Fiscal Year 2014-2015 Proposed Budget Released

(from Press Release)

The City of Davis released the Fiscal Year (FY) 2014-2015 Proposed Budget and posted it on the City website www.cityofdavis.org . Hard copies will be available next week at the library, senior center, Davis Chamber of Commerce and city hall.

The FY 2014-2015 Proposed Budget is scheduled to be presented to the City Council on June 10, 2014, with the adoption scheduled for June 24, 2014.

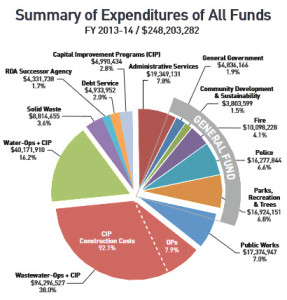

The City’s overall budget is $196,146,382, which decreased by approximately $88 million from FY 13-14, mainly due to the removal of capital funds for the wastewater project. In total, the proposed budget has 428 full-time equivalent staff positions, with the equivalent of vacant 5 positions eliminated.

The General Fund is $48,133,841 of the overall budget and is balanced by using $4.2 million from reserves. Although the Proposed Budget already incorporates $1.2 million in reductions, the current structural deficit needs to be addressed and highlights the gap between revenues and expenditures. To begin tackling the issue the City Council placed an additional ½ cent sales tax measure (Measure O) on the ballot which will raise $2.7 million in FY 2014-2015 and $3.6 million annually, thereafter. Without new revenue, the City has to draw down on its reserve and/or make reductions; this is not sustainable. In the event Measure O does not pass, major program areas, such as community services, transportation, public safety, planning and building and administrative services, will have to make additional reductions upwards of $4 million to programs and staffing.

The City is working on long-term solutions to the General Fund deficit, which include advancing economic development endeavors compatible with community values and continued review of operational efficiencies.

City Of Davis Launches Advanced Financial Transparency Platform

Cloud-Based OpenGov.com Enables City of Davis to Engage Residents by Inviting Them to Explore Financial Data on the Internet at http://davis.opengov.com/

The City of Davis and OpenGov.com announced the deployment of a powerful new tool that visualizes the City’s financial data. In conjunction with the release of the 2014-2015 Budget, citizens and staff can use OpenGov’s web-based software to enhance access, understanding, and analysis of the City’s annual budget and historical financial information. This partnership supports the City of Davis’s goals of demonstrating ethics, performance management and transparency.

In an effort to promote understanding and communicate information more effectively, the City of Davis initiated the partnership with OpenGov.com. “The budget and financial data explain how the City operates and what the priorities are,” said Joe Krovoza, Mayor of Davis. “OpenGov is a powerful solution that makes accessing and understanding this information easy for both citizens and staff.”

City of Davis Councilmember Lucas Frerichs added, “Communicating and sharing financial data is often a challenge. Budget books, spreadsheets, and PDFs have their place, but aren’t the best means of disseminating information across the government or to citizens. OpenGov’s web-based platform allows visitors to explore the finances from anywhere, at any time.”

“The City of Davis joins a growing number of governments across the country who are leading a movement towards financial transparency,” says Zachary Bookman, CEO and co-founder of OpenGov. “With the financial data readily available to residents and staff, the City is improving efficiencies and building trust and engagement in the community.”

About OpenGov, Inc.

OpenGov offers web-based software for state and local government finances. The OpenGov Platform provides instant access to the budget and visualizes current and historic revenue and expenses—from multi-year trends to object-level details. Government officials and citizens use the platform to understand, analyze, and share the data. OpenGov is an International City/County Management Association (ICMA) Strategic Partner. Learn more at http://opengov.com/

City Manager’s Transmittal

Honorable Mayor and Members of the City Council:

Introduction

Presented for your consideration is the proposed Annual Budget for Fiscal Year 2014/2015, a period that covers July 1 through June 30. The Budget is the primary policy document adopted by the Council that establishes the service levels and capital projects to be provided to the community by its city government. It establishes the financial and human resources devoted to accomplishing community goals and objectives as reflected by the City Council. It provides a logical structure to organize its various programs, projects and other expenses. It provides a sound system for control of its revenues and expenses. Finally, it is a document that is widely available to the public and others interested in the operations of the city government.

The City began experiencing significant general fund budget problems in the latter half of last decade. Since then, the City has eliminated 110 positions, which represents almost 24% of the current workforce. Its effects may not always be evident to the public, but it is fair to say the City’s service levels have been affected and the city’s ability to fund capital expenses has also been diminished.

Even with the extreme attention applied to City finances the past several years, it is apparent that the improving economy is not going to solve the City’s seemingly perpetual budget problem. This came into sharp focus with a December 17, 2013 staff report revealing that if the City continued its existing service levels with no significant new source of revenue, its general fund reserves would be completely extinguished by the end of the FY 14/15 budget year. The term used to describe this persistent deficit is “structural budget deficit,” a situation that assumes that service levels and their cost structure remain fixed and there are no new significant revenue sources available. At that time, the structural budget deficit was estimated at about $5 million. Allowing the reserve to be extinguished is unthinkable as it would negatively impact the City’s credit rating; it would provide no margin for dealing with contingencies and emergencies; and it would result in more major reductions in FY15/16 and beyond.

On the topic of the budget, over the past five months there have many public meetings and more than two dozen meetings with the community and business leaders. The general consensus is that the City needs to have a long-term financial strategy which would include, but not be limited to, continuing to pursue cost-control measures; investigating alternative revenue sources; and supporting economic development activities which are compatible with community values.

After hearing from community and business leaders, City Council placed a % cent sales tax ordinance Measure 0 on the June ballot. If passed, Measure 0 would generate an estimated $2.7 million in FY 14-15 and $3.6 million annually, thereafter. Its status is not known at the time the Annual Budget is released, but it may be known shortly thereafter if the vote is decisive one way or another. Obviously this will have a material impact upon the forthcoming budget deliberations.

If Measure 0 fails to pass, the impact of not having the new sales tax revenue available will require significant expense reductions beyond those already identified within the proposed Budget will need to be considered immediately. At Council direction, staff is prepared to present budget reduction options.

This proposed Budget follows the direction given by the Council as discussed above, with emphasis on assuring the long-term fiscal stability of the city government. The following is a list of actions included in or related to the proposed FY14/15 Budget:

- General fund reductions of $1.2 million have been built into the proposed Budget. In April, staff returned to Council with updated financial projections and reduction lists totaling $5 million to address the structural imbalance. Of this amount $1.2 million in cuts were recommended by staff, endorsed by the Council and included in the FY 14-15 Proposed Budget.

- Additional % cent sales tax measure on June 2014 ballot. Technically the proposed Budget has been constructed without including the $2.7 million in revenue that would be available if Measure 0 is approved by the voters. The expenses have not been adjusted to include the reductions that would otherwise need to be recommended to avoid the reduction of nearly $4 million of the general fund’s reserve. Council previously gave general direction about the nature of the cuts that would be considered, but there was no direction to implement them commensurate with the approval of the Budget. In the event Measure 0 is defeated, staff will seek immediate guidance regarding the scope of the cuts that would be implemented in the first quarter of the fiscal year. The estimated target for the cuts is projected in the $3-4 million range.

- Growing revenues with economic development activities which are compatible with community values. The revenue focus group and other community members indicated that it was important to pursue compatible economic development activities to provide a stable source of income for the City. Recently, the Council approved issuing a Request for Expressions of Interest in developing innovation center proposals. While achieving the economic goals and objectives is critical to achieve sustainability of City finances, this has a long-term impact that would roll out over time. The reality is that this will have little impact over the next several budget years. This is why the City is exploring alternative revenue sources in the meantime.

- Update User Fees and Policies. Funding is in the Budget to study user fees and identify the fees that could be adopted to achieve full cost recovery. It will be up to Council to approve any revised fees. Along with this effort will be a review of fee policies to determine whether any subsidies exist and in what cases subsidies may be in order. Given the fact that user fees haven’t been thoroughly reviewed in many years it is likely that there are some significant subsidies being given, perhaps in areas where the Council would want to strive for full cost recovery, such as development processing fees. This is an important element for improving the City’s revenue base and needs to be given high priority.

- Proposed Legislative Changes. Recently AB 2372 was introduced which, if adopted, will raise an estimated $73 million statewide. It proposes to close a loophole in Proposition 13 which some corporations have used to avoid a reassessment when property changes hands. The fate of this is uncertain and the revenue impact in Davis is unknown, but if enacted it could be a positive revenue development.

- OpenGov Launch. Providing information about the City’s finances and budget is important to enhancing transparency about City budgeting and finances. The release of OpenGov software, which is now available, will allow the community to see past expenditures as well as those that are planned. Also, this document contains more expenditure detail than in the past.

- Street/Bike Lane Infrastructure Budget. Council decided last fiscal year to include a $500,000 allocation to fund a maintenance program for streets and bike lanes. In the proposed Budget, the allocation has been increased by $2.5 million to $3 million in General Fund support in the upcoming year. When combined with other funding, the City will be addressing a total $4.7 million in street and bike lane improvements in the proposed Budget.

- Water Conservation in Parks and Greenbelt Facilities. Water costs have been budgeted at $1.5 million with offsetting estimated revenues of $600,000. To offset increasing water costs the sum of $500,000 has been budgeted to continue the ongoing water conservation efforts to reduce consumption and to be more water efficient.

- Measure P and the New Surface Water Treatment Facility. Measure P proposes repealing the new water rate structure that was adopted to fund the joint water project with the City of Woodland. The proposed Budget assumes that the current rates stay in place, though recent Council action changed that direction and rates may be recalculated whether or not Measure P passes. This will affect water rate revenue by roughly $1 million which will need to be made up in the recalculated rates. Staff is working with the Utility Rate Advisory Commission to consider revised rates. This may affect the Water Division’s ability to secure financing whether it’s low-interest loans or selling revenue bonds.

- Wastewater Treatment Facility. Construction will begin on this is design-build project. The project is funded by rates and will cost approximately $101 million.

- Funding for Publically-Owned Utility (POU). At its May 13, 2014 meeting, the Council directed staff to remove the $600,000 loan to the General Fund which had been set aside for the purpose of continuing work in pursuit of a city-owned electrical utility. This direction is reflected in the proposed Budget.

- Technology Improvements. As the City continues to make budget adjustments, automation is an important tool to maintain services levels and to stretch staff resources. Work will continue on replacing/updating the City’s antiquated accounting system with $100,000 that has been carried over for this purpose. The smart-phone and web-based Citizen Response Manager (CRM), a website redesign, evaluating ebills/e-notification for utilities, and $82,000 for the exploration new/updated functionality in the enterprise software are also included in the proposed Budget.

- Medical Insurance Savings. After the April update, the CalPERS Board of Administration voted to move Yolo County from the Bay Area health insurance rates and place it with Sacramento area. This change will be effective January 1, 2015 and save $52,500 in the general fund for six months. In subsequent years, the annual savings across all funds will be approximately $150,000.

- Annual Full OPEB funding. This marks the second full year of funding the Other Post-Employment Benefit (OPEB). This amount may change. Every two years, the OPEB amount has to be recalculated by an actuary and the City is currently awaiting the results which could change the contribution amount. If it does, staff will return to Council with recommendations.

- Restoring negative fund balances. Examining the City fund balances revealed that the Employee Benefits Fund and the Fleet Replacement Fund had shortfalls which needed to be addressed. The Employee Benefits Fund had a $2.9 million deficit and Fleet replacement Fund had a $1 Million shortfall. The FY 2014-15 Proposed Budget contains resources to begin repaying both funds over a seven-year period in the amount of $305,000 and $110,000 per year, respectively.

- Updated Overhead Expense Plan. The City’s cost-allocation plan, which is a mechanism for recovery of General Fund overhead expenses, such as City Administration, City Attorney, Personnel Services, and Accounting, was evaluated and revised by an outside consultant. The overall analysis resulted in a reduction in billable expenses and general fund revenue of $295,000. In part this is due to reduced staffing over the years which means there are less costs to recover.

- Removal of Salary and Operations. Savings factor. In the past, the City has removed estimated savings from the Budget which may occur over the course of the year. It is approximately $400,000 for vacancies and $700,000 for operations. The problem is that over the past seven years with additional position cuts and expenditure reductions the savings became harder to realize. In FY 14-15, this savings was removed.

- Updated Employee costs. Employee services and benefits were calculated according to the terms of the Memoranda of Understanding (MOU). There was a 1 % increase cost-of-living adjustment with offsets of a decrease in the amount of cash out in the cafeteria plan with employees picking up the final half-percent (0.5%) toward their retirement contributions, therefore paying their full share (8 % Miscellaneous and 9 % Public Safety).

In summation, the proposed FY 2014/2015 general fund Budget is increasing from the prior year, even with reductions and labor savings. More than half of it comes from the addition of another $2.5 million to the infrastructure budget.

On an all-funds basis, the Budget reflects an overall decrease in appropriations of $88 million dollars, of which $76 million can be attributed to the Water and Sewer Capital projects (Surface Water Project, Water Tank & Wells Fargo Loan Repayments and Wastewater Treatment Plant).

FY 2014-15 Budget-Balancing Plan

In December 2013 and April 2014, the City reported that it had a $5 million general fund structural imbalance and, absent any change, the reserves would be extinguished as noted previously. This is despite $11.1 million overall in reductions over the past several years consisting of $5.3 million in general fund labor concessions and $5.8 million in position reductions. The proposed Budget does not contain any staff layoffs though a net of 5 positions are being eliminated.

With a goal of reducing the $5 million structural imbalance when building the new Budget, departments were asked to develop General Fund reduction scenarios. This meant 12 percent reduction scenarios for all departments; and, up to 25 percent if Police and Fire were held harmless. These scenarios were presented to Council in December 2013 and in April 2014. The Council directed staff to include $1.2 million of these reductions into the proposed Budget. The Council made no decisions on further cuts pending the outcome of Measure O.

If Measure 0 does not pass, the City will need to make additional expense reductions. The Council will need to decide the magnitude and services to be affected by the reductions. Pursuant to previous Council direction, such reductions would be effective October 1, 2014.

click here to see specific proposed cuts – pages 5 to 10

Summary

The past few years have been challenging for many cities, including Davis. Much has been done in Davis to control costs and look to the future. A ballot measure affecting finances is before the voters in June. If Measure 0 passes in June, it will help to stabilize the City’s finances. If Measure 0 is unsuccessful, the City is prepared to make cuts. Due to the magnitude of the reductions, some service levels will be affected and this will take time to work through. The outcome of Measure P for water rates is another unknown but the City is prepared to recalculate rates. Another aspect of this is how the passage of Measure P may affect the water revenue and what consequences it will have on the City’s ability to bond. It may impact the Water Division’s ability to secure financing whether it is low-interest loans or selling revenue bonds.

Paring back the size of the organization and applying the skills learned in dealing with the existing economic reality continues to present challenges. These challenges include California Public Employees Retirement System (CaIPERS) and Other-Post Employee Benefit (OPEB) cost increases, but it is encouraging that long-standing problems with the system are being acknowledged and addressed at least in part. Health care increases have outpaced inflation and it’s helpful that CalPERS offered subscribers in Yolo County some relief. More savings may be possible down the road with the new health-care insurance exchange. The Council has been dealing with these cost drivers for several years and there is guarded optimism about the future.

The preparation of the Annual Budget, though routine, is an enormous task. Budget building is a team effort and this year has been particularly challenging. Special thanks to the Budget staff (Kelly Fletcher, Bob Blyth and Kathy Mcintire), Dominique Sayer, Mary Morris and Pam Day who gave up weekends and evenings to produce the Budget. Department staff such as Jim Ivler and Stacy Winton worked after hours to quickly turn around sections of the Budget. Thanks to the department heads and executive management team (Herb Niederberger, Landy Black, Nate Trauernicht, Rob White, Mike Webb, Bob Clarke, Melissa Chaney, Kelly Stachowicz, Darren Pytel, Zoe Mirabile, Jason Best); the City Attorney, Harriet Steiner; the Finance staff and others too numerous to mention. The teamwork and effort is much appreciated.

This is a unique budget year insofar as the work behind it was peaking commensurate with the departure of the City Manager in late April. As a practical matter there hasn’t been adequate opportunity for the Interim City Manager to have a significant role in the strategic decisions which shaped the proposed Budget. A report will be prepared by the Interim City Manager after this is published to update the Council on the implications of the Measure 0 election if known and provide additional recommendations about the proposed Budget.

Respectfully Submitted,

Yvonne Quiring

Assistant City Manager/Administrative Services Director

Approved by:

Interim City Manager

Gene Rogers

“This is a unique budget year insofar as the work behind it was peaking commensurate with the departure of the City Manager in late April.”

A bit of (slightly on topic) news of Steve Pinkerton: His Davis home is (not surprisingly) for sale. The asking price is $929,000. The Pinkerton’s bought it in September of 2011 for $720,000. However, Steve mentioned to me shortly after he moved in that the place needed a lot of work and (because I think they expected to stay there for the long run) he and his wife put a lot of money into it. I’m not sure how much that was. Regardless, his tenure in Davis timed the housing market fairly well, giving him an appreciation of probably $100,000 over his investment.

Here is the home:

http://www.redfin.com/CA/Davis/641-Bianco-Ct-95616/home/19469850

Nice pad.

According to Zillow.com, the median home value at Incline Village is $598,500k and in Davis it is $529,500.

Good thing Steve will make a bit of cash on his Davis home sale. In terms of timing, it appears that he has hit the public trough jackpot.