ARE SODAS REALLY SO BAD?

ARE SODAS REALLY SO BAD?

A Discussion about the Health Impacts of Sugar-Sweetened Beverages

A lot of people know that sugary beverages aren’t very healthy, but are they actually harmful? Are they so damaging that they should be taxed? Come to this fascinating and enlightening discussion to hear about remarkable new research on sugar-sweetened beverages and how they lead directly to heart disease, Type 2 diabetes, and fatty liver disease. Learn about the health and economic impact of these products and the latest efforts to reduce their consumption. You may never see a bottle of Coke the same again!

Date: Thursday, January 28, 2016

Time: 7:30 pm – 8:45 pm

Location: Congregation Bet Haverim – 1715 Anderson Road

Kimber Stanhope, Ph.D., RD is an internationally recognized expert on the health effects of sugar consumption. For the last 16 years she has been investigating the effects of sugar consumption on the development of metabolic disease, utilizing well-controlled diet intervention studies in human subjects. At this briefing, Dr. Stanhope will share her cutting-edge findings and research behind the science of sugary drinks and the effects of these beverages on health. Dr. Stanhope has a PhD in Nutritional Biology from the University of California at Davis, where she is currently a Nutritional Biologist in the Department of Molecular Biosciences.

Harold Goldstein, DrPH is the Executive Director of the California Center for Public Health Advocacy (CCPHA), which he founded in 1999. CCPHA is a nationally recognized authority on public policies to address the social, economic, and community conditions that perpetuate the obesity and diabetes epidemic. Dr. Goldstein has a bachelor’s degree in physiology from UC Berkeley and a doctorate in public health from UCLA.

Robb Davis, PhD is the Mayor Pro Tempore in Davis. Robb has over 25 years of experience working in the field of food security, child nutrition and maternal and child health, primarily in francophone West Africa. In more recent years he has focused on bringing the principles and practices of restorative justice to Yolo County and dealing with the challenges of homelessness and addiction in Davis. He continues to work in child health as a consultant in curriculum design, program design, monitoring and evaluation. Robb has a Masters’ in Public Health and a PhD from Johns Hopkins University School of Public Health.

Kimber Stanhope, Ph.D., RD

Harold Goldstein, DrPH

Robb Davis, PhD

Well, a broad range of views in that group, not!

So, I am wondering whether opponents of sugary beverage tax would be willing to take a few minutes to lay out briefly, why, specifically, they oppose such a tax. I have been thinking a lot about this issue over the past few weeks and trying to grasp the underlying concern of opponents. If you say something like “it represents social engineering”, please humor me and describe what that concept means. This would be valuable to me. I have some thoughts on what is driving the opposition but want to hear from folks. (No need for snark, just be honest about your concerns).

Thanks.

Robb, I do not oppose the tax, but strongly feel that if it goes forward it needs to be implemented in a way that is consistent with the FBC’s December advisory recommendation to Council regarding ALL new taxes. That advice was as follows:

For the sugary beverage tax to move forward that means the ballot language needs to include (A) a detailed scope of the proposed new services that the tax will fund, (B) specific measurable success metrics for those proposed new services, (C) an inventory of the specific costs that will be incurred to provide said proposed services, (D) a clear requirement that the scope document will be updated each year as part of the Budget adoption process, (E) a clear requirement that the annual Budget adoption process documents submitted by staff to City Council report the specific work done (accomplishments) during the prior Fiscal Year, and (F) designation of the sugary beverage tax as a special tax requiring a 2/3 majority for passage.

If you do all of the above prior to February 16th then I would not oppose putting the tax on the ballot.

I would oppose the tax if the money just goes into the general fund. I would support it if it goes entirely to educational programs, preferably without establishing any new programs but, rather, providing funds directly to existing ones. School garden/nutrition programs, county health education, etc.

Here’s what Berkeley is doing with the money:

http://www.mercurynews.com/business/ci_29408346/berkeley-city-council-allocates-soda-tax-funds-declares?source=rss

Robb, In what way does this workshop, or the flier that came out, have anything to do with a soda tax? More specifically, this is about educating people about the harm of sugar, more specifically soda, correct? Therefore, the flier and workshop are about educating people about the long-term harm of sugar consumption, and the specific harm of the delivery system of liquid sugar.

I am a huge advocate of healthy eating, education on healthy lifestyle, and most concerning to me is the sick, sick culture we have that glorifies the consumption of toxic food in toxic quantities — i.e. people feel no shame whatsoever in wolfing down garbage in groups and declaring to each other how “good” that was. In fact, food is in its pure form, nutrition, not gluttonous pleasure. I observe in horror the long-term effects of gluttonous American culture as I observe in horror the short-term effects of a drunk passed out on a street corner. Both are slow suicide. I say this having lost family members to this as well as struggling with it myself, as most of us have.

So you are having an event. Good. You are educating people. Good. And where is the connection to a soda tax? My brain simply doesn’t go there . . . clearly your brain does . . . I won’t go over the multiple reasons this tax makes no sense from the perspective of someone like myself for which my brain goes “does not compute” — it’s all been said here before.

The only connection I see to the great message of the flier and workshop, about the toxicity of sugar, and a soda tax, is the timing. Big Sugar has always been toxic (as are many other vacuous foods — I’d personally target hydrolyzed fats as arguably a greater threat), but instead of regularly educating people with cheap tools such as fliers and workshops, the education effort comes only when we are threatened with a soda tax. That makes no sense to me. Why not educate regularly if that is the goal?

Again, “does not compute”.

I don’t see anything about a soda tax in the brochure or the announcement of the meeting. Where is all the discussion of a soda tax coming from?

I’ve brought up the fact that we have a SNAP program (formerly called “food stamps”) that essentially allows SNAP recipients to have taxpayer funds used to buy as many sugary beverages as they want. There has been virtually no interest in getting rid of this taxpayer subsidy for unhealthy eating. My conclusion is that the “public health” advocates aren’t really that interested in changing a terrible policy that is directly contributing to the problems that they say they are interested in solving.

Tomcat – I am calling “foul” on this. I responded to this comment last weekend and pointed out why public health advocates are having problems in this area. The beverage industry has fought such limitations. That is the short story.

I think the general approach is just wrong-headed and will be ineffective.

On the wrong-headed side…

– The continued proliferation of the soft bigotry of low expectations… something that leads to a perpetual dumbing down of human capability as people rise to the level of these low expectations.

– The demonstrated elitism of the ruling-class that can control their eating habits making rules and penalties for those that cannot.

– The time, energy and money spent on this rather than solutions that build lasting capability of people to make better life-choices.

– The obvious tax grab.

On the ineffective side…

– Not enough of a tax penalty to change habits.

– It will only take more money out of the accounts of low-income people that could otherwise be used for healthy food choices.

– It isn’t just soda that is causing obesity, so even if you caused a drop in consumption with this tax, those consumers used to getting that much sugar in their diet would just find it elsewhere.

This argument reminds me of the AEsop Fable:

The “kind” approach is to treat each human with the same dignity, respect and expectations that you yourself expect. And in doing so you would focus 100% of your efforts to educate people to make better choices in a world where many, many, many unhealthy but pleasing things are placed before them.

What I find weird here is the utter assertion that it will be ineffective. Cigarette taxes in combination with other efforts really worked. So how can you just flat out assert it won’t work with soda tax?

“So how can you just flat out assert it won’t work with soda tax?”

It might have some impact if it were State or Nationwide, as was the case with cigarette taxes, but that is not what is being proposed. This will be a City of Davis only tax. A local tax, where other shopping options are readily available and often already being used (Costco anyone?), will have no measurable impact on consumption and even less on health.

First, it isn’t clear that taxes are the cause of smoking reductions. They have contributed in some areas, but even that is arguable given the trends for decreased use even in placed where there are fewer taxes and less public area smoking restrictions.

Second, the rate of taxation on cigarettes is much, much higher than could ever be approved for soda because soda has a legitimate healthy use in moderation and cigarettes do not. In other words, you can successfully demonize cigarette smoking to a large degree with the general population because of the direct health risk to even moderate smokers, but not the same for soda. Also, cigarettes are chemically and physiologically addictive. Soda is not. Although I do at times feel a strong attraction to rum and Coke at times (rum and Diet Coke for me).

eCigarettes use is on the rise. While arguably better for a smoker than regular tobacco, the point here is that government-class social engineering just causes the problem to shift.

Social justice crusaders like to pick their good guys and bad guys. They have picked soda and the soda manufacturers as a bad guy. But they are wrong in this case… it is the eating choices that some people make that is the bad guy.

To add to Frankly’s list, it wasn’t the cigarette taxes that caused the shift in public perception of smoking, it was the information and realization that ‘second-hand’ smoke was harmful to those who just happened to be around someone who was smoking. That fact brought about the pressure to ban smoking from public places and making smoking less desirable in the marketplace. Clearly, though, even that hasn’t been enough since there are still numerous smokers looking to light up.

Maybe the Wind was too stupid to stop blowing because of its overblown (pun intended) ego, and not a team player to engage with the Clouds to dissipate. Maybe the fable should instead teach: “Don’t be an isolated egomaniac dumb ass”.

While the intentions are portrayed as pure, I cannot help but be wary when the government takes money out of citizens’ pockets, for something that should be easily handled by schools and existing public health entities within the scope of their normal business. The creation and nurturing of bureaucracies, serving only to create jobs and resume’ citations, is a common result of such “sin” taxes, imho.

As in mine! (my “h” o)

Should smoking also be handled by the schools?

It is.

I never forget the day I was with a friend of mine with his grade-school aged daughter. We lit up a good cigar and he noted his daughter sobbing uncontrollably in a corner of the yard with his fiance (he was divorced and was remarrying) trying to console her.

He came back and extinguished his cigar after hearing his daughter claim through her tears that “daddy was going to die because he was smoking”

So there is that risk here… that education will turn into an out of control social engineering brainwashing. E.g. “Run from soda because it is poison and it will kill you!!!!”

and my view it’s a package deal to change the culture here.

Biddlin

“for something that should be easily handled by schools and existing public health entities within the scope of their normal business.”

Except for the inconvenient fact that the existing public health entities, and in many cases the schools, have been trying to address this issue for years “within the scope of their normal business” without success. At what point would you concede that there is need for another strategy ? When one in four adults are obese ? One in three ? 1/2 the adult population ?

We don’t need our city council proposing taxes that only one other city in America has instituted. Here we are looking to tax our residents for roads and infrastructure, which I think people get it, but yet we get slapped with yet another new tax, soda tax, being proposed when the people are already taxed enough. This tax will do nothing to get people to actually stop drinking sugary sodas.

I agree BP, it is nothing more than a ploy to get more money for the City under the guise of “Public Safety”.

NOTHING has been said about the other ingredients of any of these drinks, like caffeine, and that will be the next to tax.. Wait until there is a “coffee Tax” and see what happens.

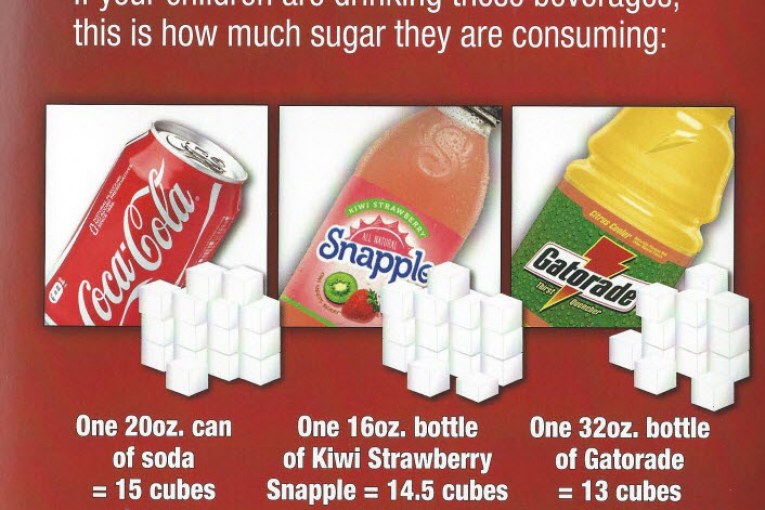

They show a Gatorade bottle in the photo, so you are targeting stuff developed for Sports Medicine, and appears on NCAA sidelines and dugouts all over the country? Is the CC pretending to know more then they? Are they targeting Gatorade because they have stock in a competitors company?

People that get paid by the Public have an inherent conflict when they vote on things taxing the Public. Most politicians are not humble enough to admit it.

I just wonder when people on the CC and Vanguard think they have a right to legislate other peoples’ lives? Apparently all the time.

“I agree BP, it is nothing more than a ploy to get more money for the City under the guise of “Public Safety”.”

Agree or disagree with the soda tax, but suggesting that it’s a ploy for the city to get money is a complete and total falsehood. The proposal came from the health community not the city. There are plenty of real arguments against it – why stoop to just making stuff up?

That’s funny, Senator Lois Wolk, former Assemblymember Helen Thomson and Former Mayor Ann Evans just happen to show up on the same night as some health officials? This was definitely a staged event to try and orchestrate the soda tax.

And those people are with the city?

They are very city connected.

“staged event”; read: “conspiracy”.

but they aren’t the city.

“They show a Gatorade bottle in the photo, so you are targeting stuff developed for Sports Medicine, and appears on NCAA sidelines and dugouts all over the country? “

Given how long it took the NFL with their physician specialists and sports trainers to acknowledge the enormous impact of concussions on both the short and long term health of their players, I would not be too quick to accept this as a good example. Just because athletes use a certain product does not mean that it is the best that could be developed or used.

“I just wonder when people on the CC and Vanguard think they have a right to legislate other peoples’ lives? Apparently all the time.”

No one on either the CC or the Vanguard is attempting to “legislate any other people’s lives”. The ask is to put it on the ballot and let people decide for themselves. The only one’s that are being undemocratic here are those that would block the ability to vote on the measure. Talk about dictating other people’s lives !

According to the link we had better start taxing pies, cakes, chinese food, pizzas, sweetened coffee drinks, shakes, donuts, fried chicken………

When asked why soda tax, dr. Goldstein answered that ssb’s accounted for a huge increase in sugar consumption. That doesn’t mean it ends there.

No need to comment on that softball, eh folks?

BP

Are you honestly unable to differentiate between what may be harmful to an already diagnosed diabetic vs attempts at primary prevention of diabetes ? Because this is the distinction that you have failed to make in your post.

You asked s fair question, Robb… you’ve gotten (mostly) fair answers… to put my response in context :

I only drink ‘sugary drinks’ when the fast food places/restaurants are out of normal iced tea, I’ve already paid for the drink, and I have to settle for sweetened iced tea or 7-up [maybe 3-4 times each year]. So, on one level, I don’t care. I also do not consider myself as part of the “opposition”, if you mean an organized effort. See “really don’t care”. However, I would not vote in favor of such a measure put forward by the City.

I agree that the proceeds of such a tax should be earmarked only for the educational/treatment uses. I agree with others that it should not go to the GF, particularly not to establish a ‘Chief Sugary Drink Officer’ @ the City. However, the first proceeds of such a tax should go to reimburse the City for all the staff time involved in researching, pursuing this, and moving forward, implementing/monitoring the collection/distribution of the proceeds.

I agree with others that after City costs to implement/monitor are funded, the rest should go to existing agencies/entities who deal with public health.

I would more readily support such a tax at the County level (slightly), State (more so) or federal level (hey, I’ll sign THAT petition).

The proposal, as it stands, is nebulous/unclear, and does ‘smell’ of a ‘feel-good’/posturing deal… I am concerned that it takes away from the focus on other needs (infrastructure, etc.), and might doom ANY revenue increase(s) put before the voters. Some have opined that we should increase/maintain sales tax levels, add parcel taxes, increase the Parks tax, school district assessments and/or the proposed sugary drink tax. Just can’t see that being realistic to do ‘all of the above’. The “soda tax” is sooooooooooo far down on my list of what we should consider.

Still think the UUT, by itself, should go back on the table.

My guess is that the soda tax is attractive to our CC to help fund a sports park that will be a political feather in the cap of certain CC members with larger political ambitions. It is supported though by other CC members with a tendency for being supportive of social engineering through taxation.

my guess is that the soda tax isn’t attractive to our cc except for robb.

Hope you’re right.

Frankly

“My guess is that the soda tax is attractive to our CC to help fund a sports park”

Then how do you explain that the biggest proponent of the sports park, Mayor Wolk, has disavowed his support for the soda tax ?

This happens in politics Tia. He has to take a pass because of his political need, but his colleagues can run cover for him.

Tia

“Then how do you explain that the biggest proponent of the sports park, Mayor Wolk, has disavowed his support for the soda tax ?”

How do you spell politcal pressure?

I am very much appreciating the honest input here. A couple of things:

1) A good number of people have talked about “education.” Health education is something I have spent about 25 years engaged in in one way or the other and I think it might be useful to lay out some definitions and dig into what that concept means. It is not a simple thing. I will commit to writing something for the VG on this and linking to a document I wrote a few years ago that got wide circulation in the international child health practitioner community.

2. There is an apology I need to make based on my comments at the last CC meeting on this topic. I suggested that proceeds from a sugary beverage tax could be used for park or other infrastructure. I was dead wrong about that. I concur with a few posters here who suggest that it must go to health related activities (e.g. school feeding programs). I also agree that we should be very careful about creating “new bureaucracies” with whatever programs we would do. Finally, if this were to go on the ballot in June it would go on as a general tax. However, using an approach based on the FBC accountability points, I think we could commit to clearly accounting for how such a tax is used. Again, this would be subject to legal requirements related to not specifying a general tax’s use. This may not be enough for some folks but I think it makes sense.

I reject the idea that this is about “feeling good.” I don’t even know what that means. When you attack a public health problem of this magnitude you go all in. The idea that somehow I (as a member of the CC) want to do something quaint in Davis ignores the efforts I have made my entire career to improve child nutrition–both in zones where under-nutrition was a problem and in areas where the so-called “epidemiological transition” had chronic disease–including obesity-related diseases–emerging next to infectious ones.

Some have argued that this is not the purview of a City but I would respond that cities are taking on MANY issues that counties and or higher levels of government used to do. I mean, who is complaining that the City is doing more to deal with street backlogs? And yet, until a few years ago most funding for significant road upgrades came from the state and feds. That is no longer (for now at least) the case. Cities all over are dong more things to solve problems locally.

Others may feel it is inappropriate for me, a public health practitioner to bring that “bias” to my work as a City Council member. My only response is “What did you expect?” Sorry to be crass about it but public health is a critical lens through which I view the world. How could I not bring that bias, that lens, to my work on the CC? I never hid my background nor the work I have done in this arena.

Thanks for all the input. I look forward to more.

OK, here’s a question for you Robb: As a public health practitioner, what is your take on the SNAP program allowing recipients to purchase sugary soft drinks using their SNAP benefits? The money that funds this program comes from the taxpayers and so we have a situation where the taxpayers are making a serious public health problem even worse.

As an observation, I am curious why there is so little interest and attention to this issue?

SNAP benefits are regulated by the USDA based on provisions of the Farm Act. They aren’t subject to local or state regulation. The Farm Bill is one of the most complicated, pork-laden, special-interest-driven piece of legislation the Congress deals with. SNAP benefits already have a number of restrictions on them, and getting more would take, literally, an act of Congress. So that’s a windmill that I doubt any local city council member wishes to tilt at.

I’ve said before that I don’t really see the point in making even more restrictions on what people can and cannot buy with their benefits. If you’ve watched people use those funds at the grocery store, you can see that they will just buy them with other dollars if they want them. Restricting the usage there isn’t likely to curtail consumption to any measurable degree. So helping people get the information to make sensible choices seems to me to be a better use of local political efforts and funds.

Yes, I understand that it is a National issue that would require congressional action. I am merely curious as to why there is so little interest in discussing this as a public health issue? Posters on the Vanguard are eager to jump in to the local soda tax issue which will have very little impact on public health, but they are not interested in discussing restricting SNAP benefits which could have tremendous health benefits.

TopCat

“Yes, I understand that it is a National issue that would require congressional action. I am merely curious as to why there is so little interest in discussing this as a public health issue? “

Not speaking for Robb, but for only myself, I would like to try to answer. I am most interested in addressing issues that we can have an impact on locally. I cannot change the minds of sufficient legislators to change the Farm Bill. But perhaps I can present a perspective that some may not have considered about differing actions that we could implement here in the city.

Are my responses not getting through Topcat? How many times must I address this?

Perhaps I missed something, but I have not seen anything that directly addresses the issue that I have asked about.

Last weekend when this came up I linked to a number of articles about how the beverage industry is blocking the kind of change you are looking for. No time to find them now.

Thanks for responding. I do understand that the beverage industry has an extremely powerful lobby that would fight any effort to make improvements in this area. I can see that those who post on the Vanguard would see it as a futile effort to try to address this issue.

Robb’s reply from 1/23:

A few months back we had a City Council member push for a new sports park for the City’s youth. The pushback from other Council members was that we needed to keep our focus on dealing with the current backlog of unfunded obligations, not creating new ones. In addition, the sports park, we were told, was not one of the City Council’s priorities.

Now we have a different City Council member advocating for his own pet project which ‘surprise surprise’, requires a new tax and a new set of funding priorities.

When it comes to fiscal issues, this City Council has a credibility problem.

And yet I voted to put into place a sports park task force to look at funding mechanisms and priorities.

I DO think we should focus on infrastructure backlogs but think we should look at cost cutting too. Where is the credibility problem in that? I have been consistent in that.

Creating a new sports park creates future liabilities if the city does it alone. Creating an improved school lunch program (for example) from proceeds from a SBT does not.

A sports park will make a direct difference in children’s lives. A soda tax will make life more expensive for the children’s parents with no actual benefit. I don’t think either should be a priority for the City at the moment, but one is clearly a better idea than the other.

School lunch programs are the purview of the School Board. Last I checked, the Mayor Pro Tem does not serve on the School Board.

The real credibility issue as far as I am concerned is the false pretense that is being used to push the soda tax. The claim is that it will improve public health by reducing obesity and the incidence of diabetes. When it is pointed out that there is no evidence that even suggests that a local tax on sugar will do that, the response boils down to ‘trust us, it is just part of a long process.’ No, it is a tax grab to fund your pet project. The health problems are real; the health claims justifying the tax are false.

The City has serious fiscal problems. Our first ten priorities should be focused on fixing those issues. The soda tax is a distraction and does nothing to address our existing unfunded obligations. We don’t need new expenses, and new taxes should go to address our existing needs.

If I were not working full time on the fiscal challenges your criticism of me, at least, would be just.

Partnership with the school district happens at many levels. You are correct, the Mayor Pro Tem is not on the school board but we are not that siloed in our efforts that we cannot collaborate.

True, a sports park would be a benefit to children. We have a task force looking at how to make it happen. I supported that and appointed a strong member to it.

The amount of staff time taken up by the SBT is minuscule.

I never said the SBT would, in and of itself, reduce obesity. Indeed, I have said the opposite ever since this discussion began.

“Now we have a different City Council member advocating for his own pet project which ‘surprise surprise’, requires a new tax and a new set of funding priorities.

When it comes to fiscal issues, this City Council has a credibility problem.

”

I see this differently. I see a credibility issue only when the same CC member reverses themselves without a full explanation of why they now see things differently. A reasonable explanation, such as additional facts or a new perspective on the issue, restores credibility for me even in the face of a change of position. And never in my mind should one CC member’s credibility be impugned because of the position or explanation of another.