Members of the city council were thankful that the for the first time in 13 years there is no cut list. But while revenues grew faster than expected last year, the reason that the city is in the black is not due to the improved economy but rather the temporary tax increase.

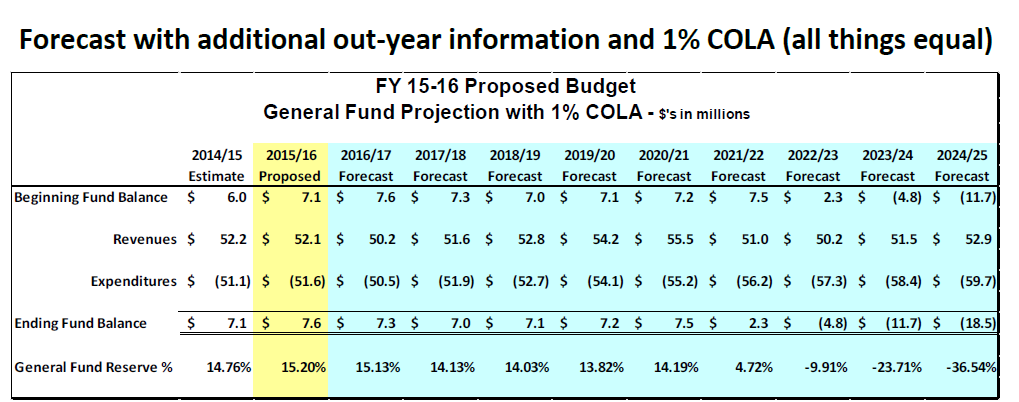

At the last council meeting, several council members asked the city to present a graphic that showed the true impact of the drop off of Measure O funds past 2020-21. Those figures were presented at the Finance & Budget Commission Meeting last night.

More importantly, there are talks of a COLA (cost-of-living adjustment) and the city prepared a chart that shows what a one percent per year COLA throughout the period would lead to, compared to no COLAs. The original city chart, showing the city in the black, had no increased employee compensation and did not show the impact of what happens when the sales tax goes away.

What becomes clear is that when the tax increase falls off the rolls after the 2020-21 year, the city revenue drops by $4.5 million. The city goes from being in the black in 2020-21 by nearly $2 million to being in the red in 2021-22 by about $3.4 million. And while revenues continue to increase modestly throughout the period, expenditures increase as well.

The result is that the fund balance, which is projected to be as high as $12.8 million or 24% as late as 2020-21, is in the negative just three years later if there is no extension of the city’s tax or otherwise an influx in revenue – either through economic development or unexpected revenue sources.

But even this might represent a rosy picture. That model still assumes no increase in employee compensation as the result of two MOUs. How realistic is that? At the same time, even a very modest compensation increase in the form of a one percent COLA has a very dramatic impact on the budget.

The chart shows what happens with a one percent COLA and projects it out past when the tax increase will drop off the tax rolls.

The first thing we see is that a one percent COLA will basically track with expected revenue increases across the board. So the city’s projection of being in the black will no longer hold. The city will fluctuate between slight deficits and slight surpluses. By 2020-21, the city will be in the black by $300,000 under this scenario.

When 2021-22 hits, and the tax increase disappears the city will immediately find itself right back in the $5 million deficit it was in previously. By 2024-25, the city would be back in a $7 million deficit.

The fund balance under a one percent COLA scenario will never reach the 15 percent mark after 2016-17. By 2021, the city will be down to a four percent reserve and in the deep hole by 2024-25.

The city concludes, “The forecast has been extended out beyond the expiration of Measure O so that the effect of its sunset can be seen in relation to anticipated expenses in FY20/21. It is evident from this projection that, absent new revenue sources or expenditure reductions, the City will have expenses far in excess of revenues.”

Dan Carson believes that the city budget has understated the likely property and sales tax revenues. He wrote, “If city revenues from these two important tax sources grew instead more in line with actual city historical trends, new statewide projections by the Department of Finance and the Legislative Analyst’s Office, and as suggested by other relevant data (like the 38 percent increase in resale permits), the city could realize annual growth in property tax revenues in the range of 5 percent annually, and sales tax growth in the range of 4 to 5 percent annually, over the next five years.”

Mr. Carson believes, “If these alternative revenue projections proved correct, the city General Fund could realize $750,000 in combined additional revenues in 2015-16 from these two tax sources. By 2020‐21, the final year of the five-year projection period, the compounded effect of better revenue growth could be as much as $4 million more annually than is now being estimated if positive economic trends continue.”

However, the city responded. They found that “increases in assessed values are not correlated to increases in property tax and that over the past five years of actuals we are only seeing revenue equivalent to 81% of the increase in assessed values, the City feels comfortable that using only a portion of the projected increases in assessed values for the increase in Property tax over the course of the forecast.”

The city adds, “If City assumptions, which are admittedly more conservative, prove to be below actual revenue collected, the additional revenue could be used to accelerate the City’s plans to deal with the unfunded liabilities and infrastructure improvement backlogs.”

Given that, it seems reasonable for the city to assume a more conservative growth model.

There are several important points that should be made here. First, even a one percent COLA changes the city’s budget forecast drastically. Last decade, the city council approved MOUs that included a 36 percent increase over four years for fire, and 12 to 18 percent increases for other bargaining units.

As it stands now, the city would be unwise to implement a one percent annual COLA.

Moreover, it becomes clear that, absent new revenues or cuts, the city will have little choice but to attempt to extend the sales tax at one percent before 2020-21.

Given the projections about innovation parks – even if they come to fruition, the city might be wise to look toward additional cuts in the next MOU round. However, comments by some public officials have made that exceedingly unlikely.

—David M. Greenwald reporting

Am interested to know if the quotes you attribute to Dan Carson were after the new numbers were presented to the Commission or as I think, his quote of several weeks ago. If the latter, would be interested in his assessment of the new ‘numbers’. Thanks!

Those were from his memo from a few weeks ago.

Several questions:

1) Is the reported 38% increase in resale permits the number of net (net of closures) new resale permits? Do we have the BOE category breakdowns for these new resale permits and locations?

2) With respect to the COLA projections – do these projections include the need to increase our funding of the post-retirement contributions to insure that the unfunded balance of the pension fund is not further increased? This is one of the fundamental challenges with the current defined benefit model – i.e. the tendency to disassociate the periods in which contributions expenses are recognized from the actual term of service. GASB estimates that the average term of service over which newly created obligations should be expensed (to help the smoothing effect) as seven years (rather than having all of the present value impact in the year the new benefits are accorded). So, the question should be: Do these projections include both the current 1% COLA salary increases as well as the projected additional contributions to the pension fund created by these salary increases – and if so – how many years are allocated in the model to help catch-up the pension fund account?

This is a fundamental accounting issue. The reason for this question is that an employee’s true cost of services should be fully recognized during the term of their service employment. More simply yet, it is totally inappropriate to be burdening the budgets of future administrations and taxpayers with deferred expenses associated with prior period budgets.

Doby – the point of the resale permits is to assess the potential for assessed value “resets” that accompany home sales. If home sales are up that offers the opportunity for increases in AV, especially if the previous homeowner lived in the house for a long time and the AV was only subject to the maximum 2% increase allowed by Prop 13. If the rate of resale activity is growing (as it has been over the past 3 years), that suggests the potential for additional property tax revenue (even without accounting for new constructions).

As to the COLA projections the answer is “yes”, my understanding is that the projections include both direct salary impacts of annual 1% increases as well as increased PERS costs they would occasion. Having said that, I do not know the formula used to phase these increases in over time so I cannot fully respond to the question. But I can find out.

Robb,

Thanks very much for your interest and attention to these comments.

I think we are talking about two different types of “resale”, with my emphasis and questions pertaining to retail sales type “resale” permits per Dan’s quote above.

Doby, Here’s what I know: 1. The data on resale permits can be found on page 10-19 of the new city budget proposal. It is permits issued by the city’s Building Division. BOE is not involved. You’d have to ask the city if they have a list of locations. 2. The COLA projections include total compensation impacts, salary and pension particularly. It assumes CalPERS established rates for 2015-16 and the estimates of the employer contribution rates by the city’s private consultant actuary for the subsequent years of the forecast.

dan: do you agree or disagree with the city’s analysis?

DP, we had a very good discussion of these issues between commissioners and city staff about the budget at the Finance and Budget Commission last night. I think it is fair to say that the city is fundamentally in agreement with the analysis I sent to the commission earlier that (1) the loss of roughly $8 million in annual sales tax revenue after the expiration of Measure O would be financially harmful to the city and that we need to practice fiscal constraint, pursue economic development, and look for opportunities to leverage surplus city assets to improve our financial position during the intervening years. We have no way to be certain whether future City Council members or voters would want to extend the 1-cent of sales tax that would phase out, or at what level. (2) providing a 1 percent COLA each year of the forecast period would add roughly $1.7 million to General Fund costs by the last year of the five-year forecast period. So, as David suggests in the piece above, fiscal constraint is definitely called for in the pending labor negotiations.

i think we’re in agreement. my concern has been that you end up justifying employee compensation increases that aren’t really sustainable in the medium term.

I agree.

How about we calculate the impact of a 1% and 2% reduction in compensation across the board?

Also calculate the savings of a pension cap on highly compensated employees.

you wouldn’t save money on pensions by reducing compensation

DP, why not?

because pensions are formulated to your highest salary, not your current one. once you get your 2.5% of your salary at the age of 55 based on a $80,000 salary, that $80,000 is locked in. also pensions are based on salary not total compensation.

Disclaimer: I am a member of the Finance and Budget Commission (FBC), but my comments here are as an individual City of Davis resident.

Dan, one of the other concerns that needs further discussion (or explanation) is what the annual inflation rate percentage is for current employee health care benefit premiums, as well as OPEB health care benefit premiums. As we all know the health care benefit market has experienced volatility in recent years. In addition, life expectancies continue to rise, and each year that the average City retiree lives past the expected life span costs the City added OPEB and Pension costs that are currently unbudgeted.

At last night’s FBC meeting during the Budget review I suggested that the City use “scenario analysis” for both revenues and expenses, with the expected case bracketed by a best case and a worst case. That approach would allow the Council to be proactive about infrastructure maintenance spending if the best case provides the kind of increased income stream. Right now Council is in a read and react posture, which requires them to reconvene and go through a decision process about how the additional revenue dollars should be spent (if at all). By formally identifying up-front the impact of the improved revenues associated with the best case, the Council can establish the policy directive (also up front) regarding how the added revenues should realize value for the City.

Similarly, if another Recession hits and revenues dip to the worst case, formally identifying up-front the impact of the reduced revenues associated with the worst case, the Council can establish the policy directive (also up front) regarding how the City’s expenditures should be reduced to avoid deficit spending.

Decision-making based on scenario analysis is a tried and true staple of the private sector that should be used by our City of Davis decision makers and managers.

Matt wrote:

Matt – I understand the intent here but wonder about its practical import and usefulness. There is NO DOUBT that scenario analysis is critical to decision making but budget projections have a number of parameters and I am unsure what it means to vary several parameters at once–how do I analyze that? Also, what is a “best case” and what is a “worst case?”

I think that exercises like reported here are useful to explore key decision points–1% per year versus flat. There may be other such policy-specific scenarios we might use. Perhaps we should take some time to specify these simpler analyses and routinely run them (essentially holding all else constant while altering a key policy variable). The key is that assessing the independent impact of all the things that go into “worst case” does not lend itself to analysis (even if there is co-variance among parameters). Just trying to think through how to make this practical.

Like the discussion below: what if CalPERS changes contribution requirements as it has done in the past–let’s look at that. What about health insurance inflation? Let’s look at some scenarios. My point is that doing simpler one variable at a time data runs might be easier to examine and analyze. I would like to explore this more.

Robb,

The reason I believe my suggestion has merit is that even with all the moving parts (which we both agree are substantial in number), it is not unreasonable to come up with a reasonable sense of what might be an aggregate “better than expected” scenario and an aggregate “worse than expected” scenario. In his comments last night Dan Carson gave us all a sense of what the individual revenue deltas might be between the ‘expected” (as presented by Staff) and what he felt the “better” might be. To Dan’s credit he used an evidence based approach. To Staff’s credit they also used an evidence based approach. The difference was what evidence they felt was appropriate to use. When all the dust is settled, the reality is that both Dan’s numbers and Staff’s numbers are projections. and reality, when it happens, will differ from both of them.

If that is true, then why is it worth worrying about them? In a word “proactivity” or, alternatively “transparency.” Currently, if reality differs substantially from expectations, Staff comes back to Council and in a discussion in a Council Agenda Item, a game plan is formulated for what to do with the surplus, or what to do about the deficit if actuals have fallen short of expectations. In effect we perform a “reboot.” That is reactive rather than proactive. It is not nimble. It more often than not doesn’t achieve an optimal outcome.

You ask, “what is a ‘best case’ and what is a ‘worst case?’” In truth, knowing those values with precision is not meaningful. What is meaningful is that the “best case” is any combination of factors that produces a surplus over the “expected” that meets or exceeds a threshold amount of money … and as part of the budget approval process Council makes a Policy decision on how and when that surplus should be deployed. Proactive, not reactive. Up to that level any surplus is retained as an increase to the Reserve. Same thing on the down side. Revenues fall short and/or extraordinary expenses are incurred enough to make the deficit exceed a threshold, predetermined, proactive operational adjustments are activated. No lost opportunity due to the need to discuss the options in Council Chambers. Proactivity based on evidence-based decision making. That is “its practical import and usefulness.”

Dan,

I think would help immensely if the projection of future COLA increases could be separated as between the direct wage component and the expenditures associated with increased contributions to fund the associated growth in future pension liabilities. Simple format, using two expenditure lines rather than one.

One would hope that the city’s actuary could clearly state the basis of their assumption concerning the number of years allotted for smoothing and catch-up contributions for all NEW increases in salary and other NEW formula-related adjustments. Any model requires some input. What forms the basis for their current assumptions and what is the current number of years being used in calculation of their current report for the city?

Doby, Linked below are the slides at the Bartel actuarial presentation on pension benefits you saw at our commission meeting last fall, I believe. It spells out a long list of assumptions that go into these numbers. In particular, to answer your question, it shows that future gains and losses to the system are amortized over 30 years. Other kinds of changes, like when the life expectancy of pensioners was adjusted upward, are amortized over 20 years. I’ve included a link to the slide show for reference below.

http://city-council.cityofdavis.org/Media/Default/Documents/PDF/Finance/Commission%20Agenda%20-%20November%202014/11.3.14/Item_5b%20BA%20DavisCi%2014-11-03%20CalPERS%20Misc%20Safety%2013%20Short.pdf

Dan,

Thank you for the additional research and reference.

To my point, then, all COLA adjustments will be negatively impacting the budgets of future administrations and taxpayers rather than being absorbed and expensed during the actual tenure and service career of the employee.

In other words, going forward, we are assuming a built in “system” of deferring current period expenses to future year’s budgets and future period taxpayers. Obviously that helps with the current administration’s budgets, but given the accrued problems we face today, is that really what we want to do going forward for our future generations of young taxpayers.

Dan,

Again, thanks for the referral back to the Bartels report, but I think that my question actually predated his report and the subject was not addressed during their presentation to your committee.

I own some property in Sonoma County. So I made a few phone calls to their Finance Department and in fairly short order received the following reply to my question:

Question: I am working on trying to establish a budgeting format for the City’s Finance & Budget Committee that would separate out the effects of new and future COLA adjustments in terms of the direct salary component versus the deferred contribution expense component. How many years are allowed to make up for any new underfunding created by a COLA adjustment?

Reply: You would compute it (the amortization/absorption period) by calculating the remaining service life of all plan members, both active and retired. For Sonoma, the mix of actives to retirees is about 50/50. With an average remaining service life of actives at 14 years, 7 years becomes the average. The remaining service life is determined on an employee by employee basis using their normal retirement age. In Sonoma that it is about 59 years. So for an average employee at age 45 has a remaining service life of 14 years.

I do realize that City staff is running very lean and, more importantly, that we currently do not have a Finance Director. But, I had asked this same question of our former Finance Director and, as with your response, was referred to the Bartels report.

I’ll be the first to admit that I don’t understand the math behind an actuarial analysis. I’ve also gone on the record that I am not overly concerned, as many of the DV posters seem to be, about current compensation levels being too high. Bottom line, we have slashed staffing by over 20%. As others have said, we are not going to cut our way to prosperity.

For me, it’s all about whether and how we go about “affording” the compensation packages we are offering. By this, I mean – if and whether we truly are willing to “account” for the total cost of employment during the employee’s life of service. That would mean that we would have had to charge ourselves as taxpayers and put away enough to pay all of the promised benefits by the time of the employee’s retirement. Doesn’t seem like a real complicated proposition. Today, however, we use accounting gimmicks which result in the systemic, chronic underfunding of our true costs, preferring instead to “share” those underfundings with future generations of taxpayers.

When a report like this implies that we plan to “fund” any adjustments to the current base over a period of 20 or 30 years, that’s like saying we need to add a new mortgage in order make good on funding the increase in future pension payments that arise from routine salary increases and adjustments. Seven years to absorb those additional costs, as example, I get that – the active employee is likely to be working all of that time so the added costs to the current budget coincide with the period of service. Twenty years, or thirty years – that’s where you lose me – that’s when you are asking some future city budget and future taxpayer to cover the costs we weren’t prepared to afford today.

Hopefully that clarifies the concern. It’s not about how much somebody makes, it’s about how we account for it and how we charge our budgets for these discretionary, additional costs. Maybe I’m just too dense to understand what they are telling us in their actuarial reports. As of today, how we account for such things is as clear as mud, and over the longer term, I don’t believe it is doing anybody any favors.

Doby wrote:

Last night’s was a textbook case of “less is more.” Kelly Fletcher and Bob Blyth walked into the meeting totally and completely prepared. Their answers to the questions the FBC members posed were direct, efficient and informative. Their immediate supervisors, Kelly Stachowicz and Dirk Brazil, rarely injected themselves into the dialogue, which very different from prior FBC meetings when Yvonne Quiring filled the supervisory role. Several FBC members stated that it was the “best FBC meeting” they had ever seen.

Doby… there is something folk have suggested that would “help”… a severe, negative COLA imposed on all employees, either thru negotiations or otherwise. A completely “flat” zero increase in COLA [salaries, medical/dental costs, PERS contributions for retirement, OPEB, etc.] to reign in City expenditures completely, will definitely give the “haircut” (if not scalping) that some here would like to see. Better yet, to some there should be a 10- 35 % reduction in total comp BEYOND that.

Don’t expect the best employees to stick around after the “scalping”. [particularly non-safety]

hpierce,

Don’t know why you direct your comments to me. Did you happen to see my previous comment:

As stated above, I simply want a model in which all the business of contributions to employee retirement plans is finished, complete and squared away on the day they walk out the door – with no negative consequences for the agency, employee or taxpayer after that date. Promises of continued, post-employment “inflation protection” would become the responsibility of the CalPERS money managers – not the employer agencies or taxpayers.

At the May meeting of Finance & Budget, I was encouraging the commission members and staff to consider a relook at the compensation model for NEW hires with more of an emphasis on transition to the “defined contribution” program with opportunity for higher current base salaries and greater flexibility – at the discretion of the employee – in taking a larger current compensation or socking away a greater portion towards a larger retirement savings account.

It would seem that such an approach would be attractive to many entering employees, while also protecting the agency employer, taxpayer and future administration budgets from having to deal with the unpleasant business of covering deferred expenses and liabilities from prior periods.

Doby wrote:

Please see this for an explanation of how difficult your proposal would be re: exit fees.

Robb,

Yes, this is a complicated problem. More importantly, it is a conversation that will continue to pose tremendous anxiety for many members of the Davis community – i.e. worrying about the integrity of future pension benefits. It should not be that way. A promise of the government should be a sacred promise.

You will note in earlier comments, my earnest concern and belief that we can and we must retain and protect current vested programs for all existing beneficiaries and enrollees. We can do this much.

Looking to the future, that’s where its gets more difficult. Thanks for posting up this press release. Yes, it is a complicated dilemma that has been created. By my reading, this proposed amendment would honor this fundamental obligation to all existing employees, while also recognizing – going forward – the formal constitutional protections to future generations of taxpayers, insuring that they will not be saddled with new and additional debts without their explicit vote and formal approval.

It is interesting to note that the proposed amendment is fully bi-partisan in its political support. And, perhaps more important to note, those sponsoring this initiative are primarily mayors of California cities – large and small – who have seen the damage to their communities that can be caused by prior decisions to forego mandatory contributions and defer expenses.

It needs to be recognized that the brilliant and common sense foundations that went into drafting of the “County Employees Retirement Act of 1937”, which formed the basis for the original public sector retirement benefits in California, would no longer be remotely recognizable in today’s version. The original version truly was a document the employee could take to the bank – it made sense for the employee, their employer and the taxpayer – and it was something a banker could read and understand.

The basic accounting has been broken for a long time. And, while all of us are in this together, there needs to be enough oxygen in the room that thoughtful and rational conversations can ensue.

I greatly respect and appreciate your willingness to explore the subject and provide thoughtful leadership in this very important conversation.

During the campaign for the increased sales tax rate, we were told by the City that the new monies would not be used to pay for increases in compensation.

“a one percent COLA will basically track with expected revenue increases across the board.”

So much for campaign promises…

i think you should hold off on that pronouncement. the cola mentioned here is only demonstrating what happens if the employees got a 1% cola, i don’t think there is any consensus that that cola would occur.

The CC is free to prove me wrong, and I will have no problem admitting it if they do.

my only point was that the chart didn’t seem to be a proposal. you could be right in terms of the ultimate plan. although i’m willing to be robb disagree with you.

the bottom line from this article is that anyone who is arguing that the city is in good fiscal shape is simply trying to sell a line

And note the absence of adequate expense allocation to meet the long-term obligations for underfunded city employee retirement benefits, road repair and infrastructure maintenance. That is big elephant in the room not being discussed.

Said another way, if we accounted for the true amount of annual injection we should be making into the funds to cover the growing future gaps for these three things, we would already be in the red… and the expiration of the sale tax increase, plus any COLA increase would just push us farther down.

Frankly wrote:

I think this is partially correct. Certainly, these projections do not account for road repair needs or other infrastructure needs (particularly, as staff noted last evening at the FBC, in the parks and city buildings/properties category–building fleet and IT funding reserves are included in this year’s budget).

Where I think you are wrong is in adding “underfunded city employee retirement benefits” to the phrase. We are using CalPERS and our own actuary assessment to project the costs, as best as possible, of funding our PERS requirements and we are one of the few cities on track (over time) to fully fund our OPEB obligations using, what I think the FBC and others accept as, reasonable actuarial assumptions. Last night the issue of funding OPEB and PERS at even higher levels was raised and that is a potential use of any “unexpected” revenues we might have. Of course bringing forward critical, already-defined, infrastructure projects is another option.

I will also note that the projections provided here are based on requests made by council members (longer projections that show the effect of the sales tax coming to an end) and FBC members (the effects of annual 1% COLAs). They were produced not to propose anything but merely to inform decision making and create clarity about risks ahead.

Robb – Thanks for this reply.

I guess where this leads us is to debate the CalPERS projections of returns. There have been three previously unplanned rate increases due to resets of CalPERS current estimated returns of 7.75 or 7.5%.

What I understand about the main criticism of CalPERS estimated rate of return is the lack of consideration for the impact of the downturns… those years where returns are lower than the estimated long-term rate of return but where payouts still need to be made.

Let’s say for example you have 4 years of 6% ROR, and two years of 9% ROR and the six year average is 7.5%. In actuality, those four years of 6% caused the median ROR to drop below the average because the funds were being depleted from payouts in those down years.

Said another way, it isn’t just the average ROR, is is also the number of down years vs. the number of up years that impacts the true cost of these retirement benefit commitments.

At least this is how I understand the problem with CalPERS estimated ROR used for budgeting purposes. The net impact to cities is likely to be more rate increases to shore up the actual cash imbalance.

I think we need Rich Rifkin to chime in.

Frankly, I get your point and it gives me great pause. Anyone paying attention to the ROR and other factors influencing CalPERS’ requirements should be deeply concerned. See this, for example

Good stuff Robb.

A couple of key points:

This gets to my point about the negative swings causing so much havoc. Ideally CalPERS would adopt a less aggressive ROR to smooth out the impacts of so much volatility. But then that sheds light on the true cost we should be budgeting… and it is more than what we are currently budgeting.

Note that. Private business has to fund pensions at a much lower rate of return because of the risk of business volatility. But since, I guess, politicians can always come back to the big taxpayer ATM, we don’t require the same risk appetite for public pension managers. What is real? Even if we split the difference between 4% and 7.5%, the impacts to city budgets would tremendous.

One last thing that does not get a lot of press. The government estimates of life expectancy are lower than what some recent well-done studies project. Just adding a few months of increased longevity to the CalPERS models adds a significant increase to the pension liability.

In lending we need to maintain a loan loss reserve as a hedge against losses from defaulted loans. Conversely, most cities delegate full pension and OPEB benefit risk management to CalPERS. From my business perspective I would budget more conservatively than CalPERS. I would consider funding a separate city-wide risk pool as an additional hedge against CalPERs over-estimating the ROR, or under-estimating payouts. City employees should demand this too so as to protect their retirement benefits from being impacted at some point in the future.

As I understand, the US CPI for the last year as of April 2015 is -.2%. It was .8% for the year ending 12/31/2014. Certainly there has been inflation over the prior years, but there are signs of deflation. Plus we have this problem that the total compensation of most city employees significantly exceeds that of their peers in the private sector.

It seems prudent to hold firm on compensation until there is equalization with the general labor market.

this is a good point so even a 1% cola seems way to high

Why not consider a 1% reduction across the board, how would that impact city finances 10 years out?

Also consider the benefits of different pension reduction plans, including capping the pensions of highly compensated employees. The impact of moving to a 401K type system is another option, where there could be substantial savings.

Has there been a similar 10-year tabulation on the various expenditures, road, park, and pool repairs?

National CPI or State? No. Cal or So.Cal. ? Social Security increases (CPI) are 1.7% as of the beginning of the year. CALPERS retirement increases [CPI] effective in May are 1.6%. Why do you understand the USA CPI is – 0.2%? Cite Sources?

Or, just blowing smoke?

btw, the staff projections has ten years of economic growth out to 2024, that doesn’t seem likely.

Are you an employee of a government agency [or, was the source of your funding from government]? If so, what was your COLA? If not, what was your total comp increase (%) in the past year? Put up, or…

Hawkeye/Hortense, for me the problem with your question to Davis Progressive is that it doesn’t take into consideration prior events.

For example, the 2005 contract negotiation with the Davis Firefighters resulted in a 36 percent salary increase (other bargaining units got 15-18 percent), which lasted until the next contract negotiation in 2009. That works out to an annual increase of 9% per year. The CPI increase over that same four year period was 3.4% (2005) 3.2% (2006) 2.8% (2007) 3.8% (2008) for a total of 13.4%, approximately 37% of the increase that the Firefighters received.

Looking at a COLA in 2009 after that history would be very different than looking at the same COLA after four years of no salary increase … or even four years with an aggregate 15-18 percent increase.

Look at the five years prior to your numbers. Cherry-picking? Look at the last 5 years. Perhaps too ‘generous’, but nowhere as bad as your example makes it out to be. BTW, Fire and PS in general were “outliers”.

Spawned in large part from the ‘pension holiday’ that PERS and the system for UC folk gave when PERS and other public agencies were “super-funded”. Had those “holidays” not occurred, agencies would not be in the situation they are today. The money ‘saved’ during those ‘holidays’ was not held in reserve, as it should have been, but spent on “feel good” programs/services.

Using FD compensation increase to ‘brand’ all employees, is not fair, in my opinion. The former was truly egregious.

You and I are substantially in agreement. What I would like to see is a year-by-year table that separates City employees by category (for the most part that would be Bargaining Unit), showing the year-by-year changes to their component by component Total Compensation compared to (A) that year’s overall CPI and (B) that year’s Health Care CPI. That way the “whole picture” would be evident at a glance … and any “outliers” (like Fire in 2005-2009) would be pretty clearly illustrated as outliers.

That would be transparency … as well as a platform for evidence-based decision making.

Matt, I do not disagree with the essence of your 10:41 post.