by Jeff Boone

by Jeff Boone

COLUMN RIGHT – This November we will be asked to vote on Proposition-30, Governor Brown’s state ballot initiative to increase sales and income tax to help fund education and public safety.

If approved, Prop-30 will require an amendment to the California Constitution. It will increase sales tax by .25% for four years.

Lastly, it will increase top income tax brackets for families making more than $250,000, $300,000, $500,000 and $1 million by 10.6%, 21.5%, 32.26% and 29.13%, respectively, for the next 7 years retroactive to the year 2012.

I have some big problems with Governor Brown’s proposal.

#1: We are already taxed too much in this state.

With this change, California will earn the distinction of having the highest income tax in the nation, while being near the top on all other taxes.

High tax rates have an adverse impact on investment and economic activity because business and capital gravitate to the highest rates of return. We compete with other states to attract and retain business and investment capital. In a growing global economy, higher tax rates make it more difficult for California business to be competitive and win. We lose market share to high-producing, low-tax, states and countries. Consequently, higher taxes lead to fewer jobs.

Governor Browns tax increase would save some teacher jobs, but at the expense of jobs in the private sector. Sure we need teachers, but we need private sector jobs more than anything these days. What good is an education when they are not enough jobs for graduates?

#2: Prop 30 will increases tax revenue volatility.

The top 1% earns 21% of the state’s total personal income, but pays 41% of the state income tax. Income at the top tends to drop more precipitously in economic downturns. So does sales tax revenue. Latching nondiscretionary government funding to a shrinking pool of high economic achievers and discretionary consumer spending has already proven disastrous, so why just add to this problem?

#3: Temporary tax increases and tax cuts have a way to become permanent.

Government tends to spend more than all the revenue it receives. For example, for the Federal government, over the last 80 years, 66 of those years were deficit spending years and for only 14 of the years did the government run at a surplus.

Likewise, the Bush tax cuts have become the new normal for individuals and businesses. Allowing those cuts to expire would send ripples through an economy still struggling to grow. There is significant political pressure to keep extending these cuts.

Will the Prop 30 tax increases be extended? I think there is a strong probability that this new revenue will become the new normal for government with a track record of spending much more than it takes in.

#4: Prop 30 delays realization that California’s K-12 system is in need of complete reform.

I think our K-12 education system is wholly inadequate for our times. The entire system – including our much-lauded, better-than-average, Davis schools – need to be flipped and re-innovated as a more efficient, technology-enabled, customer-driven modern marvel that cranks out the world’s most capable young thinkers and workers. We are far from that vision today… and we are drifting farther away every year.

In 2012, from a study using the Science and Engineering Readiness Index (SERI), California schools ranked 34th of all states in math and science. A 2009 study ranked the US as 25th out of 34 countries in math and science.

From a 2011 Civic Report Study from the Manhattan Institute, California schools had a graduation rate of 68%; putting it near the statistical bottom for all other states.

The consultant company Deloitte surveyed industry this year and found 600,000 perfectly good jobs going unfilled because of a lack of basic work skills like basic math, reading and writing proficiency.

We hear all the stories of how school funding is inadequate. The political message is that students are suffering while the rich grow richer. However, the truth is that education choice and quality have declined while costs have increased much faster than inflation for the last 30-40 years.

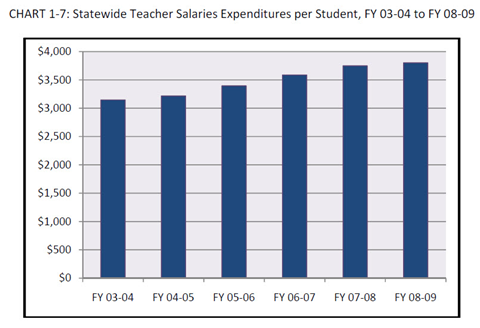

The following graph and table from a Pepperdine University / School of Public Policy study illustrates this point:

During this period of 2003 – 2009, costs per student increased by 25.8% while the California Per Capita Personal Income (PCPI) – a measurement of the inflation rate for the State – increased only 15%.

The primary inflation of K-12 education costs has been employee costs: mostly pay and benefits to teachers, counselors and administrative employees. There were some cost decreases during this time; but, unfortunately they were for student resources like books, supplies and education equipment.

Prop-30 does nothing to move toward significant reform. It does not specifically allocate spending toward students. It does nothing to create greater efficiencies and reign in K-12 education’s hyper inflationary cost increases. In fact, Prop 30 just strengthens the status quo. The status quo is a system that shrinks in service quality while it inflates in cost. That is not good enough for me.

#5: We don’t control where Prop 30 money will go… and it will go to unions.

Part of the money from Prop-30 is already earmarked for local public safety workers belonging to unions that fund the campaigns of the same politicians pushing the initiative. It is union-politician cronyism that got us into this California mess of having debt and payment obligations a staggering $600 billion more that we can afford.

Now that the Great Recession has corrected for almost two decades of fake real estate-driven economic growth, I think we need be honest admitting that our public-sector (i.e., government) employees are compensated too richly.

On a national level, compared to their working peers in the private-sector – when accounting for all valued job benefits (including defined benefit pensions, paid leave, healthcare, job security, and other benefits) – public-sector employees receive an astounding 145% greater compensation (excluding farm labor… this is $27.75 per hour versus $40.28 per hour in total compensation).

At a local level, after working 30 years of an annual schedule that is less than 70% of a standard 2080-hour work year, and includes pay for sleeping and almost 50 paid days off per year, firefighters in our city routinely retire in their early 50s with a pension paying a six-figure salary and free healthcare coverage for the rest of their lives.

What we pay firefighters, police, prison guards and other non-safety government employees directly impacts state and local budgets and both directly and indirectly contributes to state cuts to education funding.

#6: It rewards the bad behavior of politicians.

The Great Recession (that is the reported cause of the education funding problems that Prop 30 is a reported solution for) only acerbated an existing problem with California spending too much. It was the lack of fiscal discipline in State government – the same that approves over-priced bullet trains to nowhere and misplaces $50 million in State Park monies – that prevented us from saving for the inevitable downturn. Economies are always cyclical. They go up, they go down. Frankly, the recession has given cover to the politicians making the mess out of our finances. It has provided them a slick snake-oil salesman opportunity to slither their way back into our pockets to pay for their mistakes.

Summary

There are my six big problems with Governor Brown’s proposal to increase sales and income tax.

However, after ranting against Prop 30, I plan to vote “yes”. I am going to hold my nose and vote for it. The reason: my son wants to transfer from community college to a specific degree program in the CSU system. In-state transfers are currently restricted. I could help him pay higher tuition if allowed, but there is no way around this restriction short of moving to another state and transferring in as an out-of-state student.

And, for his degree/career interest, California state colleges hold the monopoly.

I also do not want to cut funding to community colleges. I think the community colleges do well in terms of the value provided relative to the cost, and are worthy of additional funding.

But this is the trap we California voters find ourselves in.

State politicians and the education system hold the power with respect to education services for residents of the state. They are effectively collaborating using this power to strong-arm us to vote for tax increases. It has been their winning strategy for decades: threaten to starve the voting public of education services unless they vote to increase taxes.

K-12 schools hold most of the public as captive customers: many cannot afford the cost of private schools for their children while also paying a big property tax bill. Public-funded universities hold a monopoly on certain degree programs in this state.

What do we do as voters, as residents and as parents?

As much as I would like to see us all vote based on the big-picture, long-term, dollars and cents sense; a decision for which way to go on Prop-30 will come down to our personal and family needs. Our children do not get a second chance with education. We adults have messed it all up and we have to figure out how to fix it and make it better without causing children any more damage than we already have and already will.

Too bad your chart 1-7 ends in 08-09 because the last few years would likely be illuminating and might even undermine your thesis. The big jumps in the graph came in 05-06 and 06-07 when Arnold spent every penny in the treasury trying to get re-elected with the capital gains windfall generated by google going public. For most teachers this was the last time they got a raise to their salary schedule. In fact, Arnold later took it back through furloughs, that have reached into the pockets teachers.

Mr. Toad wrote:

> In fact, Arnold later took it back through furloughs, that

> have reached into the pockets teachers.

Did Arnold make any Davis teachers take a pay cut with the Friday furlough days like other state employees?

The structural imbalances that Arnold created by using one time money to fund ongoing operating expenses has resulted in Davis teachers, like many teachers throughout the state, taking pay cuts through furlough days.

Mr. Toad: [i]Too bad your chart 1-7 ends in 08-09 because the last few years would likely be illuminating and might even undermine your thesis. [/i]

I have those numbers, but I think there is value in excluding the impacts of the Great Recession to demonstrate that the education funding problem that Prop 30 is supposed to address are actually, in large part, endemic hyper-inflationary tendencies of the education system.

I also have data going back (although not at the level of detail for this Pepperdine study) for the last 40 years and it supports my thesis. One of the explanations given for inflated cost-per-student spending over the last 40 years is the requirement (from the Rehabilitation Act of 1973 and the Individuals with Disabilities Act of 1990) that public schools accommodate special needs students. Although it is clear that FAPE rights have increased the operational costs of K-12 education, it only accounts for a small percentage of the total inflation we see today.

What we have is a system problem: one where there are inadequate incentives and inadequate developed processes to grow efficiency (do more with less). Unless we fix the system we will constantly be back to propositions and measures to fix the next crisis in education funding.

As long as we have the 2/3 rule for raising taxes and total intransigence from Republicans to any new taxes we will be forced to balance the budget at the ballot box instead of through the legislature.

I have no doubt Mr. Boone would have problems with any amount of tax increase. All six of his points are non-issues. 1. We are not taxed too much when one considers total taxes paid, cost of living, etc.,; 2. Tax volatility is a concept that exists only in Mr. Boone’s head for purposes of this article; 3. If people like Mr. Boone would support permanent tax increases, he wouldn’t have to worry about “volatility” and we could be more strategic in how we allocate tax spending; 4. You don’t reform or build quality education with the tax code. In fact, that’s the best way to politicize public education and destroy it. Mr. Boone either is ignorant about how children learn, or is more interested in using education as a cudgel for his ideas on taxes; 5. Taxes are used to pay total compensation as well as pay for private sector contracts. Arguments can be made that private sector contracts are more inefficient than public employee compensation primarily because private contractors build in a component called “profit” that more than offsets public employee compensation; (that’s why we should be leery of the “O” in DBO public works contracts) and 6. If the legislature, under the law, is incapable of raising revenue or completely destroying all public services, it should fall to the electorate to make the decisions.

I believe these tax measures will fail. Mostly because of the surplus time and resources devoted to bashing public employees, public institutions and the entire concept of pooled and common resources. Things will get very bad in this state until even people like Mr. Boone finally realize that taxes really are the price we pay for civilization. That day is still a long way off, unfortunately. Mr. Boone may draw comfort in that. I’m reminded of what Winston Churchill is purported to have said about Americans: “You can always rely on Americans to the do the right thing: after they’ve tried everything else.”

First of all, I’d like to urge everyone to vote for Prop 30. Regardless of whatever objections you may have (such as the need to reform), voting No will hurt the kids.

Can someone explain the first chart to me? It seems to say that we spend over $3500/yr on teachers per student. With a class of even “just” 30, that would make the average teachers salary to over $100K (30 X 3500). That obviously is not close to being right, so what gives?

EastDavid: [i]Can someone explain the first chart to me?[/i]

That is just the cost of teacher salaries per student which are only a percentage of the total spending per student.

Here is a graph showing the trends for total spending per student:

[img]http://www.cscdc.org/miscjeff/edspendperstud.jpg[/img]

Jeff: interesting, well-research article. Thanks for taking the time to write and post. I think about our little city’s budget wreck every time I see 4 member FF crews go past in their two trucks heading for non-injury accidents. I understand your concerns, and I agree with many of them.

However, at the end of the day, we are all fiduciaries for the children who need education and our public schools. It’s not their fault that the parents and voters have screwed up so badly. My oldest son went through the Davis schools at the height of the population boom caused by all of the new sprawl developments that were given away to developers before the schools were built to house the kids of those new families. My son couldnt get a locker; often skipped lunch because the lines were too long; etc etc. He was a victim of the sins of the public authorities and the voters who forced that overcrowding.

THe economy will improve.

We simply have to have more money for the schools.

I think many of the senior administrators are overpaid, and some grossly.

However, I do not think we pay our teachers nearly enough. We entrust our sweet kids to those teachers, and they deserve better compensation and classrooms and supplies and tools to do their jobs.

Jeff, from what I personally know as to how our little city has been pillaged and budgets wrecked by self-interested and conflicted staff and negotiators, at the end of the day, we have got to get more money flowing back into the pbulic schools to assist our professional teachers to whom our kids are entrusted.

Jeff, if you really want to help the city residents and small businesses stay afloat, and reduce their costs, I suggest you go down to CC and protest what they are about to do to us with the oversized, too expensive, and too soon surface water plant. None of the numbers add up. It’s Sept 6th 2011 all over again, with the gloss of a majority WAC vote from people appointed by the original JPA proponents.

Sorry, Jeff, you sure did not answer my questions. Your chart: ” Statewide Teacher Salaries Expenditures Per Student” concerns “cost of teacher salaries per student” as you “explain”. Putting another chart about total expenditures does not address my question: What gives? IF we spend over $3500 per student on teachers and an average class has (at least) 30 students, won’t that make the average teachers salary over $100K? I know no teacher getting close to that, let alone an average. So, how does that compute?

EastDavid: I’m not sure I completely understand where you are going with your question. The $3500 number is simply the total annual statewide teacher salary expense divided by the statewide number of students.

Class-size reductions would tend to increase the number as there would be more teachers required (resulting in higher total annual statewide teacher salary expense) to teach the same statewide total number of students.

But, what if, for a list of subjects, using technology and part-time employee college students as tutors, we could effectively teach 60, 90 or 300 high school students per teacher/class? That type of approach would decrease the cost of teacher salary expense per student. That savings could then be invested into education enhancements like more books, more technology and smaller class sizes for the younger students.

“EastDavid: I’m not sure I completely understand where you are going with your question. The $3500 number is simply the total annual statewide teacher salary expense divided by the statewide number of students.

Class-size reductions would tend to increase the number as there would be more teachers required (resulting in higher total annual statewide teacher salary expense) to teach the same statewide total number of students.”

Jeff, on top of what you just stated adding to the teacher’s salary are also medical insurance and retirement costs, unemployment insurance, etc. It all adds up.

Jeff, I hate to see you cave on Prop. 30. The line has to be drawn at some point.

EastDavid: Thinking a bit more on your question…

The average salary for CA teachers is about $68,000 per year. The teacher-to-student ratio is about 20. $3500 * 20 = $70,000. That is in the ballpark.

Remember that teachers get sick and have to be trained, etc. You never have 100% resource coverage. I would guess that number to be about 80% or maybe a bit less. In other words, for every 1000 teachers employed, on average about 200 of them would be out of the classroom for some reason.

[i]Jeff, I hate to see you cave on Prop. 30. The line has to be drawn at some point.[/i]

Rusty – I appreciate that point. I struggle with the question “what is the right thing to do?”

The problem at the college level is that they can refuse students. The UC and CSU systems – even while taking state money derived from tax payments coming from parent of college bound children – have the authority to reject these children solely on the basis of funding. Conversely, K-12 schools will continue to operate and have to accept all qualified students regardless of funding.

In the game of denying service versus starving the beast, the colleges win because they can cause the ultimate damage to young people by denying 100% education services. Also, as I pointed out, I think the community colleges do a very good job for the level of funding they receive. I don’t want them hurt as pawns in the Democrat/union vs. taxpayer game of chicken.

We are going to eventually hit a wall. In fact, that State wall may be right in front of a failed Prop-30 wall. And we will hit the local wall if Measure E also fails.

Humans are naturally resistant to – and often terrified of – change. There are a lot of people in this State and in our community trying to hold on to the old education version 1.0 system while they only pretend they are progressing and changing. I think the key to getting all critical stakeholders to the table to truly plan and execute REAL substantive change is for them to grow more fearful of the consequences for NOT changing.

We need education system version 2.0 yesterday, but not at the expense of young people without other options to get their needed education.

Where I’m “going” with this is clarification and verification. Are you saying that the average salary for K-12 teachers is 68,000? I find that hard to believe. And no way is the average teacher-to-student ratio ‘about 20″. In the good old days, that was just for K-3 grades. Now the school has to be specially qualified (QEA?) to get 20 in a class. I’ve heard of 40 in some classrooms! I would also guess that you guess of 80% is way off. That would mean that a teacher would miss 1 day each week (on average. Doubtful.

So, rusty49, what would your solution be that would help kids NOW deal with the cuts that would come if Prop 30 fails to pass? I doubt that you would draw this line if you had kids in our public schools.

JB: It’s too bad that you make your argument based on a few good economic years. You would have built a better case to account for the kind of fluctuations in revenue that have affected the schools. When planning for a comprehensive K-12 education, ideally you need a solid plan and 13+ consecutive years of stable funding to know if the plan worked we almost never get that.

“The average teacher salary last year was $67,871, a decrease of 0.1 percent from 2010, according to new state figures.

Read more here: http://www.sacbee.com/2011/01/26/995141/see-how-well-your-school-district.html#storylink=cpy“

EastDavid:

“I doubt that you would draw this line if you had kids in our public schools.”

How do you know anything about me?

“Such benefits as health insurance can comprise as much as 15 percent of teacher salary in California, according to the Education Data Partnership. By law, all school districts must contribute funds to the State Teachers Retirement System (STRS), which typically consists of 11.5 percent of a teacher’s total compensation.”

[i]JB: It’s too bad that you make your argument based on a few good economic years.[/i]

wdf1: I think this is a bit of a red herring challenge. Frankly, I do not know any enterprise where there is an expectation for stable revenue, including a corresponding trigger to punish the customer if revenue drops.

Funding stability requires a reserve to be built during the good years, to help ensure the organization can survive the lean years.

However, we cannot grow a reserve with government deficit spending even in the good years. We cannot grow a reserve if the growth in tax revenue is consumed by the system and becomes the new expense benchmark.

The reason I did not go back further in time is that it introduces many more variables that are used as arguments and explanations to deny the simple facts. The simple facts in this case are that education over-spends and this over-spending largely contributes to our ongoing funding challenges.

Interesting discussion, everyone, but if you want to talk about money, remember: all public finances and politics are essentially local.

Here, all of you have the chance right now to tell the Davis CC to stop the planning for the JPA project, and study options more, including buying water from West Sacto. It will save $100,000,000’s from being drained from the local economy. And you dont even have to deal with the state and federal governments. Take care of our own budgets. Right here. Right now. Just tell them to stop the planning to take our money.

Mike, not only are you way off topic, but there is no connection between funding for the schools and funding for the water project.

“no connection between funding for the schools and funding for the water project.”

WRONG. Parcel tax support for our schools and private donation support is distinctly impacted by draining money out of the local economy to meet the profit needs of the DBO multinational corporations being considered. The Davis voter is less likely to support school funding as their water bills(along with sewerage and waste treatment bills) triple.

Don: I can see your point, but Jeff was applying the Prop 30 to how we are overtaxed at the local level. Every dollar drained out decreases resources to pay for other services and utilities.

The water bills are hugely going up, and that necessarily effects the money I have, and the willingness, to pay for other public services. The members of the 2011 Surface Water Referendum havent gotten a thank you card yet from the Board of the DJUSD for basically saving two of their parcel tax elections, but maybe one will come some day.

(The No on X Committee is still waiting on a case of nice wine from the developers of CV who would have been wiped out if their project had been approved in Nov 2005, just before the economic disaster hit the next year.)

davisite2: well stated. It’s all tied together.

Vote for Prop 30 to help the schools.

Vote NO on the surface water project, and help all of us.

Yes, we keep hearing about this possible indirect impact on the likelihood of voter support for future tax measures. Without any evidence, of course, and strictly conjecture. But the fact remains: there is no connection between funding for the schools and funding for the water project.

What percentage of your income goes to the parcel tax?

What percentage of your income goes to your water bill?

…and to pull it back on topic, what percentage of your income goes to state tax?

‘But the fact remains: there is no connection between funding for the schools and funding for the water project.”

I don’t agree Don. I think that raising money locally for both is the common nexus there and if you look at the polling done last year, the voters prioritized schools a lot higher than water. Will that be a factor? We don’t know and yes it is conjecture – but conjecture is permitted here, no?