(Editor’s Note: Political season is here. The primary is March 5 and the general is in November. The Vanguard will keep readers updated throughout the season on the latest news and announcements. The Vanguard accepts submissions on all sides of issues and campaigns. Publication on the Vanguard does not imply Vanguard support or endorsement.)

The School Board has completely ignored the massive student enrollment decline while they ask all of us to pay ever increasing taxes, indefinitely!

The only way to stop this disconnect is to vote NO now while you have the chance.

By Michael J. Harrington, a downtown neighbor and Davis voter for 29 years:

On March 7, 2023, only months before Measure N was finalized and placed on the ballot, DJUSD Superintendent Matt Best testified to the Davis City Council that:

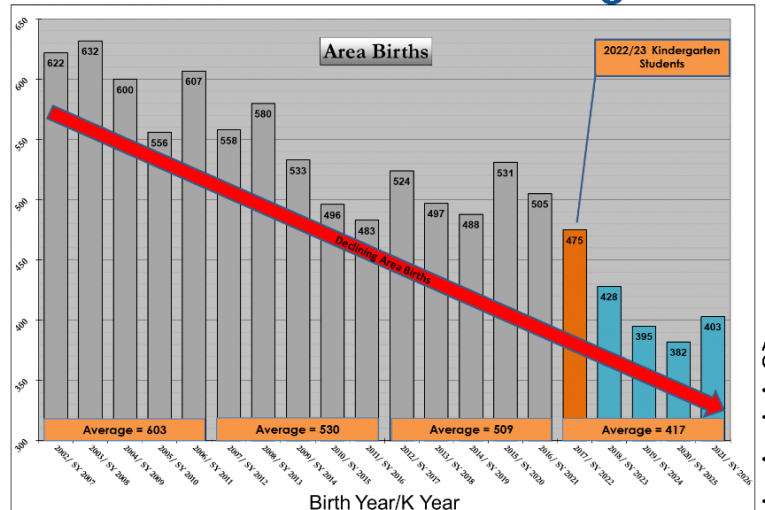

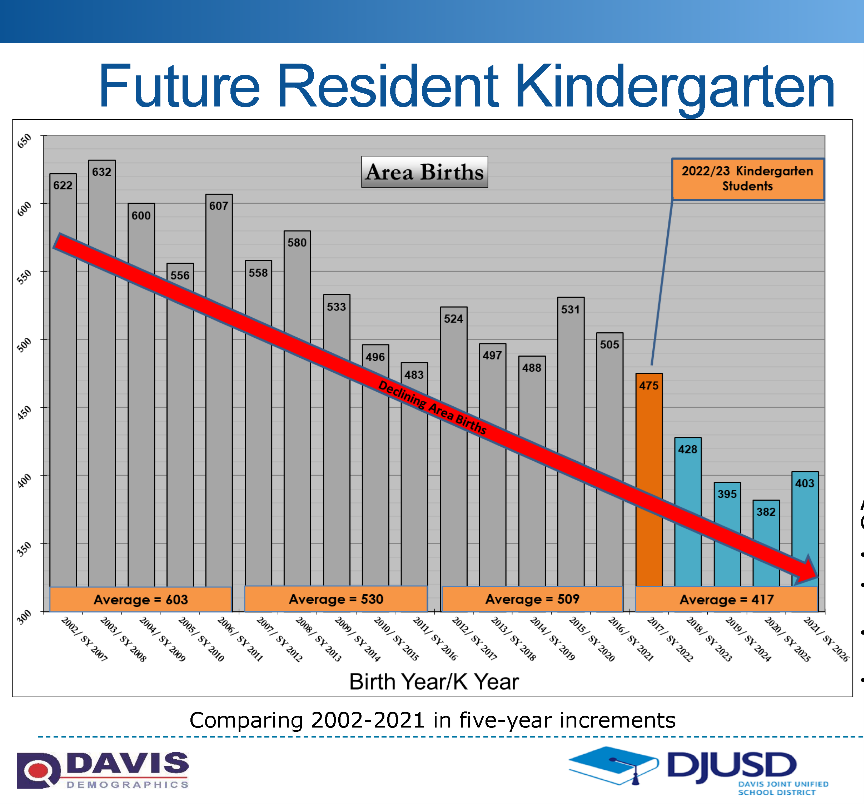

“There are fewer students of school age in our region. Not only being born but in the 5–19-year age group. This is information from the census.”

In my courtroom work, we lawyers call the testimony and slides in this video a “party admission.” It is considered the highest caliber of evidence because the best possible  evidence comes from the other party’s mouth.

evidence comes from the other party’s mouth.

Mr. Best further states

“ … the number of resident students has declined by more than eleven hundred over the past seventeen years. This decline has been masked primarily due to a large extent by the increasing number of nonresident students joining our district and it wasn’t until the pandemic that the number of nonresident students stopped keeping up with the decline of resident students … that is why we are seeing the overall decline in the district’s enrollment during the last couple of years.”

This shocking set of admissions was hidden in plain sight, on the City Council web site last year.

Even the DJUSD Officials – long before they placed Measure N on the ballot – testified to the Davis City Council that the declining enrollment is a big problem, the supply of non-Davis transfer students is drying up, and without changes, the Davis school system is facing a major enrollment decline. This testimony was backed up with detailed professional slides filled with demographic data provided by a third-party demographics company, and clearly demonstrate DJUSD enrollment is declining and will drop further in coming years.

The video from the March 7, 2023, presentation to the City Council is so shocking that I decided to try and get it out even at this late hour so voters can see for themselves that the district is asking for an ever-increasing permanent tax even while the district enrollment shrinks. Voters deserve to know about this disconnect and you certainly won’t see any mention of it in the Yes on N campaign literature. The video included here is a collection of outtakes from the council meeting (the full meeting video is available on the City of Davis website).

Considering this plummeting enrollment data, that the Measure N tax will never expire because it lacks a sunset clause, and that the tax increases every year without end, voters will see that the only responsible course is to vote NO on Measure N.

Because it lacks a sunset clause it is all but certain that today, March 5th is your only chance to vote NO. Future repeal will be almost impossible.

The enrollment data through 2027on this chart is taken directly from the DJUSD projections. The projections past that are based on CA department of Finance projections.

The enrollment data through 2027on this chart is taken directly from the DJUSD projections. The projections past that are based on CA department of Finance projections.

I have voted for every previous school funding measure, but Measure N’s indefinite increases when the student population is declining is outrageous, so I must vote NO.

The Board has long known about the declining enrollment and did not apply it to the Measure N tax amounts and removed the sunset clause so it would be almost impossible for the public to undue the tax in the future. Now, if voters slap their hands and vote this tax down, the Board has 15 months to fix this problem and several opportunities to bring a new measure to voters before the current tax expires in June 2025.

Despite the fearmongering Yes on N claims, there is no emergency to approve this!

Vote NO and make them bring back a more reasonable proposal with a sunset clause so we can be sure the district properly addresses the demographic crisis in enrollment.

I think there are three fundamental errors in this analysis.

1. The No campaign has equated an inflator for inflation to be an “increase” when technically baselining a tax to inflation is keeping the tax steady in real dollars.

2. The Parcel Tax is attempting to bridge the fundgap from the level of state funding granted DJUSD to average level of support which is significantly lower than the average district due to LCFF.

3. Declining enrollment puts a strain on district dollars separate and distinct from the parcel tax. Declining enrollment threatens to reduce ADA money coming into the school district and while the district can attempt to shed spending, our previous analysis showed that in general the district could only shed 60 cents on the dollar.

Thank you David for calling out the FUD.

One important reason an expiration date was necessary is that the value of the school parcel tax needed to be reset from time to time to account for cost of living increases. A four-year school parcel tax value used to be set at a flat rate with an estimate for how much the cost of living would increase in the next four years. More money was collected in the initial year or two, with the excess saved for the latter years, when the cost of living began to overtake the flat rate assessment. Four-year economic projections are very shaky at best, and are more prone to error in the 3rd and 4th year.

An alternative inflator factor was first included in the school parcel tax passed in about 2012, and then renewed again in 2016. This tied any inflation to the established California Consumer Price Index (CPI). If Measure N is approved, the assessment next year will be $768 per parcel. In subsequent years the board can vote to authorize an increase to offset inflation up to the California CPI, which has averaged 2.8% annually over the past 10 years. Measure N contains the same CPI clause as the measure it would be replacing, Measure H. From the $620 / year authorized by Measure H in 2016 to the $768 proposed for Measure N in 2024-25 there has been a total increase of $148, an average of $18 per year. This is how the school parcel tax can best guarantee consistent real value over time.