By David M. Greenwald

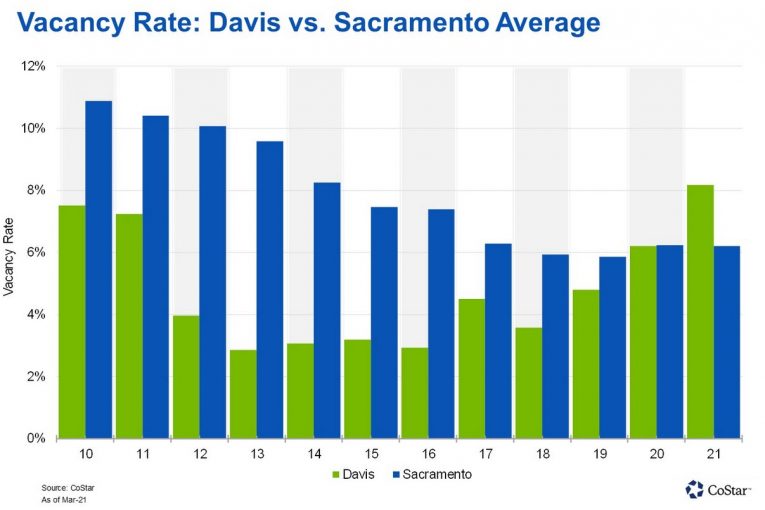

Davis, CA – Someone shared with me a CoStar Analytics report that looked at Davis’ retail vacancy rate compared to the Sacramento average. It shows the retail vacancy rate, which had been under 4 percent from 2012 until 2017, soaring to over 8 percent—the first time it passed the regional average in at least a decade.

“The Sacramento retail market has proven remarkably resilient during the ongoing coronavirus pandemic, but one area that has been inordinately impacted by the resulting economic turmoil is Davis, California,” writes David Whitmore of CoStar Analytics.

“Since the first quarter of 2020, vacancy rates in the Davis retail submarket have increased by 120 basis points to 7.7%, an all-time high,” the report notes. The previous peak was back in 2010 at 7.5% during the height of the Great Recession.

Historically, just like the city’s rental market for residential apartments, the retail vacancy market has been tight. They attribute it to the presence of UC Davis, but perhaps limited commercial space has also played a role.

“It is notoriously difficult to gain development approvals for new properties in the city of Davis,” CoStar notes. “As a result, the average retail vacancy rate in Davis during the past decade was 4.4%, while Sacramento’s average figure was almost double that, at 8.5%.”

The CoStar report notes that, since the start of the pandemic, UC Davis has limited on-campus instruction, which has led to a large reduction in the number of students in Davis.

“Apartment vacancies in Davis have similarly soared to an all-time high, indicating students have opted to live with family, cohabitate with friends, or live in a more cost-effective area. Davis’  apartment market is easily the most expensive in Sacramento,” they note.

apartment market is easily the most expensive in Sacramento,” they note.

They added that “this flight of student renters has clearly impacted local retail operators. Before the pandemic, vacancies in Davis had never exceeded the market average.”

But some of this figures to be quite temporary. With vaccines and reduction in cases, UC Davis right now says they will resume full in-person fall instruction by September. If that’s the case, the rental market and apartment vacancies figure to return to normal.

But examining the chart I noticed something not covered in the Co-Star report.

The vacancy rate bottomed out back in 2016. It rose slightly in 2017 only to drop again to 2018 near the low point. But in 2019, 2020 and now 2021—each year over the past three—the vacancy rate has risen.

So a key question is whether this is a pandemic-driven aberration, in which case we would expect things to rebound once the pandemic ends and the students return. Or whether this is the continuation of or exacerbation of a new and disturbing trend.

We note some long time businesses, including restaurants, are now gone and probably not coming back. Of note, the loss of Bistro 33 in the large historic old City Hall. What will become of that space with the loss of that business?

There were some downtown vacancies as the result of the sale of the Brinley Building and the loss of some longtime businesses there. Davis Commons saw key businesses leave. University Mall was largely shut down.

It will be interesting to see what happens. The University Mall is going to undergo an immense redevelopment. That will take a lot of those spaces offline for a sizable period of time but ultimately the city hopes it will revitalize it.

Then there is the Downtown Plan. COVID has devastated business in the downtown. Will the end of COVID combined with efforts to redevelopment spur new retail?

There has also been the slow loss of retail in the core, replaced with restaurants and other entertainment.

Overall, it will be interesting to monitor. Are we seeing a momentary blip or did COVID merely accelerate an existing trend?

—David M. Greenwald reporting

Support our work – to become a sustaining at $5 – $10- $25 per month hit the link:

Ominous sign.

The steady trend since 2016 is pretty obvious in the graphic. (The upward blip in 2017 is the anomaly but it’s more confirming than anything else.)

I submitted comments last night to the City Council on its triennial goal setting. We need to reenvision where we want to go as a community. We should not simply just stand back and let the future happen to us–we could easily spiral into a miasma.

In setting the goals for the City over the next several years, the Council should specify objectives with clear actionable steps with metrics toward accomplishing those goals. The current set of listed objectives generally do not contain quantifiable metrics or specific tasks upon which either City staff or citizens can act. I propose that the Council take this further step on several of these goals.

Using the current set of goals, I suggest the following:

1. Ensure Fiscal Resilience

– Revise the reserve policies for the enterprise funds as an overall reserve target, and base the target on historic City fund performance (not on unsubstantiated “industry traditions”). Use the remaining excess enterprise fund surplus to provide low-cost internal financing resources.

– Prepare a comprehensive strategic plan on managing City costs in a comprehensive, transparent manner

– Prepare a forecast of City revenues in a transparent manner, relying on the economic development plan (prepared in response to Goal 2 below).

2. Drive a Diverse and Resilient Economy

– Prepare a vision for the City’s economy in response to the changes wrought by the pandemic and in anticipation of changes that may occur due to climate change.

– Prepare an economic development strategy to implement that vision that includes implementing the Downtown Specific Plan, preparing the General Plan Update, and active interaction with the state’s private sector and the University of California to spawn and support the businesses that fit with that vision.

– Clearly delineate the actions needed to support and grow the City’s existing businesses given the changed environment due to the pandemic.

3. Pursue Environmental Sustainability

– Prepare ordinances and develop programs to implement the mitigation and adaptation measures identified in the forthcoming Climate Action and Adaptation Plan Update.

– Prepare sustainable development guidelines for all new developments that follow the CAAP and additional sustainability and resilience guidelines such as those included in the Downtown Plan. These guidelines should be incorporated into any development agreements and baseline conditions, and be non-negotiable for a development to meet the conditions specified under Goal 6.

4. Fund, Maintain and Improve the Infrastructure

– Develop a comprehensive, transparent infrastructure investment plan and identify synergistic opportunities to gain federal and state funding

5. Ensure a Safe, Healthy, Equitable Community

– Prepare social equity and access development guidelines for all new developments that should be incorporated into any development agreements and baseline conditions, and be non-negotiable for a development to meet the conditions specified under Goal 6.

– Prepare a plan that implements a community policing and social services organization that reduces the incentives for crime, addresses mental health issues and crises, and reduces overall City costs.

6. Build and Promote a Vibrant City

– Develop an alternative to the requirements of Measures J/R/D that fosters the proposal of new developments that can be preapproved if the sustainable and social equity development guidelines are approved by a citizen vote and fully incorporated into the development agreement and baseline conditions.

– Explore specific housing development options to relieve market pressures that hinder affordability for lower income and family households, and has created segregated housing in Yolo County.

7. Foster Excellence in City Services

– Adopt the transparent government proposals being considered by the Council’s subcommittee.

Or, on a more simple (and to-the-point) level, in regard to the article – Davis could just let restaurants and bars fill the vacancies, as they come back. :)

There will always be a demand for those types of businesses – especially in a college town. Don’t they generate revenue for the city, as well?

And for god sake, do everything possible to hang onto ACE.

The problem with your proposal Richard is that you assume there is a desire to change. The simple fact though, is that the City Council, City Manager, and frankly the voters in town, do not want change. You need look no further than the downtown plan which was an expensive farce designed to protect the status quo. Until the City shows a willingness to alter the course of six decades of protectionist policies, there will be no significant change, just a continuation of the ongoing deterioration.

8. Don’t buy a fire truck.

I don’t believe that any alternative to the present format of Measure J/R/D will pass with the voters.

I just had a light bulb appear over my brain — let us (by us I mean those against JeRkeD) sue the City of Davis based on Measure JeRkeD being a RACIST law!!!! We can’t lose!

I know you’re largely kidding, but I have often wondered if someone could challenge it on the basis of disparate impacts – of course it couldn’t be you, it would have to be a person of color, probably one who doesn’t live in Davis though perhaps not necessarily.

I understand that someone tried that, in regard to the Davis buyer’s program at WDAAC. Which spelled out “who” could purchase at that development, and is quite different than what is essentially an urban limit line.

And, that the disparate impacts of that program were purposefully repeatedly downplayed by someone with a blog – can’t remember who, along with the council itself. :)

Both of which are normally at the forefront of such stated concerns.

Of course, that type of program could have been presented to a council (regardless), in the absence of Measure D.

In 2015 the Brinley properties sold to Browman Development Co. Leases increased steadily and substantially downtown, so Davis retail vacancy rose to the rate of the surrounding market. Some restaurants have closed due to the pandemic; most will reopen soon.

Yes, they will rebound. The trend is the replacement of retail stores with restaurants, which will exacerbate the downtown parking problems due to the higher parking usage of those types of businesses. Other than that, I expect that a year from now the retail market in Davis will be pretty much back to normal. Hard to say about commercial properties. We’d need to know more about which types of commercial businesses we have locally, as some can continue readily with home-based employment while others can’t or won’t.

Don

Reading the many articles (including yesterday) in the SF Chronicle on how the office market is changing dramatically, I’m far from sanguine that the Downtown real estate market will return to where it was in 2019 (when it was already in decline vs 2016). Restaurants were already closing before the pandemic here. Restaurants need daytime foot traffic and without office workers, that disappears. The world is going to be very different as at least one key trend was accelerated by the pandemic. We need to plan for this change if we want to keep a vibrant town.

I would be very cautious about extrapolating from Bay Area conditions to Davis. San Francisco real estate market is struggling; outside of high-density urban areas such as SF and New York, home sales are at record highs and prices are soaring.

I recall (can’t find the figure quickly) that the pandemic cut sales tax revenues to Davis about 15% in the last quarter of 2020. That is not that significant overall, especially with students expected to return at full rental occupancy in the fall and their spending returning. Restaurants that rely on student business will likely be at full capacity and revenues in the fall.

Overall I expect very little change to the restaurant business in Davis. We will likely continue to lose walk-in retail downtown. Projections are that commercial real estate may take a few years to rebound, but we would really need more data about the types of businesses that occupy commercial office space in Davis to assess the impact on this market. Demand for ‘wet space’ and research-oriented facilities will continue to increase IF we can actually lure those types of business here and keep the ones that are growing and need expansion sites.

I don’t agree with your central premise. The world is not going to be very different. A lot of people seem to want it to be, but I don’t see that in any of the broader trends. People are moving out of the cities, looking for houses in nice neighborhoods with yards and good schools. There may be reductions in use of mass transit, and that really merits some regional planning focus. Definitely not my expertise as to what is needed or how to implement it, but I’m guessing there’s going to be a big pot of money for transit projects in the next few months and I suggest Davis officials scramble to figure out how to make good use of that.

I repeat my earlier suggestion that the Business and Economic Development Commission be resurrected. I suggest that it focus specifically and narrowly just on business and economic development, not on transportation or climate change or social equity or police reform or any of those other things that are better left to different commissions. Just: how to attract and retain the kinds of businesses that would like to locate here but aren’t doing so currently.

Maybe we should get bids for innovation parks on the periphery and spend a few years trying to attract those. We could even hire a city employee with a similar title, perhaps an innovative title. I’m sure the effort will turn out smashing :-|

I’d suggest a report with a title that’s strikingly-similar to a 1970s disco, and then referring to it for the next several decades as evidence of something relevant. Given that freeway-oriented office parks are also more-suited to the 1970s.

In any case, Robb Davis is now the “Impact and Innovation Officer” for the Yolo Food Bank, so it seems that “innovation” is happening there, at least. Not to mention “impact”. :)

https://davisvanguard.org/2021/03/robb-davis-former-davis-mayor-joins-yolo-food-bank-as-impact-and-innovation-officer/

I mostly agree that not a a lot of things will change; I think in 2-5 years things will look fairly similarly to how it was in 2019.

People are social creatures. They will go back to socializing. Even for work. Work creates a cult of corporate personality. So people like to gather for work…it makes them feel good and important and it gets things done. So people won’t all be working from homes in the near future. Yes, more will be working in their homes but for the most part; people will be looking for ways to get that personal interaction with their customers, biz partners, bankers, investors….etc…..

Davis will be much the same. The commercial real estate problem will be the same. Retail spaces holding out for a micro custom boba tea burger place or avocado flavored coffee shop that caters the new hip college crowd….all the while not lowering their rents and not quickly signing other types of less nouveau premium tenants. Unfortunately, commercial retail is stuck catering to the biggest (low hanging fruit) market in Davis; students. As for stores; most of them shop at Target, Costco or Amazon. It’s hard for the knickknack local stores to make it work with the inflated commercial real estate costs (again because those rates are all competing and inflated by the nouveau premium tenants (I see Chipotle is renovating….not so much nouveau but certainly a low hanging fruit).

Eh, I guess the point I’m making is because of the heavy student focus of downtown; not much else can prosper that doesn’t cater to them and those kids are good with computers so they can get most of what they want online. I for one would love for retail to cater to a more…..uh…not so young adult market…and become a target destination for shopping. But under the current circumstances, that just won’t happen.

I’m surprised and maybe a little dismayed that companies like Browman Development Co. can tolerate rental loss and vacancies at their properties for so long. Watermelon Music moved out of their old place a few years ago and the site still appears to be vacant. Why was it worth it to raise rents in retrospect? In time vacant sites become a liability, but it seems like Browman Development doesn’t feel any sense of responsibility for local sentiment for that issue.

Move downtown to West Davis and build it out around Watermelon Music!

Whose? Yours? Not according to City or County standards…

Or perhaps you wish to further define “essentially”?

Looks wrong..

I don’t own any urban limit lines.

Do tell. Also, maybe compare to all of the various growth restrictions on farmland (outside of city boundaries), throughout the state.

You don’t understand that word?

O.K., attorney Bill.

In any case, pretty sure there’d be a long and lengthy battle, regarding any challenges.

Ignore Commenter

“Davis’ apartment market is easily the most expensive in Sacramento, they note.”

The residential landlords would like to thank all those who have supported Measures J, R and D for protecting their real estate interests from competition. They especially would like to thank those who have argued that these ordinances have had no impact on the local housing market through flawed analyses that failed to account for the above trend increases in multi-family rental rates.

Accurate analyses are an outgrowth of systemic white supremacy.

They really don’t in terms of lowering prices. Look at any major project. Do you see a flood of units available for purchase or rental at any one time? No. Developers release units for sale or rent on a schedule that is economically optimal to them.

Yes from a simplistic standpoint constrained supply does increase demand/prices/rents. But the fact of the matter is that supply will never be effected to a degree that will make residential units more affordable. Builders will continue to constrain the supply because they’ll make more money that way. I think measure J is utterly moronic. But I have no illusions that if more space were annexed for housing that it would make a dent in home and rental prices.

It’s not about prices going down. It’s about prices not continuously skyrocketing with a near 0% vacancy rate. That skyrocketing is real. Ask a renter. Take a look a vacancy rate vs. rental prices.

Student housing has pretty much been addressed. It would not be located on the periphery of the city, regardless.

Many landlords have likely taken a beating this year. For smaller landlords (mostly outside of Davis), it’s likely going to lead to significant foreclosures when forbearance ends. (There’s many news stories regarding that.) It’s also going to lead to evictions when the eviction moratorium ends (again, mostly outside of Davis).

It would be interesting to know how much the larger landlords in Davis have lost over the past year. I suspect that it’s significant, but that they are in a position to weather the impacts of the pandemic.

But ultimately, they’re going to have to be able to pass on those types of costs/risks to renters, for their business to continue to be viable.

Even keeping the prices stable…the impact of new housing (including rental) isn’t going keep the prices from going up….in fact new residential units often make them go up. Again you’re still looking at it simply from supply and demand. If I (every builder) only build when the prices stay the same or go up….then prices are not going to stop skyrocketing.

Given the massive disruption and decline in the need for commercial space (some of which is permanent), I’m wondering if Davis ever considered one of them-there “innovation centers”, to add even more unneeded space.

Years ago I posed this question to a commercial developer, because the long-term loss of rent on a vacant property didn’t make sense to me. He explained that commercial loan terms specify the rent level that must be maintained in order to qualify for the loan, and that if rents are reduced the lender can call the note due to increased risk of borrower insolvency. So an owner may prefer to lose rent for a time — even years — rather than risk having to refinance the property under less favorable terms.

Seems like perverse incentives if one would hope for an economically active downtown area.

Thanks for explaining that.

Welcome to America.

(and Perverse Incentives is a great band name . . . )