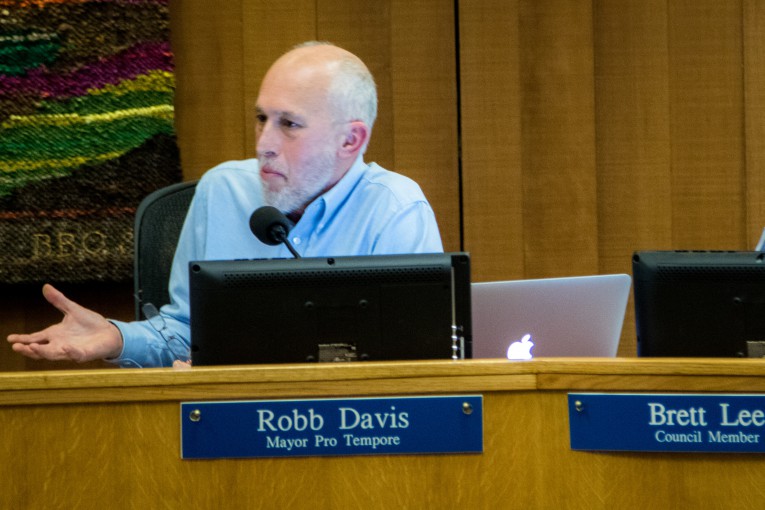

Editor’s note: Councilmember Robb Davis put this forward during the tax discussion. We are posting it as a point of more discussion.

Editor’s note: Councilmember Robb Davis put this forward during the tax discussion. We are posting it as a point of more discussion.

1. Undertake a full staffing analysis to determine match between service delivery needs and staffing.

2. Based on 1, consider best ways to provide services going forward with focus on training workers to take on multiple tasks (as is happening already). Consideration of targeted and appropriate outsourcing of services.

3. Examine all means to further reduce growth in compensation costs including analysis of OPEB options (as other CA cities are doing).

4. Create more transparent and accessible accounting systems that enable a more precise estimation of costs of specific services—building on work done by the Fee Study consultants.

5. Promote a more aggressive analysis with the county and other cities, via LAFCO, of shared bidding, service, and consulting options to reduce duplication and obtain scale efficiencies.

6. Determine what current city programs might be candidates for reduction or elimination and which we want/must keep.

7. Determine what current city infrastructure we could/should shed (buildings, properties) to reduce expenditures related to them.

Though not a cost containment item, we should also receive an analysis of all non-enterprise fund balances to determine if/how we can use these funds to meet current needs.

Good points. Hopefully the council will take his suggestions seriously.

BP, the FBC has been very actively working on this very subject in virtually every FBC meeting I can remember. Robb is the Council liaison to the FBC, and he actively participates in every meeting. The eight steps that Robb presented last night were developed by him in conjunction with Jeff Miller, the FBC Chair.

The one place where I believe both Jeff and I and many of our colleagues on the FBC would go a step further than Robb did is in his first step

Our FBC discussions have not only embraced a staffing analysis (building on John Meyer’s study last year), but we have also discussed the belief that a thorough Business Process Re-engineering engagement is necessary as well. Staffing poorly designed, inefficient, ineffective service delivery processes makes no sense. Einstein said it perfectly, “Insanity: doing the same thing over and over again and expecting different results.”

The FBC is not just talking the talk. We have taken steps to walk the walk. At the FBC’s direction, with excellent guidance from Robb, Assistant City Manager Kelly Stachowicz has been working with an expert consultant to present a formal plan for bringing Business Process Re-engineeringto Davis. A brief agenda item will be on the February FBC agenda and a thorough agenda item will be on the March FBC agenda, with the expected outcome being a strong “next steps” recommendation to Council.

This is where the focus of the conversation should be, and not on finding ways to make Davis a more expensive place to live. While it is true that we cannot ‘cut’ our way out of our fiscal problems, it is also true that we will never gain fiscal sustainability until and unless we control the rate of growth of costs.

The obvious problem, however, is that there is no ‘big evil’ corporation or trade group to attack here so we won’t see our ‘leaders’ at canned media events surrounded by bright young faces calling out for more cost cutting. Cost cutting is the hard slog of civic leadership mainly because the ‘big evil’ is ourselves, with our demands for more services and higher compensation for employees. Spending money on pet projects and bright new toys is a lot more fun than outsourcing jobs and cutting benefits.

I give Robb all the credit for having the guts to put this conversation on the table, especially since none of his colleagues have been willing to do so. I just wish he had done it more conspicuously 18 months ago.

the irony mark is that robb led on soda tax AND he led on this. it’s not an either / or thing. and as much as you make fun of attacking an evil corporation, the fact is, robb did that without any of his colleagues at his back. you’re creating a false dichotomy here. tia’s right, this community isn’t just about fiscal issues. they proved that when john munn ended up losing because he refused to address any other issue other than fiscal.

We can do all those fun things DP once we have honestly addressed our fiscal issues. We don’t need to solve all of our problems, but we should, at least, acknowledge that they exist, something this Council has not done effectively. In the short-term, the only thing we should be raising taxes for is to fund our current backlog of obligations. The soda tax was not intended for that purpose, and consequently, should not have been placed on the City’s agenda at this time.

John lost due to his involvement in a lawsuit against the City, and even then, didn’t lose by much.

fun things? that’s hogwash. this wasn’t a feel-good measure. people weren’t singing kumbaya. instead this was a knock down, drag them out issue. this was an issue that the bev industry spends millions to defeat precisely because it does impact their bottom line. fun is putting in a pool. this is war.

I think you know what he means.

You should not be spending time waxing your car when you should be fixing a meal for your children and washing their clothes.

and what i mean is there is no reason we can’t do both. the council could have treated this like they do a measure r vote – have the applicant (in this case the health industry) pay for the fees, be responsible for putting the ballot materials together, promoting the campaign. it’s not like we can’t walk and chew gum at the same time.

And, DP, the health industry can still act, and fund the measure’s consideration, independent of the CC… as they always could have…

Except… there is no measure, to date… just a concept…

yes and they may. but now you’re asking them to get 7000 signatures and get two-thirds vote. that’s a huge escalation in level of difficulty.

Actually, that is all it was. The only beneficiaries of the soda tax would have been the non-profits and public health professionals who would have received funding for their grants. It would have provided no benefit to public health, certainly none to the incidence of obesity or diabetes in the community. You used the correct term; the entire effort was ‘hogwash.’

i think it was robb who nailed it – you can’t have it both ways. you can’t say it will cripple local merchants and argue that it would have no effect.

. . . or your dolphin.

I never said it would cripple local merchants (except for the new business complexity for compliance)… they would just pass the costs on to customers that would still buy the soda. It would financially hurt those low-income customers who… surprise, surprise… don’t change their sugar cravings just because the cost of sugar goes up a few cents.

I see that the social justice crusaders are all riled up against the soda manufacturers. And I see that this is them feeling like they are taking some action against the soda manufacturers. And so it is a “feel good” pursuit… because it will not do a damn thing to reduce the occurrence of obesity in Davis. Before Tia Will had her healthy-lifestyle epiphanies, should would just pay the extra to get her four Cokes a day.

A soda tax does not cause healthy lifestyle epiphanies in people.

Funny… but this reminds me of the left charge that Bush 2 pushed the Iraq war because he was mad at Saddam and Iraq for some reason because of his Daddy’s failed re-election bid… even in consideration of all the harm he would cause others by pursuing a war against his make believe enemy.

Of course that narrative has been proven false.

But I see a similar narrative with social justice crusaders pushing a soda tax. They feel angry at the soda manufacturers and want to go to war with them no matter how much harm they cause others.

Not a good thing.

Mark West said . . . “John lost due to his involvement in a lawsuit against the City, and even then, didn’t lose by much.”

That’s how I remember it as well.

Mark, one of the other positive dynamics in last night’s taxes discussion was the hard line that Rochelle took both in support of Robb’s comments and of the FBC’s “accountability process” regarding our infrastructure maintenance/repair/replacement needs.

You left out wearing their brand new colorful t-shirts and wheel barrel props.

Who paid for those brand new colorful t-shirts! I demand an investigation, one that I will not participate in, because I don’t care all that much . . .

While i applaud Robb for suggesting this, i wonder why it takes a city councilperson to bring this up. it seems to me that a good city manager would have suggested this -years ago.

City Managers reflect the will of the Council majority. We learned early on with the compensation package offered the current CM that cost containment was not going to be the focus for the majority of the current Council. Cutting jobs and slashing compensation is not the preferred course of action for those looking to run for higher office.

Normally I would agree with this, but I’m skeptical in the instant case. The CM’s pushback against the majority on the sugary beverage tax was unusually strident for a subordinate, and was ostensibly in response to staff capacity. But a few weeks later the report requested by the majority comes back containing not just the majority’s items, but also the mayor’s pet proposal as a “bonus.”

The cynic in me is starting to wonder if the rumors about the CM’s ultimate goal being to get Dan elected to the Assembly might not be so far-fetched after all. It’ll be interesting to see if he sticks around after Dan leaves in June.

I second Mark’s points.

Consider that is not in the natural best interest of the top manager in a government entity to have to cut his staff nor the pay and benefits of his staff unless he is incentivized to do so. In fact it is just the opposite. A top manager has an easier job if he can over-staff and over-compensate assuming he is not held accountable for the budget imbalance. Also, when making the case that as the top manager he should be paid the most of all his subordinates, he is also better served by seeing his subordinates’ pay and benefits increased.

If you disagree, then please explain how you see it differently.

Items 1, 2, 4 and 6 should all be handled with a Lean Six Sigma (LSS) project.

https://en.wikipedia.org/wiki/Lean_Six_Sigma

http://americancityandcounty.com/blog/lean-six-sigma-works-local-government

http://www.slideshare.net/SDeas/lean-six-sigma-for-municipal-government

An effort like this would first require city leaders adopt a mindset of “lean”.

Let me know if you need a reference for a good consultant to take this on. I know several.

Or, the signature collection process itself will bring a lot of awareness to the evil behind Big Soda and the harm it does to human bodies. Probably more awareness than the tax itself ever would, implemented and silent. How could that be seen as a negative?

Alan… no disagreement, but thought this would be a good place to ask the question (again) of David/DP/others, can anyone give a valid cite of where it is written that if the CC put a measure on the ballot, it would need a simple majority, but if citizens get it on it requires a super-majority?

It would seem a General Tax is a General Tax… am not understanding…

Prop 62 passed in 1986: “Required all proposals for a new or higher general tax to be approved by two-thirds of the local agency’s governing body, and by a majority of the voters.” So the answer is the voters can’t put a general tax on the ballot.

The official ballot summary said, “Enacts statutes regarding new or increased taxation by local governments and districts. Imposition of special taxes, defined as taxes for special purposes, will require approval by two-thirds of voters. Imposition of general taxes, defined as taxes for general governmental purposes, will require approval by two-thirds vote of legislative body; submission of proposed tax to electorate; approval by majority of voters. Contains provisions governing election conduct. Contains restrictions on specified types of taxes. Restricts use of revenues. Requires ratification by majority vote of voters to continue taxes imposed after August 1, 1985.”

The fiscal estimate provided by the California Legislative Analyst’s Office said, “This measure would prevent the imposition of new or higher general taxes without voter approval by local agencies other than charter cities. The measure also could reduce the amount of tax revenues collected by local agencies in the future, if a majority of their voters do not authorize the continuation of new or higher taxes adopted after August 1, 1985.”

Thank you… I believe we need to change the laws to allow for a citizens’ initiative to have the same standing as one proposed by the CC… but now I understand…