For the last several months, Davis has been having a debate over the Cannery Property. Make no mistake, there are a number of critical questions which will not be resolved this week and may not be resolved in a month when the council makes a final decision.

For the last several months, Davis has been having a debate over the Cannery Property. Make no mistake, there are a number of critical questions which will not be resolved this week and may not be resolved in a month when the council makes a final decision.

I’m not going to pretend like these are not critical questions in the community – do we need housing? What kind of housing do we need? Should we put housing at the Cannery site which has a number of serious limitations? And then there are the project-specific concerns such as connectivity.

At the end of the day, the Davis City Council will resolve these questions for better or for worse, and if a segment of the community does not like the answers, they will put it on the ballot.

It is important stuff, but at the end of the day, it is just housing. While there are some who lament the lack of available housing, it is still just a question of how much housing, where and at what time. The answer to those questions, while important, are not, to use the parlance of sports, game changers.

To me, the much more critical discussion is the one that is going to take place on the same meeting agenda – or at least the start of that conversation.

In 2008, even before the collapse of the US economy, it was becoming apparent that the way that Davis was doing business was not sustainable. Under pressure and control from powerful groups of city employees, most specifically the firefighters, the city of Davis ratcheted up compensation, benefits and retirement to its employee groups.

The funding was made possible by double-digit annual increases in property tax revenues in the city. But even in the heart of the housing boom in the last decade, those revenues were constrained both by Prop 13 and the city’s meager share of property taxes, and the boom was not enough. So the city, claiming that services would be cut back, passed a half-cent sales tax, $3 million in revenue, that, instead of saving city services, simply fueled massive increases to payroll and pensions for city employees.

However, by 2008, it was obvious that this path, even absent the catalyst of the recession, was unsustainable. The city was slow to act. Even after the recession hit, the MOUs signed by all groups in 2009-10 except DCEA were a drop in the bucket.

With a new council starting in 2010 and continuing in 2012, a new city manager, and a new focus, the city of Davis put a lot of its economic house in order. While the firefighters and DCEA continue to hold out, costing the city $114,000 a month for their failure to reach a contract, and while the state’s pension system is going to spike costs, the city has done what it needs to do to stabilize its expenditures.

But with a sluggish economy and limited tax base, the city has no margin. So, necessary expenditures for roads and infrastructure as well as water threaten to bury the city in another avalanche of red ink.

Something has to change.

There is an opportunity now to change that game in the long term. To bring in the revenue from much more diverse sources than the current and ironic overreliance on auto sales.

The city has an opportunity to become much more than the small and, at times, quaint college town. The city has the opportunity to take advantage of the next wave of the high-tech revolution.

It has a willing partner and catalyst in UC Davis which, while still struggling to gain full traction, has the ambition to move beyond a middle-tier school in the University of California system. We have seen the tip of the iceberg in the renewed drive for research money.

When the city of Davis sent its first delegation to Washington last spring in the Cap-to-Cap, the region for the first time took notice of the awakening of a sleeping giant.

Davis has an opportunity not just to put its economic house in order, but for much more than that. I have spoken in the last few weeks to people who believe that Davis has the opportunity for greatness. To take advantage of the university investment and the opening it has in fields like biotech, ag tech, and medical technology.

At the same time, we are really at the crossroads. This summer, Davis lost a giant. Bayer-AgraQuest was a company that was started in the city of Davis. It grew and expanded. It was bought out by Bayer. Now it is moving out to West Sacramento.

City officials have put the best possible spin on it, and, while it is good that the jobs are not leaving the area, the money and resources will no longer be flowing back to Davis. The culprit here is available business park land and Bayer-AgraQuest is not alone.

If we do not act quickly, we may well lose Schilling Robotics, another native Davis business. We may lose the successor to Bayer-AgraQuest, Marrone Bio-Innovations.

This says nothing about the opportunities for turning research at the university into start-up tech companies and ultimately have them grow into companies with large employee bases that bring revenue into the city.

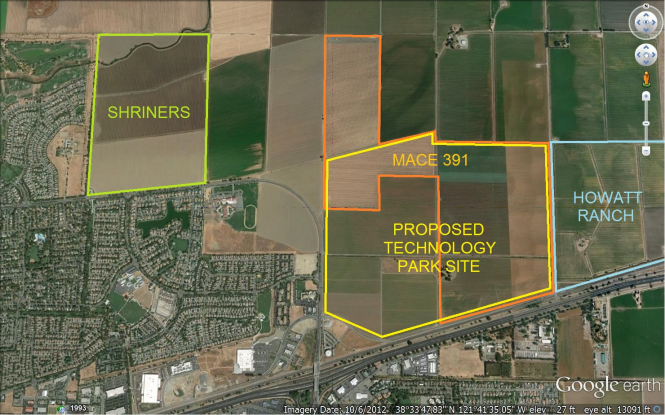

The discussion starts on Tuesday with the update on the Mace Curve 391 project. It may be that the best use of that land is indeed an agricultural easement. It may be that we have alternative uses for that land. It may be that the best place for us to develop a business park is to the west.

However, the most important conversation we need to have right now is where to put a business park, how large it needs to be, where it needs to be, and then how we can protect the remainder of the agricultural land.

Those who can balance our economic and fiscal needs with preservation of agricultural land and preservation of the unique characteristics of this community can help us move forward here.

But we need to have that discussion and it needs to be a true and honest discussion. Right now, we see too many cooks in the kitchen, each of them with their own unique interests and drivers. We fear that the grand compromise that emerges may be less about what we need, and more about what certain stakeholders in the community want.

We have seen this debate already spilled out in hundreds of comments over a half dozen to a dozen articles on this site.

Until a few weeks ago, however, these discussions did not make it into the broader community. We continue to be stuck on smaller, more parochial issues that impact our community, but avoid the big view.

Housing is important, the environment is important, but what we do on economic development could impact this community for the next hundred years.

Does Davis wish to become a small, elite, bedroom community where people either work at the university or commute to Sacramento? Or does Davis want to forge forward to become great, to have a chance to be the place where people go when they want to get into fields like ag tech, biotech and other leading edge industries?

The great thing is that we can do this while maintaining what is great about Davis. The best thing about Davis is its active and engaged citizenry, the great neighborhoods, the wonderful open space, the bike paths, and the ag-urban boundary.

But we are on the brink. We are close to not being able to afford to keep our parks and greenbelts because we lack the money for upkeep, water and infrastructure.

We are a community blessed with great city services that allow for parks, recreation, and community events, but if staff needs to be cut, if programs need to be slashed, if we cannot afford to pay for continued emergency services, where do we end up?

And what people really need to understand is that if things get bad enough – if we move toward bankruptcy, if we have to slash more programs, more employees, more services – at some point the people of this community will panic.

Panic does not produce smart policies – it produces quick solutions and knee-jerk responses.

If we want to preserve the great things about this community, if we want the community to thrive, not just survive, then we need to have this full discussion and we need to have it soon.

Growth and housing will always be an issue for Davis, but fiscal sustainability and economic development are at the core of the future of this community.

—David M. Greenwald reporting

[quote]However, the most important conversation we need to have right now is where to put a business park, how large it needs to be, where it needs to be, and then how do we protect the remainder of the agricultural land.[/quote]

The answer to the “where” question needs to be informed by the answer to the “how large” question. We need to see all the relevant budget numbers — the running deficit, the retiree benefit “pig in the snake,” the business park net return per acre, and the cost of urban limit line land acquisition — in one place before we can begin to answer the “how large” question.

Here is the data from 2011 economic impact report of NDSU Research & Technology Park and 2 links to more economic impact reports.

Currently, the Park is comprised of six buildings totaling 295,000 square feet on 55 acres of land.

The 19 businesses located at the NDSU Research & Technology Park account for 893 direct, on-site jobs, and an additional 551 indirect, off-site jobs.

Out-of-state sources pay for an estimated two-thirds of all jobs, earnings and local tax revenues generated by NDSU’s Research & Technology Park.

The total number of jobs in the Park increased more than 74 percent from 2006 to 2010, from 511 to 893.

Industries in NDSU’s Research Park pay out $50.9 million in wages annually and account for another $22.7 million in indirect off-site wages, due to multiplier effects, for a total of $73.6 million in labor income in North Dakota.

The NDSU Research Park generates an estimated $10.9 million per year for state and local governments, which includes $7.3 million in government revenues through sales taxes, personal and corporate state income taxes and other charges, both directly and indirectly.

The Park generates an estimated $3.6 million annually for governments through property taxes, other taxes and fees, both directly and indirectly.

Approximately 65 percent to 70 percent of the NDSU Research Park’s annual revenues originate from of North Dakota.

By 2011, out-of-state revenues flowing to businesses in the Park are expected to have grown 74 percent, while international revenues will have jumped 77 percent.

Total revenues flowing into the Park increased 51.8 percent from 2007 to 2010, from $95.8 million to $145.5 million. For 2011, projected revenues flowing into businesses in the Park are $172.8 million.

The report estimates that Research Park industries and off-site, linked businesses generate $28.4 million in direct or indirect property income in North Dakota. This measure includes retained earnings, dividend, interest and bond payments and depreciation allowances.

Companies in the NDSU Park conduct trade with 26 nations on six continents, contributing approximately 10 percent of the Park’s revenue.

Clients in the NDSU Technology Incubator received approximately $3.9 million in private and other grants, venture capital and angel investment funds in 2008. In 2011, such funding is projected to be $16.1 million.

Businesses in the Research Park pay an average salary of $57,000, up from $51,000 in 2005.

Four of 19 companies in the Research Park earn royalty and licensing revenues from patents and discoveries and for every $1 of costs incurred, companies earn $2.80 in present value terms.

On-site employment in the Park includes 138 jobs for NDSU students and 286 jobs for NDSU graduates, for an estimated 32 percent of Park jobs held by NDSU graduates and 15 percent held by NDSU students.

http://www.sstp.org/about-sstp/economic-impact

http://aurp.memberclicks.net/index.php?option=com_content&view=article&id=92&Itemid=116#Economic Impact Studies

I concur with Jim.

Some of those answers (the running deficit and the retiree benefit “pig in the snake”) are pretty easy to come by given that (according to an e-mail I got from Yvonne Quiring) the Fiscal 2012-2013 Budget ending position is available at [url]http://administrative-services.cityofdavis.org/budget-and-financial-planning/city-of-davis-budgets[/url] and the adopted Fiscal 2013-2014 Budget is available at [url]http://administrative-services.cityofdavis.org/budget-and-financial-planning/city-of-davis-budgets/2013-2014-budget[/url]

The business park net return per acre and the cost of urban limit line land aquisition are the two pieces that need serious fleshing out in order to answer the questions you pose.

If one looks at the two items on Tuesday’s agenda it is intriguing to think about the simple fact that one of those two decisions has 4-times the fiscal impact on the City as the other one does, and yet the amount of fiscal analysis that has been done on the “1” is substantial while the amount of fiscal analysis that has been done on the “4” is non-existant.

From my perspective the ideal decision that Council can make on Tuesday night is to honor and tell Mitch Sears to continue the steps under way in processing the easement so that all the paperwork and agreements are in “ready to go” on March 1, 2014. Council would also authorize a parallel process that would very quickly and as thoroughly as possible gather the answers to the questions you pose and a few others that you haven’t asked. Those answers would need to be assembled by February 1, 2014 so that they can be analyzed by Council and the community during the month of February. That way when March 1, 2014 arrives, if the answers to the questions are not compelling then on Tuesday, March 4, 2014 Council can tell Mitch to “go close the deal” for the easement. That way we would be fully in compliant with the March 31, 2014 deadline set by NRCS and their grant would not be lost.

That to me would be the kind of open, transparent, informed community dialogue that should have been happening in 2011 and 2012. We can’t change the “silent period” (as shown by the Staff Report for Tuesday’s Item 6 (see [url]http://city-council.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/CouncilMeetings/Agendas/20131022/06-Mace-Curve-Update.pdf[/url] that existed from July 29,2011 through March 20, 2013. We can only do our best to deal with the information and timeline we have before us in the present.

Thank you for that Stephen.

[i]Growth and housing will always be an issue for Davis, but fiscal sustainability and economic development are at the core of the future of this community[/i]

This sums it all up.

We have two competing ways for looking at our current situation. One is to put protection of our existing design as a first priority and decide what we are willing to accept as a subordinate issue. The other is to put financial sustainability and health as a first priority and have a subordinate goal of ensuring we retain as much of our good design as possible.

I take the second path but altered a bit to include the idea that the design can be significantly improved.

But in any case I think the “earn before play” approach is the right one.

For those who don’t know, the “ND” in NDSU Research & Technology Park stands for “North Dakota.” The park is in Fargo North Dakota and according to their website is “a place where university researchers and private industry can combine their talents to develop new technologies, methods and systems.”

At the risk of insulting any Dakotans out there, how do the University of North Dakota and UCD compare in terms of their research output and their international reputations as research universities? The core competencies of UCD in Agriculture, AG Technology, Food Safety, Viticulture and Enology, Professor Yamazaki’s Applied Mechanical Engineering are all “world class”

As a result NDSU’s Technology Park represents only the tip of the iceberg of the kind of technology transfer that UCD can accomplish and will accomplish.

“We have two competing ways for looking at our current situation. “

Frankly, you missed my point here. What I’m really proposing is a third way, or at least a 2B way. It is protecting the positive assets while figuring out a way to take advantage of opportunities. I don’t see protecting open space and ag land as subordinate – I don’t to find a way to protect them while finding ways to economically develop.

I fear that if we keep the pendulum too far swung toward no development, we either trigger economic collapse or backlash. A well considered middle approach is my advocacy here.

[quote]Currently, the Park is comprised of six buildings totaling 295,000 square feet on [b]55 acres[/b] of land. [/quote]

Kind of negates the purported need for hundreds of acres as tech park.

[quote]The city has an opportunity to become much more than the small and, at times, quaint college town. The city has the opportunity to take advantage of the next wave of the high-tech revolution.

[/quote]

[quote]Growth and housing will always be an issue for Davis, but fiscal sustainability and economic development are at the core of the future of this community [/quote]

[quote]The funding was made possible by double-digit annual increases in property tax revenues in the city. But even in the heart of the housing boom in the last decade, those revenues were constrained both by Prop 13 and the city’s meager share of property taxes, and the boom was not enough.[/quote]

[quote]Does Davis wish to become a small, elite, bedroom community where people either work at the university or commute to Sacramento? Or does Davis want to forge forward to become great,[/quote]

I cherry picked these four concepts from your article to make a point.

You point out appropriately that much of the current city budget woes are due to unsustainable fiscal practices based on rapid growth associated with the housing bubble. You, and many others, then make the case for

“taking advantage of the ‘next wave of the high tech revolution’. The word “wave” is key. To me, this is just another example of the “boom and bust” mentality that leads us repetitively into these cycles of prosperity with a subsequent “crash” because people do not plan adequately for the lean times which will inevitably come.

I would like someone to define “great”. This is a definition which the proponents of growth, whether economic or demographic do not like to address. Deciding what our community defines as “great” is a huge obstacle to

the idea many have of economic and or demographic expansion because they cannot, or do not want to consider what the reasonable limits might be. Some just do not think it is an important question ( Mr. Toad).

Some think that I want to preserve something that does not exist ( Mark West before he graciously retracted that comment). Some have expressed the opinion that I want a small European village ( Frankly). Even Matt Williams who I consider to be a master of the reasonable, has not as best I can tell, stated clearly what he envisions as the limits of growth. What none have done is to describe what they see as the optimal, potential end point. Because there most assuredly is one, whether it is determined by geography, or finances, or personal or political pressure. I do not believe that we have a consensus in our community about what constitutes “great”. Some consider Davis a pretty great place as it has been and as it is and would be perfectly content to work out the fiscal problems, get the city on a track to sustainability without

“awakening a sleeping giant”…..nice metaphor for rapid, expansive growth.

I am much in favor of David’s third way which does not favor the needlessly divisive idea of “We have two competing ways for looking at our current situation. ” but rather gives consideration to the view that perhaps there might be common ground to be found, but only if each side respects ,honors, and chooses to refrain from disparaging the values of the “other side”.

“Kind of negates the purported need for hundreds of acres as tech park.”

Only if our imagination is limited to mimicry of North Dakota State University with 14,629 students and 3759 Full Time Equivalent employees. Just on population alone and not trying to calculate creativity or imagination, nor compare the size of the science and technology staffs, it is less than half the size of UCD.

Expanding on Mr. Toad’s remark, the size of a business park in North Dakota doesn’t have much to do with our situation. To my way of thinking, we first want to identify and prioritize the city’s financial needs in hard numbers, then determine whether creating one or more business parks is a practical and desirable way of meeting some or all of those needs. All the stuff about adding great jobs and making space available for innovative businesses is secondary to meeting the municipal budget objective. The city’s income increment from adding local jobs seems to be small — if not insignificant — compared to the secured and unsecured property tax flow.

Jim Frame

Well written.

I agree that defining the actual problem before leaping into solutions is almost always the more prudent course.

I agree with Jim’s questions. Jim, can you compile that data by Tuesday?

The comment was made on a prior thread that he/she was unaware of a successful business park smaller than 200 acres. Stephen Souza has provided an example of an apparently successful business park smaller than 200 acres. Smaller business parks would be in keeping with the ‘dispersed business park’ model.

“Smaller business parks would be in keeping with the ‘dispersed business park’ model.”

Or it would create a logistical nightmare with delivery trucks running throughout the community in concert with bike traffic instead of being concentrated near existing freeway off ramps.

Medwoman wrote:

> You point out appropriately that much of the current city

> budget woes are due to unsustainable fiscal practices based

> on rapid growth associated with the housing bubble.

There is a long list of reasons that we have the “current city budget woes”, but I would put “unsustainable fiscal practices based

on rapid growth associated with the housing bubble” way down the list after “politicians that have no incentive at all to save money spending too much”.

> The word “wave” is key. To me, this is just

> another example of the “boom and bust” mentality

> that leads us repetitively into these cycles of

> prosperity with a subsequent “crash” because people

> do not plan adequately for the lean times which

> will inevitably come.

In the past we had a lot more people that would “plan for the lean times”, but today less and less people (including almost all elected officials) seem to worry about planning for lean times since “the government will save them” (e.g. NYC Bailout, Chrysler Bailout, GM Bailout, Just about every bank bailout…). With most of the people that remember the Great Depression (and people who got in trouble not getting bailed out) dead today we have a lot more grasshoppers than ants (see below).

http://en.wikipedia.org/wiki/The_Ant_and_the_Grasshopperhttp://en.wikipedia.org/wiki/The_Ant_and_the_Grasshopper

Today it is easy for politicians to pretend that everything is OK by just plugging in “dream” numbers in to a spreadsheet. The fact is that we live in a world with very low investment yields and governments have a contractual obligation to pay generous pensions that most years will require us to pay out more than the yields (basically eating the seed corn).

Davis (like other cities) made a lot of promises that will be hard to keep, but at least Davis (unlike Detroit and Stockton) has people that want to develop here and bring us more money. We are past the point of debating if it is a good idea to pay the retired 50 something Davis fire chief and her 50 something retired Davis firefighter husband close to a quarter of a MILLION dollars in cash and medical benefits every year (at least until a pension reform act amends the state constitution to allow the city to reduce benefits)…

Sandia Science and Technology Park by the numbers (as of 2011):

Jobs

Direct jobs in the park: 2,470

Indirect jobs supported by the park: 4,123

Average park salary: $74,949

Tax revenue

Cumulative impact on taxable personal consumption: $1.89 billion

Cumulative impact on gross receipts tax revenue to the city: $10.4 million

Cumulative impact on gross receipts tax revenue to the state: $73.4 million

Companies: 33

Buildings: 23

Available space for rent: 92,917 square feet

Total available land: 233 acres

Contracts from Sandia Labs to park companies since 1998: $390 million

Contracts between park companies since 1998: $9.4 million

Public and private investments in the park since 1998: public, $86.6 million; private, $263.9 million

Posted before a few times

[quote]– The City of Davis municipal budget is currently running at a significant deficit, and that deficit is expected to increase.

— Significant cuts to costs such as the “3 on an engine” cuts to the Fire Department and the outsourcing of tree trimming have been implemented and/or proposed, and said cuts have produced significant pushback from substantial portions of the Davis community.

— Therefore, in order to balance its budget, it is apparent that Davis needs the tax revenue that derives from increased local business growth.

— As a community, we have a responsibility to work with the university and other regional economic development entities to grow the regional economy.

— If UCD’s core competencies are collaboratively leveraged, then Davis could end up growing business at a rate of growth per year that will mean that the municipal budget deficit will become a relic of the past.

— If that kind of economic growth and budget stabilization is achieved, then aggregate housing units across all classes (multi-family and single family) could possibly grow by as much as 1% per year, focused on accommodating the people filling the newly created jobs, which is the upward bound of the One Percent Housing Growth Cap reaffirmed by the Davis City Council in September 2007

— Said housing growth should be predominately in the multi-family (apartment) class and the City should take proactive steps to incentivize the conversion of single family residences that are currently rented to groups of students back into either single family rental occupancy or single family owner-occupancy..[/quote]

The numbers for the Sandia example can benefit from some interpretation:

1. They’re cumulative, apparently over 13 years (1998-2011).

2. The per-job (direct and indirect) taxable personal consumption comes out to about $22k annually, but figuring out how much of that consumption occurred locally is another matter. Even assuming that all of it does (unlikely, especially given the rise of Internet purchasing and the presence of nearby regional retail centers), in a Davis scenario the city would only get 1.5% of that, or $330 per job per year.

3. The “gross tax receipts” refers to a tax that New Mexico jurisdictions impose on business transactions (services as well as goods). California doesn’t have a GRT, and since most tech businesses don’t generate sales tax revenue, the $10.4M ($800k per year) to the city wouldn’t pertain here.

4. There’s no mention of property tax revenue to the City of Albuquerque, which seems odd. (I wonder if the city granted some sort of tax rebate in order to snag the park.) In any case, in Davis a park of this size would, using magnitude numbers Rob provided, return about $700k per year to the city. (Thus offsetting the lack of a GRT.)

[quote]Or it would create a logistical nightmare with delivery trucks running throughout the community in concert with bike traffic[/quote]

Delivery trucks already run throughout the community. Is that a problem?

Jim: [quote]In any case, in Davis a park of this size would, using magnitude numbers Rob provided, return about $700k per year to the city. (Thus offsetting the lack of a GRT.) [/quote]

So the next question is what would be the agricultural yield of a farm of that size. That would depend on the crop and how it’s managed, of course. For example, I could quickly find two examples of certified organic farms (23 acres and 35 acres respectively) yielding $60,000 – $100,000 per year in food crops. Conventionally farmed land would be considerably less.

The $700k I cited represents a high-side estimate of the city’s share of secured property tax receipts for 25 acres of business park. The unsecured receipts might add another $125k annually. The property tax value of ag use would be significant, but much less than for a business park.

If someone can tell me the cropping history of Mace 391, I would find it pretty easy to calculate the rough agricultural value of what it’s been producing. But it’s harder to quantify the impact on the agricultural economy locally.

Basically, what is being proposed it to take the property out of the local farm economy in order to produce revenues for the city’s budget. Revenues from farming go to the farmer, the farm workers, the banks such as First Northern that lend to the farmer, the ag equipment dealers, the fertilizer and pesticide distributors, the irrigation supply stores, the irrigation district, the nurseries that grow the seedlings and trees, and on and on.

Agriculture is the underpinning of Yolo County’s economy, and for that matter of the economy of non-urbanized parts of Sacramento Valley. Developing ag land is bad for the county’s economy and bad for much of the private sector in rural areas. Hence the use of ag conservation easements to protect ag land, protect food production, and help sustain rural economies.

[quote]Basically, what is being proposed it to take the property out of the local farm economy in order to produce revenues for the city’s budget.[/quote]

This would be true of any ag-to-tech conversion, but I’d like to note that I’m not advocating a business park for Mace 391. Barring a potent argument I haven’t heard yet, I’m in favor of putting it into a conservation easement. I think the 180 acres at the NE corner of Mace and Road 32 is a different story, and I’m interested in seeing how the economics of that site work out for business park use.

“Delivery trucks already run throughout the community. Is that a problem?”

It is when people get hurt like the person who died at Covell and 102 when they were hit on their bike by a truck headed to Conagra.

“Developing ag land is bad for the county’s economy and bad for much of the private sector in rural areas.”

Depends on what you develop it into. If it produces products with greater value added after conversion it can be better for the local economy. Of course if you want to featherbed the status quo by standing in the way of the creative destruction of capitalism you will support some at the expense of more.

“in Davis a park of this size would, using magnitude numbers Rob provided, return about $700k per year to the city.”

Problem is that the community doesn’t get a park. It spends millions to get a conservation easement but the land itself gets sold to a farmer who isn’t required to provide access to the community.

[quote]Of course if you want to featherbed the status quo by standing in the way of the creative destruction of capitalism you will support some at the expense of more.[/quote]

I’m sorry, but I have no idea what you’re trying to say.

I think the chart below is accurate, but…

[img]http://www.thesocialmisfit.com/DavisRevenue.jpg[/img]

…sales tax revenuege percentage for Davis seems too high given the US Census Bureau data for sales revenue per capita.

For example, in 2007 the sales revenue per capita was as follows:

– Davis = $7,752

– Palo Alto = $26,751

– Chico = $19,626

– STATE AVG = $12,561

What this seems to say here is that Davis is much too reliant on property tax revenue; it takes in much less in city service fees as a percentage of revenue (is this because UCD is the largest land-owner, and it provides its own services?), and this causes the sales tax revenue to be overstated as a percentage of revenue when compared to other CA cities… but in reality it too is way below average… especially when compared to other comparable college towns about the same size.

Unless I have some sigificant mistakes in this comparison, it seems clear that Davis has to grow service fee income and sale tax income to bring it to equalibrium in terms of sources of revenue.

Based on the 2011 crop report, here would be the values of specific crops on 391 acres:

Alfalfa Hay: $437,820.29

Corn, field: $476,068.94

Sunflowers: $403,660.11

Tomatoes: $1,041,217.36

Wheat: $188,375.19

Organic production for fresh market sales: $3,792,593.69!

(note: most organic farms are much smaller)

Almonds: $705,099.10

Walnuts: $1,125,560.00

[quote] it seems clear that Davis has to grow service fee income and sale tax income to bring it to equalibrium in terms of sources of revenue. [/quote]

I don’t think we have to replicate the same revenue mix as any other community as long as the total results in a balanced budget. The comparisons are useful in identifying underutilized sources, but needn’t be considered a blueprint.

]Don Shor said . . .

[i]”Based on the 2011 crop report, here would be the values of specific crops on 391 acres:

Alfalfa Hay: $437,820.29

Corn, field: $476,068.94

Sunflowers: $403,660.11

Tomatoes: $1,041,217.36

Wheat: $188,375.19

Organic production for fresh market sales: $3,792,593.69!

(note: most organic farms are much smaller)

Almonds: $705,099.10

Walnuts: $1,125,560.00 “[/i]

Don, I think you are comparing apples to oranges, but I could be wrong, so correct me if I am. The numbers you appear to be sharing are the values of the crops rather than the revenue to the City’s General Fund. The numbers shared in the innovation park examples were for revenue realized by the General Fund. Can you please translate your numbers into the net amount such crop values would contribute to reducing the City’s annual deficit? Thank you.

Jim Frame said . . .

10/20/13 – 06:08 PM

…

[i]”The $700k I cited represents a high-side estimate of the city’s share of secured property tax receipts for 25 acres of business park. The unsecured receipts might add another $125k annually. The property tax value of ag use would be significant, but much less than for a business park. “[/i]

Don, here are the comparative numbers that Jim provided.

[quote]Don, I think you are comparing apples to oranges, but I could be wrong, so correct me if I am. The numbers you appear to be sharing are the values of the crops rather than the revenue to the City’s General Fund. The numbers shared in the innovation park examples were for revenue realized by the General Fund. Can you please translate your numbers into the net amount such crop values would contribute to reducing the City’s annual deficit? Thank you.[/quote]

I am sharing what Yolo County and the local farm economy would lose if Mace 391 is developed. Crops grown in Yolo County on farmland that is not in the city limits do not contribute to the City’s general fund or resolve the annual deficit. They provide income to people who live in the county, and to the County itself.

Unlike others here, I am trying to show that we need to look at the whole picture. Not just what is good for the City of Davis, but what is good for the County of Yolo and the residents of our whole area.

Now, looking at it from the very narrow viewpoint of ‘what’s good for Davis’, the city could lease the land to farmers. Current average irrigated land lease rate in the Sacramento Valley is about $250 an acre, or $97,750 per year.

[i]I don’t think we have to replicate the same revenue mix as any other community as long as the total results in a balanced budget. The comparisons are useful in identifying underutilized sources, but needn’t be considered a blueprint. [/i]

I learned this in business a long time ago… you ignore norms and best-practices are your own peril. If you are far outside the range of normal then it is likely that you are in trouble or will be in trouble.

I’m not suggesting that we ignore other situations, only that we not be slaves to them.

Among those who choose a different path are not only the failures, but also the wildly successful, who had the vision to see what the average couldn’t.

Don Shor said . . .

[i]”Now, looking at it from the very narrow viewpoint of ‘what’s good for Davis’, the city could lease the land to farmers. Current average irrigated land lease rate in the Sacramento Valley is about $250 an acre, or $97,750 per year.”[/i]

Don, if that were legally possible, then I probably would agree with you; however, the terms of the NRCS grant [u]require[/u] the City to sell the property on or before March 31, 2014, and thereafter the land must remain in private ownership.

As a result the $250 an acre times zero acres = $0 per year.l