By Rob White

As a continuation of the article last week on Frequently Asked Questions, I offer some information, resources and experienced thoughts on the who, what, where, when and how (and even why) of an innovation center concept in Davis. Again, we shouldn’t be avoiding the hard questions in discussing the innovation centers… either the concept stands on its merits and has more positives than challenges, or it is a concept that is not right for Davis.

As I said last week, I am committed to provide as much data and information as I humanly can and will continue to enumerate resources where those that want to do their own research might begin. To reiterate, I don’t in any way represent that my answers to these questions are the only answers nor that they are complete answers at this stage of the discussion. This is a sort of wiki project, where we can all provide collective knowledge and try to get to the best fit solution for Davis.

Now to the FAQ. I will continue to number the questions sequentially with no forethought of importance or relevance. In my mind, all questions have merit and we should approach this as we do any other academic exercise – through rational consideration and sorting of ideas, looking for facts and evidence.

Remember, the answers herein are the beginning of trying to address each of these points. My answers reflect two decades of experience in development and land use, public policy and innovation. But they are understandably incomplete (though they represent a thoughtful and knowledgeable viewpoint) and can only be improved from more information, data and facts – which will be useful as we work to address community concerns.

10. “The City needs to educate the public on revenue from business parks.”

No specific revenue projections or data have been generated to date, as the City and project proponent(s) will need to work through the specifics of what will be proposed for any innovation center concept. The specifics needed to conduct a true revenue projection will need to include parameters like the total amount of square feet, building coverage, cost of infrastructure, community amenities, number of jobs and forecasted timing of the build-out. From these data, a robust economic model can be built that will help to forecast the revenue generated by a project. The City will require this economic model as part of the discussion for the development agreement, much like we did for The Cannery. Once this information is completed, we will then use the model to also inform the public regarding the types of revenue sources and potential amounts that might be generated.

11. “The City will not generate any new revenue because they will be offering discounts to entice companies to come to Davis.”

Though the City has occasional (and very rarely) offered incentives to retain a business in Davis (the last such incentive was for Mori Seiki in 2011), the amount was small in comparison to the overall annual impact of the company. The staff at the city have been very careful in making sure that any incentive offered in the past is less than what a company would generate through taxes and fees, creating a net positive since the revenue would not exist without the company. Within the first year of operation, the incentive was less than the realized property tax. The City also collected sales and use tax and permit fees. We also realize some business to business sales tax as the company buys from local vendors and retailers. Additionally, the jobs created at Mori Seiki (now DMG Mori) are higher wage manufacturing and technology jobs and the employees of the company can often be seen around Davis and in downtown spending their disposable incomes.

12. “Permit fees cannot really be counted as revenue.”

Though partially true, permit fees also help to defray the cost of administration of the City and are not just to cover the direct cost of the staff member working on the project. That means that our HR, finance, city management, IT and other administrative functions are also included as a partial reimbursement in the fees that are collected. Therefore, permits fees do help the overall City revenue profile. Additionally, though permit fees are meant to be a reimbursement structure, they also help to generate overall cash flow for the City. As any financial expert will tell you, cash flow is also a very important part of the health of an organization as it conducts its work.

13. “More retail gives us sales and property tax and reduces trips to other communities, so why not just focus on that type of economic development?”

It is true that retail generates significant sales tax, but the property tax is low in comparison to other commercial uses. The Local Government Commission (www.lgc.org) has worked with several partners’ organizations to demonstrate that retail uses have much less positive revenue impacts on a community than commercial and research uses. The point about driving is a valid one, but as the world of commerce changes and more and more commodities are coming from internet sales, it is difficult to know just which retailer is the right one to have in your community. Who would have believed 20 years ago that Gottschalks would close? Or Circuit City? And the downside of these large big box stores and their surrounding centers is that once the anchor closes, they can be hard to fill (usually because they are specialized to that retailer) and then the center suffers. Only now are many communities beginning to fill the vacant stores and centers that were left when Mervyn’s closed. Commercial and research spaces turnover more frequently and are constantly being reassessed for value and redesigned for tenant improvements, which means that property valuation can climb more rapidly and permit fees are generated again and again as businesses redesign the spaces.

14. “The City needs to do more to get the word out about the innovation center concepts.”

In any project proposal, the City’s role is not to be the public relations manager for a proposal. The City’s primary role is to provide regulatory oversight and legislative approvals to projects and it is not typically the job of a city to conduct outreach about the cost-benefit of any specific project. In the economic development role, we often discuss projects types in generalities and overall financial impacts… e.g. are innovation parks a positive thing for communities, but not which park or where. We also work with the specific businesses that might locate in a park to assist them in navigating the permitting and regulatory process (think of us as guides). It is also the City’s chosen economic development role to provide branding and marketing of the overall City and the opportunities that companies might enjoy if they were to locate in Davis. This translates in to making investors and those that want to stay or come to Davis aware of what we are doing to make Davis the ideal place for their efforts. In the case of ‘getting the word out’, the City needs to be neutral and is best as a facilitator to project proponents. Using sources like the Vanguard, project proponents can tell the community about their specific projects and the benefits and challenges of their specific proposal.

15. “Consultants resort to tricks to make it appear that companies will generate net revenues for cities.”

Though I am sure that there are consultants that will skew the data in an effort to positively illuminate certain aspects of a proposal, I am confident that in a community like Davis, these efforts would be seen as what they are and additional facts would be brought to the discussion. The City’s role in this effort is to be a resource to the discussion and to bring as much research and data to the discussion as possible. That is why we will be hiring independent evaluators for financial, environmental and regulatory aspects of any proposal. That is what our community development process is designed to do. These types of points, though interesting, seem to really be intended to cast doubt on the process. A more helpful approach would be to find research and resources that indicate that any assumptions or data might have alternative interpretations. Just saying something isn’t true doesn’t make the accusation true. I would encourage Davis as a community to demand research and data on any statement, pro or con, that can be verified independently and validated by multiple sources. This is the root of our academic society in Davis, and we might be best served using the scientific method of inquiry for arguments that are both for and against any concepts.

16. “Property tax splits with the County only result in about 6% of new property tax to the City.”

This point is actually not correct. The lowest current tax split that the City has on any significant piece of land is at about 9%. But it also ranges as high as about 27%. Any new land annexations in to the City (of which there haven’t been any significant pieces done in over 12 years), would require a negotiation with the County on the splitting of new tax revenues. This ‘tax sharing’ agreement suggest that we are likely to see some kind of more even split since both Davis and the County will be required to provide new services to an innovation park. As an example, if the total County split on each $1 collected in property taxes (based on just the normalized property tax valuation, not including parcel taxes for schools, etc.) on the current agricultural land is 32% (or $0.32), then the County is getting about $32 per acre if the land is valued at $10,000 per acre. If you are wondering, the rest of the $1 goes to the State and other local agencies. If the land values goes up due to development of an innovation park (let’s just say $500,000 for purposes of simplicity), then the new property tax amount based on the 32% is $1,600 per acre. That delta between $32 and $1,600 is what the City and county would negotiate in the ‘tax sharing’. And history seems to indicate that the split will be much more equal than suggested in the statement above.

17. “An innovation park won’t solve the fiscal problems of the City and we should cut spending and raise taxes.”

Though an innovation park in and of itself will not solve the City’s fiscal problems, it will go a long way in diversifying the economy and spread out the revenue sources across many inputs, instead of the very few we have now. It has been noted in previous articles in the Vanguard and the Enterprise that cities of similar size and scale as Davis have many more businesses and jobs than Davis. In one extreme, Palo Alto has over 100,000 jobs and about 35,000 businesses. That is more than 100% greater than Davis in both respects, if you include UC Davis as a data point. Additionally, many of the retailers in Palo Alto are specialty and generate a much higher per capita sales tax than those in Davis. This is in part due to the larger daily workforce frequenting the establishments in downtown and throughout the city. To use another example, San Luis Obispo has many more retailers in the downtown than Davis. This is in large part due to the continued redevelopment and densification of the downtown, but also the aggressive economic development that the City has conducted (putting both staff and fiscal resources in to the effort). It is also in large part due to the fact that they are the largest city in the region and the next closest place you will find such retailers is in Santa Barbara. Another way to look at this is to use the baseline calculation of $8.25 million in new revenue from about an additional 8.5 million square feet of innovation park (that is roughly a floor area ratio of 1.0 for 200 acres). I arrived at this number in three ways: 1) by multiplying 5 million square feet by an average value of $300 per square foot (an industry standard average for Sacramento region), dividing by 1% for property tax rate, and then divide again by 16% for what could be our split on those dollars designated locally (32% of each dollar generated stays in the county) = about $4,000,000 in property tax; 2) current sales tax generated by technology businesses in our region indicate an average of about $0.50 per square foot generated annually (a very rough calc at best) = $4,250,000 in sales tax; and 3) special assessment placed on the development for services (as has been the discussion for several years now) of $1 per square foot per annum (and this is still to be negotiated) = $8,500,000 for assessment revenues. That equals $16,750,000. Cut that number in half for uncertainty, and we might see about $8,250,000 annually in about 10 years (depending on build out). In order to generate that same amount in cuts to the City programs, we would need to reduce the staffing levels by about 50 more employees. To create that amount from a parcel tax, we would need to tax each of the approximate 50,000 parcels an additional $165. Obviously, my calculations could use refinement, but my point here is that just saying let’s cut or tax is not a fair comparison… the data should be discussed and validated for all scenarios. Preferences are valid subtext, but they make for a substandard basis for evaluation of options.

18. “I used to be on a certain committee, commission or organization, so my view has additional merit above others.”

Although experience is valuable, it should not be the only determining factor in making decisions. Peer review, public dialogue and broad discussion are the best sources to make sure we get a project as good as can be. It is always nice to have anecdote to back up one’s views, but actual data and research is paramount. We all have that case that disproves the norm, but that doesn’t mean the facts are not in evidence. Because my son chose not to wear safety glasses while working in my yard yesterday and didn’t get hurt doesn’t mean it’s not a good idea to wear safety glasses. These type of fallacy arguments are interesting and make for good banter, but they do not prove a point and should be taken as experiential and not research.

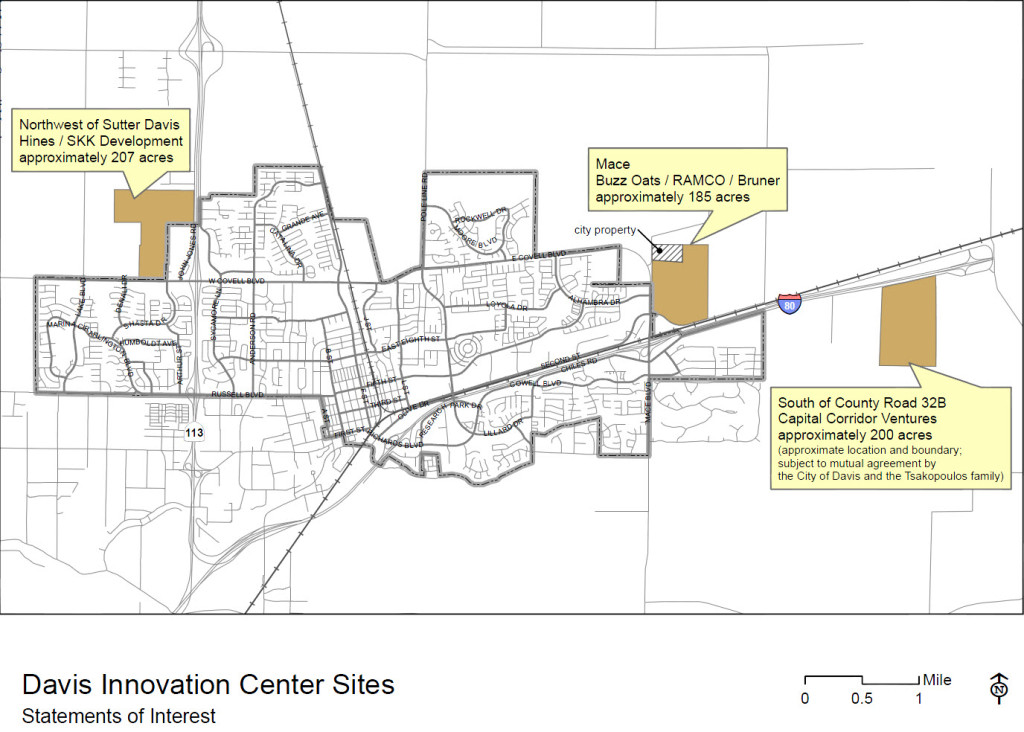

19. “Where is the mitigation acreage?”

A very valid point, but again we are early in the process and the project proponents are all very well aware of the Measure R requirement for a 2 to 1 mitigation. As the projects move forward into an application phase, this detail will be worked through and the location of mitigation acreage will be identified for City review and approval. The community input will be provided during the normal development process and will be ultimately approved by the community through a Measure R vote.

20. “The economics or an innovation park are terrible for the City.”

I am curious about this view as I do not have any resource or report that demonstrates this to be true fiscally. I realize that there may have been policy drivers in the past that made an innovation park not palatable, but I am unaware of any study or resource that indicates this to be the case. If someone has this information, please let me know. I have read through 30 years of reports and studies, but I may have missed one.

21. “Innovative business parks are just a lot of Hollywood level hype.”

We have specifically chosen the words innovation park to make sure that we are discussing a location where research, advanced manufacturing and technology businesses are located. Davis has not previously indicated that they are interested in a food processing plant, a call center, or a warehouse district. Not all “business” parks are created equal. The opportunity to build something akin to Stanford Research Park, Mission Bay (SF), La Jolla Mesa (San Diego), or Bishop Ranch (San Ramon) is unique and not typical of the hundreds of other business and commercial parks across the US. This is further demonstrated by the recent studies by Brookings and Battelle (among others). As far as hype, I realize that it is difficult to sometimes believe what others may impart from a knowledge basis. That is why I continually reference where my ideas and concepts are rooted and what research, reports and studies inform my thoughts. I would encourage all of us to require of any participant in this discussion to reference from where their views are informed and in the case where ideas are presented as absolutes, we should demand that the individual cite the source of research. Opinion and conjecture are interesting for dialogue, but as a community founded in academics and research, we should demand more of ourselves when making important decisions. Using terms that make others out to be “those people” is beneath this community and seems to really detract from the conversation at hand.

22. “Innovation parks in Davis were bad news a few years back, they are bad news now.”

I am again curious where the studies or reports are that make this case. I am hopeful that someone can point me to them. As far as what was bad then could be good now… timing is everything. And project scope. Previously, the discussions centered on building a research park for a specific cause or industry. Now we are talking about a large cross-section of technology sectors (medical, biotech, agriculture, manufacturing, engineering, IT, and vet science, to name a few) that are core elements of the research being done at UC Davis. Almost a billion dollars of research annually. UC Davis is now the number one agriculture university in the world. Significant investment in technology and science are continuing by the federal government, but now a large amount of venture money is being expended in the technology fields listed above (14 years ago was the dot com bubble and investments really only happened in IT). We have numerous companies that are asking to have room to grow and stay in Davis, with plans to increase their staffing by factors or 2x and 3x. We have the top 10 seed research companies in the world locating in and around UC Davis and looking to grow their local presence and investments. And Battelle recently demonstrated that research parks in close proximity to a university actually grew their employment base by over 20% during the recession, while most other industries and business parks suffered dramatic declines. As just a very few proof points, it appears that conditions in Davis are considerably different than in the past.

For future articles, I will continue to address ideas and concerns, so please feel free to send me your thoughts. Or take the opportunity to add your own perspective on the ideas and comments above. I certainly don’t have all of the answers, but I am committed to seeking out best practices and modern research on how we might best discuss and potentially build an innovation center that will be something Davis can be proud of for many years to come.

rob – i have drunk the kool-aid on this. but i read the vanguard on a daily basis. i think we need we really need a cheat sheet as much as we need this exhaustive explanation (which i’m not dissing). what do i tell my neighbor when he asks how a business park generates tax revenue?

1. property tax increase from annexing the land (adding it to the Davis tax rolls) and increasing its value.

2. property tax on unsecured property; e.g., equipment, infrastructure.

3. sales tax from business-to-business transactions.

4. small amount of sales/restaurant tax revenues from retail component (stores and eateries that are included to serve the employees who work there.

that’s helpful. the next question of course is how much is that likely to be.

Don’t forget property tax from the improvement of the annexed land.

oops… Don already included “and increasing its value”.

you make several real good points that don’t normally get raised in the big box debates. the biggest is that a lot of time while you plug tax leakage, you drive out local business at the same time. look across the country – big boxes and national chains have competitive advantages over local companies. however, you raise more interesting points about changing economies and vacancies. i think that gets lost in this debate.

I am concerned about the massive amount of prolixity being generated concerning the pros and cons regarding the development of “Innovation Centers” on the periphery of Davis. Do ICLEI Plans and Policies play a part here?

The City of Davis is one of 544 American cities that are participating members of the International Council for Local Environmental Initiatives*. ICLEI is a private, non-profit foundation dedicated to helping local elected officials (mayors, city councilmembers, etc.) implement progressive regional and international planning within their community as well as in adjacent, unincorporated areas. Because of extensive unfavorable local reaction to a variety of ICLEI’s “Sustainable Development” and “Innovative Development” proposals, ICLEI has had to rebrand itself as” Local Governments for Sustainability” to continue to gain access and support of community staff and residents. Once support is gained, ICLEI can then provide numerous resources to the community. An essential step is to recommend that the community hire a full time “sustainability (innovation?) manager,” to implement relevant ICLEI policies. Once that is done, other benefits follow. Some of these include: (1)access to a network of Green experts, newsletters, conferences and workshops; (2) software programs to help set the goals for community development; (3) toolkits, online resources, case studies, fact sheets, policy and practice manuals, and blueprints successfully used by other communities; (4) notification of relevant grant opportunities conforming to ICLEI objectives; and, (5) training workshops for staff and elected officials on how to develop and implement ICLEI programs.

For a foreshadowing of what could happen to local planning within our local, six county (Central Valley) region, please see the results of the adoption of ICLEI’s One Bay Area Plan (http://www.onebayarea.org/plan-bay-area.html) . This Plan has been essential in curtailing control and implementation of local planning within the communities of the Nine County Bay Area.

______________

*Please see http://www.iclei.org (ICLEI) for more detailed information concerning this massive, multi-tentacled, international organization).

Prolixity?

Add to Don Shor’s list: taxes from an innovation park assessment district.

To DurantFan: Robb White can speak for himself, but I have listened to him many times. The idea of an innovation park for Davis is deeply rooted in regional cooperation, is my understanding.

http://www.icleiusa.org/

it’s interesting stuff on that page, but frankly, its mosty stuff we’re already doing. i don’t think the community is going to back anything short of highly innovative.

I’m betting the community will back any innovation park that will generate significant tax revenue.

i’m not sure about that. i think we have higher standards than that.

Anon

I certainly hope that is not true. We are sitting here next to a major university with a wealth of agricultural and environmental experts in our community….why exactly would we want to do anything but play to our own strengths by accepting “anything that will generate significant tax revenue ” ?

Because some of us think enticing new businesses to come to town is a better approach than raising taxes on current residents. You have made it clear that your preference is to make Davis a more expensive place to live but there is always hope that your approach does not reflect the desires of the majority of voters in town.

Tia, I don’t read Anon’s comment the way that you do. When he/she says “… any innovation park …” I think he/she is by definition saying “We are sitting here next to a major university with a wealth of agricultural and environmental experts in our community….any innovation park we do will play to those strengths.”

That means that an an innovation park that generates significant tax revenue is having our cake and getting to eat it too.

Here is a bogie: http://otm.illinois.edu/UI_Research_Park

This is 200 acre technology park adjacent to the University of Illinois.

Unfortunately this does not report on the local municipal tax revenue benefit. It is possible that the land here was never annexed to the city, and remained a county-university project.

However, here are the key numbers:

– Total state and country 10-year build out revenue of $9.3 million.

– Ongoing annual state and county revenue of $5.4 million.

But this park has 604k square feet versus the 5 million square feet that Rob estimates/envisions. And with that increased business density, the estimate of $8.25 million per year seems reasonable.