The presentation by Bob Leland on Tuesday night revealed some sobering news on the state of the city’s finances. At the same time, there were several surprising findings that required additional questions.

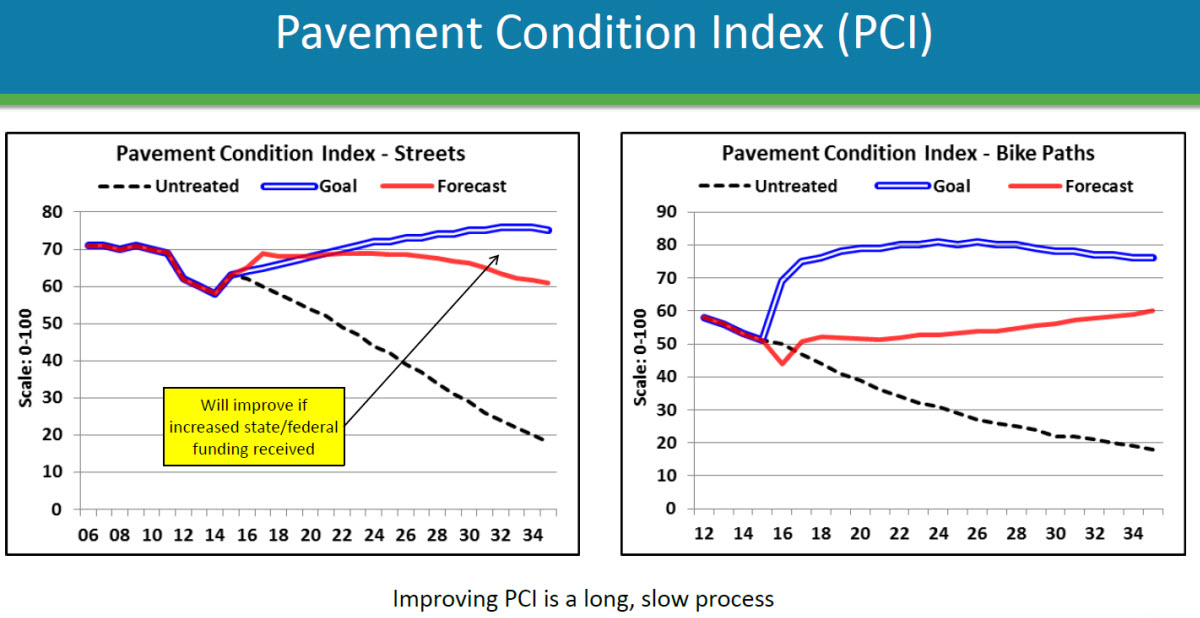

The first question had to do with the roads funding. The PCI (Pavement Condition Index) chart shows an oddity in that the forecast suddenly rockets back up to 70 PCI by 2018 but then slowly retreats over time back to nearly 60 by 2035.

Since that didn’t seem very logical, we inquired with Public Works Director Bob Clarke who explained, “The model that was presented to Council Tuesday night is the initial draft and is intended to be thoroughly reviewed and vetted by City staff. The presentation was intended to show what variables are built into the model and the output it produces. It was not intended to suggest it is in its final form and without possible refinements still needed.”

He further added, “Based on my knowledge of the current overall average PCI for our roads, the value projected for 2017, near 70, seems high.

“While we do have a great deal of pavement-related work in progress and expected to be completed this year, I don’t know if it is enough to raise the average PCI to the 69-70 range, but without further review, I just can’t say. I just received the model today and [plan] to begin vetting the logic embedded in the model next week to determine if appropriate assumptions have been used for transportation infrastructure,” he added.

Consultant Bob Leland explained to the Vanguard, “The original NCE [Nichols Consulting Engineers] study originally envisioned the City spending a total of $4.3M on streets under Scenario 3-City’s Target PCI, in the two-year period of FY16 and FY17, but given outside funding for certain projects, the City will spend more like a total of $14.15M over this period.

“The front-loading produces a higher PCI, but the funding level can’t keep up over time with Scenario 3 funding levels, and thus the PCI starts dropping off later. That said, my PCI numbers are just extrapolations using the funding scenarios from the NCE report,” he explained. “I don’t have access to their extremely detailed model, and in that universe, it can make a big difference which streets you spend money on, their condition, etc. The NCE report will likely be updated periodically, and PCI will be re-benched at those times. The budget model is just an approximation intended to give a sense of whether alternate spending patterns are generally improving or eroding the PCI levels.”

However, the findings on parks seem more significant and it seems like a realistic finding that the funding gap is between $1 million and $1.9 million per year rather than the mind-boggling $300-plus million figure from the Kitchell figure.

Bob Fung, from Project Toto, explained, “The Parks department (Dale Sumerville) revised their estimates from the Kitchell report.” He said, “Estimates for years 6-30 went from something like $315M to $3M.”

Matt Williams told the Vanguard, “A partial explanation of the surfaces reduction was that (1) Kitchell had assumed an ‘end of useful life’ approach to turf, which meant significant turf replacement in Years 16-20. Staff believes those replacement costs can be avoided through more diligent annual maintenance.”

As Bob Leland explained to the Vanguard, “The reality is that you don’t tear down parks and start over every 20 years.”

He adds, “With proper maintenance parks can last for decades. So the budget model focus is on maintenance. The annual unmet need of around $1.2M comes from a combination of staff work done in December 2015 and a recent update by staff of Kitchell’s numbers for parks.”

It is worth noting that even this revised figure “is in excess of what the current park tax can pay for, and includes amounts for playground replacement, tennis court resurfacing, pool equipment, irrigation replacement, general park rehab, urban forestry and wildlife habitat.”

He said, “Kitchell’s actual suggested maintenance expenditures over the next 5 years was a total of $2.69M, an average of only $538K per year. The issue of turf comes up in connection with Playfields Park. The replacement cost of the turf there is $1M. That cost is not included in the $1.2M annual average cost of unmet maintenance needs noted above. Because of its large cost, the city will likely require a variety of revenue sources to address that project.”

Finally Bob Leland explained the PERS (Public Employees’ Retirement System) and OPEB (Other Post-Employment Benefits) funding.

He told the Vanguard, “The costs of both of these are expressed in terms of percent of payroll. There is a chart showing pension costs as a percent of total GF costs, because that is a benchmark people like to point to, but that is not how it is collected.”

He explained, “The normal cost to pay for current pension liabilities is charged as a percent of payroll, while unfunded actuarial liabilities (UAL) are billed to the city as a fixed dollar amount (although the reality is that cities charge UAL out as a percent of payroll to departments for cost allocation purposes, and just settle up with PERS by year-end to hit their required UAL obligation).”

He continued, “There are charts in the slides that show the total PERS obligation (normal cost plus UAL) as a percent of payroll for each of the 3 plans (police, fire and misc). Police is now 35% of payroll and is projected to peak at 65%. Fire is now 37% of payroll with a peak of 77%. Misc is now 30% of payroll with a peak of 50%. OPEB is also charged as a percent of payroll.”

Mr. Leland continued his explanation: “The Annual Required Contribution (ARC) for OPEB is around 22% of payroll, by way of comparison. The chances of an agency meeting such increased pension obligations over time will be improved if the agency utilizes long-range forecasting so they can plan accordingly, and Davis is doing that. But clearly there will be budgetary trade-offs involved as the higher pension costs will preclude alternative investments in service level improvements or improved infrastructure.”

This is an issue of great concern to Mayor Robb Davis, who told the Vanguard, “The growing proportion of the budget that must go to pensions and OPEB means that fewer resources will be available to deal with critical City needs for infrastructure maintenance–be it roads, buildings or parks.”

As he explained, “Local government agencies across the state find themselves increasingly constrained in their ability to meet basic community needs. Over the past generation, more and more tax dollars generated locally have been taken from local jurisdictions. The combined effect of increased pension costs and decreased tax take is clearly not sustainable in the sense that local needs to maintain already developed infrastructure cannot be met without further local taxation or deep cost cuts in other areas.

“The City of Davis faces these realities and we find ourselves more and more constrained in our ability to meet local needs,” the mayor told the Vanguard. “Only difficult choices lie ahead.”

—David M. Greenwald reporting

Talk about living living life through the rear-view mirror. All of these expenses you discuss, which will be impacting our future budgets for years to come, are – without exception – examples of deferred spending. That is, they are expenses of prior periods – when the funds should have been set aside and recognized as part of those earlier budgets.

Like most other communities we are faced with the threat of “crowd out” – where those older expenses are taking precedent over other current programs and priorities.

We are where we are, and accordingly, our conversations must now turn to the issue of how these prior period expenses will be paid for under our future budgets.

Whether they understood it or not, with its recent votes, the community has rejected the idea of economic development as a tool and pathway towards enhanced revenue generation.

It seems, therefore, that City Council is left with the straightforward task of determining when and how much our parcel taxes should be increased in order to meet our spending needs.

I think it would be worthwhile to determine what an ‘all-tax’ solution would look like, as part of an education and outreach program that readdressed the economic development question. Now that we have a better understanding of what our real costs are going forward, we can produce a better estimate of how much new revenue will be needed, and how that looks for the individual taxpayers. I suspect though, that all we will see from the current CC/CM combination is a piecemeal approach, as I doubt that the CC majority will want to accept responsibility for dealing with the total bill.

I think what we need is actually similar to what we need for housing – an analysis of various options – what a tax scenario looks like, what a mixed scenario looks like, what an all cuts scenario looks like, etc.

Yes, but. In order to “readdress the economic development question” – we need some context, specifically in reference to the REALISTIC OPPORTUNITIES for various types of economic development IN CONTEXT OF UNDERSTANDING HOW PROJECT SPECIFIC ECONOMIC DRIVERS GENERATE REVENUE FOR THE COMMUNITY AND THE CITY.

Components of that analysis absolutely MUST INCLUDE a realistic look ahead at our projected 25-Year Community and Municipal Revenues streams in context of:

1) Changing Demographics – both by age and by socio-economic status – in the Davis Community – based upon established Department of Labor “Spending Statistics” for these future populations.

2) Employment Demographics – particularly by their Tax-Status (i.e. Public/Non-Profit versus Taxable For Profit). The only group we know today, that has any meaningful plans for expansion is the University and the attendant increase in student enrollment.

3) Implications for future sales tax revenue growth as the economy increasingly trends towards a “service economy” and continued growth of the “online retail model” with its attendant loopholes related to state and local sale tax collection.

Do Vanguard readers understand that Berkeley, for example, incorporates a section of its Annual CAFR report which details the breakdown of Commercial Property Tax Revenues to the city. It details the categories, separates as between single and multifamily properties, commercial properties, and tax-exempt commercial properties. If Davis were keeping similar statistics, we might find some useful basis to compare our Per Capita Commercial Tax revenues available for municipal services.

If we ever intend to get serious about looking at “what if” scenarios related to potential sources of increased municipal revenues from commercial development – in particular – we really need to understand our current baseline AND THEN PROCEED TO PROJECT FROM THERE FORWARD.

Point being, if the community is unwilling to expand its borders – thereby increasing its base of employers and daily workforce employees, where and how do we expect to see any significant gains in potential for increased Economic Activity and Associated Municipal Revenue generation?

In this context, all GROWTH is not the same. There exists a fundamental difference between the “community level municipal revenue potential” of a new multi-story residential housing project and a similar sized commercial property development – that being the difference between a building or “campus” filled 5 days a week (or more) with employed individuals spending their breakfasts, lunches, some dinners, casual purchases, gas and latte money within the City of Davis versus on-campus. In that sense, expansion of new commercial development works somewhat like a “daily driver of local tourism” in terms of its overall impacts on the local economy.

Without, or unwilling, to discuss the actual economic and revenue implications of these dynamics – the community is deprived of the “deep dive” required in order to truly understand our current predicament or the universe of potential options as we move forward.

In advance of many good and positive comments about the very tangible benefits of new urban living and increased residential living options in our Downtown, I would ask if you might concede that our more permanent, or long term residents, of Downtown market-rate apartments and condos – versus student housing residents – are more likely to have a greater community-level, economic impacts in terms of local per capita discretionary spending potential?

Similarly, to the extent that such higher density, market-rate housing is encouraged for the Downtown – where are these residents expected to find local jobs commensurate with the attendant mortgage payments?

And, to the extent that such projects can reasonably be expected to appeal to a certain number of automobile drivers (particularly if there are limited local employment opportunities) – how do you propose to address the increased parking demand to support these developments?

I tend to agree with this sentiment. We are going to need more tax revenue. I would also add that the Council should be looking at the following things:

* Renegotiation of City employee labor agreements to reduce future liabilities.

* Cost reductions including some that will be very painful to many citizens.

* Continued attention to economic development including such controversial things as bringing cannabis dispensaries to Davis.

That’s what I was warning about a decade ago – we were balancing the budget through the creation of unmet needs and some day those needs will come through.

“Gas-tax increase to pay for road repair clears California Legislature”:

http://www.sacbee.com/news/politics-government/capitol-alert/article143237054.html

Yes, but will the City of Davis will see any of that money?

Did you read the story from Aguiar-Curry (below), it looks like Davis will be getting about $3 million per year. That’s about 30 percent of what we need.

Link: https://davisvanguard.org/2017/04/aguiar-curry-votes-fund-crumbling-state-local-transportation-infrastructure/

That would be a good start on the needed repairs. Let’s hope it actually comes through.

David:

I took a quick look at your referenced article.

Regarding the estimated $3 million per year, just wondering if that includes all of the allocations in the following categories (assuming that this is all accurate):

Yeah I think that’s the total

David Greenwald said . . . “Did you read the story from Aguiar-Curry (below), it looks like Davis will be getting about $3 million per year. That’s about 30 percent of what we need.”

Actually David, if you look at the table Assemblymember Aguiar-Curry provided, Davis has already been getting $1.45 million per year, which to the best of my knowledge based on the information provided to the FBC, is already part of the $4 million per year General Fund monies being spent annually on pavement maintenance. So the incremental amount appears to be only $1.57 million.

I have submitted a request to Public Works and Finance, asking them to confirm whether they agree with Assemblymember Aguiar-Curry’s FY 15-16 $1.45 million number. I’ll provide an update when I get a response.

Matt:

It might be helpful if you asked Public Works and Finance if the estimated increase includes all potential categories (e.g, does it include “transit, bike, and pedestrian access programs”, for example). Seems like Davis might be somewhat uniquely “qualified” to take advantage of such funds.

I’d also be interested to know if the categories listed in the quote above are accurate and complete, and what (if anything) Davis can do to maximize/leverage the various categories/allocations (e.g., via matching funds). (I assume that city officials will be interested in this, as things become more clear.)

Matt:

Another question I would have is, what was the amount of state funding for road maintenance that Davis received in prior years (perhaps going back 10 years, or so)? That might also provide some perspective, regarding the amount (at least $3 million) expected to be received annually, as a result of the approval of the transportation bill, today.

Ron said . . . “It might be helpful if you asked Public Works and Finance if the estimated increase includes all potential categories (e.g, does it include “transit, bike, and pedestrian access programs”, for example). Seems like Davis might be somewhat uniquely “qualified” to take advantage of such funds.

I’d also be interested to know if the categories listed in the quote above are accurate and complete, and what (if anything) Davis can do to maximize/leverage the various categories/allocations (e.g., via matching funds). (I assume that city officials will be interested in this, as things become more clear.)

Another question I would have is, what was the amount of state funding for road maintenance that Davis received in prior years (perhaps going back 10 years, or so)? That might also provide some perspective, regarding the amount (at least $3 million) expected to be received annually, as a result of the approval of the transportation bill, today.”

Ron, those are all good questions that you yourself can ask Public Works and Finance since you are interested . . . and let the Vanguard readers know what they tell you.

Matt:

You’re right – I could (and may) ask those questions, myself at some point. Not sure if Public Works and Finance is the correct source for all of those questions.

In any case, since you were planning to contact them with your single question, I thought you might be interested in asking the other questions, as well. You know, to provide the “whole story” (perspective), as you like to say to me.

The time has come for you to do your own work Ron. You are very good at sniping at the work of others, but you rarely pull your own weight. Time to walk the walk, not just talk the talk.

Matt:

“Sniping”, “deflection”, and outright “denial”, has been directed at me as well, when I’ve presented evidence. Quite often, you engage in those practices.

Go ahead and continue to present your “one-sided” facts, which often fail to tell the “whole story”, as you sometimes say to me. I’ll continue to decide whether or not to challenge them.

I love it, “the bill will provide $52Billion in new funds”….

It could have been written, “the $52Billion in proceeds will be financed by a new transportation tax for the next 10 years to pay off the estimated $60 billion in new bonds and associated interest payments”.

It’s not like we aren’t using a new long-term borrowing strategy to further burden our state credit rating. The article goes on to say that some:

Starting to sounding familiar…………..?

Indeed, yes… at all levels of Government, including Federal… nothing new under the sun…

The general “gist” of your statement might be a valid and accurate criticism regarding “local” efforts to raise funds for roads and pensions, as well.

A stretch, Ron… pretty much “double-jointed”

Local roads and local pensions are local problems… unless you really want to pay more taxes to bail out Bell, CA, and their extravagence… if so, make a personal donation… don’t ask us to do the same…

I look to keep local obligations, well, local…

If you choose to bail Bell CA out, a few million ought to do it…

[yeah I know, you’ll see that as an insult, but I care not]

Howard:

Seems ironic to make a statement like that, given the examples that David has provided regarding the unwise (local) decisions made, e.g., regarding pensions and salaries. (The “gist” of John D’s statement is that the STATE ALONE wastes tax money.) Are you suggesting that local government has a better “record”?

Also seems strange to make a statement like yours, given that CALPERS is controlled (and manipulated) by the state (which impacts cities such as Davis), and that communities such as Davis are now poised to receive at least $3 million in state funds, for road maintenance from the state.

Another article, regarding the state transportation legislation which was approved, today. Our governor does strike me as “effective and experienced”, even if one (including me) doesn’t agree with all of his goals. (Note the Chamber of Commerce support for this bill, as well).

Overall, it’s good news for those who care about roads, statewide. It is also not an “excessive” increase, for (most) individual motorists. The legislation includes funding for some non-auto transportation projects.

And perhaps most importantly, it puts the tax exactly where it belongs – on motorists (myself included).

It is a big deal.

http://www.sacbee.com/opinion/opn-columns-blogs/dan-morain/article143366054.html

To clarify the 10-year aggregate amount of “new city streets and roads investments (in millions)” prepared by CalTrans, go to this link. The total amount for Davis is listed as $15.63 million for the 10-year period, or $1.563 million per year.

To clarify, that’s the ADDITIONAL estimated amount, based upon “historical data”. The total estimated amount received from the state is more than $3 million/year, as discussed above. That also may not include funds available for other non-auto categories, as discussed above.

Correct Ron. I have submitted a request to Public Works and Finance to confirm that the “historical” data amounts CalTrans has reported have indeed been in the annual General Fund spending on pavement (roads and bikepaths) maintenance each year.

I will also submit a request to CalTrans for their calculations of the historical $1.45 million amount they have reported.

Again, since you’re contacting them anyway, it would be helpful to know some historical data as well. (For example, funding received from the state for the past 10 years or so, and generally how it was used.) This would provide some much-needed perspective. (I understand that you can decline that suggestion, and that I can pursue it if I wish.)

It would also be helpful to know if this new legislation is fundamentally different, in terms of funding for non-auto categories/allocations (e.g., the $850 million for pedestrian, bike, and transit programs, or any other category). However, I realize that Public Works and Finance might not be the best source for an analysis of the new legislation.

Quote from article:

http://www.pressdemocrat.com/news/6866022-181/sonoma-county-residents-react-to?ref=most&artslide=0

Ron,

In your opinion, does that mean that you would like the state legislators to issue new Pension Obligation Bonds to fully fund the unfunded portion of their Pension & OPEB liabilities – as well as those for all of the unfunded programs of all the cities, counties and agencies – and then stick the taxpayers with a new statewide sales tax (for example) to pay for same? In your opinion, would this be another worthy example of what “Sacramento can do when they put their mind to it?”

Financially speaking, how would that be any different than what they have done with the new Roadway Bonds – in terms if fiscal discipline.

John D:

I was just providing a quote from the Executive Director of the Sonoma County Taxpayer’s Association (regarding pension liabilities), which I happened upon while reading that publication, online. (It’s not something I was “searching for”.)

I will say that the new legislation regarding road repairs puts the tax exactly where it belongs – on motorists.

I think I’ll refrain from further comment.