This morning the Sacramento Bee published an editorial that showed the PERS (Public Employees’ Retirement System) costs to local governments across the region. Writes the Bee: “The numbers are alarming. To replenish its recession-battered pension fund, CalPERS is requiring cities, counties and special districts to pay out millions more in retirement contributions.”

This morning the Sacramento Bee published an editorial that showed the PERS (Public Employees’ Retirement System) costs to local governments across the region. Writes the Bee: “The numbers are alarming. To replenish its recession-battered pension fund, CalPERS is requiring cities, counties and special districts to pay out millions more in retirement contributions.”

“The retirement system made two policy changes that have raised costs for its clients,” the Bee writes. “It lowered its expected rate of return on investments, and it changed accounting practices to cover massive recession-era investment losses over a shorter period of time. Both changes were long overdue. But they will cost local governments, and taxpayers, a bundle.”

“As hard as it was to achieve, last year’s pension overhaul legislation was woefully inadequate. The changes have not given cities, counties and special districts the fiscal relief they need to restore healthy budgets,” the Bee continues. “As the numbers in the accompanying chart show, most local governments are paying 50 percent more in retirement contributions than they did just five years ago.”

Davis is one of the smaller cities in the comparison graphic, but the impact of pension costs are just as sharp. In 2007-08 Davis paid out $4.4 million in pension costs according to the data from CalPERS collected by the Bee. In 2013-14, Davis will pay out $7.4 million.

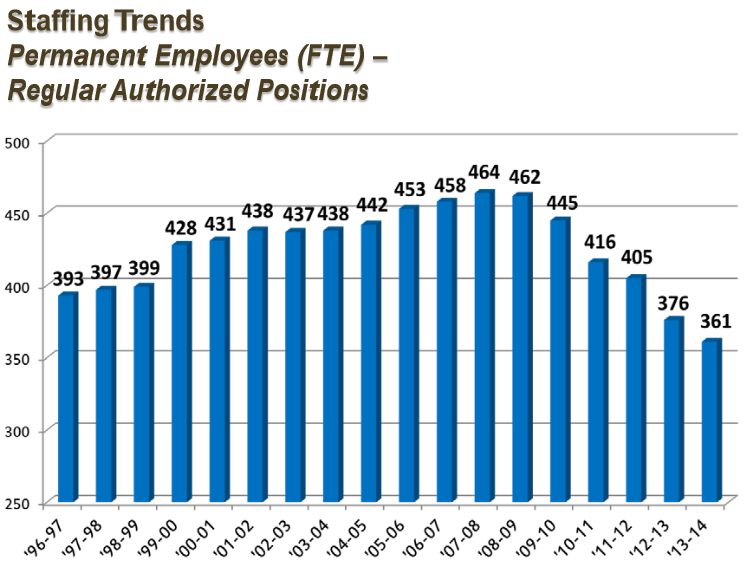

As the graphic from the June budget workshop shows, Davis’ raw number of employees peaked in 2007-08 at 464 and, in 2008-09, Davis employed 462 to full-time equivalent positions.

By 2013-14, the city shows a fewer number of employees since prior to 1996-97, at 361. That’s more than 100 employees that have either been let go, or allowed to transfer or retire without replacement, over the last six budgets.

That represents a 21.8% decline in employees but a 68.2% increase in PERS costs over the same period of time.

While the $3 million in increased cost, despite 100 fewer employees, does not cripple the city’s budget, it does strain it, at a time when a budget deficit of $5 million is about to open up in the next few years.

Davis, of course, is not unique. The Bee notes, “In 2008-09, Sacramento’s pension bill was $51.8 million, or 12.2 percent of the city’s $423 million general fund budget. Even though the city has shed 1,000 employees and reduced its budget to $372.7 million during the last five years, its pension costs have jumped to $55.4 million, or 14.9 percent of the general fund budget.”

Davis’ figure is actually higher, with the $7.4 million representing 18 percent of its $41 million general fund budget.

The Bee writes, “Ronald Bates is city manager for Pico Rivera in Los Angeles County and chairman of the League of California Cities’ pension working group. Even if things remain as they are today, pension costs will increase by another 50 percent for most cities during the next five years, he predicts.”

“Sacramento Finance Director Leyne Milstein is blunt about the pension squeeze,” the Bee writes.

“Municipal revenues are not growing at a pace that will support these retirement cost increases, and pay for services our residents want and need,” she says. “We need police and fire services. We have to pay our debt obligations. We need to continue to invest in infrastructure.”

For Davis, the increased pension costs come at a time when the city needs to invest huge amounts in fixing its long overdue and strained roadway system, has additional costs for water, and is looking to make capital improvements along its two main east-west corridors.

The Bee writes, “San Jose Mayor Chuck Reed, author of a pension reform initiative aimed at the November 2014 ballot, invited labor leaders last week to join him in a search for a solution to the pension crisis. So far, union leaders have scoffed at the idea, claiming the effort is an attack on public employees.

“In reality, public employees’ jobs and pensions are most at risk if effective reform is not enacted. Just ask the 1,000 former city of Sacramento employees and tens of thousands more across the state who have lost their jobs in recent years,” they write. “Reed’s invitation to union leaders to join him in crafting fixes to the pension problem offers labor a golden opportunity to be part of a solution to a pension crisis that grows bigger by the day. They would be foolish to spurn it.

“The Pension Reform Act of 2014 would amend the California Constitution to give government agencies clear authority to negotiate changes to existing employees’ pension or retiree healthcare benefits on a strictly going-forward basis,” a release stated two weeks ago. “The measure explicitly protects retirement benefits government employees have already earned, while allowing benefits to be modified for future years of service.

“Many of California’s public employee retirement plans are simply unsustainable and it’s in everyone’s interest to provide the tools to fix the problem now before even tougher actions are necessary,” said Mayor Chuck Reed of San Jose. “During tough economic times, we believe employees would much rather adjust their future expectations than risk seeing their accrued benefits slashed in bankruptcy.”

That system is created by California Supreme Court rulings that have held that benefits not yet earned are nevertheless contractually protected through vested rights. This initiative would allow state and local government to protect those benefits already earned but alter future benefit packages.

“Federal law allows private pension plans to prospectively change employee retirement benefits. At least 18 states have the flexibility to do so for public employees as well. However, in California, a series of judicial decisions has made it extremely difficult for government employers to make any changes to retirement benefits for existing employees, even if he/she has only been on the job for a single day,” the group said.

Given California’s skyrocketing retirement costs and huge unfunded liabilities for pension and retiree healthcare benefits, numerous independent experts have argued that prospectively modifying current employees’ benefits is the only way to solve the problem, the group believes.

Davis’ situation is compounded by the fact that two of its employee groups continue to hold out from signing a new contract, and that continues to cost the city $114,000 each month.

—David M. Greenwald reporting

Almost every defined benefit pension plan in America has no hope of paying out as promised without massive growth (just like Bernie Madoff got in trouble when his “investment fund” growth slowed).

The city of Davis is doing better than most cities since we have grown ~6x in the last 50 years (vs. ~3x for the state as a whole). If we keep up the growth of the last 50 years and have ~360K people in Davis in 50 years (and ~100mm in the state) we will have enough taxpayers to pay the pensions.

I wish it was not true, but it just isn’t possible to invest a portion of a cop or firefighter’s salary for the past 25 years and pay out $10K a MONTH (increasing with inflation) when the guy is 50 years old for the rest of his life.

http://www.pensiontsunami.com/

it’s not clear that davis is doing better than most cities. the numbers suggest davis, while smaller, is actually paying more of its general fund on pensions than other cities.

and the amount we are giving to ffers is ridiculous.

Davis Progressive wrote:

> it’s not clear that davis is doing better than most cities.

I spent the weekend in the Sierra foothills, I didn’t see any pension fund numbers, but many small towns in rural California sure don’t look like they are doing better than Davis with many boarded up homes and business…

> and the amount we are giving to ffers is ridiculous.

The pension database says that former Davis Fire Chief Rose Conroy and her husband Jesus “Jess” Garcia (both retired in their 50’s) and getting a combined pension of over $190,000 a year.

Last month I mailed in my taxes (after filing a 6 month extension in April) and I figured out that if I were to pay off the mortgage on my rental home in East Davis (that is worth ~$500K) I would have cash flow of about $12,000 a year.

It is funny to think about it, but former Davis “public servants” are actually getting more in pension payments than a Davis “multi-millionaire real estate owner” With $7 MILLION (~14-15 nice Davis homes) worth of real estate owned free and clear…

i guess we were not talking about the same thing. i was talking about the city with regards to pensions, you were talking about the city’s health over all.

Davis Progressive wrote:

> i guess we were not talking about the same thing.

> i was talking about the city with regards to pensions,

> you were talking about the city’s health over all.

Pensions and overall health are connected, when a city is growing it can always pay the bills, when a city is shrinking pensions will often take most of the tax revenue. Detroit has a lot of “other” problems but the main reason the city is in BK “today” is that the city has less than half as many “taxpayers” as it had just 50 years ago…

“With $7 MILLION (~14-15 nice Davis homes) worth of real estate owned free and clear..”

Must be tough. Of course you could sell your real estate and buy an annuity that would pay you $190,000 a year forever with that kind of money. You could buy 7 million in treasury bonds even at todays low rates you would get $240,000 a year and your money back at the end of thirty years.

This situation is as inevitable and forseeable as the tide coming in; and doesn’t help give confidence in the wisdom of public officials–idiotic and/or grossly irresponsible to agree to early retirement combined with huge retirement incomes. Of course, by the time the tide comes in on a more than 1-decade timescale, the politicos who caved-in to union over-reach are long-gone; having benefited from union support in boosting their political careers. How can we have confidence in our politicians in properly handling inherently complex and uncertain problems and issues; when they cannot handle something as straightforward as doing the arithmetic on future costs of pension policies, and whether they will reasonably be affordable? Or did they assume the economy and investments would continue to grow in perpetuity at the maximum rates of the 1990s, as though boom times would last forever? Idiotic and irresponsible. Ironically by not agreeing to modest pensions; there is real danger of bankruptcy at which time they’ll be fortunate to recover a small fraction of their pensions. (This is not just a Davis issue, but government pensions at all levels in most locations; city, county, state, federal).