Yolo County Will Get 74.6 Million Under the Terms of the Agreement

It was a landmark decision that will see California homeowners receive compensation for the mortgage meltdown. Attorney General Kamala Harris had rejected an earlier agreement that would have given inadequate relief to homeowners.

California’s Attorney General announced on Thursday what she called “an historic commitment to California of up to 18 billion dollars that will benefit hundreds of thousands of homeowners in the state hardest hit by the mortgage crisis.”

“California families will finally see substantial relief after experiencing so much pain from the mortgage crisis,” said Attorney General Harris. “Hundreds of thousands of homeowners will directly benefit from this California commitment.”

“This outcome is the result of an insistence that California receive a fair deal commensurate with the harm done here. We insisted on homeowner relief for Californians and demanded enforceability so homeowners actually see a benefit that will allow them to stay in their homes, and preserved our ability to investigate banker crime and predatory lending,” continued Attorney General Harris.

(click image to enlarge)

Assembly Speaker John Perez said on Thursday in a statement, “All Californians have suffered harm, directly or indirectly, from the foreclosure crisis caused by bad actors in the banking industry. Today’s historic settlement holds banks accountable, helps thousands of Californians stay in their homes, and gives us new tools to help stabilize our state’s housing market.”

He added, ” California’s strong position in the enhanced settlement is due to the advocacy and tenacity of Attorney General Kamala Harris, and Californians owe her our thanks for how strongly she stood up to the banks on our behalf.”

“There is still work to be done,” the Speaker said, “As the Assembly continues our efforts to help California recover from the recession and the housing crisis, we look forward to working with the Attorney General and other concerned parties to make sure today’s giant step forward is followed by additional relief for the people of California.”

Senate President Pro Tem Darrell Steinberg added, “In a clear case of David versus Goliath, Californians have a champion in Kamala Harris. At a time when people are struggling, and in need of a reminder of the important work government and its leaders do every day to protect consumers and efforts to grow our economy, our Attorney General fought tooth and nail to put California’s need above all else. She could have easily signed onto the settlement weeks ago and claimed victory, but instead she dug in her heels and worked around the clock for a settlement that acknowledges the extent the banking industry’s bad behavior had on California homeowners and our economy.”

The Senate leader noted: “There is still much work to be done and Senate Democrats stand ready to partner with the Attorney General on a reform bill package that will offer greater consumer protections for struggling homeowners.”

“California secured the $18 billion agreement as part of a national multistate settlement to penalize robo-signing and other bank servicing and foreclosure misconduct. The agreement comes after California departed from the multistate negotiations last September when the estimated relief to California was $4 billion,” the Attorney General’s office reported.

Attorney General Harris says that she insisted on more relief for the most distressed homeowners, meaningful enforcement, and the ability of California and other states to pursue investigations into misconduct.

What this means is that homeowners could potentially see their loans reduced by as much as tens of thousands of dollars.

California’s participation in the settlement also increased the amount of relief other states will receive by approximately $6 billion.

Attorney General Harris also obtained separate, enforceable guarantees to ensure that banks will be accountable for their commitments to California. As part of the separate California guarantee, banks must enact a minimum of $12 billion in principal reductions for California homeowners.

Failure to achieve this minimum level of reductions will result in substantial cash payments of up to $800 million that the banks will have to pay to the state. Unlike the larger multistate agreement, which is enforceable in a federal court in Washington, D.C., this payment provision empowers the Attorney General to summon the banks to California state court.

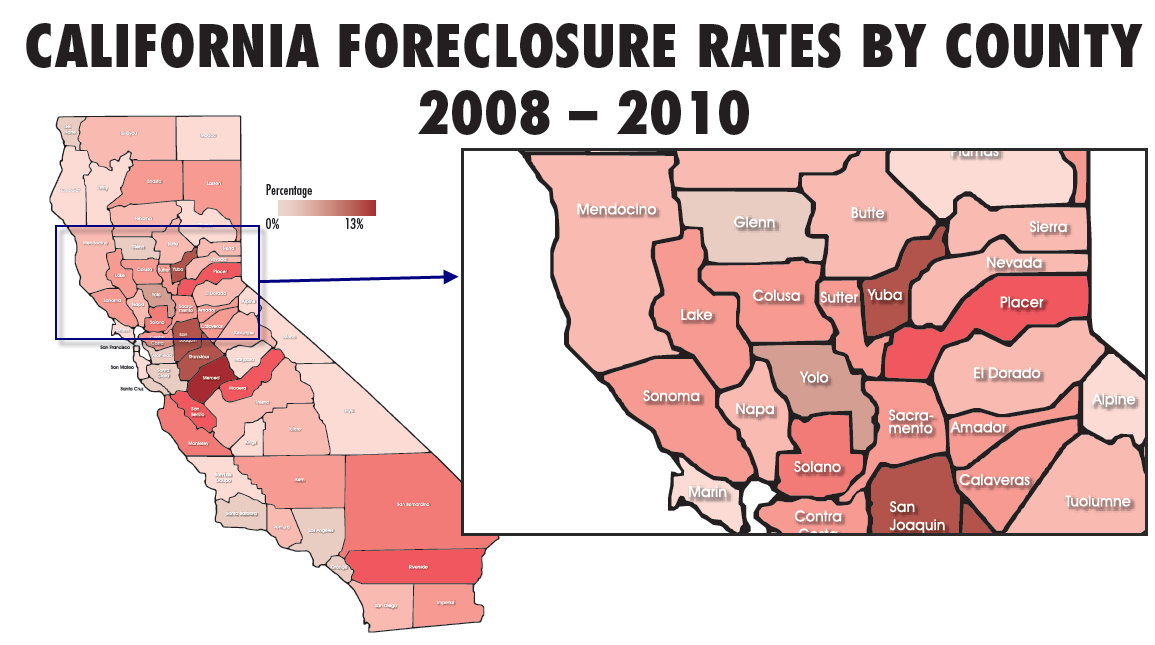

California’s separate guarantee also creates important incentives to ensure that banks will reduce the principal mortgage balance of underwater homeowners in California’s hardest-hit counties and that the principal reductions in these communities will occur within the first year of the settlement.

To speed investigations and strengthen prosecutions of these mortgage cases, California will expand its Mortgage Fraud Strike Force, adding to the more than 42 members already working on the team. The state will continue its investigative alliance with Nevada, that allows the sharing of resources, information and strategies, and will look to collaborate with additional states focused on a law enforcement response to the wave of mortgage fraud.

To speed investigations and strengthen prosecutions of these mortgage cases, California will expand its Mortgage Fraud Strike Force, adding to the more than 42 members already working on the team. The state will continue its investigative alliance with Nevada, that allows the sharing of resources, information and strategies, and will look to collaborate with additional states focused on a law enforcement response to the wave of mortgage fraud.

The national multistate agreement and California commitment will provide substantial relief for thousands of Californians whose mortgages are owned by the five banks in the settlement, but thousands more will still need help as they struggle to stay in their homes.

“I will continue to fight for principal reductions for the approximately 60 percent of California homeowners whose loans are owned by Fannie Mae and Freddie Mac,” Attorney General Harris added.

Attorney General Harris will propose a comprehensive legislative agenda to protect homeowners in the mortgage market. This legislation will build on the three-year reforms agreed to as part of the California commitment, including a single point of contact for mortgage-holders and an end to the unfair and confusing system of dual-track foreclosures.

“This is an historic amount of relief for California homeowners, but it is one piece of a broader focus. We will continue our crackdown on mortgage fraud and quickly move to pass legislation that will simplify, reform and upgrade our broken mortgage system,” Harris added.

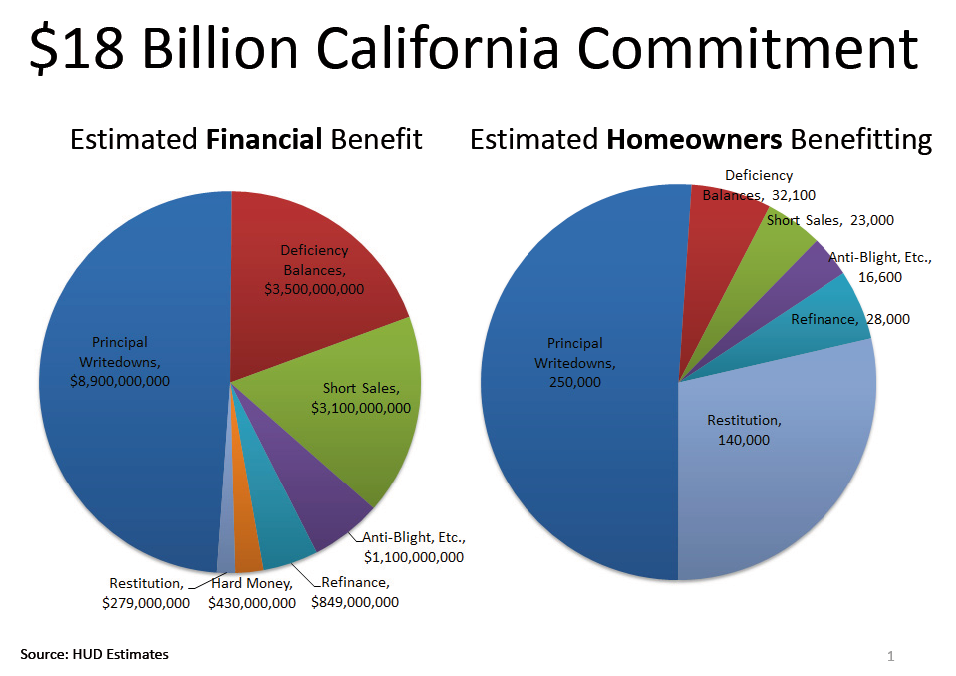

The financial benefits of this historic agreement extend to homeowners whose loans are owned or serviced by one of the five largest mortgage lenders. Benefits include:

– More than $12 billion is guaranteed to reduce the principal on loans or offer short sales to approximately 250,000 California homeowners who are underwater on their loans and behind or almost behind in their payments.

– $849 million is estimated to be dedicated to refinancing the loans of 28,000 homeowners who are current on their payments but underwater on their loans.

– $279 million will be dedicated to offering restitution to approximately 140,000 California homeowners who were foreclosed upon between 2008 and December 31, 2011.

– $1.1 billion is estimated to be distributed to homeowners for unemployed payment forbearance and transition assistance as well as to communities to repair the blight and devastation left by waves of foreclosures, targeted at 16,000 recent foreclosures.

– $3.5 billion will be dedicated to relieving 32,000 homeowners of unpaid balances remaining when their homes are foreclosed.

– $430 million in costs, fees and penalty payments.

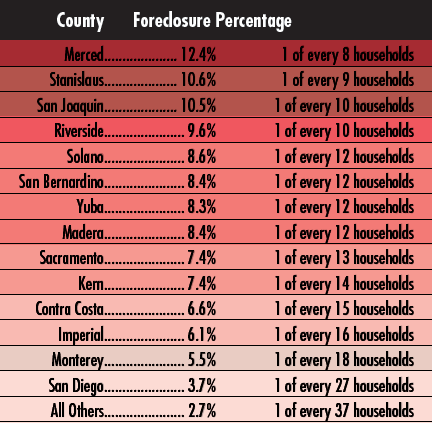

County-specific payments are based on the number of homeowners and the depth of the foreclosure crisis. It is estimated that homeowners in the following counties will accrue the following level of benefits over the three-year life of the commitment.

The biggest chunks of this settlement will go to these counties:

– Los Angeles: $3.92 billion

– Riverside: $1.59 billion

– San Bernardino: $1.13 billion

– Sacramento: $820 million

– Stanislaus County: $368 million

Yolo County will get roughly $74.6 million. As many as 500 people in Yolo County will be impacted by this deal.

—David M. Greenwald reporting

Frankly, to a great extent, I find this entire settlement disgusting. The homeowners that were bilked by the banking industry have already lost their homes. This just appears to be a feel good political measure that will do nothing for those who already lost their homes and were the real victims of banking fraud, while essentially providing a bailout to homeowners who were not necessarily caught up in any fraud…

Elaine is correct.

This is a vote buying scheme, before the election.

The feds are directing banks to funnel money to voters that they supplied to the banks through bailouts.

The long term effect on the economy is negative. It will get harder and harder to get financing for housing, as potential lenders ask themselves “Why should I lend money at 4% for long periods and be subject to continual lawsuits, changes of contracts, and vilification?” Added to the danger of inflation given our trillion dollar deficits, it seems likely that our housing markets have a bleak future.

ERM: actually, I am one of the Yolo County victims of Chase Home Finance. I fought with them for nearly 3 years as they ran the double track of foreclosure and loan modification. They lied to me constantly. If I had not been an active litigator, with most phone calls confirmed in writing via fax to them, my home would have been gone via what would have been basically a secret sale. Finally, at the end, I was forced to sign the loan modification agreement with loan balances that were questionnable, and months later I still do not have their accounting that supports what they put into the modification agreeement. If I did not sign by their deadline, they were going to sell the home.

David G: I have all the records. Let me resolve the modification balances with Chase, or through court, and I will let you do a story from my experiences.

We have all been through the worst economic meltdown since 1932; it is still going on; there are hundreds in Davis alone who have suffered at the hands of those 5 banks.

Mike Harrington: I don’t understand what your problem was. Are you saying that Chase sent your property to foreclosure without ANY justification? Certainly with the explosion in problem loans and bank failures there have been record-keeping problems and problems for banks keeping up with the workload (this latter problem is one I face with my commercial loan portfolio); however, there are not THAT many instances of wrongly identified problem loans occurring. They have been sensationalized by the media because they are frightening to any homeowner that has managed to stay current on his/her loan payments.

I’m trying to understand what you and “hundreds in Davis alone who have suffered at the hands of those 5 banks” have in common here to justify your hostility toward them. Of course the law is pretty clear about a lender’s rights and responsibilities when payments are missed. Let me write a book about the how the entitlement mentality permeates our client base and makes dealing with problem loans a nightmare. For example, I have a borrower today with a personal net worth of several million demanding a loan reduction or he will just walk. I have another that actually quit his job rather than allow some recovery for losses derived from his wages.

There is little press about the scope and level of bad behavior of borrowers, but there is a lot of it… and it makes some demonized banks appear angelic by comparison.

Jeff has it right. How many of these people that will now game the system bought a house they couldn’t afford in the first place then decided to not pay the mortgage, even though they could afford to, while they lived in it for years before they got foreclosed on? Sorry, but this sends a bad message to the people who only bought a house they could afford and faithfully paid their mortgage payments.

My dear friend rusty49 and others: Chase and WAMU and the rest of them gamed the markets, traded those bogus securities backed by bad mortgages, caused the economic meltdown that cratered my income for several years, and Chase should not be held responsible for the havoc they helped cause me and hundreds more in Davis alone? Please.

Mike, Just to be clear, we are talking about the same Chase bank that provided:

– Mortgage loans to thousands of people so they could own their own home;

– Car loans to thousands of people so they had a way to get to work and to school;

– Student loans to thousands of people so they could get an education and learn skills to get a higher-paying job;

– Capital to thousands of businesses so they could provide jobs for the people needing income to pay for their mortgages;

– Jobs to thousands of workers that could pay taxes that government could then use to pay for programs that feed and house the poor.

Is this the same Chase Bank you are referring to?

Traditional Logic: If someone borrows money and doesn’t pay it back, they cause economic harm and should be ashamed of themselves.

The proposed new Logic: If someone borrows money and doesn’t pay it back, they are victims and should be compensated. The people they borrowed from should be penalized and fined.

I have heard some people say that the people who took out mortgages they couldn’t afford deserve some sympathy because they are naive buffoons, unable to make rational decisions about how much to borrow. Perhaps this is the argument that Michael Harrington is proposing?