By Liam Benedict

By Liam Benedict

As more Republicans among the Trump administration abandon his flailing attempts at undoing the results of this year’s election, President-elect Joe Biden has been able to continue building his cabinet––filling out the necessary positions within the highest levels of government.

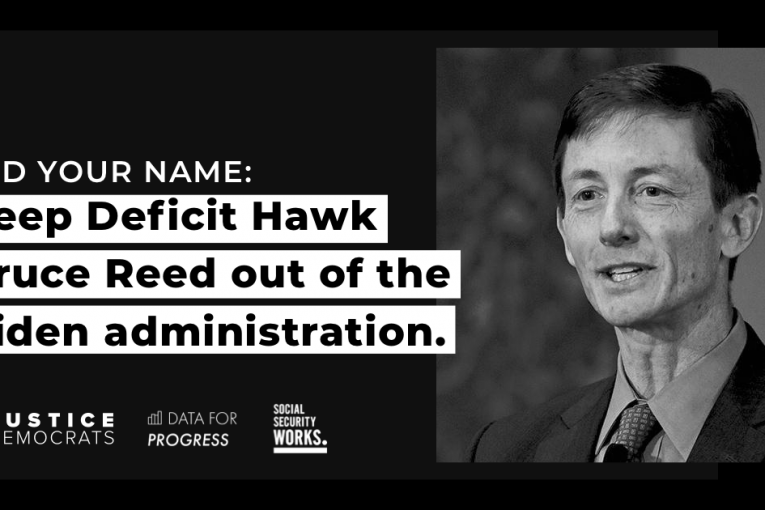

So far, the Biden administration is looking promising, with a diverse group of experienced experts filling out the now vacant positions. However, there has been the occasional disappointment here and there: The most recent being the appointment of Bruce Reed.

Given his history as a Deficit Hawk, Biden tapping Reed for the deputy chief of staff position has drawn fire from the progressive left. Even though it may look like a bad omen, fighting to break out so early, many people see it as a positive sign. If we want things to get any better, then progressive politicians must pressure the new President-elect whenever he starts to stumble.

Biden’s appointee Bruce Reed has a long history of work in the government, specifically alongside the President-elect, dating back to the early 1990s. Since then, Biden was still a senator, while Reed worked in the White House as an assistant to the current president for domestic policy. Unfortunately, Reed’s long history of government work is not one to be particularly proud of.

To start, he worked closely with Biden on the now-infamous “Crime Bill,” one of the more shameful parts of the president-elect’s history.

He would go on to become chief of staff under the Obama administration until 2013. During that time, he worked on the Bowles-Simpson Commission, a bipartisan task force organized under former President Barack Obama to deal with the great increase in national debt brought about by the recession.

The plans suggested by this commission did not have the American people’s best interests in mind. As The Independent reported: “The group recommended increasing the federal gas tax by 15 cents, raising the retirement age to 69 by 2075, cutting 200,000 federal jobs, and reforming – making cuts – to Social Security and Medicaid, among other suggestions.”

It is also worth noting that Reed previously ran a think tank where one author argued for partial privatization of Social Security. This same think tank also published a column promoting Iraq’s invasion, again showing a history of bad judgment on Reed’s part.

When you examine Reed’s record, the danger surrounding his return to the White House is clear. In the time of COVID-19, having a deficit hawk back in power could be disastrous for future relief efforts.

Not to mention that both Biden and Harris have both promised that they would protect and expand Social Security, making Reed’s appointment look surprisingly counterintuitive. Luckily, his appointment is facing some staunch opposition from progressive members of congress.

A petition from the progressive group, Justice Democrats, has been making rounds over the internet, calling for Biden to reverse his decision. The Petition accurately sums up the danger of his appointment stating: “Putting someone in the administration who will prioritize paying down the deficit ahead of all other concerns in charge is a recipe for cutting our earned benefits and turning the COVID recession into a depression.”

This petition has already received 35,000 signatures and has the backing of several important politicians, including the influential group of progressive congresswomen known as “The Squad.” The newly elected representatives Jamaal Bowman (D-NY) and Cory Bush (D-Mo) have also thrown their support behind the petition.

Some people may view this turn of events as negative, saying that infighting has already broken out among the Democratic Party. Despite that, I consider what’s happening as a positive event.

The progressives rallied behind Biden in the 2020 election after Bernie Sanders dropped out––helping him win. However, just because they helped him win doesn’t mean that they accept Biden and his policies exactly as they are.

It is their duty, along with the rest of the American people, to pressure Biden when we disagree with his actions. This is the danger that we faced with Trump as his political allies, who weren’t fired, were yes men. To see that Biden’s allies are willing to criticize him gives me hope for the future.

And for those that see the same dangers in Bruce Reed that I do, I’d encourage you to sign the petition here.

Liam Benedict is a first year English major from the small town of Galt, California. He is a writer and is planning on becoming a lawyer in the future.

Support our work – to become a sustaining at $5 – $10- $25 per month hit the link:

LOL, just LOL

Joe Biden also was for the 2003 Iraq invasion.

Thought this is what the phrase meant, but had to Google to make sure:

Deficit Hawk is a political slang term for people who place great emphasis on keeping government budgets under control.

On what planet is keeping government budgets under control a bad thing?

Oh yeah, Planet Unlimitedfreemoney, which is just beyond Uranus.

It used to be that Republicans would run on a platform of fiscal responsibility, but under both Bush and Trump that is no longer the case. Democrats have almost always been free spenders. There will be a huge financial reckoning coming someday, it won’t be pretty.

Bruce Reed sounds like one of Biden’s better picks.

Nah, you got it wrong KO, you just turn the money press up to “11” . . . . . . and if you can print enough money, everyone will be rich!

I don’t think it’s the intent of the DV to promote reasonable candidates by slamming them as not receiving the progressive stamp of approval 😐 —> but FYI, UR

I think that’s where we’re headed. Unfortunately a loaf of bread will cost $58

Keith O… you speak much truth (even a stopped clock is right twice a day)…

I foresee that minimum wages will go up 30%… other wages, 2.5%… annual inflation by creating ‘fiat money’, low GDP, at about 15%… maybe two, three years out… not a pretty sight…

Please note that a Republican (?) president [conservative or opportunistic?], ‘conservative’ Republican Senate, set up the dominoes… they did not support taking SS taxes from highly paid folk… they supported tax changes that supported the well-off and screwed the middle class… the middle class will be screwed by inflation, as will lower middle class and poor…

I’m not sure who is genuinely worried about inflation.

“The Survey of Professional Forecasters was first published in 1968. The Federal Reserve Bank of Philadelphia took over publishing the survey in 1990. The latest results of the survey for inflation expectations are shown below.”

How is their track record?

source:

https://moneyandmarkets.com/us-inflation-forecasts/

I would say there are a lot of more pressing concerns than inflation right now.

DS, you put up a chart that ends in 2010. The top one I don’t know what it says.

A couple of trillion dollar giveaways and a near shutdown of much of the economy may be a reason for concern about inflation.

The top one (which you could figure out by clicking on the link to the source I provided) shows what they are projecting for the next 120 months; i.e., the next ten years. The “chart that ends in 2010” was simply to illustrate their accuracy over time.

I am unaware of any economists who are concerned about significant inflation at this time. Are you?

The fed is projecting near zero interest through 2023 – which is a proxy for their inflation estimates.

Seriously, in 2010 our national debt was $13 trillion, after the second quarter of 2020 it has spiked to over $26 trillion. That doesn’t even include the latest Cover stimulus and Omnibus bills being worked out now.

The top chart (which you could figure out by clicking on the link to the source I provided) shows what they are projecting for the next 120 months; i.e., the next ten years. The “chart that ends in 2010” was simply to illustrate their accuracy over time.

I am unaware of any economists who are concerned about significant inflation at this time. Are you?

I’m concerned. Does that count?

Too much work – explanations should always be in the chart. But of course that doesn’t give one the chance to criticize people for not clicking a link.

I don’t feel “personally” concerned, but if David, Don, economists and the Fed aren’t worried about inflation, why not just “go nuts”, then?

Someone else (the other day) claimed that the “old rules” no longer apply.

So apparently, there’s no consequences for anything, anymore. 😉

By the way, Trump signed the bill today.

The Fed is more concerned about unemployment at this time and into the next year or two, and is, in fact, more worried about deflation than inflation.

https://www.fool.com/investing/2020/09/03/what-fed-long-run-inflation-outlook-means-bonds/

The incoming administration is going to have to spend lots of money on lots of things. Anybody carping from the sidelines about deficits will need to present their bona fides as to how they viewed the last few years of spending and deficits before anybody should take them seriously at all. Assertions about current risk of inflation would seem to need at least some evidence. None has been presented.

I’m not actually criticizing it.

Say what you will about Trump, but I think he kind of understood what was needed at this time. I do think he had some business sense.

It’s going to be interesting to see what happens with the upcoming eviction crisis. That seems to be a primary concern – across the country. Maybe another mortgage crisis related to that, as well.

And beyond that, I don’t pretend to know how all of the stimulus will affect things. I suppose it depends upon how well employment recovers, etc. Probably a lot of variables.

But it does seem kind of incredible that the government can just (essentially) print more money, without some kind of consequence.

I have been looking at some Youtube videos, which suggest that another housing crash (or at least, a “correction”) is coming as a result of all this. A flood of inventory, post-Covid. Not right away.

Approximately 90,000 people have left San Francisco, alone. Approximately 1/10 of the population. And an approximately $90 million lease cancellation, by one of the tech companies (Pinterest, I think).

Cities that contract usually experience fiscal problems, as they’re already “counting on” that tax money (and cannot give it up easily).

And no money from the federal government so far, for cities and states.

Am I on the sidelines? Regardless, I have been told I look like a carp.

Rather than go down this inflation rat hole, let me say I don’t know how it is going to play out, but I do not believe that multi-trillion dollar debts and deficits can go on indefinitely without systemic collapse at some point.

If you believe we can keep deficit spending without consequences, then I believe we should just keep mailing people more and more money, until everyone is rich and doesn’t have to work anymore.

why not?

It is not intended to go on indefinitely. It’s necessary during an emergency, and should be mitigated when the economy recovers. Reversing the massive tax cut is one step, but if that is done too quickly it can stall the economy. Giving a huge tax cut just as the economy recovered from the Great Recession was disastrously bad policy. But it needs to be undone carefully, and there is a lot of pent-up social spending needed right now.

There is massive corruption whenever you give away free money, but this program could have been done much saner, with actual small businesses (instead of large corps and Chinese owned companies) and only people who really needed the money to survive getting the money, but so much more popular: free money!

I’m not talking about the Covid-19 spending going on indefinitely, it’s the ever-increasing national debt that concerns me, the Covid-19 just massively exacerbating the situation. We now have generations that have never known anything but mass overspending, and with the free money coming out in the trillions, it must look like we could afford anything if we can just open up the federal printing presses. But unlike Celin Dion’s heart, this cannot go on.

A mind blowing fact is our national debt is now over $80,000 per person and heading higher.

The same disastrous financial reckoning that happened after WWII when we ran our national debt up to 107% of GDP? Oh wait, I guess that didn’t actually happen. Never mind…

Deputy chief of staff doesn’t make policy. The two individuals Biden has named for those positions have long experience in Washington and know how to work with legislators. I suggest progressives might want to choose their battles more carefully, and avoid unsubstantiated hyperbole like “will prioritize paying down the deficit ahead of all other concerns.”

It is clear that deficit reduction is not among the top priorities of the incoming Biden administration. So Bruce Reed’s past efforts on that are not really relevant. This is a position where the president wants someone he can trust and who can be effective in implementing Biden’s policy goals.

Don, I agree that this is really a non-issue. Biden has many other positions, including Janet Yellen at Treasury, that will be much more influential. This is almost like they had to find something wrong with the appointments, so let’s attack this one.

On the other hand, the deficits that California cities (and the state itself) are facing will look like “pocket change”, at some point.

A win-win? 😉

Hey, is Alan entertaining any guesses, regarding what will happen with Trump’s demand for $2,000 checks?

What am I, an effing crystal ball?

I was hoping, though this one seems much more difficult to predict than the other issue (that no one would take you up on).

Seems likely to be resolved quickly, one way-or-another.

I’ve made two $50 political bets in the last few years, and I lost both of them. So don’t look to me for predictions 😐

Well, you can lose 40 more of those, if this goes through. And still have the same amount of money that you have now. 😉

It just won’t be “worth” as much.

i.e., less free money.

Earned benefits? Free money.

Perhaps, he’d figure a way to give more to those who need it instead of just giving out free money to all.

Good point… the Feds have “an out” (or more) they can use, that States and Cities cannot… they can print money, ignore the growth in debt, and keep on ‘truckin’…

Cities have to use terms like “deferred maintenance”, and “unfunded liabilities”… since the Feds use ‘bonds’ a lot to mask deficits, keeping interest rates near zero, helps a lot…

So, can you name a 10 – 20 year period where deficits and increases in debt did not occur? Where sustained, substantial, debt reduction occurred?

It is always passed off to the future…

I agree that the times are ‘unique’… but when have they not been? Seems like there have always been, “the times that try folks’ finances” (apologies to Thomas Paine)… like any other “impact”, environmental or financial or social, ‘mitigation’ is not a bad idea… I have heard no credible ‘mitigation’ to the increasing deficits/debt…

No, I can name an eight year period in which the deficit was replaced by a surplus.

President Bill Clinton: Total = $63 billion surplus, a 1% decrease

FY 2001 – $128 billion surplus

FY 2000 – $236 billion surplus

FY 1999 – $126 billion surplus

FY 1998 – $69 billion surplus

FY 1997 – $22 billion deficit

FY 1996 – $107 billion deficit

FY 1995 – $164 billion deficit

FY 1994 – $203 billion deficit

Here’s the national debt figures during Clinton’s 8 years in office.

Debt when Clinton took office…..$4,411,488,883,139.38

Debt when Clinton left office…….$5,807,463,412,200.06

Debt percentage increase during his presidency…..31.64%

https://www.self.inc/info/us-debt-by-president/

So now we’re talking ab0ut the debt, not the deficit?

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Check my comments, I’ve been talking about the national debt all along. In fact from the article:

Yes, Clinton was handed a a relatively huge national deficit created by the Reagan-Bush administrations. Clinton then decreased the national debt by $559 billion from 1997-2001. Then Bush II came in and immediately squandered it with an ineffective tax cut. (I’ve seen two economic studies that show that business investment didn’t increases due to the 2001 tax law.) Obama also greatly reduced the deficit from what Bush II handed him. Hmmm, I’m seeing a pattern here…

One causes the other. True, it’s sad when people don’t know what the difference is, but they are rather closely related, like rainfall and creek levels.

We can pay down the large debt created by the COVID-19 response pretty easily with a 1% net asset surcharge tax. That would raise about $7 trillion over a seven year period. It is highly progressive and taxes those individuals and entities that have seen their wealth increase in 2020. It also will have no real impact on economic growth–a recent study I just saw finds that the level of the marginal tax rate has no impact on economic growth rates.