It took a lot longer than expected for the City of Davis to get the annual CalPERS (California Public Employees’ Retirement System) report that laid out the upcoming rates. It was expected that the news would not be good with respect to rate hikes, however, it was worse than expected. And for reasons we will get into shortly, this may be only the tip of the iceberg.

It took a lot longer than expected for the City of Davis to get the annual CalPERS (California Public Employees’ Retirement System) report that laid out the upcoming rates. It was expected that the news would not be good with respect to rate hikes, however, it was worse than expected. And for reasons we will get into shortly, this may be only the tip of the iceberg.

Interim City Manager Paul Navazio stressed that the city is still working out what the impact of these rate hikes will be on the city’s budget. That information should be ready to roll on January 18, when the council has their study session on pensions and the city’s unfunded liability, which is soaring with this latest report.

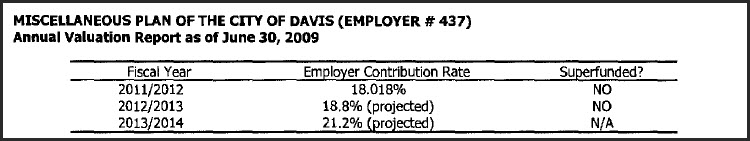

On the non-safety side, the unfunded liability has increased from $18.4 million up to $30.7 million. And overall it went from about $31 million up to $45 million, meaning a 50% increase in just one year.

Keep in mind as we look at these numbers that these rates are based on an assumption of a 7.75% investment return. There is a strong likelihood at this point that CalPERS will lower their projected earning to 7.25% which would increase these numbers by a significant margin.

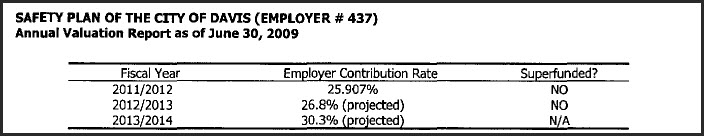

For safety, the contribution rate will increase from 22% this year, up to 25.9% for 2011-12, and up to 30.3% projected in 2013-14. One thing to bear in mind is that the last round of Memorandums of Understanding (MOUs) included the employees covering the first 3% of the PERS contribution rate increases. That is the good news.

The bad news is that the firefighters, who make up half of the employees, did not agree to that, although the police did. The worse news is that the expected rate increase is about eight percent, of which the police only will cover the first three. So a greater than 33% increase in rate that the city will pay.

On the non-safety side, the employees did all agree to take on the first three percent increase in the contribution rate. The bad news is that the rate goes from 12 to 18 percent this year, and up to 21% projected for 2013-14, and that assumes they keep the projected increase at 7.75%.

Due to rate smoothing, the city’s unfunded liability is now soaring with regards to PERS and it may continue to get worse with a continuing slumping economy.

Obligations to the retired employees will continue to eat up larger and larger amount of city assets.

One of the things that CalPERS is now acknowledging is the fact that safety employees do not live shorter lives than non-safety employees. That was a huge factor in going to the enhanced benefits of 3% retiring at age 50. The assumption was that because they did not live as long, they could get their benefits at a higher rate starting at a younger retirement age.

Fixing this problem will be quite difficult. Many unions have moved to concede to a two-tiered system. That offers their current membership several advantages. First, it offers a concession at the table when they are under pressure to do so. Second, it does not impact current membership. And third, while it does disadvantage future members, the unions understand that they have twenty to thirty years to get the benefits back for their members. All it takes is one negotiation during good times by the right legislative body and they get their full benefits back.

From the city’s perspective, a two-tiered approach does little to solve the problem. The city would get no short-term savings. There would be savings, but it would occur over the next twenty to thirty years which is not when the city needs the help.

There are four ways to fix this problem, each one wrought with difficulties and problems.

First, we need to increase the employee contribution rate. The MOUs started that process, but at the very least employees should be picking up their full employee share. Right now for non-safety, the employees do not do that at all.

Second, we need to see about lowering the benefit amount. There are arguments that this is a vested right – but is a future benefit, not received, really vested? In other words, if I agreed to pay you 3% at 50, am I obligated to pay you that in two years or just up until the time a new rate is negotiated? Moreover, when the employees retroactively got bumped from 2.5 percent to 3%, an amount not previously budgeted or funded, was that not a gift of public funds?

Third, we need to raise the retirement age from 50 to at least 55 for safety and from 55 to at least 60 for non-safety. That would really help the city’s unfunded health retirement benefit unfunded liability because it would reduce the period of the benefit from 10 or 15 years down to 5 to 10 years. That is anywhere from a 33% to a 50% savings that could be used to help pay for pensions.

The other factor is while that would increase the number of years the city pays into retirement funds during employment, it would reduce the number of years CalPERS would have to pay retirement. There may be practical issues of age for a firefighter or a police officer moving past 50 in retirement, but those could be addressed by further study.

Fourth, the other fix here is more long-term. Part of the pension spike problem had to do with the large increase in salaries given employees. With higher salaries comes higher pensions. By freezing salaries and holding future increases to inflation, we could reduce our pension funding liability due to inflation and attrition.

None of these are easy solutions. Some will take changes to state law to enact. Most will take approval at the bargaining table.

The city needs to change its stance on bargaining. First, it has tended to downplay fiscal concerns, meaning that during the time that they needed to drive hard bargaining decisions, they were downplaying the problem.

Other cities may be worse off than we are, but we still face severe challenges moving forward, particularly if the economy continues to stagnate. The last round of MOUs barely moved the ball further, but the city tried to spin it like these were great concessions. As you can see just from these numbers, the city has failed to make advances in addressing challenges.

In order to gain concessions, the city needs to acknowledge we are in crisis, call on joint sacrifice and lay out the truth – the city cannot continue to provide the current level of services at the current level of compensation for employees. Something has to give. The council needs to decide what needs to give and they need to do so quickly.

—David M. Greenwald reporting

[quote]Keep in mind as we look at these numbers that these rates are based on an assumption of a 7.75% investment return. There is a strong likelihood at this point that CalPERS will lower their projected earning to 7.25% which would increase these numbers by a significant margin.[/quote]

Jeremy Grantham and GMO, who have one of the best records prognosticating longer run returns on Wall Street forecast a 1.2% return on US stocks over the next seven years (higher for blue chip stocks which CalPers may own more of). Their forecasted return on US government bonds is actually negative!

So I am not sure how you get a 7.25% return from that. CalPers estimate is over a long time period but it will be hard to overcome another 7-10 years of very little growth or no growth in the stock market plus pension funds, which typically have stock and bond holdings, will also face a tailwind in the bond market over the coming years. But that is what we are faced with.

This puts another huge strain on state and city budgets. At some point we will realize our pension obligations are unsustainable. This was unthinkable even a few years ago (though a few of us were thinking it privately) but is now part of the conversation and even on 60 minutes.

Does anybody know the status of the Vallejo bankruptcy case? The last I read, public employee unions were throwing copious resources at this to prevent it… for the obvious reason that it sets a precedent that other cash-strapped municipalities would use to force a renegotiation of their labor contacts with union employees.

Unions developed as a counter to the labor exploitations of company owners. As we the people are the owners of our government, public employees all work for us, and as such, cannot be exploited beyond what the democratic process would allow. Unionization, however, provides a legal cover that corrupts the democratic process and holds the majority voters hostage to a very small minority able to extort a greater share of government-provided economic benefits.

Other cities across the nation are filing bankruptcy as a necessity. Prichard Alabama, for example, has simply run out of money and options and has filed. My guess is that this will be the eventual required solution. Unions are not a cooperative enterprise. They are selfish by design. Like a giant leech, they cannot stop themselves from eventually killing their host supplier. With enough municipal insolvency, we will eventually get around to asking ourselves why we even allow public employees to unionize. It does not make any sense. There are millions of people that would line up to take the jobs of our firefighters for 2/3 the pay, and half the benefits.

I’m going to hold my fire on this topic, as this is the subject of my next Enterprise column. But nevertheless, I should point out that the situation for Davis is even worse than David reports. Our debt on a market value basis is far, far higher–and the debt which counts is market value, not actuarial value.

[quote]Jeremy Grantham and GMO, who have one of the best records prognosticating longer run returns on Wall Street forecast a 1.2% return on US stocks over the next seven years (higher for blue chip stocks which CalPers may own more of). Their forecasted return on US government bonds is actually negative! [/quote]I suspect that the large pension funds will try to achieve the needed rates of return by shifting their investments overseas to markets in developing country, which will lead to further disinvestment in the United States.

Sue:

GMO’s forecast for foreign and emerging markets are a little better but still won’t get you to 7.25%. For example, GMO forecasts 2.9% for foreign large cap equities over the next 7 years–better than the US but still low compared to what most pension funds and foundations require.

Incidentally this is a 7 year forecast. Next year is the third year of a presidential term which has historically been bullish and even Grantham himself thinks we may see a nice rise before we see another plunge.

On that note, Happy Holidays.

So, Dr. Wu, would you advocate for a retirement system for public employees, like Social Security, where recipients are virtually guaranteed increases to adjust for inflation, independent of investment results? After all, they could just increase SS taxes, as the current recipients are being paid not thru their contributions, but actually, those currently working…

Full Disclosure: I am in CALPERS.

Hawkeye: There is no short answer to your question though it is an important one. The idea of a defined benefit pension or social security (which is essentially defined benefit) is a good one since it takes away the risk of the market from the recipient. The problem: a) we have promised far more than we can deliver, b) financial markets have been very bubble/crisis prone in recent years and I don’t see that changing.

As a practical matter there are limits on what the public sector will be able to payout in pensions. As I am sure you know, the longer we wait the worse it will get. And medical care is a ticking time bomb. I don’t really favor privatizing or moving to defined contribution programs either.

I recently poke with an in-law who is a police officer in the Bay area. She told me her boss just retired at 45 at 85% pension !!!!!!!! That is outrageous. My Dad was in the military and retired after 30 years with 75% (maximum one can make). That strikes me as generous enough but police officers now do much better. Its appalling.

[i]”She told me her boss just retired at 45 at 85% pension !!!!!!!!”[/i]

A CalPERS affiliated city* recently conducted a study of its public safety “retirees” to see if they are really no longer working after retirement from CalPERS. (The study excluded those who left work due to a disability.) What they found was that almost every “retiree” under age 60 takes another “public safety” job. The most common form of “post-retirement” employement is to work for a new agency which has no affiliation with CalPERS.

So Dr. Wu’s friend’s boss who “retired” at age 45 is probably now working for an agency like San Francisco, which has its own pension fund, SFERS ([url]http://www.sfers.org/index.aspx?page=57[/url]). When this “boss” retires again in 20 years, he will still get his CalPERS pension and other CalPERS benefits; and he will have 20 more years of a SFERS pension tacked onto that. From age 45-65, he will have a large income (presuming he is making a management-level salary) plus his 85% PERS pension. That is the classic double-dipper scenario.

You might wonder, who hires a 50 or 55 year old cop or firefighter?

According to the study done for my friend’s city, common “post-retirement” non-CalPERS jobs for cops and firefighters are as program administrators (such as police or fire safety programs), investigators for district attorney offices or special detectives for county agencies or arson investigators. They also found a number of “retired” firefighters working as EMTs and paramedics for non-PERS public agencies.

The same study found a big drop-off when safety employees remained with their original agency to age 60 or later. Those folks actually tend to retire when they retire. And those among them who continue working tend to not go to work for government agencies. Many 60+ retirees work as consultants for “private” firms which sell their services to government agencies.

*I am not at liberty won’t say which one. A friend of mine who works there showed me a paper copy of the report, which was written by an outside consultant. I don’t have a copy of it. It is not available on that city’s website. This study, he told me, was commissioned because his city is considering a second-tier pension plan which would put all of its new hires (safety + miscellaneous) on 2% at 60. They currently have the same plans we have in Davis: 3% at 50 for safety; and 2.5% at 55 for misc.

One more thing about double-dippers: I would imagine they are very attracted to work for a second agency which offers a medical care cash-out. That way, their original employer–say Davis–will pay $20,000 a year or so to buy their lifetime medical insurance through CalPERS, while their second employer will just hand them $20,000 or so a year in cash for not taking that employer’s medical insurance. … And we wonder why California cities and counties are in such bad fiscal shape?

I think David’s suggestions on retirement ages are too generous. When the retirement age was set at 65, I believe in the late 30’s, the average lifespan for Americans was below 60. It didn’t top 65 until 1950 (68.2). A male born in 1985, 25 years old today, should live to 71. In 2035, he will be 50 years old, and if hired as a fireman today, will be ready to retire. He will have worked 25 years, and will draw a pension for 21 years–very nearly as long as he worked. Up retirement to 55, and it is still 16 years. When the retirement systems of the US were set up, they were intended to provide a level of dignity for the elderly in the last few years of their lives; not for decades. A fireman may not be able to hump a ladder at 60, but he should be able to still handle one of the many desk jobs in the department. I suggest 65 for safety workers and 70 for the rest of us.

I got my date from the following link:

http://www.infoplease.com/ipa/A0005148.html

Nobody should make more than a six figure pension (or lower–I’d say 70-80k) from a State or local public agency.

You shouldn’t be able to retire at 45 unless you have a real disability. If you can no longer work as a police officer we can find you something else.

Double-dipping has a long history. My Dad retired at a nice 75% pension at 51 from the Air Force and consulted for the “company” (CIA) for ten years.

We cannot afford that anymore. We are not competitive in terms of education, our government sector has gone berserk and we have massive debt.

The retirement age was initially set at age 65 for social security because that was the life expectancy at the time. I fully expect to work until I drop or nearly drop. At what point did the entitlement expectation kick in that we all deserve a full expenses-paid vacation after working about 30-40 years? Considering that most people able to enjoy this early retirement benefit have five or more weeks of paid time off every year… and considering fire fighters have additional big chunks of time off because of their 24-hour work schedule… increasing the retirement age to 65 is the least that should happen.

Cash out medical makes no sense. That should be the first to go. Rich’s op ed about Don Saylor taking ~$20K in medical benefit cash out is outrageous and is so far from what the original intent if medical benefits were for. Sorry if there are typos. On iPhone and type cannot be enlarged. David, this happens sporadically on iPhone. Very frustrating!

[i]”You shouldn’t be able to retire at 45 unless you have a [b]real[/b] disability.”[/i]

Every so often an insurance company, suspicious of someone who has requested Worker’s Comp for an on-the-job disabling injury, will conduct an undercover investigation where they find the “disabled” worker lifting heavy objects or some such thing ([url]http://www.youtube.com/watch?v=Lfy3jXgOH0g[/url]). I’m sure everyone has heard of these cases or has seen a news report about one.

Those “fake disabilities” cases make me wonder about how many of our public safety retirees are truly injured. (I have no information at all, not even second hand, to suggest that any Davis or Yolo County retirees have faked an injury.)

The City of Davis currently has exactly 100 safety retirees. Of those 35 (or 35.0%) left work for Davis on disability. That strikes me as a high number. Of those 35, most are now actually of retirement age. 7 are 60-64; 14 are 65-89. The other 14 range in age from 35-59.

Yolo County currently has 235 safety retirees. Of those 86 (or 36.6%) left work for Yolo County on disability. That’s an even higher percentage than Davis has. Of those 86, 57 are 60 years of age or more. The other 29 range in age from 40-59.

My guess is that no one has an incentive to investigate if a public safety retiree who left on disability was really injured. What does any other city executive in Davis have to gain by spending money on a P.I. to determine if Joe Firefaker was really disabled? It’s the taxpayer’s money, not his. I think Davis is actually self-insured for worker’s comp–as opposed to buying w.c. insurance from a private company. If I am right on that, then there is also no private party who would have an incentive to investigate any potentially fake claims.

I am not saying that all or most of these claims are fake. But I’d be surprised if none of them are.

Dr Wu, I’m familiar with the PERS system and it would be impossible for an officer to retire at 45 with 85% retirement UNLESS that individual purchased service credits and I don’t know if five years of credits can be purchased. I’ve heard of people buying one or two but never five. If no service credits were purchased the max available at 45 would be 72% and a hefty penalty would apply for retiring five years before fifty. I’m not saying the info you received is incorrect but highly unlikely.

As far as the number of people retiring with disabilities. Does that number include those retiring with partial disabilities? IF you have a job related hearing loss and are 10% disabled because of it I would think that would count as a disability retirement. Without counting the partial disabilities that number sounds a bit high.

[i]”As far as the number of people retiring with disabilities. Does that number include those retiring with partial disabilities?”[/i]

In the CalPERS actuarial reports there is no mention of “partial disabilities.” There is, however, a distinction between “Industrial Disability” and “Non-Industrial Disability.” I assume “Industrial” means the injury happened on the job, while “non-industrial” (such as getting cancer or heart disease) was outside of work. Almost all of the disability retirements in Davis and Yolo County are “Industrial.”

[i]”I’m familiar with the PERS system and it would be impossible for an officer to retire at 45 with 85% retirement UNLESS that individual purchased service credits and I don’t know if five years of credits can be purchased.”[/i]

Purchasing service credits is just one of the ways extra service time can be awarded. Agencies have the ability to add service time at their discretion. Some of that can be done to encourage an early retirement, to make an exchange with an employee for unused vacation* or sick leave time* or for no reason at all.

A few months ago, the Rocklin city manager, Carlos Urrutia, retired. It was reported that Rocklin just gave Mr. Urrutia 2 years of service credits: [quote] Last year, Urrutia and four other managers retired ahead of schedule to save the city nearly a million dollars in salary. In exchange, the retirees got two years service credits toward their pension. The city is paying CalPERS more than $50,000 a year for the next 19 years to accommodate that plan.[/quote] *Sick leave and vacation payouts are not considered compensation under California’s Public Employee’s Retirement System rules and do not impact retirement benefits. However, some agencies will trade service credits instead of having a retiree cash out his unused sick leave or vacation time. In Davis, we also have a management leave time for about 2 dozen or more City employees every year. They often cash out this benefit in January and are not allowed to carry it forward. However, if it is in their final year of work, they can just retire early and get service credit and full pay for that unused leave. Moreover, I know of one case where an employee was fired by the City of Davis about 11 months before he could qualify for his PERS retirement. So the Davis City Council gave him a sweetheart greenmail deal: He could sit on his duff for the next 11 months and then his employement would be terminated and for the rest of his life we would pay for his medical insurance and his wife’s, too. Never mind that this person, Jim Antonen, is working full-time as a city manager in Minnesota.

Mr Obvious said

“Dr Wu, I’m familiar with the PERS system and it would be impossible for an officer to retire at 45 with 85% retirement “

For what it is worth, Dr. Wu wrote “85% at 51” – not 45.

[quote]I recently poke with an in-law who is a police officer in the Bay area. She told me her boss just retired at 45 at 85% pension !!!!!!!! [/quote]

It was in one of the comments earlier in the thread. Again I’m not saying the info is wrong but I don’t know how one can get to 85%.

ALF: [i]”For what it is worth, Dr. Wu wrote “85% at 51” – not 45.”[/i]

DOC: [b]”I recently poke with an in-law who is a police officer in the Bay area. She told me her boss [u]just retired at 45[/u] at 85% pension !!!!!!!!”[/b]

Alf, I think you misread Wu’s comment.

FWIW, I think, as Mr. Obvious notes, there’s reason to be skeptical if someone really did retire at age 45 (which, btw, is five years shy of the minimum PERS retirement age for any formula) at 85% salary. It’s not impossible, but it seems unlikely.

Nevertheless, there is (in my opinion) a widespread problem of public employees having a great financial incentive to retire young (such as 50 for safety or 55 for miscellaneous). These early retirements are a main source of the serious problem* of retiree medical liability for public agencies in California. The fact that so many early retirees are also willing and able to take on “post-retirement” employment, very often elsewhere in the public sector or in the consultancy sector which is funded by gov’t agencies, makes it plain that the taxpayers are getting suckered, having to pay for the retiree’s pension and other benefits and at the same time pay the full costs of the retiree’s replacement.

*The other main source of the medical liability problem is that agencies are buying luxury medical plans for their retirees. They need to cap the amounts they spend per capita and the amount the agency is willing to spend on premium inflation.

“Alf, I think you misread Wu’s comment. “

You are right!

I think there should be incentives to encourage people to work longer – for example, offer Police Officers 2% per year for the first 20 years and then 3% per year after that. That could be adjusted in cases of serious work related injuries, on an exception basis.

The same sort of staggered plan could be used for all public sector jobs.

[i]”I think there should be incentives to encourage people to work longer …”[/i]

Agreed. In my opinion, a 2% at age 60 formula* for all employees plus a provision that no employee, other than the truly disabled, can get any post-employement medical benefits until 65 years of age or older would do the trick.

Because we have such monstruously large debts for pensions and retiree medical — $159.2 million in Davis — I think one more change should be made for retiree medical which would also encourage later retirements: No retiree with a pension which pays more than $120,000 a year** gets any retiree medical benefits paid for by the taxpayers of Davis. These retirees could pay the full price of their plan, which would be bought for them through CalPERS. Or they could continue to work and the taxpayers would pay for their full medical plan.

*I am aware of about 25 cities in California which have recently changed their pension plans for new hires. Most of them, but not all, have imposed a 2% at 60 plan for their new public safety and new miscellaneous employees.

**The way to do this kind of thing is to start with pensions of $100,000 per year. Require a retiree to pay out of pocket $950 a year for his $20,000 benefit. For every increase in annual pension of $1,000, make the pensioner pay an additional $950 for his annual medical plan. By the time you get to the pensioner taking in $120,000 per year, he will have to pay $19,950 for his $20,000 benefit. Those making any more than $120,000 will have to pay their full amount each year if they want retiree medical benefits.

There is an old saying… “no one in business pays attention until they have to write their own check and spend their own money – then they turn all the lights up in the room and make dam well sure than all the “i’s” are dotted and “t’s” are crossed and that everything is clear and perfect, before signing on the bottom line or spending any money at all…”

Why don’t they do the exact same????