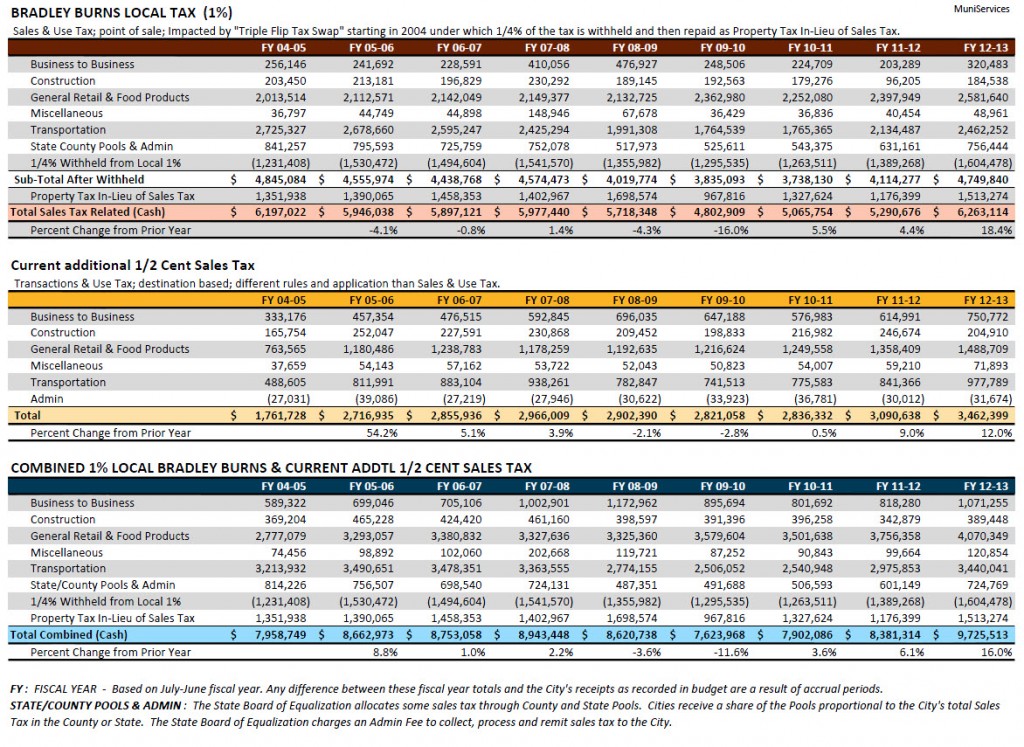

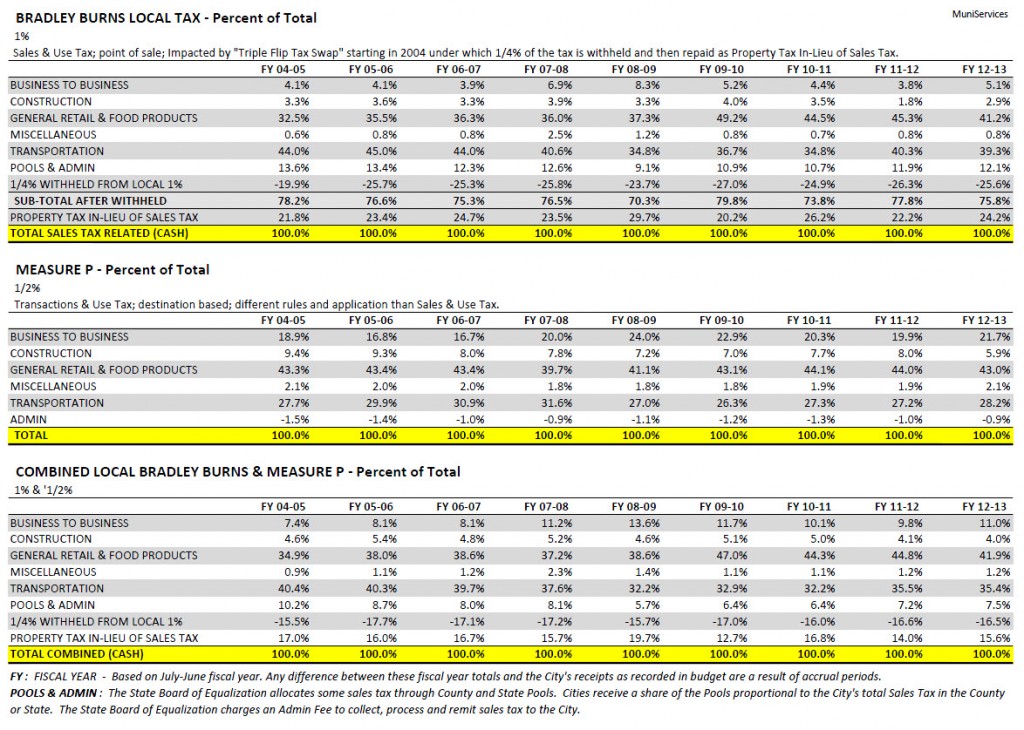

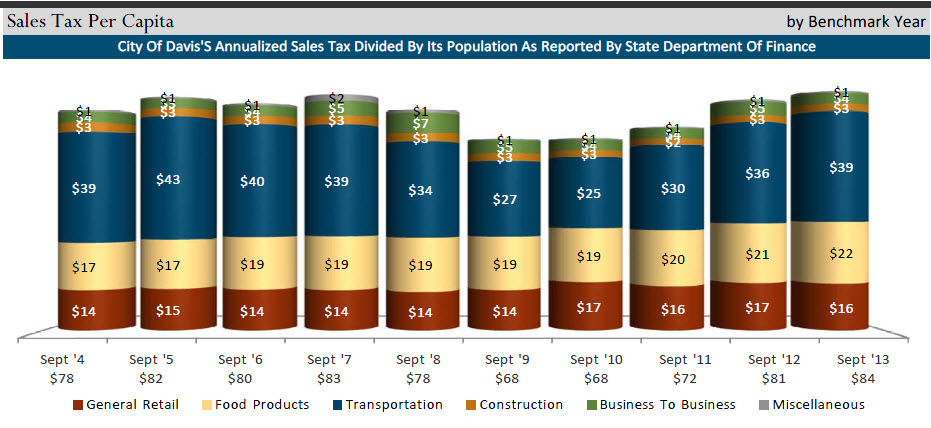

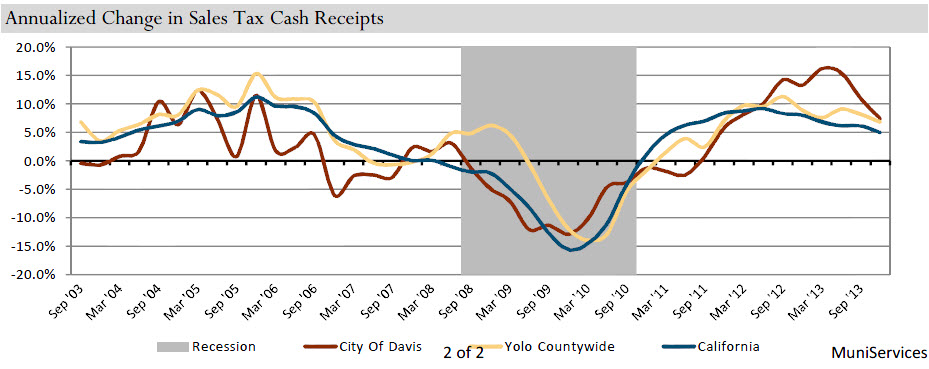

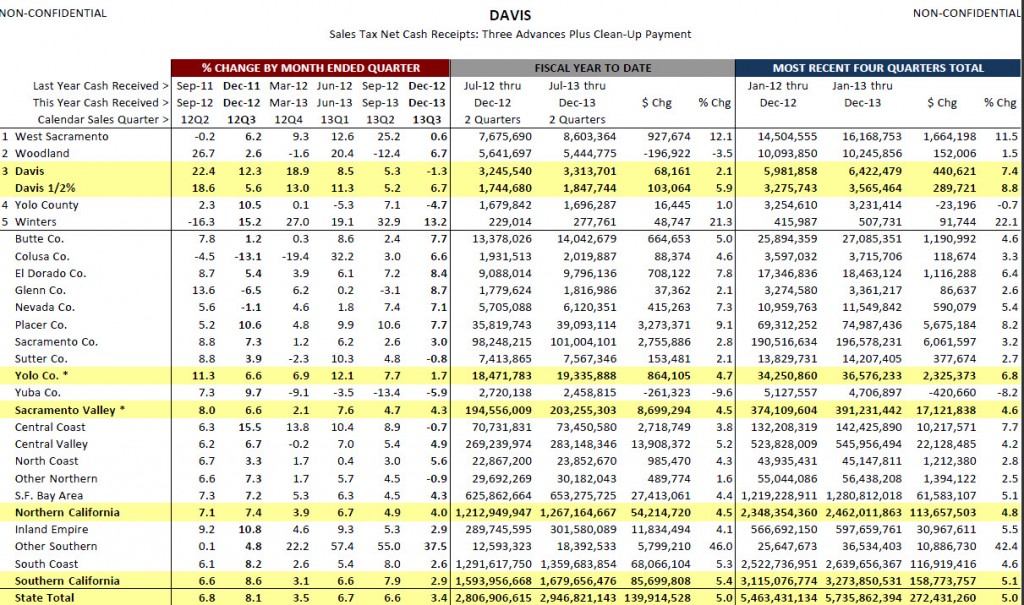

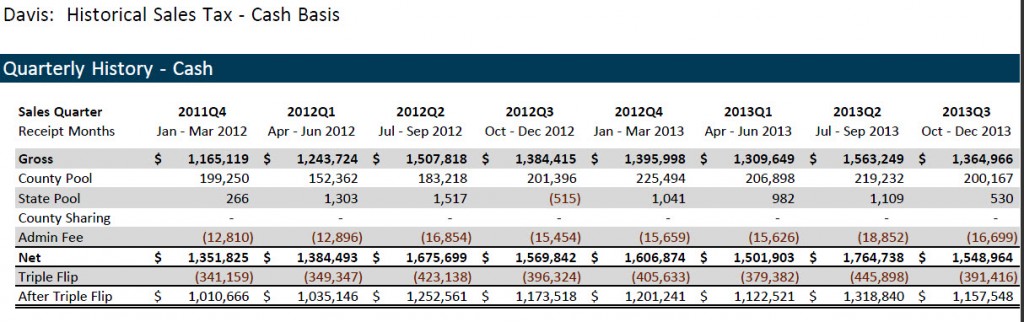

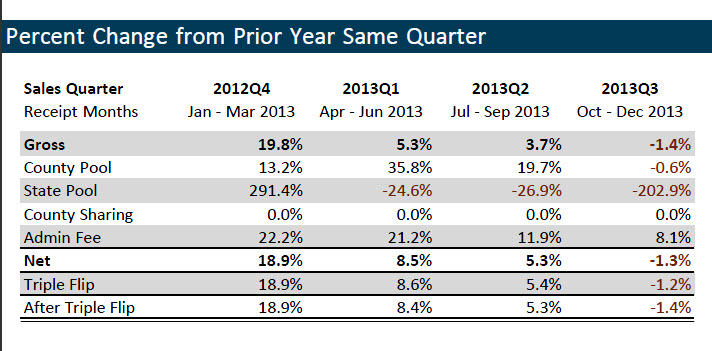

There have been repeated requests from the city to provide sales tax data. We present the data here in graphical forms. The first set of data is the Davis historical sales tax numbers since the adoption of the half cent sales tax in 2004. This is the greatest level of detail that the city can publicly disclose.

There have been repeated requests from the city to provide sales tax data. We present the data here in graphical forms. The first set of data is the Davis historical sales tax numbers since the adoption of the half cent sales tax in 2004. This is the greatest level of detail that the city can publicly disclose.

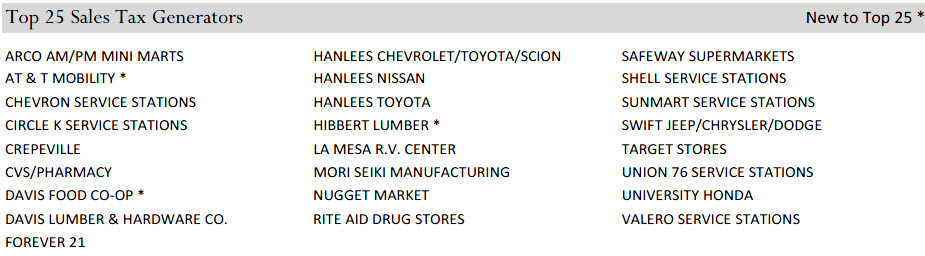

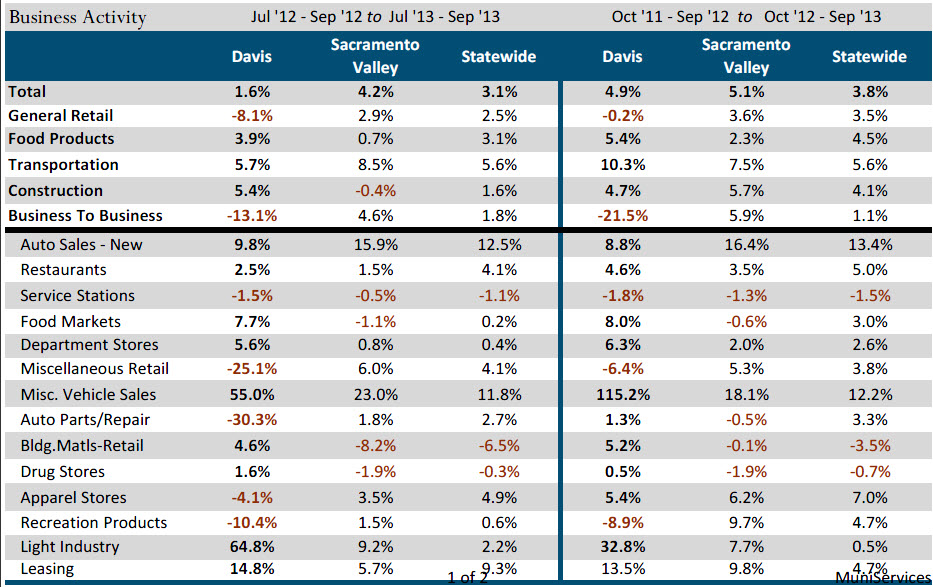

The second set of charts go from October 2012 to September 2013. While these are six-month-old data (at their newest), at least it provides a breakdown of top 25 sales tax generators, business sector activity and much more.

Be sure to click on the graphics to enlarge.

Thanks David – There is enough data here for lots of good discussion and learning in the days ahead. A few quick questions:

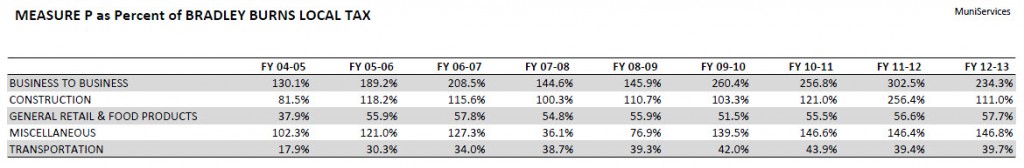

1. In the chart “Measure P as a Percent of Bradley Burns Local Tax” why would something like “Business to Business” be have such a higher percentage than general retail (for example)?

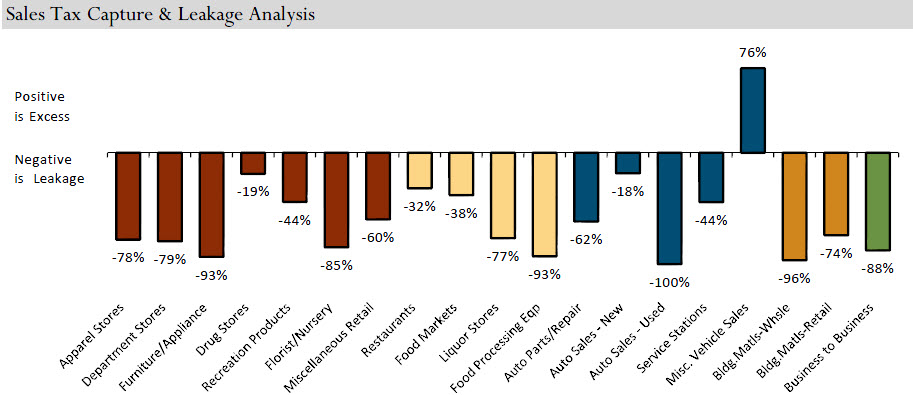

2. This may have been discussed before on the VG but what is the methodology used to assess sales tax leakage? What exactly does it mean in this context?

3. An observation more than a question: Given that food is not taxed (speaking of grocery not restaurant), it is interesting that three supermarkets are on the chart of Top 25 sales tax generators. What drives that? Alcohol sales, non-food items? Interesting to me.

I will be interested to look at how the most recent four quarters sales tax totals suggest in relation to the City Manager’s projections of revenue in his budgeting projections. Thanks again.

The top 25 sales tax generators is the most fascinating thing posted on the vanguard in a while. Car dealerships are no surprise, but 7 gas stations? And Crepeville generates more sales than In-n-out burger and all the fast food restaurants in town? Go figure.

And just to tack on to Robb’s question, I assumed Mori Seiki would generate virtually no sales tax because they sell their product globally. But here they are in the top 25. Anyway we can combine the estimated property tax with the sales tax? It must be quite a bundle, and a strong argument in favor of more non point of sales businesses like it. Thanks for the article.

Daniel–I thought the same thing. Gas stations! I am assuming that is in-store products and not gas? Is there a local sales tax on gasoline? I wonder if Crepeville includes the other restaurants owned by the same person which includes Burgers and Brew and the restaurant the name of which I am forgetting, on 3rd by the Post Office.

R. Davis: the restaurant the name of which I am forgetting, on 3rd by the Post Office.

El Toro Bravo?

The asterisk in the list of top 25 sales tax generators indicates a new business to the list. I wonder which businesses may have fallen out of the top 25.

There is a sales tax component to gas sales – the more the sale price goes up, the better for revenues. Sadly, this is the opposite effect than what the Davis community would like to see… i.e. the more hybrids and electric cars driven in and around Davis, the lower our revenue goes from sales tax on gas. And the amount generated can be significant, as you can see here.

I can look in to Crepeville’s recording of sales tax. It shouldn’t be combined with Burgers and Brews and El Toro, as these are separate businesses, but sometimes the owners combine their business lines in to one corporation.

For most cities, the most lucrative sales tax is typically business to business. This is because a significant amount of goods transfer between entities in the supply chain. It is taxed at the end use. This is one reason Mori Seiki pays a significant sales tax component, because it is an end user of raw materials. It also paid significant sales tax on machinery purchased as it opened up its manufacturing plant.

Grocery stores collect sales tax on prepared foods. Therefore, grocery stores with significant deli, coffee, and prepared food counters are good for the city’s revenues.

Thanks for the clarifications Rob. Very helpful.

Rob,

Thank you for your clarification. Paying sales tax on the machinery they purchased makes a ton of sense and would explain why they might be higher the first year than in years to come. Do you have any estimate on what you expect Mori Seiki to generate from raw materials in future years? Or is that info not available to the public… (It should be!) Thanks Rob.

DP

I can’t give you specific data (it’s illegal under California law), but I can tell you that I expect that as they continue to add new manufacturing lines, it will likely be about 50% to 60% of what it was at the high. And don’t forget, they also pay a property tax (on unsecured property) as part of the ongoing costs for the large machinery. This is of course depreciated over time, but the good thing about technology is it requires companies to reinvest often to keep up with the latest best practices.

In the case of business to business, unlike Bradley Burns (1%) sales tax collection, Measure P (0.5%) is a transactional use tax and records to Davis when materials or equipment is shipped to Davis, even when the 1% records to another jurisdiction. This is a massive oversimplification, but you get the idea. The reason for the significant difference in business to business is that there are lots of tax origination deals that have been made with companies to locate in a specific city. As an example, Ontario has a vast amount of supply companies that located in Ontario specifically for a tax rebate. But if these items ship to Davis, the 0.5% Measure P amount comes to Davis regardless.

Tax leakage is a very simple calc. The amount of goods in a certain category are determined based on zip code of purchaser versus zip code of purchase. When you buy your landscape materials at Home Depot in Woodland, your furniture at IKEA in West Sacramento, or your pet supplies at Wal Mart in Dixon, you are “leaking” those sales tax collections to other cities. Ever wonder why you are asked for a zip code at a store when checking out? Ever wonder what happens to the data on your card each time you swipe it in the terminal? Now you know. There are several companies that can do a very specific study on this leakage. I used one in Livermore (company called Buxton – at http://www.buxtonco.com) to determine types of retail we wanted to target for the new retails centers and downtown. These are called analytics based on psychograqphics, and they are very detailed and discuss the major types of shoppers and their habits. BUT, this data is only useful if we plan to recruit for retail, which has so far not been the case. A typical leakage study costs about $70,000 to $100,000.

I think we should get the data and use it to figure out who is going to Dixon for pets supplies, and Woodland for landscaping material and then shame them for not buying local;-).

Thank you, David, for providing this data. This should be part of an annual income/expense budget report prepared by the City not just for the City Council and appropriate commissions, but for Davis residents/taxpayers. Such a report should include at the least the past and current year fiscal year for comparison, as well as the proposed budget for the next fiscal year. After readers digest the information you’ve provided here, the level of detail needed in this public report can be better discussed.

Such a public report would then be available along with other data for discussions in particular about economic development, but also if Participatory Budgeting is implemented in Davis, what portion of city income might be allocated to the PB process with citizen participation.

May want to take a look at this:

http://www.californiacityfinance.com/index.php

This has a section on sales and use taxes which should help to answer questions about sales tax data.

In particular, this page:

http://www.californiacityfinance.com/CityTrUseTax.pdf

Big thanks to city staff for compiling and providing this information!

No city sales tax before 2004? I bet if Costco were located here, that would have solved a lot of the “leakage” categories.

The UCD Bookstore isn’t in the top 25?

UCD Bookstore isn’t in Davis.

You are correct. But UCD has opened up a storefront in Downtown Davis, and suspect they skirt not only sales tax, but property tax for their landlord, who I believe is represented by one of the Vanguard’s advertising sponsors.

I am wondering if we know how much money is generated by tobacco sales.

Tia: I don’t know if regular sales tax is charged on cigarettes or other regulated tobacco products. Below is a link to the California Board of Equalization pdf about California tobacco taxes: http://www.boe.ca.gov/pdf/pub93.pdf