A Field Poll released Wednesday indicates the voters are willing to consider an extension of the tax measures that Governor Jerry Brown has proposed, as a means for closing the deficit and avoiding an addition 11 to 14 billion dollars in cuts to the state budget.

A Field Poll released Wednesday indicates the voters are willing to consider an extension of the tax measures that Governor Jerry Brown has proposed, as a means for closing the deficit and avoiding an addition 11 to 14 billion dollars in cuts to the state budget.

In a release from the Field Poll, they find, “Voters generally do not favor simply increasing taxes as a way of dealing with the estimated $25 billion budget deficit facing the state over the next eighteen months.”

Moreover, the vast majority of voters favored calling a special election to deal with these proposals. 61% of voters prefer calling a special election to settle the budget issues, while just 36% prefer leaving it to the legislature to decide.

Asked more directly, “The governor is proposing to extend for five more years the one-cent increase in the state sales tax, the ½ percent increase in vehicle license fees and the ¼ percent increase in personal income taxes that the state enacted in 2009. Some of the money would be transferred to local governments for schools, public safety and other services. If the statewide special election were held today, would you vote yes to approve this extension of taxes or no to return these taxes to their previous levels?”

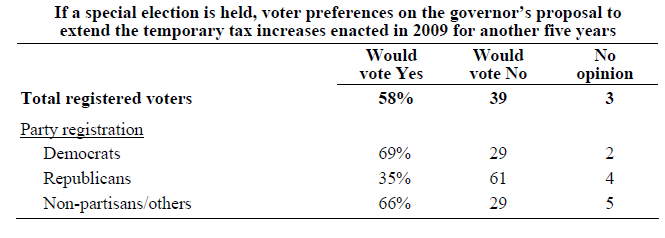

In this setting, by a 58% to 39% margin, voters say they would vote yes to support the governor’s proposal.

Democratic voters (69%) and non-partisans (66%) heavily endorse the governor’s proposal. This is in sharp contrast to the views of Republicans, who are opposed 61% to 35%.

“Generally, the governor’s proposals have been pretty much in sync with where the public has been coming from,” poll director Mark DiCamillo said. “The problem is that he needs the Legislature to get these on the ballot.”

Governor Brown only has weeks to put his proposals on the ballot, and right now he does not have Republican support. Democratic leaders have scheduled floor votes today on the budget plan, but most analysts believe there is little chance that the Democrats have been able to secure the two Republican voters they need in both houses to reach two-thirds.

There are, however, ways to accomplish this through a majority vote – an approach the Republicans have pushed but Democrats have balked at.

It should be clear that, while people support a special election and even the extension of the tax increase already on the books, they do not support higher taxes in general.

Only 11% of registered voters favor favor relying mostly on increases in tax revenue as the way to close the deficit. 32%, on the other hand, favor mostly spending cuts as the remedy. Whereas the bulk of the voters, 52%, would opt for some equal mix of spending cuts and increases in tax revenues.

Democrats and Republicans are polarized on this issue. 62% of Democrats favor an equal mix, 20% favor spending cuts, and 14% favor tax increases.

Republicans, on the other hand, favor a budget based primarily on spending cuts (51%), but 40% would favor the mixed approach.

And time is ticking. The current tax rates on sales and vehicles expire at the end of June. If they expire, opponents to tax increases could call the Governor’s plan a tax increase.

While 61% percent support the special election, that does not mean that everyone who supports the election backs the Governor’s plan. Indeed, 56% of Republican want to vote on the plan even though only 35% of them support it.

Governor Brown’s press secretary Gil Duran said on Tuesday, “It is unclear why the Republicans think it is smart to obstruct the right of the people to vote on a budget solution.”

However, Republican Senator Tony Strickland indicated that he thinks it makes sense that voters want to have a say in their government.

“Of course, people want their voice to be heard, and the thing we’re pushing for is that people should have more options than Jerry Brown’s option,” said Senator Strickland

However, at this point, something is going to have to change. Time is running out to put the measure on the ballot for June. Democrats are either going to have to do a majority vote tax extension or Republicans will have to allow the measure to be put on the ballot.

If they wait too long, we are looking at an all-cuts budget that figure once again to decimate education and the programs that most voters least want to cut.

The Field Poll found between 61% and 74% opposition to cuts in six major spending areas: the k-12 public schools, law enforcement and police, health care programs for low income and disabled Californians, higher education including public universities, colleges and community colleges, spending for child care, and mental health services.

Small pluralities also oppose cuts in six other spending areas: environmental regulations, state road building and repair, state parks and recreational facilities, public transportation, public assistance to low-income families with dependent children, and water storage and supply facilities.

Overall, while a majority of voters prefer “eliminating the state budget deficit through a roughly equal mix of spending cuts and increases in tax revenues, voters have a hard time identifying which specific state program areas they would be willing to cut.”

Indeed, the majority only supports cuts in two areas: the courts, and state prisons and correctional facilities, which is interesting because they strongly oppose cuts to law enforcement and the police. On the other hand, the voters have led to a huge increase in the costs to prisons and correctional facilities by voting in a series of mandatory determinate sentences that have clogged the court system and filled the prisons.

—David M. Greenwald reporting

dmg: “However, at this point, something is going to have to change. Time is running out to put the measure on the ballot for June. Democrats are either going to have to do a majority vote tax extension or Republicans will have to allow the measure to be put on the ballot.”

If the Democrats can extend taxes through a majority vote, then they should put up or shut up. Either they have the courage of their convictions or they don’t. They should stop looking for cover from Republicans, who clearly are not going to give it. If the Democrats so firmly believe that the tax extensions are the right thing to do, then they should suck it up and do it!

I agree with Elaine. the republicans do not have the power to stop a democrat backed extension of the tax. The democrats are being cowards – trying to hide behind republican “opposition” which could not stop them if they wanted to press through.

Marcos Breton: Republican city schools chief fights to bring GOP around on taxes

[url]http://www.sacbee.com/2011/03/13/3471411/marcos-breton-republican-city.html[/url]

What happens when the shoe is on the other foot; a Ronald Reagan Republican supports the state tax extension.

The Democrats can ram it through, they only want Republican votes so they can say it was bi-partisan if their whole scheme fails.

I’m not a Democrat. I support the tax extensions. I don’t need Republican cover.

It’s funny, the Republicans sought the legislative counsel’s opinion. Why? The opinion is very shaky. Here is Senate Republican leader Bob Dutton’s spokesman:

“‘If it stands up legally, it shows Democrats could put tax hikes on the ballot without Republican votes,’ said Dutton spokeswoman Jann Taber.”

[i]If it stands up legally. [/i]So if the Democrats put the tax measure on the ballot, and it passes, it is sure to end up in court. I’d guess Republicans would be the ones filing the first lawsuits. That’s how Republicans want to govern?

[i]It’s funny, the Republicans sought the legislative counsel’s opinion. Why? The opinion is very shaky.[/i]

It’s Republican cover to not feel pressured to participate.

Don hits on a key point and actually I should have made it more clear, the tax extension would be extremely limited if legal to do it majority rule. I think they may have to do it that way, but in fairness to Democrats, it is not only political considerations that are part of the calculation, they will lose a ton of flexibility and as Don points out if it is even legal. It is also interesting to me how many people are willing to give Republicans a complete pass here for their non-cooperation.

I give the republicans a pass for their non cooperation because it doesn’t require their cooperation to get it through.

Don Shor: “So if the Democrats put the tax measure on the ballot, and it passes, it is sure to end up in court. I’d guess Republicans would be the ones filing the first lawsuits. That’s how Republicans want to govern?”

why would it end up in court? and even if it did, are you saying the tax extensions are unlawful? if you are, then they should not be passed. if they are not, then the democrats can weather any legal battles, and the republicans are out of gas. but either way, you and david are still hiding behind republican opposition. the democrats could get it through in the next second, if they wanted to.

dmg: “It is also interesting to me how many people are willing to give Republicans a complete pass here for their non-cooperation.”

It is also interesting to me how many people are willing to give Democrats a complete pass here for ducking responsibility… do what Gov. Walker did in Wisconsin…

DTB: “I’m not a Democrat. I support the tax extensions. I don’t need Republican cover.”

Precisely…

Jon Coupal can and would.

File a lawsuit, that is.