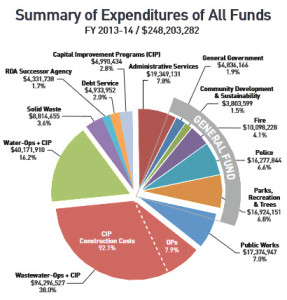

The opponents of Measure O keep using the $248 million figure to explain the city budget and they argue if the city cannot manage that quantity of money, they should not be trusted with an additional $3.7 million in tax revenues.

The opponents of Measure O keep using the $248 million figure to explain the city budget and they argue if the city cannot manage that quantity of money, they should not be trusted with an additional $3.7 million in tax revenues.

We can certainly make the argument that the city has mismanaged its money, however, at the same time, it is not true to say that the city has a $248 million budget.

As the city explained in its mailing, “The city organizes the budget into several fund categories. Each one functions like a separate bank account with different revenue sources and targeted expenditures.”

Most of the time, we deal with the general fund. The general fund is roughly $42 million and represents the city’s “main source of revenue paying for public safety and essential community services. It is also the most flexible fund allowing the city to apply its revenue to other city expenditures when necessary. This fund relies heavily on property or sales tax revenue.”

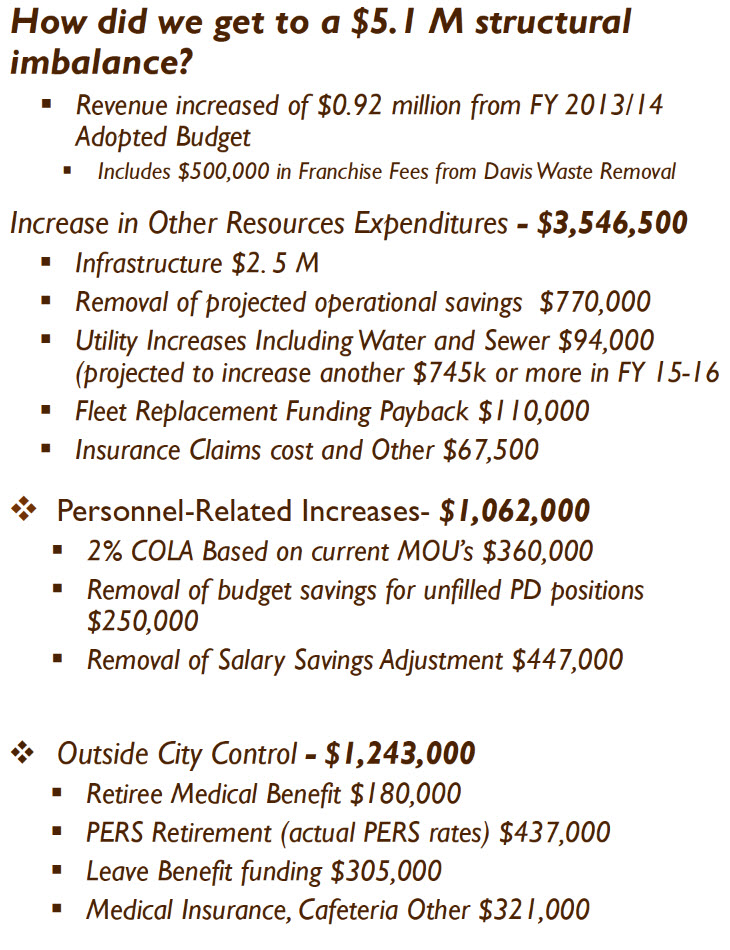

The projected $5.1 million deficit is in the general fund. At times over the last six years, we have seen deficits within all funds and at times, budget cuts and contract agreements have impacted the all-funds budget as well.

The biggest portion of the all-funds budget is the enterprise fund. There are five enterprise funds in the city – water, sanitation, sewer, storm sewer and public transit. That accounts for a huge amount of the all-funds. These services are funded not through taxes but rather through fees, charges by the city for service, and they are generally established at a level that will cover the costs to provide the services for the current fiscal year.

There is roughly $4.3 million left in the RDA Successor Agency. That money is used to pay the obligations that the city still has from the Redevelopment Agency, and some of that money goes to pay the pass-through agreement.

The city also has about $5 million in debt service for general obligation bonds, and that’s a figure that is likely to grow as the city borrows for the surface water and wastewater project.

The city has about $7 million in the Capital Improvement program. This is used to account for financial resources to be used for the acquisition or construction of major capital facilities.

The city also has about $19 million in administrative services, and much of that is funded through internal service funds which fund programs that provide services to other city departments. Internal Service Funds are used to account for the financing of goods or services provided by one department or agency to other departments or agencies of the city, or to other governments, on a cost-reimbursement basis.

Finally, while some of public works is a general fund expenditure, most of it is not. About $17 million of the public works funding is non-general fund. This is a main reason why cuts to the public works department do not help the general fund that much.

A lot of the public works funding comes from transportation funds, state and federal grants, and the gas tax. Fleet and central stores also have a large portion of funding coming from the utility funds.

Where is the general fund deficit coming from?

The $5.1 million deficit is really a misnomer. On the one hand, the city has been neglecting to put substantial amounts of money into the roads fund for the last decade. The council has asked for a more realistic accounting of unmet needs and deferred maintenance into the budget.

However, the $5.1 million is really a theory more than a reality.

When the city council voted to reduce the tax from three-quarters-cent to half-cent, it stripped out $1.5 million of the $2.5 million ticketed for roads and other infrastructure. In reality you could argue that the actual deficit is about $3.4 million or so.

If you want to include roads in that, the number soars. The city really needs to fund roads at a rate of $5 to $8 million per year, with additional funding for parks and buildings which have yet to be determined.

Right now, the plan is if Measure O passes, the city would fund the $2.3 million in personnel-related costs plus PERS and retiree medical benefit cost increases, plus $1 million for roads.

The city has designated about $1.2 million in additional cost cuts, regardless of whether Measure O passes.

If Measure O fails, the city would either cut 12.5 percent across all departments, or 25% holding public safety harmless. The most likely option is the latter.

The parcel tax, proposed for November, would then have to fund capital projects like roads, parks, buildings and other maintenance. While the city clearly needs to find those monies, the council is likely to base their willingness to go forward on the results of the Measure O election.

—David M. Greenwald reporting

“The city really needs to fund roads at a rate of $5 to $8 million per year, with additional funding for parks and buildings which have yet to be determined.”

David, where is this mentioned in the City’s glossy mailer, or the Mayor’s two State of the City speeches, or in any other community outreach piece?

-Michael Bisch

I haven’t seen it. I never was able to attend one of the City Manager’s talks, but there has been little discussion in the public of the magnitude of the problems we face.

David, there is an entirely different order of magnitude between what you have asserted above and what the CM and the CC have been asserting these past many months. The measures needed to effectively address each assertion have an entirely different order of magnitude as well. Both assertions cannot possibly be accurate, i.e. one assertion is accurate and the other must be inaccurate. So why are you and others who agree with you saying one thing and the CM and CC saying something entirely different?

-Michael Bisch

I’m basing my figures on this: https://davisvanguard.org/council-stunned-at-the-magnitude-of-the-road-repair-problem/

And this:

Michael – what is your assertion here… is David over-stating or under-stating the city road maintenance nut?

I believe David’s assertion is far closer to being an accurate reflection of the City’s fiscal condition. That being the case, why have the CM and CC been making entirely different assertions in the info they’re disseminating? And that being the case, why are they proposing measures for an entirely different set of circumstances? Surely the remedy for a +/-$5M annual deficit is different than that for an $8M – $10M deficit. All of this of course is ignoring the maintenance of infrastructure/assets apart from roads and bike paths.

-Michael Bisch

Ok – thanks for explaining. We are on the same page.

The CM and CC is walking a razor’s edge… pushing the need for a tax increase without spilling the beans that the extent of our problems are not going be solved by the tax increase.

Here is the CM and CC thinking…

Sales tax increase to temporarily shore up the GF budget for the next five years, and to do minimal road maintenance. Then a parcel tax increase in November. If that passes then float a bond for $50 million to catch up on the road and building maintenance and take care of some of the waterworks infrastructure too.

But the problem with all of this is the growing cost trends are steeper than these taxes increases are going to cover beginning 6 years. Even the road maintenance bond will eventually run out. And these tax increases have a term… they have to be renewed. That is not a sustainable solution. The CC will have to come back again for another tax increase unless…

1 – More cuts are made.

2 – More sustainable revenue sources are developed.

Those are the two solutions we should be focused on. It is my belief that the passing tax increases will cause the CC to punt on those two things because they are both more politically difficult.

You offer 2 solutions to this, cutting costs and developing more revenue sources.

We can and should do these regardless of whether or not Measure O passes. I would prefer we do it with the breathing room the revenues from Measure will give us.

To borrow an analogy, if Measure O fails city will be be forced to cut with an axe rather then a scalpel.

Davis will lose some of the amenities that make it a desirable place to live. In the long run maintaining these amenities now is cheaper then losing them and bringing them back.

Attempting to “punish” the city council by not passing this sales tax may make their “job” more challenging, but it is the community as whole that will be negatively impacted by the consequences of the cuts that will need to made.

Bring on the axe…………

we’re you just complaining about brown lawns? imagine brown parks and green belts?

Comeon, from the responses I received you liberals love brown lawns. Funny how liberals always seem to like it when something gets taken away or they can change another’s lifestyle so it fits into their idea of a Utopian society.

just pointing out the inconsistency in your position, not mine.

i also find it interesting that you would complain about brown lawns, but not potholes.

I have a big ass 4×4 truck with a Confederate flag in the back window next to my gun rack, potholes don’t bother me.

oh you’re that guy

We don’t have a $5.1 or a $3.4 million dollar structural deficit if you look out 10 years, 20 years, 30 years. The slope of high spending is steep because of the benefits paid to retirees and existing city employees that will retire.

So, unless those costs are dealt with, the city will keep coming back for future tax increases.

When does it stop?

It stops right now. Vote NO on Measure O. Tell the City Council that they will no longer get easy bailout money from the financially-stressed out voters. Tell the Council that the first priority job is to balance the budget by cutting the cost of city labor and/or developing the economy to bring in more dollars.

If you don’t do this then the city will only balance its books for a while and then they will be back for more, and more, and more and more.

Fully agree with Frankly, it’s time to pull the plug on the taxpayer ATM machine.

one problem with the view that the taxpayers shouldn’t be the atm machine is that the taxpayers are actually the atm machine. the citizens of davis receive services in exchange for financing its governance. the question then is quite simply what should we pay for and are we getting the best bang for the buck.

While I would like this to be a council priority I do not believe it should be it’s first, nor would I want it to be. We chose to pay more to live in Davis because of the amenities it offers. If cutting city labor results in a decrease in the quality of life of this community then I’d prefer to pay more in taxes to keep this from happening.

This is not say that I’m in favor of uncontrolled or wasteful spending of tax payer dollars, nor I’m I against the idea of finding ways to generate revenue-as long these ways to do not compromise the quality of life here in Davis.

As long as our city council continues to move towards controlling employee and other costs I’m willing to support a sales tax increase.

I like pools and parks and greenbelts. I like living in a safe community. I don’t have a problem paying more for these things. If I did, I wouldn’t be living in Davis.

Michelle, do you think the CC/City should be transparent about the cost of these services and amenities you value and the strategies they intend to implement to pay for them? Or do you prefer to wake up every few months to read about another cut here, another tax there, always with the uncertainty that they have not been entirely forthcoming?

-Michael Bisch

No Michael, I think the CC should be opaque about the costs of amenities, I love uncertainly.

Regardless of whether Measure O passes I would like transparency and certainty. Not sure who these things are connected.

The problem with taking this “general fund is the only fund to concern ourselves with” is the practice of intermingling funds and doing temporary inter-fund transfers to shore up spending shortfalls.

If I ran my business books like the city runs it books, I would be in jail by now.

Frankly wrote:

> The problem with taking this “general fund is the only fund to concern ourselves with”

It is just politics, in a family you can show your kid the “general checking account” with only $45 in in and say “see we don’t have any money for a new bike for you” while Dad’s “boat checking account has $20K, and Mom & Dad’s Europe trip account has $10K…

Exactly, I don’t think the public in general gives a hoot what fund the money spent from when they vote. All the public knows is their money is getting pissed away whether it’s in this account or that account.

the public may not, but the government should. if the city is improperly intermingling monies then it should be audited and cited.

They are audited. The problem is that the rules for public finance are much softer than for private business.

And if you want to know why someone like me is such an advocate of small government, there you have it.

The government watches me like a hawk… layering on rule after rule after rule… suffocating private business with costly and largely unnecessary regulations just because there are some shysters, crooks and incompetents out there.

But who watches government? Who can layer them with rules and regulations to prevent the shysters, crooks and incompetents from making a mess of things?

It is the proverbial fox guarding the hen house. And even the good people pick up the bad habits.

I started the Vanguard precisely for the reasons you lay out – who watches the Government? The Vanguard.

Yes you did… well I think to watch the Davis Police Department first… but eventually to watch the rest of our local government. And I think you provide a great service to the community in doing so. I think you make our government more accountable. The Enterprise cannot do this level of heavy lifting in deeper digging, even though they still have a much wider audience reach.

Keep up the good work!

Why not opt out of PERS and go to a defined contribution plan so that you can easily calculate your annual labor costs? I think that it is insulting that the City published a graphic saying that PERS and medical benefit costs are “outside their control”. They offered each one of those benefits in each contract so it was in their control. If they had any fiscal sense they would know that PERS is going to need to increase again by another 50% to be fully funded. We can’t afford to pay such luxurious benefits, it is time to stop! I think that voting no on Measure O will start those conversations.

Sam wrote:

> I think that voting no on Measure O will start those conversations.

I think voting no on Measure O will just give us a bigger parcel tax…

“I think voting no on Measure O will just give us a bigger parcel tax…”

That takes 2/3’s to pass, we’ll defeat it too.

I agree. I don’t think the parcel tax has a chance to pass. I think Measure O is a toss up… mostly because people don’t think another $.005 per dollar spent is a big deal. They don’t get the “death by a thousand cuts” problem (literally being nickled and dimed to death), and the other problem that giving the city these small incremental tax increases means more of the same in the future.

But a parcel tax comes all at once and voters feel it more profoundly.

Where are you expecting to get roads money from? At least with a parcel tax, you can direct ticket the funds to a specific line item.

Bond at market rate. Not with a discount backed by another tax increase. Cuts in spending so we can service the debt.

Or better yet, urgent economic development to bring in more revenue. In fact, I think with a business park or two on the books we could probably use the probability of revenue increase to buy down the bond rate for road maintenance.

I am in favor of temporary parcel taxes to back a bond to fund new development projects… for example a downtown revitalization… but not to cover existing expenses.

No “hey sorry, I spent all of your tax money you gave me to fatten the wallets and early retirement benefits of all those city union members that contributed to my campaign and voted for me… now I need more of your money to pay for all the other obligations that I ignored.”

And I don’t want to hear the “prior CC” excuse… you inherit the mess of your processor in almost every new leadership assignment.

David wrote:

> Where are you expecting to get roads money from?

A modest cut in pay and benefits for city workers will easily cover the cost of road maintenance.

David keeps sounding like a guy who’s ex-wife stuck him with a $10,000 month housecleaning service and the only way he can think of getting the money to fix his car is to work weekends or put the kids to work…

A modest cut? $8 million is about 20% of the general fund budget.

Davis wrote:

> $8 million is about 20% of the

> general fund budget.

But $3.7 million (the number you quote for Measure O) is only 9%). Get rid of the POU, the fancy trash cans, and sell the DACHA homes and we are talking about a modest “cut” of about 1.5% of pay and having the workers pick up an extra 1.5% of the benefit cost for a 3% hit. Not great (if you get the cut, but we won’t have anyone losing their home), and I’m betting we will not lose a single employee (who will ALL “still” be making more in pay and benefits than people in the private sector)…

I know something needs to done but when I vote for someone to represent me that’s my word they are putting forward.The deals they made on my behalf might not have been the best but the employees kept their word.I am only as good as my word and I would like to stand by it as close as I can.

I’m sorry, I’m not following your point here.

Pointing out that the council represents you and me.So when they make a deal with the employees of this town it’s a deal on my behalf.I as a citizen of this town I would like to live to my end of the deal we made with them.

DG wrote:

> I would like to live to my end of the deal we made with them.

I don’t think that anyone has said we need to violate any contract or break any promise (since it is against the law and we can’t do it even if someone wanted to), but when a new contract comes up and the city has less money they can say here is the new offer, you can take it or leave (and try to find another job where you work 10 days a month and get paid $100K+ and can retire at 50 with a full pension)…

There you go with the extreme end of it.Most of the employees make much less than the firefighters.I am not saying things aren’t bad but low balling with a new contract doesn’t set well with me.