Yesterday we argued that the Enterprise was wrong in criticizing the council’s timing of a parcel tax discussion. While the Enterprise may think that it’s “rubbing salt in the wounds” to discuss how to fund critical infrastructure less than two months ahead of the functional deadline to get a measure on the November ballot, we think even if we opt against a November parcel tax measure, it’s vital to have the discussion as soon as possible.

Yesterday we argued that the Enterprise was wrong in criticizing the council’s timing of a parcel tax discussion. While the Enterprise may think that it’s “rubbing salt in the wounds” to discuss how to fund critical infrastructure less than two months ahead of the functional deadline to get a measure on the November ballot, we think even if we opt against a November parcel tax measure, it’s vital to have the discussion as soon as possible.

On Friday, Dan Carson, a periodic columnist for the Vanguard and member of the Finance and Budget Commission for the city, made the case that a “slower track for a second tax makes sense.”

He noted that the Vanguard recently urged the city council to act immediately to put a sizable parcel tax increase, requiring two-thirds voter approval to pass, on the November ballot. That would require council action to place the matter before voters by mid-July.

While he was an advocate for Measure O, he sees “real problems with this rush to judgment on a matter that has grave long-term consequences for the fiscal health of this city. I’m not disputing that additional resources are needed to address important projects for deferred maintenance and new infrastructure. The problem is that city staff presented our commission and city staff with a cut-and-paste wish list of expensive proposals without vetting or explaining many of the items, let alone justifying them as a spending priority.”

On that point, we completely agree. The council last week discussed a wide range of options, but I do not believe there is going to be support, for example, for a $200 parks tax. What I think we are going to see emerge on Tuesday is a very streamlined approach, asking for a modest amount of money.

The view expressed by one councilmember in an off-the-record discussion was a $50 a year parcel tax for 30 years. That would allow the city to bond to create an immediate pool of $25 million and a revenue stream of $3 to $4 million per year.

Last May, the city laid out the scenarios. The best was Scenario A which heavily front loaded $55 million over the first year which, would produce a relatively low backlog by 2032. However, it goes beyond saying that $55 million over six years is not practical.

The $25 million scenario would leave the city in a $3 million scenario escalated at around 3% (less than the inflation rate for pavement). The city concluded that this would not be enough to maintain a good average PCI (Pavement Condition Index).

This is, I think, the saddest commentary, that the city’s optimal strategy is to accept relatively poor PCIs on residential streets and will focus on maintaining the main thoroughfares and arterial streets. That’s where a decade and a half of relative neglect has left the city.

I take heart in the fact that I was sounding the alarm on streets in 2009 and 2010 when no one else cared. Literally the first two articles on roads had zero comments, and even then, that was unusual. So to get from no interest to serious discussions about a parcel tax is a success.

Mr. Carson recommends a good approach overall of creating a study that would “consider a wide range of methods to pay for these critical projects so as to stretch General Fund resources, and the monies from any second new tax measure, as far as possible.”

Where I think we differ is that I believe we should first tackle the roads issue – for which we already have a study and a clear basis, and then approach the rest of the needs. A general tax in 2016 or a utility tax in 2016, as one councilmember suggested, could be such a follow up approach.

“Once this difficult, analytical work has been accomplished, the public could be provided with a transparent accounting of the findings and engaged in a discussion about priorities and strategies,” he wrote. “What a perfect opportunity for participatory budgeting that the City Council has long been interested in implementing.”

Call me a skeptic on such approaches. In 2009, the Vanguard hosted a town hall meeting. In a bit of an early coup for the Vanguard, it featured Paul Navazio, the city’s finance director, Johannes Troost chair of Budget and Finance, and Mark Siegler, a Sacramento State Economics Professor. About sixty people attended the meeting.

In 2011, the city had budget workshops that attracted very small crowds. In early 2013, Joe Krovoza and Steve Pinkerton had a budget talk at Avid Reader that drew maybe 20 to 30 people.

The public has long been unaware of the fiscal danger, and our efforts to date at informing the public have been inadequate. Perhaps participatory budgeting, which has worked elsewhere, is a way to activate the electorate.

It is one reason I lamented the poor opposition to Measure O, which really did not grasp the economic issues facing the city and was unable to engage the public in a discussion.

I remain concerned along with Mr. Carson that the community is lacking clear understanding and transparency; however, I think the risks at this point are too great to delay.

Here is the issue on which I most disagree with Mr. Carson.

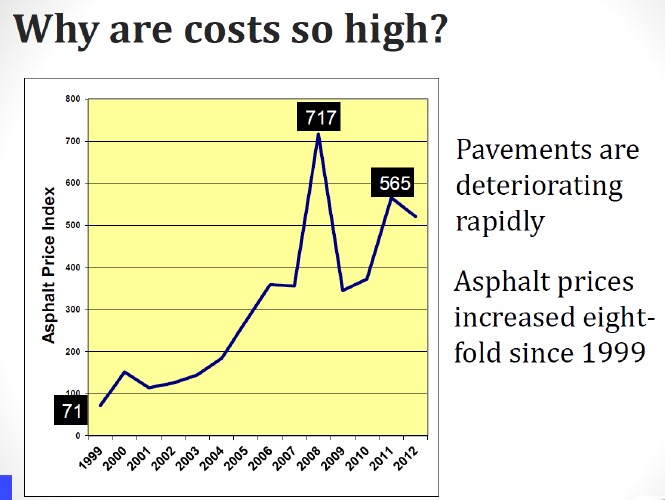

He writes: “The Vanguard fears any delay in moving forward to the ballot would cost tens of millions in higher project costs. This is based on the assumption that asphalt road costs will grow 8 percent a year. That’s a highly speculative claim. While asphalt costs have grown significantly in the past, that has not been true of late. As shown in the attached graph, California Paving Asphalt Price Index data shows that asphalt costs are generally lower than they were 18 months ago.”

He cites about an 18 month trend line on asphalt prices.

He argues, “Rushing ahead without a good plan, in contrast, ensures missed opportunities to make smarter decisions and a waste of taxpayer monies for some projects that the public will not support. And, if too many Davisites decide not to support a new tax measure (just one-third of the voters plus one would block approval of a parcel tax in what is likely to be another low-turnout election in November), efforts to address the city’s maintenance and infrastructure needs could be thrown in reverse for years.”

But that, of course, is one side of the coin.

If 8 percent inflation were the only issue, I would agree with Mr. Carson. Even at $100 million price tag, 8 percent is less than $1 million in added costs per year. Given the magnitude of the costs, an 18 month delay would not kill us. And I’m not necessarily opposed to a March 2015 election either.

However, Mr. Carson is wrong to cite the inflation rate rather than the PCI issue.

The price goes up dramatically based on the deterioration of the pavement condition. Ever month that has passed since 2009 to deal with this problem is adding costs – a lot of costs.

As the chart shows, it’s relatively inexpensive to patch the surface. However, the cost quickly rises five-fold to pay for the $20 per square yard cards of a thin AC Overlay, it goes up another 35% to do a thick AC Overlay and, for the streets that are almost gone, $81 per square yard.

Defeatists who say, let’s just let our streets decay to gravel have to understand how much cost reconstruction adds to the process.

The trend line on asphalt costs has mirrored the cost of oil. What we have seen is that, after costs peaked in 2008, they plunged during the economic downturn and then have for the most part leveled off.

Will oil prices rise or level off in the future? Hard to know, but my guess would be we will see a rise in oil costs.

But regardless, the danger here is less the cost of asphalt and more the further deterioration of roads. That’s why the costs have gone up so much since the issue first caught the Vanguard’s radar in 2009.

Do we want to delay? Can we sell the public on a $50 or $75 per year parcel tax? If we can’t, then we will have to take an alternative approach for 2016 anyway.

—David M. Greenwald reporting

Kudos to the unnamed CC member who is suggesting a specific $50 parcel tax to “immediately” address the roads/bike-paths backlog. That said, $50 per parcel does not go nearly far enough to solve the problem. The starting point on solving any problem should be identifying the scope of the problem. Public Works has stated that the backlog is currently $54-$58 million right now. Over a 5-10 year expedited work schedule, the repair cost likely rises to +/- $80 million. I.e. to fully address the backlog, we’d have to borrow +/- $80 million today, spending it over 5-10 years, while repaying the borrowed amount over 30 years.

There may be reasons why the CC can’t or chooses not to fully address the problem, instead resorting to half-measures. Nevertheless, a transparent community discussion requires fully disclosing the extent of the problem as I have above. Anything less is not helpful in fostering a robust community debate.

-Michael Bisch

By retaining Mace 391 as a city asset, and either developing it or selling it to a developer for a business park, the city would have received all the revenue required to pay for our road maintenance backlog.

I will be sure to continually remind voters of this and also the list of over six figure compensated city employees and retirees while the CC again goes for our wallets.

I will also remind them that the Davis schools are likely to again come back for another parcel tax.

And then there is the parks…

This town needs 1000 acres of peripheral commercial development to meet our revenue needs. What are we waiting for?

Responses to the RFEI.

Analysis paralysis?

I think this and a lack of poitical will.

“By retaining Mace 391 as a city asset, and either developing it or selling it to a developer for a business park, the city would have received all the revenue required to pay for our road maintenance backlog. ”

First, given development and build out times, it is unlikely that the city would have the revenue in place.

Second, they wouldn’t be able to bond off that revenue to have the money needed upfront

Third, once again you are assuming that the city voters would have supported 391, I think given the political reality that is very unlikely.

David wrote:

> First, given development and build out times, it is unlikely

> that the city would have the revenue in place.

When you sell land to a developer you (almost always) get the cash up front (and don’t care about build out times)…

that’s not what generate the revenue for the city on an ongoing basis

The Willow Creek Business Park parcel is currently for sale for $7MM. It is 18 acres… and $389M per acre.

Let’s assume Mace 391 after the Measure J/R open space requirements netted 200 acres of develop-able land. At a wholesale price of $150M per acre. That is $30 million.

Now let’s consider the total business tax revenue that would flow in over the next 10 years of a complete build-out. That is easily $20 million.

That is where we get our $50 million in revenue to the city for Mace 391.

And the CC just pissed it away.

if they develop the 200 at mace and the 200 in the nw, it’s the same.

We don’t own the land. We do not get the revenue from selling land we don’t own. It is not the same. It is at least $30 million less. And it will also take us much more time since we don’t own the land and cannot as easily dictate everything we want the land owner to do.

I get the sense that at least half of the well-educated posters on the VG skipped their business and financial accounting classes.

And if the city instead decided to develop the park itself, and sold the lots as build-ready, then the price would have been more like $500M per acre or $100 million dollars. Subtract the $20 million it would have taken to build out the infrastructure, get the lots build-ready and pay for the project management, and we get $80 million. Add the $20 million in business tax revenue and we get to that $100 million in total revenue to the city in 10 years.

That is where the $50-$100 million in value to the residents of the city comes from.

And the CC pissed it away.

And not only pissed it away, but did so for a $500,000 loss of our Measure 0 monies.

Some people fear the future and prefer to live in the past.

Moreover, I don’t believe that an accurate statement.

Some people prefer to put their head in the sand to ignore difficult reality.

Other people prefer the embarrassing reality of their gross mistakes get hidden away.

And then there are some people committed to making sure the previous people don’t get their way.

David wrote:

> I don’t believe that an accurate statement.

Do you think that NO ONE fears the future or that NO ONE prefers to live in the past?

I apologize for the clack of clarity, I was referring to the statement that Jim was quoting, not Jim’s statement.