by Alan Pryor

Measure I is a 10-year parcel tax for Transportation Infrastructure maintenance at $99 per year (or per apartment for multifamily dwellings) increasing at 2% per annum.

The signers of the Argument Against the Measure and the Rebuttal to the Argument For the Measure are all the same, as follow;

Michael Nolan, Acting President of Yolo County Taxpayers Association,

John Munn, Former Member of the Board of Education of the Davis Joint Unified School District,

Don Price, Emeritus Professor of History, University of California Davis,

Pam Nieberg, Former Co-Chair, Yes on Measure O (City of Davis Open Space Ordinance)

These signers are a disparate group of individuals representing fiscal conservatives and social progressives in Davis.

In their Argument Against Measure I and their Rebuttal to the Argument in Favor of Measure I, these signers made some serious claims and allegations against the City as a fiscally  responsible agent and the trustworthiness of the statements made by the Measure’s proponents in fairly assessing the Measures’ impacts and honestly reporting them to the electorate.

responsible agent and the trustworthiness of the statements made by the Measure’s proponents in fairly assessing the Measures’ impacts and honestly reporting them to the electorate.

This article investigates these claims and attempts to quantitatively verify their accuracy. In doing so, some independent investigations and fact-checking were done and some of the information was obtained in response to direct inquiries to the campaign signers.

Following is the Argument Against the Measure and the Rebuttal to the Argument in Favor of the Measure. Immediately after each one of the claims in the Argument Against or the Rebuttal, a bold text statement is highlighted in parentheses stating the authors opinion if the claim is TRUE or FALSE and a numerical reference to the appendices to this paper which has the independent data supporting or negating the claim.

In summary, all of the claims made by the measure Opponents had a verifiable basis and none are considered misleading to the general public.

Argument Against Measure I – Transportation Tax

Our City is again asking taxpayers for new money for transportation infrastructure repairs that have been deferred for the past decade so employee salaries could be raised to unsustainable levels.

However, our City is now promising that this time they really will use ALL of the new taxes only for transportation infrastructure needs. Additionally, they promise that now these

new taxes,

new taxes,

“…shall not be used to supplant existing funding for street and bike path maintenance improvements. The baseline maintenance of effort budget for this purpose shall be $3,000,000…” (TRUE – Directly from Ballot Language)

But this promise is hollow. $3,000,000 is actually the annual amount the City is now budgeting only for road repavement alone. But this new tax measure also proposes to fund a wide variety of additional transportation infrastructure repairs including,

“…sidewalks, bike paths, curbs, gutters, street and bike path drainage, signs, striping, and pavement markings, traffic signals and street lighting.”(TRUE – Directly from Ballot Language)

The current budget for maintenance of all of these other infrastructure needs is an additional $4,550,000 annually. So the City is really only promising to continue spending $3,000,000 annually for road repavement but there is no guarantee they will continue to spend the additional $4,550,000 annually now budgeted for all of our other transportation infrastructure needs. (TRUE – See Fact Check Item 1)

One might fairly ask if the City has any other spending plans for this $4,550,000 if they do not spend it on transportation infrastructure repairs. Well, on December 19, 2017 Davis Mayor Robb Davis stated,

“…over the next 10-years our pension costs alone are going to go up by over $6,000,000 a year.” (TRUE – See Fact Check Item 2)

Davis voters have seen years of repeated broken promises by our City about how they will spend our taxes. And now they are using deceptive language in this ballot measure to do it again. Enough is enough!

Please vote “No” on Measure I.

Rebuttal to Argument in Favor of Measure I – Transportation Tax

Davis objectively has the worst road conditions in Yolo County. But instead of maintaining our streets over the past decade, the City has chosen to provide unsustainable compensation increases to its employees.

But now there is a large new source of state funds for road maintenance. Last year California passed Senate Bill SB1 – the Road Repair and Accountability Act of 2017 which raises the gasoline tax from $0.24/gallon to $0.417/gallon. (TRUE – See Fact Check Item 3)

It is estimated this will raise $1.5 billion/year statewide for local street repairs. Davis’ fair share of this money will be about $3,000,000/year – about the same amount as would be raised by this new tax. (TRUE – See Fact Check Item 3)

The City has not disclosed this new funding source to voters and is instead pleading poverty. Given the City’s profligate past behavior in excessively compensating employees while deferring critical roads maintenance, it has no right to ask voters for $3 million per year while keeping silent on the expected receipt of these millions of new dollars from the state.

The City must at least wait until they more accurately determine exactly how much money will be received from the State before asking for our tax money for the next 10 years!

If state monies are subsequently found to be insufficient to repair our streets, then the City can honestly disclose this and come back to voters with a realistic assessment of our needs.

Until then, this knowing misrepresentation by omission on the part of our City should not be rewarded.

Please Vote “NO” on Measure I

Fact Check Item 1

Claim -”The current budget for maintenance of all of these other infrastructure needs is an additional $4,550,000 annually. So the City is really only promising to continue spending $3,000,000 annually for road repavement but there is no guarantee they will continue to spend the additional $4,550,000 annually now budgeted for all of our other transportation infrastructure needs.”

Judged to be TRUE

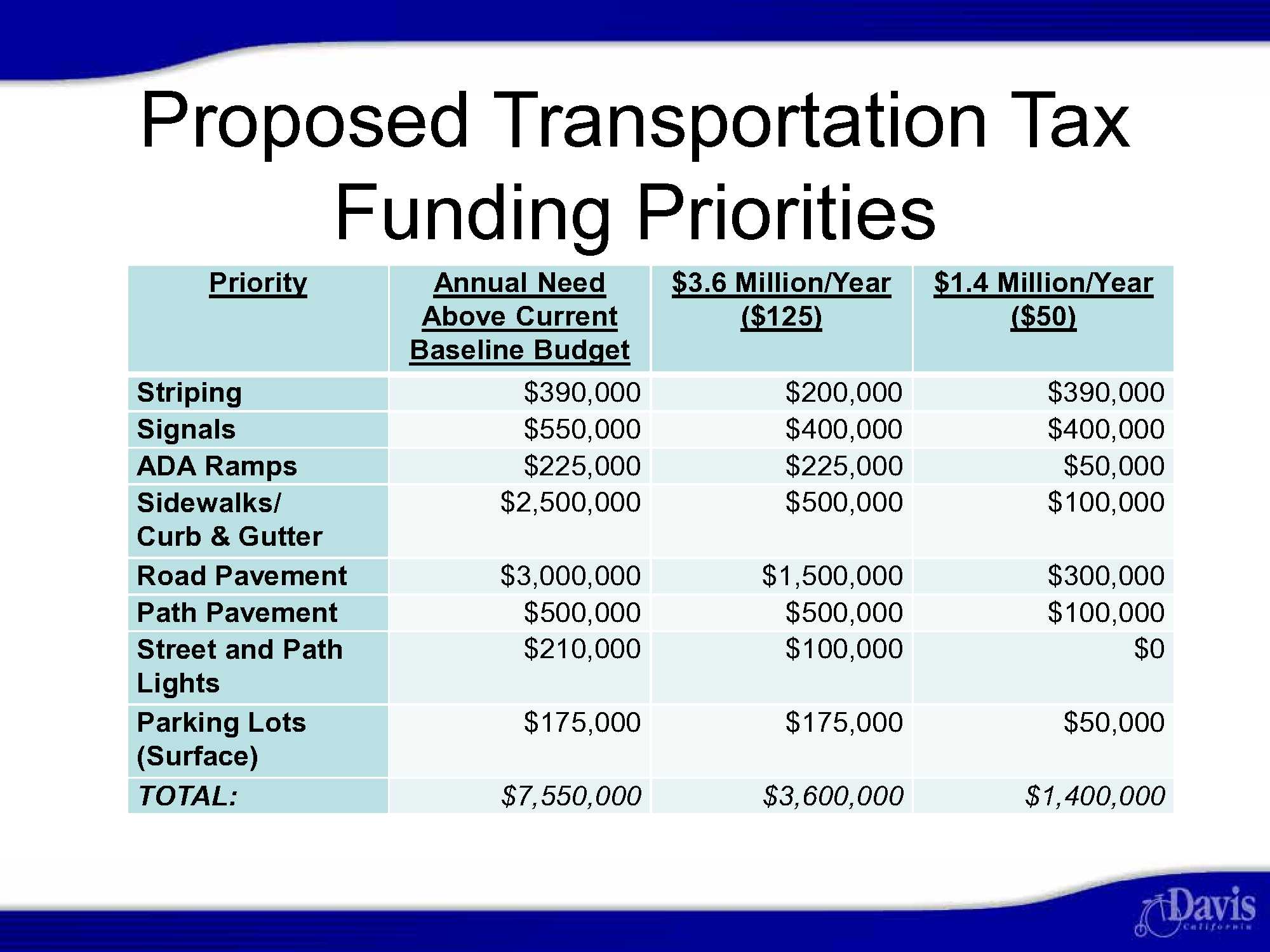

Basis for Claim – On 12/19/2017, Staff presented the following summary FY 2017-18 budget of the Dept of Public Works Traffic division to Council for purposes of informing the Council to assist in setting a transportation-related Parcel Tax.. This table clearly showed that the street resurfacing-only budget was only $3,000,000 while the total transportation infrastructure costs for all transportation infrastructure needs potentially-funded under this Parcel Tax. were actually $7,550,000

Fact Check Item 2

Claim -”One might fairly ask if the City has any other spending plans for this $4,550,000 if they do not spend it on transportation infrastructure repairs. Well, on December 19, 2017 Davis Mayor Robb Davis stated, “...over the next 10-years our pension costs alone are going to go up by over $6,000,000 a year.”

Judged to be TRUE

Basis for Claim –

That is exactly what was said by Mayor Davis at 2 hr:17 min:40 sec of the City Council meeting of December 19, 2017 meeting which is accessible through streaming video at http://davis.granicus.com/MediaPlayer.php?view_id=2&clip_id=786.

Fact Check Item 3

Claim -”But now there is a large new source of state funds for road maintenance. Last year California passed Senate Bill SB1 – the Road Repair and Accountability Act of 2017 which raises the gasoline tax from $0.24/gallon to $0.417/gallon.

It is estimated this will raise $1.5 billion/year statewide for local street repairs. Davis’ fair share of this money will be about $3,000,000/year – about the same amount as would be raised by this new tax.”

Judged to be TRUE

Basis for Claim – This information was obtained from a document published by the League of California Cities, “City and County Tool Kit – SB 1: Road Repair and Accountability Act of 2017 – Talking Points”. It can be downloaded at https://www.cacities.org/Resources-Documents/Policy-Advocacy-Section/Hot-Issues/Transportation-Funding/SB-1-Toolkit/SB-1-Local-Streets-and-Roads-Talking-Points.

“SB 1 enables cities and counties to address significant maintenance, rehabilitation and safety needs on the local street and road system. SB 1 generates over $5 billion annually for state and local transportation improvements. Cities and counties are slated to receive $1.5 billion annually at full implementation of SB 1 (in 2020)“

The City of Davis’ fair share of this $1.5 billion can be determined by the ratio of the population of the Citycompared to the population of the entire state estimated at

68,000 (Davis Population) / 35,000,000 (California Population) x $1,500,000,000 = $2,914,285

Let’s take another look after reading the law itself and taking a look at the context of the predicament we’re in road-wise:

False Claim #1: The city won’t keep spending the money they’re currently spending.

In a town where lawsuits are the most common way for many of the opposition signers to get their way, I don’t think the City would be stupid enough to violate this provision. Then again, math isn’t always the “no” crowd’s strong suit.

False Claim #2: The city is going to spend the money on other things.

This is even more misleading than the first claim, conflating the cost of road maintenance with other budget items when the whole point of a special tax is that the money cannot be spent on anything else. Hence the 2/3 voter threshold. Turns out people tend to like taxes if they’re required to go to the thing they pay for. If you’re wondering where this comes in, look at Article 15.21.070. Limitation on Disposition of Revenue.

Let’s focus on whether or not this ordinance is a good way to fix our roads, not whether or not the City has other problems– I think everyone agrees that we have a lot of work to do.

False Claim #3: The State will fix it for us.

We’ve been hearing this claim for over a decade now. Let’s face it: we need to handle our own issues now– this magical State government wand is dangled over us on every issue in this community from housing to homelessness.

It seems strange to me that the self-proclaimed “responsible” crowd is so bent on having other people fix their problems, and then whenever someone tries to address problems in this community, they get served another frivolous lawsuit that is so costly and time-consuming they’re forced to settle.

Let’s take responsibility and meet our community’s needs ourselves, read the laws we’re voting on, and be honest with each other. I get it, some folks don’t want to pay just under $9/month to fix our roads. I’m already paying $100-$200/month more each year just to live here–but if paying a small amount each month means my friends stop going to the ER after hitting potholes on their bikes, that’s a small price to pay.

I have not been on here for some time but had to correct two errors:

1. This statement is incorrect.

The table shown is NOT a summary of the FY17-18 budget. It was a table prepared by City Staff to give their best estimate concerning total additional annual costs to deal with all infrastructure items listed. What this is saying is that we need an additional $7.55 million over what we are spending. The confusion might be caused by the fact that staff is saying on streets alone we need an additional $3 million, which, at first blush, might be mistaken for the $3 million we are currently spending on ALL these things. I would ask the author to correct this error. Again, this is a projection of need, not a budget document showing current spending. Please read the title of the column.

2. The Road Maintenance and Repair (RMRA) estimates for Davis are 17-18 $392,037 and 18-19 $1,141,500. These are on Michael Coleman’s website californiacityfinance.com. The first year is only a partial year. Keep in mind that SB-1 is under threat and facing possible repeal via a ballot initiative.

As the author of this article I acknowledge my error.

I erroneously referred to the total current FY 17-18 budgeted transportation expenditures by the City as at $7. 55 Million. Based on this erroneous assumption I then stated that the claim by the Measure H’s opponents was factual that the City could legally cut the $4.55 Million difference between the $7.55 Million budgeted for transportation and the guarantee of $3.0 M was factual.

In making this error I did, as pointed out, rely on a City budget presenattion slide that showed the current projected transportation needs shortfall and not the current FY 17-18 transportation budget.

One can look at the actual current FY 17-18 budget at http://documents.cityofdavis.org/Media/Default/Documents/PDF/Finance/2017-2018-Budget/Final/14-Public-Works-Department-Final-17-18.pdf

Here one can see that the total FY 17-18 budget for the Transportation division’s Transportation related is actually $11,633,631 and not $7.55 Million as I incorrectly claimed.

However, this actually makes the problem much worse than I had incorrectly projected earlier. This is because now the City could theoretically divert up to $8.63 Million for transportation needs in the future and still comply with the provisions of the Transportation Ordinance which only requires an annual expenditure of $3.0 Million.

Thank you for correcting me and making me do the homework to show the degree of funds diversion by the City could actually be much greater and still comply with the ordinance.

So I should change my statement to read that the claim is “Judged to be TRUE – But Understated”

The 3 million referred to in the ballot measure is general fund money that the City Council is committing to street/bike path projects. So, since you did your homework, how much of the $11 million is general fund money? Of course we get money from many sources in any given fiscal year that go into streets/paths. Some of this is general fund money we control and some of it is restricted money that can only be used for certain projects. Water funds were used in some cases to repair and stripe streets after pipeline laying (for example). We also received grants from SACOG for several projects and used project fees for others.

You are wrong to imply that the $11 million is from discretionary, i.e. general fund. The ONLY commitment we can make is to maintain the level of General Fund allocations. We cannot commit to maintaining levels of funding that are one-time and or otherwise restricted.

Please examine the revenue going into transportation projects by source.

Here are the relevant links:

http://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/CouncilMeetings/Agendas/20180206/05-Revenue-Measures-June-2018.pdf

On page two of this document you will see:

To find the details on the CIP for Transportation Infrastructure Rehabilitation you must go to the budget document on CIPs. It is found here:

http://documents.cityofdavis.org/Media/Default/Documents/PDF/Finance/2017-2018-Budget/Final/15-CIP-Final-17-18.pdf

If you go to page 68 (15-58) you will find the Transportation Infrastructure Rehabilitation fund 8250. Go down to the “Financing Sources” section to find the $3 million.

There, I did your homework for you.

Everyone should keep in mind that this tax is ONLY for rehabilitation and repair NOT new projects.

So from the last CIP budget link you provided, it appears that the projected $3,000,000 in general funds money budgeted for road repavement in FY 17-18 and future years (and which serves as the basis for the minimum Maintenance of Effort clause built into the tax ordinance) has already been reduced from Est. $3,456,484 in FY 16-17 and $5,409,504 in previous years. This brings up some questions:

1) Why is the City’s general fund road repavement budget commitment going down in recent years and projected to remain down going on for at least several years into the future compared to the past?

2) No matter the reason, is it true that the City is now using a general fund repavement expenditure commitment threshhold in the Tax Measure that is the lowest it has been in recent years?

3)This seems like the City has picked a pretty low bar to meet to satisfy the Maintenance of Efforts clause in the Tax Measure. This again begs the question, what is the City planning to do with the extra money it saves by putting less general fund money into road repaving?

And your post still does not address the observation that the City is promising only to maintain $3,000,000 in general fund money for repaving only. It could still divert ALL OTHER general fund monies now used for striping, traffic signals and signs, curbs, gutters, sdewalks (which can all be paid for with the proceeds of this Tax measure) and still comply with the Maintenance of Efforts clauses in this Ordinance because that only specifies the City will still spend $3,000,000 per year in general fund money ONLY for road pavement alone.

So, Alan… should additional staff costs to turn out capital projects just come from the GF?

There was no fund 8250 before 13/14 budget. Here are the amounts year by year since then:

13/14 – $1.4 million

14/15 – $3.8 million

15/16 – $5.1 million

16/17 – 3.0 million

17/18 – 3.0 million

15/16 saw revenues growing much faster than had been expected and the City Council (this was my first budget), instructed staff to increase the amount as a one-time extra amount, assuming that could not be maintained without growth. Following that, concerns over revenue stagnation or even reduction based on the loss of car/RV sales tax revenue led to a reduced commitment but one that we instructed staff to build into budgets going forward.

You know Alan, before 13/14, no one was even talking about infrastructure backlogs. The CC at that time did the PCI study and then the two CCs I have been part of pushed those studies out to include parks and buildings. We have tried to honestly lay out the need and prudently put general fund monies towards meeting the needs. I realize there is nothing I can say that will lead you to value the efforts we have made to transparently lay out the needs and, rather than hide the ball, put general fund money towards them. I think this has been prudent budgeting and the level of service commitment reflects a desire to maintain that prudence while seeking more funds to do more.

The bottom line here is that you have made two factually incorrect statements and corrected them only in the comments section. The opponents have an erroneous statement published in the ballot argument against Measure I. No one will correct it for the voters. It will remain wrong in every voter guide that went out, based on an incorrect reading of a table that was clearly labeled. I find that objectionable.

My error is in my accidentally incorrectly reporting that $4.55 Million in funds now budgeted transportation purposes could be diverted from transportation needs in the future and not violate the Maintenance of Effort language in the ordinance. But my only honest error is the exact amount of money now used for striping, sidewalks, curb, gutters, signals, signs, etc that could be legally diverted. My error is probably only off by a million or so either way. But the statement that millions of dollars now spent annually on striping, sidewalks, curb, gutters, signals, signs, etc. could be diverted to non-transportation need is still factually correct. But you noted my honest error and I owned up to it. You find it objectionable, fine…that’s your right.

But I find your and the Council’s actions extremely objectionable due to the fact that you are using sneaky language to only maintain an already reduced amount of general fund money planned to be used only for repavement in the future while intimating that you are guaranteeing to maintain all levels of current traffic expenditures. I believe that language used was intentionally designed to deceive voters and I think voters will find that intentional deception very objectionable. Will you own up to that deception?

But I do not see the City making the commitment to maintain ALL general fund transportation expenditures as you claim. The City is only committing to maintaining general fund expenditures for ROAD REPAVEMENT ONLY. All other general fund transportation expenditures can be otherwise diverted to any other non-transportation use. That is at the heart of my beef with the ordinance language.

And since you are on your high horse about deceptive ballot argument language, I see the City l has ALSO made a whopper in your Yes on Measure J arguments by estimating that Nishi will generate “<em>almost $2.5 million in additional property taxes every year</em>”. The language clearly intimates that all of these taxes will flow into City coffers. We both know that the actual amount of property taxes estimated to be received by the City is about $200,000/year as presented by City Staff to the Finance and Budget Commission. That is less than 10% of the $2.5 Million portrayed in the Yes on J ballot argument. I don’t see you getting your britches in a pinch over that. How about it? Was that an honest error or intentional deception?

That is incorrect Alan. The 8205 fund is for a variety of street and bike path repairs.

Sneaky language? Seriously? We are putting $3 million per year into street repairs. That is true. We are committing to maintaining that amount. Other funds for new construction often come via a match of impact fees and grants. They are restricted and often one-time funds. We cannot build a budget around promising them in the future.

The other thing I would note is that it is not merely the Mayor who has laid out the pension challenges ahead of us. The community is knowledgeable of them because this City Council insisted on developing a transparent fiscal model that uses clear assumptions to assess our ongoing pension (and OPEB) needs. Further, this and the previous City Council tasked staff with producing full projections of infrastructure needs and we did not come to the voters with an initiative until we had those needs defined based on careful analysis.

In relation to Measure I, the vast majority of paving and maintenance projects are outsourced to private firms using competitive bidding processes. This reduces costs and assures high quality work. Having a predictable revenue stream means the City can go out to bid at the most propitious moments, further lowering maintenance costs by allowing us to enter the market at the best times.

Less than a quarter of your property taxes are returned to the City to provide for basic city infrastructure. In contrast 100% of the revenue from Measure I stays in the city, making it the most efficient means to raise money to fund critical needs.

Does anyone know the status of the California Supreme Court case on whether to review the Marin County dispute of a case that was upheld by the applet court that allows Marin County to continue eliminating certain compensation from the pension calculation?

It seems we are on the cusp of breaking the public employee union cartel theft of public money to fund much too generous government employee retirement benefits and return it to spend on things like road maintenance.