Editor’s Note: On Thursday, Interfaith Housing Justice of Davis presented “Davis Housing Solutions: A Community Conversation” – a forum at the Davis Community Church. What follows are the full comments by Georgina Valencia, a Planning Commissioner and Realtor in Davis.

Full comments by Georgina Valencia:

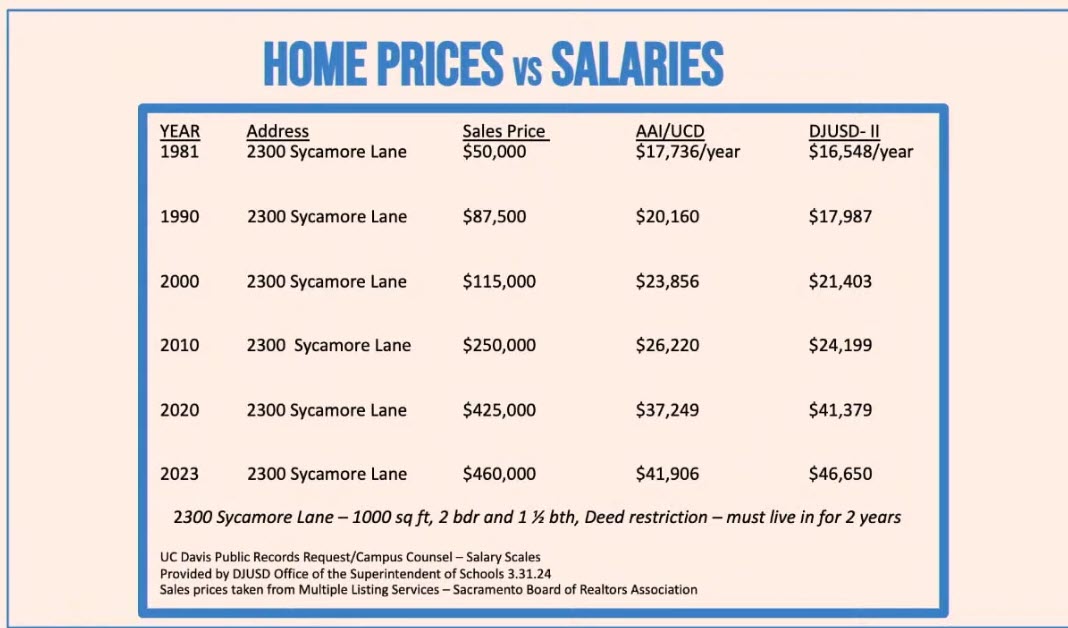

Wow, I’ve learned a lot tonight, a lot to take in and I really appreciate all my fellow speakers here tonight. So if you could put up my first slide, it’s that housing continuum that Dana Bailey already mentioned, and I’m going to focus on where the point of the arrow is because that’s really my background and expertise and that is affordable home ownership and first time home buyers. So if you’ll move to the second slide, please. That’s kind of the meat of my whole conversation. So I’m going to give you a very personal story. In 1981, I was a 20 something year old here in town looking to try and buy my first home. I was working at the university at that time and you can see by the salaries there, you’re actually going to see how much I made in 1981. And I’ve also got, so let me give you the categories.

I’m doing every decade there. I won’t talk about each decade, but 1981, the property I’m talking about is an affordable project that is at 2300 Sycamore Lane. It was roughly 25 units. They were town homes. So they’re attached a thousand square feet, two bedrooms, one and a half bathrooms, and a quaint little tiny backyard. That was an affordable home in 1981 in Davis, and it was $50,000. Doesn’t that sound good? So the salaries there that you’ll see in 1981 at the university beginning level administrative assistant, which I was at that time was making roughly 18,000 a year. I’m going to round these numbers off to make it easy for me. And also teachers. So a beginning level teacher in 1981 was making about 17,000 a year. What you see there is at $50,000, it was about two and a half times what somebody was making.

Alright, let’s jump down to 2023. These same properties, they’re resale properties. So in 2023, now the property is at 460,000. But what’s really illuminating is look at the incomes, the income for that same starting level staff person, administrative assistant at UC Davis is just under 42,000 a year and for a teacher it’s just under 47,000 a year. So now you’re talking about almost more than nine times that starting income. How does that person buy that home? Okay, that’s part of the problem.

So let’s break it down just a little bit more. I’m going to give you a definition of what’s a first time home buyer. Who are the people, what’s the demographic of the folks they’re trying to get into Davis and buy this first home.

So I want to stop and kind of illuminate. I’ll say one a little bit of an idea here, and that is many of you may have read Richard Rothstein’s book, the Color of Law, and it’s important I think to note here, I think it was mentioned earlier, but it’s important to note that if you were a person of color post World War ii, you didn’t get much opportunity to buy a house. In fact, you got no opportunity. You couldn’t get an FHA loan, you couldn’t get conventional loans. Builders wouldn’t sell you a house. So what that means as a person of color is you couldn’t get into the market to earn some of that what’s called generational wealth. That’s what’s important. That’s what’s left a lot of people of color behind and propelled. Those of us that have had the opportunity to buy. So first time home buyers, that’s one group.

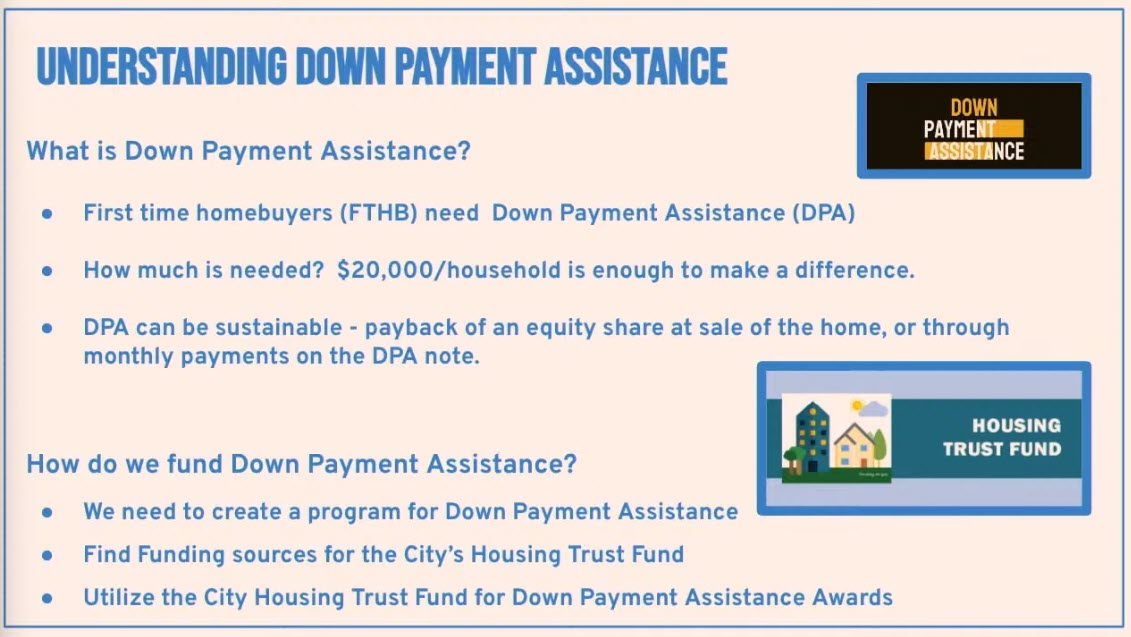

They haven’t had that opportunity. The other folks that I’ll describe are service workers. We’ve heard about them already when Cafecito some of the folks that we’re talking about. So not only is it restaurant workers and oh, maybe the person that’s  helping you at Nugget Market, these are all people, university workers, these are all people that are commuting into our town because they can’t afford to live here. So okay, if I’ve got a problem, I always try and find a solution. So the solution that I’m offering up is down payment assistance and it’s actually a proven, I’ll say method for helping first time home buyers actually purchase a home. There’s all kinds of programs out there in various cities, but our city doesn’t have a program like that. We don’t have a mechanism to try and help these young first time home buyers, people of color service industry. We don’t have any mechanism to help them buy a home. My mouse getting dry. Sorry. Okay, so how do we help them then? Well, I’ll share with you. You may have read in the last two years, the state of California actually did a program that was called Dream for All and Dream for All was a down payment assistance program. I see some smiles in the audience, they may be associated with this program.

helping you at Nugget Market, these are all people, university workers, these are all people that are commuting into our town because they can’t afford to live here. So okay, if I’ve got a problem, I always try and find a solution. So the solution that I’m offering up is down payment assistance and it’s actually a proven, I’ll say method for helping first time home buyers actually purchase a home. There’s all kinds of programs out there in various cities, but our city doesn’t have a program like that. We don’t have a mechanism to try and help these young first time home buyers, people of color service industry. We don’t have any mechanism to help them buy a home. My mouse getting dry. Sorry. Okay, so how do we help them then? Well, I’ll share with you. You may have read in the last two years, the state of California actually did a program that was called Dream for All and Dream for All was a down payment assistance program. I see some smiles in the audience, they may be associated with this program.

Last year, the state allocated $330 million, that allocation of money for down payment assistance was scooped up in 11 days. I mean, think about that – 11 days. That tells you the level of need out there for people that need some help, need that down payment assistance just so they can cut a break and get in and buy a home. This year, I think it was 220,000. I don’t know what the status of that program is right now, but it was a real help. I had some clients honestly that, and I like Rob’s comment about side hustles that we’re working three jobs to try and buy a home. We weren’t able to get them in a home in Davis, but with that dream for all program, we did find them a great home in one was in West Sacramento and another one was in South Natomas.

Okay, so down payment assistance, how much money am I talking about? Well, actually $20,000, that’s not a lot of money. What would $20,000 do? Well, if you go back to that house that I mentioned last year, 20 23, 400 60,000, all you need is three to three and a half percent down. Well, 3% of 460,000 is $13,800. There’s the down payment. The next piece is, oh gosh, there’s money left over in that 20,000 to pay for closing costs and there might even be a little bit of money to buy an interest rate down. So $20,000 can change somebody’s life can get them into the game. Okay, well what if we said, okay, that sounds great Regina, let’s do that. But how do we or why would we, how’s that? Why would we want to have down payment assistance? Why would we want to help these people? Well, we’ve been hearing it.

You don’t have a vibrant community without everybody being involved. We’ve got all of these demographics of folks commuting into this town and there’s one that I’ll add in too, and that is our schools don’t have enough students. So we’ve got now what’s called, I’ll call a commuter student. So parents can’t, families can’t afford to live here in Davis, so they’re in West Sacramento or Woodland. I know I contributed that with my clients, but they’re in other communities. Their kids are registered here and going to school here. Parents come in to do their job, drop the kids off at the school and then they pick the kids up at the end of the day, head off to their respective communities. Well that’s wage leak. The wages those people are earning in this town, we’re losing that. You know what else we’re losing? We’re losing those kids.

Those kids are getting educated here, but we’re losing them from our community as well as those families. That’s a real loss for us. What would be maybe some benefits for us? Well, keeping those kids here. Another statistic I’ll give you. Nearly 58% of our homes are rental properties and as the university continues to grow, I’m not here to dispute the university. They’re a major employer in this community and I support them. I worked there at one time, I already told you that. But as they continue to grow, there’s going to continue to be pressure on housing in this community and they’re going to continue to be more and more rental housing. If we had something like a down payment assistance program, we could help to shift that dynamic and get people into houses as opposed to landlords creating another rental for themselves. So okay, I need to kind of bring this to an end here.

How do we fund down payment assistance? I would submit to you that we would fund it through a housing trust fund. We have a housing trust fund in our city. There is money going into it. I would say that there’s not enough money going in to support a program like this, but that doesn’t mean that we couldn’t find funding sources with the help of our community to fund that trust fund. We would also have to create a program, but if we can find the money and create the program, I think we can really make a difference for people.