by Scott Steward

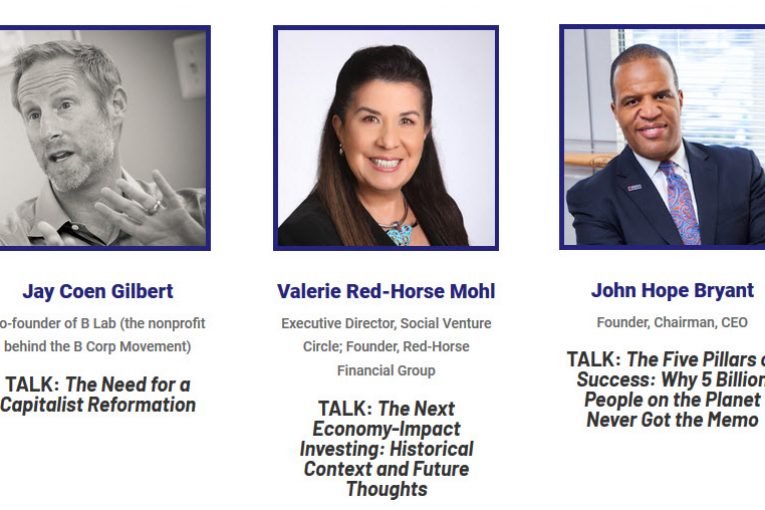

This is a mini review of Day 2 of the People-First Economy Online Summit (about 30 speakers in all) (https://peoplefirsteconomyonlinesummit.com). I am providing a progressive economy menu for the reader to reflect on and choose from. The speakers are mostly concerned with intentional inclusive economy that turns away from waste stream fossil fuel dependence. I am learning from these speakers as well and offering my perspective on what the speakers have to say. Here are the 3 speakers from Day 2.

Jay Coen Gilbert: “The Need for a Capitalist Reformation.” Jay Gilbert, founder of B Lab, reflects on a business system that is broken and then points to viable alternatives. The business system has grown to become the most powerful institution and it is in need of reformation to create an economy that is people-centered not profit-centered.

Jay’s journey has led him to B Lab and the formalization of processes that atone for business systems that have, and continue to perpetuate, inequities around race, class and gender. “We have a chance to re-center the economy” and give every person what they need to succeed. It’s Jay’s opinion that “we are lucky to have been born at an inflection point” and that it is not enough to recognize that the system is broken. “If all we do is recognize that there is a problem then all we get is anger.” We have solutions and they need to be offered and re-offered until they become the norm.

Jay points to the convergence around creating just economy: Elizabeth Warren is calling for companies – worth in excess of $1 billion – to adopt a Benefit Corporation governance. Mike Pence (then Governor) signed B Corporation charters into law in Indiana. Larry Fink – CEO of the largest ($6 trillion) asset management company Blackrock – has come out say we need to protect the natural  systems that we need to survive. Marko Rubio issued a report on the floor of the senate about the need to overthrow shareholder primacy.

systems that we need to survive. Marko Rubio issued a report on the floor of the senate about the need to overthrow shareholder primacy.

Action to go with these words has taken the form of a “declaration of interdependence” signed by 3,000 B corporations. These corporations have made themselves legally accountable to employees and customers and have thereby become more trusted and valuable to investors. Danone North America (food company) is currently the world’s largest B corporation. Natura (cosmetics) is a B Corporation, and with the acquisition of Avon, will become the largest B corporation in the world at $10 billion.

Using business as a force for good requires design and intention. A bleak future is also possible if we program the growing power of automation toward earnings per share and not toward people and planet nurturing systems. It is a choice and we need to overcome our own TINA (there is no alternative) marketplace thinking. “Making business a force for good” into a meaningful and lasting reformation is a team sport. Social, system and cultural shifts are team sports. Bonus: The B impact assessment at bcorporation.net.

Valerie Red-Horse Mohl: “Next Economy-Impact Investing: Historical Context and Future Thoughts”. Valerie starts with “we have a long way to go.” We are at a critical juncture, we can avoid the point of “fourth stage terminal cancer” as a people and a planet.

Valerie works with Social Venture Circle, a 2018 merger between the incubator/venture companies, Social Venture Network and Investor’s Circle. Valerie walks through the taxonomy of impact investment that dates back to the 1758 “social screen” applied by Quaker communities to divest from anything related to the slave trade. To bring us up do date Valerie describes “the Next Economy as one that is regenerative, just, and prosperous for all.” Impact investment is part of Next Economy and addresses investments that strive to promote social justice, human rights, gender diversity, poverty, access, environment and local empowerment in business. Impact criteria are used to select well governed companies and avoid companies who green wash their otherwise toxic businesses. Impact does not mean you have to accept “concessionary” returns. Social Venture Circle will be sponsoring a “Next Economy” conference in Berkeley from November 13-16 https://conference.svcimpact.org. Bonus: download Naturally Native film.

John Hope Bryant: “The Five Pillars of Success: Why 5 Billion People on the Planet Never Got the Memo.” The memo that John outlines, the memo that was not delivered to poor white, 1st peoples or blacks in America, is the omission that explains a good amount of the disenfranchised in the United States. The memo outlines 5 pillars of financial success that are needed – provided or not, given or not, withheld from you or not – that you need to find or invent: 1) education, 2) financial literacy, 3) strong family ties, 4) self-esteem, and 5) spiritual wealth. In combination these lead to access to role models and relationship capital.

You can listen for yourself, but it appears to be that John admires and inadvertently undermines the 5 pillars by suggesting that it all leads to inclusion in a class based culture. John’s description of relationship capital seems to be built on exclusivity, “they are segregating themselves.” “They are curating a world where they and their children’s children are building a rapport.” I believe the point is that If you are not part of this club you are not getting the memo and John is doing us all a favor in delivering the memo unvarnished. It is important for us to hear about how to lift ourselves up and that is John’s expertise, but I’m not sure how the relationship capital portion of his method speaks to the kind of progress we seek in a just and climate beneficial world. Perhaps he addressing what success has required up until now and what we must re-construct in building the next economy. Bonus: Chapter 2 and 7 of “How the Poor Can Save Capitalism: Rebuilding the Path to the Middle Class”

There is no Corporation B!

By Gum, I do believe the author is a socialist!