One of the hottest topics in the recent MOU’s that the city has approved from fire and the management group has been the issue of the cafeteria cast-out plan. The cafeteria cash-out plan applies to those employees who are covered under the health plan of a spouse. Since they do not need to take that particular benefit, the city compensates them in cash payouts to the tune of nearly 18 thousand dollars per year.

One of the hottest topics in the recent MOU’s that the city has approved from fire and the management group has been the issue of the cafeteria cast-out plan. The cafeteria cash-out plan applies to those employees who are covered under the health plan of a spouse. Since they do not need to take that particular benefit, the city compensates them in cash payouts to the tune of nearly 18 thousand dollars per year.

The new contracts only partially address this issue. The fire contract proposes a 20% of reduction of the cash payment maximum over the three year MOU. The management group contract proposes no changes for existing employees but a $500 maximum payment for new employees.

Countering that argument has been Councilmember Sue Greenwald, who has argued that these benefits are unusual in government service and also highly unfair as they reward some employees but not others.

The Vanguard did a quick survey of a few select cities to see how unusual the Davis policy is. At the onset here it is important to note that comparison to other cities is fraught with difficulties. Moreover, it was perceived competition between other cities that have generate justifications for current unsustainable policies and created an escalation of benefits and salaries. We then justify our unsustainable policies by pointing to the even more unsustainable policies of others.

However, in this case, Davis is so far more generous and out of line with the practices of other cities that it is important to point it out to the public.

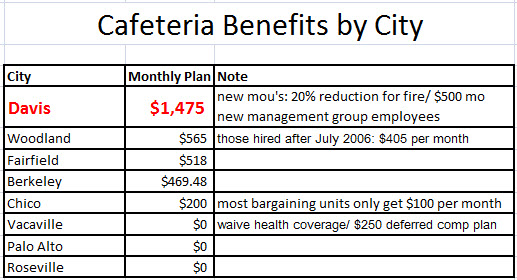

As we can see from the chart, Davis gives out nearly three times more in cash than the other cities. A quick note on the methodology here. We used these cities because they are frequently the cities that Davis uses in making comparisons. We had sent out the notice late last week and have not received responses from Folsom, San Luis Obispo, or West Sacramento. Nevertheless, we have seven comparison points that show a good amount of validity to this finding.

We also listed the maximum contribution and noted when other bargaining units received less.

As the chart demonstrates, Woodland has already modified their policy, reducing their benefit to $405 per month for those hired after July 2006. Fairfield is the only other city to break $500. It is not clear how Vacaville’s deferred compensation plan works, but they give out no cash and the benefit is only $250 per month.

As mentioned above, Davis has made some effort to modify their highly unusual cafeteria cash out plan. However, none of the proposals really bring Davis anywhere close to being in line with other cities.

The new fire MOU also contains a provision to convert unpaid cafeteria benefits to longevity pay:

The new contract includes a provision to allow for any portion of the cafeteria benefit remaining after cash-out to be converted to longevity pay for employees with 25 years or more City of Davis service. Longevity pay is included as part of salary calculations for retirement.

Councilmember Greenwald was particularly outspoken on this point during the discussion of the firefighter MOU:

“The cafeteria cash out is an extraordinary benefit that the city gives that means that if you have a spouse that have coverage, you can take home in cash, what that insurance would have cost you… If we didn’t have this extraordinary benefit that hardly any other public sector agencies have… and if we structured it intelligently, we could pay off our entire unfunded employee retiree liability.”

She continued:

“The cafeteria cash out is the biggest fiscal disaster facing us and it’s where we could really, if we had wanted to, had made a difference. Unlike almost every other public agency, a worker who lives in Davis, our employees, if they have a spouse, who has coverage, they get to take home currently 100 percent of the cost of their medical and related benefits. So they get to take home cash, it’s about $18,000 in the base year.”

She pointed out this was not even a fair benefit, since some get it and some do not.

“It’s not fair between employees and it’s not standard in public employment.”

Councilmember Heystek registered similar objections, telling the Vanguard he would have preferred to see the benefit at 20% rather than at 80% after a 20% cut for the firefighters.

“The cafeteria cash out, taking money for benefits you don’t take, I’m not against taking a small amount of cash for a benefit you don’t take, because it does save the city money and we’re willing to pay to save a greater amount of money. But to pay an equal amount and to use that are your take home pay, and to be a cost-basis for compensating people forever more, I think that’s something that will plunge us into greater financial debt.”

It is important to note that under the current policies for most employee groups, the city derives no benefit at all from employees who have additional medical coverage.

The city often justifies its policies based on the unsustainable practices of others, this is a case where they cannot. Once again our chief complaint is that this was really the moment to make these kinds of structural changes and we squandered that opportunity. It is left to a council in three years to grapple with these issues, but they likely will be negotiating in far better economic times and it will be much more difficult to gain the kind of concessions needed to make drastic changes.

—David M. Greenwald reporting

I continue to be amazed at this benefit since I have never seen it in private sector.

Do councilmembers receive the same benefit if they are eligible by their spouses’ coverage?

David

your article makes it clear that this cash out plan is inexcusable. What does our illustrious City Council majority have to say in response? We are talking about furloughs, cutbacks and tax increases while we give away money we don’t really have. I can see no good public policy reason for these high cashbacks. A small cashback can save the City money (but not society) by encouraging folks to get insurance alsewhere. (Note: I am not reccomending this policy.) However these paybacks go well beyond the amount necessary and amount to pure payola for union constributions to City Council folks.

[quote]Davis has made some effort to modify their highly unusual cafeteria cash out plan. However, none of the proposals really bring Davis anywhere close to being in line with other cities.[/quote] I appreciate this study and find it informative. I have no problem comparing what Davis does with what comparable agencies do. However, I think you would agree with me that [i]we shouldn’t ultimately increase our wages or reduce our benefits based on what other cities are doing.*[/i] Our decision should be made on what Davis can afford for the long-term**.

I would not argue, on the one hand, that it was wrong of us to inflate our employee salaries and benefits well above the rate our long-term revenues have grown in a keeping-up-with-the-Vallejos game, while on the other argue that because Palo Alto and Roseville don’t afford this particular perk we ought to get rid of it.

Perhaps we should do what other agencies are doing. But if we make that change — three years from now when the contracts come up again — it should be because doing so improves our situation for the long-run.

As to the specifics of allowing no cash-out provision, there is a problem with that. Our medical policy is a gold-plated Mercedes plan. It costs around $20,000 a year. A typical private-sector plan costs far less and covers less (esp. with regard to dental, vision, drugs and various deductibles). If you don’t allow a cash-out of any amount, why would any of our employees opt for their spouses’ cheaper plans? Chances are very small the spouse’s plan is as good. For that reason, the City of Davis could save money by offering a modified cash-out — now it is 80%; maybe a better number is 50% — but would not save anything offering no cash-out.

*The exception to this is, if we cannot attract decent candidates for open positions which we need filled because other agencies are offering much more money or benefits. In that type of case, we may have to match what others are doing. That said, it is important to know that there are many smaller cities (including neighbors of ours) with a lot less money than Davis who will always play a lot less than we pay. They get along just fine paying what they can afford.

**Without a doubt, we will not be able to afford city services if we don’t moderate our growing costs for employee and retiree medical care, and perhaps changing our cash-out policy will be a good step in ameliorating that problem.

This is a set cost times the number of employees , whether there using the insurance or cashing out , pretty basic math used for this one . Every employee gets the same amount of money spent on them if they use the insurance or not .

Rich:

“However, I think you would agree with me that [i]we shouldn’t ultimately increase our wages or reduce our benefits based on what other cities are doing.”

Agreed and tried to preface the discussion by saying as much. However, this is a glaring exception in that we have a clear discrepancy from other cities here.

Avatar:

“This is a set cost times the number of employees , whether there using the insurance or cashing out , pretty basic math used for this one . Every employee gets the same amount of money spent on them if they use the insurance or not .”

No one else operates this way.

Maybe it’s time to turn in the Mercedes for a ……? Prius or ?

[quote]Maybe it’s time to turn in the Mercedes for a ……? Prius or ? [/quote]I believe that is where we will ultimately go, SODA. The DJUSD medical coverage (I am told) is more Toyota than it is Mercedes. A great number of us in the private sector have Yugo packages with very high deductibles, no dental coverage and poor drug coverage.

What might drive us down to a more modest package is the new caps on total compensation. Heretofore, when medical premiums paid by the City went up in price, the entire added expense was borne by the taxpayers. Because medical inflation has been so steep*, our total compensation costs have increased at an even higher rate than salaries have gone up. But with the caps, wages will [i]decrease[/i] if the Mercedes keeps going up in price at a super-inflated rate**.

If that happens, I think many City workers, who don’t want their wages cut, will say, “How about we opt for the Toyota and not get a cut in pay?”

*I am not sure what the naitonal medical inflation rate has been. I have read that it has been more than double the CPI inflation. However, Paul Navazio told me that the premiums paid by the City of Davis for cafeteria benefits have inflated at 10% per year for a decade. If that is the case, the inflation rate is more than triple the CPI inflation. (I believe medical care is a component of the CPI, as well).

**An even bigger item affecting total compensation is the City’s expense for pension contributions. When CalPERS raises its rates — as expected — employee wages will decline by the amount of the increase, once the caps are met.