The item did not end until well after 1 am on Wednesday morning. Just as it appeared that the council had an agreement, they decided to take one last break to think about it. When they returned, Lucas Frerichs announced that they had decided to go back to a half-cent sales tax from the three-quarters that had been recommended by a focus group and that had seemed to be a consensus moments earlier.

The item did not end until well after 1 am on Wednesday morning. Just as it appeared that the council had an agreement, they decided to take one last break to think about it. When they returned, Lucas Frerichs announced that they had decided to go back to a half-cent sales tax from the three-quarters that had been recommended by a focus group and that had seemed to be a consensus moments earlier.

The measure would set the sales tax rate at 8.5% for six years. The term would mean that the previous tax measure, renewed in 2010, would no longer sunset in 2016, but would rather extend until 2020 with the rest of the ordinance.

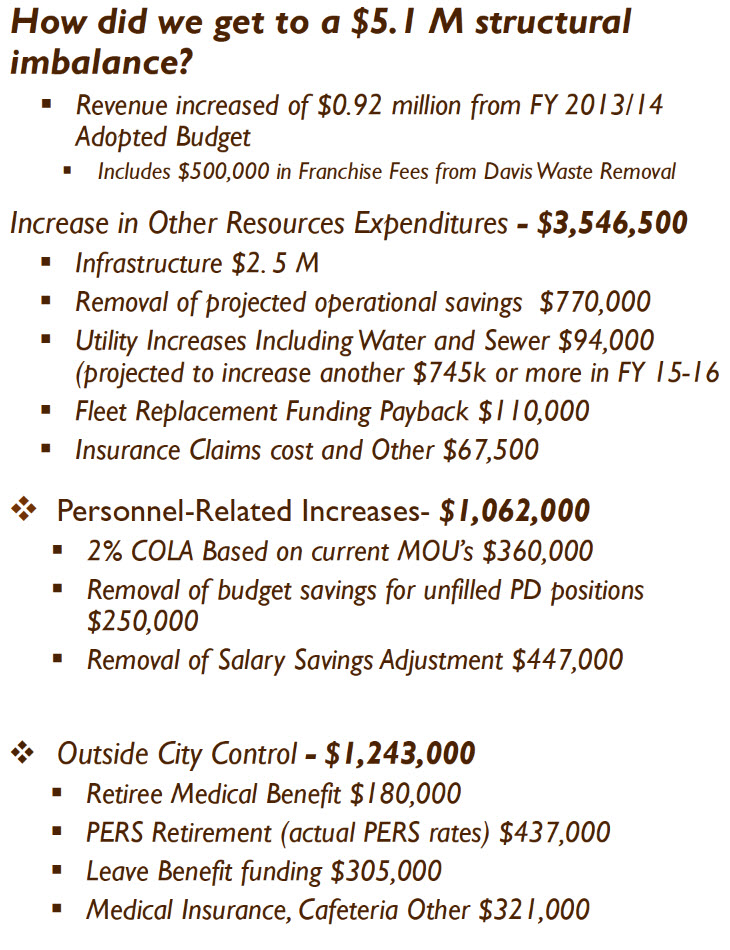

As Joe Krovoza would explain, the half-cent sales tax would only generate about $3.6 million of the needed $5.1 million. The result was going to be that instead of $2.5 million for roads, the city would only be getting $1 million for roads – at least for now.

The council, concerned about the practicality of locking themselves in to specificity, decided to go with no advisory measure after toying with language that would require at least three-quarters of the tax revenue go to infrastructure. After reading expenditure needs, Councilmember Brett Lee argued that such a requirement would not work.

Instead, this council acknowledged, albeit informally, that the money needed primarily to go to budgetary shortfalls and not compensation increases. However, ultimately, they decided against the advisory measure.

The council would go round and round about the timing of the parcel tax and the need for the parcel tax. Mayor Pro Tem Dan Wolk said, “As I said last time, I’m in strong favor of both. I’m not afraid to say it. I think it’s critical. I think this community has the appetite for it. I was the one who brought up the parks tax issues, as a mechanism that could be utilized in June to get at ideally both of these at once.”

Time and time again, he would argue that the parcel tax was the way to gain assurances that the money would be spent on infrastructure needs rather than other purposes. But at the same time, Mr. Wolk acknowledged the need for the council to ultimately speak with one voice and support the consensus 5-0.

Others on the council were concerned that putting both measures on at once might lead to both measures being defeated as the public effectively split their vote between the two.

“I don’t think two in June is going to do it,” Councilmember Lucas Frerichs stated. “I think one of them is going to fail.” He also repeatedly noted that the city has done no polling, a scary proposition given the two-thirds threshold.

Mostly, the council would agree, with Dan Wolk the only member holding out for a parcel tax in June, but willing from the start to accede to the will of the council.

Councilmember Rochelle Swanson would suggest a sales tax in June with the parcel tax no time before November. Councilmember Brett Lee said that he was open, but “I want to be clear that we need both.”

Joe Krovoza stated that he was not in favor of moving toward a parcel tax this fast in June.

While the initial motion was to go to a half-cent sales tax, Lucas Frerichs stated that he was willing to go to a three-quarters cent sales tax but it was not his choice. Likewise, Rochelle Swanson was not in favor of going to that higher amount.

Ultimately, for a time, they all agreed on three-quarters cent but could not agree on the advisory language.

Dan Wolk noted that if we want to increase the revenue we take in and direct it toward infrastructure, “I think the challenge is, is the sales tax measure the route that we take to address those large infrastructure items.” He added, “My conclusion was the parcel tax, even though it was a two-thirds vote, was the way that I kind of came down, because that allows you through a measure to say, ‘hey voters this is what we’re going to do with this money, this is the only thing we can do with this money…’”

Ultimately, that is the route the council took, but instead of putting the parcel tax on the ballot right now, they reduced the size of the sales tax and will put the infrastructure into a parcel tax later in the year.

Councilmember Lee, in the meantime, clarified that belt-tightening did not mean laying off more city employees. “I don’t support lowering the police force,” Councilmember Lee. “It’s nice for us to talk tonight, the problem is that what we decide tonight is what goes before the voters in June. If we think there’s this mysterious efficiency and waste savings that we can make, I’m not comfortable planning what we propose which requires us to lay off ten or fifteen employees. Absolutely not.”

“If someone shows me a plan where we’re able to maintain services and there’s some magic way of reducing this $2 million that we’re talking about, great I’m for it,” he said. “But without a specific proposal on the table which outlines how we’re wasting $2 million, I’m not comfortable with this idea of laying off city employees. Absolutely not.”

While Joe Krovoza pointed out the half cent sales tax leaves you $1.5 million short, Brett Lee responded, “If you subtract the $2 million for the road repairs, the half cent covers all of that. We definitely need a parcel tax to cover the roads costs.”

While it took the council another 45 minutes, they ultimately decided to do exactly that. The half-cent sales tax was put on the ballot. The difference between the $3.6 million generated by that tax and $5.1 structural deficit was offset by again reducing the general fund contribution to roads from $2.5 million down to $1 million and forcing the voters to pass two tax measures this year.

In the meantime, the city has work to do, and the city manager, even if he takes the position in Incline Village, still has two months left and he will be reaching out to the Senior Commission, the Old North Davis Neighborhood Association, the Progressive Business Lunch, the Homeowners Association, Davis Board of Realtors, Rotary Sunset, Chavez PTA, Arrowhead/Bueno Park Homeowners Association, and La Buena Vida Homeowners association in the next two and a half months.

The sales tax will require a simple majority, and the heavy lifting will come in the fall as the city looks at a parcel tax to fund roads and parks, among other infrastructure needs.

—David M. Greenwald reporting

I would like to commend the City Council for moving forward with this necessary step towards improving the financial situation of the city. I also commend them for having the stamina to remain lucid at 1 am.

Surely however, there must be a more efficient way of organizing CC meetings rather than having awards ceremonies, followed by lengthy discussions of marginally related topics, ending with votes of major significance to the entire community.

I know this has been brought up many times, but I thought this extreme example might be a good time to mention it again.

I’ll be voting yes and will encourage others to do as well.

Tia: at one time, I think Mayor Ruth put all awards ceremonies into one meeting every couple of months? I share your comments on the late night meetings.

From my experience, most bad CC decisions occur after 11 pm. I am not commenting on last night’s meeting.

Do I have this right? There won’t even be a resolution where the voters can advise how these monies will be spent? Then the FF and some overpaid staff will get their raises and increased packages from these new tax funds.

Mike, if you watched the meeting you would understand that an advisory vote would be non-binding and a useless endeavor. The City Attorney pointed out that if it were worded in a way that specifically directed where the funds should go, then it would a different type of tax and require a 2/3 approval.

If you watched the meeting, you would understand that the money from this tax will cover the identified deficit in the City’s budget and a parcel tax (which you have previously said that you would prefer) will need to be approved to cover deferred maintenance of roads and other infrastructure. That parcel tax will have a specific allocation.

With the current efforts by the City Council to rein in costs with the Fire Fighters and other employees, I feel that your allegations that this sales tax will go to raises and increased benefit packages is not only wrong, but working directly against efforts to solve our financial problems. Please stop.

Ryan, there is no doubt in my mind that Mike watched the proceedings. I also have no doubt that he understands the City Attorney’s argument. He simply doesn’t trust the Council, and his remarks express that lack of trust.

I personally believe that asking him to stop is counterproductive on two levels. 1) he won’t listen to you, and 2) the more he voices his prediction that the Council will use the money for employee raises and increased employee benefits, the more the members of the Council will focus on how important it is not to give Mike an “I told you so” moment. Bottom-line, Mike is doing us all a favor. He is single-handedly strengthening Council’s resolve.

I think there are a lot of voters that do not trust the Council and city. There is a bit of fox guarding the hen house, but in general, the perception is that government at all levels is incapable of controlling spending.

You can lament this and complain about it, but it is reality. I don’t think you are going to get very far shaming people that do not trust.

The council risks a big no vote on the tax increases for not coming out with an advisory vote at least. The fact that they would not is a bit troubling from my perspective. I think they are trying to hold on to political cards while gambling that the vote will prevail. I am not so sure.

“With the current efforts by the City Council to rein in costs with the Fire Fighters and other employees, I feel that your allegations that this sales tax will go to raises and increased benefit packages is not only wrong, but working directly against efforts to solve our financial problems.”

The Council did a good job with the recent contracts, but they still failed to stop the growth of payroll. Of the $5.1 million projected shortfall, $2.25 million is due to increases in pay and benefits for this year. The simple fact is that nearly 45% of the revenue generated from this new tax will be needed to pay for increases in pay and benefits. In addition, pay and benefits will continue to rise next year such that nearly 90% of this tax will be eaten up by those expenses.

This tax increase does not solve the problem, it just gives us a little more time to put a comprehensive solution into place. The Council will need to stop the growth in payroll, which means cutting $2.25 million out of total compensation this year, and a similar amount next, either through outsourcing or staffing cuts. We will also need a new parcel tax, probably much larger than the amounts talked about last night, continued reductions in expenses across the board, and a robust actions to boost economic activity in town.

The next couple of months will be critical. If the CC pushes forward and acts to put a comprehensive solution in place, then I think we will see little opposition to these tax measures. If instead they act like they have already solved the crisis and don’t need to do anything else, then I expect the opposition to the tax measures will increase significantly.

I wrote the above thinking that the tax would bring in the $5 million total…I blame it on the late night and lack of sleep.

Since we are only projecting $3.6 million increase in revenues, 63% will used to pay for the increases in compensation costs this year, and all of it will be required for next year and we will still be a $1 million short.

“Of the $5.1 million projected shortfall, $2.25 million is due to increases in pay and benefits for this year.”

While true, let’s look at that more closely.

$360,000 of that came from a COLA. That’s probably the portion that the city actually had control over. The city did this in a trade off for structural changes to pensions and health care in the course of bargaining.

$250,000 for removal of unfilled PD positions – so we hired police to fill positions that were vacant.

$447,000 salary savings adjustment – that’s because Fire and DCEA held out for their contracts and the city had to pay more than budgeted.

The other $1.243 million is outside of city control.

So based on that analysis, I think your analysis is wrong. The city could have kept police short handed, they had little control over DCEA and Fire holding out. So that really leaves $360,000 in question.

David: It doesn’t matter why the expense is rising, just that it is. The City can control the amount by either doing a better job negotiating, or getting rid of employees. The City should have analyzed needs, and made reductions in staff based on priority, which could well have included laying off someone in parks or the CM’s office, in order to hire a police officer. That was entirely under the City’s control, yet they decided instead to allow attrition to control the day. They cannot use their poor planning (or poor contract negotiations) to justify the continued rise in total compensation.

The facts remain the same. The new sales tax will be used to pay for increases in salary and benefits that the CC had already approved.

As I’ve presented a number of times, the council in 2009 made it impossible for the current council to go further than they did.

Not impossible, just more difficult.

In my view, council went as far as they could this time, seven groups declaring impasse would have not worked from the city’s perspective.

Doesn’t really matter. What they didn’t get in the contracts they will just have to get by reducing the workforce. Every job, from the CM on down, needs to be evaluated for the potential for either being cut outright, or being outsourced.

It doesn’t matter that Brett Lee doesn’t want to layoff more employees. That is what needs to be done. Last night was easy, now is when the heavy lifting starts.

I was hoping to be there for this discussion, but when at 8:00PM they were still discussing Item B on the consent calendar I decided it wasn’t in the cards. Now I have to decide what to watch when folding laundry, Jon Stewart or the 5 hours of the council meeting I wasn’t there for.

Once again pretty badly mishandled meeting. Too much on the agenda. Items that didn’t need to be heard last night were given priority. I’ve often suggested that ceremonies be given their own night rather than take up prime time for councilmembers when they are most fresh.

“Now I have to decide what to watch when folding laundry, Jon Stewart or the 5 hours of the council meeting I wasn’t there for.”

Tough choice, they’re both pretty good comedy.

I know, maybe I’ll switch back and forth, I do have ALOT of laundry….

I watched the whole thing…..and when they were talking advisory, the slide about deferred compensation was up on the screen. No one mentioned it but it seemed some of the sales tax WILL be going to salaries, just not raises?

We need to understand this. If true I will vote no and encourage everyone else I know to do the same.

The council took a break — together? — and upon return announced a decision? Which provision of the Brown Act allows that?

I was thinking the same thing Jim. Maybe they all had an epiphany at the same time?

They didn’t did discuss it during the break amongst themselves.

“Didn’t did”?

They didn’t discuss it…

I think you are going too far with your application of the Brown Act. Are you an attorney? Attorneys seem to frequently lose the context of the laws that they battle over. The Brown Act does not prohibit communication between council members. As the courts have stated, the purpose of the Brown Act is to facilitate public participation in local government decisions and to curb misuse of the democratic process by secret legislation by public bodies.

Take a chill pill on the Brown Act claims please.

Jim, based on my observation of the flurry of activity, Lucas was the person driving the discussions during the break. I have to assume he knows the Brown Act inside and out. So, I doubt there was a Brown Act violation, unless his zeal overwhelmed his knowledge. I was about to talk to Rochelle when he came over and asked her to join him in the Council support room behind the dais. They headed off together and talked behind closed doors for a while. I got involved in another conversation, so I didn’t see whether that pattern was repeated.

Frankly is probably right that since this was clearly an open public meeting the Council members are pretty much free to talk to one another in the process of the unfolding of the meeting.

Confused. How is a private conversation in the back room considered an open public meeting?

If the open public meeting exists, then there is no Brown Act violation.

Are you making a case that no two city Council members can ever talk about any policy issue without it being on the agenda and in session?

That is more than absurd.

Can we all use some common sense please?

“If the open public meeting exists, then there is no Brown Act violation. ”

That’s untrue, if council is not in session, it is not a public meeting.

The purpose of the Act is to ensure that the public has an adequately noticed opportunity to be present during all discussion, deliberation and decision-making that involves a majority of the body. If any of that activity takes place during a break, neither the rule nor the spirit of the law is being followed.

I wasn’t concerned that some nefarious intent was present in Tuesday’s situation, I just wanted to make sure that the Council wasn’t getting too casual about observing the terms of the statute.

It looks like this was a false alarm, the result of my misinterpretation of what was reported. I did get a nice call from one of our council people, assuring me that all was well Tuesday night.

Actually I’m not sure a lot of the Brown Act and common sense go together.

Irrelevant of the Brown Act, a private conversation is not the same as a public meeting, just making that distinction.

Update: One of the Council members reached out to me this morning and pointed out that the Brown Act partners for that item last night were Dan and Brett in one partnership, as well as Lucas and Rochelle in a second partnership. Joe was the Brown Act “stand alone” for that item. So as long as neither of the “partnerships” communicated outside their ranks, no Brown Act issues would have ensued.

So Brown Act partners are allowed to meet privately.

I watched. Yes, it was late. I thought the conversation was very thorough and I feel that the Council is right on board with how the community feels about the money being used for infrastructure and deferred maintenance and not directed toward employee raises. We know that we need to raise 5.1 million. The sales tax will not do it all and we will probably be asked to approve a parcel tax next year. The advisory vote would be non-binding anyway so it is an unnecessary action. The community needs to see the City’s budget summarized in a way that we can understand all of our obligations to be able to confidently approve a parcel tax. I felt that the discussion mirrored the discussions I’ve heard all over town, including this blog.

I will be voting Yes on the sales tax and hope that there is not a significant campaign against it.

“The council, concerned about the practicality of locking themselves in to specificity, decided to go with no advisory measure”

This is unfortunate. I think it might cause me to vote no and encourage others to do the same.

We should absolutely demand that this and every council get locked into specificity since there is ample evidence that the body is incapable of controlling their urge to spend it on things that advance their political careers.

First, let me say that this is a good piece of reporting. Good job.

Secondly, I will be voting no because of the amazing fact that Personnel costs for the city are going up by $1,062,000, as shown above.

The city has still not stopped increasing employee costs, despite all the actions they took. Why should there be a 2% COLA when most Davis residents are taking pay cuts and paying higher fees and taxes to the city?

David keeps telling us that the Davis citizens are partially responsible for the mess we’re in because we didn’t pay attention in the past, and so we have an obligation to pay for past decisions.

Well, I’m paying attention now and noticing current decisions are still increasing costs unnecessarily.

Vote no.

Long but worthwhile council discussion. The tax will have my vote. Based on watching the meeting, I think foregoing the advisory measure was the right decision, but I hope opponents don’t try to make something out of nothing, pointing to that. Kudos to the whole council for emphasizing unanimity at the expense of their bedtimes, and I thought Krovoza played the role of mediator very effectively.

I agree Day Man, in the end unanimity was very important. Another thing to thank Dan and Brett for. They fought for what they believed was right, and then did what was best.

As Tuesday ticked over into Wednesday and the discussions continued, I felt like I was watching the late stages of the 4th Quarter of an NFL game where one team has a 4 point lead and their actions on the field scream out “We are playing not to lose” rather than clearly indicating that “We are playing to win!”

With the exception of Dan, all the initial discussion last night was about the palatability of the possible solutions for the voters, as well as the devices (like polling) that are used by politicians in order to manage the voting process. Dan, to his credit, focused on the problem right from the start. He (joined by Brett later in the discussion) clearly articulated the fact that even at 3/4 of a percent the Sales Tax was at best a partial solution for the overall problem. He also pointed out that at a half percent there would be virtually no dollars for addressing the infrastructure/roads issues that are a core component of the problem. He was arguing that we should try to win, rather that to try and avoid losing.

Brett expanded on Dan’s argument by showing how the numbers in the slide that David has included in this article can only match the $3.4 million that a half cent Sales Tax will raise if $1.7 million of the $2.5 million Infrastructure amount is removed from the Budget. The $800,000 that will be left isn’t going to even be enough to fix the burgeoning number of potholes, much less actually rehabilitate any of our crumbling streets.

Fire Chief Trauernicht, in a recent discussion with Council Candidate Robb Davis, characterized the City’s fire stations as being “in terrible shape” with substantial capital repair needs. Those buildings and structures issues can’t be addressed from the $800,000. They will have to be “deferred.”

For me, the sad part about last night was that the Council didn’t trust the voters, and took the right to choose out of the voters hands. They expressed a fear that the voters would vote down a Parks Tax if it were placed on the June Ballot. What harm would that outcome have created. Te voters would simply have chosen more potholes over more taxes. At least they would have had the opportunity to choose. The Council decision last night took that right to choose out of the voters hands. Dan Wolk clearly stated that he trusted the voters to make a decision that was in their best interest. Kudos to him for that.

I’m not sure which of the following two ideas I dislike more.

The idea that council was not willing to lay it all on the line and put both tax measures on the June ballot because they think voters can’t be trusted.

Or that they were right in doing so, because voters indeed can not be trusted.

“Or that they were right in doing so, because voters indeed can not be trusted.”

Or maybe voters feel that they can’t trust the council? Or maybe voters feel that if the council is coming after them for two new taxes and at the same time throwing $1 million at studying a POU that they really don’t have the funds for they just might have to vote no. So in actuality, maybe voters can be trusted to do the right thing, all depends on how you look at it.

They weren’t deciding on wether the tax should be implemented, they were deciding on wether or not to let voters decide. Why not out lay everything we need out on the table and let voters decide if they want to pay more, or by not paying more accept the consequences. . They took that decision out of the voters hands. I’m questioning their wisdom in doing so.

G.I., those are all important alternatives to consider, but last night the voters were on the outside looking in. Any say that the voters might have on the issues being considered was somewhere in the future. Therefore:

— whether the voters feel that they can’t trust the council was a non-issue for the span of time of the Revenue Measures item.

and the fact that some

— voters feel that if the council is coming after them for two new taxes and at the same time throwing $1 million at studying a POU that they really don’t have the funds for they just might have to vote no, was also a non-issue for the span of time of the Revenue Measures item..

Why? Because whether the voters voted yes or no on the Parcel/Parks Tax, the vote could do no damage to the City. Either way it would be the will of the people. A “no” vote would have been an expression of that will. A “yes” vote would have been an expression of that will. Either way, the will of the people would have been expressed. This way, that will has been denied its voice. Are you happy that your voice has been denied the opportunity to be heard?

But won’t your voice be heard in June when you vote?

IMO it is misleading to the public to put a sales tax on the ballot that does not come close to covering the expenses the city is incurring, unless it comes with some serious public outreach explaining to people that it will only cover a portion of the structural imbalance, and that it will not address the deferred maintenance cost we are currently aware of (much less the ones we have yet to discover).

Parsing this out in small pieces may make it more palatable in the short term, but my guess is that if people are not informed in advance that more tax increases will be necessary, and/or services need to be cut it’s going to leave a bitter taste in people’s mouths, leading to further distrust of our elected officials.

Frankly, your voice would indeed be heard when you vote in June … if you were afforded the opportunity to vote in June … but the Council decision took that opportunity off the table for the voters. Said another way, no ballot measure = no opportunity to vote.

What I dislike is that you imply that voters who don’t agree with you cannot be trusted.

Not trying to imply that at all (but see how it came across that way).

Clearly a half a cent sales tax is not going to address the fiscal needs of our community. Not asking for what we need does not seem an appropriate path to take.

So why did council go this route? What are the implying about voters by not laying out exactly what our options are on the ballot? Are they implying that voters are not capable of fully grasping the economic situation are city is in and thus cannot be trusted to make decisions based on this reality (wether it be increase sales tax or cuts in services) ? Did they make the right call? Are they correct? Can we not trust our voters to do this?

Again I’m not sure which idea I like more, that they think this, or that they may be correct.

^disiike more^

Or maybe it wasn’t about what the voters would like or not and more about lowering the sales tax a little to try and placate the the downtown businesses?

Personally, I feel the .75% tax would’ve passed easily, it was the council that punted.

Well said G.I. Well said.

Regrettably, an informed decision, let alone an informed discussion, is not possible at this time. The reason for that is that the entire process over many months has been entirely lacking in transparency. The community has not been provided a full set of coherent facts. For example, does anyone know the cost of immediately and fully addressing the roads and bike paths backlog? Is it even possible to obtain the funding to immediately and fully address the backlog? What is the amount of the maintenance backlog for other city owned infrastructure? Does anyone even in the city government have a coherent set of facts?

It’s awfully difficult to assess proposed solutions to problems when the extent of the problem is unknown. The only things we do know is that the community has only been shown a small portion of the problem and the proposed solutions fall way short of addressing even that.

It’s as if someone has screamed “jump” and some people are now jumping different heights, in different directions, while others are saying “huh?” or “did someone scream something?”, etc.

We know decisive action is long overdue, but the required action has not been proposed. In my mind, the prepared comments delivered by Robb Davis last night to the City Council come closest to properly framing the dilemma.

-Michael Bisch

Michael, your comments above are 100% in line with what Robb Davis said in Public Comment last night.

I too concur with both you and Robb.

Can Robb post his comments? I missed the meeting. Had real work to do so I can pay my taxes.

David posted then on Facebook as well as Sheila Allen’s.

Right here: https://davisvanguard.org/city-council-candidates-and-other-community-voices-on-tax-measure/

Thats easier, plus transcription…nice.

I will add, that instead spending time and energy polling voters to see whether they would approve a tax measure, I’d prefer the city spend their time and energy and resources educating themselves and the public on the actual fiscal needs of the city.

that’s part of what polling does.

Not at all DP. The polling that Lucas was talking about was polling about the level of pain that people would be feeling from the taxes proposed. That polling would only be about the solution.

The information we are missing about the size of the problem will never come from a poll response from a citizen. it has to come from the City Finance Department based on 1) input from all the other City Departments and and 2) policy guidance from the Council and City Manager.

How can an accurate poll be conducted if people do don’t fully understand the economic situation the city is facing?

Maybe a poll should be conducted to see what people know, and if they fully understand the consequences they we be facing if and when the city can’t pay it’s bills.

We have not been informed of the actual revenue picture or the actual deferred maintenance issues. I just hope the city council had more information than the public as they made their decision.

Michelle, that’s precisely the issue. See my post further above.

-Michael Bisch

Joe ran a really good meeting last night.

he ran a horrendous meeting. he pushed the must do items off until after 11 pm. the budget/ tax discussion was completely disjointed. lucas and dan and to a lesser extent brett took over the meeting and ran it far more effectively.

I lost, but he correctly moved up my appeal of a planning issue to early agenda position so those nice people could go home . I’m on the East Coast for work so could not attend.