it looks like we will be taking a hit for some time.

The bottom line is that [b]when you take the money lost to the DRDA from the money gained by the Davis general fund, you come out with a substantial negative[/b] which redounds to the benefit of Yolo County and the DJUSD.

All that said, it will not be the case that the City of Davis (post-RDA) will not be able to finance needed infrastructure projects with bond financing in the future. If, say, the City wants to build an overpass from Olive Drive to E. 2nd Street, the Council could fund that with a new bond. The bond would have to be approved by the voters. (The legislation written by Lois Wolk would lower the percentage needed to pass such new bonds.) And those bonds would be repaid over time with general fund money.

So Rich, we are committed to the bonds the CC negotiated but what will that money be used for? Why couldn’t that $ be used for the Olive Dr connection?

RR, did your state govt. contact say how Brown was going to close budget deficits after 2012-2013 if future deficits are just as large or larger than they currently are? What’s stopping the state from using the funds that formerly went to RDAs every time they have a budget deficit?

[i]”RR, did your state govt. contact say how Brown was going to close budget deficits after 2012-2013 if future deficits are just as large or larger than they currently are?”[/i]

All I was told in this regard is that closing down the RDAs will provide the state budgetary relief just for one fiscal year; and thereafter this action will be neutral to the state budget.

In fact, the person who called me did so to let me know that my perception, voiced above, that this was going to be a transfer of money into the state’s coffers was wrong. (In truth, I was mixing my own presumptions with the understanding that it was going to benefit the state this year. I had not realized that was a one time deal until this person cleared it up for me.)

[i]”What’s stopping the state from using the funds that formerly went to RDAs every time they have a budget deficit?”[/i]

The extra money is going to the schools, the counties and some to cities (though, in cases like Davis, the amount going to Davis is well less than what is now going to the DRDA on a net basis). There is nothing to stop the legislature some point down the road from writing a new law which takes this extra money going mostly to the schools and giving it to the state. I specifically discussed that issue with the person I spoke with who works in state government.

[i]”So Rich, we are committed to the bonds the CC negotiated but what will that money be used for?”[/i]

Yes, apparently we are committed. I had no idea the bonds would be sold so fast, but was told they were sold at the end of last week. I was also told they came with a 9% interest rate, but that strikes me as very high. (See note below.)

[i]”Couldn’t that $ be used for the Olive Dr connection?”[/i]

I think it could. However, I think RDA money for as long as Davis has had an RDA could have been used to pay for a pedestrian/bike overpass or underpass connecting Olive Drive with a site on the other side of the tracks.

Note: I looked up current muni bond rates ([url]http://finance.yahoo.com/bonds/composite_bond_rates[/url]) and the highest rate seems to pay 5.54% for a 20 year A grade bond. A 20-year AAA grade muni pays 4.08% for comparison. The bond issuer does not necessarily get all of the interest. Some likely goes to a company, such as Goldman Sachs or JP Morgan, who conducts the sale. So if their vig is 2%, then I think the most we would be paying is 7.54%, if the DRDA is A-grade. (For the record, I really don’t know what the vig is on these sorts of sales, what Davis’ bond rating is, and if there are bond grades lower than A for munis. A is just the lowest listed on that chart.)

Alas, I still didn’t get this exactly right. My contact told me two things I posted above (6:27 pm) are slightly off:

1. Shutting down the DRDA does not have any benefit to Yolo County, because of our pass through agreement. However, there are 3 other RDAs in Yolo County, and closing them will become a $500,000 net benefit to Yolo County; and

2. The recently sold DRDA bonds will be paid off half by the City of Davis and half by the DJUSD. I would guess that the DJUSD portion will be covered by the amount it gains from closing the DRDA. So the City of Davis portion, if they sold 20-year grade A bonds at (let’s use a middle number) 8% will cost our general fund $845,373 per year for 20 years (and an equal amount will be covered by the DJUSD).

[quote]”But it very much reminds me of the push to finance redoing the school’s stadium w fancy press box and all… The analogy is apt.”[/quote] What’s the connection you see? I’m also curious why we should disregard the World’s Best California School Finance Expert who told the City Council that there’s no doubt that RDA results in less funding of schools and municipalities?

The RDA may have had a worthy objective when set up, but it seems to have turned into giant shell game, encouraging Davis and other governments to engage a series of questionable (but, apparently legal) schemes that we wouldn’t have seriously considered many of the projects if they had to compete with other general fund needs.

Lately, it seems, the program has been rolling along partly because everyone involved agreed to look the other way. Otherwise, what could account for the $1-million car dealer loan set up to wash RDA money so that the repayment comes to the general fund via taxes? Or channeling $2-million of RDA funds a year to Woodland in the form of a bribe to avoid zoning changes on our borders? (How can this arrangement be justified? Why would we buckle under the threat of stupid planning decisions. After all, the County is OUR government too. We couldn’t think of a better use for $20-million-plus in all this time? And, where we will we find the money now for this highest of city priorities?) [quote]Back in 2002, “(Katherine Hess) said the pass through agreement between the City, RDA and the County calls for passing through much of the county’s share of the tax increment. The agreement also provides that the amount of money passed through to the county can be stopped if the county approves urban development within the area specified in the pass-through agreement until the year 2025….(RDA Counsel Dave Beatty said that) the agency has the ability to acquire property and sell property for private purposes and has the ability to sell property for less than fair market value at its highest and best use. Agencies have the ability to sell bonds without the usual voting requirements. (A nice post-Prop. 13 workaround.)”[/quote] A significant amount of RDA money–ever wonder how much in the last decade?–has fueled our so-called affordable housing initiatives. What percent of the homes financed under these programs still are available at “affordable prices” and how many did anything more than provide a one-time windfall for their lucky first owners? Of which rental type programs are we proud?

Would our housing programs been developed less expensively and managed more effectively if easy money from the state and from no-vote local bond-selling? Or would many of them been pursued at all?

How many of the other recent projects–energy, art, cute street concepts, you know the list–would we have funded if we didn’t have free money to spend. If we never again hear that we should overlook the craziness of some idea because RDA money’s involved, it’ll be a week too soon.

We’ve known for years that our “grandfathered blight” wouldn’t come close to qualifying if we needed to reapply, but we aren’t at all embarrassed to keep spending on solving “blight” like the Hanlees business. Every bit of RDA money we spend costs serious money in the form of bonds. And it doesn’t shame us to be borrowing millions on our kid’s credit to keep chasing after this cash in one, giant last burst as though the program’s having some kind of going-out-of-business sale.

No doubt, I’d feel differently about RDA spending if in all these years there’d been some effort to deal with the true blight in our town: almost any part of Olive Drive neighborhoods and business areas as well as our dead-zone [u]Enterprise[/u] and Davis Hardware blocks. And to dress up Bob Dunning’s neighborhood. And to help our school district to rebuild the high school multi-purpose room for Elaine.

Unfortunately, I have been too busy today to log on, but to repeat what I have written in previous threads: The RDA’s are important for two reasons.

1) First, they provide some extra money to urban areas. Since proposition 13 has eroded local revenues, both the schools and the cities have needed some additional revenue. Schools, for example, have gotten state matching funds for school construction. The RDA’s began to perform a similar function for cities. Both schools and cities need the extra funds. To pit one against the other is ridiculous. The state can give the schools as much money as it wants to. It can take that money from cities (AKA RDAs) or, for example, from prisons and unsustainable public safety compensation packages. Or it can raise taxes on the wealthy or try to adjust Prop. 13 with regards to commercial property (it can exempt ownership homes adjustments if desired).

In summary: There are many ways to give the schools more money. It has been spun as schools vs. cities, which is not constructive. Redevelopment Agencies do need some major reform and oversight, but they should be maintained.

2) RDA’s set money aside which must be used for public investment such as infrastructure and economic development loans. If RDAs are eliminated, whatever fraction of the tax revenue that remains for cities will go into the general fund. Once in the general fund, it will doubtless end up in labor compensation.

I have always suspected that the RDA elimination attempt is motivated more by promises to a certain public safety union than by the belief that it is necessary component for balancing the state budget. The amount of money involved just isn’t large enough compared to the state budget. And it is opposed by the same Republicans who oppose the absolutely tiny tax increase on the wealthy that would be necessary to maintain it.

When you hear hoofbeats think of horses, not zebras. If the RDAs are eliminated, there is nothing to protect the set-aside of public infrastructure and economic development funds from the bottomless pit of unsustainable compensation packages. And the rank and file non-public safety workers are NOT where the main problem lies.

I would just like to add that we will not be able to merely “pass bonds” to substitute for the RDAs, with or without a lower passage threshold. The advantage of RDAs is that they receive funds from the state’s general revenue. As I have said, these funds have become increasingly essential as Prop. 13 has eroded the cities revenue base, just as it has eroded the schools’ revenue base (requiring state matching funds for school construction).

There is only so much that can be laid on the homeowner before the homeowner will refuse to pass more taxes and bonds. I hope I am wrong, but I am a realist. And does the school district really want more homeowner property tax-related city bonds and taxes on the ballot when they themselves need to dip into that pocketbook?

Unless we want to become a banana republic, we will have to invest in infrastructure, and we need to have money set aside in an untouchable fund, such as the RDA. Those funds will ultimately have to be supplemented, perhaps with with commercial property tax increases, oil extraction taxes, etc. We will have to look at state laws that forbid jurisdictions from charging developers for the full costs associated with new development. We will have to deal with collecting internet sales taxes for local jurisdictions.

But I don’t think that homeowners are going to voluntarily step forward and pay these bills, most of it related to infrastructure that is basically made necessary by state-mandated new development.

To Sue Greenwald: You make some excellent points, to wit:

“In summary: There are many ways to give the schools more money. It has been spun as schools vs. cities, which is not constructive. Redevelopment Agencies do need some major reform and oversight, but they should be maintained.”

“RDA’s set money aside which must be used for public investment such as infrastructure and economic development loans. If RDAs are eliminated, whatever fraction of the tax revenue that remains for cities will go into the general fund. Once in the general fund, it will doubtless end up in labor compensation.”

“There is only so much that can be laid on the homeowner before the homeowner will refuse to pass more taxes and bonds. I hope I am wrong, but I am a realist. And does the school district really want more homeowner property tax-related city bonds and taxes on the ballot when they themselves need to dip into that pocketbook?”

These are some of the intended/unintended consequences of eliminating RDAs. Reform them yes, do away w them no. As Paul Navazio pointed out, Davis schools only stand to gain a measly $250,000 next year if RDAs are eliminated. Yet Davis would literally lose millions in redevelopment funding.

By the way, Sue, is CDBG funding in any way connected to our city’s RDA?

JS: “I’m also curious why we should disregard the World’s Best California School Finance Expert who told the City Council that there’s no doubt that RDA results in less funding of schools and municipalities?”

There is a huge assumption here – that if RDAs are done away with, all that money will end up back in the hands of our local schools and counties. Trust me, this is NOT GOING TO HAPPEN. EVEN THE LAO REPORT ADMITS IT IS NOT CLEAR HOW THE MONEY FROM ELIMINATED RDAS WILL BE TRANSFERRED BACK TO THE LOCAL SCHOOLS AND COUNTIES. If the gov’t doesn’t know how that is going to work, you can bet your bottom dollar that is a euphamism for “well, perhaps not all of it trickle down to the local level….after all we have a massive state budget full of PEU employees who have to be paid their wages/benefits first, PEU employees which after all make up at least 67% of the state’s budget…”

JS: “How many of the other recent projects–energy, art, cute street concepts, you know the list–would we have funded if we didn’t have free money to spend. If we never again hear that we should overlook the craziness of some idea because RDA money’s involved, it’ll be a week too soon.”

So what you are admitting is that if RDAs are eliminated, voters will choose to turn over whatever former RDA funding trickles down towards schools, and the heck w infrastructure/economic development? Schools are a bottomless pit – there will never be enough money for our schools until we have one on one student ratios…we have been spending more and more on schools and yet the quality of education has been getting worse rather than improving…

JS: “We’ve known for years that our “grandfathered blight” wouldn’t come close to qualifying if we needed to reapply, but we aren’t at all embarrassed to keep spending on solving “blight” like the Hanlees business.”

For every dollar brought in by Hanlee’s per year over approx $130,000, the city would keep the tax revenue in exchange for a dollar in loan indebtedness to the RDA. That would have generously fed the tax coffers of our fair city…

To Rich Rifkin: You make excellent points, to wit:

“The extra money is going to the schools, the counties and some to cities (though, in cases like Davis, the amount going to Davis is well less than what is now going to the DRDA on a net basis). There is nothing to stop the legislature some point down the road from writing a new law which takes this extra money going mostly to the schools and giving it to the state. I specifically discussed that issue with the person I spoke with who works in state government.”

“3. The state itself, after 2012-13, will be revenue neutral from this change. However, this fiscal year, the state will be a big winner, and Gov. Brown expects to use that money to help solve the state’s current budget deficit problem;”

“4. The big loser will obviously be the RDAs. It is true that more money than currently goes into the City of Davis general fund will be available to the City Council. But, that added money to the City is far less than the money they now have to spend acting as the Davis RDA. In other words, the members of our Davis City Council will have less money than they do now once the RDA money is eliminated.”

“The money which is now going to the DRDA will no longer be available for Davis projects. Much of it will go to the K-14 schools, which relieves state obligations. The counties will be treated on a revenue neutral basis. In sum, the state is relieved of some of its school expenses, the counties become revenue neutral, and the RDAs (which generally are cities) are s.o.l.”

“That’s not an unintended consequence. That is precisely why Brown wants to get rid of the RDAs. Doing so feeds money that is being spent locally to the state.”

[i]there will never be enough money for our schools until we have one on one student ratios…we have been spending more and more on schools and yet the quality of education has been getting worse rather than improving… [/i]

So do you believe we should spend less on the schools than we do now?

DS: “So do you believe we should spend less on the schools than we do now?”

I think we should spend smarter…

Let’s take one example in higher education: did we really need a new sports stadium at UCD and all the money it takes to operate it?

Let’s take another example in public education K-12: did we really need a fancy press box as part of the stadium upgrade and all the money it takes to operate it?

That isn’t an answer. Do you think the budget for public education should be lower, the same, or higher than it is now?

[u]Don and Elaine[/u]: I’ll grant that one person’s school athletic field with fancy press box for DHS is another person’s new Chiles Road building with a fancy breakroom for Hanlees salespeople.

I’d like the community to have more freedom to chose without the state redirecting the money from schools and municipalities to send along to an RDAs to pass out to developers and other businesses like Hanlees and Zipcar via secret negotiations.

One can make arguments for each type of investment. I can’t really prove that nice school facilities will provide a bigger payoff for Davis in 15 years than most of our RDA projects. But, to answer Don’s question, I think the budget for public education should be higher. It undoubtable would be if RCAs had not existed during the last decade.

Does anyone here know why we’ve been paying $2-million in protection money to keep our own county from approving development near us (development that, incidentally and ironically, would have improved the local economy)?

Why has this been such a high priority and expensive proposition for our city council for all these years? Couldn’t we have come up with ANYTHING that would have done more to rid Davis of blight and improve the economy in our town for our $20-million?

Now that we won’t have the RDA cash to pass through, will we have to start a militia to keep Don Saylor and his minions from desecrating our borders?

JustSaying, what an appropriate name. Is it just me, or do JS’s posts come across as some serious ranting consisting of gross generalizations, opinions unsupported by facts, and factual misstatements? Either that, or I simply don’t have the mental horsepower to keep up.

JustSaying: if you want to know the whole history of how the redevelopment agency and the pass-through agreement came to be, here is Mike Fitch’s account of the Mace Ranch development that spawned the whole thing: [url]http://cityofdavis.org/cdd/cultural/30years/chapt06.cfm[/url]

[u]Mr. Businessman[/u], I suspect I do better when I’m agreeing with you. I’d guess I rant as much as the next poster when the topic primarily is a question of conclusions and I sometimes generalize grossly when the topic is a big picture one. I try to avoid factual misstatements in any case and am open to changing my generalizations (while ranting or not) if people correct any misstated facts. I’ll work harder on it.

In this case, I was trying to find out some things. Why the $2-million annual payment to the county, and what happens to the “agreement” if RDA money no longer is available to pay them? I’ve asked Sue, David and others for the history and rationale several times and have yet to get an answer.

I’ve provided sources and specifics for my limited knowhow about this pass-through issue. I’d welcome your knowledge about this since I recognize that you have a lot of Davis economic development background. Please help on this topic if you’re able.

I joined Don’s and Elaine’s education-priority discussion with my own opinion while granting that others have different ones. You know about opinions–they can develop before all the facts are in.

So far, I agree with the California finance expert who claims that RDA’s have been funded to the disadvantage of school and city budgets. That means we should requiring a very high standard for RDA spending, in my opinion.

I’ve given specifics for projects I think haven’t met such a standard. It’s not that I’ll never change my opinions if I find out my “current facts” are wrong. As you’ve said before, I don’t know what else I can do at this point. Change my name?

[u]Don[/u], thanks for the reference link. Hadn’t known about this resource before, so I’ll get to reading….

To Don Shor: Right now, I would not change the funding to schools. To do so would require more layoffs, which is not to anyone’s advantage. But I would demand a change in the way schools do business. We have a mediocre school system in general that could do better w proven tried and true techniques that work. I agree w your assessment in another post that computerized classroom instruction will not work well for most students, particularly those w learning disabilities or who are not self-motivated.

I find it interesting that those who would end RDAs to free up money for the state’s general fund are not demanding the end to compartmentalizing of funds in our schools, so that things like press boxes are not built as teachers are getting laid off…

To Just Saying: If RDAs are eliminated, the pass-through agreement between the county and city will most definitely be in jeopardy. If the pass through agreement is no longer in place, and the county then chooses to build on the periphery of the city no matter how much the city cries foul, it means all the fallout/responsibility from additional traffic, competing businesses, etc. will fall to the city. The county will gain tax revenue, but the city will be the big loser. How does that possibility work for you?

[u]Elaine[/u], I’m still working on the fascinating reading assignment Don gave me. So, I’ll have to get back to you on this and the other questions you’ve asked of me.

In the meantime, please help me with these questions related to your last point:

1. Do you think it’s worth the City of Davis paying Yolo County $2-million every year in the HOPE (but with no guarantee) that the county won’t encourage then approve developments along our city limits?

2. If so, do you support taking the money from our general fund in order to continuing paying off the county to keep this hope alive if the RDA money dries up?

JS: “1. Do you think it’s worth the City of Davis paying Yolo County $2-million every year in the HOPE (but with no guarantee) that the county won’t encourage then approve developments along our city limits?

2. If so, do you support taking the money from our general fund in order to continuing paying off the county to keep this hope alive if the RDA money dries up?”

1. With RDA funds, probably yes, bc the fiscal impacts to the city of peripheral development will be far, far greater than a measly $2 million.

2. If RDA funding goes away, I think the city will have to accept the fact that peripheral development will happen, bc the city just will not have $2 million in general fund money at its disposal to continue funding the pass-through agreement. The money that trickles back to the city from defunct RDAs will be far less than what is available in RDAs in existence today (For every $10 million in RDAs, only $2 million will find its way back locally is what I read – i.e. 20%).

And just to add context, that 20% returning locally will have to be divided between city, county, schools….

“[quote]…the fiscal impacts to the city of peripheral development will be far, far greater than a measly $2 million.”[/quote] Accepting your opinion, I’m still perplexed. If paying the county has been making financial sense for all these years, why would we abandon the cost-effective practice if the only thing that’s changed is RDA?

So far, I’m gathering the arrangement was a poor one for Davis to make in the first place. It provides no guarantees that the county won’t approve nearby subdivisions the instant it figures it can increase its revenues that way. It has sucked away $20-million+plus(?) away that we could have used for Davis streets and other infrastructure.

It’s just plain offensive that a municipality would be paying blackmail to our own county government to influence its land use decisions. There are other, better ways to affect county zoning decisions. It implies that we’ll acquiesce county bad acts if the day comes that we stop making the protection payments (the situation we now find ourselves facing, right?).

The concept that paying the county $2-million a year from our RDA money is just fine, but that paying from our other pockets isn’t, illustrates the bigger, unfixable problem I see with RDA. Our RDA cash is seen as less valuable (by 25%? 53%? 89%?) than the city’s other money. It’s easier to obtain. It makes bonds easy to issue.

The way RDA is managed also encourages spending on questionable local schemes that twist RDA’s declared objectives, that compete only with unprioritized or low-priority local projects and that require low planning and accountability levels.

I don’t know what the future holds for largesse of the state with respect to Davis. With or with RDA in our future, it doesn’t look at all promising. Keeping RDA won’t guarantee we’ll keep getting our level of funding. Getting rid of it will improve California’s budget planning and transparency…and the city’s.