Yesterday we looked at the new Measure J arguments and impartial analysis including the ballot argument against Measure R (2010’s Measure J). Today we will examine the sales tax measure.

Yesterday we looked at the new Measure J arguments and impartial analysis including the ballot argument against Measure R (2010’s Measure J). Today we will examine the sales tax measure.

As we have previously argued, back in 2004 when the original half-cent sales tax measure was proposed, the city had told the public that this measure would ensure continued city services and it looked at a variety of expansions of city services. The city argued at the time that without passage of this measure, there would be a huge cutback in the provision of services.

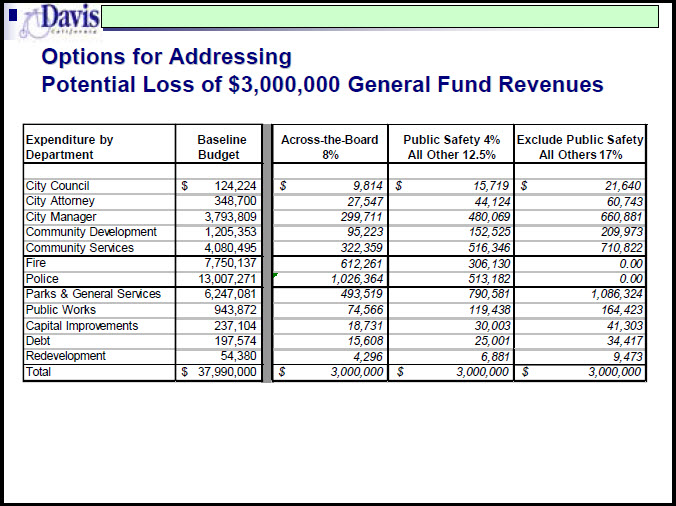

To help us in that view is a preliminary look at the budget for 2010-11 without renewal of the sales tax. Now as it turns out, because the sales tax goes until the end of the calendar year of 2010, the city can ease into the $3 million in cuts. Nevertheless, here is the possible plans for accommodating such cuts.

The three scenarios include an across-the-board 8% cut, a public safety cut of 4% with everything else being cut 12.5% and a 17% for non-safety with no cuts for public safety.

In our views, these type of cuts miss a lot of the points. First, as we see with the parks reorganization, the city may be able to restructure the provision of services to be more cost effective. Second, unless the city wants to re-open its already failed employee bargaining, the city will end up cutting services and probably employees while leaving the high levels of employee compensation in place.

It is for this reason, that the city has largely missed its window to get spending in line, and further cuts are going to come directly out of city services. Nevertheless, the belief is there that facing layoffs, the employee groups, may decide to opt to re-open negotiations. In our view that is probably a long shot.

And so what we have seen is that increased revenue has equaled higher amount of employee compensation, but decreased revenue means lower levels of services. This is a very poor deal for the taxpayer who paid more to get the same amount of city services and now will be getting far less as the system struggles to reach some sort of equilibrium.

With that in mind, here are the ballot arguments for Measure Q, the half-cent sales tax measure.

The argument for the sales tax was signed by four of the five councilmembers, Lamar Heystek did not sign the statement, and Johannes Troost, the Chair of the Finance & Budget Commission.

They argue that this tax has helped fund services that define our community:

- Police/Fire and emergency services

- Street, sidewalk, bike path maintenance and repair

- Street trees, landscape and parks maintenance

They continue:

“Revenue from this modest tax provides approximately 3 million dollars a year for essential city services. Even with this tax in place, Davis faces substantial service cuts. Without it, the service cuts will be extreme.”

What they do not say is that the tax did not go to fund anything other than employee salary increases.

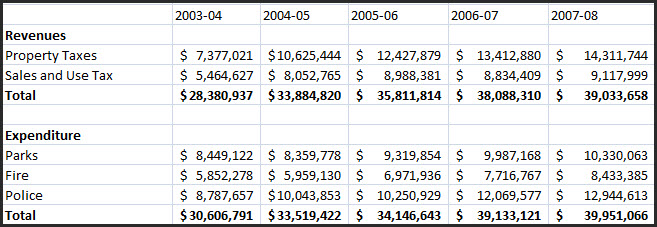

Since the passage of the sales tax measure in 2004, the city used all of the increase from the sales tax plus additional revenue from the real estate bubble to finance increases in employee salary without increasing provisions.

The argument against the sales tax hits on a few of the key points, but does not bring enough of the points home to those who not been engaged in the debate.

At times, the argument makes little sense even for someone who agrees on the bottom line.

“Many businesses in Davis have recently been forced to close because excessive rent and property taxes have become unaffordable.”

This may be true, but the sales tax has been in place for nearly six years and it is not one of the reasons that businesses in Davis have closed. The economy is a primary problem, the excessive rents are also crucial.

The argument goes on to say:

“Meanwhile, the city is wrapped up in a major financial scandal, where some public employees are receiving salaries in excess of $100,000 per year, including promotions for higher pay.”

The word “scandal” is misplaced here. The argument should say that the city is facing fiscal crisis, and while some public employees are receiving salaries in excess of $100,000 per year, the real problems lie with retirement benefits including health and pensions.

I do agree that the city talks about the need for essential services and has in the past, however, they needed to hammer home the point that when this measure was placed on the ballot, they talked about maintaining and expanding specific services and instead the measure went to employee compensation increases.

“Residents should not fork over additional money to a city government that has not kept its financial house in order.”

Unfortunately, they have failed to make the case to the public that the city government has not kept its fiscal house in order. They assume people know, but they do not. The average person in this town has no idea what looms down the road in unfunded liabilities and pension hits and unfortunately this argument does not mention either one of them.

“If Measure Q passes, businesses most undermined will be smaller retailers.”

I think this is a very minor impact at best. We are talking half a cent on the dollar, which is 50 cents for every $100 dollars spent or $5 for every $1000 spent. I do not believe that this amount is going to undermine businesses, or that making it go away will provide any kind of boost to them.

In the final argument, they make the point that “it is now time to prioritize where tax revenues will go” and I agree with that point, unfortunately that could have been their opening statement and then they could talk about the problems that the schools are facing, the problems at the county and the social service cuts, and then ask if we really need to fund luxuries such as parks and recreation during times of fiscal crisis.

As I said at the outset, they hit on some of the points, but the failure to explain them means that the argument will not resonate with a general public in Davis that is inclined to support tax measures unless given a real reason not to.

I would also note that in the impartial ballot analysis, the vote required a two-thirds vote on the part of City Council to place this tax measure on the ballot. Councilmember Lamar Heystek was the lone hold out as he had hoped to have used it as leverage to get the city council to drive tougher negotiations for the new employee contracts, had he had a second vote, he could have blocked the measure and really forced the hand of the council majority. Unfortunately, no one stepped up to use one of the few powers the council minority has in Davis.

—David M. Greenwald

ARGUMENT IN FAVOR OF MEASURE Q:

- Police/Fire and emergency services

- Street, sidewalk, bike path maintenance and repair

- Street trees, landscape and parks maintenance

Revenue from this modest tax provides approximately 3 million dollars a year for essential city services. Even with this tax in place, Davis faces substantial service cuts. Without it, the service cuts will be extreme.

Many cities have a similar local sales tax. Sacramento, Woodland and West Sacramento all have the same half cent sales tax measure in place. Shoppers in cities such as San Francisco and Berkeley pay even more. San Francisco has a local sales tax supplement over twice that of Davis. Berkeley and Oakland have local sales tax supplements 3 times higher than the Davis tax.

When we shop and eat in these other cities, we pay their local sales taxes which help fund their local services. If we renew our own local sales tax supplement, visitors from the region and from the Bay Area will in turn continue to help us pay for our local services when they shop and eat in Davis.

The current recession has caused a steep decline in local revenues, and coupled with the state’s ongoing shift of property tax revenues away from the city, it is more crucial than ever that we protect local funding for essential city services.

Please help protect the quality of life in Davis that we all enjoy. Please join us in voting yes on Measure Q.

For more information: www.yesonq.net. Thank you.

Signed: Mayor Ruth Asmundson, Councilmembers Stephen Souza, Sue Greenwald, Mayor Pro Tem Don Saylor, and Johannes Troost, Chair, Finance & Budget Commission

ARGUMENT AGAINST MEAUSRE Q

Meanwhile, the city is wrapped up in a major financial scandal, where some public employees are receiving salaries in excess of $100,000 per year, including promotions for higher pay. Yet, the city talks about the need for “essential services” as a justification for tax-hike renewals. Residents should not fork over additional money to a city government that has not kept its financial house in order.

If Measure Q passes, businesses most undermined will be smaller retailers. Because non-taxable items such as unprepared foods and medicines are largely the stock of larger retailers, they would not be placed at a competitive disadvange by the sales tax renewal to the extent of smaller retailers whom sell mostly sales taxable items.

As the old adage goes, “you cannot get blood out of a turnip.” In this lagging economy with pay cuts, furloughs, or citizens laid-off, it is now time to prioritize where tax revenues will go. The city should respect the fact that Davis residents do not have bottomless pockets. Please consider voting no on Measure Q.

For more information, please visit our website at: http://www.yvm.netlvme/no-on-q

Signed: David Musser, Thomas Randall, Jr. and John W. Jones

IMPARTIAL ANALYSIS – CITY OF DAVIS CITY ATTORNEY’S IMPARTIAL ANALYSIS OF MEASURE Q

California Revenue and Taxation Code sections 7285.9 and 7290 authorize the City to levy a transactions and use tax (sales tax) in quarter cent (1/4 cent) increments (generally up to a maximum of 2%) so long as the tax is approved by two-third’s of the members of the City Council and by a majority of the voters voting in an election on that issue.

The current sales tax within the City (including state and local sales taxes) is at total of 8.75%, including this City Y:z cent sales tax and the temporary 1% state sales tax in effect through June 30, 2011. If Measure Q is approved by a majority of the voters voting on this measure, the total sales tax would remain at 8.75 percent. If Measure Q is not approved, effective January 1, 2011, the total sales tax would decrease to 8.25 percent. In either case, the total sales tax will reduce by 1% when the temporary 1% state sales tax expires, unless the state takes action to extend this 1% tax.

The 12 cent sales tax re-authorization and extension set forth in Measure Q would sunset and be repealed on December 31, 2016 and could not be collected after that time unless two third’s of the City Council place an extension or re-authorization of the tax on the ballot and a majority of the voters voting in an election approve it.

Signed: Harriet Steiner, Davis City Attorney

The name of the game here on the part of the city, is to cut essential services and keep the frills, such as fat salaries for upper management. That way, the city can argue if citizens don’t vote for continuing the sales tax, essential services will be cut. What the city fails to say is that while the city cuts essential services, to make sure the average voter feels the hurt, the city keeps cushy jobs nice and cushy. So the voter is damned if they vote in favor of the sales tax renewal, damned if they don’t vote for the sales tax renewal.

The bottom line is that the city has given voters an illusory choice, whereas the only choice voters are given is to decide whether to cut city services or not. The sad part is that if voters choose to renew the sales tax, it sends a message to the city that the city’s gamemanship was successful, so it will be business as usual. If voters choose to vote against renewing the sales tax revenue, they will be voting to hurt themselves to send a clear message that gamemanship of this sort is unacceptable.

We clearly need new leadership on the City Council, but effective leadership. And we also need more citizen involvement – to remind the City Council that voters are a force to be reckoned with and won’t stand for business as usual anymore…

[quote]Councilmember Lamar Heystek was the lone hold out as he had hoped to have used it as leverage to get the city council to drive tougher negotiations for the new employee contracts, had he had a second vote, he could have blocked the measure and really forced the hand of the council majority. Unfortunately, no one stepped up to use one of the few powers the council minority has in Davis — David Greenwald[/quote]I am going to treat this coy, back-handed remark as if it were upfront and staghtforward. Yes, I, Sue Greenwald, am the “second vote” that Lamar Heystek did not have.

I did everything in my power to try to bring fair and reasonable reform to our labor contracts. I lost that battle. But we have a democracy, as imperfect as it is, and I made a decision not to vote against the tax merely because decisions were made that I disagreed with.

I voted for the one-half cent sales tax override because, without it, our city service cuts will be draconian. Even without this tax, our city service cuts will be extensive.

David Greenwald suggests that our tax dollars should go to the schools and county, rather than to the city. I support the school taxes, but the school district already costs taxpayers far, far more in the way of supplementary taxes and bonds than does the city. I don’t think the small taxes charged by the city compete significantly with the school taxes.

And I find it odd that David complains about the city labor contracts without examining the county labor contracts or the county’s inefficiencies. Yolo county is in need of the same labor contract reforms as is the city, and I would be willing to wager that the city runs a tighter ship than does the county.

I am puzzled by David Greenwald’s single-minded obsession with our city labor contracts. I don’t recall one Vanguard article about the county labor contracts.

Correction:

I voted for the one-half cent sales tax override because, without it, our city service cuts will be draconian. Even with this tax, our city service cuts will be extensive.

Sue:

here’s the point. You and Lamar lost on a series of 3-2 votes on the budget, on the MOUs, and I assume without knowing that you and Lamar lost on a bunch of 3-2 votes in closed session as well.

However, you and Lamar had leverage on one issue and one issue only–the sales tax. Because without 4 votes on the sales tax, it doesn’t get on the ballot.

You are correct, that without the sales tax, our service cuts would be draconian. You know it, Lamar knows it, and you bet your bottom dollar that the three other guys on council know it. So on that issue and that issue only you had leverage and could have used it to get what you wanted or more of what you wanted on the budget and MOUs. When you signaled otherwise you lost leverage and lost every single vote.

You say: “I did everything in my power to try to bring fair and reasonable reform to our labor contracts. “

No you didn’t. You had this card to play and failed to play it, incidentally the only card that you actually had voting leverage over.

Even if you weren’t going to actually vote against the sales tax, you should have threatened to do it and bluffed it. Had you done that, the council majority would have been forced to do more than they did.

That’s my criticism. I’m sure you’ll try to twist my words or bring in extraneous facts as you did in your previous post, but you blew it in my opinion.

Sue Greenwald: “I am puzzled by David Greenwald’s single-minded obsession with our city labor contracts. I don’t recall one Vanguard article about the county labor contracts.”

Generally, DPD reports on Davis issues, which are his primary concern. And rightly so, since it is the Vanguard which has had some very positive effect on local politics.

Sue Greenwald: “I voted for the one-half cent sales tax override because, without it, our city service cuts will be draconian. Even without this tax, our city service cuts will be extensive.”

As I noted above, the city is playing a shell game, to ensure money for paying city employees is available first and foremost (which it now must be by law), and so “essential services” must now be cut which will hurt the taxpayer mightily. The taxpayer is left with the evil of two lessers – 1) hold its collective nose and pay for a tax renewal going to pay for overly generous city employee salaries/health care benefits/pensions; 2) vote against the sales tax renewal and suffer the consequences of more severe decreases in city services than are already going to be instituted.

Frankly, I will be glad to see some fresh faces on the City Council, but whether they will be more fiscally responsible remains to be seen. Sue, your lone voice for greater fiscal responsibility needs support – you cannot do it alone.

[quote]So on that issue and that issue only you had leverage and could have used it to get what you wanted or more of what you wanted on the budget and MOUs. When you signaled otherwise you lost leverage and lost every single vote — David Greenwald[/quote]I don’t understand your analysis at all. The last, best offers for this round of labor negotiations were made well before the discussion of the sales tax renewal.

You say “You had this card to play and failed to play it, incidentally the only card that you actually had voting leverage over.” As I said, there was no card to play because the last best offers had already been extended.

Our budget problems are so deep that by the time we start new negotiations in 18 months, the pressure will for reform will still be profound.

Why should I have voted to bring down the city after the opportunity to make constructive changes had passed? How is your position reasonable or responsible?

It’s simple, Lamar early on signaled unless the city made reforms with the MOUs, he would vote against the sales tax measure, had you followed suit, and continued to press the council majority, you had leverage.

That is an incorrect analysis, David. The council majority was going to vote the way they were going to vote concerning the employee negotiations. They were not going to be blackmailed.

Your analysis shows little understanding of the political dynamics in play. If Lamar and I had made a blatant threat to destroy the city if we did not get our way, I suspect the council majority would have gleefully replied: “Make my day!”