Last month the city of Davis’ Budget and Finance commission began to look at the city’s model which is used to evaluate the fiscal impact of new development. Last month they discussed the overall model and the various assumptions and interpretations of the model.

Last month the city of Davis’ Budget and Finance commission began to look at the city’s model which is used to evaluate the fiscal impact of new development. Last month they discussed the overall model and the various assumptions and interpretations of the model.

From last month’s discussions, there are three types of fiscal impacts. There are projects that are always positive in terms of fiscal impacts, we could think of these as economic development projects. There are also projects that will always have a negative impact, for example a zero tax affordable project will always have a negative fiscal impact.

One suggestion from the commission is rather than having a final number to reflect the fiscal impact of the project, they ought to have a range. Toward that end, the staff has now examined the fiscal impact of the 29 unit Willowbank project that will be heard later this month.

Staff has run various adjustments to the model’s assumptions to determine how sensitive these assumptions are to the final output of the model. They also grouped some of these scenarios labeling them optimistic, base, and pessimistic where several assumptions have changed.

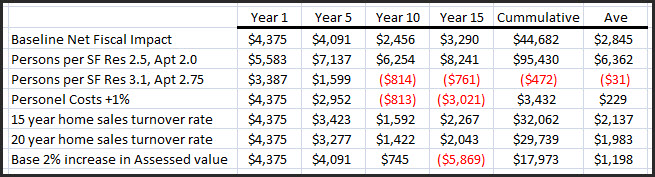

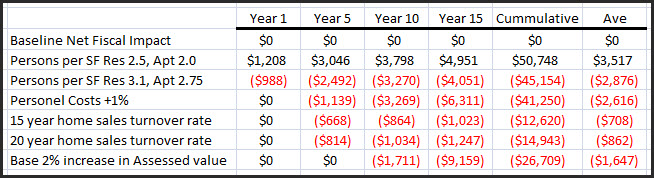

For the sake of simplicity and space, I have parsed down the table showing just year 1, year 5, year 10, year 15, and the cumulative impact of the model assumption. The first table shows the absolute value and the second table shows only the net effect.

From these two tables we can get a sense for the impact of altering each of the key assumptions. The biggest impact occurs when you change the assumption of the numbers of persons who inhabit a single dwelling unit modified both up and down.

Next biggest assumption is the impact of changing the assumption about the increase of personnel costs. As we have discussed previously, that is a large impact on the model. Here they assume the personnel costs will increase by 1%, we would see a similar impact in the other direction if personnel costs decreased by 1%.

The next biggest impact was the assumption of a base 2% increase in assessed value. While the two smallest impacts were the impacts of the turnover rate, one set at 15 years and the other set at 20 years.

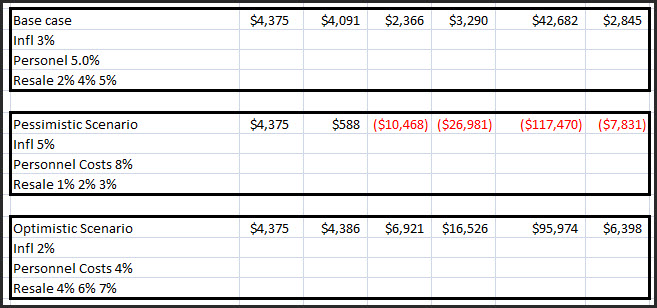

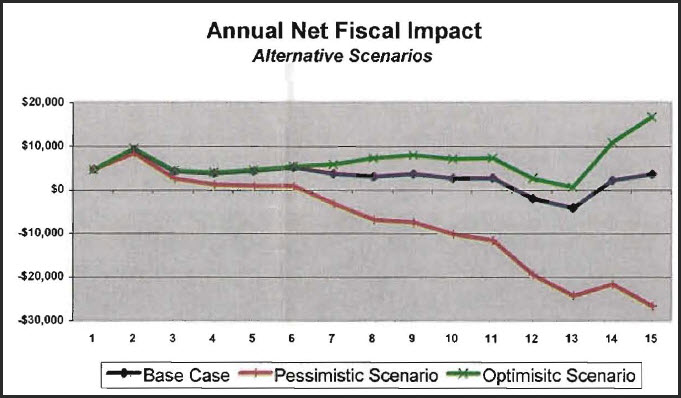

City staff then grouped these alternatives together into three different scenarios–a base case, a pessimistic, and an optimistic.

The alternative scenarios show exactly how sensitive the model is to each of these assumptions. The base case averages around $2645 in a net positive impact on an annual basis. The optimistic model improves on that producing an average net positive of $6398 but the pessimistic model runs a net negative of $7831.

Where does this leave us?

We are still in a quandary. We can see that the model is completely sensitive to the assumptions that are plugged into it. So the first problem would be to determine what the most reasonable assumptions are, and that remains a quandary.

Part of this problem goes back again to the issue of personnel costs. Leaving aside the issue of people per dwelling, the biggest variable is the issue of personnel costs. We see in this model once again the impact of personnel costs. If we assume a 5% increase, the project seems to be basically fiscally neutral given the small size of the project overall, however, we have seen with other projects that if we continue to grow our personnel costs at 5% per year, we are going to have fiscally negative impacts. If we are able to slow down the growth of personnel costs even by a small number our fiscal models will improve greatly. If the opposite occurs, we will begin running huge deficits.

The discussion last night left of with the commission trying to figure out ways to better assess the fiscal impact while eliminating the subjectivity of such modeling endeavors. Unfortunately that would seem easier said than done. There are a variety of scenarios in which a given project might end up negative or positive, depending on how factors that cannot be controlled and factors that may be controlled such as personnel costs pan out over a 15 year period.

We comeback then to where this discussion began. There are some projects such as commercial developments that will be clearly positive, others such as zero-tax affordable projects will be clearly negative, the rest will largely depend on the assumptions of the model. We can play around with the formula and try to determine the best formula, but at the end of the day it seem very likely we will never really reach a true consensus on the single best model.

—David M. Greenwald reporting

Interesting. What would the numbers be if/when a developer designs a zero impact subdivision? (Self-contained waste/water, power, fire-resistant construction, integrated businesses.)

Why stop at 15 yrs? Wasn’t that a major argument in the WHR model?

The major reason is that the precision just isn’t there past 15. One of the points made yesterday was that it become more uncertain even at ten years.