Proposal for 610 Housing Units Bears Striking Resemblance to Lewis’ 2007 Proposal –

ConAgra has a very aggressive time frame in which they will be rolling out their proposal for a 610-unit housing development, along with 20 units of business park. A second community forum is tentatively scheduled for January of 2011. By March of 2011, they will be into the EIR (Environmental Impact Report) preparation phase. Commissions will make their reviews in January and February of 2012, with the council taking final action by February 2012, before the next council election.

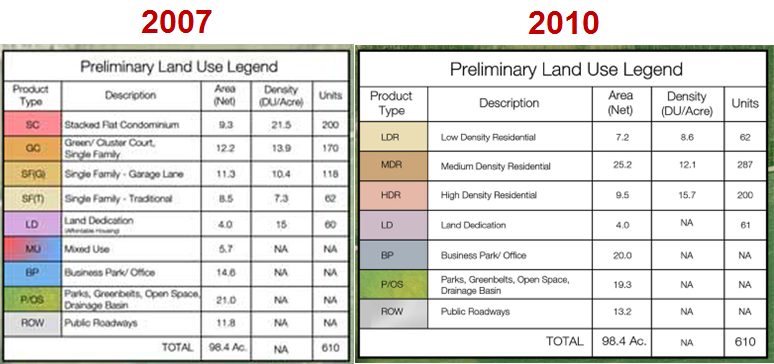

The most striking feature of the presentation was really how similar it was to the previous Lewis Planned Community proposal. Back in 2008, Councilmember Stephen Souza said that this project does not have the “wow factor” that he is looking for, and thus is not a project he is inclined to approve. Has two years of a continued slump in the real estate market changed things?

On Thursday night, what we saw was remarkably the same thing that we saw back in 2007 and 2008 from Lewis Planned Communities.

In fact, the biggest difference between the two projects, other than minor alterations, is that the current proposal has 20 acres of a Business Park/Office component, whereas the previous one was for 14.6 acres with an additional 5.7 acres of mixed use that is now gone.

Other than that, there are not a lot of changes. The size remains 610 units. The open space component, which they trumpeted in their presentation, is actually slightly smaller than the 2007 proposal which had 21 acres. The size of the roadways has increased slightly.

Other than that, the maps look almost identical. Mr. Philips argued that the 20-acre business park is the gateway to the project, as it sits on the road and would have to attract people to live there who have to drive through a business park to get to their neighborhood.

He touted their 260,000 square feet of office and professional buildings along with neighborhood-serving retail, with the opportunity for live work residential housing units.

Given the quick timeline, the green proposals here lack any sort of specificity. They talked in vague terms of about energy savings, mainly looking at transportation, water conservation, reuse of materials, reduction of greenhouse gas without specifics and improving the natural hydrology.

Mr. Philips pitched this like one might pitch a time-share. He basically said that no one piece makes this a sustainable project, but put all together it forms a bigger picture. This sounds a lot like he is acknowledging that if we examine the sustainability  components and the greenhouse gas reductions, we will be unimpressed.

components and the greenhouse gas reductions, we will be unimpressed.

We have seen two recent projects in this community touting their sustainability, with both Wildhorse Ranch and the West Village proposal claiming rather specific numbers in terms of reduction of greenhouse gases and other sustainability features. Nothing like that in this proposal. They did briefly talk about photovoltaic, wind and solar orientation as passive energy design features.

The project presents a tapered approach, with density highest in the south and decreasing as it heads north. They are proposing 261 units of high density housing just north of the business park in the middle of the development. Medium density housing would be toward the central portion of the development at 287 units, and 62 units of low density residential housing in the north.

The overall density would be 13 units per acre. They touted reduced lot sizes, with more emphasis on direct connections to open space.

They are clearly marketing this as a means to bring in more school age children and help quell fears of declining enrollment. They argue that there is the potential for about 350 school age children.

While the street and paved portion has increased, they have talked about smart street design with separated sideways, four primary street sections, wide parkway strips for streets, dedicated off-street bike and pedestrian trails and traffic calming measures.

While the overall size of the open space is reduced from the previous proposal, they emphasized a public gathering area along with urban green spaces, neighborhood gardens and orchards, and a neighborhood park (which would be required for a project of this size).

Commentary

We just had a campaign a year ago in which the principle argument by opponents of a much smaller project was 200 units is too much. So instead of a project of around 200 units, we have a project of 610 housing units, with no required Measure J/ R vote. We are proposing this at a time of a still-slumping housing market.

We just had a campaign a year ago in which the principle argument by opponents of a much smaller project was 200 units is too much. So instead of a project of around 200 units, we have a project of 610 housing units, with no required Measure J/ R vote. We are proposing this at a time of a still-slumping housing market.

The impact of this project would be to take away around 100 acres currently zoned light industrial. This is coming at a time when the city has made it a priority to bring in high-tech and green business to the city and at a time when the city lacks land in its borders to provide the acreage needed for this type of economic development.

The byproduct of developing this property as 20 acres of business park and the rest as 610 units of housing will be to put pressure on other peripheral sites such as Nishi, Northwest Quadrant and the Mace-Signature Curve.

The thinking here is that if the public will not support housing in a Measure R vote, maybe it will support a business park in such a vote. So there is a shift of 100 acres to housing and a hope that the voters will later approve a business park.

It is fairly clear that the business park here is an afterthought and ConAgra is simply trying to mitigate the complaints of those who believe that the entire nearly hundred-acre site should remain zoned for light industrial, and that the city should be actively and aggressively seeking companies to come here.

The project is fully lacking in any specificity about sustainability. Both the Wildhorse Ranch and the West Village projects touted their sustainability features – here it seems like an afterthought that has been included, in hopes of making the project more palatable to a psuedo-environmentally conscious community.

There was very limited discussion and nothing concrete relating to Senior Housing needs or universal design. There was no discussion, at least in the main presentation, about concepts like accessibility and visitability. It is unclear where this project fits into the city’s goals developed in their Senior Housing needs. They talked about an opportunity for senior housing without much in the way of specifics.

In short, while the project does not need to go to the voters, it does not yet even appear ready to go to council, lacking specifics for key features.

There is little “wow” for the prospective community about this project. It appears to be the same dull proposal from three years ago, which even Councilmember Souza was unenthused about.

As it stands now, if this proposal goes forward, the community may very well use the referendum process to put it on the ballot and have a de facto Measure R vote on it. Right now, I would not bet on this project passing such a vote. That will be the test of the developers to head that off.

—David M. Greenwald reporting

Its Deja Vu all over again.

Lets have some community forums to say we invited folks.

Lets schedule the first one 2 1/2 weeks before Christmas (do you think that is a good time)?

Lets call it “workforce housing?”

I am getting a sick feeling in my stomach. For the last project (WHR) many people (on both sides) thought the process was terrible. This one is off to an inauspicious start.

It’s just not a good project right now – even if it weren’t 610 units.

Right now the developers better be prepared to wage a Measure R style vote because if this project gets approved by council, we will see a referendum and one can only imagine what would result from such a process.

What, did Conagra just buy the Lewis plans and make a few small changes to make it look a little different? How can Souza possibly vote for this when he didn’t like basically the same plan in 2007?

Rusty:

ConAgra has always owned land but they had Lewis work on getting it entitled and the zoning change. So they basically took the Lewis plan and slightly modified it.

Souza hasn’t voted to do anything other than process the application yet.

I’ve talked to more than one councilmember privately telling me that the plan better change if they want council approval. We’ll see.

My take from the meeting was that there was:

1) deep concern about the fiscal impact of this project;

2) deep concern that the development process would end up out of the control of the city and in the control of developers other than ConAgra who initially proposed it. (These two issues came up repeatedly.)

3) Many were wondering why the aggressive time line/rush during an economic downturn?

There were far more negative comments in the room, and even the positive ones were laced w concerns.

The one issue that was not discussed is why this property was essentially taken off the market as fully industrial, at a time when that is what we need to generate tax revenue? It was the City Council’s decision (not city staff’s) to opt out of doing an equal weight EIR for a business park. One wonders why? Is the City Council afraid of the results of such an EIR?

I have to agree w dmg’s assessment here:

a) Why more residential development during a housing slump, when the city clearly is not interested in more housing?

b) And why take out of commission the only large industrial zoned infill property that could support a high-tech business park, the type of business development that the city says it wants?

Matt Williams had a very good suggestion though, and I chimed in to support it. If ConAgra could talk to UCD and join forces, and between the two bring research business to Davis to generate enough tax revenue to make this project pencil out fiscally, then go for it. Otherwise, the city just cannot afford another net fiscally negative housing project that will cost the city money at a time when the city is in dire fiscal straits.

Both the city and developer did a lot of tap dancing when it came to specifics, another troubling aspect of this project, especially in light of the agressive time line.

[i]”Otherwise, the city just cannot afford another [b]net fiscally negative housing project[/b] that will cost the city money at a time when the city is in dire fiscal straits.”[/i]

New housing is [b]not a net fiscal negative[/b] to the City, unless:

A) The City forces the developer to sell its product at a sub-market price; and

B) The City inflates the compensation of its employees at an unsustainably high rate.

I agree with those who say, in this economic climate we don’t need new housing developments.

Also, given the fragility and or limitations of our transportation infrastructure and thus the negative consequences any development (housing or commercial) would have on people who live nearby or don’t want to get stuck in a traffic jam nearby, I fully understand the antipathy to this or similar developments at the old cannery site (or at Covell Village).

However, it is sophistry to tell the developer: 1) You cannot charge a market rate for your project; 2) because you are not charging a market-rate for your project this development does not pencil out for us; and 3) because we choose to increase the compensation of our employees at an unsustainable rate far in excess of the inflation of our tax revenues, you can never build a new housing project, because housing does not pencil out.

Ultimately, the anti-housing, anti-growth faction in town–arguably now about 75% of all Davis residents–will find one reason or another, no matter what the market conditions, to oppose every substantial new housing project. But at least know that the “net fiscal negative” argument is horsesh!t on a stick.

Rifkin: “New housing is not a net fiscal negative to the City, unless:

A) The City forces the developer to sell its product at a sub-market price; and

B) The City inflates the compensation of its employees at an unsustainably high rate.”

Since the City has a track record of not forcing the developer to pay its fair share of the costs of development; and inflates the compensation of its employees at an unsustainable high rate, new housing IS A NET FISCAL NEGATIVE TO THE CITY. As you should well appreciate, the City needs to make sure it does not incur any more needless costs until it gets its own fiscal house in order. I personally am not anti-growth, but I am for fiscal responsibility. You may call that horsepoo on a stick – I call it common sense. This city cannot afford to incur any more costs at a time when it is in the midst of a fiscal crisis.

“Ultimately, the anti-housing, anti-growth faction in town–arguably now about 75% of all Davis residents–will find one reason or another, no matter what the market conditions, to oppose every substantial new housing project”

Just as the pro development faction will try every angle they can scheme up like changing the land use designation from housing to business, saying we need more housing to bring children in for our schools, calling it work force housing when everyone knows it isn’t, creating an artificial need for retirement development, etc………….

rusty49: “…changing the land use designation from housing to business…”

I assume you meant to say “…from business to housing…”? And your point is well taken…

RUSTY: [i]”Just as the pro development faction will try every angle they can scheme up like changing the land use designation from housing to business …”[/i]

I have never, not even once, changed a land-use designation from housing to business. I have not even attempted to change a land-use designation from bowling alley to tennis pavilion.

RUSTY: [i]”… saying we need more housing to bring children in for our schools …”[/i]

Yet it is a shame to have so many homeless children attending our schools.

RUSTY: [i]”… calling it workforce housing when everyone knows it isn’t …”[/i]

I am strongly of the opinion that workforce housing is workforce housing.

RUSTY: [i]”… creating an artificial need for retirement development, etc.”[/i]

Bread bakers with bionic hands certainly can appreciate an artificial knead.

Rifkin…that was lame.

rusty49: “Rifkin…that was lame.”

Perhaps I am dense, but I couldn’t even follow what he was getting at!

Nice moats! I think all new housing in Davis should be built with moats on 3 sides….

[i]”Perhaps I am dense …”[/i]

Perhaps?

“Perhaps I am dense, but I couldn’t even follow what he was getting at!”

ERM, I think that was his attempt at being clever.

[quote]I think all new housing in Davis should be built with moats on 3 sides….[/quote]

That would add to our housing value and the moats could potentially be wetlands.

On a more serious note, ERM is correct. Housing doesn’t pay for itself in California unless you build very expensive homes (~750k or more) or make developers pay large upfront fees.

The primary culprit is Prop 13 but if you want to blame someone or something else that is fine. Either we build more expensive homes that people want, charge developers large fees or the City loses money. there isn’t much “wow” in that factor but its a hard truth.

[i]”Housing doesn’t pay for itself in California unless you build very expensive homes (~750k or more) or make developers pay large upfront fees.”[/i]

Last year, in an Op-Ed for The Davis Enterprise, Sue Greenwald cited $535,000 as the break-even price for a new Single Family Home, given that the new house is not located on a parcel where Yolo County takes a much larger share. That $535,000 figure presumes total comp to city employees will inflate far beyond the rate of land inflation. If we froze compensation rates, the break-even number would be far lower.

I’m not saying, by the way, that I think the City leaders will freeze compensation rates. I am simply saying that the City itself can control for what its break-even rate on housing is.

Rifkin: New housing is not a net fiscal negative to the City, unless:

A) The City forces the developer to sell its product at a sub-market price; and

B) The City inflates the compensation of its employees at an unsustainably high rate.

Last year, in an Op-Ed for The Davis Enterprise, Sue Greenwald cited $535,000 as the break-even price for a new Single Family Home, given that the new house is not located on a parcel where Yolo County takes a much larger share. That $535,000 figure presumes total comp to city employees will inflate far beyond the rate of land inflation. If we froze compensation rates, the break-even number would be far lower.

Rich, then City Finance Director Paul Navasio made a January 2008 presentation to the Housing Element Steering Committee supported by a 20-page document entitled “Fiscal Considerations in Review of Housing Development Opportunities.” In that presentation Paul told the HESC that the tipping point for a single family residence was between $400 and $450 thousand dollars. That is considerably lower than Sue’s figure from the Op-Ed, but still higher than the figures that were so actively discussed during the Measure P process.

If ConAgra brings jobs and workers to Davis in synergy with and in an intellectual partnership with UC Davis, then the current fiscal conundrum that the site by itself poses will evaporate. Davis (and Yolo County) will derive benefits (fiscal and otherwise) from a permanent relationship with ConAgra.

What ConAgra offers to the City right now is simply an exit strategy. They take whatever money they can extract for their land, and leave the City holding the bag. They can do better . . . but the only way they can do so is to think outside the box-like shape and constraints of their Cannery property.

How good would a ConAgra research facility look along Chiles Road rather than the ever growing For Sale and Available signs that once housed the businesses of Davis’ fledgling Auto Mall?

Council should tell ConAgra that the next step in this process should be a joint meeting with Chancellor Katehi, the City, Yolo County and ConAgra to explore and identify research opportunities that will benefit all parties.

I should have said

In that presentation Paul told the HESC that the tipping point for a single family residence was between $400 and $450 thousand dollars. That is considerably lower than Sue’s figure from the Op-Ed, but still higher than the [u]affordable housing price[/u] figures that were so actively discussed during the Measure P process.

Well, lets take a closer look at the horseshit Rich . . .

Rifkin: Ultimately, the anti-housing, anti-growth faction in town–arguably now about 75% of all Davis residents–will find one reason or another, no matter what the market conditions, to oppose every substantial new housing project. But at least know that the “net fiscal negative” argument is horsesh!t on a stick.

In the perfect world, and we all know there is no such thing as a perfect world, but if there were (and you were in charge of Davis’ current finances) what would the tipping point value of a break-even single family residence be? What would you do to bring down the expense numbers Paul presented to the HESC?

Hey Matt, such a meeting, minus Conagra, already occurred. It was the DSIDE workshop. Katehi described her desire to create an innovation ecosystem where creative individuals could spontaneously create, innovate, exchange, adapt, evolve, in close proximity to one another. She described a seemless transition between the research on campus and the commercialization thereof. She emphasized that such an ecosystem would have support services, entertainment, dining, in short, a mixed-use, vibrant urban environment.

Does Katehi’s description match the ConAgra site? Only if you’re deaf. It sounded a heck of a lot more like a vision for the Core Area. Come to think of it, it sounds exactly like the DDBA’s Downtown Framework. But that may be my own personal prejudices playing tricks with me.

DT, if ConAgra and UCD were to explore their synergies, the very last place I would expect a research facility to land would be the Cannery site. As you have said, the Core Area makes infinitely more sense. Coupled with revenue streams from the jobs and taxes at the research facility, The Cannery site could/would be able to go forward with a 100% housing configuration with an affordable average home price well below $400,000, maybe even below $300,000.

DT, one other thing. ConAgra’s desire to rid themselves of their White Elephant provides an excellent opportunity for making the conceptual framework discussed at DSIDE into something real.

So far DSIDE represents “inward and spiritual grace.” That is good as far as it goes. A synergistic partnership with ConAgra is an opportunity to create an “outward and visible sign.” Good for them. Good for us. Win-Win . . . and no more White Elephant on their books in the process.

[i][b]In the perfect world[/b], and we all know there is no such thing as a perfect world, but if there were (and you were in charge of Davis’ current finances) what would the tipping point value of a break-even single family residence be? [b]What would you do[/b] to bring down the expense numbers Paul presented to the HESC?[/i]

No. 1 — I would get rid of the 25% affordable housing requirement set by the city. (Note that state law requires 15%. I would get rid of this too “in a perfect world.”)

I am not against helping the poor. I am convinced that these nutty set-aside percentages don’t do a damn thing for the poor as a class, though probably some lower-income individuals are helped.

What I would do in place of set-asides is figure how much say, 25% of housing units priced as affordable would sell for at a market rate. Some percentage of the amount of difference should then go into a rent-subsidy program, exclusively helping low-income renters make their rent payments. So for example, instead of telling a developer he has to sell a $525,000 house for $125,000, a $400,000 difference, let the developer sell the house for the market rate. Then say tax that difference at 50% as a “low-income housing assistance fee.” That would provide $200,000 for the poor as a class in Davis.

The result of all houses being built at the market rate would be much greater property tax collection for the city, more help for more poor people, and better profits for the developers. The main people who get screwed by this change are the shysters who manage these b.s. low-income housing operations, where their fees seem to be more lucrative than any help given to the poor.

No. 2 — I would cap the annual nominal growth of the net present value of labor compensation at the average inflation rate of general fund tax revenue growth over the preceding five years. By basing that on NPV, I would capture the present value of post-retirement employement benefits, so total comp would truly be total comp.

Doing that would prevent the DCC from awarding their financiers 36% raises in irresponsible labor contracts. The total value of salaries, benefits, pensions, and retiree health would never be allowed to inflate beyond the City’s tax income.

… or the city council could simply declare that until the rental vacancy rate gets to 5%, the only housing units they will approve are rental units.

Just to clarify, my $750k number is for non-affordable units and assumes that some affordable units or apartments will have to be built–bringing the avg down in the $500-$600k range. I also have some concerns about the overly optimistic assumptions in some of the projection about tax revenues/prices in the City’s model.

Just a couple of questions:

Why is “affordable housing” generally couched in ‘ownership’ units? Given the nosedive in home prices, wouldn’t many have been better off renting?

If “ownership” is so important, why not propose more manufactured/mobile home projects, like Rancho Yolo? There, altho’ they rent their space, they own the unit.

[i]” … or the city council could simply declare that until the rental vacancy rate gets to 5%, the only housing units they will approve are rental units.”[/i]

This is the City of Davis Municipal Code Section 18.05.060: [quote] A developer of multifamily rental developments containing twenty or more units shall provide, to the maximum extent feasible, at least twenty-five percent of the units affordable by low income households and at least ten percent of the units affordable by very low income households.[/quote] I would get rid of this provision, as well. This kind of monkeying around with prices depresses the supply of rental housing; and that hurts almost everyone in Davis who is a renter.

I agree fully with Don Shor that we ought to encourage a stronger supply. Although the vacancy rate is higher now than it was a few years ago, we have had a perpetual undersupply of rentals.

I think the best approach would be for the City to have a working arrangement with UC Davis, where, at a minimum, the rental housing stock (on-campus plus in town) grows at the 5-year average growth of the student population. By building West Village, it seems likely that much of the growth of student housing over the next 5-6 years will be taken up on campus.

However, the City still has a part to play. Many non-student Davis families are renters, and they are harmed by a tight rental market.

Moreover, a large number of single family houses, tucked into neighborhoods with owner-occupied houses, are rented by 4-8 students. If we had more large apartment complexes, ideally more families with children could be renting the house-rentals. I think, in general, families renting houses is a better fit in most neighborhoods*.

To get developers to build more apartments, I think these approaches make sense:

1. Vacant land now zoned for other uses could be re-zoned to include the option of building market-rate apartments;

2. For large parcels, land now zoned for single family houses could be re-zoned so that say for every 3 acres of SFH’s, 1 acre must be multi-story market-rate apartments;

3. For new apartment buildings constructed near campus or on a bus-line which goes to the campus, allow the developer the option of providing little or no on-site parking, but instead paying an in-lieu parking fee (full cost**) for each “required” parking place*** waived. Doing this has two advantages: A. It allows for much denser housing, which eats up much less land; and B. It creates a funding source for multi-story parking garages in town. Obviously, anyone who would rent an apartment at a building that lacked its own parking would have to ride the bus, walk or bike, or if he owned a car, he would have to find a legal place to park it;

4. For existing apartment complexes 1/2 mile or closer to campus, I would allow the owners of the buildings (in most cases) to tear them down, pay a full in-lieu parking fee, and rebuild at a much greater density (so long as the much greater density did not demonstrably harm the quality of life for neighboring landowners). Doing so would be profitable to developers and it would allow more students to live close to campus.

*I happen to live in such a neighborhood, and my neighbors who are students are very good neighbors and cause no problems at all.

**Currently, the City has an in-lieu parking fee program for the core area. If, for example, a new downtown restaurant is built, it is required to include some large number of parking places on-site or the builder can instead pay the City $4,000 for each parking place it chooses not to build. The City then puts that money in its fund for a future parking garage. This is a great idea, and it works very well. The problem, though, is that the City charges $4,000 when it really costs closer to $12,000 to provide a new parking space. If we were to adopt this kind of a plan for large, new apartment complexes, I think the developers ought to have to pay the full freight for each parking space they don’t include. But, again, letting them not provide parking is the only way you can ever achieve housing density.

***City Code 40.25.090 Number of parking spaces required: [quote](g)Dwellings, multiple, one for each efficiency apartment, one for each one bedroom apartment, one and three-fourths for each two bedroom apartment and two for each three or more bedroom apartment. Where the total number of spaces required by this subsection calls for a fraction of a space of one-half or greater, it shall require the provision of one full space.[/quote]

hpierce: “If “ownership” is so important, why not propose more manufactured/mobile home projects, like Rancho Yolo? There, altho’ they rent their space, they own the unit.”

This model is not without its problems. The rent is continually going up, and if it becomes prohibitively high for someone, they need to move out, but cannot do so if they cannot sell the mobile home. The mobile home park is very depressed right now. Had a case of just this sort of thing about two months ago. Mobile homes in Rancho Yolo are not selling, but the rent is becoming prohibitively high for some. Not to mention some of the maintenance problems or lack thereof that some seniors have mentioned to me…

Matt Williams: “If ConAgra brings jobs and workers to Davis in synergy with and in an intellectual partnership with UC Davis, then the current fiscal conundrum that the site by itself poses will evaporate. Davis (and Yolo County) will derive benefits (fiscal and otherwise) from a permanent relationship with ConAgra.

What ConAgra offers to the City right now is simply an exit strategy. They take whatever money they can extract for their land, and leave the City holding the bag. They can do better . . . but the only way they can do so is to think outside the box-like shape and constraints of their Cannery property.”

I agree that this is nothing more than an exit strategy at the city’s expense. But ConAgra, if highly innovative, could pull this out of the muck. I think your suggestion of a ConAgra/UCD partnership to bring research to Davis is an excellent one – AND SHOULD COME FIRST before thinking of building any housing. ConAgra has not done its homework…

Thank you Rich for responding. Tell me if I heard you correctly.

First, it appears that under your plan, very few if any new single -family houses would be sold for less than Sue’s OpEd figure of $535,000. Adjusting for inflation, that makes sense given the sale prices of the vast majority of new homes built in the last 15 years (for example Mace Ranch and Wildhorse and Willowbank and Oak Shade).

Second, some portion of the profits the developers make from those higher priced houses would go into a restricted use fund. What isn’t clear to me is whether those funds would be used for home purchases or rent subsidization? Can you clarify that for me?

Third, one of the attendees Thursday night talked about how the children of present Davis residents can’t afford a $400,000 home, much less a $535,000 home. Nor can a substantial portion of the employees of UC Davis. It appears that your proposal takes care of those with the resources to purchase a $535,000 and up home. It also addresses the low-income population cohort. How does it address the “starter home” population cohort?

Well, ConAgra isn’t really a development company. Speaking of which, here is what they are doing with a plant they are abandoning in North Carolina: [url]http://www.garnercitizen.com/2010/10/29/garner-eyes-big-costs-bigger-returns-with-conagra-property/[/url]

E Roberts Musser: “I agree that this is nothing more than an exit strategy at the city’s expense. But ConAgra, if highly innovative, could pull this out of the muck. I think your suggestion of a ConAgra/UCD partnership to bring research to Davis is an excellent one – AND SHOULD COME FIRST before thinking of building any housing. ConAgra has not done its homework…“

At the risk of being redundant, the most important words in your post are “SHOULD COME FIRST before thinking of building any housing” As long as the zoning is what it is, and any and all entitlements are absent, then ConAgra has a clear incentive to reach out to UCD and the City in a meaningful way. If Council changes the zoning and/or grants entitlements then they are giving up negotiating leverage for nothing. That would be both fiscally irresponsible and incredibly foolish.

MW: “If Council changes the zoning and/or grants entitlements then they are giving up negotiating leverage for nothing. That would be both fiscally irresponsible and incredibly foolish.”

Exactly my point. Let’s hope the CC sees it that way and doesn’t blink…

ERM, one added possibility is that Chancellor Katehi takes the initiative and reaches out to ConAgra to begin dialogue about synergies between UCD and ConAgra. Were actual discussions taking place, Council (and for that matter Yolo County) should be even less likely to blink, and more likely to be supportive of Chancellor Katehi and UCD.

DT Businessman, how do you feel about that?

[i]”What isn’t clear to me is whether those funds would be used for home purchases or rent subsidization? Can you clarify that for me?”[/i]

Only for rent subsidies.

[i]”It appears that your proposal takes care of those with the resources to purchase a $535,000 and up home. It also addresses the low-income population cohort. How does it address the “starter home” population cohort?”[/i]

The price of land in Davis (compared with say Dixon, Winters, Woodland and W. Sacto) makes new starter homes here cost-prohibitive. Our regulations make building much more costly. But the real killer is the price of land, and that is due to growth controls plus the high income families who want to live in Davis.

Yet there are still reasonable options for people with modest income: if they could buy a fixer-upper in some older Davis neighborhoods; or they could start in a neighboring town and later “move up” to Davis.

When I was a kid, most of the new houses in Davis were starter homes. However, that was possible because the land was cheap, we had no growth restrictions or budensome regulations, and there were not so many wealthy lawyers around here, making a mint off of state government. But all of that has changed to make the starter home an impossibility in Davis.

DT Businessman, how do you feel about that?

I’m not speaking for him, but I’m not sure why Chancellor Katehi would facilitate discussion about a development far from the campus, when she has apparently described the desire for something much closer and when there is land available already at Nishi.

Woodland homes on the market right now: 444 in foreclosure, out of 617 on the market. Not a single one of them is new construction.

Davis: 103 in foreclosure, out of 319 on the market. 4 are new construction.

Dixon: 206 in foreclosure, out of 255 on the market. Not a single one is new construction.

ConAgra must know something we don’t about the pending housing market. Or maybe, just maybe, they’re just planning to sell off the entitled property to home builders. In that case, this proposed development is simply a way to increase the value of the land before they unload it. Note from my previous link that ConAgra isn’t noted as a land development company. Where there is no market at all, they simply gave away the land.

Any timeline for construction on this site should be taken with a grain or two of salt. Nobody is lending, nobody is building, nobody is buying, and there is a major glut of housing in every nearby community at substantially lower prices.

I would urge the city council members to spare the city a likely referendum and simply reject this land development proposal, decline to rezone the property for now, and wait to see what happens over the next 3 to 5 years vis-à-vis housing values, economic growth, and any possible development of business land closer to the campus.

D Shor: “. . . I’m not sure why Chancellor Katehi would facilitate discussion about a development far from the campus, when she has apparently described the desire for something much closer and when there is land available already at Nishi.”

Don, Chancellor Katehi wouldn’t be facilitating discussion about housing. Rather she would be facilitating discussion about partnering with Con Agra with respect to agricultural research . . . located in target areas such as the ones identified in the DSIDE process. Any discussions about housing would be between ConAgra and other parties. The City in looking at the totality of ConAgra’s actions/initiatives would be able to calculater the cummulative fiscal impact on both the City’s economy and the City’s current and future Budgets.

Let me repeat meyself for clarity. I do not see any portion of the Cannery site being good for business park unless and until there is vehicular access to the site other than through Covell. Even with such non-Covell access, I think the site is best used as 100% housing.

DS: “ConAgra must know something we don’t about the pending housing market. Or maybe, just maybe, they’re just planning to sell off the entitled property to home builders. In that case, this proposed development is simply a way to increase the value of the land before they unload it. Note from my previous link that ConAgra isn’t noted as a land development company. Where there is no market at all, they simply gave away the land.”

I think your assessment that this is just a way for ConAgra to unload this site (exit strategy as Matt Williams called it) is spot on. Especially in light of the article you cited.

DS: “Any timeline for construction on this site should be taken with a grain or two of salt. Nobody is lending, nobody is building, nobody is buying, and there is a major glut of housing in every nearby community at substantially lower prices.”

The aggressive time line is being pushed by ConAgra and city staff, ConAgra for self-serving reasons. I agree w you the CC should hold off and not be rushed into doing something not in the best interests of the city.

MW: “Let me repeat meyself for clarity. I do not see any portion of the Cannery site being good for business park unless and until there is vehicular access to the site other than through Covell. Even with such non-Covell access, I think the site is best used as 100% housing.”

The Cannery, when it was a tomato factory, had vehicular access somewhere in the back onto Pole Line Road. I remember this bc after the killing of the Davis Athletic Club employee at the corner of Pole Line and Covell by a truck driver for the factory, trucks were instructed to only come and go by the back route.