City Shrugs Off PERB Setback and Keeps Going to Fiscal Solvency –

City Shrugs Off PERB Setback and Keeps Going to Fiscal Solvency –

The city suffered an expected but momentary setback when it learned, on Tuesday afternoon, that the Public Employees Relations Board had denied their appeal and made the Administrative Law Judge’s ruling from November 2011 its own, finding that “the City violated the Meyers-Milias-Brown Act by implementing its last, best and final offer without exhausting impasse resolution procedures set forth in the City’s applicable local rules.”

One thing was par for the course on Tuesday night, in that the budget discussion did not begin until nearly midnight, but it was a short and quick discussion, with the real discussion and work coming at the next meeting.

As we noted previously and will discuss in far greater detail in a separate article, in order to absorb the $800,000 hit to the budget in back pay and benefits, the city has moved to lay off at least nine employees and reduce the workload of three others.

Late last night, City Manager Steve Pinkerton introduced his first budget as city manager for the city of Davis. And while we have fuller discussion and analysis, in many ways this is an even more revolutionary budget than the one the council adopted last year, which cut $2.5 million from personnel costs.

If employees believed they would gain advantage from the delay, they will be sorely mistaken. We expect a fuller response shortly from employee groups.

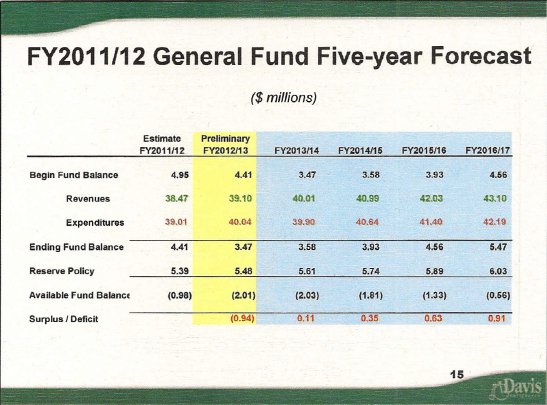

The budget increases general fund expenditures by $1 million from last year, while revenue increased only $600,000. In so doing, the city manager is asking for a temporary reduction in the general fund reserve to 9.5%.

For several years now we have been warning about road maintenance and the declining condition of the city’s roadways and bikepaths. This new budget deals with that issue head on, increasing funding by nearly $2 million.

That puts the expenditures at $3.14 million, of which $2.34 million come from the general fund and another $800,000 from the roadway impact fee.

Meanwhile, the city has taken steps to deal with the unfunded liability in retiree medical. Under previous plans the city would slowly ramp up to full annual funding at the 20% level. Under this budget, they get there now reaching $1.74 million with a one million overall hit to the general fund.

On PERS (Public Employees’ Retirement System), the city is not going to wait for PERS to rate-smooth their way into the reduction in the earnings forecast; the city proactively will fund the $678,000 all funds and $490,000 general fund hit.

Finally, the city takes the hit on the PERB ruling to the tune of $1 million, of which $405,000 comes from the general fund.

To pay for this, the city is going to find $3 million of it, $1.7 million from the general fund in the city’s reorganization plan which combines a number of factors like functional efficiencies, retirement, attrition, shared services and community partnerships to reach savings.

A huge hit is coming from the employee groups. The city, instead of the $2.5 million hit last year, is looking at $4 million from all bargaining units and $3 million from the general fund.

By our count then, the city is getting more than halfway to the $7.5 million general fund cuts in one budget. It will be interesting to see how the city manager calculates the remaining needs.

The city figures this will result in a 29 FTE (full time equivalent) hit to the city. That number could be higher if the personnel savings do not come in with the MOUs.

The city would actually add one police officer position due to AB 109 funding, but have 4 regular positions reduced to part time and 26 others eliminated.

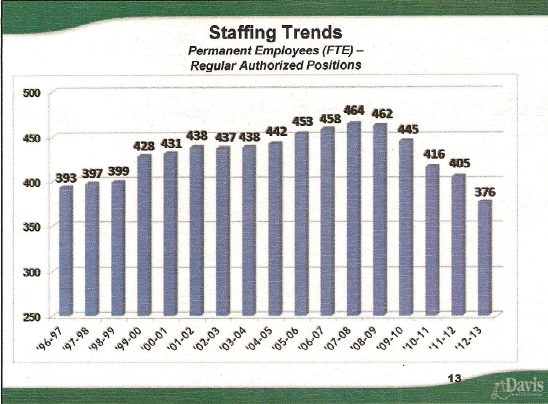

That will make a 15.5% overall staff reduction over the last four years, and they estimate the elimination of eight management positions, which marks a 22% reduction.

We will have 69 fewer FTE’s than we did in the 2009-10 budget.

That will put the city at 376 FTE positions, meaning we will have the smallest actual work force in 17 years, and a reduction of 88 positions since the 2007-08 peak just before the economic crisis hit.

The revenue and expenditure forecasts now remain relatively flat with only a slight uptick expected in revenue and expenditures in the next five budgets.

Will this avert the crisis?

Obviously, we will have much more on this question. However, in the interim, it is important to note that much of the hardest work still remains to be accomplished.

$4 million of this proposal, which takes about $4.8 million from general fund expenditures and $7 million from all funds, comes from contract proposals from the bargaining units.

Recall last year, a more modest but at that time stunning $2.5 million proposal resulted in 150 employees coming to city hall to complain. This is a much more expansive move.

In order to get to where the city needs to be they cannot simply lay off $4 million worth of employees – from all funds. They have to actually fix the pensions, OPEB (Other Post-Employment Benefits), cafeteria cash out systems – make the structural changes.

We will get the city employees’ perspectives on this shortly, but the bottom line is that the easy part is to put the $4 million number on paper (along with $3 million in layoffs and reorganization) – the hard part is still to come.

However, the fact that the city is willing to put on paper a commitment to fully fund unmet infrastructure needs, the willingness to attack unfunded liabilities on OPEB and pensions, and put real numbers to the proposals is a promising beginning.

—David M. Greenwald reporting

[quote]That will make a 15.5% overall staff reduction over the last four years and they estimate the elimination of eight management positions, which marks a 22% reduction.[/quote]Per the earlier CM piece, these were the percentages that have ALREADY occurred. How many “new” cuts in FTE, and how many of THOSE will come from “management”?

We know of one, Elvia Garcia’s positions will not be filled.

But in my opinion, not nearly enough will come from management.

Seems like a fair start.

[i]A huge hit is coming from the employee groups. [/i]

So the City Manager is willing to throw employees overboard ($4 million as an *[i]opener[/i]*???), in order to replace them with privateers? Been there, seen those tactics by, among others, union-busting law firms during the 80’s. Cry the ‘necessary’ loss of services, blame the last of the middle class wager-earners, while personally taking home a ‘total compensation’ package twice the size of the highest paid City employee. Play ‘pained and constrained’ in public, hardball behind closed doors.

Nothing new here, except the supposedly ‘progressive’ nature of the Council and the community, who have, for the most part, been exposed as allied with the conservative right.

As hpierce notes, Pinkerton wrote yesterday: “Since budget year 2009/2010….the City’s work force has dropped from 445 full time equivalents to 376 full time equivalents over the last four years, a 15.5% overall staff reduction. Included in this reduction is the deletion of 8 management positions….”

Your report suggests an “estimate” of eight management positions, which makes it sound as though this new budget is eliminating more management positions. Which eight management positions already are gone? Were any management positions created during this period? Are any additional management positions specifically targeted in this new budget? If not, how do we come up with an “estimate” of any savings from manager positions in the new budget proposal?

One of the graphs shows a roughly $4.5 million revenue increase over the projected 5 year period. What are the assumptions supporting the revenue projections? David, you gloss over the revenue “uptick”. What does the budget look like without the “uptick”? It seems to me the “uptick” is critical.

-Michael Bisch

You’ve given us the Vanguard reaction. What was our city council’s reaction to the budget proposal? Or did you leave at a respectable hour? Good thing Harriet has agreed to give us a per-meeting (instead of an hourly) rate. If the meetings keep going into the next day, we’ll eventually get her to “reimburse” us for her incorrect legal advice.

“A huge hit is coming from the employee groups. The city instead of the $2.5 million hit last year, is looking at $4 million from all bargaining units and $3 million general fund.”

Please clarify the differences between the $3-million general fund money and the $4-million “from all bargaining units” money.

“So the City Manager is willing to throw employees overboard ($4 million as an *opener*???), in order to replace them with privateers.”

How much savings come from eliminating city positions and paying private companies to do the work?

Have our city employees priced themselves out of the competitive market entirely through unreasonable collective bargaining demands? Or, are two changes in broad public vs. public employment practices (defined benefit pensions and generous health care plans at low employee cost) really what’s responsible?

[i]How much savings come from eliminating city positions and paying private companies to do the work? [/i]

False equivalence. There is no comparison between a private company driven to make profit by any means necessary, and government workers charged with the health and safety of the people in their respective communities.

[quote]Or, are two changes in broad public vs. public employment practices (defined benefit pensions and generous health care plans at low employee cost) really what’s responsible? [/quote]Let us not forget two other programs that are not sustainable without more contributions from employers and employees…. Social Security and Medicare. One fix for the latter two seems to be removing the income ceilings from the taxation formulae. If the rates are unchanged, and all we did is remove the ceilings. bioth programs could be made solvent.

[i]”The budget increases general fund expenditures by $1 million from last year, while revenue increased only $600,000. In so doing, the city manager is asking for a temporary reduction in the general fund reserve to 9.5%.”[/i]

I think this is a good move. The purpose of having a general fund reserve is to help smooth out spending during recessionary periods.

In normal times, Davis can count on revenue growth of 2.5% to 3.0%. During the bubble years (due in part to a lot of construction tax and much more so due to rising property tax), the city’s revenues were growing much faster than 3% per year. Since the crash of 2008, our revenue growth has been closer to 0%.

When the city’s income is growing faster than 3%, we should try to restrain the growth of expenditures and either put money in the reserve account or fund one-time major infrastructure projects or improvements. When the city’s income is growing fslower than 2%, we should spend down the reserve funds in order to avoid lay-offs or reductions in salary to city workers.

I know David Greenwald disagrees with me on spending down the reserves. But I strongly feel that is what we have them for–to use when the economy is bad in order that we don’t have to hurt our labor force so much. Yes, we need some money for the possibility of a natural disaster of some sort. But we probably should just purchase insurance for cases like that.

My take on the state budget crisis follows this same sort of thinking: I believe we got into the trouble that we are in at the state level because revenues grew very fast from 2002-08 and state spending (due in large part to Prop 98) grew equally fast. We should have restricted the growth in spending during those years to 3% per year, and put away the rest for a rainy day. But when the crash came in 2008, the state was put in a position where it had to make deep cuts, and that has been the case every fiscal year since. If the state had spent rationally during the bubble years (and had not built up such huge retiree benefit liabilities), the post-2008 crisis would have been much less painful.

And if you understand that–and you understand that the State of California spends 25% to 50% more than almost every other state for construction costs, freeway maintenance, prisons, direct labor costs, etc. and you know that we have the highest tax rates of all states–you would have to conclude that Jerry Brown’s plan to raise taxes this fall is crazy. It does not solve any of our real problems. It approaches the problem from the wrong direction. It does not give us any way to get out of the messes we keep getting in. And, worst of all, it probably won’t generate very much marginal revenue, because it will likely drive a lot of income that is now in California to other states (even if the rich people don’t move away).

[quote]When the city’s income is growing faster than 3%, we should try to restrain the growth of expenditures and either put money in the reserve account or fund one-time major infrastructure projects or improvements. When the city’s income is growing slower than 2%, we should spend down the reserve funds in order to avoid lay-offs or reductions in salary to city workers. [/quote]Mr Rikkin’s comments make sense, with one caveat: we need to look at “real” growth, subtracting ‘growth’ due to inflation. With everything else, we have been historically lucky (in recent years) in not dealing with significant inflation (particularly compared to the late 70’s). If inflation runs @ 8%, revenues might be expected to match this. If not, or even if revenue increases exceed this, limiting expenditures to 2-3% increase could be disastrous to employees.

[i]”In order to get to where the city needs to be they cannot simply lay off [b]$4 million[/b] worth of employees – from all funds. They have to actually fix the pensions, OPEB (Other Post-Employment Benefits), [b]cafeteria cash out[/b] systems – make the structural changes.”[/i]

I don’t know what the cafeteria cash-out will cost the City in 2011-12, but a few years back it was $4 million, and I would guess it is roughly the same.

(Why not higher? Because now non-safety employees can cash-out only 90%; safety gets 80%, though safety has a higher benefit basis. Why not lower? Because each year medical premiums have inflated by roughly 8% to 10%.)

The most important change in the last round of labor contracts (for all but DCEA) was an effective end to cafeteria cash-outs for new hires (starting in 2010 for most, I think)*. New hires still have the same cafeteria basis, roughly $20,000 per person per year. But they are capped at $6,000 per year for their cash-outs, and that really gets rid of the cost of cash-outs for them. Why? Because $6,000 per year is roughly what a minimum plan for one person with no spouse, no kids costs. So if the new hire takes the City’s plan and has no wife and no kids, he will spend $6,000 and have nothing left to cash-out. If the new hire has her husband on her plan, it will cost well more than $6,000 and she will get no cash out. And if the new hire is covered by her husband’s insurance, she can get a $6,000 cash-out, but that costs the City no more than if it just covered her, and it costs the City half of what it would cost to cover her and her husband.

So why is that an important change, given that we have had almost no new hires since this change went into effect? Because, I believe, it will serve as the model for the new contracts for all ongoing City employees starting the next fiscal year (July 1, 2012). That won’t make that annual $4 million bill disappear. But I would guess that it will reduce it to under $2 million, and maybe closer to $1 million. That is a fairly substantial savings, and it will not be a one-time savings. It gets bigger every year, as premiums go up in price (as long as we don’t let the $6,000 per year figure inflate).

———————

*This is the language from the PASEA contract: [quote]For those employees hired after February 8, 2010, a lower “cash out” cap applies. If such an employee uses the health and/or dental insurance benefit, then the difference between the premium and [b]$500 can be cashed-out each month[/b] provided a proper election has been made. If such an employee has outside health/dental insurance coverage (such as through a spouse, domestic partner or alternative retirement), the employee can cash-out a maximum of $500 per month provided a proper election has been made. [/quote] Note, of course, that $500 per month = $6,000 per year.

[i]”Mr [b]Rikkin’s[/b] comments make sense, with one caveat: we need to look at “real” growth, subtracting ‘growth’ due to inflation.”[/i]

Although I have not met Mr. Rikkin, I tend to like that Finnish sounding name.

That said, HP makes a good point. If inflation is running very high (and as a result the City’s nominal income from taxes is running very high), it would not make much sense to hold steady to a figure, 3%, which assumes relatively low inflation. So maybe the right answer is to figure out a steadier growth constant in real dollars, whatever that is. And also, of course, we should try to make real revenue growth higher by attracting more business, if the residents of Davis do not object.

[i]”If inflation runs @ 8%, revenues might be expected to match this. If not, or even if revenue increases exceed this, limiting expenditures to 2-3% increase could be disastrous to employees.”[/i]

FWIW, the argument that CalPERS used to lower its expected returns on investment were based entirely on the premise that we will have much lower inflation going forward. CalPERS did not say that its real rates of return on its investments would be lower. Only that its nominal returns would be lower due to a reduced inflation assumption.

“Yes, we need some money for the possibility of a natural disaster of some sort. But we probably should just purchase insurance for cases like that.”

We’ve already got the top end of this “insured” already, by the longtime practice of the federal and state to step in to assist in declared disaster areas.

“False equivalence. There is no comparison….”

I’m not trying to make some “equivalence” here, just asking how much in real savings are being claimed by privatizing what have been government positions. Given the differences in worker motivations and other values of civil service employment that you note, is it “worth it” to outsource the work?

“Let us not forget two other programs that are not sustainable without more contributions from employers and employees….”

But, this doesn’t affect the cost of doing business city staff vs. private contractor, does it?

Re. cafteria cash outs, I see no reason for them at all except to disguise past salary increases. I guess a case can be made that some “bonus” might encourage employees to turn down city health insurance (resulting in a savings our tax money) if they already are covered elsewhere. But, wouldn’t, say, $500 a year it a $1,000 one-time payment be enough to overcome inertia in these cases?

“False equivalence. There is no comparison between a private company driven to make profit by any means necessary, and government workers charged with the health and safety of the people in their respective communities.”

Neutral, a similar comment was made a few days ago on another thread. It rubbed me the wrong way then, and does so now. There are plenty of of private sector employees charged with the health and safety of the people in their communities. Health care workers are only one example. I do not accept your notion at all that public sector employees are more conscientious and loyal to their communities than private sector employees and therefore deserve greater compensation. I don’t think these comments are helpful given the magnitude of the challenge. We need to come together as a community, not splinter.

-Michael Bisch, Davis Commercial Properties

[quote]But, this doesn’t affect the cost of doing business city staff vs. private contractor, does it? [/quote]No. The comment was regarding the sanctimonious comments made by those in the private sector who tend to see the public sector as uniquely “privileged”. The fact of the matter is that SS recipients today stand to draw far more in benefits than they and their employers ever contributed. It is a sort of a Ponzi scheme, using current contributions to pay for current benefits. The SS folks rely on “old” actuarial data. PERS, on the other hand, looks to fund retirements with past contributions, though, admittedly, they might not be using the perfect actuarial data.

BTW, SS is pretty much immune to general inflation. PERS adjustments, under the general plans (including Davis’) is limited to the LOWER of actual inflation, or 2%.

DT: Good point on asking for assumptions for those projects. David G probably does not have them, but maybe someone from the City will post? How about the Mayor?

Also, I dont take any of this seriously until I see 3 member crews on those firetrucks; the FD stops sending 2 trucks to every single accident, even the non-injury; and the City settles DACHA, and fires the City Attorney and involved senior staff.

One more thing: on the surface water project, it completely amazes me that the CC is even considering any sort of advisory referendum for November. That tells me that so far, the CC majority and staff dont have a clue on true budget reform.

Want fries with that, Michael?

“Your report suggests an “estimate” of eight management positions, which makes it sound as though this new budget is eliminating more management positions. “

If that’s the impression, I apologize, as I read the slides, it appears that’s over a four year period of time.

“David, you gloss over the revenue “uptick”. What does the budget look like without the “uptick”? It seems to me the “uptick” is critical.”

That’s a revenue uptick over five years, we’ll see if that happens.

“What was our city council’s reaction to the budget proposal?”

Council received the report. We’ll see their reaction next time. Also I really haven’t given the Vanguard’s reactions over than a stray comment or two.

“Please clarify the differences between the $3-million general fund money and the $4-million “from all bargaining units” money.”

I’ll try to do that at some point, my guess is there are positions that are funded through the enterprise fund and other non-general fund monies that are getting cut as well.

“I know David Greenwald disagrees with me on spending down the reserves. But I strongly feel that is what we have them for–to use when the economy is bad in order that we don’t have to hurt our labor force so much. “

That’s because spending from the reserve just defers the problem. Had we started spending from the reserve when you started advocating it, the reserve would be gone and we would have solved nothing.

David, my point is that if the “uptick” fails to materialize, the result is a $0.63 mil to $4.63 mil hole in the budget every single year for the next 5 years ($12.88 mil cumulative). The risks are not restricted exclusively to achieving cost savings. The risks also include not achieving projected revenue. What happens if revenue actually dips? Your analysis focuses exclusively on the cost side. Why?

-Michael Bisch

Mainly because the cost side is what we have control over right now. If the revenue fails to materialize then we are going to end up having to cut more programs and services.

If one makes unwise assumptions regarding the revenue side, then one is likely to make unwise descisions regarding the cost side. Also, revenue is not something over which one has zero control. Smart budgeting requires examining and managing both sides of the budget.

-Michael Bisch

They have to make some kind of assumptions regarding revenues. This looks like a projection of 2- 2.5% growth in revenues over the five year period, with a lower assumption for next year. That’s probably not unreasonable based on historic patterns, but their projections were certainly off from 2008 – 10. Maybe they use LAO estimates for state revenue growth.

[i]”Had we started spending from the reserve when you started advocating it, the reserve would be gone and we would have [bsolved[/b] nothing.”[/i]

I don’t claim that spending down the reserves would [i]solve[/i] the structural problems built into the contracts or the organizational problems which in some cases have led to overstaffing or excessive bureaucratic layering.

Yet the empirical evidence is clear that while retaining our large reserve fund through this steep recession, we have, up to now, not solved any of those problems. So if your contention is that keeping up a high reserve fund will solve something, the evidence for that seems to be lacking.

What I argue spending down the reserves shuld do is save the jobs of people who provide important public services for the people of Davis. Not everyone who has lost his job was unnecessary. Most of those out of work did good work for the City. Same thing with those positions which have gone unfilled over the last 4 years. By not filling those jobs, we are getting worse public service.

Let me give a personal example I ran into recently. I needed to get a Davis police officer to come to my house to do a VIN verification on an old car I own. The DMV requires it. I went down to the DPD to make an appointment, and I was told, “Sorry, we no longer do VIN verifications. We don’t have the personnel for that.” So now I will have to get my old car towed to the DMV and back again, where they can do the VIN verification. That sucks for me.

But what sucks much worse for the people of Davis is that the police department has lost a lot of its non-sworn staff, who process the required paperwork for police officers. So with those folks unemployed, police officers have less time to patrol and to respond to calls. They are now processing the paperwork that non-sworn staff formerly did. That means all of us are a little bit less safe.

… Oh, and while I am at it, one more little personal anecdote. A few days ago I had some major surgery and was home in bed trying to rest post-op. Alas, a car parked a few houses down the street from me had a malfunctioning car alarm, which was going off every couple of minutes and blasting its sounds that are designed to annoy the entire world. After an hour of hearing that car through my closed and good quality double pane windows, I called the DPD to see if they could address the situation. Nearly 3 hours later, a cop came and the problem was solved. So because of police understaffing, I had to put up with that noise for 4 hours. It sucked. Fortunately, I have made an amazingly nice recovery and should be back to full health before too long.

Rich

Quite frankly you guys are over my head with the economic issues, but I wanted to wish you a speedy recovery.

I look forward to the time when you once again, affectionately, refer to me as “meds” before writing a scathing critic of whatever idea I am expounding. Only then will I rest assured that you are back to full health !

Thanks, Meds.

IMHO, the only solution to budget woes for at least 5 years is to cut costs. I dont see city revenues up until the state and local governments have sustainable, balanced budgets. Not even close yet. I dont see the private sector recovering locally until the five govt entities in town are all back on track. We are, and will always be, mostly funded by those five govt entities. The Chamber PAC can dream all it wants to about massively large influx of big retail revenue, but it’s just a summer dream.

Rich-Getting old ain’t for sissies ! Medical science offers me no reasonable explanation for the sudden failure of my knees, ankles, back, and hips after six decades of perfect serviceability . During my recent convalescence, I discovered that we have a neighborhood mocking bird that imitates car alarms and ambulance sirens ;>( ! Feel better soon !

Biddlin: Those mocking birds can be quite loud! You should hear the downtown owls while they hunt just after dark; then there are the babies screaching about hunger pains from the palm trees right in front of the STEAC food locker.

Hope you get better soon,

The (First) Other Downtown Mike

biddlin: [i]”During my recent convalescence, I discovered that we have a neighborhood mocking bird that imitates car alarms and ambulance sirens”[/i]

I’m sure when you were trying to recuperate that was horrible. The car alarm in my neighborhood on Monday sure was. But, at the same time, that is a pretty cool skill for a bird. Not recently, but in the past I have been in my garden and heard the sound of car engines starting up, only to look up and see the “engine noise” coming from a mocking bird resting on the telephone/power pole situated in my next door neighbor’s house.

Yet as interesting as that is, what many cuckoo birds do takes the cake. This is a layman’s explanation ([url]http://www.toptenz.net/top-10-strange-animal-behaviors.php[/url]) of what ornithologists call ‘brood parasitism’:

[i]”Cuckoo birds have a rather interesting approach to parenting in that they do not build a nest to lay their eggs in, but do so in other bird’s nests for them to look after their young. The Cuckoo bird is solitary and will lay or drop its eggs into the nest of another bird once she’s observed that the other birds have gone out. She will then quickly lay her eggs or transfers them there. Each breeding season she will find new places to deposit her eggs and once her eggs hatch, she will attempt to drop the other species eggs out of their own nest when the foster parents are out in order to secure her own babies’ survival.”[/i]

According to Wikipedia, not all species of cuckoos pull off this trick. In fact, it says, most cuckoos raise their own young. Nonetheless, a lot do behave just as this quote above suggests. It’s a pretty interesting evolutionary trick. … It is, by the way, from that behavior in cuckoo birds that the word cuckold (“a man whose wife cheats on him”) came into our language.

“They have to make some kind of assumptions regarding revenues. This looks like a projection of 2- 2.5% growth in revenues over the five year period, with a lower assumption for next year.” -Don Shor

The city better not be taking this approach to budgeting. Given how precarious the budget is, I would expect the city to peel into each revenue category and make far more precise assumptions than simply applying a percentage annual increase.

-Michael Bisch

“IMHO, the only solution to budget woes for at least 5 years is to cut costs. I dont see city revenues up until the state and local governments have sustainable, balanced budgets. Not even close yet. I dont see the private sector recovering locally until the five govt entities in town are all back on track. We are, and will always be, mostly funded by those five govt entities. The Chamber PAC can dream all it wants to about massively large influx of big retail revenue, but it’s just a summer dream.” -Mike Harrington

1) This reactionary mentality is precisely why we are confronted with a budget train wreck.

2) Where the heck did you get the notion that the Chamber PAC’s plan is based on a massive large influx of big retail revenue? I’m pretty sure you didn’t get that from any PAC communication, so you must have dreamt that up yourself.

-Michael Bisch, Davis Chamber PAC

Michael Bisch,

We are confronted with a train wreck because we increased wages and benefits to levels we could nt support.

If not through retail, how does the chamber/PAC intend to increase tax revenue?

David, you have a fixation on the cost side when actually a budget has two sides: cost and revenue. The city didn’t just woefully underestimate its costs, it woefully overestimated it’s revenues (the same is true of the county, state, and feds).

The Chamber PAC is focusing on all aspects of the budget: costs; and all revenue streams. Retail sales tax is only one component of the revenue stream. We need to grow all components.

-Michael Bisch, Davis Chamber PAC

David, I should also point out that government has never fulfilled all of the Davis community needs. Businesses, faith-based organizations, service clubs, community activists have always filled a void. These organizations are all going to have to step up to fill an even greater void as government retrenches. This transition already been happening for some time.

-Michael Bisch, Davis Chamber PAC

[i]”The city didn’t just woefully underestimate its costs, it woefully overestimated it’s revenues (the same is true of the county, state, and feds).”

[/i]

I think it’s fair to say that most policy-makers at all levels of government and industry underestimated the depth and duration of the recession.

[i]””IMHO, the only solution to budget woes for at least 5 years is to cut costs. I dont see city revenues up until the state and local governments have sustainable, balanced budgets. Not even close yet. I dont see the private sector recovering locally until the five govt entities in town are all back on track. We are, and will always be, mostly funded by those five govt entities.”[/i]

Michael B: Michael H’s analysis is reasonable. Government is the driver of our economy. Economic development of any kind isn’t likely to yield dividends for at least a few years. Even if Nishi gets annexed in a year, for example, development will take many months after that and there are logistical hurdles. I’m not aware of anything bigger than Nishi. Other projects you may have in mind aren’t likely to significantly increase city revenues. Retail vacancies are going to take awhile to fill. I don’t know what will replace Dimple, but vacancies are increasing at this time with that closure. Whole Foods may yield less tax revenue than Borders did, depending on their product mix of taxable vs. non-taxable. And all of the non-government sector put together is substantially less than the impact of the public sector in Davis. UCD is what matters locally.

Don, I’m not blaming anyone at all for the inaccurate projections. I’m trying, but apparently failing, to make the case that inattention to the revenue side is going to result in further failed projections. I’ve already pointed out that revenue flatlining results in a $12.88 million hole over 5 years. That doesn’t appear to concern David in the least. Maybe David is aware of some magical indexing that’s going to cause revenue to increase 2-2.5% p.a. It would be great if he would share this info with us. But in the absence of this magical indexing, some kind of action is going to be required on the revenue side otherwise David’s “uptick” is never going to happen. Last time I checked, property tax and retail sales tax were stagnant. Maybe TOT is up, I wouldn’t know. Why would these revenue sources suddenly begin to climb in the absence of action?

-Michael Bisch, Davis Commercial Properties

Don, you’re posting faster than I can respond. I’m now reponding to your 11:26pm post. You are making the case that we as a community are not acting fast enough due to the inherent lag in economic development cause and effect. I agree. We should have been taking decisive action 4 years ago, 3 years ago, 2 years ago, last year. We will never take action if we follow Mike Harringtons’s strategy. I prefer Katehi’s budget strategy: decisive action with foresight.

-Michael Bisch

Property taxes and sales taxes are stagnant but are expected to grow. They will “suddenly begin to climb” because they are at historic lows. As the economy recovers, so will property taxes (as homes get reassessed o resale) and sales taxes. There’s nothing magical about it. It’s just that the economy is projected to improve over the next five years. I expect the city’s projections are not based on any significant new sources of revenue coming on line, because nothing is in the works yet.

Here is the LAO forecast for the state budget. Personal income and retail sales are expected to continue to increase slowly but steadily. Recovery from this recession is not expected to be as fast or as steep as recoveries from past recessions, but the 2 – 2.5% increase seems reasonable based on these forecasts.

[url]http://www.lao.ca.gov/reports/2011/bud/fiscal_outlook/fiscal_outlook_2011.pdf[/url]

I doubt the city’s finance director is pulling their projections out of thin air. Generally I’ve found city officials very forthcoming when you send them questions.

Here’s something else to consider. In the absence of action on the revenue side, David’s prescription of only cuts (austerity) is actually going to reduce revenue. We would then have to cut even more, which inevitably leads to further revenue decline. That’s why Katehi is refusing to go the austerity route because all it does is lead to a downward spiral.

Fortunately, I’m fairly certain that the council is NOT going to follow David’s austerity prescription.

-Michael Bisch

[i]I prefer Katehi’s budget strategy: decisive action with foresight. [/i]

Yes, but she doesn’t have to implement anything. As far as I know, the Chancellor mostly gives speeches. It took UCD something like a decade to plan and build West Village.

We’ve discussed on other threads what the council can do to move forward on economic development. But nothing they do will yield revenues quickly.

I put zero reliance on LAO forecasts or analysis.

-Michael Bisch

Whose do you prefer? Budget planners have to use economic models and make projections. Is there one you find more reliable?

“But nothing they do will yield revenues quickly.” -Don Shor

Yes, but I draw the exact opposite conclusion from you. All the more reason for rapid action. The sooner we take action, the sooner we benefit. Whereas, you seem to be taking the position that we may as well delay further because of the lag between action and benefit. David’s and Harrington’s prescription is even worse, we will never benefit because we will never take action.

-Michael Bisch

I prefer my analysis. Last I heard, the projection is for 250,000 additional layoffs statewide in the government sector. In the absence of significant private sector job growth, our regional economy is not going to grow 2-2.5% p.a. over the next 5 years. Why would it in the absence of some kind of action? Fortunately, as I have already predicted, action will be taken at the local level. We have no choice. The status quo is not sustainable.

-Michael Bisch

[i]you seem to be taking the position that we may as well delay further because of the lag between action and benefit.[/i]

I haven’t said or implied that.

[i]In the absence of significant private sector job growth, our regional economy is not going to grow 2-2.5% p.a. over the next 5 years. Why would it in the absence of some kind of action?[/i]

If UCD adds 5,000 more students in the next few years, that will spur the local economy. 2 – 2.5% growth (not expected until two budget years out) would reflect a slow recovery back to pre-recession levels. Normal recovery would be faster. It’s not an unreasonable assumption.

Michael Bisch: For some reason you keep referring to my numbers and my analysis, you should actually be referring to these as Steve Pinkerton’s as they are his numbers and I’m simply reporting on them.

My original question still stands. What are the assumptions for what David calls an “uptick” in revenue? In the absence of some solid assumptions, it is not prudent to assume that the “uptick” is going to occur. Secondarily, I was taking issue with David’s characterization of the revenue increase assumption as an “uptick”. In a government sector dominated local economy going through layoffs, and with an anemic private sector, and with a massive city budget issue, ANY revenue increase at all is significant. Thirdly, if the “uptick” doesn’t occur, what is already a dire situation becomes, I don’t know, what’s worse than dire? $12.88 million is not chump change. Fourthly, in the absence of action at the local level, I would not count on the “uptick” panning out. Given all the foregoing, I’m surprised that David focuses the discussion on the expense side only.

Don speculated first that the “uptick” assumption was based on an expectation of a general economic recovery, presumably one that would also occur in the Sacramento region. He then speculated that the assumption was based on UCD’s 2020 plan. Maybe one or both of these come to pass, maybe they don’t, but simply waiting around for some outside agent to bail us out of our difficult situation does not seem prudent. I made similar comments on the school budget thread.

-Michael Bisch

[quote]Here is the LAO forecast for the state budget. Personal income and retail sales are expected to continue to increase slowly but steadily.[/quote]

Didn’t the LAO forecast a rosier projection that never materialized, and is the reason for the push to tax the wealthy and increase the sales tax? See [url]http://arc.asm.ca.gov/BudgetFactCheck/?p_id=334[/url]

Again, if you know any economic forecasters with better records to work with, I’m all ears. If you want to know what the city based its forecast on, you can contact them. FinanceWeb@cityofdavis.org

[i]”I think it’s fair to say that most policy-makers at all levels of government and industry underestimated the depth and duration of the recession.”[/i]

I think it’s fair to say that most policy-makers at all levels of government and industry don’t really understand what causes a recession, what caused this recession, and what we should have been doing for the last 3 years to solve the underlying problem which has caused our recovery to be so anemic.

For those who do not understand what (normally) causes a recession: It is inventory. Excess inventory. Inventory that is built, but cannot be sold. A recession will (normally*) end when the excess inventory is absorbed.

In the case of the 2008-09 recession, the major inventory build up was with residential real estate. For almost 10 years, nationally, we had been adding too many new housing units (especially in the sunbelt states and on the Eastern seaboard). Those excessive units were being purchased by speculators and undercapitalized homebuyers, all based on the assumption that prices had to go up forever. Loose credit allowed this speculation to go on. But once the credit markets understood that their was far too much product out there, the game was up and prices began to collapse and demand died and we were stuck with way too much housing inventory, and we still to this day have way too much housing inventory.

The solution (which I proposed in a column in early 2009) is to encourage capital to absorb the excess inventory. We didn’t need to try to loosen up the credit markets. We didn’t need to keep people in houses where their loans exceeded the homes’ values. We needed to encourage investors with a lot of capital to buy up all of the underwater properties and buy up all those properties which were foreclosed or could soon be foreclosed.

My “encouragement” was (if I recall correctly what I wrote 3.5 years ago) to have the federal government offer cash investors a tax credit to cover all local property taxes on these properties for some number of years and to eliminate the capital gains tax for any gains made over some number of years. So if an investor paid $200,000 cash to a bank for 100% ownership of a foreclosed property, the debt on that property would be zero, and there would be no holding costs for the investor for some number of years. The investor would just rent the house to new residents until all the inventory was absorbed and the market price exceeded what he paid for it. If 5 years later the house was worth $250,000, the investor could sell the house for that and pay no capital gains tax on his $50,000 gain.

My solution would have ended this recession. It also would have caused us to have a much lower rate of unemployment and a much faster rate of growth. And by now the banking sector would have fully recovered and would not have so much reluctance to make loans. The problem with my idea is entirely political: That it would have caused millions of Americans who think they own their own homes to become renters, and millions of American homes would be owned by wealthy investors who got big tax breaks to buy them. Even though that’s what our economy essentially still needs, no Democrat will ever want to do that. And probably no Republican would do it, either. It makes too much good sense.

————————-

*The Great Depression is somewhat of an exception to this. It also began as a result of excess inventory in the late 1920s. But it kept going on an on for a number of other reasons that had nothing to do with the overbuilding at the end of the 1921-28 business cycle: First, the Federal Reserves’ tight money policy starved the money-center banks of liquidity and that caused a great number of banks to collapse and the insolvency of the banks caused businesses which relied on the banks for credit to go bankrupt and that spiraled in a vicious circle for a few years, made all the worse by the Fed’s policies; and Second, after the United States, which was then by far the largest single economy in the world and the world’s most important trading nation, became protectionist and passed the Smoot-Hawley Tariffs, almost all world trade came to a halt. That badly hurt our farm sector, which relied on export markets, and that made all the world poorer, and that poverty killed off demand for most trade in commodities and manufactured goods.

Rich, to what you have written above, I would add that there was, and still is, too much price and wage inflation built into various sectors of the ecomomy partially due to the funny money being printed/supported by the inflated real estate values. This led to numerous imbalances including a bloated public and private sector. Quite a bit of hot air has been bled out of the system, but there is still a ways to go.

So in answer to Don’s questions, I would go with my economic forecast. It is prudent, given all the economic uncertainty remaining, to forecast 0.0% growth in the regional economy. I would then look at each of the city’s individual income streams and base growth assumptions based on what was in the pipeline. For example, I would increase property tax assumptions by the impact of Verona coming online. If there was nothing known that would positively or negatively impact a particular income stream, assume zero change in revenue over the 5 year period.

Based on these assumptions, I would then devise my strategy and execute. A strategy based on these conservative assumptions would no doubt necessitate a significant shift in priorities over the 5 year period. Should the assumptions prove too conservative, adjust.

-Michael Bisch

It isn’t reasonable to assume zero growth in retail sales or housing values over the next five years. Increase in property tax assumptions is based on slow, steady increase in property values as houses and commercial properties begin to sell again. Retail sales have slowly been increasing.

Moreover, from a planning standpoint it doesn’t make that much difference. The staff updates the projections mid-year for the council. I think using the numbers they’ve put forth, which appear conservative, is reasonable. I’m not sure what is gained by forecasting 0% growth in the regional economy, nor do I see a rational basis for your assumption that there will be 0% growth for five years. Businesses don’t plan that way, and neither do government bodies. The adjustment you are calling for already occurs. You can look at the city’s mid-year reports to see how that plays out.