In March of 2004, the voters of Davis approved the passage of a one-half cent local transaction and use (sales) tax that is scheduled to sunset on December 31, 2010 unless the voters reauthorize it. The council is set to have a public hearing on the matter this evening, where they will introduce the first reading of the ordinance that would place the measure on the June 2010 ballot.

In March of 2004, the voters of Davis approved the passage of a one-half cent local transaction and use (sales) tax that is scheduled to sunset on December 31, 2010 unless the voters reauthorize it. The council is set to have a public hearing on the matter this evening, where they will introduce the first reading of the ordinance that would place the measure on the June 2010 ballot.

According to the staff report, the tax currently generates $2.9 million in annual revenues, which represents around 8% of the City’s overall General Fund Revenues.

“As a general purpose tax, a measure to renew this revenue source can only be placed before the voters on a ballot where members of the legislative body are up for election. The upcoming June 2010 ballot presents the only opportunity for the amendment to continue the local sales tax, prior to its scheduled expiration in December 2010.”

The tax was originally proposed as a means to address historical structural budget shortfalls, as well as provide funding for a variety of expanded service demands.

In the argument in favor of Measure P on the ballot the signers that included Lois Wolk Assemblywoman), Helen Thomson (Supervisor) and then Mayor Susie Boyd argued:

“The City faces increasing costs. We will face higher expenditures if we are to provide the additional police protection and meet park and recreation and open space commitments we have made to our citizens.”

It continues:

“Without Measure P revenue, given the uncertain state support to the General Fund, we would be faced with very deep service cuts in police, fire, and parks.”

What they did not say, is that the money would go largely to increased salaries, particularly for fire who in April 2006, were retroactively givens an annual increase in compensation of 8.46% per year, or 34% over the course of their four year contract.

While the city sold the public that this would pay for additional protection for police, it actually went for increase salaries, and fire got by far the largest increases in salaries. And while it billed it as a way to meet park and recreation commitments, in fact, we had to pass a parks parcel tax just two years later because we had used the entire sum to pay for employee compensation.

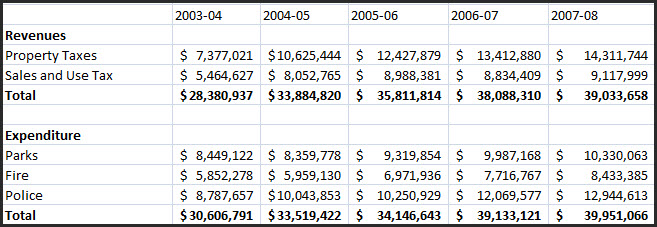

Vanguard analysis shows that the city’s expenditures increased nearly 33% over a five year period from 03-04 to 07-08. The sales tax accounted for about 30% of that increase, while the rest of that increase was fueled by the real estate boom.

Property tax revenues from 2003-04 to 2007-08 nearly doubled. Almost all of that increase went to employee compensation which also increased by huge margins.

The key problem that we face now is that with the real estate market tanking, with the fact that the increase in property taxes during this period were unsustainable, in the previous go-round, the council acted inappropriately by increasing employee compensation by as much as they did.

Not only did they increase salaries and benefits which were short-term problems, but they created unfunded liabilities that will sap future budgets that likely will not grow as robustly.

Current Sales Tax Measure

The question that the Davis City Council has to make but also the public has to consider is the current sales tax measure. Measure P in 2004, was used almost exclusively on increased salaries and almost none of it went to greater police protection or parks as advertised. With the salary increases, even with the property tax revenue boom, the city did not vastly increase services during this time, instead it merely paid more for existing services.

It is interesting to note that during good times, the council expanded compensation far more rapidly than it expanded service. However, now that times are lean, as we have seen with the MOU, council is acting quickly to cut services rather than cutback on the salary increasing enjoyed during the roaring 00’s for public employees. To add to the problems, the council is also failing to deal with the longer term structural issues that have now been pushed off to the next council.

The voters are left in a conundrum. They can vote to preserve the tax and reinforce the wastefulness of previous councils and reward the stubbornness of the current council in dealing with the tough issues. Or they can vote to repeal the measure and face another $3 million in service cuts.

It is a tough decision to make. Only Councilmember Lamar Heystek has expressed any desire to oppose the measure. At the December meeting, Councilmember Heystek issued a long statement in opposition to the renewal of the sales tax measure:

Said Mr. Heystek:

“At this moment in time, I’m not currently in favor of the extension of the existing sales tax override if our financial system isn’t fundamentally overhauled. “

He concluded by saying:

“I don’t feel that after this round of negotiations we’ll be at a place where we want to be and making our target. For that reason I don’t feel we can do this at this time.”For me it is difficult to reward fiscal waste and dishonesty. The previous tax bill was clearly billed as a way to expand services and avoid service cuts, instead it helped fuel the largest employee compensation increases we have ever seen. And it was based on a bubble that was inevitably going to burst and no one back then had the foresight to see that.”

In fact, Mr. Heystek was spot on, the current round of bargaining negotiations did little to solve either the long or short-term problems. They will have to do an additional round of service cuts.

Will the market ever return to where it was? Doubtful that we will ever seen an increase in property tax revenue over a five year period like that. Without that type of revenue increase, it is hard to sustain these levels of salaries.

There is a very simple concept that seems missing. During good times we are very quick to increase salaries and benefits. But when bad times hit, we do not contract them very easily, instead we cut services. So we pay more in the long rum for far less.

Those who suggest that failure to pass this measure will result in service cuts are correct, but in the end, it is just too distasteful to reward past short-sightedness and incompetence.

—David M. Greenwald reporting

Is it possible to know how many employees were covered by this sales tax through the years? If significantly fewer employees are covered now than when the sales tax was first collected, that’s not a good sign, and presents an obvious opposition argument.

Employee compensation needs to be rolled-back six years at least. If they don’t like it, they can always go work in Vallejo. Seriously, getting a city job in Davis is like winning the lottery- if you can collect your early pension without too much guilt.

I won’t be voting for the sales tax extension and I plan to actively discourage friends from voting for it either. They city has too much revenue as it is. They need to show some degree of fiscal restraint and an ability to get out of bed with the unions.

First, I don’t know where 33% comes from. I am looking at “summary of expenditures, general fund, actual” for FY 2007-08 and FY 2003-04 here ([url]http://cityofdavis.org/finance/budget/09-10/pdfs/03.-Bud-Summary-Final-09_10.pdf[/url]) and here ([url]http://cityofdavis.org/finance/budget/05-06/pdfs/1-03_Budget_Summary.pdf[/url]). The published numbers are $39.1 million in 2007-08 and $30.6 million in 2003-04, which is then 28%, not 33%.

Second, apparently it’s too distasteful to adjust for inflation when throwing around these numbers. In constant dollars, spending went up by 15%, not 33%, from 2003-04 to 2007-08.

It doesn’t seem reasonable to accuse the city of increasing spending by 33%, when general spending actually only increased by 15% in real dollars. This, after lecturing Souza that he needs a math lesson?

Okay, so why did real general fund spending increase by 15% in this period? There are two evident reasons. First, city employment (in FTEs, “full-time equivalents”) went up from 438 in 2003-04 to 464 in 2007-08. That is a 6% increase. The city did not promise that the sales tax would go entirely to expanded services; it also said that it was needed to cover budget shortfalls. But to the extent that expanded services were part of the argument, this 6% increase in the number of city employees represents exactly that. (It is true that the city payroll slid back down again in later years, but that was in response to bad economic news.)

So finally, average compensation per employee did not go up by 33%, but rather by 8.6% in real dollars in this period. How did that happen? One explanation comes from the title of a posting to this site, Davis, like other local jurisdictions, faces a ticking bomb in pension costs ([url]https://davisvanguard.org/index.php?option=com_content&view=article&id=2946:davis-like-other-local-jurisdictions-faces-a-ticking-bomb-in-pension-costs&catid=58:budgetfiscal&Itemid=79[/url]). The article shows a chart with millions of dollars in increased CalPERS expenses, roughly on par with the increase in per-employee cost. But now the vocabulary has changed. “Like other jurisdictions” and “ticking bomb” have become “short-sightedness” and “incompetence”.

So it seems to come down to a fight over who should pay for the big changes to CalPERS. Should employees keep getting what they have been getting, adjusted for inflation, and have the city absorb the bad news from CalPERS? Or should the bad news from CalPERS be carved out of what city employees receive for their work? You could argue this either way, maybe, but it’s a wild leap from that to ending the sales tax as a strike against so-called “incompetence”.

On the other hand, I don’t live for the sales tax extension. If city voters want the tax cut and the service cuts that will come with it, so be it.

[quote]Vanguard analysis shows that the city’s expenditures increased nearly 33% over a five year period from 03-04 to 07-08. The sales tax accounted for about 30% of that increase, while the rest of that increase was fueled by the real estate boom.[/quote]Even if that is true — I have no doubt it is — the question going forward is this:

[i]If we fail to renew the sales tax, will the subsequent cuts take away those “Fire and Other Employee Salary and Benefit Increases,” or will they take away the jobs of young police officers and people who repair the streets, cut lawns, trim city trees, help seniors and the poor and result in closed public swimming pools and other public rec facilities?[/i]

I opined against and voted against the sales tax in 2004 ([url]http://4.bp.blogspot.com/_-iCrgpX1jNM/S1YwobQmv1I/AAAAAAAAAYQ/dzXov6HPXeA/s1600-h/Sales+tax.jpg[/url]). But I cannot see how not renewing it in 2010 makes our city better off any time soon. The result is surely going to be worse services and less public safety.

Here’s my thought there, the calculation is whether you think the city would simply cut services to cover the $3 million gap or whether they would work with the community to rebuild the trust. Because if this were to lose (and I think that’s a long shot), that is what it would mean–lack of trust by the community for the city. Short of that, this is simply a protest vote.

[i]The calculation is whether you think the city would simply cut services to cover the $3 million gap or whether they would work with the community to rebuild the trust.[/i]

If a third of your mistrust comes from currency inflation, then I’m not sure what they can tell you to rebuild trust. Maybe you should protest the Fed for expanding the money supply.

As far as I can tell, another sixth of your mistrust comes from incorrect arithmetic. You said 33%, but the expenditure increase in your own chart is 30.5%. Moreover, the final expenditure figure for 2007-08 is $850K less than the dated estimate that you reprinted, which gets you to 28%. If a sixth of your mistrust comes from incorrect arithmetic, then again, I’m not sure what they can tell you to rebuild trust.

[i]Even if that is true — I have no doubt it is[/i]

Rich, how can you not have any doubt?

GREG K. [i]”First, I don’t know where 33% comes from. I am looking at “summary of expenditures, [u]general fund[/u] … The published numbers are $39.1 million in 2007-08 and $30.6 million in 2003-04, which is then 28%, not 33%.”[/i]

The City changed its accounting in recent years, shifting some General Fund expenses (salary, overtime, pensions, cafeteria benefits, etc.) into the Enterprise funds (notably into 511, 512, 513, 520, 531, 532, 533, 541, 542, 543 and 544). The result of that accounting change is that by looking at the General Fund alone*, you don’t see the full picture in the growth of labor costs.

In the 2004-05 budget summary, the total Enterprise Fund expenditures were $28.0 million. Of that, $3.1 million was for Unitrans. So you have a total Enterprise expenditure (excluding transit) of $27.9 million.

In the 2008-09 budget summary, the total Enterprise Fund expenditures were $61.4 million. Of that, $5.2 million was for Unitrans. So you have a total Enterprise expenditure (excluding transit) of $56.2 million.

That’s a 101.4 percent increase in 4 years of Enterprise expenditures outside of Unitrans.

*I am not sure that you were just looking at the GF alone. But if so, you could draw some incorrect conclusions.

[i]The City changed its accounting in recent years, shifting some General Fund expenses (salary, overtime, pensions, cafeteria benefits, etc.) into the Enterprise funds (notably into 511, 512, 513, 520, 531, 532, 533, 541, 542, 543 and 544). The result of that accounting change is that by looking at the General Fund alone*, you don’t see the full picture in the growth of labor costs.[/i]

First, it wasn’t that I just looked at the General Fund, it was that David did. Second, if you make this claim with no other explanation, it makes it impossible to read the budget pages and conclude anything. You’re saying that if I read that Davis spent $28 million in 2009-10 on 531, sewer maintenance, then actually some unknown amount of that could have been for police cafeteria benefits.

If you claim that I need to dump that much sand onto the budget pages, then there is no way to make sense of what you are saying unless you provide a reference to explain it.

Besides, even I could make sense of your interpretation, 101 percent isn’t 33 percent, and your 2008-09 isn’t David’s 2007-08.

For the record, I am looking at the column labeled ACTUAL for past budgets in the table SUMMARY OF EXPENDITURES BY DEPARTMENT in the “Budget Summary” chapter. It is true that the later tables for the present year include have items called “Transfers” and “Adjustments”. My best guess is that you are talking about transfers and adjustments. But I do not see that the column labeled ACTUAL includes any of these transfers or adjustments.

what about the overbloated parks and recreation increase…i wanted my curb to be repainted red..there’s a no parking zone but the neighbors wouldn’t know it cause it hasn’t been painted in years. so i asked them to repaint it, they said they couldn’t cause there was no money, i asked if i could paint it myself and they said i would have to pull a permit for 150 dollars. can you imagine that? i have to pay the city in order to do their work for them for free??

what a racket…the public works department is the biggest croc…over the past 5 years, there’s been nothing but cuts to services,, yet the budget has ballooned to 10 million????

outrageous

[quote]If you claim that I need to dump that much sand onto the budget pages, then there is no way to make sense of what you are saying unless you provide a reference to explain it. [/quote] I looked at the city documents you linked to above, Greg. I thought they were your references.

Turn to page 3-10 in this document ([url]http://cityofdavis.org/finance/budget/09-10/pdfs/03.-Bud-Summary-Final-09_10.pdf[/url]) for 09-10; and page 3-10 of this document ([url]http://cityofdavis.org/finance/budget/05-06/pdfs/1-03_Budget_Summary.pdf[/url]) for 04-05.

i just heard on npr, that the greedy teacher’s union of california voted against receiving federal baillout funds from the stim package, because it would require that they actually be held accountable, and it called for more funding for vouchers for private education.

once again, the california teacher’s union, acting solely in their own interest, without regard for the kids or fiscal crisis of this nation.

they are much like the republican party who they criticise as being greedy.

they are also like the rest of the public union workers of this state that care nothing about the fiscal crisis, but care very much about their own personal paychecks.

not all government unions in california are like this, but the following are a list of govt. unions in california that are bleeding the state dry.

police unions..

fire fire fighters unions…

public works unions…

teachers union….

[i]Turn to page 3-10 in this document for 09-10; and page 3-10 of this document for 04-05.[/i]

Yes, I saw those pages. They give the numbers that you quoted; that’s not the problem. They don’t say anything about “shifting some General Fund expenses into Enterprise funds”. Those eight words are the ones that need a reference.

Let me add this: I was told (by a city staffer who works under Paul Navazio in Finance) that prior to the accounting change, which moved a number of employee salaries, benefits and so on from the General Fund expenses to Enterprise fund expenses, the only expenses in the Enterprise fund were material expenses, never personnel. Thus, most of the marginal change was added labor costs.

I was told by a member of the CC that the motivation for the accounting change was to justify greatly increased utility rates (to pay for better salaries and benefits). The council could not raise taxes without a popular vote. But they could raise utility rates in a CC meeting.

So far, Rich, there is no way to make sense of your rumors. Who is to say what phrases such as “in recent years” or “a number of” or “and so on” or “some expenses” actually mean.

I can say this much. If there was a time that “the only expenses in the Enterprise fund were material expenses, never personnel”, it was before 2001. For instance, page 17-15 of the 2001-02 budget ([url]http://cityofdavis.org/finance/budget01-02/pdfs/17-Public-Works.pdf[/url]) clearly describes the Water Division as part of Enterprise Funds, and a big chunk of that budget subtotal is “Salaries and Benefits”. In fact, every section of the public works budget in 2001-02 fits that pattern.

Since there is no logical way to rely on verbal rumors, the simple thing to do is to take a phrase like ACTUAL EXPENDITURES in the budget pages at face value. That is what David did. I’m just still wondering how he got 33% instead of 28%, and why currency inflation should be a source of mistrust.