Yesterday we highlighted four possible initiatives that could be on the ballot by June 2014. While you may be overwhelmed at that prospect, in a way we actually underplayed our cards by looking only at four possible citizen-based ballot measures. Again, right now, we only see the water initiative and a Cannery referendum as likely.

However, that is just the tip of the iceberg as to what faces Davis voters. Right now, it looks like the primary battle is between Joe Krovoza and Dan Wolk – and, oh by the way, there is also Matt Pope, Anthony Farrington and Bill Dodd in that battle.

The Davis City Council control will be at stake, as well. Joe Krovoza’s run means there will be one open seat and Rochelle Swanson has already said she’s running for reelection. And if Dan Wolk wins, we may well have another appointment process, but we probably won’t know until November.

Add in the water initiative and Cannery, and you really have the recipe for fun times. But wait, there’s more.

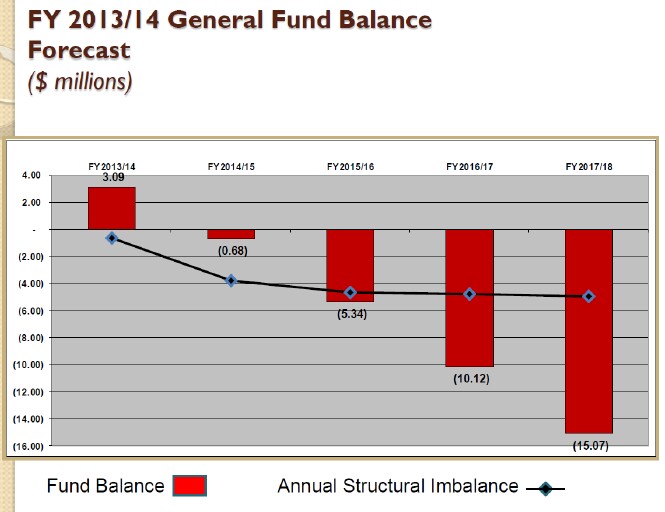

The city of Davis, in the meantime, faces a renewed fiscal crisis as it attempts to keep the budget balanced by paying down unmet needs on water and roads. The result is an exploding budget deficit over the next five years.

The city ends this past fiscal year with a negative cash flow of $1.62 million, but the real problems start this year when the city’s deficit balloons to $3.77 million. From 2012-13 to 2017-18, revenues grow from $41.55 million out to $45.19 million. The problem is that costs increase from $41.7 million this year out to $50.14 million by 2017-18.

By the end of this five-year period, the yearly deficit is expected to hit $5 million, with the overall deficit over the entire period at $15 million.

“We have an uphill battle in the future if we want to balance our budget and address our unmet needs,” City Manager Steve Pinkerton told the council during a budget meeting in June. “It’s frankly not incredibly difficult to balance the budget if you’re putting off costs into the future.”

The city is assuming about $3.8 million a year toward roads out of the general fund, with another $1 million from grants or other funds. Mr. Pinkerton noted while that is a big portion of the negative figures, we would still be in the red without addressing roads.

By 2016-17, the city is looking at about a $2 million impact from increased water rates.

In summary, most expenses will continue to grow at double or more the rate of revenue growth. The city can no longer defer unfunded liabilities without severe consequences in the future.

The city has put off talking about revenues, particularly as they were working on ways to finance the water project through rate hikes. But the time has come.

The city is looking at a possible sales tax hike for next June. That would begin to head off what would be a negative $5 million fund balance by the end of 2015-16. But the bigger crunch is to come as the city continues to plop down nearly $4 million for roads, additional costs for pensions and retiree health – and then the full effect of the water rate hikes take effect.

Eventually, the city is probably going to look at a parcel tax, but a parcel tax right now is going to be problematic, as it competes with the school district for funding.

So, what is the likelihood of the tax measure being on the ballot in June? We think pretty good. There is no advantage to the city waiting into the fall, because putting the tax measure on the ballot in June, allows the next fiscal year’s tax to be collected in July. Waiting would mean deferred benefits.

If you look at the budget, it is obvious that the city needs additional revenue. The city would have resolved their contract situation with the bargaining units, even with fire and DCEA still holding out right now. The city will have dealt with pensions, OPEB, unfunded liabilities, and will have started to address infrastructure and other unmet needs.

In short, the city will have done as much as it can to address the expenditure side without starting to cut core services, which it has rightly attempted to avoid.

On the revenue side, the city, long term, is working on an economic development strategy.

So the time is right, from that perspective, to ask for temporary additional revenue.

The problem they face is that they are competing for that revenue now with themselves since the largest increase in cost will be the new water rates. They are also competing with the school district’s $400 per year in parcel taxes.

The vote on sales tax would require a simple majority vote. The city got that in 2010 during worse economic times and a less responsible fiscal track record. This would be an increase over and above that half-cent sales tax.

Some have suggested to us, “People are so pissed off that any parcel tax would be screwed right now.”

We don’t see that level of anger. So we think that the sales tax would have a reasonable chance of passing, so long as the city lays out the fiscal picture, their efforts to be fiscally responsible and the need for that money.

—David M. Greenwald reporting

CORRECTION: The original version falsely reported that a sales tax measure required a two-thirds vote. It is not true. A sales tax measure only requires a simple majority, a parcel tax requires a two-thirds vote.

Sales tax increases are a very inefficient means of generating revenue at the city level with the vast majority of the revenue going to the State. What am I missing?

-Michael Bisch

Ease of passage at the majority vote requirement versus a two-thirds requirement for a parcel tax.

Taxing people right out of Davis.

I don’t get it. We have a city budget crisis. The way we’re going to solve it is to raise a bunch of money from the community, use 15% to solve our problem, and send 85% to the State?

-Michael Bisch

Some have suggested to us, “People are so pissed off that any parcel tax would be screwed right now.”

Who is being quoted? You know of more than one person who uttered these words in this order to you recently?

Thank you for noting the change you made in the original article (“correction”). This is a excellent practice; hope it becomes routine whenever an article is revised.

It’s a shame that we have to be focusing on the path of least resistance rather than on the best, most predictable method of financing our government services, schools, etc. But, we all know why we’re in this fix: Prop 13. Several of my friends have said, “I’m so pissed off that people passed Prop 13 and screwed things up for generations to come.”

[i]”Several of my friends have said, “I’m so pissed off that people passed Prop 13 and screwed things up for generations to come.”[/i]

Let me guess, these friends primarily live off the soft money of government our count on some government benefits.

They are the people either retired or getting ready to retire somewhere in their 50s with 70%-90% of their pay and 100% of their healthcare covered for more years than they actually worked.

These are the people who own lives that the rest of us are funding.

They are people that haven’t lived here long enough to remember all the fixed income retirees losing their houses as California real estate bubbled – ironically due to other government programs to feed the homeless with homes. Or, they are just dense or in denial about the negative impacts that would have occurred had prop-13 not passed.

These are people that cannot do math. They cannot count up all the government taxes and fees that have mounted since prop-13 was passed, and that would not go away if it was overturned. They don’t understand that California is ALREADY the highest taxed state in the nation, and that property tax revenue per capita is ALREADY the 12th highest in the nation.

Anybody that supports increased taxation of any type at this point is public enemy #2. Those that support increased taxation and continue to block economic development are public enemy #1.

We are heading to a social war where the selfish adults from the embarrassing Baby Boomer generation need to have their keys taken away so subsequent generations have a chance for a good life.

Frankly, I’m beginning to believe that liberals never saw a tax they didn’t like.

“Anybody that supports increased taxation of any type at this point is public enemy #2. Those that support increased taxation and continue to block economic development are public enemy #1.”

I think we’re more endangered by people who demand incredibly government services and refuse to let us tax ourselves to pay for them (Iraq, Afghanistan, Medicare drug benefit, are a few examples).

How much of the cost of just these three items purposely is being financed by China to be paid off later by our grandchildren and their kids? And, we’ve got conservative Republicans to thank for every one of these crippling debts.

Closer to home, lots of folks I know realize that Prop. 13 has helped drag us from a leader in education spending per student to a laggard. At the college level, this has turned our kids into student loan paupers.

Taxes are needed to pay for the government’s number one responsibility to protect us and its most productive function of educating our children. We also should be pleased and honored to finance the government we’ve inherited and chosen.

“…people who demand incredibly (expensive) government services….”

“Taxing people right out of Davis.”

really? we’re still less than sac or sf, right?

“I don’t get it. We have a city budget crisis. The way we’re going to solve it is to raise a bunch of money from the community, use 15% to solve our problem, and send 85% to the State?”

suggest you educate yourself on how taxes work and then post.

you can thank the “no-growthers” – particularly those living in the core area – for the failure to appropriately expand the Davis tax base as costs of maintaining their “village feel” are becoming increasingly unaffordable. And by the way “FRANKLY” New York City and New York State taxes are substantially higher than those in Ca.

“You know of more than one person who uttered these words in this order to you recently?”

i said something similar a few weeks ago, but not exact.

“We are heading to a social war”

we’re not. don’t be hyperbolic and hysteric, you discredit yourself when you utter such nonsense.

“Frankly, I’m beginning to believe that liberals never saw a tax they didn’t like.”

right

“you can thank the “no-growthers” – particularly those living in the core area – for the failure to appropriately expand the Davis tax base as costs of maintaining their “village feel” are becoming increasingly unaffordable.”

blame it on the no-growthers. go visit natomas and elk grove, and then come back here and see how much you want to blame on the no-growthers. also, imagine what our budget would have looked like during the recession had we not held the line on growth. covell village folks are thanking their lucky stars they didn’t get that project or they’d have declared bankruptcy by 2008 or 09. maybe you want to re-think your comment.

One thing being overlooked when it comes to the city, is that the city is very top heavy with management. I recently had the oppotunity to see a information relating to just the public works department and was mortified by the amount of supervisors and managers overseeing the workers. Out of 137 full-time employees in public works, 50, yes 50, were management! That’s 36%. There were several instances of one supervisor to one employee. For example, at the wastewater treatment plant, there are 12 full-time employees supervised by 5 members of management, which means more than 40% of the employees there are management. It’s likely other departments are managed the same way. This ‘too many chiefs and not enough indians’ situation is a large drain on the city’s budget. It’s time the city cleaned house!

Whoops! I got it all wrong on my sales tax split info. I retract both of my postings.

Regarding the slaes tax hike–I hope my fellow citizens of Davis remember what happened June 2012, after the measure D tax was approved. Just after the Parks Maintenance Tax was approved for the next six years, the city laid off parks employees. What is the Parks tax money being used for?

Now the city wants mores taxes? Where will it end? I’m tired of my hard earned money going to line the pockets of city management.

A higher local sales tax will just drive more people to shop outside the city.

[quote]”Taxing people right out of Davis.” [/quote]

[quote]really? we’re still less than sac or sf, right? [/quote]

Are you just counting sales tax? Have you figured in all of our parcel taxes, the tripling of our water cost tax (yes it’s in a sense a tax to pay off the bond), plus even though they’re not considered a tax but we’ll soon pay higher garbage fees, parking fees, paper bag fees, etc.

Yes indeed, Davis is getting pretty expensive.

[i]I think we’re more endangered by people who demand incredibly government services and refuse to let us tax ourselves to pay for them (Iraq, Afghanistan, Medicare drug benefit, are a few examples).[/i]

This is a tired, false and wholly discredited piece of political propaganda routinely brought up by leftist, doves and those with their head in the sand.

Total defense spending per GDP compared to total non-defense spending per GDP… even including the cost of the wars. NOT EVEN CLOSE.

Over the last 50 years defense spending per GDP has declined, while non-defense spending has SKYROCKETED.

[i]And by the way “FRANKLY” New York City and New York State taxes are substantially higher than those in Ca.[/I]

Wrong, WRONG, w r o n g… [url]http://www.caltax.org/research/calrank.html[/url]

There is nothing “substantially higher” about N.Y. and N.J. tax rates compared to California. You are leaving out the other gems of California like gasoline taxe, cigarette taxes, you name it tax..

Let’s add up all the taxes…

1. Accounts Receivable Tax

2. Accounting and Tax Preparation (cost to taxpayers $300 billion)

3. Accumulated Earnings Tax

4. Accumulation Distribution of Trusts

5. Activity Fee (Dumping Permit Fee)

6 . Air Tax (PA coin-operated vacuums)

7. Aircraft Jet Fuel Tax

8. Aircraft Excise Tax

9 . Alcohol Fuels Tax

10. Alcoholic Beverage Tax

11. Alternative Minimum Tax – Amt

12. Ambulance Services (Air Ambulance Services, SD)

13. Ammunition Tax

14. Amusement Tax (MA, VA, MD)

15. Animal Slaughter Tax (WI, others, Per Animal)

16. Annual Custodial Fees (Ira Accounts)

17. Ballast Water Management Fee (Marine Invasive Species)

18. Biodiesel Fuel Tax

19. Blueberry Tax (Maine)

20. Bribe Taxes (Pay If You Dare)

21. Brothel licensing fees

22. Building Permit Tax

23. Capital Gains Tax

24. California Interstate User Diesel Fuel Tax

25. California Redemption Value (Can and Bottle Tax)

26. CDL License Tax

27. Charter Boat Captain License

28. Childhood Lead Poisoning Prevention Fee

29. Cigarette Tax

30. Cigarette Tax Stamp (Acts) (Distributors)

31. Compressed Natural Gas Tax

32. Commercial Activity Tax (OH – for Service Providers)

33. Corporate Income Tax

34. Court Fines (Indirect Taxes)

35. County Property Tax

36. Disposable Diapers Tax (Wisconsin)

37. Disposal Fee (Any Landfill Dumping)

38. Dog License Tax

39. Duck Hunting Tax Stamp (PA, others)

40. Electronic Waste Recycling Fee (E-Waste)

41. Emergency Telephone User Surcharge

42. Environmental Fee (CA – HazMat Fees)

43. Estate Tax (Death Tax, to be reinstated)

44. Excise Taxes

45. Facility Fee (CA – HazMat Fees)

46. FDIC tax (insurance premium on bank deposits)

47. Federal Income Tax

48. Federal Unemployment Tax (FUTA)

49. Fiduciary Income Tax (Estates and Trusts)

50. Fishing License Tax

51. Flush Tax (MD Tax For Producing Wastewater)

52. Food License Tax

53. Fountain Soda Drink Tax (Chicago – 9%)

54. Franchise Tax

55. Fresh Fruit (CA, if Purchased From A Vending Machine)

56. Fuel Gross Receipts Tax (Retail/Distributor)

57. Fuel Permit Tax

58. Fur Clothing Tax (MN)

59. Garbage Tax

60. Gasoline Tax (475 Cents Per Gallon)

61. Generation-Skipping Transfer Tax

62. Generator Fee (Recycled Waste Fee)

63. Gift Tax

64. Gross Receipts Tax

65. Habitat Stamp (Hunting/Fishing in some states)

66. Hamburger Tax

67. Hazardous Substances Fees: Generator, Facility, Disposal

68. Highway Access Fee

69. Household Employment Taxes

70. Hunting License Tax

71. Illegal Drug Possession (No Carolina)

72. Individual Income Tax

73. Inheritance Tax

74. Insect Control Hazardous Materials License

75. Insurance Premium Tax

76. Intangible Tax (Leases Of Govt. Owned Real Property)

77. Integrated Waste Management Fee

78. Interstate User Diesel Fuel Tax

79. Inventory Tax

80. IRA Rollover Tax (a transfer of IRA money)

81. IRA Early Withdrawal Tax

82. IRS Interest Charges

83. IRS Penalties (Tax On Top Of Tax)

84. Jock Tax (income earned by athletes in some states)

85. Kerosene, Distillate, & Stove Oil Taxes

86. Kiddie Tax (Child’s Earned Interest Form 8615)

87. Land Gains and Real Estate Withholding

88. Lead Poisoning Prevention Fee (Occupational)

89. Lease Severance Tax

90. Library Tax

91. Liquid Natural Gas Tax

92. Liquid Petroleum Gas Tax

93. Liquor Tax

94. Litigation Tax (TN Imposes Varies With the Offense)

95. LLC/PLLC Corporate Registration Tax

96. Local Income Tax

97. Lodging Taxes

98. Lump-Sum Distributions

99. Luxury Taxes

100. Make-Up Tax (Ohio, applying in a salon is taxable)

101. Marriage License Tax

102. Meal Tax

103. Medicare Tax

104. Mello-Roos Taxes (Special Taxes and Assessments)

105. Migratory Waterfowl Stamp (addition to hunting license)

106. Minnow Dealers License (Retail – For One Shop)

107. Minnow Dealers License (Distributor – For One+ Shops)

108. Mobile Home Ad Valorem Taxes

109. Motor Fuel Tax (For Suppliers)

110. Motor Vehicle Tax

111. Music and Dramatic Performing Rights Tax

112. Nudity Tax (Utah)

113. Nursery Registration (Buying and selling plants)

114. Occupancy Inspection Fees

115. Occupation Taxes and Fees (Various Professional Fees)

116. Oil and Gas Assessment Tax

117. Oil Spill Response, Prevention, and Administration Fee

118. Parking Space Taxes

119. Pass-Through Withholding

120. Pay-Phone Calls Tax (Indiana)

121. Percolation Test Fee

122. Personal Property Tax

123. Personal Holding Company (undistributed earnings)

124. Pest Control License

125. Petroleum Business Tax

126. Playing Card Tax (Al)

127. Pole Tax (TX – A $5 Cover Charge On Strip Clubs)

128. Profit from Illegal Drug Dealing

129. Property Tax

130. Property Transfer Tax (DE, ownership transfer between parties)

131. Prostitution Tax (NV – Prostitute Work Permits)

132. Poultry Registered Premises License (Sales License)

133. Rain Water Tax (Runoff after a Storm)

134. Rat Control Fee (CA)

135. Real Estate Tax

136. Recreational Vehicle Tax

137. Refrigerator and Freezer Recycling Fees

138. Regional Transit Taxing Authority (Trains)

139. Road Usage Tax

140. Room Tax (Hotel Rooms)

141. Sales Tax (State)

142. Sales Tax (City)

143. Sales And Use Tax (Sellers Permit)

144. School Tax

145. Service Charge Tax

146. Self Employment Tax

147. Septic And Drain Field Inspection Fees

148. Sex Sales Tax (UT, when nude people perform services)

149. Sewer & Water Tax

150. Social Security Tax

151. Sparkler and Novelties Tax (WV Sellers of Sparklers, etc)

152. Special Assessment Tax (Not Ad Valorem)

153. State Documentary Stamp Tax on Notes (FL RE Tax)

154. State Franchise Tax

155. State Income Tax

156. State Park Fees

157. State Unemployment Tax (SUTA)

158. Straight Vegetable Oil (SVO) Fuel Tax

159. Stud Fees (Kentucky’s Thoroughbred Sex Tax)

160. Tangible Personal Property Tax

161. Tattoo Tax (AR Tax On Tattoos)

162. Telephone 911 Service Tax (some states)

163. Telephone Federal Excise Tax

164. Telephone Federal Universal Service Fee Tax

165. Telephone Federal Surcharge Taxes

166. Telephone State Surcharge Taxes

167. Telephone Local Surcharge Taxes

168. Telephone Minimum Usage Surcharge Tax

169. Telephone Recurring Charges Tax

170. Telephone Universal Access Tax

171. Telephone Non-Recurring Charges Tax

172. Telephone State Usage Charge Tax

173. Telephone Local Usage Charge Tax

174. Tire Recycling Fee

175. Tobacco Tax (Cigar, Pipe, Consumer Tax)

176. Tobacco Tax (Cigar, Pipe, Dealer Tax)

177. Toll Road Taxes

178. Toll Bridge Taxes

179. Toll Tunnel Taxes

180. Tourism or Concession License Fee

181. Traffic Fines (Indirect Taxation)

182. Transportable Treatment Unit Fee (Small Facility)

183. Trailer Registration Tax

184. Trout Stamp (Addendum To Fish License)

185. Use Taxes (On Out-Of-State Purchases)

186. Utility Taxes

187. Unemployment Tax

188. Underground Storage Tank Maintenance Fee

189. Underpayment of Estimated Tax (Form 2210)

190. Unreported Tip Income (Social Security and Medicare Tax)

191. Vehicle License

192. Vehicle Recovery Tax (CO, to find stolen cars)

193. Vehicle Registration Tax

194. Vehicle Sales Tax

195. Wagering Tax (Tax on Gambling Winnings)

196. Waste Vegetable Oil (WVO) Fuel Tax

197. Water Rights Fee

198. Watercraft Registration Tax

199. Waterfowl Stamp Tax

200. Well Permit Tax

201. Wiring Inspection Fees

202. Workers Compensation Tax

Kind of a pointless list, since it appears to cover all fifty states.

Not really, since 75% of them apply to CA.

You sure? You counted? Most of those are user fees. The more user fees, the less general taxes. So what exactly is your point?

I am sure.

My point is that the government is taxing the crap out of us. How many of these special taxes and fees have been implemented and increased since prop-13 passed?

It is absolutely ridiculous to be talking about any additional tax increases at this point in time. Like I wrote, either you directly benefit from government distributions, or you are clueless as to the real story about taxation.

Democrats in control of this state have pissed away our state treasure to buy their power (paying off their union benefactors) while also chasing business out by appeasing environmental wackos’ demand for hyper environmental protection of anything they can find that looks endangered except the human animal.

Now you want to go back and squeeze more out of that shrinking pool of people that pay their own way and employee others that pay most of their own way.

Want to keep the roads maintained?

It is simple… cut the pension expense, and reform public sector compensation to market rates. If the unions won’t do this, then we need to be come a right to work state. Then reduce taxes and regulations that prevent economic growth in the state so more business locates here and thrives, and open up land around us to develop a stronger local business base, and more tax revenue flows into state and city coffers.

It is completely unsustainable to keep raising taxes. Anyone that proposes this as a solution to our budget problems is an idiot.

” Just after the Parks Maintenance Tax was approved for the next six years, the city laid off parks employees.”

and the reason they did that had nothing to do with parks and everything to do with dcea and impasse.

[i]This ‘too many chiefs and not enough indians’ situation is a large drain on the city’s budget. It’s time the city cleaned house![/i]

Oh, and as Kay Cera points out, we need to cut the number of managers, and make city employees work more days and more hours.

The number of managers and the number of sick, vacation and holidays are all WAY over the top.

“Yes indeed, Davis is getting pretty expensive.”

indeed, look at the cost of housing. you, like me, is generally against growth, and so that’s part of the price of living here. higher cost of housing, more taxation to supplement for the lack of businesses in the city. we can’t have our cake and eat it. i’m happy to pay an extra half cent sales tax now that the city has done the heavy lifting on personnel.

“Total defense spending per GDP compared to total non-defense spending per GDP… even including the cost of the wars. NOT EVEN CLOSE.”

can we please stick to local issues on articles about local issues?

“Oh, and as Kay Cera points out, we need to cut the number of managers, and make city employees work more days and more hours.”

i’d like to see an organizational structure before jumping on the bandwagon. making city employees work more days and more hours will increase the cost of business. are you willing to pay for it?

[quote]Enemy #1…clueless…wackos’… idiot….[/quote]

Always good to talk to you. Enjoy the rest of your day!

[i]can we please stick to local issues on articles about local issues?[/i]

Every tax that a family pays goes to the amount of the income they have left to pay their bills. So, you cannot discuss local sales tax without giving consideration to all taxes.

It is in fact this demand that we DON’T discuss ALL the taxes levied that has led to social changes like mothers OR fathers having to work full time instead of one of them being able to care for their young children. You tax happy people are friggin’ nuts. Over 50% of my income goes to pay employment related taxes. Then add up the rest. The Laffer curve is real. Have you looked at REAL unemployment figures. It is increasing again across the nation. It does not even include all the people that have stopped looking for work. Young people are being damaged for life because they cannot find work.

But, we are going to increase our sales tax again because idiots in government can’t manage a budget.

So what happens next time, and next time, and next time?

[i]making city employees work more days and more hours will increase the cost of business. are you willing to pay for it?[/i]

I am talking about reducing the number of paid days off that city workers get. It is about 200% more than the average private sector worker gets.

Take a team of workers like tree trimmers. To make up for all that paid time off, you need one additional employee for every four. So half the amount of paid time off. Now you need one additional employee for every eight.

“How many of these special taxes and fees have been implemented and increased since prop-13 passed? “

I suspect that lots of user fees and special levies and special taxes and parcel votes, etc., were instituted post-Prop. 13 in order to provide the services that people wanted to continue or that were needed for public health, safety and education. The problem I see is that property taxes hit corporations and rich folks harder than the rest of and many of the special and newer taxes and fees result in regressive charges.

—

“I think we’re more endangered by people who demand incredibly (expensive) government services and refuse to let us tax ourselves to pay for them (Iraq, Afghanistan, Medicare drug benefit, are a few examples).”

“This is a tired, false and wholly discredited piece of political propaganda routinely brought up by leftist, doves and those with their head in the sand.”

Apparently I didn’t make my point clearly. I said nothing about percentages of GDP represented by defense vs. everything else or how that might have changed over 50 years. You’re taking in an argument I didn’t bring up.

I’m sure that lots of money was spent on these three domestic AND defense undertakings and that the conservative Bush Administration undertook them off-budget with no intention of paying as we went. Are you suggesting these things are false and discredited, albeit they’re a little tired as a lot of historical facts tend to be?

How much have these three major, deficit spending initiatives cost and how much does financing them cost? I’ll bet that once we total them up you’ll agree that it’s a lot of money and maybe even a significant portion of our GDP.

[quote]In summary, most expenses will continue to grow at double or more the rate of revenue growth. [/quote]

What assumptions are they making about revenues with respect to growth of the economy over the next five years?

We have a spending problem, and it is not national defense…

[img]http://www.cscdc.org/miscfrank/SpendingGDP.jpg[/img]

[img]http://www.cscdc.org/miscfrank/spendingpergdpNYT.jpg[/img]

[img]http://www.cscdc.org/miscfrank/spendingpergdpstateNYT.jpg[/img]

[img]http://www.cscdc.org/miscfrank/spendingpergdptotalNYT.jpg[/img]

[img]http://www.cscdc.org/miscfrank/spendingpergdprateNYT.jpg[/img]

[img]http://www.cscdc.org/miscfrank/spendingpergdpgrowthNYT.jpg[/img]

[quote]

In 1940 fed, state and local government spent $5 billion on monthly payroll.

In 1960 fed, state and local government spent $14 billion on monthly payroll.

In 1990 fed, state and local government spent $36 billion on monthly payroll.

In 2011 fed, state and local government spent $70 billion on monthly payroll.[/quote]

Don: Please keep this on topic – local government.

Ok, let me bring it back to local.

Each new tax is added to the existing family tax burden. It is not some new stand-alone consideration. Just like the next power plant built must be considered in relation to the carbon produced by the entire inventory of power plants… each new tax needs to be considered in relation to the entire inventory of taxes. The Federal government has increased taxes. the State has increased taxes. Davis has increased taxes. And our water rates are significantly increasing. Now we hear that there is an idea to increase local sales tax. This will be just another rock in the large bag of taxation that struggling middle class families will have to absorb. We keep demanding that they absorb more… why? Because our government, at all levels, cannot control spending. And because Davis does have enough taxable economic activity to support that uncontrolled spending at the local level.

I am sick and tired of hearing that another state or local employee has reached 55 and is jetting off to Europe to start his/her retirement; while the private sector middle class continues to stay behind finding it increasingly impossible to make ends meet and planning to retire at age 70 or greater.

You want more funding for roads and parks? It is simple…

1. Fix the over compensation of government workers.

A. Bring their pay in line with the overall labor market.

B. Make them pay more for their health care.

C. Convert their defined benefit retirement plans to defined contribution plans.

D. Make them retire at 65 and 67 like the rest of us lucky ducks in the private sector.

2. Streamline to reduce the number of employees needed.

A. Reduce the number of managers.

B. Reduced the number of paid days off.

C. Cut non-essential services.

D. Exploit technology to facilitate self-service.

3. Grow the local economy

A. Open up land for more commercial development.

B. Realize tax increases from increased economic activity

Note that this is a sustainable approach.

very good frankly.

so let me suggest that davis is trying to do each of those things. what recent policies that have been implemented with the current council and under pinkerton do you think are not headed in those directions?

[quote]And because Davis does have enough taxable economic activity to support that uncontrolled spending at the local level. [/quote]

Assume you meant does NOT have enough.

Again, before anyone can consider a revenue problem, we need to see the underlying assumptions about revenues. I would also be curious, with respect to what Frankly has posted above, how much personnel and payroll have been cut over the last couple of years, and what their plans are going forward. In other words, we need to see the whole picture.

[quote]1. Fix the over compensation of government workers.

A. Bring their pay in line with the overall labor market.

B. Make them pay more for their health care.

C. Convert their defined benefit retirement plans to defined contribution plans.

D. Make them retire at 65 and 67 like the rest of us lucky ducks in the private sector.

2. Streamline to reduce the number of employees needed.

A. Reduce the number of managers.

B. Reduced the number of paid days off.

C. Cut non-essential services.

D. Exploit technology to facilitate self-service. [/quote]

Anybody care to take a stab at which of those are contract issues, and which could be implemented by the city manager directly?

“before anyone can consider a revenue problem, we need to see the underlying assumptions about revenues.”

that doesn’t seem to be a tough call. at avid reader, the city manager said we have a revenue problem. he laid out in what way we have a revenue problem. i don’t see how this is in dispute.

“A. Bring their pay in line with the overall labor market.”

agreed on this.

“B. Make them pay more for their health care.”

we’ll have to see how aca affects this. the bigger question that we should address is whether davis is providing too lucrative a health care – compare city plans to school district’s.

“C. Convert their defined benefit retirement plans to defined contribution plans.”

can’t legally do so

“D. Make them retire at 65 and 67 like the rest of us lucky ducks in the private sector.”

city can’t do that i don’t believe, certainly not for current employees.

2. Streamline to reduce the number of employees needed.

A. Reduce the number of managers.

B. Reduced the number of paid days off.

C. Cut non-essential services.

D. Exploit technology to facilitate self-service.

Davis Progressive states: ” ” Just after the Parks Maintenance Tax was approved for the next six years, the city laid off parks employees.”

and the reason they did that had nothing to do with parks and everything to do with dcea and impasse. “

The reason the city laid off the park employees and others is because the city was found guilty of unfair labor practices and was ordered by the court to pay almost $800,000 to employees for back pay owed to them. There would not have been an impasse if the city had negoiated in good faith.

[i]Assume you meant does NOT have enough[/i]

Yes, thanks.

I type MUCH faster than my editing processor can handle.

“The reason the city laid off the park employees and others is because the city was found guilty of unfair labor practices and was ordered by the court to pay almost $800,000 to employees for back pay owed to them. There would not have been an impasse if the city had negoiated in good faith.”

there was an impasse because the association refused to take the same deal as everyone else. the city simply failed to cross all of their t’s and failed to follow the proper impasse procedure. nevertheless, the city had to recoup the loses one way or another.

The argument that we “can’t” because of labor contracts needs to be restated as that we “won’t” because of the difficulty, and we “haven’t” when we have had the opportunity.

It is clearly unsustainable, so where does it end?

See Vallejo, Stockton, San Bernardino, etc.

I understand that New York is heading toward bankruptcy too.

So apparently, it is so difficult to fix the clearly unsustainable public sector pay, benefits and pension, that we will just let all cities eventually file bankruptcy.

If that is the ultimate result, then I suggest we do everything possible to get there as quickly as possible.

My question about labor contracts is in order to get at the process, since it seems that it takes quite awhile to change them. So again, I would like to know what assumptions the city finance officer is using regarding that rather significant budget item.

[quote]that doesn’t seem to be a tough call. at avid reader, the city manager said we have a revenue problem. he laid out in what way we have a revenue problem. i don’t see how this is in dispute.[/quote]

For those of us who weren’t there, it would be useful to have that info. If someone wants to send me the spreadsheets involved (donator@gmail.com) I’ll load them to a server and provide the link.

There seems two approaches to assess adequacy of revenue:

1. Compare past year’s revenue with current revenue relative to population and maybe other factors.

2. Compare Davis’s revenue with other comparable cities.

Of course the fallback position for those against economic development and/or increased taxation to increase revenue will probably be “Davis is unique”. Which essentially translates in they can’t be reasoned with on this topic.

[quote]Of course the fallback position for those against economic development and/or increased taxation to increase revenue will probably be “Davis is unique”. Which essentially translates in they can’t be reasoned with on this topic. [/quote]

I continue to be amazed at how you can read other peoples’ minds. Or perhaps it’s just projection.

[quote]1. Compare past year’s revenue with current revenue relative to population and maybe other factors. [/quote]

The ‘maybe other factors’ seems rather important. Compare Davis income projections to state finance department projections, for example. My question is how realistic, rosy, or gloomy or financial staff is being.

Here is the legislative analyst’s report including projections and discussion of revenues for the state through about 2018:

[url]http://www.lao.ca.gov/reports/2013/bud/may-revise/overview-may-revise-051713.pdf[/url]

Personally i haven’t gotten a tax refund in years. The Toads write checks to the Feds and the State every year. We pay property taxes to the county including all those special Davis extras. We pay sales taxes, gas taxes, phone taxes, beer taxes and vehicle registration fees. We probably pay some others I don’t even know about. What is odd about this conversation is i don’t get all worked up about it. The tax guy or the tax collector tells me what i owe and when to pay it. I sign the forms and mail the checks and try to forget about what i would have done with the money. The Toad family uses some standard deductions with Roths and IRA’s, writing off charity and so forth. Although our marginal rate is almost 40% our effective rate is around 10%. Add in all the other taxes we pay and our effective rate is still under 20%. I don’t find that we are over taxed or get upset about it. My only regret is that my effective tax rate is higher than Mitt Romney’s.

Mr. Toad. I think you are a retired teacher right? Here is the deal about all that tax money that you pay and don’t get worked up about. That is what the taxers count on. The expect you to set your life-style to meet the amount of discretionary income you make. They expect you to get used to them reaching deep into your pocket and taking a huge chunk of your earnings. They get a thrill out of giving away money… your money… to other people that will thank them for it and keep them in power.

But maybe you are not one of those people that would invest in or start a business if you had more money in your pocket.

Maybe you are not one to renovate your house, or renew your landscape, or purchase new clothes or furniture.

Maybe you don’t have kids going to college that you have to pay 100% of the expenses for.

Maybe you don’t like to vacation or go to nice restaurants.

Maybe you don’t need to save for your own retirement and healthcare.

There are a lot of people that are not doing these things too. But they would if they had more of their earnings intead of having the crap taxed out of them.

Senor Bufo,

[quote]Although our marginal rate is almost 40% our effective rate is around 10%. Add in all the other taxes we pay and our effective rate is still under 20%.[/quote]

Exactly my experience, although I’ve never gotten into the 38% marginal bracket. If you do, congratulations.

I’m a proud member of the “Baby Boomer” generation, who has worked all his life, retired at 66, and has paid all taxes due for 50 years of my working life. And I didn’t ask to be born when I was, but my Vet Navy father came home from the war and decided to start his family then.

Taxes are the cost of good roads, and a decent civilization.