By David M. Greenwald

Executive Editor

Davis, CA – On Monday the city of Davis released the updated EPS Pro Forma and Fiscal Analysis of DiSC 2022.

“UC Davis has continued to improve its standing as a major research university, creating rising expectations for a burgeoning high-tech and innovation concentration that contribute to the region’s efforts to diversify the  economic base,” EPS noted citing Aggie Square as a “testament to this.” “The Project continues to signal the next phase in the development of university town predicated on a major research presence: the advent of private investment leveraging a nationally significant public investment in the form of UC Davis.”

economic base,” EPS noted citing Aggie Square as a “testament to this.” “The Project continues to signal the next phase in the development of university town predicated on a major research presence: the advent of private investment leveraging a nationally significant public investment in the form of UC Davis.”

The project anticipates it will built out in two subphrases with office and flex/R&D space absorption assumed to be spread across the first phase and the easly part of the second phase.

They note, “the residential buildout is anticipated to be tied to the completion of commercial space, assumed to be 2,000 square feet of commercial space per residential unit.”

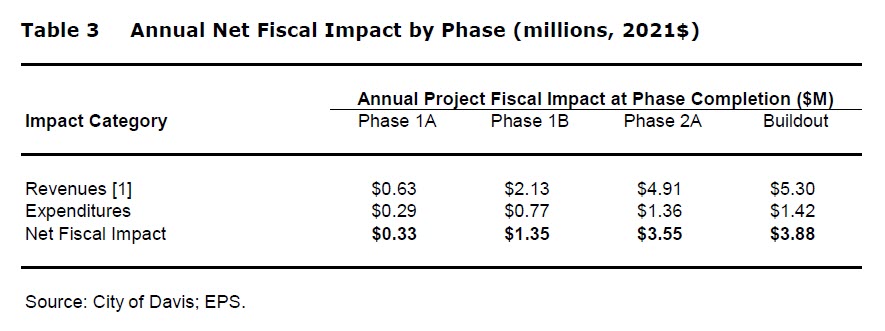

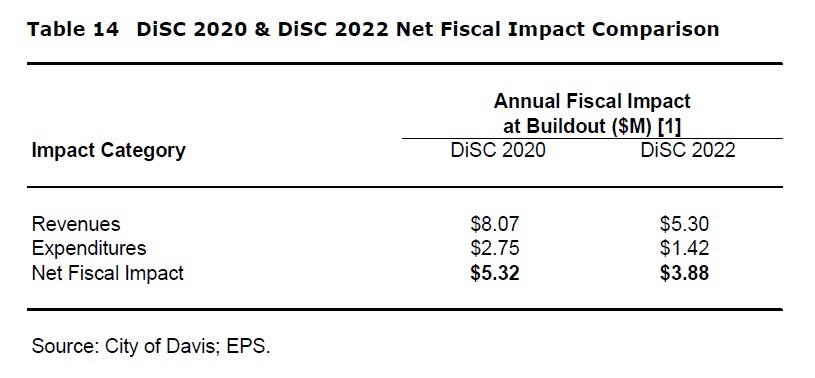

The annual on-going fiscal impact for the city naturally is roughly half the size of the 2020 project with the anticipated net fiscal impact being about $3.88 per year at build out anticipated within 10 to 15 years.

The analysis by EPS is based on an assumed 50/50 property tax split between the city and county.

In addition, they anticipate about $45 million in one-time revenues mostly from permitting fees and impact fees. Affordable housing is assumed to be on-site and therefore will not have in lieu fees.

“The economic impacts include the one-time impacts (multiyear) from construction of the Project and the ongoing impacts that occur annually as a result of the operations that take place after occupancy,” EPS notes.

EPS estimates about an $850 million ongoing economic impact for the city and $1.1 billion countywide with another $320 million during the construction phase for the city.

“The number of comparable rental workspace properties in Davis, with available data, is somewhat limited. However, a few good examples of newer buildings exist,” EPS notes.

They note, “Class A office space is generally leased on Full Service Gross basis, with taxes, utilities, and common area maintenance included in the rent.” They add, “Flex/R&D space is more commonly rented on a Triple Net (NNN) basis, meaning that all expenses are passed through to or otherwise paid by the occupant.”

The hotel is “assumed to be a limited service, business-oriented property.” They assume a daily rate of $180 and around 79 percent occupancy.

EPS notes: “Hotel demand is strongly correlated with proximity to professional employment. By the third phase, when the hotel is assumed to come online, employment growth in the Project likely would induce greater demand and therefore higher room rates or occupancy levels than those currently indicated by the market.”

For the full analysis – click here.

For the full analysis – click here.

In my opinion it’s all going to come down to how voters feel about the added traffic to the Mace Mess and are they willing to accept it?

Oh, you mean the same EPS that did the Yolo Rail Relocation economic study that Davis paid for, the one the predicted economic development from filling in apartments across the railroad right of way from H Street to I Street, never considering that such right of ways are valuable and preserved for transportation corridors? That EPS?

Sorry, lay down with fleas, wake up with dogs.

Alan M

The modeling for these studies is usually pretty straightforward if the analysts are given the specific project parameters as is the case here. You’re complaining about EPS when they were asked to create a new plan, which is a very different endeavor.

There is a whole lot of detail in the analysis that needs to be reviewed. The FBC has created a subcommittee of three of its members, who will be poring over the analysis in detail in order to produce an in depth report for the whole FBC when it meets on Monday, December 13th.

One of the concerns that I have is that EPS (perhaps with guidance from the City) did not follow the new standard fiscal analysis protocol that came out of the June 2021 FBC’s detailed analysis of the Contribution Margin the City receives from new development projects. To illuminate that deviation from standard, I sent the following e-mail to Elena Adair, the City’s Finance Director, last night.

.

The pretty clear question that that deviation from Elena’s stated two-scenario standard is “Why not follow the standard?” There are a number of possible answers to that question. I’m sure the FBC will be discussing those possible answers on Monday.

Note: Elena Adair was the person who provided me with a link to the report last night. I thank her for doing so.