The city’s current long range budget forecast shows an annual shortfall of $7.8 million in terms of unbudgeted infrastructure and retirement benefit needs for the city. These have been called “unmet needs” and encompass expenditures for “transportation, parks and public facilities now and into the future” which “have been the primary focus of attention, although other issues have been discussed, such as public safety, health, and human/social services.”

Since voters passed a sales tax in June 2014, the city council has been unable to agree on the next revenue tax and what form it would take. Concerns over low polling numbers in July 2014 led the council not to put a parcel tax on the November 2014 ballot, and concerns over form and type of tax led the council to scrap plans to put a measure on for June 2016.

That probably won’t be an option in 2017. The current Parks Maintenance Tax set at $49 per parcel and raising around $1.4 million annually is scheduled to sunset in June 2018. By itself, the parks tax does not cover more than a quarter of overall costs.

The staff report calculates that a $100 parcel tax would generate around $2.8 million. A one percent utility user tax on all utilities would raise around $1 million. A one percent utility user tax  that excludes water and sewer would drop to $820,000. And a Sugar Sweetened Beverage Tax at one cent per ounce would generate around $1 million.

that excludes water and sewer would drop to $820,000. And a Sugar Sweetened Beverage Tax at one cent per ounce would generate around $1 million.

As staff notes, should the current parks tax not be renewed or replaced, “alternative reductions in service levels would need to be considered.

“In order to place a measure on the June ballot, the County must complete all documentation for the election no less than 88 days prior to the election,” staff writes. That gives the council until January 2018 to make a decision – however, often the council has waited until the deadline is upon them and has been unable to act.

Staff further notes, “During a general municipal election, the City Council may choose to place either a special or a general revenue measure on the ballot.

“General taxes, which are not specified for any particular purpose, are only allowed during a general municipal election, absent an emergency. Davis holds general municipal elections in June of even numbered years. Special taxes, such a parcel tax or any tax specified for a particular purpose and therefore requiring a 2/3 vote, may be submitted to the voters at any duly called election.”

The advantage of a general tax is that it only requires a simple majority. However, it may not specifically target areas of spending. On the other hand, a special tax has the advantage of having specified purposes, but requires a two-thirds approval – a much higher barrier.

With regard to unmet needs, staff notes, “While there is general consensus that the City has unmet needs, there are mixed opinions about what defines a need and whether new revenue should be pursued to address those needs.”

Staff notes the following:

- Transportation infrastructure (streets, bike lanes, bike paths) ($167 million over 20 years);

- Parks infrastructure (parks, pool enhancement and/or replacement, urban forest, etc.) ($62 million over 20 years)

- Facilities infrastructure (city buildings) ($25 million over 20 years)

- Public Safety

- Social Services needs

- Employee costs, specifically long-term unfunded liabilities for retiree obligations ($66.9 million)

Available Tax Options

Parcel Tax: “A parcel tax can be targeted to address any legitimate need of the City, including infrastructure needs for streets and roads; recreation amenity needs like repairs and/or enhancements to existing pools; irrigation expenditures in the parks; road and bike path maintenance and rehabilitation; or other potential enhancements to the community. Different fee structures can be put into place for residential and non-residential properties. If the measure notes that the revenue is for a specific purpose, then funds may only be spent in that way.”

Utility User Tax (UUT): “Utility user taxes are levied as a percentage of the direct cost of the utility service delivered, and may be levied on utilities such as gas, electric, telephone/ communications, water, sewer, sanitation and/or cable TV. The tax appears in the monthly billing paid by the customer and the tax is paid to the utility, which in turn remits the taxes to the local government that levied the tax. Many California cities levy a utility user tax and it is often a substantial revenue stream for their general fund. Utility user tax tracks with inflation, it applies to a broad range of the population (e.g. homeowners, renters, businesses) and it is not as sensitive to economic downturns as the other general taxes.”

Staff does warn: “UUTs have experienced mixed rates of success. In November 2016, voters in eight cities considered measures to increase or expand utility user taxes. All were majority vote general taxes. Five of the eight measures passed. Four of the passing measures were no change in rate, only to expand to wireless telecom, the fifth passing was an extension of existing tax. There were three that failed, two were to increase the tax amount and one was to expand to wireless telecom.”

In the last budget/election cycle, the city got feedback from the Finance and Budget Commission and Community on the UUT.

“In 2015, the Finance and Budget Commission discussed a potential Utility User Tax at multiple meetings. While the Commission on the whole was sympathetic to the fact the City has unmet needs, considerable conversation was devoted to defining actual needs (vs. preferences or wants) and determining true unfunded costs.”

Among other things, the commission wanted to update multi-year projections of revenues and expenditures which included unfunded liabilities. This has largely occurred through the work of Bob Leland this year. They asked the city to further review cost saving measures and create a complete list of deferred maintenance and capital improvement projects.

The community group in 2015 said, “Much like the Finance and Budget Commission, there were mixed viewpoints about whether a utility user tax was the right mechanism to fund unmet needs. Primary reasons included a concern about the city’s ability to continue to rein in costs in the face of additional revenue, the sense that the City had not yet cut expenditures sufficiently and concern that a utility user tax was not the correct taxing mechanism to generate revenue for infrastructure needs.”

Staff noted, “There were differences of opinion about the levels at which to tax specific utilities, but the general feedback was not to exceed 5% for any of the utilities.”

There were also “mixed viewpoints about whether to put forward a general tax or a special tax, there was consensus that the city needed to provide as much information and transparency as possible to the public about the need for the tax and the projects which such a tax would fund.”

Sugar Sweetened Beverage (Soda) Tax: “The City Council has had discussion in the past on sugar sweetened beverages, a different kind of measure – one where the primary purpose is less to raise revenue as much as it is to address a public health policy issue.”

While the Berkeley tax passed in November 2014 and generated $1.46 million its first year, staff notes, “The policy goal of the tax, however, is to reduce consumption, so it is possible that revenue will decrease over time.”

Staff estimates that “a tax in Davis similar to the Berkeley model could generate roughly 2/3 the amount of Berkeley’s tax, or $800,000 to $1,000,000.”

Staff adds, “The different nature of this tax makes it less suited for covering basic city needs and better suited to promote healthy lifestyles, the policy objective for which it was created.”

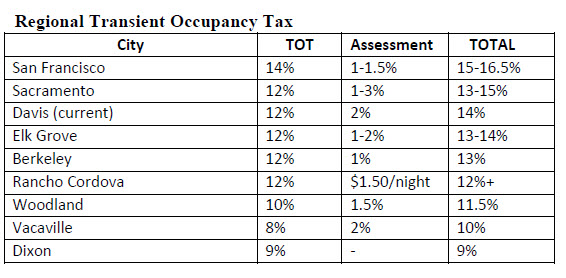

Transient Occupancy Tax: “The Transient Occupancy Tax (TOT) is charged to visitors who stay overnight in a hotel room, based on a percentage of the cost of the room night. Prior to June 2016, the TOT in Davis was equivalent to 10% the cost of a room night and generated $1.5 million in Fiscal Year 15-16. Subsequent to that time, Davis residents approved a 2% increase to TOT, which is estimated to generate an additional $300,000 in annual revenue.”

Transactions & Use Tax (Sales Tax Override): “In June 2014, the voters of Davis approved passage of a one cent local transaction and use (sales) tax through December 31, 2020, unless reauthorized by voters. This tax currently generates over $6.0 million in annual revenues. The tax was originally proposed as a means to address historical structural budget shortfalls, as well as provide funding for a variety of expanded service demands.”

Staff notes that Davis could add up to an additional one percent sales tax, with each eighth cent increase adding roughly $375,000 in annual revenue. However, they warn, “When considering this option, it is to be noted that on a regional level, Davis is among one of the highest transactions and use tax rates and increasing beyond the current rate may place Davis at a competitive disadvantage.”

General Obligation Bond: “The City could also propose a general obligation bond to address capital needs. A general obligation bond requires a two-thirds vote of the electorate. A general obligation bond could be secured by an ad valorem property tax, a utility user tax or another tax with a proven and multiyear stream of income. However, the types of expenditures allowed with this type of financing are more limited. Road repair and reconstruction would be permitted under a general obligation bond, but maintenance costs would not be fundable via this mechanism. In addition, the tax would have to be imposed for the complete length of the bond repayment period, generally between 20 and 30 years.”

The city has until late January to make a decision, but, as we have seen in the past, waiting until that deadline has been one of the barriers preventing the city from putting a revenue measure on the ballot.

—David M. Greenwald reporting

Here is the basic problem with the city’s approach. When you are running an $8 million annual deficit, “alternative reductions in service levels” should have already been implemented, not just be on a list of things to consider some time in the future.

Reductions in service levels affect the quality and condition of the parks, including recreation facilities.

What reductions would you propose in either/or expenditures, service levels? Honest question.

It is kind of weird that you would make reductions to service levels to avoid reductions to service levels.

Don and David… let Mark explain himself… if the existing service levels are unaffordable, they SHOULD be examined… trade-offs…

Mark missed a key point tho’…

Current situation could have been heavily mitigated if the community listened to the warnings issued 30 years ago about street maintenance, other ‘deferred maintenance’, by staff… and if money had been spent there instead of “nice to have items”… we have been making ‘minimum payments’ on money spent for over 30 years, in effect, “on credit”. had we been making full payments for the last 30 years, and not delaying revenue measures for the last 5, what would the “amount due” have been?

That applies to capital costs, operational costs, and pension formulas and PREB… much was ‘financed’ on “credit”. The bill is now due.

Haven’t missed anything, Howard. The current situation could also have been ‘heavily mitigated’ as you say had the community understood the information in the current General Plan and actually followed the proposals for commercial development. Our community has had its collective head in the sand (or elsewhere) for decades. Nothing new there.

My point is that when you are operating with a deficit, you should be looking at every expenditure to determine if it is necessary for the continued operations. I am certain there are services that could be cut now as part of a comprehensive approach to the deficit, and it is those cuts that should already have been implemented. The quote from the staff report suggests that they will start looking at potential cuts IF the parks tax is not renewed. I am not proposing what cuts should be made, just that we should already have a list of all services and their respective costs so that the City Council can make informed decisions on what cuts to make, in advance of any discussion of a new or renewed tax.

““The policy goal of the tax, however, is to reduce consumption, so it is possible that revenue will decrease over time.”

It is not only possible. It is the desired outcome. Just as a doctor knows that if their income is decreasing, that may be undesirable for them economically, but if it is because their patients are becoming healthier, it is a tremendous win for them in terms of the efficacy of their care.

One point that is frequently missed in the soda tax discussions is that if they do indeed result in less soda consumption, and better health, that will ultimately mean that the society as a whole will be paying less for health care meaning that there is more discretionary resources available to be spent on items other than health care. Sure it is long range, and ephemeral, but it is also very real.

Have we considered a tax on manufactured housing?

I probably shouldn’t find these continued jabs amusing, but that’s the way it is, I guess.

If I ever meet you, I’ll probably avoid walking through Rancho Yolo with you. (Pursued by those using “Rascal-type” scooters – like a Seinfeld episode.)

I would never go into Rancho Yolo. Given the high wall they built to keep those people in I expect they are quite dangerous.

“It’s actually a very weird form of elitist snobbery to live in one kind of single-family neighborhood and be consistently scornful of another kind of single-family neighborhood.”

The trailer park on Pole Line is based on discrimination. Therefore I object to it.

It’s actually a very weird form of elitist snobbery to live in one kind of single-family neighborhood and be consistently scornful of another kind of single-family neighborhood.

Don: I realize that you’re right. I also hope that Rancho Yolo remains right where it is. I suspect that most feel that way.

I don’t fully know why, but I just find some of Jim’s comments amusing, even if I don’t “agree”. (Including his latest comment, above.)

Years ago, I recall David Letterman making jokes about Clinton/Lewinsky. He was relentless, night-after-night. That fact alone made it even more amusing, than the individual series of jokes. At times, the audience could almost anticipate/complete the joke, as soon as he started.

I think it would be helpful to keep this topic of conversation on the topic

For a number of reasons, including governance, and particularly revenue options, we should take a serious look at “charter city” status. Charter cities have options ‘general law’ cities do not, including options other than parcel taxes/sales tax (the one size fits all options).

I had sufficient reservations about charter city status last time it was before the voters that I argued publicly against it at forums, and I have seen little since then to change my mind about it. It should certainly be a robust debate when the voters realize how readily and in how many interesting ways a charter city council could raise taxes.

Or, the charter could very well constrain taxes… I suggest it as a concept that is worth looking at… unless you approve of a parcel tax system, where a 100 unit MF project pays the same as a SF house, which pays the same whether the family income is $350k/year or or scrapes by renting while their income is $35k/year…

I had strong reservations last time it was floated as a concept…

I’m not convinced it is “the answer”, and I have concerns about both the tax implications, and possibility of ‘district elections’ for CC.

I think you said you do not reside in Davis… if we exempted businesses from new taxes, or reduced them, would you feel so strongly?

Not sure I’d vote for it… but am strongly inclined to renew the discussion…

Yes, I would likely strongly oppose charter city status. Even then I recognized that it would probably be to my fiscal benefit for the city to go to charter status, because it would broaden the range of tax options available to the council. I pay the same parcel taxes residents do, and I pay sales tax since I do a lot of shopping here. But charter city would enable them to raise taxes that general law cities can’t, and do it more easily. It might take the pressure off the parcel tax as the main option for revenues (I doubt they’re going to revisit the sales tax for any increase there).

But I still opposed it then and probably would now. First, there were simple issues of good governance. But with respect to this discussion, I don’t think we need to make it easier for the council to raise taxes, and that’s what charter status does. Given how we got here, given even the recent fiscal history, I don’t think it should be easy. They need to make the case and work for that 2/3 vote. Davis voters are generous about taxes, but this is likely to be a bigger $ amount than before. That will be a hard sell. And it should be.

When it came up in 2010, the problem was that it was a charter that was supposed to allow for choice voting, but it didn’t have choice voting in the charter and therefore didn’t really do anything. A lot of college towns like Davis are Charter Cities. There’s no reason Davis shouldn’t be if the charter is done correctly. In 2010, it just wasn’t.

Choice voting was the impetus for the 2010 proposal, but it was the other aspects of charter city status that we were debating at the LWV forums and elsewhere. My opposition then wasn’t just due to choice voting. I’ll be happy to have this debate again. I still think charter city status has major drawbacks.

To be clear Don, before this goes too off-topic, that any real discussion re: charter city, including but not limited to district elections, choice voting, taxation mechanisms, can not possibly be done within even an 18 month period.

Charter city discussion or not, I believe we need to act sooner on revenues and/or reductions in spending, in the context of our general law status.

Still see no problem with a 60% threshold for revenue measures. After all, the vast majority decisions the CC makes has that as the bar.

Ironically, the decision as to charter status has only the 50 +1 threshold