Back in December, the Vanguard – citing projections from PKF Consulting, which was privately commissioned to do a study on the market demand analysis – published an article suggesting that hotels might be the key to short-term revenue needs for the city.

The PKF Consulting report found that four new hotels could generate between $1.5 and $2 million in new revenue for the city just by themselves. Since that time, the city council has approved a Transient Occupancy Tax increase, which could provide the city with about $300,000 in new revenues just with the existing hotel stock.

However, in January, the Vanguard ran a story where existing hoteliers believed that the PKF report was overly optimistic, arguing that, while the occupancy rate has rebounded since the recession, the rate varies heavily by day and month. Basically, from Sunday through Thursday, hotels have trouble booking rooms, and it is only on the weekends, mainly Friday and Saturday, where hotels approach 70 to 80 percent capacity.

In November, the city contracted with HVS Consulting & Valuation to prepare an analysis of the Davis hotel market to provide an analytical and objective context to assist the city with the review of the applications for the Hyatt House and Residence Inn, two of the proposals for new hotels. The council last fall had already approved the Embassy Suites Hotel Conference Facility at the site of the existing University Park Inn & Suites and Caffé Italia restaurant. That site will include a six-story 132-room Embassy Suites hotel and 13,772 square feet of conference space.

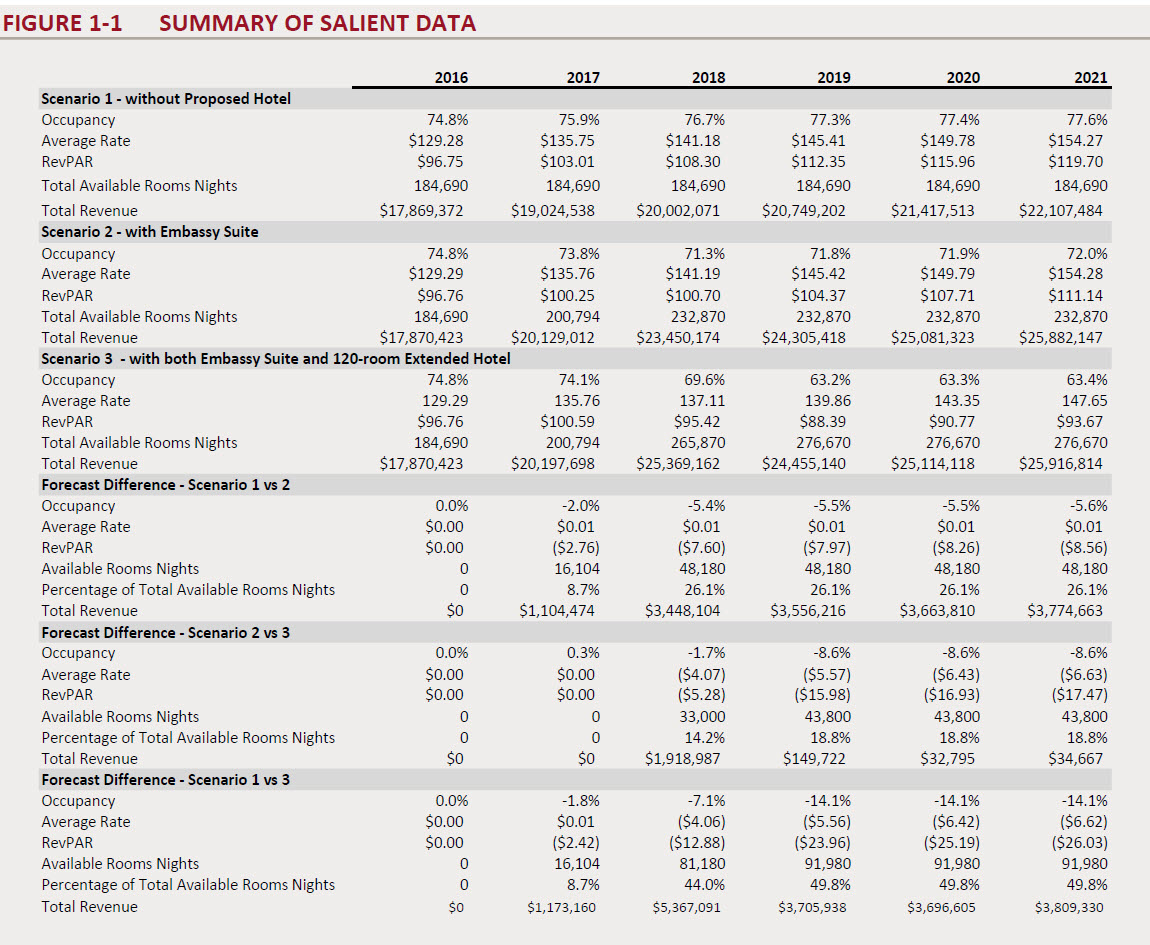

According to Tuesday’s staff report, “HVS analyzed scenarios for hotel development in Davis, with the existing room supply and the addition of Embassy Suites as the baseline. Impacts of adding additional hotels were projected. HVS concluded that the near-term development of a conference hotel facility with the addition of an extended stay hotel to be built shortly thereafter would be most beneficial to visitors, the City of Davis, other hotels in the market, and the overall community.”

However, HVS concluded “that the addition of another hotel, specifically another extended-stay facility, would not benefit the market for another four to five years after the initial extended-stay hotel has opened.”

HVS identified strengths and weaknesses of each of the two proposals, Hyatt House and Residence Inn, relating to location, brand, and development team.

The Vanguard has previously reported that the PKF study puts the proposed Embassy Suites, which is currently on hold due to pending litigation, as critical to the analysis of other hotel needs. PKF argues that utilization of “even half of the 18,000 square feet of meeting space would likely require additional guestrooms than what would be offered at the Embassy Suites, thus requiring additional, conveniently located hotels to accommodate this overflow demand.”

They note, “A hotel with approximately 18,000 square feet of meeting space would typically feature between 350 and 400 guestrooms.” But the Embassy Suites will have just 132 rooms, which means that Davis will need other hotels to complement the Embassy Suites in order “to capture either overflow group demand that is booked at the Embassy Suites (but can’t be accommodated).”

PKF argues that at least three new sites can be “readily absorbed by the market,” and they find “occupancy is projected to increase to 67.0 percent in 2019 and further increase to approximately 70.0 percent in 2020 and 2021. It is at this level we project the Davis hotel market to stabilize. While this stabilized occupancy level is above the annual average occupancy level achieved by the Davis hotel market since 2007, it is in line with the year-to-date performance and is reflective of the growth occurring in Davis.”

Existing hotel owners are skeptical of these claims from PKF, and point to their own analysis that paints a very different picture.

They note, while the occupancy rate has increased from 61 percent in 2012 to 67 percent in 2014 (the most recent data available), the rate varies by day and month. Basically, as indicated above, from Sunday through Thursday, hotels have trouble booking rooms, and it is only on the weekends, mainly Friday and Saturday, where hotels approach 70 to 80 percent capacity.

But even these are variable, depending on the time of the year, with the summer months generating heavy usage that falls way off during the late fall to early spring. In essence, there are only about five times during the year when the market is saturated – when UC Davis opens, Picnic Day, and during three separate graduations, in the spring, fall and for the law school.

The analysis notes that coupling additional hotels with the already-approved Embassy Suites would add about 328 rooms to the market that would have to be absorbed – the existing hotel owners do not see the demand generators at this time to justify that belief.

The HVS report analyzes the study performed for the Hyatt House, noting, “Based on the forecast, occupied room nights will have to increase by 40% over a two-year period to sustain a 65–66% occupancy level. Those figures are somewhat extraordinary, especially for a market that has yet to surpass 70%.”

They note that “it is likely that those occupied room nights will come from induced demand associated with the Embassy Suites and unaccommodated demand from those who would like to stay in Davis, but the types of accommodations desired do not exist or are sold out. Furthermore, the projected (2015–2021) compounded annual growth rates for the previously described metrics are higher in all categories when compared with those achieved between 2007 and 2014. Although the stabilized level of occupancy for the Davis market appears somewhat robust, it is clear that there are significant levels of unaccommodated demand in this market.”

However, HVS adds that “although projected to be higher than historically achieved in the analysis completed by PKF, it is reasonable to assume that the entry of branded, high-quality hotels would have a positive impact on the rate structure of the market as a whole.”

HVS concludes that these projects “appear slightly aggressive but not entirely unreasonable.”

City staff writes, “Staff accepts the analysis that shows that construction of one extended stay hotel in Davis would benefit the City and the market by capturing room nights from visitors who are going elsewhere because they are seeking either amenities or a hotel brand that is not available here.”

“Additional rooms in an extended stay hotel could also complement the hotel conference center by accommodating overflow guests, provided there are mechanisms to address inefficiencies of shuttling meeting-goers,” staff adds.

However, staff concurs “with the HVS conclusion that there is not current capacity to absorb the rooms proposed for both the Hyatt House and the Residence Inn if they were to open within the same period of time.”

Staff, therefore, is recommending that “the City Council review the HVS analysis, identify questions for follow-up with the consultant, and direct staff to return in April with criteria for Evaluation of hotel proposals to determine which application(s) should be processed through Planning Commission and City Council hearings.”

—David M. Greenwald reporting

Bottom line here is that TOT is not a silver bullet. WE aren’t going to solve our fiscal problems by building a whole bunch of hotels.

There is a conflict between the situation that benefits the City and that which benefits the existing hotel owners. The City benefits the most when there is an excess of rooms available in town. In that situation, every visitor looking for a room is able to find one and will not have to go to Woodland, Dixon or Sacramento. When rooms are in excess, tax revenues based on occupancy are maximized, as is the auxiliary spending by guests at other Davis businesses.

In contrast, the existing hotel owner’s revenues are maximized by maintaining a level of scarcity for rooms in town, thus maximizing the occupancy rate of their own hotels. As long as their own occupancy rate remains high, it does not matter if visitors are unable to find a room in town. This scarcity however reduces tax revenues for the City, and spending by visitors in other area businesses. In short, what is good for the existing hotel owners is bad for the City and other businesses.

The City does not need to worry about the occupancy rate of the proposed hotels, and should not be influenced by the demands or concerns of the existing hotel owners. Once the issues of zoning and planning etc. are fulfilled, the only issue should be if the proposed owners are able to obtain the funding necessary to build their project. In fact, I think the City should add a requirement to the proposed projects that approvals are contingent upon being funded within a specified deadline. Any project that is not funded and ready for construction prior to the deadline should have its approval rescinded.

If you end up putting hotels into a position where they can’t make money, they end up going out of business and the city ends up not being helped in such a scenario.

BTW, are you an investor in one of these projects?

Companies go out of business all the time, for a variety of reasons. The City should not get involved in protecting specific businesses from competition. The goal should be maximizing tax revenues and economic vitality, not protectionism.

That is not material to my comment, but unlike in your case with your anonymous posting, my answer can be independently verified. No, I am not an investor or owner of any hotel project, in this town or any other.

First of all it might’ve been if you were. I agree it’s not material if you aren’t.

Second most important what you’re missing in your comment is the fact that if you destabilized business you may end up not maximizing revenue for the city.

From that comment, it sounds like you think the City should be involved in protecting existing businesses from competition. Competition is good for our economic vitality, good for the City and residents, and good for customers. Protectionism is only good for the protected owners, their lackeys, and their ‘paid for’ politicians. Don’t really care which of those three groups you represent.

Franchising provides us a great model for optimizing competition. Understanding geographic demand is the first step, and then allowing enough competitive supply to meet that demand. Without enough competition the quality falls and the cost increase. With too much competition/supply, there can be a race to the bottom that takes out some good operators.

But the demand might be elastic… and so over-capacity can be allowed to attract more customers.

Wineries and the craft beer movement learned this some time ago. As more providers arrived in a geographic area it expanded demand in that area. Basically all benefited from geographic growth. However, there is bound to be upper limit of competitive saturation where the next new provider hurts the rest. I think Davis is a long way from worrying about that for hotel rooms.

Frankly – The financing required for the proposed projects acts as a ‘fail safe’ to your nightmare scenario of a ‘race to the bottom’ at least as regards to hotel projects. New projects won’t be able to find the necessary financing if the demand softens to that degree.

Puglist, google “ad hominem”.

The only destabilizing that is done is via protectionism through the guns of the City. I prefer having a market which is subject to voluntary trade, not subjugated by politicians and bureaucrats.

There is no “putting hotels into a position where they cannot make money.” Unbridled, uninhibited, free competition is sorely needed in Davis in many areas, but the entrenched and established interests keep it from happening by using the guns of the City. When you leave the market alone, you aren’t putting anyone in any position–you are allowing things to play out as they should, subject to the harsh mistress of a free market and rampant competition. When you step in with the guns of the law to restrict competition, raising barriers to entry from upstarts, that is when you put people in a bad position.

By restricting competition, you are hurting the the residents of the city. It is decidedly not for the greater good and is entirely selfish.

dooglio wrote:

> the entrenched and established interests keep it from

> happening by using the guns of the City

More often than not it is the “guns from a city” who use the “established interests” to get campaign cash by letting them know that they need to pay up or face competition from a new hotel, apartment or coffee shop.

> By restricting competition, you are hurting the the residents

> of the city. It is decidedly not for the greater good and is

> entirely selfish.

With rare exceptions (like mayor Robb) elected officials fund their campaigns by telling business owners that they will protect them and help them make more money if they fund their campaigns.

Looks like the Marriot is a better choice.